Steve Bull's Blog, page 1299

September 30, 2017

Blowout Week 196

The big news in the Energy Patch this week is the Kurdish independence vote, which threatens to disrupt the global oil market and could lead to civil war in Iraq. We follow up with the usual dose of stories from around the world: surging global demand for diesel; the Aramco IPO; US loans billions to two nuclear plants; Australian coal plants running out of coal; Tesla sends storage batteries to Puerto Rico; Denmark wants more solar; California mulls ban on fossil-fuel vehicles; Canada’s expanding farmland; the utility death spiral; no more wood-burning in London; batteries at Burbo Bank; the Barrier Reef stages an unexpected recovery; evaporation engines replace nuclear power and how global warming could damage your car’s suspension.

The big news in the Energy Patch this week is the Kurdish independence vote, which threatens to disrupt the global oil market and could lead to civil war in Iraq. We follow up with the usual dose of stories from around the world: surging global demand for diesel; the Aramco IPO; US loans billions to two nuclear plants; Australian coal plants running out of coal; Tesla sends storage batteries to Puerto Rico; Denmark wants more solar; California mulls ban on fossil-fuel vehicles; Canada’s expanding farmland; the utility death spiral; no more wood-burning in London; batteries at Burbo Bank; the Barrier Reef stages an unexpected recovery; evaporation engines replace nuclear power and how global warming could damage your car’s suspension.

Vox: Iraq’s Kurds just voted to secede. Here’s why that could cause a new civil war

The Kurds have just taken a large — and very dangerous — step by overwhelmingly approving a referendum on formally declaring independence from the Iraqi central government in Baghdad.

The mere act of holding the vote risks a new rupture between the Kurds and the Iraqi government — one with a real risk of actual fighting between the two sides. Kirkuk is the flashpoint largely because of its massive oil wealth. Nine billion barrels of oil reserves lie just outside the city — 6 percent of the world’s total and 40 percent of Iraq’s. Until recently, Baghdad produced and sold all of Kirkuk’s oil. But after ISIS sabotaged Baghdad’s pipeline and peshmerga forces streamed in, Baghdad lost control. Kurds now control three of the five oil fields. A deal reached in August 2016 ensured that both Kurdish and Iraqi governments get a share of the oil proceeds, but Baghdad wants its oil fields back. Yet Kurdistan needs oil revenue from Kirkuk to pay even a fraction of the costs of running a quasi-independent Kurdish state. Baghdad’s only way to regain control of Kirkuk is through negotiations or fighting.

…click on the above link to read the rest of the article…

The Financialization of America… and Its Discontents

The Financialization of America… and Its Discontents

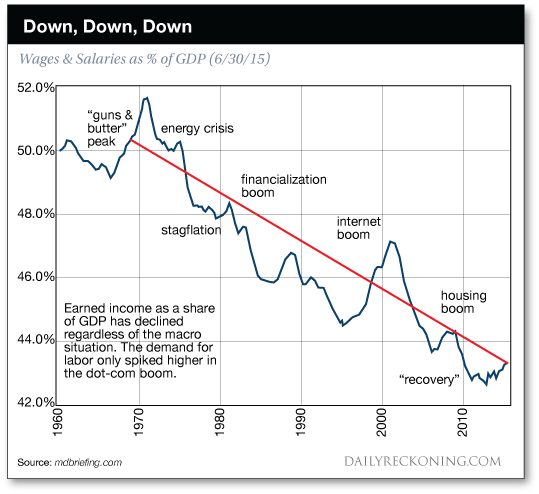

Labor’s share of the national income is in freefall as a direct result of the optimization of financialization.

The Achilles Heel of our socio-economic system is the secular stagnation of earned income, i.e. wages and salaries. Stagnating wages undermine every aspect of our economy: consumption, credit, taxation and perhaps most importantly, the unspoken social contract that the benefits of productivity and increasing wealth will be distributed widely, if not fairly.

This chart shows that labor’s declining share of the national income is not a recent problem, but a 45-year trend: despite occasional counter-trend blips, labor (earnings from labor/ employment) has seen its share of the economy plummet regardless of the political or economic environment.

Given the gravity of the consequences of this trend, mainstream economists have been struggling to explain it, as a means of eventually reversing it.

The explanations include automation, globalization/offshoring, the high cost of housing, a decline of corporate competition (i.e. the dominance of cartels and quasi-monopolies), a failure of our educational complex to keep pace, stagnating gains in productivity, and so on.

Each of these dynamics may well exacerbate the trend, but they all dodge the dominant driver of wage stagnation and rise income-wealth inequality: our economy is optimized for financialization, not labor/earned income.

What does our economy is optimized for financialization mean?

It means that capital and profits flow to the scarcities created by asymmetric access to information, leverage and cheap credit — the engines of financialization.

Financialization funnels the economy’s rewards to those with access to opaque financial processes and information flows, cheap central bank credit and private banking leverage.

…click on the above link to read the rest of the article…

‘Patriotism’ and Manipulation of it by the State

The notion that we must ‘support our troops’, that we must be ‘patriotic’ towards our nation state and its military because they are fighting for our freedoms and democracy is at a minimum misguided and more egregiously a manipulated conditioning by the state.

The idea that military ‘interventions’ are necessary to maintain our freedom or expand democracy ignores the evidence that the invasion and occupation of foreign sovereign states is motivated by imperial expansion to control fundamental resources (e.g. fossil fuels) and sustain or improve financial/economic hegemony (i.e. maintain the US petrodollar as the world’s premier reserve currency).

War is racket as US Marine Corps Major General Smedley Butler argued. It serves the financial interests of the State oligarchs. The State, however, must persuade the masses that this is not the case. It must have the support of the people for the political class to remain in their privileged positions and avoid blowback from the citizens over which they rule.

As Murray Rothbard argues in The Anatomy of the State

“[t]he State is almost universally considered an institution of social service…[and that] we are the government…[But] the government is not ‘us.’ The government does not in any accurate sense ‘represent’ the majority of the people…Briefly, the State is that organization in society which attempts to maintain a monopoly of the use of force and violence in a given territorial area…Having used force and violence to obtain its revenue, the State generally goes on to regulate and dictate other actions of its individual subjects…[Moreover, the] State provides a legal, orderly, systematic channel for the predation of private property; it renders certain, secure, and relatively ‘peaceful’ the lifeline of the parasitic caste in society…The State has never been created by a ‘social contract’; it has always been born in conquest and exploitation…While force is their modus operandi, their basic and long-run problem is ideological. For in order to continue in office, any government (not simply a ‘democratic’ government) must have the support of the majority of its subjects…[Thus] the chief task of the rulers is always to secure the active or resigned acceptance of the majority of the citizens…For this essential acceptance, the majority must be persuaded by ideology that their government is good, wise and, at least, inevitable, and certainly better than other conceivable alternatives…Since most men tend to love their homeland, the identification of that land and its people with the State was a means of making natural patriotism work to the State’s advantage.”

The State uses this patriotic ‘feeling’ to convince its citizens that any ‘attack’ is upon them and not upon the ruling caste. Any war between rulers thus becomes a war between people, with the masses defending the rulers in the misguided belief that they are defending themselves and certain ideologies.

In Hegemony or Survival, Noam Chomsky argues that Empire (the American one in particular) attempts to maintain its hegemony through military, political and economic means, demonstrating a total disregard for democracy and human rights in the process. He goes on to provide evidence that ‘preventative’ wars by the current global superpower are often used to keep potential/imagined threats from ever reaching a stage where they become real threats to its hegemony.

There is also increasing evidence that, in fact, the State’s citizens have far more to fear from its own government with regard to a loss of freedoms and erosion of democracy than some concocted threat from outside its own borders. The mass surveillance programmes revealed by NSA insiders, undermining of elections, and constant devaluation of currency/purchasing power comes to mind.

To once again quote Murray Rothbard:

“The greatest danger to the State is independent intellectual criticism; there is no better way to stifle that criticism than to attack any isolated voice, any raiser of new doubts as a profane violator…[and] to depreciate the individual and exalt the collectivity of society…[In fact,] the State must nip the view in the bud by ridiculing any view that defies opinions of the mass…Thus, ideological support being vital to the State, it must unceasingly try to impress the public with its ‘legitimacy,’ to distinguish its activities from those of mere brigands.”

The State, therefore, relies upon and manipulates its citizens’ very emotional notion of ‘patriotism.’ It uses it to maintain and expand its control of resources (both physical and financial) both domestically and abroad. And those who question or challenge it are branded treasonous and attacked/ostracised in any number of ways. Questioning is not allowed.

War is Racket. 1935. Smedley D. Butler.

Anatomy of the State. 1965. Murray N. Rothbard.

Hegemony or Survival: America’s Quest for Global Dominance. 2003. Noam Chomsky.

Rajoy Shuts Down Airspace & Orders Google to Stop Assisting Separatists

The Spanish Prime Minister, Mariano Rajoy who is becoming a disgrace to the image of a free society,

The Spanish Prime Minister, Mariano Rajoy who is becoming a disgrace to the image of a free society,

The Catalan supporters are now occupying poll points to protect their right to vote, while Rajoy has now blocked airspace over Barcelona as he wants to prevent the referendum in Catalonia by all means.

Rajoy had his puppet Spanish Supreme Court order that Google had to delete an app that had been used by the operators of the referendum to communicate with each other. The corrupt Spanish court ruled that the “On Votar 1-Oct” application on the Google Play smartphone app shop violated the ban imposed by Spain to conduct the referendum. Rajoy is totally out of control and is illustrating everything that is wrong about the EU and how it claims to stand for human right with the refugees but crushes anyon Europe who disagrees with the politic elite.

The vote will take place in a total of 2,155 polling stations. The government has shut down airspace to prevent others from flying into Barcelona to join the protests.

The Rajoy’s judiciary has also initiated investigations against more than 700 Catalan mayors, who support the independence referendum. The Regional Parliament had passed a bill in Barcelona in early September, which freed the way for the popular decision. The government in Barcelona had originally declared that if the independence won a majority, they would decline independence in 48 hours.

Canada allowed Quebec to vote of separatism TWICE. Even Britain allowed Scotland to vote on separation from the UK. Spain is showing the world that it is still a fascist state true to heart – not a democratic state. This raises serious concerns about foreign investment into Spain. If the government changes its position, you will find that country risk overpowers investment opportunity. BEWARE!

September 29, 2017

Just Because the Hedge Fund Wise Guys Have Forgotten

Today’s post will be about Japanese yen vol, but I am sure to bore some readers with that topic, so I am starting with something a little more interesting. As many of you know, I am a little bit of a bitcoin skeptic. At the end of the day, I have trouble investing in the ledger in the sky.

Call me old-fashioned, call me a troglodyte, call me a bitter gold bug, call me whatever you want, I just can’t bring myself to get long bits in the cloud. And before you send me messages how I don’t understand it, don’t forget I was mining bitcoin before most of Wall Street had ever heard of it. So I am much more than just some trade-a-saurus that refuses to get with the times, I am the knob who passed on bitcoin at $5.

Yet I have the privilege of counting Tony Greer from TG Macro as one of my pals, and his enthusiasm about using crypto currencies for micro-payments has piqued my interest. From Tony’s great letter the other day:

For selfish reasons, this is the article that gets me most excited about bitcoin and the blockchain. The streamlining of media distribution is going to kick the door open for individuals to compete with publishing powerhouses and main stream periodicals.

Publishing content on Amazon, iTunes, even YouTube is extremely costly for the author/artist. Youtubers can’t earn money until they get 10,000 views. Apple and Amazon take between 30% and 75% for the right to their distribution networks. Since media consumption has gone digital, it’s been difficult to charge on a PER ARTICLE basis because of high transaction costs making it prohibitively expensive. All that’s about to change.

…click on the above link to read the rest of the article…

Upon The Next Crisis, The Rules Will Suddenly Change

Upon The Next Crisis, The Rules Will Suddenly Change

For the benefit of the elites; not the rest of us

We can add a third certainty to the two standard ones (death and taxes): The rules will suddenly change when a financial crisis strikes.

Why is this a certainty? The answer is complex, as it draws on human nature, politics and the structure of societies/economies ruled by centralized states (governments).

The Core Imperative of the State: Expand Control

As I explain in my book, Resistance, Revolution, Liberation, the core (i.e. ontological) imperative of every central state is to expand its reach and control. This isn’t just the result of individuals within the state seeking more power; every centralized state views whatever is outside its control as a threat. The way to reduce or neutralize a threat is to take control of the mechanisms that generated it.

Once the state has gained control of these mechanisms, it is loath to relinquish them; to relinquish control is to invite chaos.

There is of course an intensely self-serving dynamic to extending state control: those being paid to enforce this state control have an immense vested interest in the state retaining (or even extending) this control, as their livelihoods now depend on the state doing so.

The higher-ups in the state also have a vested interest in retaining these new controls, as more control means more wealth and power accrue to those at the top of the centralized power pyramid: this extension of state control means private enterprise must now lobby the state for favors, and it gives the higher-ups more perquisites and favors to dispense—for a price, of course.

This vested interest arises throughout the power pyramid, from the bottom functionary with newfound power over common citizens to the managers of the departmental bureaucracy tasked with enforcing the new control to the apex of state authority.

…click on the above link to read the rest of the article…

The US Economy Is Failing

Do the Wall Street Journal’s editorial page editors read their own newspaper?

The frontpage headline story for the Labor Day weekend was “Low Wage Growth Challenges Fed.” Despite an alleged 4.4% unemployment rate, which is full employment, there is no real growth in wages. The front page story pointed out correctly that an economy alleged to be expanding at full employment, but absent any wage growth or inflation, is “a puzzle that complicates Federal Reserve policy decisions.”

On the editorial page itself, under “letters to the editor,” Professor Tony Lima of California State University points out what I have stressed for years: “The labor-force participation rate remains at historic lows. Much of the decrease is in the 18-34 age group, while participation rates have increased for those 55 and older.” Professor Lima points out that more evidence that the American worker is not in good shape comes from the rising number of Americans who can only find part-time work, which leaves them with truncated incomes and no fringe benefits, such as health care.

Positioned right next to this factual letter is the lead editorial written by someone who read neither the front page story or the professor’s letter. The lead editorial declares: “The biggest labor story this Labor Day is the trouble that employers are having finding workers across the country.” The Journal’s editorial page editors believe the solution to the alleged labor shortage is Senator Ron Johnson’s (R.Wis.) bill to permit the states to give 500,000 work visas to foreigners.

In my day as a Wall Street Journal editor and columnist, questions would have been asked that would have nixed the editorial. For example, how is there a labor shortage when there is no upward pressure on wages? In tight labor markets wages are bid up as employers compete for workers. For example, how is the labor market tight when the labor force participation rate is at historical lows.

…click on the above link to read the rest of the article…

Expert Analysis: Oil Prices Have Risen Too Far Too Fast

Last Friday we argued that the rally in WTI and Brent looked overstretched from technical and positioning viewpoints. This week obviously didn’t serve our viewpoint as geopolitical tensions in Iraq alongside bullish long-term calls from Citi and the trading group community- particularly Trafigura- at APPEC pushed the market slightly higher. There are undeniably glut-clearing trends at work in the U.S. and abroad but we continue to feel that crude oil has risen too far, too fast and positioned for length-liquidation on any fundamental speed bumps as WTI’s 14-day RSI touched 70 this week while RBOB + Heating Oil net length held by hedge funds reached 2.5 standard deviations above its 2yr average.

– Despite our view that the market is technically overbought we still need to acknowledge tightening fundamentals in several key global trading hubs. PADD IB gasoline stocks are now -13 percent y/y at their lowest level since 2014, PADD IB distillate inventories are -32 percent y/y, Singapore middle distillate stocks are -7 percent y/y and ARA gasoil stocks are -20 percent y/y.

– Now for the not-so-good news. We’re already seeing the next stages of shale progress in North American markets opposite increased production in Libya. U.S. crude production printed 9.55m bpd last week which is 60k bpd shy of its 2015-high following a 750k bpd rebound from Harvey disruptions. Producer hedging in Cal ’18 and ’19 WTI was significant this week and is currently driving a 7-vol premium for WTI M18 25 delta puts relative to the 25 delta call. We expect U.S. and Canadian production to be a thorn in the side of bulls in coming months. Further east, Libyan production also topped 950k bpd this week (according to Bloomberg) which could also pour some cold water on the current Brent spread strength.

…click on the above link to read the rest of the article…

Trump Administration Lobbying Hard for Sweeping Surveillance Law

Photo: Saul Loeb/AFP/Getty Images

TRUMP ADMINISTRATION LOBBYING HARD FOR SWEEPING SURVEILLANCE LAW

THE TRUMP ADMINISTRATION is pushing hard for the reauthorization of a key 2008 surveillance law — section 702 of the Foreign Intelligence Surveillance Act, known as FISA — three months before it sunsets in December.

To persuade senators to reauthorize the law in full, the Trump administration is holding classified, members-only briefings for the entire House and Senate next Wednesday, with heavy hitters in attendance: Attorney General Jeff Sessions, Director of National Intelligence Dan Coats, NSA Director Mike Rogers, and FBI Director Christopher Wray will give the briefings, according to an internal announcement of the meetings provided to The Intercept and confirmed by multiple sources on Capitol Hill.

Section 702 serves as the legal basis for two of the NSA’s largest mass surveillance programs, both revealed by Edward Snowden. One program, PRISM, allows the government to collect messaging data sent to and from foreign targets, from major internet companies like Google, Facebook, Apple, and Microsoft. The other, UPSTREAM, scans internet backbone sites in the U.S. and copies communications to and from foreign targets.

Both programs ostensibly only “target” foreigners, but likely collect massive amounts of Americans’ communications as well. And despite persistent questioning from members of Congress, the Obama and Trump administrations have repeatedly refused to provide an estimate of how many domestic communications the programs collect. Civil liberties advocates have long warned liberal defenders of the program under President Obama that one day the surveillance apparatus may fall into the hands of a president with little regard for rule of law or constitutional protections.

Privacy activists have also raised concerns about how the data is shared with law enforcement, and routinely used for purposes unrelated to national security. The FBI frequently conducts “backdoor searches” on the data during ordinary criminal investigations, which allows them access to Americans’ communications without having to get a warrant.

…click on the above link to read the rest of the article…

What’s The Matter With Inflation?

What’s The Matter Kansas inflation?

The divergence of official inflation as measured by the government versus inflation realized by the consumer and businesses has never been greater, in our opinion. Go ask anybody on the street in America and Europe if think “doing life or business” is getting more expensive.

We have some thoughts on what is the matter with the inflation data:

Defining inflation – what is your definition of inflation? What are we trying to measure? The prices in a consumer basket of goods and services? Wages? Asset prices?

Measurement problems – the official measurement procedures seem archaic given the advent of big data in the past few years. Even Bloomberg is out with a recent piece warning the Fed about low-balling inflation due to measurement errors.

Low-Balling Inflation Puts the Fed at Risk

Beware of any metric that doesn’t fully reflect housing prices.

The U.S. has an inflation problem. It has nothing to do with inflation being too high or too low. Unlike the raging inflation of the 1970s, it doesn’t need to be solved with a lengthy and painful recession. Instead, it is a problem of measurement because the cost of housing — the single biggest expense for many Americans — isn’t explicitly included in the inflation data.

…Recent research from the Bank for International Settlements finds that the transmission mechanism for monetary policy has shifted. In their paper “Monetary Policy Transmission and Trade-Offs in the United States: Old and New,” Boris Hofmann and Gert Peersman concluded that changes in monetary policy — rate hikes or rate cuts — are being filtered into the economy increasingly through housing prices and less so via businesses raising prices as in years past. So even though the Federal Reserve’s policies are causing those prices to rise, they aren’t registering in the form of higher overall inflation.

…click on the above link to read the rest of the article…