Steve Bull's Blog, page 1297

October 2, 2017

Spain Reveals EU Does Not Stand For Human Rights & Making Revolution Inevitable

The Spanish state police violence have turned against the people showing that they are clearly still a fascist reign supported by troops. Riot officers have been firing rubber bullets at crowds protesting in a Barcelona street, sending people running for cover. Countless are injured. This demonstrates that Spain is not a place for investment and one should be very cautious about even buying a house in Spain after this display of ruthless authoritarianism. The Spanish Prime Minister, Mariano Rajoy has demonstrated he is a fascist and this is EXACTLY the type of person that caused the American Revolution.

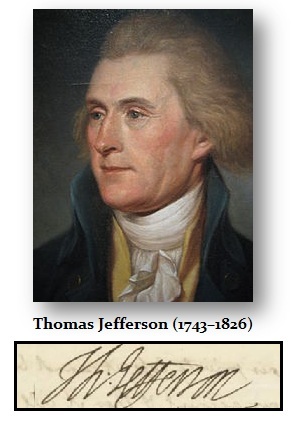

We should all take pause and read just the first two paragraphs of Thomas Jefferson’s Declaration of Independence. The King sent a whole army to his house to kill him for writing these words. He was warned the army was coming and told to flee into the hills which he did. I fully disagree with Donald Trump for supporting Rajoy. That has been a total disgrace and Trump needs to study history.

We should all take pause and read just the first two paragraphs of Thomas Jefferson’s Declaration of Independence. The King sent a whole army to his house to kill him for writing these words. He was warned the army was coming and told to flee into the hills which he did. I fully disagree with Donald Trump for supporting Rajoy. That has been a total disgrace and Trump needs to study history.

The suppression of the vote will now only turn even those who were on the side stand against the government. In war, you kill someone’s father. Their family will remember for generations. Spain has just confirmed that revolution and civil war will be inevitable. Canada allowed two referendum votes to separate for Quebec and Britain allowed Scotland to vote. It is a fundamental human right to overthrow any government when it becomes oppressive. Rajoy is a disgrace to the EU and Brussels is a disgrace for shutting down the vote of the people.

…click on the above link to read the rest of the article…

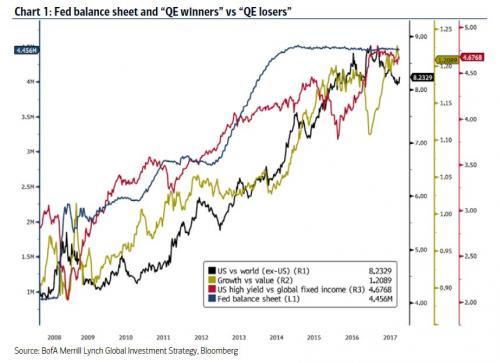

“The End Of The QE Trade”: Why Bank of America Expects An Imminent Market Correction

Last Friday, when looking at the historic, record lows in September volatility and the daily highs in US and global equity markets, BofA’s chief investment strategist Michael Hartnett said that the “best reason to be bearish in Q4 is there is no reason to be bearish.”

That prompted quite a few responses from traders, some snyde, a handful delighted (some bears still do exist), but most confused: after all what does investors (or algo) sentiment have to do with a “market” in which as Hartnett himself admits over $2 trillion in central bank liquidity has been injected in recent years to prop up risk assets.

To explain what he meant, overnight Hartnett followed up with an explainer note looking at the “Great Rotation vs the Great DIsruption”, in which he first reverted to his favorite topic, the blow-off market top he dubbed the “Icarus Rally”, which he defined initially nearly a year ago, and in which he notes that “big asset returns in 2017 have been driven by big global QE & big global EPS.”

But mostly “big global QE.”

And with global QE continuing, Hartnett, who two months ago predicted a volatile fall (and winter), now sees that Icarus “long risk” trade extended into autumn “by low inflation, big liquidity ($2.0tn central bank buying), high EPS, and promise of US tax reform.”

As a result, Hartnett’s “blow off top”, or Icarus, targets for Q4 are: S&P 2630, Nasdaq 6666, 10-year Treasury 2.85%, EUR 1.15. At this rate, the S&P could hit BofA’s target in about 3-4 weeks, and thus Hartnett lays out the following 11th hour trade recos for Q4

long US$ vs EM FX,

long oil,

long barbell of uber-growth (IBOTZ, DJECOM) & uber-value (BKX) = Icarus trade;

further unwind of extended “long disruptor, short disrupted” trade likely (i.e. death of old Retail, Media, Autos, Advertising by Tech Disruptors);

rotational outperformance of oil>credit, EAFE>EM,

value/growth

…click on the above link to read the rest of the article…

An Accountant Smells a Rat – Peter Diekmeyer

Twenty years ago Doug Noland was so worried about imbalances surrounding the dot.com boom that he began to title his weekly reports “The Credit Bubble Bulletin. Years later, he warned the world about the impending 2008 crisis.

However a coming implosion, he says, could be the biggest yet.

“We are in a global finance bubble, which I call the grand-daddy of all bubbles,” said Noland. “Economists can’t see it. They can’t model money and credit. However, to those outside the system, the facts are increasingly clear.”

Noland points to inflating real estate, bond and equity prices as key causes for concern. According to the Federal Reserve’s September Z.1 Flow of Funds report, the value of US equities jumped $1.5 trillion during the second quarter to $42.2 trillion, a record 219% of GDP.

Noland’s Credit Bubble thesis

Noland may be right. A report by the International Institute of Finance released in June estimated that global government, business and personal debts totaled $217 trillion earlier this year. That’s more than three times (327%) higher than global economic output.

Adding to the complexity is the fact that not all debts are fully recorded. For example, according to a World Economic Forum study, the world’s six largest pension saving systems – the US, UK, Japan, Netherlands, Canada and Australia – are expected to experience a $224 trillion funding shortfall by 2050.

Noland’s warnings come during a time of exceptional public trust in governments, central banks, regulators and other institutions. Market volatility is trending at near record lows.

In June, Federal Reserve Chair Janet Yellen spoke for many when she said that she did not see a financial crisis occurring “in our lifetimes.”

Unburdened by “econometrics groupthink”

So why would Noland, who during his day job runs a tactical short book at McAlvany Wealth Management, see things that government, academic, and central bank economists don’t?

…click on the above link to read the rest of the article…

Iran Deploys Tanks To Border With Iraqi Kurdistan

Days before last week’s Kurdistan referendum, Iran took steps to isolate and punish the Iraqi Kurdistan region and the government in Erbil (KRG). This included closing Iranian airspace to northern Iraq’s two international airports and sending Iran’s elite Revolutionary Guard forces to conduct drills along the northwest border with Kurdistan, but in the early hours of Monday Iran dramatically escalated its military build-up along the border by deploying dozens of tanks supported by artillery – this according to a Kurdish government official and Iranian state television.

The Kurdish official confirmed the tank build-up, saying “The tanks can be seen from the Kurdish side.” And Iranian state TV on Saturday indicated that Iran and Iraq would cooperate in joint drills and the establishment of heightened border security, to the point that Iran would “receive Iraqi forces that are to be stationed at border posts”.

Follow

Kurdistan 24 English ✔@K24English

#Iran|ian military drill on Kurdistan Region border (Haji Omaran Crossing Border) despite business being conducted as usual.#TwitterKurds

8:19 AM – Oct 2, 2017

Iranian government officials had warned just prior to last week’s referendum that, “The republic of Iran has opened its legitimate border gates on the premise of the consent of the federal government of the Iraqi state. If such an event [referendum] happens, these border gates from the perspective of the Islamic Republic of Iran would lose its legitimacy.” It appears Iran is now making good on its threats as it worries that an independent Kurdistan at its border would be a destabilizing force concerning Iran’s own sizable Kurdish minority.

Last week multiple videos and images surfaced in Iranian social media purporting to show Iranian state police and security forces deploying to the Kurdish towns in Iran’s north. Multiple reports indicate pro-Kurdistan demonstrations took place in various Kurdish Iranian towns in response to the Erbil government’s referendum, something strictly banned and thus a rarity in the Islamic Republic.

…click on the above link to read the rest of the article…

October 1, 2017

Behind Vancouver’s Housing Bubble: How Canadian Casinos Are Use To Launder Millions In Chinese Drug Money

Nearly two years after we first observed that Vancouver‘s soaring real estate market is nothing but a bubbling melange of criminal Chinese oligarch “hot money”, desperate to get parked offshore in any piece of real estate, but mostly in British Columbia regardless of price, a new multi-year investigation has uncovered extensive links – including money laundering and underground banking – between China’s criminal underworld and British Columbia drug and casino cash and VIPs, and their connections to China, Macau and the norotious triads.

Here is Postmedia’s real estate reporter Sam Cooper reporting on and explaining how British Columbia casinos are used to launder millions in drug cash.

* * *

On Oct. 15, 2015, a Mountie burst through the front door of an office in Richmond, carrying a battering ram and with a rifle slung on his back. The door swung shut behind him, locking him inside. He was in the lobby of Silver International Investment, a high-end money transfer business, surrounded by bulletproof glass. Behind a second glass door, a woman rushed to make a call while hiding several cellphones. Under her desk was a safe stuffed with bundles of cash. The Mountie, a large man, counted seconds anxiously, wondering if the woman would unlock the interior door.

It was one of 10 police raids in Richmond that day — part of a major investigation that has uncovered massive money laundering and underground banking networks with links to Mainland China, Macau and B.C. casinos, allege the RCMP’s federal organized crime unit and China’s national police service.

Postmedia has spent six months looking into the case, involving freedom of information requests for thousands of documents and dozens of interviews with government and law enforcement sources that were not authorized to be identified.

…click on the above link to read the rest of the article…

This Is What Collapse Looks Like: ‘Roving Gangs Fight For Resources… Aid Workers Being Held At Gunpoint In Puerto Rico’

What does it look like when the entire system around you collapses?

The fallout in Puerto Rico, which has left a devastating impact with no food on grocery store shelves or electricity to over three million people, gives us a glimpse:

Follow

The Daily Sheeple @TheDailySheeple

#PUERTORICO: ROVING GANGS, AID WORKERS BEING HELD AT GUNPOINT DELIVERING SUPPLIES#PuertoRicoCrisis

12:32 PM – Oct 1, 2017

As Daisy Luther of The Organic Prepper recently noted in What It’s Really Like After the SHTF, the situation with essential services and supplies is desperate and untenable:

Many homes were completely destroyed.

There is hardly any potable water.

Hospitals are struggling to keep people alive.

There isn’t much food.

There is little communication.

Help has been slow to arrive

In her widely popular guide The Prepper’s Blueprint, Tess Pennington of ReadyNutrition.com explains, with countless references to real-life events, how society and the system as we have come to know it can rapidly come to a standstill. Such disastrous aftermaths are, in fact, nothing new and have been repeated time and again throughout history:

Disasters have been going on for centuries and for someone to think they are untouchable is naive. Roughly 1% of Americans are adequately prepared for a disaster. The other 99% – well it’s not so good for them. Since disasters tend to have a mind of their own and the capacity to cripple our normal way of life, we want to create a well-rounded approach to our preparedness efforts.

…Disasters do not discriminate. In the aftermath of the event, you will be on your own, left to provide for your family with the supplies and knowledge you have accrued. If you are prepared with the mental and spiritual foundation to overcome a disaster, then you will transition into survival mode more quickly.

…click on the above link to read the rest of the article…

The Best Perennial Vegetables

THE BEST PERENNIAL VEGETABLES

One of the tasks that I most dislike about the farming life is preparing the raised beds each time I want to plant out a crop of tomatoes, peppers, eggplant, or onion. While I do enjoy eating a fresh tomato from my garden, the tedious, repetitive tasks of preparing the garden bed, weeding, and then planting out a winter cover crop does take up more time than I would like. Pasturing chickens over the beds in the fall time once the crops have stopped producing, does save some human labor, but with our orchards, pastures, and forests to take care of, I often find myself without adequate time to dedicate to beds of annual vegetables.

AN EXPERIMENT WITH ASPARAGUS

About three years ago, I purchased a bag of about 5,000 Mary Washington Asparagus Seeds. The seedlings germinated well in our cold, wet, mountain climate, and my family and I decided to dedicate about half of our on contour garden terraces (about ¼ of an acre) to the Asparagus crop. After a day or two of weeding and preparing the soil, we planted out the crop, mulched them heavily, and then eventually forgot about the Asparagus for several months as other farm jobs took over our attention.

About six months later, and two days of heavy weeding, we found the asparagus crop to be thriving despite our neglect. While we weren´t able to harvest the crop for the next two years, the Asparagus grew to cover the entire three terraces, essentially shading out most of the weeds. During the spring of the third year, we were gifted with bountiful amounts of asparagus that not only would be harvested this year, but for decades to come.

…click on the above link to read the rest of the article…

Canada’s Largest Shale Play Is Gaining Momentum

The National Energy Board of Canada released a resource assessment today, examining the Duvernay Shale of Alberta.

Deposited during the Devonian Period, the Duvernay Shale is located throughout central Alberta, running from Grande Prairie almost to Calgary. Located near, and in some locations directly below the Montney, the Duvernay is part of the larger Western Canadian petroleum system.

(Click to enlarge)

Source: National Energy Board

The NEB estimates that the Duvernay’s marketable resources are 76.6 Tcf of gas, 6.3 billion barrels of NGLs and 3.4 billion barrels of crude oil. “Marketable resources” represent the total amount of petroleum that can be recovered from the formation, not the actual reserves nor the original hydrocarbon in place.

(Click to enlarge)

Source: National Energy Board

According to Reuters, this makes the Duvernay the largest resource of unconventional crude oil and condensate in Canada. However, the Duvernay’s natural gas reserves are exceeded by two other basins in Canada. The Montney wears the crown with the largest natural gas resource, 449 Tcf recoverable. Following the Montney is the Liard Basin with 216 Tcf, located in British Columbia, the Yukon and the Northwest Territories.

(Click to enlarge)

Source: National Energy Board

Best rock lies in western Duvernay, around Whitecourt, Alberta

In its assessment, the NEB split the Duvernay into two plays, the East Shale Basin and the West Shale Basin. The West Shale Basin is the larger of the two by a significant margin, and holds a much larger area of sufficient quality that it was assessed. Other locations were not assessed because “they were considered unlikely to be developed; such as where the Duvernay Shale is less than 10 m thick, is under pressured, where its mapped in-place gas contents are less than 50 m3 of volume per m2 of area, and where oil contents were more than 2000 barrels per million cubic feet of gas (i.e., there is too little gas in the reservoir to help drive the oil out).”

…click on the above link to read the rest of the article…

2009 – 2016: Was the Eight-Year Experiment in Maintaining the Status Quo a Success or a Failure?

Clearly, the core strategy of maintaining the status quo is to borrow and spend trillions of additional dollars every year.

The Obama presidency was a grand experiment to test this thesis: the status quo of the U.S. is a self-correcting mechanism. Left to its own devices, it will automatically correct any socio-economic-political imbalances, given enough time.

The Grand Strategy of the post-Global Financial Crisis era was simple: maintain the status quo as is. The Obama administration’s major policy initiative, ObamaCare, a.k.a. the Affordable Care Act, was nothing but the formalization of the existing status quo in healthcare, i.e. the taxpayers subsidize private-sector profiteering.

That is the Affordable Care Act in a nutshell. Costs have not declined, the health of Americans can hardly be said to have improved significantly, but garsh, did healthcare sector profits soar. Most importantly, the status quo was maintained: nothing actually changed in the insurance, pharmaceutical or hospital sectors.

The same can be said for every other sector of the economy: nothing really changed, just more of the same. Higher education: nothing changed, just more student loan debt was issued. The defense industry: more of the same. Global War on Terror, a.k.a. The National Security State–more billions sluiced into the shadows.

President Obama was a master of telling everyone what they wanted to hear while changing nothing in the basic structure of the Empire. The Imperial Imperative of destabilizing nations that didn’t meet with Imperial approval continued unchanged. The murder-by-drone campaign expanded, the support of a hopelessly corrupt regime in Afghanistan continued unchanged, and so on.

There were two unstated assumptions in this eight-year experiment:

1. The status quo is perfectly fine and didn’t need changing

2. The self-correcting mechanism of the status quo–the self-serving pursuit of maximizing private gain–naturally yielded up whatever policy tweaks were deemed beneficial/ necessary.

…click on the above link to read the rest of the article…

Global Retirement Reality

Global Shortfall

UK Time Bomb

Swiss Cheese Retirement

Pay-As-You-Go Woes

Lisbon, Denver, Lugano, and Hong Kong

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop.

Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without dumping a huge and unwelcome bill on taxpayers. And since taxpayers are generally voters, it’s not at all clear they will pay that bill.

Readers outside the US might have felt smug and safe reading those stories. There go those Americans again, spending wildly beyond their means. You are correct that, generally speaking, we are not exactly the thriftiest people on Earth. However, if you live outside the US, your country may be more like ours than you think. Today we’ll look at some data that will show you what I mean. This week the spotlight will be on Europe.

First, let me suggest that you read my last letter, “Build Your Economic Storm Shelter Now,” if you missed it. It has some important background for today’s discussiion, as well as a special invitation to attend my Strategic Investment Conference next March 6–9 in San Diego. With so much change occurring so quickly now, next year’s conference is an event you shouldn’t miss.

Global Shortfall

I wrote a letter last June titled “Can You Afford to Reach 100?” Your answer may well be “Yes;” but, if so, you are one of the few. The World Economic Forum study I cited in that letter looked at six developed countries (the US, UK, Netherlands, Japan, Australia, and Canada) and two emerging markets (China and India) and found that by 2050 these countries will face a total savings shortfall of $400 trillion.

…click on the above link to read the rest of the article…