Steve Bull's Blog, page 1233

December 12, 2017

How divesting of fossil fuels could help save the planet

Recently, a number of institutional investors, including Caisse de dépôt et placement du Québec in Canada and Norway’s sovereign wealth fund, announced their intent to reduce their exposure in investments linked to fossil fuels.

The announcements show that investors withdraw their funds to either mitigate financial risks or for ethical reasons. But the question remains whether divestment and divestment announcements have a financial impact on the share price of fossil fuel companies.

We’re a team of researchers at the School of Environment, Enterprise and Development (SEED) at the University of Waterloo. We recently conducted an analysis that suggests divestment announcements have a statistically significant negative impact on the price of fossil fuel shares. Our study aggregates the impact of more than 20 announcements across 200 publicly traded fossil fuel companies.

The results suggest that share prices dropped on the days that institutional investors announced they were divesting of fossil fuels.

We’ve concluded that investors, and the market as a whole, perceive divestment as integral to the long-term valuation of the fossil fuel industry. Lower share prices increase the costs of capital for the fossil fuel industry, which in turn decreases their ability to explore new resources and exploit proven resources.

And if the majority of proven reserves remains in the ground, we may be able to meet our climate change goals.

Reserves must stay grounded

The continued exploitation of fossil fuel reserves alone has the potential to increase greenhouse gases and global temperature well beyond the 2°C threshold required to prevent the worst effects of climate change.

To achieve the 2°C target, however, no more than one-fifth of the current proven fossil fuel reserves can be burned.

…click on the above link to read the rest of the article…

Three Bubbles/Strikes and You’re Out

Those betting on a fourth bubble of even greater extremes will find their time at bat has come to an end.

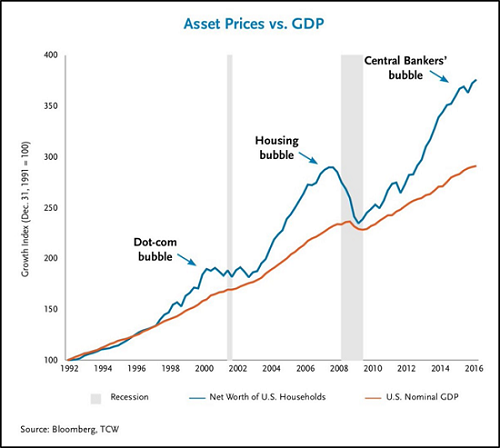

The conventional investment wisdom holds that central banks will never let markets decline. This is an interesting belief, given that two previous asset bubbles based on central bank “easy money” both imploded, impoverishing believers in central bank omnipotence.

So perhaps we can say that the conventional investment wisdom holds that any asset bubble that bursts will quickly be reflated into an even more extreme asset bubble. That’s certainly been the history of the past 17 years.

But there’s a case to be made that bubbles are like strikes, and you only get three. A recent article, Deutsche: “We Are Almost At The Point Beyond Which There Will Be No More Bubbles”, made a nuanced case for “3 bubbles and you’re out” based on volatility and other inputs.

I propose a much simpler case for “3 bubbles and you’re out”:

1. Every policy yields diminishing returns as the positive results follow an S-curve.

2. What every trader knows no longer has any predictive power.

3. Policy extremes have become normalized, leaving central banks with unintended and unpredictable consequences should they push even more extreme policies in the next bubble burst.

Radical new central bank policies work wonders in the initial boost phase (see diagram below) because the sums being deployed are so large and the policy is so extreme: quantitative easing / purchase of assets by central banks, for example: never before have central banks conjured trillions of dollars, yuan, yen and euros out of thin air and used this new currency to buy bonds, stocks and debt instruments in vast quantities for eight years running.

…click on the above link to read the rest of the article…

Saving Humanity From Itself

Since the beginning of the nuclear age and the dropping of the first atomic bombs, humankind has struggled with the reality of being able to destroy the planet on the one hand and the abolition of these weapons on the other. This year’s Nobel Peace Prize to the International Campaign to Abolish Nuclear (ICAN) acknowledges these realities and celebrates the efforts to achieve the latter. The Nobel Peace Prize with its award criteria specifies: the promotion of fraternity between nations; the advancement of disarmament and arms control and the holding and promotion of peace congresses.

From the beginning of the nuclear age in 1945 to the founding of the United Nations, 71 years ago, with its very first resolution–advocating for the importance of nuclear disarmament and a nuclear weapon-free world–nuclear abolition has been the necessary goal for our survival. The International Campaign to Abolish Nuclear Weapons (ICAN) exemplifies these ideals and brings hope to our world.

In a world armed with some 15,000 nuclear weapons, everything that we cherish and value is threatened every moment of every day. From a limited nuclear war to all out nuclear war between “superpowers,” our future is hanging in the balance. Whether by intent, miscalculation or accident, never before has the world been closer to nuclear war. From the setting of the Bulletin of Atomic Scientists Doomsday Clock in January of this year to 2 ½ minutes till midnight–where midnight represents Armageddon from nuclear war and the relationship to climate change–to the dangerous rhetoric between our president and North Korea, China and Russia resulting in the worst relations between nuclear powers in decades, we face great peril.

This year’s Nobel Peace Prize acknowledges the grave humanitarian consequences of nuclear war–a threat for which there is no adequate humanitarian or medical response and whose only solution is prevention through the total abolition of these weapons.

…click on the above link to read the rest of the article…

Are Economic Crises Inherent to Market Economies?

It is interesting to note that Marx, in his analysis of the capitalist economic system, basically concentrates on the study of the imbalances and maladjustments which occur in the market.

This accounts for the fact that Marxist theory is primarily a theory of market disequilibrium and that occasionally it even coincides remarkably with the dynamic analysis of market processes which was developed by economists of the Austrian School, and particularly by Mises and Hayek themselves. One of the more curious points on which a certain agreement exists relates precisely to the theory of the crises and recessions which systematically ravage the capitalist system. Thus it is interesting to observe that certain authors of the Marxist tradition, such as the Ukrainian Mijail Ivanovich Tugan-Baranovsky (1865–1919), reached the conclusion that economic crises originate from a tendency toward a lack of proportion among the different branches of production, a lack Tugan-Baranovsky believed inherent in the capitalist system.1 According to Baranovsky, crises occur because

the distribution of production ceases to be proportional: the machines, tools, tiles and wood used in construction are requested less than before, given that new companies are less numerous. However the producers of the means of production cannot withdraw their capital from their companies, and in addition, the importance of the capital involved in the form of buildings, machines, etc., obliges producers to continue producing (if not, the idle capital would not bear interest). Thus there is excessive production of the means of production.2

Clearly part of the underlying economic reasoning behind this analysis bears a strong resemblance to that behind the Austrian theory of the business cycle. In fact Hayek himself mentions Tugan-Baranovsky as one of the forerunners of the theory of the cycle he presents in Prices and Production.

…click on the above link to read the rest of the article…

Chinese Banks Push Back On Shadow Banking Regulations – Expose “Catch-22” For Financial System

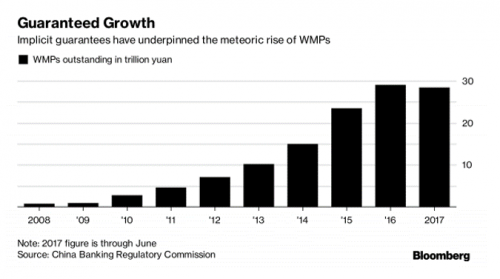

In November, we discussed how the post-Party Congress measures to deleverage and crackdown on the worst abuses in China’s credit bubble took an important step forward with the announcement of a new era of regulation for China’s $15 trillion shadow banking and asset management industry. See “A New Era In Chinese Regulation Means Turmoil For $15 Trillion In China’s Shadows”. In particular, the authorities turned their sights on wealth management products (WMPs).

On the way out are “guaranteed returns” and “capital pools” which had turned the $4 trillion sector into a leveraged Ponzi scheme. We joked that in a “radical and shocking” departure from the norm, financial institutions would have to offer yields based on the risk and returns of the underlying assets. Paying out guaranteed returns with new funds from depositors would no longer be allowed.

Commentators at the time described it as “a new era of regulation” which would lead to tighter risk control and slower but higher quality growth in the Chinese economy, blah, blah. However, our interest was piqued by the implementation date for the new rules. This is slated for the end of June 2019, providing Chinese banks and the entire shadow banking system a grade period to get their house in order. As we suggested.

We can only guess the delay reflects the enormity of the problems discovered by China’s regulators when they finally looked under the hood.

We didn’t have to wait long for confirmation that our cynicism was justified. It turns out that there was a “closed-door meeting” last week during which Chinese banks laid out the systemic risk if the regulators pursue their reform plan. According to Reuters.

…click on the above link to read the rest of the article…

December 11, 2017

Doug Noland: There Will Be No Way Out When This Market Bubble Bursts

Financial assets will become toxic to hold

This week Doug Noland joins the podcast to discuss what he refers to as the “granddaddy of all bubbles”.

Noland, a 30-year market analyst and specialist in credit cycles, currently works at McAlvany Wealth Management and is well known for his prior 16-year stint helping manage the Prudent Bear Fund.

He certainly shares our views that prices in nearly every financial asset class have become remarkably distorted due to central bank intervention, first with Greenspan’s actions to backstop the markets in the late-1980’s, and more recently (and more egregiously) with the combined central banking cartel’s massive and sustained liquidity injections in the years following the Great Financial Crisis.

All of which has blown the biggest inter-connected set of asset price bubbles the world has ever seen.

Noland foresees tremendous losses as inevitable, as the central banks lose control of the monstrosity they have created:

This is the granddaddy of all bubbles. We are at the end a long cycle where the bubble has reached the heart of money and credit.

There will be no way out. We’re not going to get enough private credit growth to reflate things when this bubble bursts. It’s going to have to come from central bank credit; it’s going to have to come from sovereign debt.

When this bubble bursts, it will shock people how far the central banks will have to expand their balance sheet just to accommodate the deleveraging in the system. And they won’t really be able to add new liquidity to the market; they’re just going to allow the transfer of leveraged positions from the leveraged players onto the central bank balance sheets.

…click on the above link to read the rest of the article…

The Psyops of the “Silence Breakers” Meme

Time magazine just named their widely acclaimed and followed “Person of the Year”, an award sometimes not given to a single person, but rather to several people, a meme or movement, an entity, basically any ‘thing’ that has greatly influenced the public discourse or narrative.

That’s their story and they’re sticking to it.

This year (Dec of 2017) Time announced their selection for the award…”The Silence Breakers”…collectively several women who have individually, and publicly, broken their silence regarding (past) sexual abuse and unwanted transgressions by men in positions of power and influence.

Where do I begin?

Just about the only thing that isn’t fraudulent about this entire affair is the fact there was actual sexual abuse and unwanted transgressions by men in positions of power, though components of this ‘truth meme’ will be challenged by me in this article.

Unfortunately this subject, as are all subjects we don’t talk (or think) about, is a cognitive landmine just waiting to ensnare and destroy. We are only as sick as our deepest darkest secrets, those people, places and things we dare not speak of, even to ourselves. Or, at best, we speak of them in hushed tones only to our closest confidants, often not our spouses and loved ones.

In an effort to defuse the worst of the triggered I shall lay out my credentials in public to demonstrate I’ve had chips in the game and I may actually know something about the subject, despite being a ‘privileged’ white male.

I was abused both as a child and as a young adult…in every way imaginable, meaning not just sexually. I am/was one of those who were ‘silenced’ by the person(s) in power, by the public’s refusal to discuss these ugly subjects and, most importantly, by myself.

…click on the above link to read the rest of the article…

December 10, 2017

The Energy Transition: Too Little, Too Late

The idea of the energy transition (“energiewende” in German) originated in the 1980s and gained legislative support in Germany in 2010. The idea is good and also technically feasible. But it requires sacrifices and, at present, sacrifices are politically unthinkable since most people don’t realize how critical the situation really is. What we are doing for the transition seems to be is too little and too late.

So, how are we doing with the energy transition? Can we eliminate fossil fuels from the world’s energy system? Can we do it before it is too late to avoid the disasters that climate change and resource depletion will bring to us if we continue with business as usual? The debate is ongoing and it sometimes it goes out of control as in the case of the controversy between the group of Professor Jacobsen at and that of Professor Clack which even generated a lawsuit for slander.

As usual, the debate is often based on qualitative consideration: on one side we see plenty of naive optimism (“let’s go solar, rah, rah!”), on the other, we have pure statements of disbelief (“renewables will never be able to…..”).

But science is based on quantitative evaluations and we have plenty of data that should permit us to do better than playing the game of the clash of absolutes. This is what we did, myself and my coworker Sgouris Sgouridis, in a paper that was recently published on “Biophysical Economics and Resource Quality” and titled “In Support of a Physics-Based Energy Transition Planning: Sowing Our Future Energy Needs”

…click on the above link to read the rest of the article…

Bitcoin Doesn’t Exist – 5

Gustave Courbet Sunset on Lake Geneva 1876

Chapter 1 of this five-part series by Dr. D is here: Bitcoin Doesn’t Exist – 1

Chapter 1 of this five-part series by Dr. D is here: Bitcoin Doesn’t Exist – 1Chapter 2 is here: Bitcoin Doesn’t Exist – 2

Chapter 3 is here: Bitcoin Doesn’t Exist – 3

Chapter 4 is here: Bitcoin Doesn’t Exist – 4

Next up: all 5 chapters combined in one big essay.

Dr. D: Bitcoin can be stolen. Although “Bitcoin” can’t be hacked, it’s only software and has many vulnerabilities. If held on an exchange, you have legal and financial risk. If held at home, you could have a hard drive fail and lose your passwords. If it’s on a hardware fob like a Trezor, the circuits could fail. For a robust system, computers themselves are pretty fragile. You could write down your passwords on paper, and have a house fire. You could print out several copies, but if any of the copies are found, they have full access to your account and stolen without you knowing. You could have your passwords stolen by your family, or have a trojan take a screen or keystroke capture.

Dr. D: Bitcoin can be stolen. Although “Bitcoin” can’t be hacked, it’s only software and has many vulnerabilities. If held on an exchange, you have legal and financial risk. If held at home, you could have a hard drive fail and lose your passwords. If it’s on a hardware fob like a Trezor, the circuits could fail. For a robust system, computers themselves are pretty fragile. You could write down your passwords on paper, and have a house fire. You could print out several copies, but if any of the copies are found, they have full access to your account and stolen without you knowing. You could have your passwords stolen by your family, or have a trojan take a screen or keystroke capture.

Hackers could find a vulnerability not in Bitcoin, but in Android or AppleOS, slowly load the virus on 10,000 devices, then steal 10,000 passwords and clear 10,000 accounts in an hour. There are so many things that can go wrong, not because of the software, but at the point where you interface with the software. Every vault has a door. The door is what makes a vault useful, but is also the vault’s weakness. This is no different than leaving blank checks around, losing your debit card, or leaving cash on your dashboard, but it’s not true that there are no drawbacks. However the risks are less obvious and more unfamiliar.

…click on the above link to read the rest of the article…

Trump Continues Obama’s Wars Against Democracy

Trump Continues Obama’s Wars Against Democracy

US President Trump’s bold support for the apartheid dictatorship of Israel against that theocratic-racist nation’s non-Jews, fits into a larger picture of the supremacist nation that America itself has increasingly become. His immediate predecessor, Barack Obama, had repeatedly referred to the United States as being the only indispensable nation — that all others are “dispensable” — such as when President Obama addressed America’s future military leaders, at West Point, on 28 May 2014, by telling them:

The United States is and remains the one indispensable nation. That has been true for the century passed and it will be true for the century to come. … Russia’s aggression toward former Soviet states unnerves capitals in Europe, while China’s economic rise and military reach worries its neighbors. From Brazil to India, rising middle classes compete with us, and governments seek a greater say in global forums. … It will be your generation’s task to respond to this new world.

He was telling the military that America’s economic competition, against the BRICS nations, is a key matter for America’s military, and not only for America’s private corporations; that US taxpayers fund America’s military at least partially in order to impose the wills and extend the wealth of the stockholders in America’s corporations abroad; and that the countries against which America is in economic competition are “dispensable” but America “is and remains the one indispensable nation.” This, supposedly, also authorizes America’s weapons and troops to fight against countries whose “governments seek a greater say in global forums.” In other words: Stop the growing economies from growing faster than America’s. There is another name for the American Government’s supremacist ideology. This term is “fascism.”

…click on the above link to read the rest of the article…