Steve Bull's Blog, page 1311

September 17, 2017

Pension Storm Warning

This time is different are the four most dangerous words any economist or money manager can utter. We learn new things and invent new technologies. Players come and go. But in the big picture, this time is usually not fundamentally different, because fallible humans are still in charge. (Ken Rogoff and Carmen Reinhart wrote an important book called This Time Is Different on the 260-odd times that governments have defaulted on their debts; and on each occasion, up until the moment of collapse, investors kept telling themselves “This time is different.” It never was.)

Nevertheless, I uttered those four words in last week’s letter. I stand by them, too. In the next 20 years, we’re going to see changes that humanity has never seen before, and in some cases never even imagined, and we’re going to have to change. I truly believe this. We have unleashed economic and technological forces we can observe but not entirely control.

I will defend this bold claim at greater length in my forthcoming book, The Age of Transformation.

Today we will zero in on one of those forces, which last week I called “the bubble in government promises,” which I think is arguably the biggest bubble in human history. Elected officials at all levels have promised workers they will receive pension benefits without taking the hard steps necessary to deliver on those promises. This situation will end badly and hurt many people. Unfortunately, massive snafus like this rarely hurt the politicians who made those overly optimistic promises, often years ago.

Earlier this year I called the pension mess “The Crisis We Can’t Muddle Through.” Reflecting since then, I think I was too optimistic. Simply waiting for the floodwaters to drop down to muddle-through depth won’t be enough. We face an entire new ocean, deeper and wider than we can ever cross unaided.

…click on the above link to read the rest of the article…

China Orders No Market Turbulence Ahead Of Party Congress

The most important event in China in five years is about to take place, and Beijing isn’t taking any chances.

Ahead of the Communist Party’s twice-a-decade congress – an event so massive that according to Bloomberg “nothing escapes its pull” – which is slated to start on October 18 in Beijing, regulators have made it clear to the nation’s top brokers, bankers and financiers that they don’t want to see any major turbulence in markets.

In a repeat of the fiasco that followed the bursting of China’s equity bubble in the summer of 2015 when Beijing effectively nationalized the stock market, and went so far as to throw prominent hedge fund managers and assorted “speculators” in prison, the China Securities Regulatory Commission has ordered local brokerages to “mitigate risks” and ensure stable markets before and during the Communist Party’s leadership congress next month, according to Bloomberg. Additionally, to leave virtually nothing to chance – and to have ready scapegoats in case someone does in fact sell – the CSRC also banned brokerage bosses from taking holidays or leaving the country from Oct. 11 until the congress ends.

Brokerage bosses were told to avoid travel of any kind from Oct. 11 until the congress ends, including business trips.

Luckily for them, China’s national day holidays are coming up in the first week of October. Local markets will be shut for an entire week, providing plenty of time to recharge for the congress.

Since the congress, which is expected to replace about half of China’s top leadership, is of paramount importance to President Xi Jinping who will use it as a foundation to cement his influence into the next decade, nothing is allowed to spoil the optics of supreme control at this critical moment.

…click on the above link to read the rest of the article…

Kyle Bass: China’s $40 Trillion Banking System Has “Largest Imbalances I’ve Ever Seen”

Kyle Bass’s Hayman Capital has been having a rough year thanks to its widely publicized bet against China’s currency, which has more than reversed its 2016 decline – its largest annual drop since 1994 – as the People’s Bank of China has cracked down on potentially destabilizing capital outflows.

However, Bass – unlike a handful of other former China bears who’ve been forced to scale back, or even reverse, their positions – has said that he is standing by his belief that China’s corporate sector is massively overleveraged, and overdue for a collapse that could destabilize the global economy. Chinese banks, according to Bass, have more than $40 trillion in assets held against $2 trillion in equity.

The dollar’s bull run against the yuan last year helped spark capital outflows as wealthy Chinese worried about the depreciation of their currency. In response, the PBOC tightened restrictions on foreign-exchange transactions for individuals, local companies – quashing a roaring international M&A boom – and even foreign companies, which in some cases have struggled to pull their money out of the world’s second-largest economy.

“So what’s going on right now? Let’s get the elephant out of the room. Let’s talk about China.

Kyle Bass: OK, how much time do we have?

RP: As long as you need. Where are we? What the hell’s going on?

KB: We’re in the such late stages of a game that is the largest global imbalance I’ve ever seen in my life.When you look at on balance sheet and off balance sheets, you look at on balance sheet in the banks, you look in the shadow banks. The number of total credit in the system, China is right at $40 trillion. Think about the number I just said. $40 trillion. And that’s using an exchange rate of call it 6.7 to the dollar, right? So it’s grown 1,000% in a decade. And we’re on a $40 trillion credit system on $2 trillion of equity on maybe $1 trillion of liquid reserves.

…click on the above link to read the rest of the article…

Jim Rogers Warns “If Trump Starts A Trade War With China, It Will End US Hegemony”

Following Treasury Secretary Mnuchin’s threat that the US could impose economic sanctions on China if it does not implement the new sanctions regime against North Korea:

“If China doesn’t follow these sanctions, we will put additional sanctions on them and prevent them from accessing the US and international dollar system, and that’s quite meaningful.”

Billionaire investor and commodity guru Jim Rogers has a warning for the Trump administration – this would hurt America more because it just forces China and Russia and other countries to cooperate.

RT: What is the likelihood that the US will go through with and actually impose economic sanctions on China if it does not implement the new sanctions regime against North Korea?

Jim Rogers: Sanctions are sanctions. They could do sanctions which are not very important or don’t do much damage. And then they will have good public relations which says they have sanctions, but it is meaningless. I would suspect if anything, that is what they will start with. If they put sanctions on China in a big way, it brings the whole world economy down. And in the end, it hurts America more than it hurts China because it just forces China and Russia and other countries closer together. Russia and China and other countries are already trying to come up with a new financial system. If America puts sanctions on them, they would have to do it that much faster and in the end America will lose its monopoly on the financial system, which will hurt America more than anybody.

…click on the above link to read the rest of the article…

September 16, 2017

“They’ve Lost The Plot” – 700 Catalan Mayors Defy Spanish Government Amid Police Raids

“The only thing I ask of (Catalan) mayors is that they comply with the law, and as such don’t participate in an illegal referendum,” Prime Minister Mariano Rajoy urged this week, calling for a return to “rationality and legality” and promised to block the vote.

However, as Reuters reports, the mayors are not complying…

More than 700 mayors from across Catalonia gathered in Barcelona on Saturday to confirm their support for a planned independence referendum that Madrid has declared illegal.

The mayors met with Catalonia’s regional head Carles Puigdemont in a show of defiance, following Spanish prosecutors warning earlier this week that officials engaging in any preparations for the vote could be charged with civil disobedience, abuse of office and misuse of public funds.

Barcelona mayor Ada Colau, who has reached an agreement with the Catalan regional government to allow voting in the city, criticized Madrid’s response to the crisis in a short speech in the city hall.

“It’s a disgrace that we have a government that is incapable of dialogue and instead dedicates itself to pursuing and intimidating mayors and the media,” Colau said.

So far, 740 of 948 municipal leaders have said they would allow municipal spaces to be used for the referendum, according to the Association for Municipalities for Independence (AMI).

As this was taking place, Reuters reports that Spanish police have raided several print shops and newspaper offices in recent days in a hunt for voting papers, ballot boxes and leaflets to be used for the referendum.

The searches are part of a concerted effort by the government to prevent the ballot from going ahead, amid fears that a vote to break away could trigger a political crisis even if Spain does not recognize the outcome.

…click on the above link to read the rest of the article…

Suddenly, “De-Dollarization” Is A Thing

For what seems like decades, other countries have been tiptoeing away from their dependence on the US dollar. China, Russia, and India have cut deals in which they agree to accept each others’ currencies for bi-lateral trade while Europe, obviously, designed the euro to be a reserve asset and international medium of exchange.

These were challenges to the dollar’s dominance, but they weren’t mortal threats.

What’s happening lately, however, is a lot more serious. It even has an ominous-sounding name: de-dollarization. Here’s an excerpt from a much longer article by “strategic risk consultant” F. William Engdahl:

Gold, Oil and De-Dollarization? Russia and China’s Extensive Gold Reserves, China Yuan Oil Market

(Global Research) – China, increasingly backed by Russia—the two great Eurasian nations—are taking decisive steps to create a very viable alternative to the tyranny of the US dollar over world trade and finance. Wall Street and Washington are not amused, but they are powerless to stop it.So long as Washington dirty tricks and Wall Street machinations were able to create a crisis such as they did in the Eurozone in 2010 through Greece, world trading surplus countries like China, Japan and then Russia, had no practical alternative but to buy more US Government debt—Treasury securities—with the bulk of their surplus trade dollars. Washington and Wall Street could print endless volumes of dollars backed by nothing more valuable than F-16s and Abrams tanks. China, Russia and other dollar bond holders in truth financed the US wars that were aimed at them, by buying US debt. Then they had few viable alternative options.

Viable Alternative Emerges

Now, ironically, two of the foreign economies that allowed the dollar an artificial life extension beyond 1989—Russia and China—are carefully unveiling that most feared alternative, a viable, gold-backed international currency and potentially, several similar currencies that can displace the unjust hegemonic role of the dollar today.

…click on the above link to read the rest of the article…

The Way Nature Works: How Common is the Seneca Curve? Ugo Bardi’s Speech at the Summer Academy of the Club of Rome in Florence

Ugo Bardi at the Summer Academy of the Club of Rome in Florence, September 2017.

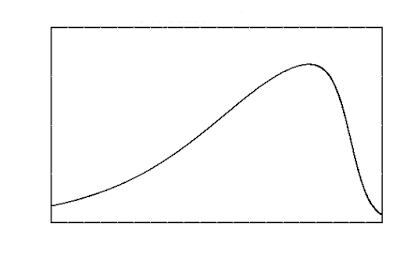

My talk at the Summer Academy of the Club of Rome was mainly a presentation of my latest book, “The Seneca Effect”(Springer 2017). In practice, of course, a book contains many more things than you can say in a 40 minute speech. So, I tried to concentrate on the idea that the behavior I call “the Seneca Curve” is very common, even universal. Below, you can see the Seneca Curve: things go up slowly but collapse rapidly, as the Roman philosopher Seneca said first some two thousand years ago. You may see the same curve also on the t-shirt I was wearing at the Academy.

You may have heard the old Latin motto, “Natura non facit saltus” (Nature doesn’t make jumps) meaning that things change gradually, not abruptly. It may be true in many circumstances but, in practice, it is wholly normal that Nature accumulates energy potentials (as when you inflate a balloon) and then releases them all of a sudden (as when you puncture a balloon). This is the theme of the cover of the German version of my book.

There are reasons why Nature behaves in this way, but the point I made at the school was not so much about why the curve is so common but how human beings are not normally aware of it. In fact, our thought is often shaped by the idea that things will continue evolving the way they have been evolving up to a certain point. Just think about economic growth, and you’ll notice how economists expect it to continue forever. It goes without saying that the economy is one of those complex systems which are most vulnerable to the Seneca collapse.

…click on the above link to read the rest of the article…

The Cardinal Sin Of Investing: Permanent Impairment Of Capital

Victor Moussa/Shutterstock

The Cardinal Sin Of Investing: Permanent Impairment Of Capital

How to avoid making it

Last week we presented a parade of indicators published by Grant Williams and Lance Roberts that warned of an approaching market correction as well as a coming economic recession.

The key message was: When smart analysts independently find the same patterns in the data, it’s time to take notice.

Well, many of you did, by participating in this week’s Dangerous Markets webinar, which featured Grant and Lance.

In it, both went much deeper into the structural fragility of today’s financial markets and the many reasons why economic growth will remain constrained for years to come.

The excessive build-up of debt in the system — and the absolute dependence on its continued expansion to keep the economy from imploding — is, of course, seen as the prime risk to future growth.

As Lance demonstrates here with several of his excellent charts, so much leverage has been taken on that its servicing is increasingly stealing capital that would otherwise go to savings, consumption and productive investment. Going forward, the demands of the debt service will simply result in less and less capital available left over to grow the economy:

As financial assets are (supposed to be) valued on future growth prospects, lower forecasted growth demands lower valuations. Grant calculates that, should the US see another decade of 2% average annual GDP growth (and it has averaged less than that over the past decade), stock prices should be roughly half of what they are today to be considered fairly valued:

And Lance builds further on this, explaining how this moribund growth, coupled with America’s aging demographic trend, will simply savage the nation’s (already troublesomely underfunded) pension and entitlement systems:

…click on the above link to read the rest of the article…

Liberals Don’t Respect a Nation’s Sovereignty

Liberals Don’t Respect a Nation’s Sovereignty

When the United States and some of its allies in 2003 invaded and destroyed Iraq on false pretenses — and without Iraq having ever invaded (much less destroyed) any of the invading countries — this was actually within the scope of the invaders being liberal countries, because a nation’s sovereignty isn’t at all respected in traditional liberal thought. This also is the reason why some of the same nations invaded and destroyed Libya in 2011, and Syria since 2012. Neither of those two invaded countries had ever invaded — much less destroyed — any of their invaders; but, in all of these cases, such invasions were accepted by the populace within each of the invading countries, all of which invading countries considered themselves to be liberal nations. Why do liberals (and not only conservatives) so routinely accept barbaric aggressions by their own country? Here is the reason (and it needs to be read slowly and carefully, in order to become understood, because what follows is densely packed with meaning; the subject here is sufficiently deep to reach the core of things, like drilling through hard rock — it’s necessarily slow going):

A nation’s sovereignty means that the residents in a land possess the ultimate authority over that land, regardless of what its ‘owner’ might happen to be: a foreign king, an international corporation, or even a domestic person who is one of the people who live there. Consequently, whereas an authentic revolution by the residents within a country, to overthrow and replace their government — or else a vote to secede — is acceptable in the concept of national sovereignty (and is recognized as “the right of self-determination”), no foreign invasion is (and this includes any internal invasion to defeat a secession), unless the invasion is authentically a response to a real and present danger of, or else in direct response to, an invasion by the country (or region) that’s being invaded.

…click on the above link to read the rest of the article…

U.S. Oil Rig Count Continues To Collapse

The number of active oil and gas rigs in the United States fell this week by 8 rigs.

The total oil and gas rig count in the United States now stands at 936 rigs, up 430 rigs from the year prior, with the number of oil rigs in the United States decreasing by 7 this week and the number of gas rigs decreasing by 1. Canada, meanwhile, added 10 oil rigs for the week ending September 15.

Oil rigs in the United States now number 749—333 rigs above this time last year.

Although the number of oil rigs are still up significantly year on year, the increases slowed in the second quarter, and have reversed in the third. The first quarter 2017 saw 137 oil rigs added in the United States, while the second quarter 2017 saw 97 rigs added. In stark contrast, the third quarter, for which there are still two weeks to go, has seen the total number of rigs decrease by 7.

The spot price for WTI fell earlier on Friday, down 0.16 percent to $49.81 at 11:53am. Brent crude, however, was trading up 0.27 percent on the day at $55.62.

Prices have been volatile in August and so far in September, with WTI going as low as $45.58 on August 31, and as high as $50.50, which it reached yesterday—the highest level we’ve seen in six weeks—as global production declined 720,000 barrels per day in August compared to July, according to OPEC’s Monthly Oil Report. It was the first drop in four months.

(Click to enlarge)

At 10 minutes after the hour, WTI was trading at $49.69 with Brent crude trading at $55.40.