Steve Bull's Blog, page 151

December 16, 2022

Germany Unleashed Half-Trillion Dollar ‘Energy Bazooka’ To Keep Lights On

Western sanctions on Moscow have backfired, failed to paralyze Russia’s economy, and ultimately sparked financial pain for ordinary Europeans and the largest economy in the block.

According to Reuters calculations, Germany has hemorrhaged cash to the tune of 440 billion euros ($465 billion) in energy bailouts and schemes, as well as keeping energy supplies flowing while it lost access to inexpensive natural gas from its leading supplier Russia in 2022.

“How severe this crisis will be and how long it will last greatly depends on how the energy crisis will develop,” said Michael Groemling at the German Economic Institute (IW). He added: “The national economy as a whole is facing a huge loss of wealth.”

Reuters said the “cumulative scale” of energy bailouts and other schemes employed by Berlin equates to 1.5 billion euros per day since Russia invaded Ukraine, or about 12% of national economic output, or 5,400 euros for each German.

Germany has shown Europe how backfiring sanctions ruin its country’s finances and send millions of its citizens crashing into energy poverty overnight. These anti-Russian measures have caused soaring electricity and NatGas prices and elevated risks of entering a recession in 2023.

“The German economy is now in a very critical phase because the future of energy supply is more uncertain than ever.

“Where does the German economy stand? If we look at price inflation, it has a high fever,” said Stefan Kooths, vice president and research director of business cycles and growth at the Kiel Institute for the World Economy.

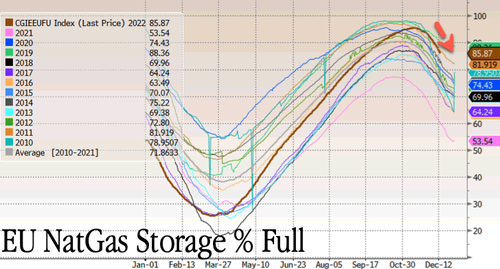

Many other European countries find themselves at the mercy of the weather as NatGas injections into EU storage facilities have flipped to draws amid a wicked cold spell boosting heating demand.

“The country has turned to the pricier spot, or cash, energy market to replace some of the lost Russian supplies, helping drive inflation into double-digits,” Reuters noted.

…click on the above link to read the rest…

December 15, 2022

Fusion Breakthrough is a Nuclear Nothing Burger

The U.S. Lawrence Livermore National Laboratory kicked off its year-end Go-Fund-Me drive last week announcing a nuclear fusion breakthrough.

“The fusion energy breakthrough by US scientists boosts clean power hopes. Net energy gain indicates technology could provide an abundant zero-carbon alternative to fossil fuels.”

–Financial Times, December 11, 2022

These claims are nonsense. The Wall Street Journal called the fusion announcement nuclear fusion hype noting that nuclear power stations are at best decades away.

The experiment used lasers to put 1.8 megajoules (MJ) of energy in and got 2.5 MJ out – proving that energy can be successfully released and gained by a Deuterium-Tritium fusion reaction. Unfortunately, they had to use 500 MJ of energy into the lasers so the EROI was 0.005. That’s the worst net energy ratio ever.

No electricity was produced in the experiment. The energy released was mostly waste heat.

But the announcement was timed to support a huge funding measure by the U.S. Congress:

“I’m…proud to announce…the highest-ever authorization of over $624 million this year in the National Defense Authorization Act for the ICF [Inertial Confinement Fusion] program to build on this amazing breakthrough.”

–U.S. Senate Majority Leader Charles Schumer

Let’s suppose for a moment that this experiment proves that fusion is now a commercially viable new source of energy.

Building fusion nuclear power stations for the country is a big project and big projects take time. If, for example, there were full funding and permits to build a major new airport, it would take about nine years to complete.

“Building a major nuclear site with the handling of radioactive waste would make things many times harder. For an experimental and totally unproven nuclear technology like fusion, the problems are nearly insurmountable and would require decades at a minimum.”

–Thomas Overton, nuclear scientist and publisher of PowerMag

…click on the above link to read the rest…

Gutting Germany — Part 3: Diesel

A story of economic suicide in the face of resource depletion

Photo by Jennifer Latuperisa-Andresen on Unsplash

Photo by Jennifer Latuperisa-Andresen on UnsplashIn the past two installments ( here & here ) we have seen how the geology driven decline in coal production in Germany has led to an increase in natural gas consumption and black coal imports. Now, that Russian coal (50% of German imports) has been sanctioned as of August, and that a range of irresponsible policy decisions (combined with an outright attack on German infrastructure) have led to a 55% loss in gas imports, deindustrialization of Germany seems to be an almost certainty. The killer blow, though, has not arrived yet: the loss of diesel fuel supplies.

Energy is the economy. No energy — no economy. Losing of a half of industrial fuel imports (black coal and gas), will eventually lead to a similar loss of German industrial output over time. As we have seen these fuels can be replaced only in part by very expensive and rather sporadic LNG shipments and an increase in low quality domestic lignite production. This means that while the lights and heat will most probably stay on for most of German residents (at least to those who can afford to pay for them), locally produced goods requiring a lot of energy (like aluminum, glass, steel, fertilizer, paper, chemicals etc.) will have to be replaced with imports — leaving an impoverished nation suffering from high inflation behind. Whether intentionally or not, the initially rejected proposal made by the United States Secretary of the Treasury Henry Morgenthau Jr. in a 1944 seems to be slowly becoming a reality.

Roosevelt and Morgenthau, who have been described as “two of a kind” — source

Roosevelt and Morgenthau, who have been described as “two of a kind” — source…click on the above link to read the rest…

Hunting the Twitter Files

Legacy Media Censor Details About Censorship

By Nolan Higdon

More than two years since Big Tech made the historic decision to limit access to the New York Post’s story about President Joe Biden’s son Hunter, users are getting a glimpse into how Twitter came to that decision. However, delusional legacy and social media outlets are doing everything they can to misrepresent and bury the consequential details of the process.

An October 2020 New York Post story titled “Smoking-gun email reveals how Hunter Biden introduced Ukrainian businessman to VP dad” offered sensationalistic photos and details of Hunter’s addiction issues coupled with damning emails indicating that Hunter utilized his connection with his father to curry favor and economic opportunity in foreign countries. At the time, intelligence officials told members of the press that the story was Russian propaganda aimed at influencing that year’s election. As a result, Big Tech platforms limited access to the story including in direct messages which is usually done only in extreme cases such as child pornography.

On Friday, December 2, 2022, Elon Musk promised to release files related to the matter. Soon afterward, journalist Matt Taibbi published a report based on thousands of internal Twitter documents. Taibbi demonstrated that Twitter’s decision to remove the Hunter Biden story was influenced in part by Biden’s campaign. Indeed, as Taibbi described, Twitter’s staff regularly fields phone calls from powerful people in government and acts upon their requests to moderate content. And it’s is not just Twitter. During a 2022 interview with Joe Rogan, co-founder, chairman, and CEO of Meta (formerly Facebook) Mark Zuckerberg admitted that his company’s decision to moderate content – including the 2020 Hunter story – is sometimes based on recommendations from the intelligence community. Similarly, The Intercept reported in 2022 that the Department of Homeland Security regularly informs Big Tech’s content moderation practices.

…click on the above link to read the rest…

The End of Europe: The Conclusion of a Long Historical Cycle.

The failure of the European Union may have started with the choice of the flag. Not that state flags are supposed to be works of art, but at least they can be inspiring. But this flag is completely flat, unoriginal, and depressing. It looks mostly like a blue cheese pizza gone bad. And that’s just one of the many things gone bad with the European Union. (attempts to make it more appealing failed utterly). It is the conclusion of a thousand-year cycle that’s coming to an end. It was probably unavoidable, but that doesn’t make it less painful.

The failure of the European Union may have started with the choice of the flag. Not that state flags are supposed to be works of art, but at least they can be inspiring. But this flag is completely flat, unoriginal, and depressing. It looks mostly like a blue cheese pizza gone bad. And that’s just one of the many things gone bad with the European Union. (attempts to make it more appealing failed utterly). It is the conclusion of a thousand-year cycle that’s coming to an end. It was probably unavoidable, but that doesn’t make it less painful. Europe has a long history that goes back to when the ice sheets retreated at the end of the last ice age, some 10,000 years ago. At that time, our remote ancestors moved into a pristine land, cultivated it, built villages, roads, and cities. They traveled, migrated, fought each other, created cultures, built temples, fortresses, and palaces. On the Southern coast of Europe, a lively network of commercial exchanges emerged, made possible by maritime transportation over the Mediterranean Sea. Out of this network, the Greek civilization was born, and then the Roman Empire appeared around the end of the first millennium BCE. It included most of Western Europe. (image from ESA)

As all empires do, the Roman Empire went through its cycle of glory and decline. In the 5th century AD, as Europe entered the Middle Ages, the Empire had disappeared except as a memory of past greatness. In the following centuries, the population of Western Europe declined to a historical minimum, maybe less than 20 million people. Europe became a land of thick forests, portentous ruins, small villages, and petty warlords fighting each other. No one could have imagined that, centuries later, Europeans would become the dominators of the world.

…click on the above link to read the rest…

December 14, 2022

More Than Half of Canadians Worried About Putting Food on the Table: Poll

A woman shops for produce in a grocery store in Toronto, Canada, in a file photo. (Nathan Denette/The Canadian Press)More Than Half of Canadians Worried About Putting Food on the Table: Poll

A woman shops for produce in a grocery store in Toronto, Canada, in a file photo. (Nathan Denette/The Canadian Press)More Than Half of Canadians Worried About Putting Food on the Table: PollA new poll suggests that more than half of Canadians surveyed are worried about having enough money to put food on the table, while 86 percent of people are worried the country will face an economic recession in 2023.

Food inflation is reported at higher than 10 percent, and the most recent Canada Food Price Report released Dec. 5 says the cost of groceries will increase another 5 to 7 percent on average next year. These are the highest increases in food prices in the last 12 years that the report has been produced.

“This year’s report predicts that a family of four, including a man (age 31–50), woman (age 31–50), boy (age 14–18), and girl (age 9–13) will pay up to $14,767.36 for food, an increase of up to $966.08 from the total annual cost in 2021,” said the report.

Food price increases in Alberta, British Columbia, Newfoundland and Labrador, Ontario, and Saskatchewan will likely be higher than the national average in 2022, while price increases in the remaining provinces will be lower.

Gas Costs

Besides food prices, Canadians are also worried about putting gas in their cars and trucks. Sixty-one percent of 1,005 adult Canadians surveyed Nov. 11–15 in the Ipsos poll commissioned by Global News said they were worried they may not be able to afford fuel for their vehicles.

Seventy-one percent were worried that interest rates will rise too fast, while 42 percent said they were worried about losing their jobs if the economy did not rebound.

Fifty-two percent of Canadians surveyed said they were worried they would be short of money to buy Christmas gifts, and 48 percent said they were worried about overspending during the holidays. Eighty-one percent of those surveyed were worried inflation was making everyday items less affordable.

…click on the above link to read the rest…

No Surprise: Wall Street Wants to Raise the Target Inflation Rate above 2 Percent

Price inflation in the United States remains stubbornly high, with October’s print at 7.7 percent. The Fed’s preferred measure, so-called core inflation is only two-tenths of a percent below 40-year highs, at 6.3 percent. Yet, it was just last year that the Federal reserve and other “experts” were concerned that inflation wasn’t high enough. In January 2021, for example, Jerome Powell stated that the Fed wanted price inflation to run above the “2-percent goal” because it had run below 2 percent for too long. The 2-percent inflation target, of course, is the arbitrary target picked by the Federal Reserve (and many other central banks) as the “correct” inflation rate.

Now with inflation running near 40-year highs, many are wondering what will be necessary to bring price inflation back down to the target level. More specifically, how many hikes in the target interest rate will be necessary, and how severe of a recession will be required? Wall Street is especially interested in the answer to this question because Wall Street is no longer about fundamentals. Rather, the “market” depends overwhelmingly on how much easy money the central bank pumps out. Naturally, the banker class wants a return to “normal”—i.e., quantitative easing and ultralow interest rates—as soon as possible. Moreover, Washington wants the same thing since the political class wants low interest rates to help ease the path to ever more government debt and higher deficits.

It’s not the least bit surprising that we’re already hearing calls for the Federal Reserve to abandon the 2-percent inflation target and instead embrace even higher perpetual inflation rates. For example, last week Bank of America economist Ethan Harris suggested that the 2-percent target CPI inflation rate be raised. We’ve seen similar urgings from both the Wall Street Journal and from think tank economists in recent months.

…click on the above link to read the rest…

Kremlin Vows To Take Out Patriot Batteries If US Sends To Ukraine

Russia has responded Wednesday to the prior day report from Pentagon sources that the Biden administration is finalizing plans to send Patriot anti-air defense missiles to Ukraine, in what will constitute the longest range defense systems transferred from the West to date.

“The Kremlin said on Wednesday that U.S. Patriot missile defense systems would be a legitimate target for Russian strikes against Ukraine, should the United States authorize them to be delivered to support Kyiv,” Reuters reports.

The Russian military has long sought to target both Western arms depots inside Ukraine, as well as inbound shipments traversing the country, which is part of the reason why early on in the invasion it heavily targeted the national rail network.

Deputy chairman of the Security Council of Russia Dmitry Medvedev posted the following warning statement directed at the US to his Telegram account (machine translation):

“If, as Stoltenberg hinted, NATO supplies Kyiv fanatics with Patriot complexes along with NATO personnel, they will immediately become a legitimate target of our Armed Forces. I hope the Atlantean impotents understand this.”

As for potential delivery of Patriot systems, The Washington Post reports according to the latest, “The plan is not yet approved by President Biden or Defense Secretary Lloyd Austin, but it could be soon, the officials said, speaking on the condition of anonymity to detail sensitive internal deliberations.”

An initial CNN report said approval could come as early as this week, but it could take a significant amount of time to train the Ukrainians on the sophisticated Patriots’ operation. Training would likely occur in Germany and could take months.

…click on the above link to read the rest…

The Mother of all Economic Crises

Nouriel Roubini, a former advisor to the International Monetary Fund and member of President Clinton’s Council of Economic Advisors, was one of the few “mainstream” economists to predict the collapse of the housing bubble. Now Roubini is warning that the staggering amounts of debt held by individuals, businesses, and the government will soon lead to the “mother of all economic crises.”

Roubini properly blames the creation of a debt-based economy on the near-or-at-zero interest rate and quantitative easing policies pursued by the Federal Reserve and other central banks. The inevitable result of the zero-interest and quantitative easing policies is price inflation wreaking havoc on the American people.

The Fed has been trying to eliminate price inflation with a series of interest rate increases. So far, these rate increases have not significantly reduced price inflation. This is because rates remain at historic lows. Yet the rate increases have had negative economic effects, including a decline in the demand for new homes. Increasing interest rates make it impossible for many middle- and working-class Americans to afford a monthly mortgage payment for even a relatively inexpensive home.

The main reason the Fed cannot raise rates to anywhere near what they would be in a free market is the effect it would have on the federal government’s ability to manage its debt. According to the Congressional Budget Office (CBO), interest on the national debt is already on track to consume 40 percent of the federal budget by 2052 and will surpass defense spending by 2029! A small interest rate increase can raise yearly federal debt interest rate payments by many billions of dollars, increasing the amount of the federal budget devoted solely to servicing the debt.

…click on the above link to read the rest…

December 13, 2022

OPEC Production Fell In November, But 3 Members Actually Boosted Output

OPEC’s crude oil production fell by an average of 744,000 barrels per day, according to OPEC’s Monthly Oil Market Report released on Tuesday.

Saudi Arabia’s November production fell by the most among its members, by 404,000 bpd, to 10.474 million bpd—Saudi Arabia’s lowest monthly average since May 2022.

Other significant production decreases were realized by the United Arab Emirates, which saw a decrease of 149,000 bpd in November, landing at 3.037 million bpd; Kuwait, which saw a dip of 121,000 bpd to 2.685 million bpd; and Iraq with a loss of 117,000 bpd to 4.465 million bpd.

Overall, OPEC’s average production for November fell to 28.826 million bpd—the lowest average production level since June.

While the overall production was significantly lower for November and largely in line with OPEC’s plan to reduce output in response to market conditions, a handful of members increased their production.

Libya’s production also decreased by 32,000 bpd, to 1.133 million bpd. Earlier this week, Libya’s oil minister said its oil production was 1.2 million bpd. “We hope to return to 2010 levels, which was 1.6 million bpd, within two or three years,” Oil Minister Mohamed Oun told reporters on Monday.

Libya lifted its force majeure on oil and gas last exploration last week in hopes of luring foreign oil companies back into the country that has seen significant unrest in recent years.

Angola, Gabon, and Nigeria went the other way, increasing their production by a collective 132,000 bpd.

While OPEC saw its overall crude production fall, non-OPEC liquids production, according to OPEC’s latest report, increased month on month in November by 800,000 bpd to 72.7 million bpd. This figure is also 2.1 million bpd higher than the same month last year.

This means that OPEC’s share of crude oil in the global production mix slipped by 0.7%, to 28.4% in November from the month prior.