Steve Bull's Blog, page 1334

August 22, 2017

How to Build a Low-Carb Prepper Stockpile

Does your health require a diet that is low in sugar and carbohydrates but high in protein? If that’s the case, you may have found that building a low-carb prepper stockpile is pretty difficult. After all, “beans and rice” is the prepper standby. And those buckets of food? Forget it if you’re watching carbs. The meals are all based on rice, pasta, and potatoes.

So how do you create pantry full of freeze-dried food for a low-carb prepper?

Why people are eating lower carbohydrate diets

There are many health concerns that require a diet that is high in protein and low in carbohydrates. To name a few:

Diabetes

Arthritis

Cardiovascular disease

Metabolic Syndrome

Obesity

Colitis/Irritable bowel syndrome

The list goes on and on. Some folks simply feel better when they lower their starch and sugar intake.

Regardless of the reason that you’ve chosen a low-carb lifestyle, going off it abruptly could result in gastrointestinal distress, a recurrence of symptoms, bloating, sluggishness, and joint pain. An emergency would be the worst possible time to deal with that.

Here’s how to build your own low-carb prepper food supply.

At this point, there aren’t really any buckets of food that will meet your needs, so you’ll have to choose an “ala carte” style supply by ordering specific freeze dried foods. A diet of protein, vegetables, and fruit is ideal.

Protein:

Beef

Chicken

Meat combo bucket

Whole eggs

Milk (This may be too high-carb for some diets)

Vegetables:

Tomato Powder

Broccoli

Asparagus

Green Beans

Carrots (this may be too high carb for sensitive people)

Chopped Onion

Fruits:

Some people on lower carb diets restrict fruits, while others consider them “good” carbs. Here are some freeze-dried fruit options.

Apple

Strawberries

Raspberries

Blueberries

Peaches

Pineapple

What would a low-carb prepper menu look like?

…click on the above link to read the rest of the article…

Back to the Future

Last week I succumbed to a bad habit of mine that I’ve been trying to put behind me – leaving snarky comments on ecomodernist websites. I won’t dwell too much here on the ins and outs of the issues, or on ecomodernism itself – hell, there’s a whole page of this site devoted to that, even if it’s not very up-to-date. In this post, I’d just like to extract a few kernels from the issue that are relevant to my next cycle of posts. But first let me venture a working definition of the creed for anyone who’s lived thus far in blessed innocence of it: ecomodernism typically combines overenthusiasm for a handful of technologies as putative solutions to contemporary problems (typically nuclear power and GM crops), underenthusiasm for any social orders other than capitalist modernity, a fetishisation of both humanity and nature as surpassing splendours each in their separate spheres, questionable evidence-selection to support the preceding points, and high disdain for those who take a different view.

Last week I succumbed to a bad habit of mine that I’ve been trying to put behind me – leaving snarky comments on ecomodernist websites. I won’t dwell too much here on the ins and outs of the issues, or on ecomodernism itself – hell, there’s a whole page of this site devoted to that, even if it’s not very up-to-date. In this post, I’d just like to extract a few kernels from the issue that are relevant to my next cycle of posts. But first let me venture a working definition of the creed for anyone who’s lived thus far in blessed innocence of it: ecomodernism typically combines overenthusiasm for a handful of technologies as putative solutions to contemporary problems (typically nuclear power and GM crops), underenthusiasm for any social orders other than capitalist modernity, a fetishisation of both humanity and nature as surpassing splendours each in their separate spheres, questionable evidence-selection to support the preceding points, and high disdain for those who take a different view.The question I want to address in this post is why I get so easily riled whenever I encounter professions of this faith. Well, I guess I got off to a bad start: my first experience of it was a brush with the absurdly apoplectic Graham Strouts, and then the only marginally slicker Mike Shellenberger. I’d acknowledge that there are less strident voices within the movement who genuinely think it represents humanity’s best remaining shot at escaping the dangers encircling us. And since all the remaining shots available to us seem pretty long ones to me, if the ecomodernists could only concede the likely length of those odds I wouldn’t so much begrudge them their schemes. But – other than being the unfortunate possessor of a bilious personality, perhaps the likeliest explanation for my ire – I’d submit three general reasons as to why ecomodernism gets under my skin.

…click on the above link to read the rest of the article…

US Gross National Debt to Spike by $800 Billion in October?

The other option: too ugly to even imagine.

“There is zero chance, no chance we won’t raise the debt ceiling,” swore Senate Majority Leader Mitch McConnell (R., Ky.) at an event in Louisville, Kentucky, on Monday.

He who couldn’t get his Republican ducks all lined up in a row to get any major legislation passed this year was confident that the Senate would pass a bill that would raise the debt ceiling so that the government could continue to pay for things that Congress told the Government to pay for, and so that the government could service its debts, rather than default on them.

Treasury Secretary Steven Mnuchin was there with him, pleading once again for a “clean” debt-ceiling increase, according to the Wall Street Journal. His “magic super Treasury powers” that allow the government to conserve cash to avoid having to issue more debt will expire at the end of September, he said.

“This is not about spending money,” he said. “This is about paying for what we’ve spent, and we cannot put the credit of the United States on the line.”

The debt ceiling is just under $20 trillion. While the government can issue bonds to redeem maturing bonds – and it does this all the time – it cannot allow the gross national debt to go beyond the debt ceiling.

But because it has to continue to pay for things that Congress mandated in its various spending bills over the years, the Treasury scrounges up the money from other government accounts, robbing Peter to pay Paul, so to speak. For example it temporarily short-changes the Civil Service Retirement and Disability Fund. These “extraordinary measures,” as they’re called, or the “magic super Treasury powers,” as Mnuchin called it, run out after a while.

…click on the above link to read the rest of the article…

August 21, 2017

Stock & Bond Markets in Denial about QE Unwind, but Banks, Treasury Dept Get Antsy

“Let markets clear.” It’ll be just “a financial engineering shock.”

Stock and bond markets are in denial about the effects of the Fed’s forthcoming QE unwind, whose kick-off is getting closer by the day, according to the minutes of the Fed’s July meeting.

“Several participants” were fretting how financial conditions had eased since the rate hikes began in earnest last December, instead of tightening. “Further increases in equity prices, together with continued low longer-term interest rates, had led to an easing of financial conditions,” they said. So something needs to be done about it.

And “several participants were prepared to announce a starting date for the program at the current meeting” – so the meeting in July – “most preferred to defer that decision until an upcoming meeting.” So the September meeting. And markets are now expecting the QE unwind to be announced in September.

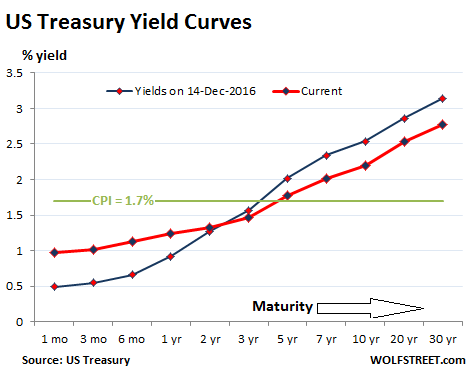

Since then, short-term Treasury yields have remained relatively stable, reflecting the Fed’s current target range for the federal funds rate of 1% to 1.25%. But long-term rates, which the Fed intends to push up with the QE unwind, have come down further. As a consequence, the yield curve has flattened further, which is the opposite of what the Fed wants to accomplish.

The chart shows how the yield curve for current yields (red line) across the maturities has flattened against the yield curve on December 14 (blue line), when the Fed got serious about tightening:

Yields of junk bonds at the riskiest end (rated CCC or below) surged in the second half of 2015 and in early 2016, peaking above 20% on average, as bond prices have plunged (they move in opposite directions) in part due to the collapse of energy junk bonds, which caused a phenomenal bout of Fed flip-flopping.

…click on the above link to read the rest of the article…

Bitcoin in an Illusionary Age

It is altogether fitting that crypto currencies, in particular Bitcoin, have witnessed a meteoric rise in this illusionary age. Not only has their monetary value gone to dizzying heights, but they are now being touted as the destroyer of the current, crumbling monetary order and the next paradigm upon which a new money and banking system will emerge.

In an era where sacrifice, hard work, loyalty, ingenuity, tradition, and independent thought are considered anathemas, while affirmative action, sloth, effeminacy, office seeking, and something-for-nothing schemes are endemic in every walk of life, it is not surprising that non-tangible, computer-generated currencies would become a “natural” feature of such a world.

While it has always been a haven for charlatans, traitors, cheats, thieves, liars, and serial adulterers, contemporary political life has become even more of a sham. The most glaring example of politics’ utter corruption can be seen in the recent departed chief executive officer of the US. Unless one abandons all critical thinking, Obummer was unqualified to be president because of the obvious fact that he was not born on American soil. Not only did this disqualify him, but his educational and professional backgrounds have not been verified. Neither his collegiate records nor his supposed teaching career at the University of Chicago Law School have ever been exposed to public scrutiny. From the few utterances he has made about his supposed specialty – constitutional law – it appears that he has only a rudimentary knowledge of the subject.

Cultural life has descended to the basest of levels and has abandoned nearly all of Western Civilization’s glorious achievements. Consider music. The dominant form of what passes as music today is not the works of the great maestros of the past – Bach, Mozart, Beethoven – but instead, noise in the form of rock, hip hop, rap, grunge, or whatever the latest degenerate trend is in vogue.

…click on the above link to read the rest of the article…

Diminishing Returns

These two words are the hinge that is swinging American life — and the advanced techno-industrial world, for that matter — toward darkness. They represent an infection in the critical operations of daily life, like a metabolic disease, driving us into disorder and failure. And they are so omnipresent that we’ve failed to even notice the growing failure all around us.

Mostly, these diminishing returns are the results of our over-investments in making complex systems more complex, for instance the replacement of the 37-page Glass-Steagall Act that regulated American banking, with the 848 page Dodd-Frank Act, which was only an outline for over 22,000 pages of subsequent regulatory content — all of it cooked up by banking lobbyists, and none of which replaced the single most important rule in Glass-Steagall, which required the separation of commercial banking from trafficking in securities. Dodd-Frank was a colossal act of misdirection of the public’s attention, an impenetrable smokescreen of legal blather in the service of racketeering.

For Wall Street, Dodd-Frank aggravated the conditions that allow stock indexes to only move in one direction, up, for nine years. During the same period, the American economy of real people and real stuff only went steadily down, including the number of people out of the work force, the incomes of those who still had jobs, the number of people with full-time jobs, the number of people who were able to buy food without government help, or pay for a place to live, or send a kid to college.

When that morbid tension finally snaps, as it must, it won’t only be the Hedge Funders of the Hamptons who get hurt. It will be the entire global financial system, especially currencies (dollars, Euros, Yen, Pounds, Renminbi) that undergo a swift and dire re-pricing, and all the other things of this world priced in them. And when that happens, the world will awake to a new reality of steeply reduced possibilities for supporting 7-plus billion people.

…click on the above link to read the rest of the article…

The US Spy Hub in the Heart of Australia

A SHORT DRIVE south of Alice Springs, the second largest population center in Australia’s Northern Territory, there is a high-security compound, code-named “RAINFALL.” The remote base, in the heart of the country’s barren outback, is one of the most important covert surveillance sites in the eastern hemisphere.

Hundreds of Australian and American employees come and go every day from Joint Defence Facility Pine Gap, as the base is formally known. The official “cover story,” as outlined in a secret U.S. intelligence document, is to “support the national security of both the U.S. and Australia. The [facility] contributes to verifying arms control and disarmament agreements and monitoring military developments.” But, at best, that is an economical version of the truth. Pine Gap has a far broader mission — and more powerful capabilities — than the Australian or American governments have ever publicly acknowledged.

An investigation, published Saturday by the Australian Broadcasting Corporation in collaboration with The Intercept, punctures the wall of secrecy surrounding Pine Gap, revealing for the first time a wide range of details about its function. The base is an important ground station from which U.S. spy satellites are controlled and communications are monitored across several continents, according to classified documents obtained by The Intercept from the National Security Agency whistleblower Edward Snowden.

Together with the NSA’s Menwith Hill base in England, Pine Gap has in recent years been used as a command post for two missions. The first, named M7600, involved at least two spy satellites and was said in a secret 2005 document to provide “continuous coverage of the majority of the Eurasian landmass and Africa.” This initiative was later upgraded as part of a second mission, named M8300, which involved “a four satellite constellation” and covered the former Soviet Union, China, South Asia, East Asia, the Middle East, Eastern Europe, and territories in the Atlantic Ocean.

…click on the above link to read the rest of the article…

European Floods and Fake Science

I wrote a post a couple of weeks ago targeting the BBC for biased reporting on energy and climate issues. It was never published because in writing it I realised that the the problem did not necessarily lie with the BBC but with the climate science fraternity. Another alarmist article appeared in Blowout last week covered by the BBC with the headline “Climate change has shifted the timing of European floods” accompanied by a picture of an Alpine village being swept away. The article in question (Blöschl et al [1] published in Science) does not contain any actual data on European floods. The ten year average of peak annual river flow is used instead which is a meaningless proxy for actual flooding. The authors fail to make an empirical connection between trends in peak annual flow and trends in actual flooding which is a basic scientific error.

I wrote a post a couple of weeks ago targeting the BBC for biased reporting on energy and climate issues. It was never published because in writing it I realised that the the problem did not necessarily lie with the BBC but with the climate science fraternity. Another alarmist article appeared in Blowout last week covered by the BBC with the headline “Climate change has shifted the timing of European floods” accompanied by a picture of an Alpine village being swept away. The article in question (Blöschl et al [1] published in Science) does not contain any actual data on European floods. The ten year average of peak annual river flow is used instead which is a meaningless proxy for actual flooding. The authors fail to make an empirical connection between trends in peak annual flow and trends in actual flooding which is a basic scientific error.

The FT also picked up this story citing implications for hydroelectric power and insurers which may well be used as an excuse to raise premiums, yet again. The scientific article in question was published in Science and I decided to have a closer look.

The FT also picked up this story citing implications for hydroelectric power and insurers which may well be used as an excuse to raise premiums, yet again. The scientific article in question was published in Science and I decided to have a closer look.

The BBC headline:

In different parts of Europe, rivers are flooding earlier or later because of rising temperatures, say scientists.

And Blöschl et al say in the abstract:

Warmer temperatures have led to earlier spring snowmelt floods throughout northeastern Europe; delayed winter storms associated with polar warming have led to later winter floods around the North Sea and some sectors of the Mediterranean coast

Polar Warming

Let us begin by taking a look at “polar warming” at the N Pole. We don’t have climate records for the N Pole and so I will use instead 32 high latitude climate stations from either side of the Arctic Circle in Norway, Sweden, Finland and Russia (Figures 1 and 2), as reported in Record Arctic Warmth – in 1937.

…click on the above link to read the rest of the article…

Can Switzerland Survive Today’s Assault on Cash and Sound Money?

“Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world than in Switzerland.”

On many levels, there is reason to believe that, indeed, Switzerland remains a unique oasis of rationality and intelligence in the ocean-wide bloodbath that is contemporary Western fiscal and social self-sabotage. On the other hand, there is the Swiss National Bank — the central bank — that oddly appears to be encouraging the same monetary policy dance-with-death that has tripped up the country’s masochistic neighbors. How viable yet is the Swiss element in that which we still admire as the nation of Switzerland? First the good news:

Direct democracy is alive and kicking: No mere opinion poll, the power and vibrancy of the referendum — one that can be launched by any local who can gather 100,000 signatures in support — constitutes one of the most impressive displays of true citizen-republicanism that there is. There is an upcoming vote on the Swiss Sovereign Money Initiative — a movement to obstruct financial speculation; recent referendums that were voted into law include a phasing out of nuclear energy to be replaced by renewables, and easier naturalization of third-generation immigrants.

Cash is still very much king and carrying around personal debt is a social blackmark. In fact, the love of cash has a counter-cultural dimension to it as an anti-State, anti-globalist, anti-anti-privacy gesture intended to underscore the Swiss love of freedom.

…click on the above link to read the rest of the article…

China Warns Of “Looming Trade War” With India In Retaliation To Anti-Dumping Duties

One of the more under-reported stories – at least among the Western press – are the growing tension between China and India. As reported over the weekend, in the latest escalation, Indian and Chinese soldiers, in addition to the ongoing tense military standoff over a contested road in Doklam, were involved in an altercation in the western Himalayas on Tuesday, further raising tensions between the two countries which are already locked in a two-month standoff in another part of the disputed border. A widely circulated clip on social media showed many soldiers from the two countries punching and kicking each other and throwing stones, a clash which luckily ended before it could devolve into something far more dangerous.

Meanwhile, in addition to a territorial dispute that has the potential to devolve into a shooting skirmish at any moment as thousands of troops have amassed on both sides of the border, a trade war also seems to be looming between India and China after New Delhi imposed anti-dumping duties on 93 Chinese products amidst a military standoff in Doklam area, India’s First Post reported last week.

The Indian publication cites an article in China’s state-owned Global Times, which urged Chinese firms to “reconsider the risks” of investing in India and warned New Delhi to be “prepared for the possible consequences for its ill-considered action.” The article said that China “could easily retaliate” with restrictions on Indian products, but added that it “doesn’t make much economic sense” for the country.

Making a less than subtle hint that a trade war would have damaging consequences on the Indian economy, the Global Times cited figures from the Indian embassy in China to show that Indian exports fell by 12.3% year-on-year to $11.75 billion while India’s imports from China rose by 2% to $59 billion, resulting in a trade deficit of $47 billion.

…click on the above link to read the rest of the article…