Steve Bull's Blog, page 1294

October 5, 2017

Ominous Earthquake Swarm At Yellowstone Supervolcano Now One Of Longest Ever Recorded

The rumblings beneath the formerly dormant supervolcano known as the Yellowstone caldera just won’t quit. And The ongoing earthquake swarm at the Yellowstone National Park supervolcano is now one of the longest ever recorded, having started on June 12. The ongoing earthquake swarm at the Yellowstone National Park supervolcano is now one of the longest ever recorded, having started on June 12.

Over the past three and a half months, almost 2,500 earthquakes have been recorded in the western part of the national park. This is on par with the biggest swarm ever recorded, where more than 3,000 earthquakes took place over three months, Newsweek reports.

In its latest monthly update about activity at Yellowstone, the US Geological Survey said 115 earthquakes had been reported in the park during September. Of these, 78 were part of the ongoing swarm 6 miles north of West Yellowstone. The biggest event in the swarm last month was magnitude 2.3.

“This is the sort of work that will happen in the months to come, as we gather up all of the available data and start crunching numbers,” Poland says. “What we can say now is that through the of September, the University of Utah has located 2,475 earthquakes in the swarm. This puts the 2017 swarm on par with that of 1985, which lasted three months and had over 3,000 located events. end

“[This is] certainly a fascinating event and one that we hope to learn more about through some post-swarm analysis,”he adds. “There’s a lot to work on this winter, for sure.”

While scientists at the USGS have brushed off the threat of a supervolcano eruption, scientists at NASA have said it represents a potentially devastating threat to the US population. These same scientists have suggested several risky strategies to prevent an eruption if one appears imminent.

…click on the above link to read the rest of the article…

Update on the Deflating Housing Bubble in Toronto

Missing Chinese money? Hardest hit is the priciest segment: detached houses.

Home sales in the Greater Toronto Area plunged 35% in September compared to a year ago, to 6,379 homes. The plunge in volume was spread across all types of homes. Even condos got hit:

Detached houses -40.4%

Semi-detached houses -30.2%

Townhouses -34.4%

Condos -27.5%.

As total sales plunged, new listings of homes for sale rose 9% year-over-year to 16,469, according to the Toronto Real Estate Board (TREB). And the total number of active listings of homes for sale soared 69% year-over-year to 19,021.

While Toronto’s housing market is still not drowning in listings, the plunge in sales volume and the surge in listings combined is a major change in market direction. And prices have followed.

The report tried to brim with industry hope: “The improvement in listings in September compared to a year earlier suggests that home owners are anticipating an uptick in sales activity as we move through the fall,” And it grabbed at straws: “Consumer polling undertaken for TREB in the spring suggested that buying intentions over the next year remain strong.”

Alas, “in the spring” – precisely in April – Toronto’s housing bubble peaked with a final and phenomenal melt-up of home prices: The average price had soared 30% year-over-year to C$920,761! And the mood of the housing market was at its most buoyant.

So how did the plunge in volume and the surge in listings impact prices?

The average price of all homes in the Greater Toronto Area, at C$775,546 in September, is down 16% from the crazy peak in April. Year over year, the average price is now up only 2.6%.

That’s a lot of backpedaling from a 30% year-over-year increase in April. To cool the housing market euphoria – and the risk it poses to lenders and homeowners – and to put a lid on ballooning affordability issues, the Ontario government introduced a laundry list of measures on April 20, including a 15% transfer tax on nonresident foreign speculators.

…click on the above link to read the rest of the article…

Catalonia’s Referendum Unmasks Authoritarianism in Spain

Monica Clua Losada, University of Texas Rio Grande Valley

I have long worried about the rise of authoritarianism in the European Union.

The Spanish government’s violent crackdown during the Catalonia referendum on Oct. 1 is the latest crisis to challenge EU institutions. Several member states are facing serious questions about territorial sovereignty. Just look to the Scottish referendum to leave the U.K. and questions opened up by the Brexit vote over the Irish border.

Catalonia experienced a level of police brutality not often seen in developed democracies. More than 800 people were injured, more than 100 of whom were hospitalized. Yet, in a rare televised appearance, King Felipe VI expressed full support for the Spanish government’s actions.

As a scholar of Spanish politics, I fear this creates the possibility for more repression and even the abolition of Catalonia’s autonomy.

Why has the Spanish government reacted with such a severe crackdown? To answer that question, it might useful to go back more than 40 years.

Franco’s legacy

When Spanish dictator Francisco Franco died in 1975, pro-democracy forces feared a new military coup. So they carefully crafted Spain’s 1978 Constitution to ensure stability, rather than create a radical change from authoritarianism.

The transition to democracy involved increasing political freedom for groups that had opposed Franco and had been persecuted by his dictatorship. But it also incorporated existing authoritarian groups and officials into the state. They included the Francoist military, the church and state structures that existed during the dictatorship – such as the judiciary, the police and the civil service.

Is Spain in danger of returning to the authoritarian days of the Franco dictatorship?

Zoeken Fotocollectie, Dutch National Archives, CC BY

…click on the above link to read the rest of the article…

Questioning the Growth Economy

QUESTIONING THE GROWTH ECONOMY

If you have ever driven through rural Kentucky or Ohio or Pennsylvania, chances are you have run across a horse drawn carriage with a group of people who appear to have emerged from the 1700´s. Many Amish and Mennonite communities still ardently and stubbornly maintain a pre-technological and pre-industrial lifestyle despite being surrounded by consumer capitalist civilization.

For many observers, these simple, hardworking farm communities are like a living antique; a surviving relic from bygone eras. Instead of seeing them as important sources of knowledge or bearers of much-needed skills that will be necessary for the construction of a more sustainable society, we see them as nothing more than as a unique field trip for elementary school kids or a place to buy strawberries come spring time.

For many people, though the Amish or Mennonite communities may be interesting, the idea of returning to a pre-industrial lifestyle is considered heresy. We may admire their sense of community and strong ties to land and place, but we can´t imagine living without our cars and smart phones.

The Hutterites are an ethnoreligious group that takes their anti-technology view to an extreme. There over 40,000 Hutterites living in colonies in Canada and the northern United States. Based on their somewhat radical religious theology, the Hutterites believe that all technological progress (from the 1800´s onwards) is a form of sin that goes against the Creator´s plan for the world. Subsequently, they sun any sort of technological advancement and live lives of simplicity.

Appropriate technology does not advocate for a return to pre-industrial lifestyles. While we do affirm that Mennonite and Amish colonies have much wisdom and knowledge and live a much more sustainable and healthy lifestyle than us modern folk, we also feel that technology can offer important instruments to help us in the task of constructing resilient and sustainable livelihoods.

…click on the above link to read the rest of the article…

What Defines Appropriate Technology?

WHAT DEFINES APPROPRIATE TECHNOLOGY?

OUR CURRENT ADDICTION TO TECHNOLOGY

If there is one defining aspect of our modern civilization it´s that we are a technological species. Compared to other organisms with whom we share this planet, we Homo sapiens aren´t exactly well adapted to long term survival. We have no coat of fur to keep us warm, we don´t have sharp teeth or claws to hunt with, and we´re extremely vulnerable to the elements around us at all times.

In fact, we kind of resemble in some ways a mishap of evolution; an unfortunate paint spill that sticks out on an otherwise beautifully painted canvas. If it weren´t for our ability to shape and alter our surroundings through technology we would have most likely long ago passed into the annals of history along with the dodo bird and the passenger pigeon.

The lion has its deftness and sharp claws, the monarch butterfly has its mesmerizing and threatening wing patterns, and us humans have nothing but a decently sized brain and the gift of self-conscious which has allowed us to reshape our surroundings through the use of technology. That which is our defining characteristic, however, has also been one of the main causes of the crises we now face.

HOW TO DEFINE WHAT IS APPROPRIATE FOR A PLACE

There are no universally appropriate technologies because we live in a diverse world where different contexts affect the “appropriateness” of each place. Agrarian author Wes Jackson states that nature must be our measure of what is right and correct for each place. We would add that the realities of the community where we live should also be an important factor regarding how we are to live in our places.

The fourth permaculture principle is “apply self-regulation and accept feedback.” Several of our current technologies are simply too large and too powerful to allow us to receive feedback.

…click on the above link to read the rest of the article…

The Sum of All Fears…..and a few related charts……

Today, I’d like to take some time to revisit a couple of related topics that we first started discussing a few years ago. I am, of course, referring to the burgeoning increases in China’s Debt levels, Shadow Bank Assets (loans) and M2, along with a high-level analysis of the most recent PBOC Financial Stability Report and FSB Global Shadow Bank Monitoring Report. (No!….please don’t click this page closed….I promise this will eventually get interesting…)

As a starting point, let’s begin by reviewing the February, 2015 McKinsey report Debt and (not much) Deleveraging . I first referenced the report in this blog in March of 2015. The report focused on the world’s, and particularly China’s, rapidly building debt/leverage phenomenon (2014 Year End Data). I encourage you to re-read the entire report, but for those of you who are pressed for time, I’ll give you the executive summary bullet-points right here:

Debt continues to grow

Reducing government debt will require a wider range of solutions

Shadow banking has retreated, but non‑bank credit remains important

Households borrow more

China’s debt is rising rapidly

I’m hoping that the McKinsey authors will consider updating the report, bringing the figures current, as I believe these observations, figures and analysis are even more pertinent today than they were back in 2015.

China’s Debt

So now, using McKinsey as a reference point, let’s take a look at where we are today, via the FRED (St. Louis FED)data below.

The FRED (Federal Reserve Economic Data – Citations below) Chart below represents US Core Debt (as defined and provided by the BIS – Bureau of International Settlements) compared to China Core Debt, as a percentage of GDP. The third (bold Red) line represents China’s debt levels adjusted for a “what-if” constant I’ll explain shortly.

…click on the above link to read the rest of the article…

Be Careful What You Wish For: Inflation Is Much Higher Than Advertised

What the Federal Reserve is actually whining about is not low inflation–it’s that high inflation isn’t pushing wages higher like it’s supposed to.

It’s not exactly a secret that real-world inflation is a lot higher than the official rates–the Consumer Price Index (CPI) and Personal Consumption Expenditures PCE). As many observers have pointed out, there are two primary flaws in the official measures of inflation:

1. Big-ticket expenses such as rent, healthcare and higher education–expenses that run into the thousands or tens of thousands of dollars annually–are severely underweighted or mis-reported. While rents are soared, the CPI uses an arcane (and misleading) measure of housing costs: owners equivalent rent. Why not just measure actual rents paid and actual mortgages/property taxes/home insurance premiums paid?

Healthcare is 18% of GDP but only 8.5% of CPI. To those exposed to actual costs of healthcare, 8.5% of the CPI is a joke.

The same can be said of higher education: households paying tuition and other college costs are exposed to horrendously high rates of inflation, as illustrated in this chart:

Revealing the Real Rate of Inflation Would Crash the System (August 3, 2016)

The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016)

Inflation Isn’t Evenly Distributed: The Protected Are Fine, the Unprotected Are Impoverished Debt-Serfs (May 25, 2017)

Then there’s the hedonic adjustments that are made to reflect improvements in quality, features, safety, etc. So the price of computers is discounted to reflect the increase in memory, etc. compared to previous models. This is a can of worms, as anyone shopping for a new car or truck can attest: yes, the vehicles have more safety features, but the sticker price is much higher. Do we knock off $10,000 the “price” because of these additional features? Why should we, when consumers have to pony up $10,000 more than they did a decade ago?

…click on the above link to read the rest of the article…

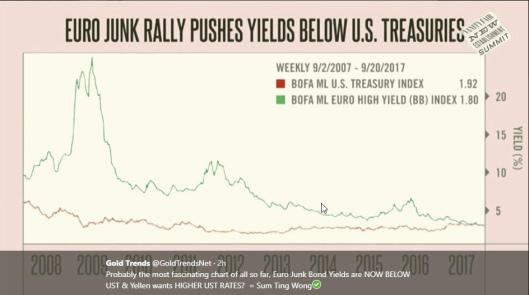

World’s Biggest Ever Junk Bond Bubble in Pictures: What Hath Draghi Wrought?

In regards to ECB QE bond purchases, inquiring minds may be asking: What hath ECB president Mario Draghi wrought?

The answer in words: The world’s biggest junk bond bubble.

I prefer gold.

On August 4, I commented on the Bubblicious Debate: Greenspan Says “Bond Bubble About to Break”, No Stock Market Bubble

There’s a bond bubble for sure, but it’s in corporate bonds, not treasuries.

This also isn’t the first time Greenspan has expressed concern about a bond bubble. Two years ago, when the 10-year Treasury yield was 2.44% and the CPI was 0.2%, he told Bloomberg TV that “we have a pending bond market bubble.” In a Bloomberg TV interview July 2016, he expressed concerns about stagflation and said “we’re seeing the very early signs of inflation beginning to tick up.” He also said with the 10-year Treasury yield pushed down to 1.50% by Brexit concerns, that he was “nervous” bond prices were too high.

“No Irrational Exuberance in Stocks”

“There is no irrational exuberance that I can see. In fact, it is just the opposite at this stage.”

Greenspan the Contrarian Indicator

Major comments by Alan Greenspan, widely portrayed by the media are most likely perfect contrarian indicators.

He has been calling the bond market a bubble for years but only recently did he say there was no stock market bubble.

With Greenspan, one needs to be careful. He is frequently correct about some things. However, the things about which he is correct are either never widely published, or they are widely disputed.

…click on the above link to read the rest of the article…

Will Brazil Be the Next Hotspot for Independence Movements?

If you’ve read my work over the past several weeks, you’ve probably noticed an increased fascination with secession/independence movements around the world. I think we’re at the very early stages of this developing trend, which will see nation-states across the world fracture for a variety of reasons. The historical significance of the political changes we’re about to live through cannot be overstated. As I wrote in last month’s piece, The Future Will Be Decentralized:

To conclude, I recognize that I’m making a huge call here. I think the way human beings organize their affairs will experience the most significant paradigm level shift we’ve seen in the Western world since the end of the European feudal system hundreds of years ago. That’s how significant I think this shift will be. There are two key things that need to happen for this to occur. The first is technological innovation, and that’s already happening. The second is increased human consciousness. As Thoreau noted, in order for us to have greater self-determination we need to be ready for it. Are we ready? I think we’re getting there.

While extremely significant, the Catalan independence movement is just the tip of the iceberg when it comes to a global drive toward political decentralization. For example, just today I came across another potential secessionist hotspot in an unexpected place, Brazil.

Bloomberg reports:

Inspired by the separatist vote in Catalonia, secessionists in three wealthy southern Brazilian states are redoubling their efforts to break away from the crisis-battered nation.

Residents of Rio Grande do Sul, Santa Catarina and Parana states are being called to vote in an informal plebiscite on Oct. 7 on whether they want independence. Organizers are also urging residents of the three states to sign a legislative proposal for each of their regional assemblies that would call for a formal, binding referendum.

…click on the above link to read the rest of the article…

Puerto Rico is on Track for Historic Debt Forgiveness–Unless Wall Street Gets Its Way

Photo: Joe Raedle/Getty Images

PUERTO RICO IS ON TRACK FOR HISTORIC DEBT FORGIVENESS — UNLESS WALL STREET GETS ITS WAY

FOR BONDHOLDERS SITTING on Puerto Rican debt, Hurricane Maria may have come just when they needed it, just as a yearslong battle over the fate of the island’s financial future was beginning to turn against them. Or, depending on how the politics shake out, they could see their entire bet go south.

Ahead of Maria, the federally appointed fiscal oversight board now in control of Puerto Rico’s finances had developed a plan that would wipe out 79 percent of the island’s annual debt payments, taking a massive chunk out of the payday hedge funds had been hoping to land from the island.

In the wake of the storm, that fight could go one of two ways: Advocates for Puerto Rico are making the case that the devastation means that 79 percent should be ratcheted up all the way to a full debt cancellation. The hedge funds, meanwhile, see an opening to attack the oversight board and reclaim ownership of the process.

While Congress focuses on the size and shape of the relief package, the battle over the much larger debt — at least $74 billion — is being overshadowed. As hedge funds attempt to undermine the board’s legitimacy in the courts, resentment toward the board from a different end of the political spectrum has made the body unpopular for entirely different reasons: It’s colonial and undemocratic. The difference between the two? The left wants debt relief for Puerto Ricans. Many bondholders want the opposite.

…click on the above link to read the rest of the article…