Steve Bull's Blog, page 1320

September 8, 2017

This Is What Miami Could Look Like On Sunday Morning

An analysis by Climate Central shows that the Florida storm surge from hurricane Irma could endanger millions, and result in hundreds of billions in property damage.

According to Climate Central, it has created the following resources to help anyone remaining in the area visually understand how dangerous the flooding will be in their neighborhood and take safety measures accordingly.

These simulations are based on the Coastal Emergency Risks Assessment (CERA) storm surge and wave model using data from the National Hurricane Center forecast track from Friday morning (Advisory 37). CERA partners include multiple leading universities and federal agencies.

The videos use Google Earth to simulate what the these storm surge forecasts would appear like in different South Florida neighborhoods. The height above mean sea level for each simulation is shown in the titles. As local topography varies, these values translate to approximately 7-10 feet of water above ground in many areas according to the Storm Surge Warming forecasts from the National Weather Service.

Downtown Miami (13.5 feet)

…click on the above link to read the rest of the article…

Weekend Reading: The “Real” Vampire Squid

First, it was Hurricane “Harvey” and an expected $180 billion in damages to the Texas coastline. Now, “Irma” is speeding her way to the Florida coastline dragging “Jose” in her wake. Those two hurricanes, depending on where they land will send damages higher by another $100 billion or more in the weeks ahead.

The immediate funding needed for relief to Americans is what you would truly deem to be “emergency measures.”

But that is not what I am talking about today.

Nope, I am talking about Central Banks. On Thursday, Mario Draghi, of the ECB, announced their latest monetary policy stance:

“At today’s meeting, the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. The Governing Council expects the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases.

Regarding non-standard monetary policy measures, the Governing Council confirms that the net asset purchases, at the current monthly pace of €60 billion, are intended to run until the end of December 2017, or beyond, if necessary, and in any case until the Governing Council sees a sustained adjustment in the path of inflation consistent with its inflation aim. The net purchases are made alongside reinvestments of the principal payments from maturing securities purchased under the asset purchase programme. If the outlook becomes less favourable, or if financial conditions become inconsistent with further progress towards a sustained adjustment in the path of inflation, the Governing Council stands ready to increase the programme in terms of size and/or duration.”

…click on the above link to read the rest of the article…

Central Banks Have Purchased $2 Trillion In Assets In 2017

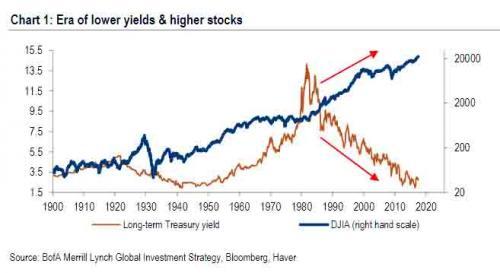

In his latest “flow report”, BofA’s Michael Hartnett looks at the “Disconnect Myth” between rising stocks and bonds and summarizes succinctly that there is “no disconnect between stocks & bonds.”

Why? The best, and simplest, explanation for low yields & high stocks is simple: so far in 2017 there has been $1.96 trillion of central bank purchases of financial assets in 2017 alone, as central bank balance sheets have grown by $11.26 trillion since Lehman to $15.6 trillion. Hartnett concedes that the second best explanation is bonds pricing in low CPI (increasingly a new structurally low level of inflation due to tech disruption of labor force) while equities price in high EPS (with little on horizon to meaningfully reverse trend), although there is no reason why the second can’t flow from the first.

The result is an era of lower yields & higher stocks, or as the chart below shows, an era in which the alligator jaws of death are just waiting for their moment to shine. Here are the three phases:

1981-2009 (disinflation/Fed put), 10-year Treasury yields down from 15.8% to 3.9% = 10.7% annualized S&P 500 returns;

2009-2016 (Fed QE/global ZIRP) yields down from 3.9% to 2.4% = 14.9% SPX ann. return;

2017 YTD (ECB/BoJ QE) yield down to 2%, SPX annualizing 17.5%.

BofA then gives a list of how to time the endgame, or when bonds become bad for stocks:

yield curve inverts,

lower yields lead to higher credit spreads (particularly high yield & EM bond spreads…watch tech spreads in coming months),

The deflation bonds discounting starts to negatively impact EPS,

flip side is never good sign to see rising yields coincide with falling bank & housing stocks;

The good news is that none of these 4 conditions are being met, for now.

…click on the above link to read the rest of the article…

Swamp Fever

Further proof, as if more were needed, that God is rather cross with the world’s number one exceptional nation: Hurricane Irma is tracking for a direct hit on Disney World. In the immortal words of the Talking Heads: This ain’t no party, this ain’t no disco, this ain’t no fooling around.

Houston is still soggy and punch-drunk, with a fantastic explosion of breeding mosquitoes, and otherwise it’s not even in the news anymore. This week, the cable networks had their scant crews of reporters scuttling around Florida, asking the people here and there about their feelings. “What’s gonna happen is gonna happen….” I think I heard that one about sixty times, and there’s actually no disputing the truth of it.

For the moment, though (Friday morning), it’s a little hard to calculate the effect of a complete scrape-off, wash, and rinse of the state of Florida vis-à-vis the ongoing viability of the US economy. There’s going to be a big hole with dollars rushing into it and that will likely prompt the combined powers of the US Treasury, congress, and the Federal Reserve to materialize tens of billions of new dollars. Overnight the DXY plunged to a new low for the year.

Am I the only observer wondering if Irma may be a fatal blow to the banking system? The mind reels at the insurance implications of what’s about to happen. Urgent obligations triggered by an event of this scale can’t possibly be serviced. Look for it to snap the chain of counterparty leverage that has been propping up the banks, insurers, and pension funds on mere promises for years on end. Finance, both private and public, has been feeding off unreality since well before the tremor of 2008. The destruction of Florida (and whatever else stands in the way up the line) will be as real as it gets.

…click on the above link to read the rest of the article…

Worst US Consumer Data Hack Ever? Equifax Confesses

Your data was likely stolen. Here’s what you can do to protect yourself even after the hack, and Equifax doesn’t want you to do it.

Equifax, as a consumer credit bureau, collects financial, credit, and other data on every US consumer. It has names, birth dates, social security numbers, driver’s license numbers, bank account numbers, credit card numbers, mortgage data, and payment history data, including to utilities, wireless service providers, and the like. It collects data on bank balances, loan balances, credit card balances, credit card purchases, and myriad personal details. It has massive digital dossiers on every consumer in the US and in some other countries. And it sells this data to other companies, such as banks, credit card companies, car dealerships, retailers, and others, as a routine part of its business model. That’s how it makes money.

But when someone breaks in and steals this data without paying Equifax for it, well, that’s a huge deal. And it is.

Turns out, Equifax got hacked – um, no, not today. Today it disclosed that it had discovered on July 29 – six weeks ago – that it had been hacked sometime between “mid-May through July,” and that key data on 143 million US consumers was stolen. There was no need to notify consumers right away. They’re screwed anyway. But it gave executives enough time to sell 2 million shares between the discovery of the hack and today, when they crashed 13% in late trading.

Given the quantity and sensitivity of the stolen data, it may well be the biggest and worst breach in US history.

That stolen data “primarily includes”:

Names

Social Security numbers

Birth dates

Addresses

“In some instances,” driver’s license numbers.

In addition, the stolen data includes:

Credit card numbers of around 209,000 US consumers

“Certain dispute documents with personal identifying information” of around 182,000 US consumers.

“Limited personal information for certain UK and Canadian residents.”

…click on the above link to read the rest of the article…

The North Sea Oil Recovery Is Dead In The Water

The oil majors issued a vote of confidence for the North Sea in recent days, citing precipitous declines in the cost of production, which they say will revive the region’s oil and gas production.

At an oil industry conference in the North Sea’s oil capital, Aberdeen, the chief executives of BP and Royal Dutch Shell both offered bullish assessments for the turnaround underway off the coast of Scotland. BP’s Bob Dudley said the North Sea is “back to growth,” according to the FT.

The North Sea has long been a costly place to produce oil. And as the aging oilfields in the North Sea suffer from declining output – a decline underway since the late 1990s – investing in a high-cost basin for the oil majors has slipped down on the priority list, especially when shale has emerged as an alternative in an uncertain market.

Even when oil prices were high, production was falling. When prices started to crash in 2014, the North Sea looked like a dead man walking.

But things are looking a little better than they were a few years ago. The oil majors say they have overhauled their cost structures in the region, making production profitable in today’s $50 market, even when the region struggled to be profitable with a $100 oil price a few years back. BP says costs of halved to just $15 per barrel.

Shell’s CEO Ben van Beurden told the FT on the sidelines of the conference that the industry managed to avoid the “death spiral” that they were facing in 2014. At the time, a growing number of key pieces of infrastructure looked like they might have to shut down.

…click on the above link to read the rest of the article…

The Real Reason Wages Have Stagnated: Our Economy is Optimized for Financialization

The Real Reason Wages Have Stagnated: Our Economy is Optimized for Financialization

Labor’s share of the national income is in freefall as a direct result of the optimization of financialization.

The Achilles Heel of our socio-economic system is the secular stagnation of earned income, i.e. wages and salaries. Stagnating wages undermine every aspect of our economy: consumption, credit, taxation and perhaps most importantly, the unspoken social contract that the benefits of productivity and increasing wealth will be distributed widely, if not fairly.

This chart shows that labor’s declining share of the national income is not a recent problem, but a 45-year trend: despite occasional counter-trend blips, labor (that is, earnings from labor/ employment) has seen its share of the economy plummet regardless of the political or economic environment.

Given the gravity of the consequences of this trend, mainstream economists have been struggling to explain it, as a means of eventually reversing it. The explanations include automation, globalization/ offshoring, the high cost of housing, a decline of corporate competition (i.e. the dominance of cartels and quasi-monopolies), a failure of our educational complex to keep pace, stagnating gains in productivity, and so on.

Each of these dynamics may well exacerbate the trend, but they all dodge the dominant driver of wage stagnation and rise income-wealth inequality: our economy is optimized for financialization, not labor/earned income.

What does our economy is optimized for financialization mean? It means that capital and profits flow to the scarcities created by asymmetric access to information, leverage and cheap credit–the engines of financialization.

Optimization is a complex overlay of dynamically linked systems: the central bank optimizes the flow of cheap credit to the banking/financial sector, the central state tacitly approves the consolidation of cartels and quasi-monopolies, and gives monstrous tax breaks to corporations even as it jacks up taxes and fees on wage earners and small business.

…click on the above link to read the rest of the article…

Rising Seas Swamp Scotland

Since April the sea around Scotland has risen by an average of 43 centimeters, reports the Sunday Herald, a rate of rise that far exceeds even the worst-case projections of climate scientists. Caught by surprise, the government is preparing emergency evacuation plans for residents of coastal areas and other low-lying areas threatened by the encroaching seas. They urge the public to stay calm but to be ready to move on short notice should the situation deteriorate further.

Since April the sea around Scotland has risen by an average of 43 centimeters, reports the Sunday Herald, a rate of rise that far exceeds even the worst-case projections of climate scientists. Caught by surprise, the government is preparing emergency evacuation plans for residents of coastal areas and other low-lying areas threatened by the encroaching seas. They urge the public to stay calm but to be ready to move on short notice should the situation deteriorate further.

The Sunday Herald, of course, never published any such report, although one suspects it would have liked to, and certainly the government never prepared any evacuation plans. But the fact remains that in the eight months between April and December 2015 the seas around Scotland rose by an average of 43 centimeters – exceeding the 20-40 centimeter rise predicted for Edinburgh over the next 73 years in the Sunday Herald article that was the subject of Euan Mearns’ recent terrifying risk post.

And no one noticed.

Why did no one notice? Because the 43-centimeter rise in 2015 was a result of seasonal sea level variations that have been going on in Scotland for centuries and which, so far as I know, have yet to have any significant impact on anything. A ~40cm rise and fall in sea level in a single year in Scotland is in fact by no means unusual.

And I myself didn’t notice this until just recently because I hadn’t looked at the monthly tide gauge data (the tide gauge graphs Euan featured in his post plotted annual means). Here I rectify this omission by presenting plots of Scottish tide gauge monthly data. First Aberdeen, the only long-term record in the country. (Sea levels in this and following graphs are given in centimeters so they can be compared directly with the Sunday Herald’s prediction of 20-40 cm of sea level rise by 2090. The data are from the Permanent Service for Mean Sea Level (PSMSL)):

…click on the above link to read the rest of the article…

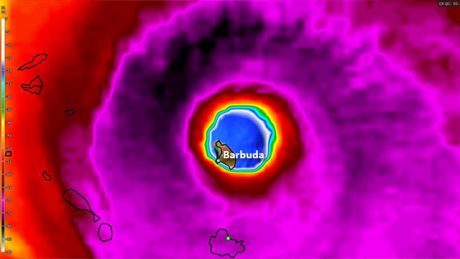

Irma Is Being Described As A ‘Nuclear Hurricane’ That Has Left One Island ‘Practically Uninhabitable’

Irma is not just another hurricane – it is a history making storm that is going to cause up to a quarter of a trillion dollars in damage once it makes landfall in the United States. In fact, Miami Beach Mayor Philip Levine used the term “nuclear hurricane” to describe this storm to the media. I would never use that term personally, but I am in agreement that it would be exceedingly difficult to overstate the danger that this storm represents. According to the National Hurricane Center, Irma has been a category 5 storm for more than 50 hours, and that is already one of the longest stretches on record.

Irma is not just another hurricane – it is a history making storm that is going to cause up to a quarter of a trillion dollars in damage once it makes landfall in the United States. In fact, Miami Beach Mayor Philip Levine used the term “nuclear hurricane” to describe this storm to the media. I would never use that term personally, but I am in agreement that it would be exceedingly difficult to overstate the danger that this storm represents. According to the National Hurricane Center, Irma has been a category 5 storm for more than 50 hours, and that is already one of the longest stretches on record.

Of course if you were to extrapolate the Saffir-Simpson scale, Irma would have been considered a category 6 storm when it had sustained winds of 185 miles per hour. This is a point that I made in my article entitled “Hurricane Irma: If There Was Such A Thing As A Category 6 Hurricane, This Would Be It”.

And just a day later, MSNBC published an article with a suspiciously similar headline: “If there were a category 6 hurricane, Irma would be it”.

So will the rest of the mainstream media attack MSNBC for saying the exact same thing that I did?

Of course not.

And will the mainstream media attack Miami Beach Mayor Philip Levine for calling Irma “a nuclear hurricane”?…

“We have talked to people in your city who say, ‘We ain’t going,’” CBS4’s Hank Tester told Levine.

“I hate to hear that. I’ll do anything in my power to convince them this is a very serious storm. This is a nuclear hurricane. They should leave the beach, they must leave the beach,” he said.

Of course not.

…click on the above link to read the rest of the article…

Capitalism, the State and the Drowning of America

Photograph Nathaniel St. Clair

As Hurricane Harvey lashed Texas, Naomi Klein wasted no time in diagnosing the “real root causes” behind the disaster, indicting “climate pollution, systemic racism, underfunding of social services, and overfunding of police.” A day after her essay appeared, George Monbiot argued that no one wants to ask the tough questions about the coastal flooding spawned during Hurricane Harvey because to do so would be to challenge capitalism—a system wedded to “perpetual growth on a finite planet”—and call into question the very foundations of “the entire political and economic system.”

Of the two choices, I vote for Monbiot’s interpretation. Nearly forty years ago, the historian Donald Worster in his classic study of one of the worst natural disasters in world history, the Dust Bowl of the 1930s, wrote that capitalism, which he understood as an economic culture founded on maximizing imperatives and a determination to treat nature as a form of capital, “has been the decisive factor in this nation’s use of nature.”

Care must be taken not to imagine capitalism as a timeless phenomenon. Capitalism has a history and that history is important if we are to properly diagnose what happened recently in Texas and is about to happen as Hurricane Irma bears down on Florida. What we need to understand is how capitalism has managed to reproduce itself since the Great Depression, but in a way that has put enormous numbers of people and tremendous amounts of property in harm’s way along the stretch from Texas to New England.

The production of risk began during the era of what is sometimes called regulated capitalism between the 1930s and the early 1970s. This form of capitalism with a “human face” involved state intervention to ensure a modicum of economic freedom but it also led the federal government to undertake sweeping efforts to control nature.

…click on the above link to read the rest of the article…