Steve Bull's Blog, page 1313

September 15, 2017

Venezuela Begins Publishing Oil Basket Price In Yuan

Two days after the WSJ confirmed Maduro’s earlier threat that he would stop accepting US Dollars as payment for crude oil imports, Venezuela has done just that.

As a reminder, and as we reported previously, in an effort to circumvent U.S. sanctions, Venezuela told oil traders that it will no longer receive or send payments in dollars. As a result, oil traders who export Venezuelan crude or import oil products into the country have begun converting their invoices to euros.

Furthermore, Venezuela’s state oil company Petróleos de Venezuela SA, or PdVSA (whose bankruptcy is fast approaching), told its private joint venture partners to open accounts in euros and to convert existing cash holdings into Europe’s main currency, said one project partner. The new payment policy hasn’t been publicly announced, but Vice President Tareck El Aissami, who has been blacklisted by the U.S., said Friday, “To fight against the economic blockade there will be a basket of currencies to liberate us from the dollar.”

Fast forward to today, when according to a statement on the Venezuela oil ministry, the country’s weekly crude oil and petroleum basket “will be published in Chinese Yuan” – oddly, not in Euros as the WSJ hinted – going forward. We can only assume that Venezuela avoided the European currency on concerns that Brussels may follow in D.C.’s footsteps and impose financial sanctions on the Maduro regime next. Which meant that the only “safe” currency to transact in, was that of the country’s two big sources of vendor (and commodity) financing: China and Russia. For now Venezuela has picked the former.

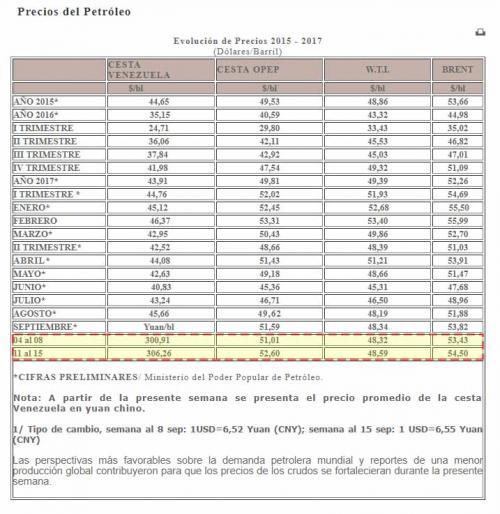

The ministry also unveiled a price of 306.26 Yuan per barrel for the week of Sept. 11-15, up 1.8% from the 300.91 in the previous week, saying “the more favorable outlook on world oil demand and reports of lower global production contributed to the strengthening of crude oil prices this week.”

…click on the above link to read the rest of the article…

Jose Expected to Regain Hurricane Status and Gun For Northeast Coast

Get your generators ready NY, Jose might be heading up here to blow away your over valued hovels. Recent models indicate Jose is making a comeback near the Bahamas and is expected to regain ‘Cane status today, then jog on towards the northeast in an attempt to destroy it.

From Dr. Masters

Jose is now completing its expected loop between the Caribbean and Bermuda, and the track forecast has become more straightforward. Our top track models—the European, GFS, and UKMET models—agree that Jose will continue west-northwest until about Saturday, then head northward toward a upper-level trough that will be sweeping through eastern Canada. By midweek, this northward movement is expected to segue into a more northeasterly track.

The main forecast challenge is how close Jose will get to the U.S. and Canadian coast. The 00Z Thursday runs of the three top track models all place Jose within several hundred miles of North Carolina’s Outer Banks by next Tuesday. Later in the week, Jose could make an even closer pass by Cape Cod and the Canadian Maritimes. At this point we can’t rule out the possibility that Jose will make landfall somewhere along the east coast of the U.S. or Canada. Of the 50 members of the 00Z Thursday ensemble run of the European model, a substantial minority bring Jose inland across the eastern U.S. (see Figure 3). However, only about 20% of the GFS ensemble members produce an eastern U.S. landfall (see Figure 2). The model guidance trended slightly westward overnight, so we’ll need to keep a close eye on any further trends in model guidance. NHC’s 5-day forecast on Thursday morning placed Jose about 250 miles east of North Carolina on Monday, and the “cone of uncertainty” included the Outer Banks.

…click on the above link to read the rest of the article…

Yesterday’s “Watershed” Central Bank Announcement Which Everybody Missed

In what may have been a watershed moment in monetary policy – which awkwardly was missed by almost everyone as a result of the concurrent launch of the latest North Korean ballistic missile which immediately drowned out all other newsflow – late on Thursday, the Bank of Canada held a conference on inflation targeting and monetary policy titled “Bank of Canada Workshop “Monetary Policy Framework Issues: Toward the 2021 Inflation-Target Renewal” in which, in a stunning shift of monetary orthodoxy, BoC Senior Deputy Governor Carolyn A. Wilkins said that Canada was open to changes in the BoC mandate.

WILKINS: OPEN TO LOOKING AT `SENSIBLE’ ALTERNATIVES TO MANDATE

Or in other words, lowering or outright abolishing the central bank’s inflation target, or explicitly targeting financial conditions and asset prices.

While still early in the process, the BOC may be setting a precedent, one which other DM central banks may have no choice but to follow: If the Bank of Canada is going to look at alternatives to their mandate (with an emphasis on inflation), it – as several trading desks have suggested – could become the first central bank to officially change its mandate to reflect financial conditions that are too loose in the context of the current low r-star lowflation environment.

In practical terms, this would mean that instead of seeking chronically easier conditions to hit legacy inflation targets around ~2.0% while inflating ever greater asset bubbles, one or more central banks could simply say that 1.5% (or less) is sufficient for CPI and call it a day, in the process soaking up record easy financial conditions and bursting countless asset bubbles.

…click on the above link to read the rest of the article…

To Hell In A Bucket

“No one really cares about the U.S. federal debt,” remarked a colleague and Economic Prism reader earlier in the week. “You keep writing about it as if anyone gives a lick.”

“No one really cares about the U.S. federal debt,” remarked a colleague and Economic Prism reader earlier in the week. “You keep writing about it as if anyone gives a lick.”

We could tell he was just warming up. So, we settled back into our chair and made ourselves comfortable.

“The voters certainly don’t care about the federal debt,” he continued. “They keep electing the same spendthrifts to office.

“And the politicians know the voters don’t care. They also know that making more and more promises is the formula for getting reelected.

“Deep down, the aging masses know they need massive amounts of government debt to pay their social security, medicare, and disability checks. On top of that, many of the so-called gainfully employed are really on corporate welfare; they hang their hats on government contracts to fund their paychecks.

“You know as well I do how this crazy debt based fiat money system works. The debt must perpetually increase or the whole financial system breaks down. The best we can hope for is that the ongoing currency debasement merely leads to a subtle erosion of living standards. That’s the best-case scenario.

“But, again, no one except maybe a handful of your readers’ gives a rip about the federal debt. Plus, if you’re gonna keep writing about it you need to use better terminology.

“The federal debt has grown at such a rapid rate that standard dollar units no longer capture what’s going on. The debt numbers are so large it is difficult to distinguish between hundreds of billions and tens of trillions of dollars.

Going Broke at Mach 30

“For better perspective, you need to describe the debt growth in astronomical terms. You see, astronomers use light years to adjust for large distances. A light year, as its name suggests, is the distance light travels in one year.

…click on the above link to read the rest of the article…

America’s Weapons: “The Dollar and the Drone”

America’s Weapons: “The Dollar and the Drone”

It was said that “the guinea and the gallows” were the true instruments of British imperial power.

The guinea represented the coined wealth of Great Britain.

The gallows represented its… constabulary zeal in policing restless natives.

This is the 21st century of course… a time of enlightenment.

Today’s instruments of imperial power are no longer the guinea and the gallows.

No. Today’s instruments of imperial power are “the dollar and the drone.”

The dollar and the drone are America’s weapons.

Like the 19th-century pound (which replaced the guinea), today’s dollar is the world’s reserve currency.

Like the 19th-century pound, the dollar finances some two-thirds of global trade.

And the gallows?

Britain hanged its foreign trouble. America explodes its own in drone attacks.

Here is civilization; here is progress.

The sun eventually sank on the British Empire… the gallows came down… and the pound lost its global reserve status.

The U.S. will have its drones. But is its other weapon, the dollar, close to losing global reserve status?

Recent developments may tell…

The global oil trade has centered on the dollar since 1974, when Saudi Arabia agreed to enthrone the dollar as currency of the oil market.

If it was oil you wanted… it was dollars you needed.

But now China — world’s top oil importer — is preparing to create an oil market that bypasses the dollar entirely.

The plan would let China buy oil from Russia and Iran with its own currency, the yuan.

But the yuan is not a major reserve currency like the dollar.

Under this plan, Russia and Iran would be able to swap yuan for an asset far more desirable than Chinese scraps of paper — gold itself.

Perhaps that explains why China’s been hoarding so much gold in recent years?

Jim Rickards says this system marks the beginning of the end for the petrodollar:

…click on the above link to read the rest of the article…

State-Sponsored Intimidation, Or When FARA Goes Too Far

The US government is blatantly violating the most basic tenets of its purportedly “sacred” ideology of “human rights” and “free speech” by egregiously overstepping the bounds of FARA to engage in the same type of state-sponsored intimidation that it regularly accuses its geopolitical opponents of for far less.

Yahoo broke the story earlier on Monday that the FBI questioned former Sputnik employee Andrew Feinburg following his public complaints to the media about how the company is supposedly being run, and this reportedly came after another former employee, Joseph John Fionda, allegedly contacted the FBI on his own initiative to share “a big packet” of information accusing Sputnik of breaking the law. The legislation at the center of this scandal is the “Foreign Agents Registration Act” (FARA), a 1938 law originally passed to expose Nazi influence operations inside of the US. It’s since been used for registering anyone who works as a “foreign agent”, which stereotypically refers to Congressional lobbyists hired by foreign governments but is nowadays being proposed by some US voices to apply to Sputnik and RT as well.

The basis for this move is that both companies are publicly funded by the Russian government, and that this therefore supposedly makes them “propaganda” because it’s assumed by the American authorities that all of their employees lack “editorial independence” from the Kremlin. As could have been expected, the same forces pushing for Sputnik and RT to register as “foreign agents” under FARA aren’t interested in equally applying these expanded “standards” to other publicly financed international media outlets such as Al Jazeera and the BBC.

…click on the above link to read the rest of the article…

Is it a Bad Idea to Have Fewer Children? Jorgen Randers at the Summer Academy of the Club of Rome in Florence

Jorgen Randers speaks at the 1st Summer Academy of the Club of Rome, in Florence, Sep 2017

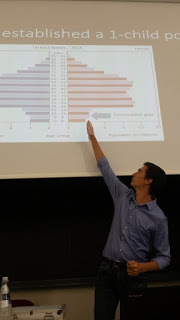

The Summer Academy of the Club of Rome saw an interesting debate when a young participant (Jacques Chartier-Kastler) asked to take the floor and speak about what he and his group were seeing as a problem: the current tendency of having fewer children. He showed data about the resulting unbalanced age distribution with too many old people who turn out to be a burden for society. And he said that having such an unbalanced distribution could be a disaster in the case of an economic downturn or even a collapse.

Jorgen Randers produced a strong response to this presentation. I am reporting from memory, but I think I am being faithful to the gist of what Randers said, which was something like this:

“Young man, you gave a very bad presentation. I think it was truly horrible and you should stop giving it. You see, the problem you are presenting is a completely fake problem. It comes from the fact that, in the past, an agreement had developed in most Western societies that the families would provide for children, whereas the state would support the elderly. Now, of course, with more old people, the state must pay more. But we forget that having fewer children the burden for families – and for society – is much reduced. So, there is a simple solution to what you see as a problem: raise the retirement age. That’s what my country, Norway, did. They leave citizens to choose when to retire, but they give favorable conditions to those who retire later.

…click on the above link to read the rest of the article…

Do 40,000 Lightning Strikes Over Southern Cali Point To A Mega Quake On The Horizon?

A volatile storm has ignited a slew of 40,000 lightning strike in southwestern California. The strikes have hit Los Angeles, Santa Barbara, San Luis Obispo, and Ventura counties – all between September 10-11.

The electric storm was most active on Sunday with an amazing 5,000 lightning bolts in the area over a three-hour period. NWS Los Angeles took to Twitter to report the tremendous display. The intense storm brought plenty of lightning to the Golden state’s southern region, but almost no rain. The greatest rain total of .44 inches at Sudden Peak on Sunday. By Monday morning, heavy showers, thunderstorms, and 35-mph winds were reported in eastern Los Angeles County.

Follow

NWS Los Angeles ✔@NWSLosAngeles

Tremendous number of lightning strikes & in-cloud flashes over SW CA in last 24-hours. Nearly 40,000 in total! #CAwx#LAWeather#LARain

11:30 AM – Sep 11, 2017

But now conspiracy is swirling around this fascinating and unique electric storm. Strange lights and electrons acting oddly seem to have been appearing either before or during major earthquakes – like the recent 8.2 magnitude quake in Mexico. Could these lightning strikes be a sign that California’s mega quake is on the horizon?

Like California, Mexico is a seismically active region that has seen smaller quakes that have caused death and destruction. But Thursday’s temblor is a reminder that even larger quakes — while rare — do occur. Scientists say it’s possible for Southern California to be hit by a magnitude 8.2 earthquake. Such a quake would be far more destructive to the Los Angeles area because the San Andreas fault runs very close to and underneath densely populated areas.

It’s often stated that California is ripe for a devastating mega earthquake and after some noticed the strange lights in the sky above Mexico during its quake, this conspiracy conclusion was an easy one to jump to.

Venezuela Has Officially Abandoned The Petrodollar – Does This Make War With Venezuela More Likely?

Venezuela is the 11th largest oil producing country in the entire world, and it has just announced that it is going to stop using the petrodollar. Most Americans don’t even know what the petrodollar is, but for those of you that do understand what I am talking about, this should send a chill up your spine. The petrodollar is one of the key pillars of the global financial system, and it allows us to live a far higher standard of living than we actually deserve. The dominance of the petrodollar has been very jealously guarded by our government in the past, and that is why many are now concerned that this move by Venezuela could potentially lead us to war.

Venezuela is the 11th largest oil producing country in the entire world, and it has just announced that it is going to stop using the petrodollar. Most Americans don’t even know what the petrodollar is, but for those of you that do understand what I am talking about, this should send a chill up your spine. The petrodollar is one of the key pillars of the global financial system, and it allows us to live a far higher standard of living than we actually deserve. The dominance of the petrodollar has been very jealously guarded by our government in the past, and that is why many are now concerned that this move by Venezuela could potentially lead us to war.

I don’t know why this isn’t headline news all over the country, but it should be. One of the few major media outlets that is reporting on this is the Wall Street Journal…

The government of this oil-rich but struggling country, looking for ways to circumvent U.S. sanctions, is telling oil traders that it will no longer receive or send payments in dollars, people familiar with the new policy have told The Wall Street Journal.

Before we go any further, we should discuss what we mean by the “petrodollar” for those that are not familiar with the concept. The following comes from an excellent article by Christopher Doran…

In a nutshell, any country that wants to purchase oil from an oil producing country has to do so in U.S. dollars. This is a long standing agreement within all oil exporting nations, aka OPEC, the Organization of Petroleum Exporting Countries. The UK for example, cannot simply buy oil from Saudi Arabia by exchanging British pounds. Instead, the UK must exchange its pounds for U.S. dollars. The major exception at present is, of course, Iran.

…click on the above link to read the rest of the article…

On the Road to Extinction: Maybe it’s Not All About Us

Photo by Nathaniel St. Clair

Photo by Nathaniel St. ClairIt is crystal clear—unlike the smoky skies where I live–to most of us who are willing to consider the facts: this summer’s ‘natural’ disasters have been seeded anthropogenically. Wildfires in the northwestern United States and Canada, in Greenland, and in Europe are often referred to in the media as ‘unprecedented’ in size and fury. Hurricanes and monsoons, with their attendant floods and destruction, are routinely described as having a multitude of ‘record-breaking’ attributes. No one reading this is likely to need convincing that humans –our sheer numbers as well as our habits—have contributed significantly to rising planetary temperatures and thus, the plethora of somehow unexpected and catastrophic events in the natural world. I’d like to include earthquakes, particularly those in Turkey (endless) and Mexico (massive), in this discussion, and while intuition tells me that there is a connection between them and climate change, research to support this supposition is just emerging, so for the nonce I will leave the earthquakes out of it.

Our proclivity for advancing our own short-term interests has made a mess of things from the beginnings of this current iteration of civilization. Irrigating the Fertile Crescent, which was not very fertile prior to the ingenious innovation of bringing water from the mountains down into the dusty plains, opened the way for a massive increase in food production and a concomitant population rise. Cities grew and became kingdoms. After a reasonably good run, though, irrigation led to salination of the soil and ultimately left it sterile and useless (for agriculture) once again. Many people and their livestock starved or were forced to migrate in large numbers. Great idea, irrigation.

…click on the above link to read the rest of the article…