Steve Bull's Blog, page 1335

August 21, 2017

One Statistics Professor Was Just Banned By Google: Here Is His Story

Statistics professor Salil Mehta, adjunct professor at Columbia and Georgetown who teaches probability and data science and whose work has appeared on this website on numerous prior occasions, was banned by Google on Friday.

What did Salil do to provoke Google? It is not entirely clear, however what is clear is that his repeated attempts at restoring his email, blog and other Google-linked accounts have so far been rejected with a blanket and uniform statement from the search giant.

Here is what happened, in Salil Mehta’s own words.

Don ’ t do a googol of evil

Freedom is not free unless corporations who exert a large influence in our lives believe in our well-being. I am a statistics professor and understand that there needs to be reasonable standards to control a large social network and make sure everyone is able to enjoy it freely. Invariably people disagree (we all see this), but some principles, such as simply showing probability and statistics with the sole hope of educating others, should be acceptable and in the middle of the distribution. I am for a higher standard, and a higher purpose. There is great care that I have taken to make sure that people treat one other well, admit faults, and present math and probability education to a wide audience.

On Friday afternoon East Coast Time by surprise, I was completely shut down in all my Google accounts (all of my gmail accounts, blog, all of my university pages that were on google sites, etc.) for no reason and no warning. A number of us were stunned and unsure, but clearly we know at this point it wasn’t an accident. Here are some examples commented from best-selling author Nassim Taleb, and they have been retweeted by government officials, and the NYT and WSJ journalists.

…click on the above link to read the rest of the article…

August 20, 2017

Marc Faber: In the Age of Cyber-Terrorism, Every Investor Must Own Gold

Take it from “Dr. Doom”: own some physical gold and keep it out of the banking system.

Dr. Marc Faber, a legendary investor and the editor/publisher of the Gloom, Boom & Doom Report, is well known for his contrarian investing style.

In a recent Metal Masters interview with the Hard Assets Alliance, he noted that the biggest geopolitical risk for Americans today is not a conventional war but rather cyber-attacks that could take down the US power grid.

In such a scenario, gold would become an irreplaceable medium of exchange. But it’s not the only reason to own gold today.

Diversified Assets Outside the Banking System

Faber grew up in Switzerland right after World War II, a tough time that caused his family to distrust paper money and taught him the importance of precious metals as a safety net.

Faber remembers how his father talked about rich people as millionaires. “That, in the ‘50s and ‘60s and ‘70s, was a lot of money. Today, a million is nothing at all—small change. Unfortunately. When people talk about, ‘Oh, there is no inflation in the system,’ this is nonsense. Compared to assets, money has lost a tremendous amount of purchasing power.”

After working on Wall Street for over two decades, Faber’s assets consisted mainly of bonds, equities, and real estate. He says it was in the 1990s when he realized that “it’s good to have a diversified asset outside the banking system and not financially related” and began to purchase some physical gold every month.

The Fed largely ignores gold as an asset, he says, because “gold is an embarrassment to central banks.”

…click on the above link to read the rest of the article…

A 1970s self-help guru’s hint why investors may be duped (again)

America’s top forecasters missed the 2008 market crash, during which stock investors lost half their money. Now with stocks approaching bubble territory it looks they are again ignoring warnings signs. What gives?

The biggest red flag is the S&P 500 index, which groups 500 of America’s largest public companies and is trading near record highs. This despite a sluggish US economy driven by record government spending, borrowing and money printing.

In short, conditions look exactly like those that prevailed just before the 2008 financial crisis, when equities investors lost half their money in a matter of months.

So why haven’t the experts, many of whom are near-genius-level, ivy-league professionals, provided clear warnings about the risks in the system?

The S&P 500 index

Wisdom from a 1970s self-help guru?

One clue might come from consulting creative thinkers from outside the economics profession, like er…Robert Ringer?

Yes that Robert Ringer. The self-help guru, who in his 1970s best-seller Looking out for #1, outlined a useful template to use when assessing human behavior.

“All people act in their own interest all the time,” writes Ringer, who believes that people re-define self-interested actions to make themselves look virtuous.

What Ringer calls the “definition game” enables politicians, like recently-retired ex-Conservative Party leader Rona Ambrose who took home nearly $5 million in salaries and pension benefits for just 13 years work, to describe herself as a “public servant.”

Ringer’s “human nature group” theory in many ways explains modern human action better than Hobbes, Nietzsche and even Ayn Rand, yet appears dark when applied to individuals – even to politicians. However it has a strong basis in academic theory.

…click on the above link to read the rest of the article…

China’s Plunge Protection Team Holds $150 Billion In Stock, Claims “State Meddling” Stabilizes Markets

It was two years ago, in June of 2015, when just as the Shanghai Composite was flirting with 5,000 and when literally the local banana stand guy was trading stocks, that the Chinese stock bubble burst, unleashing an unprecedented selling spree, a 40% drop in just two months, and Beijing’s nationalization of the stock market, courtesy of the domestic plunge protection team, the China Securities Regulatory Commission also known as the “National Team”.

The decision by local authorities to effectively shut down price discovery had a huge confidence crushing impact on local investor confidence. As Gavekal Research put it overnight, “the lack of trust was crystallized by the decision in the summer of 2015 to “shut down” the equity markets for a while and stop trading in any stock that looked like it was heading south. That decision confirmed foreign investors’ apprehension about China and in their eyes set back renminbi internationalization by several years, if not decades.”

Understandably, with the realization that China (or any other nation for that matter), no longer has a an efficient, discounting stock market, but merely a policy tool meant to inspire confidence on the way up, and punish short sellers and “speculators” on the way down, the China Securities Regulatory Commission kept a low profile: after all why remind traders and investors that the local market only exists in the imaginations of several Beijing bureaucrats who sit down every day to decide the “fair value” of all market-traded equities.

That changed last week, when for the first time in years, the Chinese Plunge Protection Team broke its silence and said that “state meddling has successfully stabilized China’s US$7 trillion stock market by curbing volatility and steering valuations to rational levels.”

…click on the above link to read the rest of the article…

North Korea Threatens “Merciless Strike” As US-South Korea Wargames Begin

Residents of Japanese coastal towns are holding evacuation drills as North Korea warned Sunday that the upcoming US-South Korea military exercises are “reckless behavior driving the situation into the uncontrollable phase of a nuclear war.”

Nearly 130 people took part in the drill in Kotoura, which has a population of 18,000, a town official said. Reuters reports that for 10 minutes, people ducked down covering their heads with their arms. Many of those taking part said they were worried. North Korea has in the past threatened to attack Japan, a staunch U.S. ally and host to U.S. military bases.

As sirens blared from speakers in the town of Kotoura, children playing soccer outside ran to take shelter in a school, along with their parents and their team coach.

“I’ve been concerned every day that something might fall or a missile could fall in an unexpected place due to North Korea’s missile capabilities,” said the coach, Akira Hamakawa, 38.

As a reminder, Japan is the only country in the world to be attacked with nuclear weapons, and so perhaps the threats from North Korea today are a little closer to heart than for many around the world.

Following North Korean leader Kim Jong Un’s statement last week that he would “watch a little more the foolish and stupid conduct of the Yankees,” as US-South Korean military exercises begin, CNN reports that Pyongyang also declared that its army can target the United States anytime, and neither Guam, Hawaii nor the US mainland can “dodge the merciless strike.”

The messages in Rodong Sinmun, the official government newspaper, come a day before the US starts the Ulchi Freedom Guardian military exercises with South Korea.

…click on the above link to read the rest of the article…

Video Emerges Showing Clashes Between Indian, Chinese Soldiers

Late last week, we reported that in the first documented clash between Chinese and Indian soldiers who have been piling up across the border between the two nations over the latest territorial dispute, “Indian and Chinese soldiers were involved in an altercation” in the western Himalayas on Tuesday, “further raising tensions between the two countries which are already locked in a two-month standoff in another part of the disputed border.” A Reuters source in New Delhi who was briefed on the military situation on the border, said Indian soldiers “foiled a bid by a group of Chinese troops to enter Indian territory in Ladakh, near the Pangong lake.” He added that some of the Chinese soldiers carried iron rods and stones, and in the melee there were minor injuries on both sides.

“There was an altercation near the Pangong lake,” said a police officer in Srinagar, the capital of India’s Jammu and Kashmir state, under which the area falls. An army source in Srinagar, quoted by Reuters, spoke of an altercation following what he called a Chinese army “incursion in Pangong lake area”. This fresh standoff at Pangong Tso lake in Ladakh comes in the backdrop of tensions between Indian and Chinese troops over Doklam plateau in Sikkim sector with the PLA skipping the ceremonial border meetings on Independence Day.

What is notable about this concerning breakout of violence, is how silent both India and China have been, with neither side issuing an official statement confirming or denying last week’s events.

Overnight, thanks to India’s NDTV, five days after the “unconfirmed” scuffle in Ladakh, a video of the clash has surfaced. The video, which has been widely circulated on social media, shows many soldiers from the two countries punching and kicking each other and throwing stones.

The truth will not be Googled

Google has come under scrutiny by free-speech organisations for shutting down neo-Nazi website, Daily Stormer, seemingly too distracted to notice the tech giant has been waging a censorship campaign against progressive news organisations that publish content which conflicts with the narrative of the Washington establishment, along with Facebook and Twitter on the grounds of ‘fake news’.

Illustration by Rachael Bolton

Illustration by Rachael BoltonWhile web-hosting services have been criticised for cancelling the registration of neo-Nazi website, Daily Stormer, progressive left-leaning sites are losing Google ranking and traffic because of a deliberate move to censor “fake” news by the internet search giant.

New data released by World Socialist Websites (WSWS) revealed that sites such as Wikileaks, The Intercept, Electronic Frontiers Foundation, the American Civil Liberties Organisation, CounterPunch and many other organisations with the audacity to provide context about the activities of federal governments not reported in mainstream publications have experienced a significant drop in traffic after Google altered its algorithm.

(WSWS is an online news and information service founded by the International Committee of the Fourth International, the leadership of the world socialist movement).

Earlier this week, internet hosting provider, GoDaddy, announced it had cancelled US neo-Nazi website, Daily Stormer, for posting an attack on Heather Heyer, the protester who was murdered at the Klan rally in Charlottesville last week. Google and CloudFlare likewise cancelled its registration after the site tried to move its hosting over to their respective services.

But while these hosting services are being congratulated by some – and condemned by others on free-speech grounds – for ensuring that those looking to commit violence have to work slightly harder to get access to their like-minded Nazi communities, those who own the means of transmission – namely Google, Facebook and Twitter – are still preventing the rest of us from accessing information that allows people to make sense of the world around us.

…click on the above link to read the rest of the article…

Taking Nuclear War Seriously

With remarkably little public debate, the U.S. government has raised the risk of a nuclear conflagration with face-offs against Russia and now North Korea, an existential issue that Dennis J Bernstein discusses with journalist John Pilger.

Emmy-Award winning filmmaker John Pilger’s latest film, The Coming War on China, deals directly with the new projection of U.S. power into Asia, as well as the toll U.S. aggression has already taken on the people of the region.

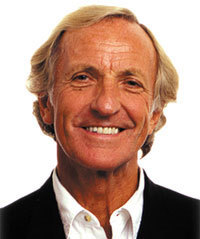

Journalist John Pilger (Wikipedia)

Pilger started his career as a war correspondent in Vietnam and has been a strong critic of U.S. aggression in Asia ever since as he twice won Britain’s Journalist of the Year Award. I spoke to Pilger on August 8 about the dangers from the current face-off between the U.S. and North Korea.

Dennis Bernstein: John Pilger, your new piece is called “On the Beach 2017: The Beckoning of Nuclear War.” Could you give a little context to that title?

John Pilger: I read Nevil Shute’s novel On the Beach for the first time recently. It came out in 1959 and is about the aftermath of nuclear war. Actually, it isn’t about war as such. It is about a great silence. At the front of the book, Shute quotes T.S. Eliot, who wrote “When it happens it will be not with a bang but with a whimper.” The novel is about the last US warship to survive, a submarine. The rest have all gone. The northern hemisphere is completely radioactive. The submarine heads south to Australia but is being followed by this closing blind of radioactivity. It is about a community in Australia that attempts to come to grips with the fact that the radioactivity is coming and will be there by September and that will be the end.

…click on the above link to read the rest of the article…

Gavekal On The Coming Clash Of Empires: Russia’s Role As A Global Game-Changer

Carthago Est Delenda

“Carthage must be destroyed”. Cato the elder would conclude his speeches in the Roman Senate with the admonition that salt should be spread on the ruins of Rome’s rival. Listening to the US media over these summer holidays from Grand Lake, Oklahoma, it is hard to escape the conclusion that most of the American media, and US congress, feels the same way about Russia. Which is odd given that the Cold War supposedly ended almost 30 years ago.

But then again, a quick study of history shows that clashes between land and sea-based empires have been a fairly steady constant of Western civilization. Think of Athens versus Sparta, Greece versus Persia, Rome versus Carthage, England versus Napoleon, and more recently the US versus Germany and Japan (when World War II saw the US transform itself from a land-based empire to a sea-based empire in order to defeat Germany and Japan), and of course the more recent contest between the US and the Soviet Union.

The maritime advantage

Such fights have been staples of history books, from Plutarch to Toynbee. Victory has mostly belonged to the maritime empires as they tend to depend more on trade and typically promote more de-centralized structures; land-based empires by contrast usually repress individual freedoms and centralize power. Of course the maritime power does not always win; Cato the elder did after all get his wish posthumously.

With this in mind, consider a mental map of the productive land masses in the world today. Very roughly put, the world currently has three important zones of production, with each accounting for about a third of world GDP.

…click on the above link to read the rest of the article…

Lord Liverpool and the Return to Gold

The following is an excerpt from Martin Hutchinson’s forthcoming book, “Britain’s Greatest Prime Minister”, a biography of Robert Banks Jenkinson, 2nd Earl of Liverpool (1770-1828). Lord Liverpool was Prime Minister from 1812 to 1827 and had led Britain through the later part of the Napoleonic Wars.

The following is an excerpt from Martin Hutchinson’s forthcoming book, “Britain’s Greatest Prime Minister”, a biography of Robert Banks Jenkinson, 2nd Earl of Liverpool (1770-1828). Lord Liverpool was Prime Minister from 1812 to 1827 and had led Britain through the later part of the Napoleonic Wars.

He was the decisive player in Britain’s resumption of the gold standard in 1821.

Parliamentary background

Definitive reports on cash payments resumption from the Commons and Lords Select Committees were presented on May 6 and 7, 1819. By this time, the economy had definitively turned down, with the temporary euphoria of 1817-18 having ended and a deflation in anticipation of the return to gold having set in.

The Commons report showed that, while the Bank of England, had in 1817 enjoyed gold and cash reserves larger than at any previous time in its history, redemption of old notes had since drained £6.76 million of bullion from it, which had mostly been sold by speculators at a profit, of which around £5 million had been carried to France, according to Alexander Baring.[1] The Commons Committee had accordingly recommended that notes redemption should cease temporarily, since only by a sharp contraction in its notes issue could the Bank reduce the bullion price to a level at which arbitrage was unprofitable.

Bank advances to the government totalled £19.4 million in Exchequer Bills at April 29, 1819, down from a maximum of £34.9 million in August 1814. Conversely, the public balances held by the Bank had declined from around £11 million in 1807 to £7 million currently (in consideration of which the Bank had lent the government £3 million interest-free in 1808).

…click on the above link to read the rest of the article…