Steve Bull's Blog, page 1231

December 14, 2017

Finding Pathways to a Better Future

Part 1: Where Have We Been?

Unlike other ecosocialists, I have long argued that the path to radical social transformation called for the formation of the most inventive social movement the world has ever seen. But as a scholar of twentieth-century revolutions and twenty-first century movements for radical social change, I have started to come around to the idea that the urgency of the crisis in which we find ourselves, and the lack of adequate action on all sides (myself very much included) means that we need to consider the necessity of imagining something akin to a new kind of party. What if we rejected the binary between movement and party, elections and direct action, acted upon the urgency of the mandate for thinking in new ways, and embraced a creative synthesis of the two? This essay will explore our predicament and the prospects for ways out of it along these lines.

The world as we know it is crashing around us. The signs are evident, and they are everywhere: intense, extreme storms, floods, drought, heat, rain, fire, and winds – nothing is as it was. Politicians don’t know what to do, and the actions of so many of them seem downright cruel, vacuous, or incompetent. The devastation of war, military operations, policing, lethal drones, and physical attacks roll over populations entirely innocent of any crime. The slow grind of debt, privation, and daily exploitation wears on more than half of Earth’s human inhabitants. Non-human creatures are dying out in record numbers as Earth’s systems are polluted, contaminated, and wracked by the endless extraction of fossil fuels, minerals, and the loss of healthy soil and water.

…click on the above link to read the rest of the article…

‘Perfect Storm’ Wreaks Havoc On Europe’s Energy Market

The natural gas market in Europe suddenly got a lot tighter this week, with two unexpected supply outages wreaking havoc across the continent, forcing Italy to declare a state of emergency.

The first incident that made big headlines was the crack in the Forties pipeline in the North Sea, which caused Brent crude oil prices to immediately spike. The outage of the crucial 450,000 bpd pipeline sent a jolt through the oil market and was felt around the world, not only because it interrupted oil flows but also because of the influence the pipeline system has on the Brent futures contract.

But the shuttering of the pipeline system will also affect natural gas.

At least two UK natural gas fields – the Elgin-Franklin and Britannia – were forced to shut down because of the outage at the Forties system. Those two fields produce a combined 20 million cubic meters of natural gas per day (million cu m/d), according to S&P Global Platts. Add in maintenance at the North Morecambe field and the UK is currently down 27 million cu m/d.

Meanwhile, some unrelated problems due to a power outage at the Norwegian Troll field in the North Sea – Europe’s largest offshore natural gas field – knocked an additional 47 million cu m/d offline, although only for a brief period of time. Piling on, the Netherlands had to briefly reduce gas shipments to the UK because of problems with a compression station.

Because the UK doesn’t have nearly as much storage capacity for gas as parts of continental Europe, the disruptions will immediately translate into higher prices. UK natural gas futures for front-month contracts spiked by 23 percent to $9.86/MMBtu, according to Bloomberg. That is the highest price in four years. Wood Mackenzie estimates the UK may have lost the equivalent of about 10 percent of winter demand from the outage at the Forties pipeline system.

…click on the above link to read the rest of the article…

Debt is a Determining Factor in History

Photo by airpix | CC BY 2.0

Sovereign debt has been a crucial factor in a series of major historical events. From the early 19th century, in Latin American countries such as Colombia, Mexico and Argentina, struggling for independence,as well as Greece when seeking funds for its war of independence, these nascent countries borrowed from London bankers under leonine conditions which finally subjugated them into a new cycle of subordination.

Other states lost their sovereignty quite officially. Tunisia enjoyed some amount of autonomy in the Ottoman Empire, but was indebted to Parisian bankers. France used the ruse of debt to justify its tutelage over Tunisia and its colonization. Ten years later, in 1882, Egypt similarly lost its independence. In the pursuit of recovering debts owed to the English banks, Great Britain launched a military occupation of the country and then colonized it (http://www.cadtm.org/Debt-as-an-ins… ).

Debt “assures” the domination of one country over another

The Great Powers were quick to realise that the interest from a country’s external debt would be massive enough to justify a military intervention and a tutelage, at a time when it was considered acceptable to wage wars for debt recovery.

The 19th century Greek debt crisis resembles the current crisis

The problems flaring up in London in December 1825, ensued from the first major international banking crisis. When banks feel threatened, they no longer want to lend, as could be seen after the Lehman Brothers crisis in 2008. Emerging states, such as Greece, had borrowed under such obnoxious conditions, and the sum in hand was so little compared to the actual loan, that fresh borrowing became necessary to repay their existing debt. When the banks stopped lending, Greece was no longer able to refinance its debt and so suspended repayments in 1827.

…click on the above link to read the rest of the article…

China–Leading Indicator? Stocks, Credit Policy, Rebalancing and Money Supply

Chinese 10yr bond yields have been rising steadily since October 2016. They never reached the low or negative levels of Japan or Germany. 1yr bonds bottomed earlier at 1.76% in June 2015 having tested 1% back in 2009.

The pattern and path of Chinese rates is quite different from that of US Treasuries. Last month rates increased to their highest since 2014 and the Shanghai Composite index finally appears to have taken notice. The divergence, however, between Shanghai stocks and those of the US is worth investigating more closely.

The chart below shows the yield on 10yr Chinese Government Bonds since 2007 (LHS) and the 3 month inter-bank deposit rate over the same period (RHS):-

Source: Trading Economics

From a recent peak in 2014, yields declined steadily until October 2016, since when they have begun to rise quite sharply.

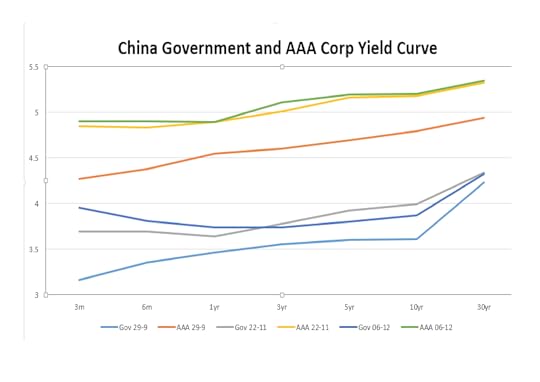

The next chart shows the change in yield of Government bonds and AAA Corporate bonds across the entire yeild curve:-

Source: PBoC

The dates I chose were 29th September – the day before the People’s Bank of China (PBoC) announced their targeted lending plan. The 22nd November – the day before the Shanghai index reversed and 6th December – bringing the data set up to date.

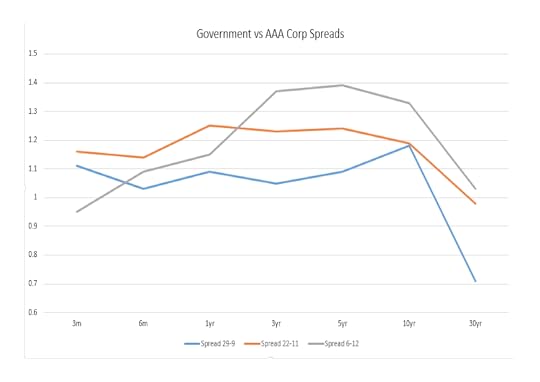

The general observation is simply that yields have risen across the maturity spectrum, but the next chart, showing the change in the spread between government and corporate paper reveals some additional nuances:-

Source: PBoC

Spreads have generally widened as monetary conditions have tightened. The widening has been most pronounced in the 30yr maturity. The widening of credit spreads may be driven by the prospect of $1trln of corporate debt which is due to mature between now and 2019.

Another factor may be the change in policy announced by the PBoC on September 30th. Bloomberg – China’s Central Bank Unveils Targeted Lending Plan to Aid Growth provides an excellent overview:-

…click on the above link to read the rest of the article…

“Loonie Longs Are Set For A Painful Dose Of Reality”: Trader

Is all hell about to breaks loose for Loonie longs?

Yesterday, Bank of America released a note titled simply enough “CAD longs at risk”, in which it said that “according to our liquid cross border flow (LCBF) data, hedge funds and real money now appear to be in the process of selling out of extended CAD longs after having been consistent buyers since the summer.” The Bank said that this represents an important directional shift and explained as follows:

As argued last month, risks remain sharply skewed to the upside in USDCAD over the next few months based largely on supportive US vs. Canada fundamentals and CAD position liquidation potential. Based on confirming trends in the LCBF data, we are more comfortable with our position liquidation thesis and continue to expect a retest of 1.33. Hedge funds began buying CAD after BoC Senior Deputy Governor Carolyn Wilkins delivered an upbeat assessment of Canada’s economic economy on June 12, marking the beginning of a pivotal shift in the BoC’s policy stance that ultimately saw the two emergency rate cuts of 2015 reversed in the July and September meetings. Hedge funds were net buyers of CAD in 13 of the 15 weeks following that speech, amassing a large cumulative position that peaked the week of November 17. In the three weeks since, roughly 40% of hedge fund longs in CAD have been liquidated.

As a result, BofA thinks that the risk is that real money follows the hedge fund lead and initiates the position squaring process, and added that “after unprofitably fading the Wilkins speech in the back half of June, real money began aggressively building long CAD positions from July through September, a period over which 80% of its peak cumulative long CAD position recorded on November 24 was put on.

…click on the above link to read the rest of the article…

December 13, 2017

What Causes Asset Bubbles?

As we showed yesterday, the price of bitcoin has finally surpassed “Tulips” in the global bubble race.

Overnight the former Bridgewater analysts Howard Wang and Robert Wu, who make up Convoy Investments, released their thoughts on what happens next… and most importantly, what causes asset bubbles…

When we see a dramatic rise in asset prices, there is often an internal struggle between the two types of investors within us.

The first is the value investor, “is this investment getting too expensive?”

The second is the momentum investor, “am I missing out on a trend?”

I believe the balance of these two approaches, both within ourselves and across a market, ultimately determines the propensity for bubble-like behavior. When there is a new or rapidly evolving market, our conviction in the value investor can weaken and the momentum investor can take over. Other markets that structurally lack a basis for valuation are even more susceptible to momentum swings because the main indicator of future value is the market’s perception of recent value. In this commentary, I quantify the balance of value vs. momentum in a market to explore how that tug of war can result in incredible asset bubbles.

The balance of value vs. momentum determines a market’s serial correlation

I believe the outcome of the tug of war between value and momentum in any market can be largely captured by a statistical measure called serial correlation – how likely is the recent past to determine the near future? A value of -1 means future returns are the exact opposite of recent past returns, a value of 0 means they are independent of each other, and a value of 1 means recent past returns are perfectly predictive future returns. After a dramatic price change, value investing would generally expect a reversion to the mean, suggesting a negative serial correlation.

…click on the above link to read the rest of the article…

China Regulators Complete Final ‘Drill’ In Preparation For Petro-Yuan Futures Trading

Amid all the chatter of Venezuela and Russia potentially creating oil-backed cryptocurrencies, the “huge news” of China’s launch of the Petro-Yuan has fallen off the front page… until now.

This week saw the Shanghai Futures Exchange complete its fifth yuan-back oil futures contract trading drill successfully…

As Bloomberg reports, 149 members of Shanghai International Energy Exchange traded 647,930 lots in the drill with total value of 268.2b yuan, according to a statement from the exchange, which added that the system basically met the listing requirements of crude futures after the drill.

While this was a success, it’s not all plain-saling…

As Bloomberg notes, as the world’s largest energy consumer and an increasing source of investment capital for oil-producing nations, China has an interest in using its own currency rather than that of a geopolitical competitor.

One hurdle for setting up a rival to Brent or West Texas Intermediate: Overseas oil producers and traders would need to swallow China’s capital controls and penchant for occasional market interventions.

Similar hurdles have kept foreign investors as bit players in China’s giant mainland stock and bond markets, and the share of payments in Yuan in the Global SWIFT system has fallen…

“This contract has the potential to greatly help China’s push for yuan internationalization,” said Yao Wei, chief China economist at Societe Generale SA in Paris.“But its success will hinge critically on the degree of freedom allowed for the capital flows related to the contract,” she said.

“It is not unreasonable to envision a world in which the overwhelming share of commodity contracts, especially for oil, are no longer denominated just in dollars,” said Eswar Prasad, a former China division chief at the IMF.

…click on the above link to read the rest of the article…

OPEC Reports Lowest Oil Output In Six Months; Fears Shale Production Surge

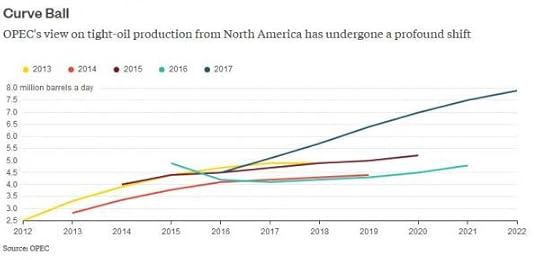

True to its perpetually optimistic form, OPEC, which last month for the first time conceded the threat posed by rising US shale production…

… sharply raised its demand forecast for cartel oil in 2018, ahead of the OPEC meeting at the end of November.

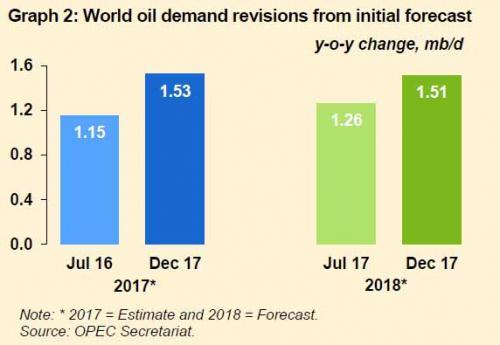

And, according to OPEC’s latest market report for the month of December, demand is set to continue rising, with global oil demand projected to grow at around 1.53 mb/d in 2017, in line with last month’s forecast. China is projected to lead oil demand growth in the non-OECD, followed by Other Asia – which includes India – and OECD Americas. Which means that an unexpected Chinese landing, whether hard or soft, will have an adverse impact on oil in addition to all other commodities.

Separately, in 2018, world oil demand is expected to grow by 1.51 mb/d according to the latest OPEC forecast. OECD will contribute positively to oil demand growth, adding some 0.28 mb/d, whereas the bulk of the growth will come from the non-OECD with 1.23 mb/d of potential growth. For 2018, the main assumptions behind the forecast are firm economic growth, lending support to industrial and construction fuels in both OECD and non-OECD. Expansion in the transportation sector is expected to provide the bulk of oil demand growth. Growth in petrochemical demand is projected to be one of the fastest-growing contributors in US, China, South Korea and the Middle East. As such, world oil demand growth is estimated at 1.51 mb/d in 2018, compared to 1.26 mb/d in the initial forecast.

More important than demand, however, was the November supply of OPEC oil, which declined by 133.5K to below 32.5 million bbl, a fresh six month low if only 195K bbl lower than last year’s output, confirming that ahead of last year’s production cut agreement, OPEC furiously ramped up production effectively offsetting the subsequent output limit.

…click on the above link to read the rest of the article…

Stressful Year Ahead for Spanish Banks

The “spillover effects.”

Just how much more stress Europe’s banking system can bear will be one of the big questions of 2018. This year was already a pretty stressful year, what with two major Italian banks being put out of their misery while, another, Monte dei Paschi di Siena, was brought back from the dead. In Spain, 300,000 shareholders and subordinate bondholders mourned the passing of the country’s sixth biggest bank, Banco Popular, which was acquired by Santander for the measly price of one euro.

Now, a whole new problem awaits. A report published by Spain’s second largest lender, BBVA, has warned about the potential impact on the sector’s profitability of new rules on provisions due to come into effect in early 2018.

Until now, banks only had to report losses when loans began deteriorating — i.e. when the defaults began. But the introduction in January of a new accounting rule, known as IFRS 9, will force banks in Europe to provision for souring loans much sooner than at present. One direct result will be that banks will have to hold more capital on their books, and that will have a detrimental impact on their profits.

If next year’s stress test by the ECB sets the same macroeconomic conditions and parameters as those used in 2014, banks holding just over one-fifth of the market share in Spain — measured in risk-weighted assets — would have to undertake provisions exceeding 200 basis points, the BBVA report predicts. That would leave some entities with a solvency rating lower than 9% — i.e., on the brink or even below the minimal level required by European regulation.

…click on the above link to read the rest of the article…

Overpopulation is a Problem, but Capitalist Overdevelopment is a Bigger Problem

Ed. note: This is a response by Richard Smith to Saral Sarkar’s commentary on Richard’s original article Climate Crisis and Managed Deindustrialization: Debating Alternatives published on Resilience.org here.

Saral misreads my statement. He says

“Richard writes, “Capitalism, not population is the main driver of planetary ecological collapse … .”. It sounds like an echo of statements from old-Marxist-socialism. It is not serious. Is Richard telling us that, while we are fighting a long-drawn-out battle against capitalism in order to overcome it, we can allow the population to continuously grow without risking any further destruction of the environment? Should we then think that a world population of ten billion by 2050 would not be any problem?”

By emphasizing population in bold italics he distorts my meaning. What I said was that “Capitalism, not population is the main driver of planetary collapse. . . ” — that is, the MAIN driver, not the ONLY driver. Though I’ve never written about this topic at length, I’ve never claimed that population growth is no problem at all. Saral’s right that some Marxists claim that the whole problem is capitalism, that there is no population problem, that the human population could grow more or less forever. They’re mostly responding to Malthusians who contend that overpopulation is the whole problem, not capitalism. I understand where they’re coming from. But both approaches seem simplistic to me. Of course overpopulation is a problem, a huge problem. Look around. I live in one of the most crowded pieces of real-estate in the world, in the middle of Manhattan. Sometimes the sidewalks are so full I have to walk along on the street to get by the crowds of people. By any rational measure there are just way too many people here.

…click on the above link to read the rest of the article…