Steve Bull's Blog, page 1316

September 13, 2017

Money Multiplier is Really About Credit Out of “Thin Air”

According to traditional economics textbooks, the current monetary system amplifies the initial monetary injections of money. The popular story goes as follows: if the central bank injects $1 billion into the economy and banks have to hold 10% in reserve against their deposits the initial injection of $1 billion will become $10 billion i.e. money supply will expand by a multiple of 10. Note that in this example the central bank has actively initiated monetary pumping of $1 billion, which in turn banks have amplified to $10 billion.

Economists from the post-Keynesian school of economics (PK) have expressed doubt about the validity of this popular framework of thinking. One of the advocates of this school, Bill Mitchell, in an article on his blog – Money Multiplier and other Myths – wrote that,

It (money multiplier) is also not even a slightly accurate depiction of the way banks operate in a modern monetary economy characterised by a fiat currency and a flexible exchange rate. In the present monetary framework, it is held the job of the central bank is to ensure that the level of cash in the money market is in tune with the interest rate target.

According to Mitchell,

The way banks actually operate is to seek to attract credit-worthy customers to which they can loan funds to and thereby make profit.

Furthermore, according to Mitchell,

So the idea that reserve balances are required initially to “finance” bank balance sheet expansion via rising excess reserves is inapplicable. A bank’s ability to expand its balance sheet is not constrained by the quantity of reserves it holds or any fractional reserve requirements. The bank expands its balance sheet by lending. Loans create deposits which are then backed by reserves after the fact. The process of extending loans (credit) which creates new bank liabilities is unrelated to the reserve position of the bank.

…click on the above link to read the rest of the article…

25% Of Homes In Florida Keys Destroyed By Hurricane Irma

After Hurricane Irma overwhelmed the Florida Keys with 15-foot storm surges and 130 mph winds, causing the worst flooding the chain of islands has experienced in nearly a century, federal officials’ first assessment of the damage suggests that nearly a quarter of the homes on the island were destroyed, according to the Associated Press. While not every home is beyond repair, officials said no structures escaped some form of damage.

“Basically every house in the Keys was impacted in some way or another,”Federal Emergency Management Agency Administrator Brock Long said at a news conference. “This is why we ask people to leave.”

While residents and business owners in the Upper Keys as far south as Islamorada were allowed back into the area Tuesday morning, Monroe County officials urged people to stay away. “Fuel, water, power & medical super limited,” the county said on Twitter, according to WSJ. The county has about 53,000 housing units, census figures show. Nearly all are on the Keys, a 110-mile ribbon of low-lying islands linked by bridges. Monroe County is home to 79,000 people, the vast majority of whom live on the archipelago.

Elsewhere, federal authorities have maintained their mandatory evacuation order during the early stages of the cleanup. Throughout the state, some 155,000 people are still in shelters and more than 9 million Floridians lack power, exposing them to the unpleasant summer heat. That’s compared with roughly three-quarters-of-a-million customers were still without power in Georgia and the Carolinas by late Tuesday, according to local utilities.

Meanwhile, workers Tuesday rushed to find any victims who had remained on the islands during the storm, and deliver food and water.

“It’s going to be pretty hard for those coming home,” said Petrona Hernandez, whose concrete home on Plantation Key with 35-foot walls was unscathed, unlike others a few blocks away. “It’s going to be devastating to them.”

…click on the above link to read the rest of the article…

The Coming One World Currency

QUESTION: Dear Marty,

I sure would appreciate any thoughts you have on rumors making the rounds that the International Monetary Fund has tipped its hand, in part via its June 2017 “Fintech and Financial Services: Initial Considerations” IMF Discussion Note, and intends to replace the US Dollar as the global reserve currency as early as January 2018 (probably later) with its decades-old Special Drawing Rights by converting the “foreign-exchange reserve assets” into a global currency using Distributed Ledger (Blockchain) technology.

It is only a matter of time until US hegemony built upon its reserve currency status (as well as other factors) goes the way of T. Rex. And, I have long believed that, while DLT (Distributed Ledger technology) is not going away, that it will be the IMF/Central Banks/Sovereigns who will end up creating their own horse in this reserve currency race that will win based upon “global” legislation and regulation … but 2018 is right around the corner.

GH

ANSWER: No. This is really rubbish. I can’t believe how many people are writing in asking about this subject matter. Nevertheless, a new one-world currency is coming. It will be different from what anyone imagines. But so many people hate the dollar because they see this as keeping gold down. You better understand what is really taking place before you start making a wish.

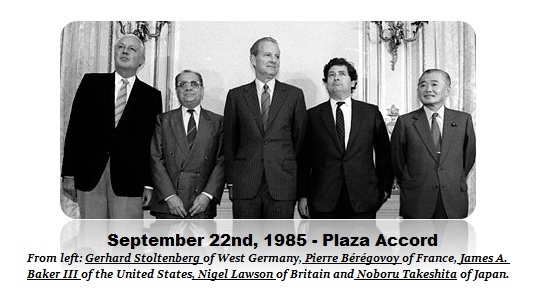

What makes the dollar the reserve currency is the national debt. It is the only game in town to park big money. All of these conspiracy theories that hate the dollar so much fail to understand that the USA is not trying to keep the dollar as the reserve currency. It was the Plaza Accord that encouraged Europe to join together to create the Euro to compete with the dollar. The USA has also tried to convince Japan to relax its regulation to freely allow the yen to participate in the world economy.

…click on the above link to read the rest of the article…

IEA Forecasts Fastest Oil Demand Growth In Two Years

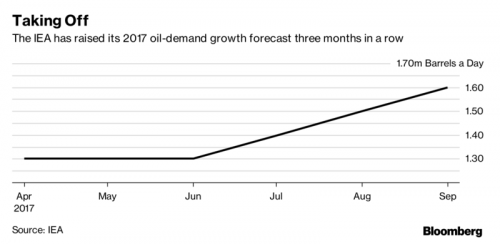

The International Energy Agency, which advises most major economies on energy policy, forecast that global oil demand will climb this year by the most in two years amid stronger-than-expected consumption in Europe and the U.S. although it was unclear just how this will offset recently fading demand by the two biggest marginal consumers, China and India. The IEA reported that global oil demand grew very strongly in Y/Y in Q2 2017, by 2.3mmb/d, or 2.4%, and increased its estimate for demand growth in 2017 by 100,000 barrels a day to 1.6 million a day, or 1.7%. The IEA has now raised its 2017 oil-demand growth forecast for three months in a row.

The agency observed that the re-balancing of oversupplied world markets continues with OPEC supplies falling for the first time in five months as reported yesterday, and inventories of refined fuels in developed nations subsiding toward average levels. In August, global oil supply fell by 720 kb/d due to unplanned outages and scheduled maintenance, mainly in non-OPEC countries. OECD commercial stocks were unchanged in July at 3 016 mb, when they normally increase.

“Demand growth continues to be stronger than expected, particularly in Europe and the U.S.,” the Paris-based agency said in its monthly report.

The IEA also said that the impact of Hurricane Harvey on global oil markets is “likely to be relatively short-lived,” according to Bloomberg. Although the oil market “coped relatively well” with the disruption caused by this year’s storms, the damage to U.S. facilities will still be felt, according to the report. The country’s production was curbed by about 200,000 barrels a day in August and 300,000 a day in September.

Meanwhile local stockpiles were at “comfortable” levels before the storm hit, while releases from government reserves and plentiful imports from Europe allayed any shortage.

…click on the above link to read the rest of the article…

September 12, 2017

All Food Is GONE! Violence Erupts On Caribbean Island Of St. Martin

Photo Credit: (New York Times) A woman in St. Martin carries a jug full of water.

Hurricane Irma ravaged the Caribbean islands last week and wiped entire islands off the map. Now that the food and water have been scavenged from every grocery store on St. Martin, people are resorting to violence.

The people obviously started with the grocery stores, scavenging what they needed for sustenance; water, crackers, and fruit. But according to the New York Times, by nightfall on Thursday, what had been a search for food took a more menacing turn, as groups of people (some of whom were armed), swooped in and violently took anything of value that was left. Things like electronics, appliances, and vehicles were all stolen.

The social fabric has begun to fray now that people are without the most basic of essentials: food and water. “All the food is gone now,” Jacques Charbonnier, a 63-year-old resident of St. Martin, said in an interview on Sunday. “People are fighting in the streets for what is left.” Residents of St. Martin, and elsewhere in the region, spoke about a general disintegration of law and order as survivors struggled in the face of severe food and water shortages, and the absence of electricity and phone service.

As reports of increasing desperation continued to emerge from the region over the weekend, governments in Britain, France and the Netherlands, which oversee territories in the region, stepped up their response. They defended themselves against criticism that their reaction had been too slow, and insufficient. Both the French and Dutch governments said they were sending in extra troops to restore order, along with the aid that was being airlifted into the region. –New York Times

…click on the above link to read the rest of the article…

OPEC Reports First Oil Production Drop In 4 Months As Deal Compliance Slides

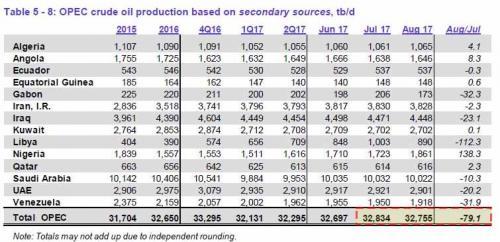

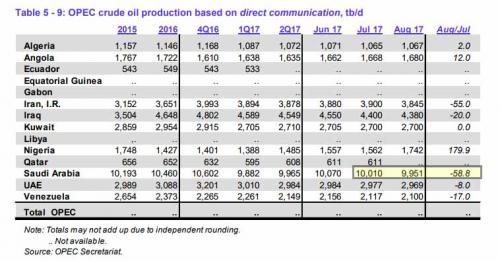

Confirming Monday leaks that OPEC production had dipped last month, the just released OPEC report for the month of September confirmed that in September, OPEC produced 32.755mmb/d (according to secondary source data), a drop of 79,100 bpd, and the first monthly decline in 4 months. According to the underlying data, in the last month output increased in Nigeria (+138.3Kb/d), while declining in Libyam Gabon, Venezuela and Iraq. Saudi Arabia.

While secondary sources pegged Saudi production in August at 10.022mmb/d, a drop of 10.3kb/d in the past month, the Saudi self-reported number was 9.951mmb/d, not a nominal difference and a drop of nearly 60kb/d from the Saudi self-reported 10.01mmb/d July number, perhaps indicating that the Saudis are trying a little too hard to demonstrate compliance with the production cut agreement.

In the same report, OPEC boosted global oil demand growth in 2017 to 1.42mmbpd, an upward revision of 50kb/d from last month’s estimate, predicting that the impact of Hurricane Harvey on demand will be “negligible”, with disruption offset by rebuilding activity. Demand for OPEC crude in 2017 is estimated at 32.7mmb/d, roughly 0.5mmb/d higher than the 2016 level. 2018 demand is now seen at 98.1m b/d, with growth rate revised up by ~100k b/d to 1.35m b/d.

At the same time, OPEC also raised estimates for the amount of crude it will need to supply next year by 400k b/d to 32.8m b/d. OPEC expects non-OPEC supply to grow by 0.78mmbpd in 2017, unchanged from the previous month due to offsets between Kazakhstan and the US. OPEC also cut its forecasts for growth in non-OPEC supply next year by 100k b/d amid lower expectations for Russia and Kazakhstan; total non-OPEC is projected to expand by 1m b/d to 58.8m b/d in 2018.

Finally, the 11 OPEC members disclosed an 83% compliance rate with the production cuts, down from last month’s 86%. Iraq was the least compliant on output cuts, with a self-reported August output of 4.38mmb/d, below the secondary sources print of 4.45, and above the quota of 4.35mmb/d.

The Crises That Have Come With Urbanization

THE CRISES THAT HAVE COME WITH URBANIZATION

One of the defining aspects of our current civilization and one of the most worrying trends of modernity is our urbanization as a species. When we take the long view of human history, it becomes obvious that for 99% of our history, we have been a rural people, the majority of us making our living off the land and in small, agrarian communities.

Though history (especially the last 2,000 years or so) has been written by the pens of the powerful. Concentrated in urban centers, our collective dependence on rural areas and the people who lived and farmed there was a stalwart of our survival.

According to recent studies, we have recently crossed the threshold of becoming a majority urban-dwelling species. Over half of our more than 8 billion people live in urban centers around the world and that number is only expected to increase in years to come. What does this mean for our collective survival? Is our urban-ness sustainable and desirable? How can we forge a healthy, ecological civilizational paradigm that is built around billions of people living away from the land where the most basic necessities of our survival are found and cultivated?

To begin with, we want to recognize and affirm that it is imperative for us as humans to reverse the trend of increasing urbanization. According to UN Habitat, every WEEK, close to three million people migrate from rural areas into urban areas. If this trend continues, the crises that come with urbanization will only propagate and magnify.

While we can construct sustainable urban spaces with the amount of people currently living in cities, we simply cannot continue to depopulate rural areas where the natural resources for our survival are found.

…click on the above link to read the rest of the article…

Irma Death Toll Climbs To 11 As Storm Surges Flood Charleston And Savannah

The National Hurricane Center downgraded Irma to a Tropical Depression late Monday night, but even in its weakened state, the storm continues to cause deadly storm surges and volatile winds as it travels through Alabama, Georgia and South Carolina, flooding downtown Charleston, South Carolina and uprooting trees in Atlanta, according to CNN.

Meanwhile, authorities have confirmed 11 deaths from the storm.

According to Accuweather, even as the storm travels well inland from the coast, Irma will put many lives at risk in northern Florida, Alabama, Georgia, Tennessee and South Carolina, where residents should anticipate severe flooding. Already, the storm has killed three people in Georgia and one in South Carolina, where a 57-year-old South Carolina man was fatally injured by a falling tree limb during the storm, Abbeville County Coroner Ronnie Ashley told CNN. The man was cutting downed limbs with a chainsaw outside of his home when he was struck.

NHC Atlantic Ops

NHC Atlantic Ops Tropical Depression #Irma Advisory 52: Irma Weakens to a Tropical Depression. http://go.usa.gov/W3H

10:32 PM – Sep 11, 2017

Irma’s storm surge overwhelmed the Battery in the downtown Charleston where the Ashley and Cooper rivers meet. Charleston police asked residents to avoid downtown in anticipation of high tide. One resident captured the surge in this chilling video. Waters in Charleston Harbor peaked at nearly 10 feet, the city’s third-highest reading ever, topping Hurricane Matthew in 2016, according to CNN.

…click on the above link to read the rest of the article…

Housing Bubble Symmetry: Look Out Below

Housing markets are one itsy-bitsy recession away from a collapse in domestic and foreign demand by marginal buyers.

There are two attractive delusions that are ever-present in financial markets: One is this time it’s different, because of unique conditions that have never ever manifested before in the history of the world, and the second is there are no cycles, they are illusions created by cherry-picked data; furthermore, markets are now completely controlled by central banks so cycles have vanished.

While it’s easy to see why these delusions are attractive, let’s take a look at a widely used measure of the U.S. housing market, the Case-Shiller Index:

If we look at this chart with fresh eyes, a few things pop out:

1. The U.S. housing market had a this time it’s different experience in the 2000s, as an unprecedented housing bubble inflated, pushing housing far above the trendline of the Case-Shiller National Home Price Index.

2. It turned out this time wasn’t different as this extreme of over-valuation collapsed.

3. For a variety of reasons (massive central bank and state intervention, the socialization of the mortgage market via federally guaranteed mortgages, historically low mortgage rates, massive purchases of mortgage backed securities by the Federal Reserve, etc.), the collapse in prices did not return to the trendline.

4. There is a remarkable time symmetry in each phase of expansion and collapse; each phase took roughly the same period of time to travel from trough to peak and peak to trough.

5. The Index has now exceeded the previous bubble peak, suggesting this time it’s different once again dominates the zeitgeist.

…click on the above link to read the rest of the article…

We Need to Admit the Government Story About 9/11 is Bullshit

It wasn’t just me of course. It was an entire nation that was callously manipulated in the aftermath of that tragedy. The courage and generosity exhibited by so many New Yorkers and others throughout the country and indeed the world was rapidly transformed into terrifying fear. Fear that was intentionally injected repeatedly into our daily lives. Fear that translated into pointless wars and countless deaths. Fear that was used to justify the destruction of our precious civil rights. Fear that was used to initiate a gigantic power grab and the source of tremendous profits for the corporate-statists and crony-capitalsits. Unfortunately, that is the greatest legacy of 9/11.

– From my 2013 post: How I Remember September 11, 2001

Unless we come to terms with 9/11 and the obvious fact that the official government story is a ridiculous fairytale, it’ll be hard for our nation to move forward in an intelligent, courageous and ethical manner. Many of the most destructive trends which have defined our post September 11, 2001 environment, such as a loss of civill liberties and endless barbaric wars of aggression abroad, have been directly related to our false understanding of that awful terrorist attack. As I’ve always maintained, I have no idea what really went down on that day, I just know that the U.S. government and its intelligence agencies are not being honest.

Although it’s been a long time coming, we’re finally uncovering some kernels of truth about the attack and the role Saudi Arabia played in carrying them out. Much of this progress has been driven by family members of those who died, some of whom are suing the Saudis for their role in that despicable slaughter of civilians.

…click on the above link to read the rest of the article…