Steve Bull's Blog, page 1337

August 18, 2017

The Nuclear Solution

When, in the middle of a card game, you realize that you are about to lose your farm, your shirt and your first-born son, you may decide to go for the “nuclear option”: kicking over the card table while reaching for your revolver. Outcomes will vary, but they are by and large preferable to the one you foresee: one of extreme humiliation and poverty. You might be slow in reaching for it and die a painful but quick death from multiple gunshot wounds. You might be the quickest and either kill or disarm your opponents. Or your opponents might run for the exits, leaving you to pick up the money off the floor. The first of these outcomes may seem less than appealing; but supposing your fancy yourself well-armed and quick on the draw, and your opponents to be cowards, you may be able to persuade yourself that this is your best bet. As for worst-case scenarios, one possibility is that your foes will shoot the revolver out of your hand before you get a chance to fire, put a bullet in your gut, take your money, laugh at you, lock you in a woodshed and leave you to die slowly.

This situation is not too dissimilar to the one in which the US currently finds itself. Frankly, I would prefer to write on other subjects, but what is happening right now on our one and only planet is that there is a certain rather large and still influential country that is in the process of rapidly losing its collective mind. Having studied and observed the US over the past 40-odd years, and now observing it from a safe distance of nearly 8000 km, at the moment I can think of no more important subject to discuss, although I hope to get back to subjects more pleasant, peaceful and closer to home sometime soon.

…click on the above link to read the rest of the article…

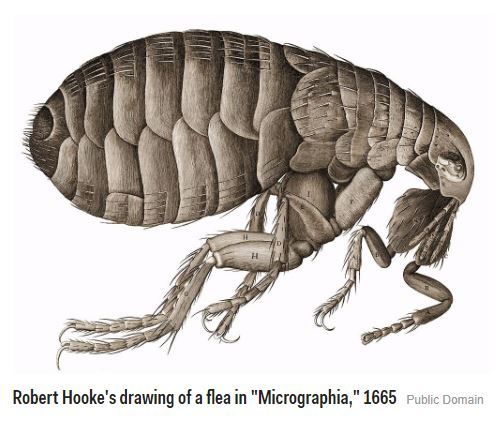

The Black Plague is Back Showing Up in Arizona

This has caused a real flood of emails since it has started right on target. Our model of plagues we wrote : “We certainly seem due for a pandemic, which likely will occur between 2017 and 2020 thanks to the abuse of antibiotics.” We wrote that January 27th, 2016. So far. health officials in two Arizona counties — Navajo County and Coconino County — have reported that fleas tested positive for Yersinia pestis, the bacteria that causes the Black Death plague. Two humans have been infected so far.

In the major pandemic of the 14th century, things were not very clean and rodents roamed freely prospering in cities and houses. This Plague actually regularly appears in the American Southwest killing rodents and prairie dogs. Only occasionally has it made it to humans. Normally, it appears in fleas, rodents, rabbits, and predators which feed upon these animals. The danger is that this is transmitted by a bite. That means a flee bite can infect a human.

In the major pandemic of the 14th century, things were not very clean and rodents roamed freely prospering in cities and houses. This Plague actually regularly appears in the American Southwest killing rodents and prairie dogs. Only occasionally has it made it to humans. Normally, it appears in fleas, rodents, rabbits, and predators which feed upon these animals. The danger is that this is transmitted by a bite. That means a flee bite can infect a human.

The symptoms of plague in humans generally appear within two to six days following exposure and include fever, chills, headaches, weakness, muscle pain, and swollen lymph glands. The disease can spread throughout the bloodstream and/or pneumonic may appear in the lungs.

Today, this is curable with proper antibiotic therapy if diagnosed and treated early.

Rig Count Drops Most In 7 Months As ‘Traders’ Panic-Buy Crude Futures

The US oil rig count dropped 5 to 763 last week, the biggest drop in 7 months. However, crude production from the Lower 48 has surged (rising the most since June last week) to the highest since July 2015. Even with today’s sheer farce panic-buying squeze higher in WTI crude, oil looks set for its 3rd weekly close lower as BNP notes the “whole supply surplus story is not likely to go away anytime soon.”

*U.S. OIL RIG COUNT DOWN 5 TO 763 , BAKER HUGHES SAYS :BHGE US

*U.S. GAS RIG COUNT UP 1 TO 182 , BAKER HUGHES SAYS :BHGE US

As we have noted previously, this inflection point in the rig count fits with the rolover in crude prices…

While the rig count growth has stabilized, crude production continues to rise in the Lower 48 (though had dropped in Alaska for 3 straight weeks) but both saw a rise this week (total production up 79k) as Lower 48 production hit its highest since July 2015…

Bloomberg notes that U.S. oil production from major shale plays is set to hit another record at 6.15 million barrels a day next month, according to the EIA. It’s not just the Permian that’s growing, as the agency sees higher output across the board.

WTI Crude remains lower on the week despite the panic-buying… with no catalyst at all except bannon momentum ignition in USDJPY.

Soime chatter on the crude curve – “Flat price is finally catching up with some of the signs we’ve seen that the physical market is tightening,” Clayton Rogers, an energy derivative broker at SCS Commodities, says.

Why There Will Be No 11th Hour Debt Ceiling Deal

A new milestone on the American populaces’ collective pursuit of insolvency was reached this week. According to a reportpublished on Tuesday by the Federal Reserve Bank of New York, total U.S. household debt jumped to a new record high of $12.84 trillion during the second quarter. This included an increase of $552 billion from a year ago.

A new milestone on the American populaces’ collective pursuit of insolvency was reached this week. According to a reportpublished on Tuesday by the Federal Reserve Bank of New York, total U.S. household debt jumped to a new record high of $12.84 trillion during the second quarter. This included an increase of $552 billion from a year ago.

Moreover, this marked the second consecutive record high on a quarterly reported basis for U.S. household debt. Indeed, this is a momentous achievement. From our vantage point, it is significant for several reasons.

One, it shows U.S. household debt has returned to its upward trend which had previously gone uninterrupted from the close of World War II until the onset of the Financial Crisis in late 2008. Second, it demonstrates that, like the S&P 500, new all-time highs are being attained with the seeming precision of a quartz clock. Is this just a coincidence?

More than likely, it’s no coincidence at all. More than likely, the mass quantities of central bank liquidity that have been injected into the financial system over the last decade have provided the plentiful gushers of cheap credit that have pushed up both stock prices and household debt levels. But remember, the easy stock market gains can quickly recede while the increased debt must first drown the borrowers before it can be expunged.

To understand where the liquidity has come from, look no further than the total combined assets of the Federal Reserve, European Central Bank, and the Bank of Japan. They were around $4 trillion a decade ago. Today, they’re over $13.8 trillion. And if you include the People’s Bank of China’s assets, combined major central bank assets jump to nearly $19 trillion.

…click on the above link to read the rest of the article…

“Armageddon Risk” Returns: North Korea Predicts “Catastrophe” As Massive U.S. War Games Begin Monday

Traders barely had time to enjoy the lull from the “Armageddon trade” – the rising possibility of a nuclear exchange between the US and North Korea, which peaked over the weekend when various US officials said a nuclear war is not imminent, echoed by a statement by N. Korea’s state-run news agency KCNA, before a new set of worries promptly took over, chief among them the ongoing slow motion train wreck in Donald Trump’s administration coupled with yesterday’s double terrorist attacks in Spain. Alas, “nuclear war” risk is about to come back with a vengeance because on Monday US and South Korea are scheduled to begin joint military exercises, a massive show of force which every time in the past has infuriated North Korea, sometimes triggering a show of force.

Held every fall in South Korea, the Ulchi-Freedom Guardian war games are the world’s largest computerized command and control exercise. Some 30,000 U.S. soldiers and more than 50,000 South Korean troops usually take part, along with hundreds of thousands of first responders and civilians, some practicing for a potential chemical weapons attack.

Scheduled long before the recent diplomatic fallout between Washington and Pyongyang, the U.S. and South Korean militaries will simulate warfare with North Korea from Aug. 21 to 31, well aware that North Korea could respond with another missile test, according to McClatchy.

In light of this perceived provocation by North Korea, which will almost certainly prompt some reaction, Scott A. Snyder, a Korea specialist with the Council on Foreign Relations said “Over the course of the next two weeks I expect tensions to escalate. This is always a sensitive issue, but it is more hair-trigger as the North Koreans are very sensitive to the likely additional nuclear-capable aircraft flyovers.”

…click on the above link to read the rest of the article…

August 17, 2017

How to Build a 30-Day Emergency Food Supply…Fast

If you’ve been paying attention to the news lately, you may be feeling on edge. You may feel as though time i

If you’ve been paying attention to the news lately, you may be feeling on edge. You may feel as though time is running out for you to get your preparedness supplies and emergency food in order. You may be new to prepping, and feeling like there’s too much to accomplish. The stress in our country is at peak level. We’ve listened to the war drums beat louder. We’ve witnessed riots breaking out in cities across America. We’ve watched the bumbling efforts of officials to respond to natural disasters and potential pandemics. Threats are everywhere, and you may be in the situation where you need to build an emergency food supply fast.

This feeling of urgency can make you feel hopeless and panicked, and that’s not productive. There’s no time for a lack of productivity. It’s time to focus and create your food supply immediately. If an event occurs during which you are unable to leave your home, you’ll want to make certain that you can keep food on the table without waiting for a handout to be doled out at the whim of some government agency. Such an event could be a mandatory quarantine or self-imposed isolation due to a pandemic, civil unrest in your town, martial law, a nuclear event, or even a natural disaster that leaves you stranded, without access to the store.

Generally, I write about healthy food. I write about focusing on whole foods without additives, and I firmly believe that is the very best way to build your food supply. I believe strongly in the value of a pantry that you will use day to day to nourish your family. You can learn how to build a pantry like that in my book The Pantry Primer: A Prepper’s Guide to Whole Food on a Half Price Budget.

…click on the above link to read the rest of the article…

Governments to Control Large Cash Transactions

I have been pointing out the crisis we face moving forward. The gist of this is the total fiscal mismanagement of government for which we, the people, are always blamed. This hunt for taxes has led down the path of arguments for eliminating currency. While people think Bitcoin is an answer, they do not understand government’s hunt for taxes no less the lack of a true rule of law. The government need only pass a law that anyone who fails to report what they have in Bitcoin is criminal and they get to confiscate all your assets.

Switzerland has its “wealth tax” which they argue is nothing just 0.02%. However, it requires you to report all assets worldwide. They then know precisely what you have and it is merely one vote away at anytime to raise the tax or impose criminal penalties for failure to report everything. Yet, once Switzerland has that info, under G20 they must share it with all other governments.

We have stood by and watched India cancel all high denomination notes. Try walking around with €500 notes in Europe and they look at you funny or won’t accept them. ATM machines have been reduced in Europe to taking a maximum of €200 in cash at best. This is all th hunt for taxes because government cannot function ethically no less morally.

Now the German Federal Minister of Finance, Wolfgang Schäuble, is proposing to control all large cash transactions claiming this will prevent black money transactions and money laundering. Of course, they see these two issues not as typical crime like drugs, but tax avoidance.

…click on the above link to read the rest of the article…

Korean War Part II: Why It’s Probably Going To Happen

Though a lot of people in my line of work (alternative economic and geopolitical analysis) tend to be accused of “doom mongering,” I have to say personally I am not a big believer in “doom.” At least, not in the way that the accusation insinuates. I don’t believe in apocalypse, Armageddon or the end of the world, nor do I even believe, according to the evidence, that a global nuclear conflict is upon us. In fact, it annoys me that so many people seem desperate to imagine those conclusions whenever a crisis event takes shape.

I think the concept of “apocalypse” is rather lazy — unless we are talking about a fantastical movie scenario, like a meteor the size of Kentucky or Michelle Obama’s Adam’s apple hurtling towards the Earth. Human civilization is more likely to change in the face of crisis rather than end completely.

I do believe in massive sea changes in societies and political dynamics. I believe in the fall of nations and empires. I believe in this because I have seen it perpetually through history. What I see constant evidence of is that many of these sea changes are engineered by establishment elitists in government and finance. What I see is evidence of organized psychopathy and an agenda for total centralization of power. When I stumble upon the potential for economic disaster or war, I always ask myself “what is the narrative being sold to the public, what truth is it distracting us from and who REALLY benefits from the calamity.”

The saying “all wars are banker wars” is not an unfair generalization — it is a safe bet.

…click on the above link to read the rest of the article…

Analyst Lays Out China’s “Doomsday” Scenario

The first time we laid out the dire calculations about what is perhaps the biggest mystery inside China’s financial system, namely the total amount of its non-performing loans, by former Fitch analyst Charlene Chu we called it a “neutron bomb” scenario, because unlike virtually every other rosy forecast the most dire of which topped out at around 8%, Chu argued that the amount of bad debt in China was no less than a whopping 21% of total loans.

Corporate investigator Violet Ho never put a lot of faith in the bad loan numbers reported by China’s banks: crisscrossing provinces from Shandong to Xinjiang, she’s seen too much – from the shell game of moving assets between affiliated companies to disguise the true state of their finances to cover-ups by bankers loath to admit that loans they made won’t be recovered. The amount of bad debt piling up in China is at the center of a debate about whether the country will continue as a locomotive of global growth or sink into decades of stagnation like Japan after its credit bubble burst. Bank of China Ltd. reported on Thursday its biggest quarterly bad-loan provisions since going public in 2006.

Charlene Chu, who made her name at Fitch Ratings making bearish assessments of the risks from China’s credit explosion since 2008, is among those crunching the numbers. While corporate investigator Ho relies on her observations from hitting the road, Chu and her colleagues at Autonomous Research in Hong Kong take a top-down approach. They estimate how much money is being wasted after the nation began getting smaller and smaller economic returns on its credit from 2008. Their assessment is informed by data from economies such as Japan that have gone though similar debt explosions.

While traditional bank loans are not Chu’s prime focus — she looks at the wider picture, including shadow banking — she says her work suggests that nonperforming loans may be at 20 percent to 21 percent, or even higher.

…click on the above link to read the rest of the article…

Will EV’s Break The Grid? While the UK government has vowed to end the sale of all new conventional gasoline and diesel cars by 2040, as part of a wider plan to fight air pollution, there is talk that electricity demand will lead to a fast and dirty res

While the UK government has vowed to end the sale of all new conventional gasoline and diesel cars by 2040, as part of a wider plan to fight air pollution, there is talk that electricity demand will lead to a fast and dirty response to a strained power grid.

But here’s what everyone’s missing in that debate: While EV sales are going to rise and electricity demand to power them will strain the grid and lead to less-than-ideal power generation solutions, the whole plan will help clean power generation to increase its market share.

Nothing is black and white. And big transformations are never immediate. We’re not talking about an overnight elixir that will magically clean up the air; we’re talking about a step-by-step process that is gradually less dirty.

Overloading the Grid (Mind the Gap)

The UK’s National Grid anticipates peak demand from electric vehicles alone being around 5 GW, which represents an 8 percent increase from today’s peak demand.

This peak demand forecast assumes what the National Grid calls the “Two Degrees” scenario, in which most cars would be EVS, with only 6 percent of them hybrids. But by 2045, only pure EVs would be on sale.

According to Wood Mackenzie, the UK plan to ban the sale of new gasoline and diesel cars by 2040 “will have a massive impact on the refining sector and the oil markets.”

To handle the extra peak demand, the most flexible way is to build open-cycle gas power plants.

One of the options for a “rapid response” plug-in capacity to make up for shortfalls could come from certain open-cycle gas-fired plants that are more polluting and less efficient.

…click on the above link to read the rest of the article…