Steve Bull's Blog, page 1332

August 24, 2017

Fitch Threatens US with Downgrade

Did it forget how the US government hounded Standard & Poor’s?

Bitter irony! Just yesterday, I had a conversation with Bill Tilles, and we agreed on all three points. This morning, we’re already proven wrong on one of them:

A government shutdown as Congress fails to pass spending levels for fiscal 2018? Yes, it could happen.

A failure to raise the debt ceiling, thus pushing the US government into default, or “selective default?” Very unlikely. Lawmakers are political animals that use charades and posturing to accomplish their goals, but they’re not stupid (we hope).

A threat by US ratings agencies to slash the US credit rating due to the debt-ceiling charade and the consequences of a “selective default?” No way, we agreed. Ratings agencies learned their lesson from how the US government hounded Standard & Poor’s after its 2011 downgrade of the US.

A new day, and we’re already wrong. Standard & Poor’s may have learned its lesson. But Fitch Ratings hasn’t – though its language this morning was a lot kinder and gentler (emphasis added).

If the debt limit is not raised in a timely manner prior to the so-called “x date,” Fitch would review the US sovereign rating, with potentially negative implications. We have previously said that prioritizing debt service payments over other obligations if the limit is not raised – if legally and technically feasible – may not be compatible with ‘AAA’ status.

In the most recent letter to Congress, Treasury Secretary Steven Mnuchin said that the US would run out of money by the end of September. This can likely be stretched into October. Just this week, Senate Majority Leader Mitch McConnell swore there was “zero chance” that “we won’t raise the debt ceiling.”

But Fitch adds that Congressional posturing alone could cause a downgrade – the same reason S&P downgraded the US during the debt ceiling fight in 2011. Fitch:

…click on the above link to read the rest of the article…

Two New Totalitarian Movements: Radical Islam and Political Correctness

The attempt in the West to impose a strict set of rules about what one is allowed to think and express in academia and in the media — to the point that anyone who disobeys is discredited, demonized, intimidated and in danger of losing his or her livelihood — is just as toxic and just as reminiscent of Orwell’s diseased society.

The main facet of this PC tyranny, so perfectly predicted by George Orwell, is the inversion of good and evil — of victim and victimizer. In such a universe, radical Muslims are victimized by the West, and not the other way around. This has led to a slanted teaching of the history of Islam and its conquests, both as a justification of the distortion and as a reflection of it.

Thought-control is necessary for the repression of populations ruled by despotic regimes. That it is proudly and openly being used by self-described liberals and human-rights advocates in free societies is not only hypocritical and shocking; it is a form of aiding and abetting regimes whose ultimate goal is to eradicate Western ideals.

Political correctness (PC) has been bolstering radical Islamism. This influence was most recently shown again in an extensive exposé by the Clarion Project in July 2017, which demonstrates the practice of telling “deliberate lies while genuinely believing in them in order to forget any fact that has become inconvenient” — or, as George Orwell called it in his novel, 1984, “Doublespeak.”

This courtship and marriage between the Western chattering classes and radical Muslim fanatics was elaborated by Andrew C. McCarthy in his crucial 2010 book, The Grand Jihad: How Islam and the Left Sabotage America.

Since then, this union has strengthened. Both the United States and the rest of the West are engaged in a romance with forces that are, bluntly, antagonistic to the values of liberty and human rights.

…click on the above link to read the rest of the article…

Beware the real Political Threat from Within

The future of military and eventually police is to replace the boots on the ground with robots. Duke Robotics has come out now with drones that carry machine-guns. This video shows really the future of war and eventually they will use terrorism as an excuse to use them domestically.

Historically, the shape a country’s Armed Forces takes has traditionally reflected first and foremost the external threats that a nation faces. In a democratic republic, the army’s main goal use to be to protect society. We were told that a republic will only commit to such an international obligation on behalf of its own well-being and security. Therefore, in only these type of situations, would an army take on such obligations requiring the use of military force.

The second factor influencing the shape of the a nation’s army was its social role. Most importantly, the army evolved post-Depression acting as a social boon to everyone who serves in it. Because of the abuse of the soldier post-World War I which they used current troops to chase out the veterans from Washington who were demanding their promised Bonus, when World War II came, the politicians had lied and abused the soldiers from World War I, they had to introduce the GI Bill and turn it into a Social Boon that became something beneficial to a specific person with careers and education. When under the Obama Administration, the VA scandal erupted showing that again politicians were cutting costs and vets were denied medical care, that aspect of the army began to fail in this function and the Armed Forces can lose its effectiveness.

The second factor influencing the shape of the a nation’s army was its social role. Most importantly, the army evolved post-Depression acting as a social boon to everyone who serves in it. Because of the abuse of the soldier post-World War I which they used current troops to chase out the veterans from Washington who were demanding their promised Bonus, when World War II came, the politicians had lied and abused the soldiers from World War I, they had to introduce the GI Bill and turn it into a Social Boon that became something beneficial to a specific person with careers and education. When under the Obama Administration, the VA scandal erupted showing that again politicians were cutting costs and vets were denied medical care, that aspect of the army began to fail in this function and the Armed Forces can lose its effectiveness.

…click on the above link to read the rest of the article…

Globalist Strategy: Use Crazy Leftists And Provocateurs To Enrage/Demonize Conservatives

The false left/right paradigm is an often misunderstood concept. Many people who are aware of it sometimes wrongly assume that it asserts the claim that there is “no left or right political spectrum;” that it is all a farce. This is incorrect. In regular society there is indeed a political spectrum among the general populace from socialism/communism/big government (left) to conservatism/free markets/individualism/small government (right). Each citizen sits somewhere on the scale between these two dynamics. The left/right spectrum is in fact real for the average person.

We do not find a ” false” paradigm until we examine the beliefs and behaviors of the elitist and political classes. For many banking oligarchs and high level politicians, there is no loyalty to a particular political party or an identifiable “left” or “right” ideology. Many of these people are happy to exploit both sides of the spectrum, if they can, to achieve the goals of globalism; a separate ideology that doesn’t really serve the interests of groups on the left or the right. That is to say, globalists pretend as if they care about one side or the other on occasion, but in truth they could not care less about the success of either. They only care about the success of their own exclusive elitist club.

This reality also tends to apply to national loyalty as well. Globalists do not carry any ideological love for any particular nation or culture. They are more than happy to sacrifice and sabotage a country if the action will gain them greater power or centralization in return. A globalist is only “Democrat” or “Republican,” or American or Russian or Chinese or European, etc., insofar as the label gets them something that they want.

…click on the above link to read the rest of the article…

Did the Economy Just Stumble Off a Cliff?

The signs are everywhere for those willing to look: something has changed beneath the surface of complacent faith in permanent growth.

This is more intuitive than quantitative, but my gut feeling is that the economy just stumbled off a cliff. Neither the cliff edge nor the fatal misstep are visible yet; both remain in the shadows of the intangible foundation of the economy: trust, animal spirits, faith in authorities’ management, etc.

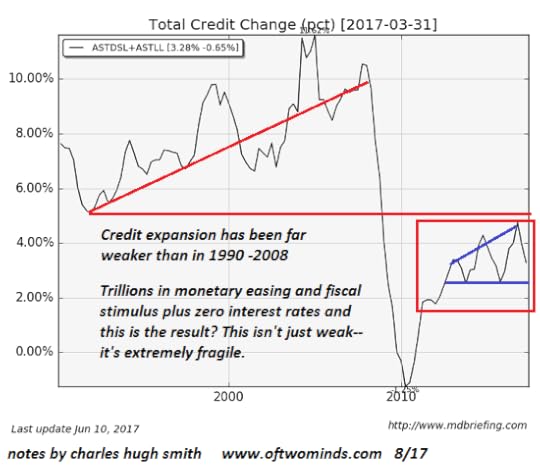

Since credit expansion is the lifeblood of the global economy, let’s look at credit expansion. Courtesy of Market Daily Briefing, here is a chart of total credit in the U.S. and a chart of the percentage increase of credit.

Notice the difference between credit expansion in 1990 – 2008 and the expansion of 2009 – 2017. Credit expanded by a monumental $40+ trillion in 1990 – 2008 without any monetary easing (QE) or zero-interest rate policy (ZIRP). The expansion of 2009 – 2017 required 8 long years of massive monetary/fiscal stimulus and ZIRP.

This chart of credit change (%) reveal just how lackluster the current expansion of credit has been, despite unprecedented trillions of stimulus pumped into the financial sector.

Here are two other snapshots of debt: margin debt and private credit. Both have hit new highs.

Note the tight correlation of margin debt to the S&P 500 stock index: when punters borrow more on margin to buy more stock, stocks keep rising.

When credit stops expanding, the economy stumbles into recession.

Back in the real world, have you noticed a slowing of animal spirits borrowing and spending? Have you tightened up your household budget recently, or witnessed cutbacks in the spending habits of friends and family? Have you noticed retail parking lots aren’t very full nowadays, and once-full cafes now have empty tables?

…click on the above link to read the rest of the article…

The Guardian view on censoring the internet: necessary, but not easy

The Guardian view on censoring the internet: necessary, but not easy

Who should protect us online? And who will guard us from these guards?

Personal abuse, when it is not accompanied by threats of violence or worse, should not be the domain of the government Photograph: Dominic Lipinski/PA

Personal abuse, when it is not accompanied by threats of violence or worse, should not be the domain of the government Photograph: Dominic Lipinski/PAAmong the more absurd things ever said about the internet was that the network “interprets censorship as damage, and routes around it”. The epigram was half true, but the half that was false gets more important every year.

The internet can be a vile place, and the instinct to enforce some standards there is not misplaced. The director of public prosecutions, Alison Saunders, is quite right to say that crime online is as serious as crime offline. Even the Guardian, wedded to the idea of free speech, does not imagine that this is an unrestrained freedom – only that the limits that the law should set are minimal and largely concerned with public order. But some limits must exist, and they must be enforced.

The questions are: who should set these limits and who then should police them? Both governments and private companies have a part to play, even if government action often takes the form of demanding that private companies execute government policies. It is here that Ms Saunders may have gone too far in her zeal to keep the web clean. The justification for government censorship is that some hate speech is an incitement to violence or a dangerous ratcheting of community tensions, whereas some – no matter how offensive – should be permitted by law, even if we are happy for private companies to act against it. Personal abuse, when it is not accompanied by threats of violence or worse, should not be the domain of the government. Courtesy and respect are vital but best enforced by the owners of web spaces.

…click on the above link to read the rest of the article…

August 23, 2017

The Goldman Sachs Regency

The Goldman Sachs Regency

There’s not many tears being shed over Steve Bannon’s departure. His ethno-nationalist and protectionist worldview are opposite to true notions of liberty, free markets and a minimalist state.

While Bannonism presented itself as a coherent alternative ideology to mainstream Big Government, it actually boiled down to an incoherent potpourri of cultural resentments and prejudices, economic shibboleths and amateur historical theorizing. His message appealed to the alt-Right because it proposed to replace oppressive statism with a more right wing version rooted in protectionism and nativism.

Notwithstanding the rotten essence of Bannonism, however, the firebrand self-promoter who was the Donald’s chief strategist got it right in his parting shots at his internal White House enemies. In so many words, he correctly asserted that the nation will now be ruled by a Goldman Sachs Regency and a team of generals.

The move embodies the essence of Albert Einstein’s famous definition of insanity: Doing the same thing over and over and expecting a different result.

“The Trump presidency that we fought for, and won, is over,” Bannon told the conservative Weekly Standard on the Friday after his White House departure. “We will make something of this Trump presidency. But that presidency is over.”

The Donald will now function, as Robert Wenzel aptly described it, as “something of a tweet master frontman” with the Vampire Squid riding higher than ever before. Expect him to be riding even higher than when the George W. Bush handed a blank check to Wall Street for a bailout at the Treasury led by former Goldman CEO, Hank Paulson.

Goldman’s crew in the current White House – Gary Cohn, Steve Mnuchin, Dina Powell and Jared Kushner – are likely to bring about the final destruction of the Trump presidency. The cast of characters will eventually trigger a thundering collapse in the markets which will finally crush Goldman Sachs and its posse of gamblers and crony capitalist.

…click on the above link to read the rest of the article…

They’re Using Bernie Madoff Math to Hide a Crisis

Politicians are always generous with other people’s money… until it runs out.

Near the peak of the late-’90s tech bubble, California’s legislature passed the largest pension increase in its history.

Today, with as much as $750 billion in unfunded public pension debt, California has one of the worst pension situations in the country. But it’s far from alone.

Illinois has a staggering $250 billion in unfunded pension obligations. State pension plans in Connecticut, Pennsylvania, New Jersey, and many other states are taking on water, too.

Unfunded public pension liabilities in the US have surpassed $5 trillion.

Taxpayers Are Stuck With the Bill

There used to be a simple formula for a secure retirement. American workers would work for a big company for decades. Then, at a certain age, they were eligible for a monthly pension check… for life.

Once common, pensions have virtually disappeared from the private sector. Today, less than 4% of companies offer them. It’s another vector in the devalued standard of living of the average American.

Essentially, only government employees get pensions now.

The government isn’t subject to the same constraints as the private sector. So it has no problem promising benefits it can’t afford to pay.

That’s because government revenue doesn’t come from the voluntary exchange of goods or services. It comes from taxes, which it extracts via coercion.

Politicians only care about the next election. So there’s no way to hold them accountable in the long term.

They automatically do the most expedient thing in the short term, like promising extravagant pension benefits. In the long term, their successors have to deal with the consequences.

Naturally, not one of the politicians who voted for California’s record pension increase is still in office.

…click on the above link to read the rest of the article…

Bill Blain On Provident’s Suprime Shock: “Can’t Get Much Worse You’d Think? Oh Yes It Can”

By Bill Blain of Mint Partners

Blain’s Morning Porridge

Provident Financial. What a mess. Is it an opportunity?

Provident has become the story of the week. In case you missed it: the stock has been hammered and its bonds are trading massively down on the back of multiple bad news bullets: an FCA investigation into the Vanquis credit card and loan repayment options, a failed new technology introduction and new staffing approach that caused a leap in defaults from 10% to 43% (!), suspended dividends and the departure of the CEO.

Ouch.

For years Provident was a respected name, secure in its niche supplying credit to the bottom of the UK credit pool. Its experienced independent door-to-door salesmen managed their clients pragmatically – a personal touch that kept defaults low and recoveries high. Earlier this year the model was turned on its head. The independent door-to-door guys were replaced by I-pad wielding scripted staff controlled by head office. The system appears to have collapsed overnight. Defaults soared.

The firm threw away control of its clients.

Venezuela’s ‘Goldman Bounce’ In Reserves Is Gone

The boost in foreign reserves Venezuela enjoyed after Goldman Sachs investment arm picked up $2.8 billion of…

Muppets.

Provident has been described as “uninvestable”.

It looks like a case of classic management incompetence. Replace a tried and tested functional business model with something new that doesn’t work. But there is more to it. It should remind fixed income investors of the importance of cash-flow – and exactly how cash is collected and overseen. Years of experience has taught us that firms with a tight control of their credit processes and sustainable businesses are the ones to invest in.

…click on the above link to read the rest of the article…

Draghi: Trillions In QE Have Made Economies “More Resilient”

When last night we previewed this week’s annual Jackson Hole symposium at which Mario Draghi is scheduled to speak just before the market close on Friday, we said that the ECB head is warming up for the trip by speaking at the Lindau economics symposium in Germany this morning “and as such he could front run himself.” Unfortunately for many who were expecting some advance highlights, Draghi disappointed those who hoped he would preview his Jackson Hole appearance.

So what did Draghi talk about? Instead of previewing the ECB’s inevitable taper (especially as the central bank will soon run out of Bunds to buy at the current pace of monetization), the central banker defended growing criticism of his unorthodox monetary policy, and said the ECB’s policies such as QE and NIRP, saying they have been a success on both sides of the Atlantic, and that the purchase of some $15 trillion in assets has somehow made economies “more resilient.”

Speaking to the Lindau audience of 17 Nobel laureates and 350 young German economists, a nation which has been one of the stiffest critics of ECB policies such as quantitative easing, Draghi’s speech avoided any specific hints on current ECB deliberations, and instead said officials must be “unencumbered by the defense of previously held paradigms that have lost any explanatory power.”

He then launched into a vocal defense of QE, saying that “when the world changes as it did ten years ago, policies, especially monetary policy, need to be adjusted. Such an adjustment, never easy, requires unprejudiced, honest assessment of the new realities with clear eyes, unencumbered by the defense of previously held paradigms that have lost any explanatory power”

…click on the above link to read the rest of the article…