Steve Bull's Blog, page 1227

December 19, 2017

Jedi Mind Trick: The Disturbing, Destabilizing Abnormal Is Now Normal

Disturbing, destabilizing abnormalities are now accepted as normal life in America.

Forgive me for wondering if the populace of America hasn’t fallen for a Jedi mind trick:

Disturbing, destabilizing abnormalities are now accepted as normal life in America:

1. Sprawling tent camps of homeless sprout like flowers of poverty in U.S. cities, leaving mountains of trash that speak volumes about systemic failure, destitution and overwhelmed city services.

2. The Federal Reserve’s vaunted “Wealth Effect” that was supposed to be a tide that raised all boats at least a bit has concentrated wealth and power in the top 5%, 1%, and 1/10th of 1%, leaving the bottom 95% with diminished prospects and a thinning stake in The American Project.

3. The stock market’s year-long levitation while the real-world economy decays is a perverse counter-correlation that reflects the widening divide between those enriched by the asset bubbles and those left further behind.

4. In the midst of a supposedly resurgent U.S. “recovery” in its 9th year of wonderfulness, the opioid epidemic has killed tens of thousands and crippled hundreds of thousands of lives and families, yet the federal government, supposedly the most powerful force on the planet, is frozen in a decades-long law-enforcement/Drug Gulag obsession, blind to the Big Pharma Cartel that has created and fueled the epidemic as a means of reaping billions in profits.

5. The nation’s Corporate/Billionaire-owned Media obsess endlessly over the chimera of Russian collusion, as if that was the Big Story That Matters, while the nation’s rigged economy is coming apart at the seams.

6. While the Sports Media Empires fret over the decline of fan engagement in the NFL, nobody dares mention that Pro Sports is now unaffordable to the vast majority of households.

7. Healthcare costs continue spiraling higher, even as Americans are visibly less healthy.

…click on the above link to read the rest of the article…

St. Louis Fed Promotes the Mathematically Impossible

It’s bad enough when economic writers are clueless about how markets work. It’s worse when Fed economists are clueless.

Check out this Tweet by @StLoiusFed.

St. Louis Fed

@stlouisfed

Negative interest rates may seem ludicrous, but not if they succeed in pushing people to invest in something more stimulating to the economy than government bonds http://bit.ly/2ASFrRz

10:00 PM – Dec 15, 2017

170 people liked this Tweet.

Understanding the Math

Negative interest rates cannot push people into more stimulating investments.

No matter how negative the rate, someone has to hold every treasury bond and someone has to hold every dollar in circulation.

In the equity markets, for every buyer of stocks, there is a seller, thus the sideline cash argument fails as well.

It’s bad enough when analysts fail to understand basic economics, but even Fed economists are clueless about how markets work.

Negative rates cannot possibly do what the Fed suggests, but they can foster an artificial wealth effect when people borrow or spend more than they should.

Any economic gain spurred on by reckless borrowing will all be taken back and then some, in the next recession.

Zombie Corporations

Negative real rates also foster zombie corporations. The BIS defines Zombie firms as those with a ratio of earnings before interest and taxes to interest expenses below one, with the firm aged 10 years or more.

As it sits, 10% of corporations are zombies, unable to make interest payments from profits.They need cheap money to survive.

For discussion, please see Zombie Corporations: 10% of Companies Depend on Cheap Central Bank Money.

If the St. Louis Fed economists see a sustainable benefit from spurring zombie corporations, they are wrong about that too.

Import and Die: Self-sufficiency and Food Security in India

India’s Vice-President M Venkaiah Naidu recently stated that the country cannot survive on imported produce for its food security. He called for a greater focus on agriculture: “We can export (agricultural produce) for the time being but the population is growing.”

Naidu pointed out what has become increasingly apparent: “People are leaving agriculture and going to other professions. An agriculturist does not want his son to continue with the profession because of uncertain monsoons, natural calamities, market exploitation, etc. All this is affecting agriculture.”

Noting that agriculture is becoming financially unviable for farmers, he called for an end to the urban-rural divide by ensuring that people living in rural areas are provided basic amenities.

There are hints of the need to achieve food self-sufficiency in what he says and that is encouraging. But there is also a World Bank-backed plan for the future of India and the majority of farmers don’t have much of a role in it. Successive administrations in India have been facilitating this plan by making farming financially unviable with the aim of moving farmers out of farming and into the cities to work in manufacturing or service sector jobs – jobs that, by the way, do not exist. It is an agenda founded on a bogus model of ‘development’.

According to this report, the number of cultivators in India declined from 166 million to 146 million between 2004 and 2011. Some 6,700 left farming each day. Between 2015 and 2022 the number of cultivators is likely to decrease to around 127 million.

The aim is to restructure agriculture according to the wishes of the US and its agribusiness corporations.

It entails displacing the existing labour-intensive system of food and agriculture with one dominated by a few transnational corporate agribusiness concerns which will control all aspects of the sector from seed to plate.

…click on the above link to read the rest of the article…

Saudis Intercept Houthi Ballistic Missile Targeting Riyadh Royal Palace

For the third time in roughly seven weeks, Houthi rebels have fired a ballistic missile into Saudi Arabia, according to a spokesperson. This time, the target was al-Yamamah palace in the Saudi capital, Riyadh.

US President Donald Trump notably held meetings with the Saudi king at the al-Yamamah palace during his May trip to the kingdom.

Witnesses in Riyadh reported hearing a blast and seeing a plume of smoke. Saudi security officials did not immediately comment on the incident, according to Haaretz.

Houthis launched two ballistic missiles at Saudi Arabia in November, but neither hit their targets. One was reportedly fired at King Khalid International Airport in Riyadh while the other was fired at a Saudi oil refinery.

According to Russia Today, the Saudi-led coalition that has been battling the rebels in Yemen has reportedly shot down the missile, according to Russia Today.

Saudi state TV claimed the missile – a Burkan 2H ballistic missile – was intercepted by Saudi defenses…

View image on Twitter

[image error]عبدالله بن خالد

@AbdullahKhaledS

Reports of a ballistic missile just intercepted over Riyadh

6:04 AM – Dec 19, 2017

There were no immediate reports of injuries and there has been no official statement from the Saudi government. However, a Houthi rebel spokesman on Twitter confirmed the missile launch.

December 18, 2017

‘Sorry Chump. You Didn’t Have it in Writing’

At a time when the United States is convulsed by anti-Russian hysteria and demonization of Vladimir Putin, a trove of recently declassified Cold War documents reveals the astounding extent of the lies, duplicity and double-dealing engaged in by the western powers with the collapsing Soviet Union in 1990.

I was covering Moscow in those days and met some of the key players in this sordid drama. Ever since, I’ve been writing that the Soviet leader, Mikhail Gorbachev, and Foreign Minister, Eduard Shevardnadze, were shamelessly lied to and deceived by the United States, Britain, and their appendage, NATO.

All the western powers promised Gorbachev and Shevardnadze that NATO would not expand eastward by ‘one inch’ if Moscow would pull the Red Army out of East Germany and allow it to peacefully reunify with West Germany. This was a titanic concession by Gorbachev: it led to a failed coup against him in 1991 by Communist hardliners.

The documents released by George Washington University in Washington DC, which I attended for a semester, make sickening reading (see them online). All western powers and statesmen assured the Russians that NATO would not take advantage of the Soviet retreat and that a new era of amity and cooperation would dawn in post-Cold War Europe. US Secretary of State Jim Baker offered ‘ironclad guarantees’ there would be no NATO expansion. Lies, all lies.

Gorbachev was a humanist, a very decent, intelligent man who believed he could end the Cold War and nuclear arms race. He ordered the Red Army back from Eastern Europe. I was in Wunsdorf, East Germany, HQ of the Group of Soviet Forces, Germany, and at Stasi secret police HQ in East Berlin right after the pullout order was given. The Soviets withdrew their 338,000 troops and 4,200 tanks and sent them home at lightening speed.

…click on the above link to read the rest of the article…

Newsweek: “U.S. Government Planned False Flag Attacks to Start War”

Mainstream Media Admits that False Flags Are Real

Last month, Newsweek ran an article headlined (all caps in original Newsweek title):

U.S. GOVERNMENT PLANNED FALSE FLAG ATTACKS TO START WAR WITH SOVIET UNION, JFK DOCUMENTS SHOW

The article notes:

The U.S. government once wanted to plan false flag attacks with Soviet aircraft to justify war with the USSR or its allies, newly declassified documents surrounding the assassination of President John F. Kennedy show.

***

False flag attacks are covert operations that make it look like an attack was carried out by another group than the group that actually carried them out.

The mainstream media is finally catching up with what historians have long documented …

After all, influential royal advisors have been advocating false flag attacks for more than 2,000 years … and false flag attacks are so common that U.S. officials commonly discuss them.

Indeed, there are now so many admissions by government officials of false flag terror that only the willfully ignorant still doubt the reality of the concept.

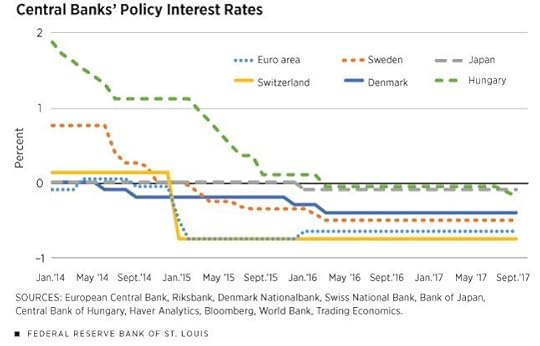

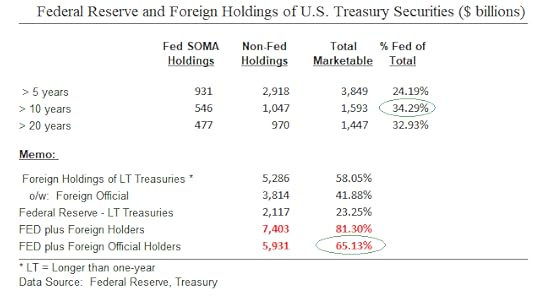

Interest Rates Starting To Bite

We have long held that interest rates have been so low (especially real rates) that it will take some time to reach a level for them to really matter and impact markets. The 2-year yield crossing over the S&P500 divie yield this past week for the first time in the last ten years is unlikely to slow the momentum driving risk markets. Nevertheless, they are getting closer to the zip code — after two years since the tightening cycle began — where they will begin to impact fundamental valuations (what is the fundamental value of Bitcoin?) and the relative pricing of risk assets. Keep it on your radar.

Long-term rates are so utterly distorted by the central banks we are not sure if the markets even pay attention anymore. Pancaking of the yield curve? Not the signal it used to be. Meh!

The above, of course, is somewhat offset by the massive stock of central bank money in the global financial system which has driven up asset values to a level that has finally kicked the real economy into third gear. This has created the perception of a Goldilocks global enviornment and positive feedback loop between markets and the economy. Now add fiscal stimulus.

The unprecedented reservoir of the mix of this type of money is still so full it will take some time to drawdown central bank balance sheets to parch the risk markets. A higher share of central bank money relative to credit based bank money reduces global systemic risk and thus asset price risk premia. Thus, additional market distortions.

The party continues. Momentum is a powerful thang! Until it isn’t.

…click on the above link to read the rest of the article…

The broken glass: some thoughts on ‘Population 10 Billion’

Danny Dorling’s book Population 10 Billion1 has been sitting in the in-tray of the Small Farm Future review department (along with a whole load of other books) for a couple of years now. I’ve been on their case about it, but until now I’ve had nothing from those slackers. Maybe I should introduce performance related pay… On which note, just a shout out for this blog’s seasonal appeal for funds, Wikipedia-style: “if every reader of Small Farm Future donated, er, about £1,000 annually, I could devote myself to it full-time and turn out the reviews a lot faster.” Or maybe I should make a pact with the devil and run ads. What d’ya think? Meantime, donate button is on the right.

Anyway, I have now read Dorling’s book and I want to share a few thoughts about it. They’re not in the form of a comprehensive warts-and-all review – rather, I want to highlight five themes of interest to me that anticipate some future posts, on which I think Dorling has thought-provoking things to say. And here they are:

1. Possibilism and the broken glass

Dorling defines himself as a ‘practical possibilist’ in his orientation to the future, arguing that we need more “stories that sit between those who say that all will be fine, and those who claim that we are doomed” (p.6).

It’s a good opening gambit, except that I think almost everyone occupies this ‘possibilist’ middle ground. Let’s call those who think ‘all will be fine’ in the future the optimists or utopians, and let’s call those who think that all of us are doomed no matter what we do from here the pessimists or dystopians. That leaves a very wide spectrum of opinion between those two poles.

…click on the above link to read the rest of the article…

Yuan-Priced Crude Futures Could Arrive Before Christmas

After years of setbacks and delays, China may be days away from launching a yuan-priced crude oil futures contract to make its currency more international and challenge the dominance of the petrodollar.

Many Chinese investors eagerly anticipate the start of yuan oil futures trading on the Shanghai International Energy Exchange, with hope it will come just in time for Christmas, when western markets will be either closed or calmer than usual.

Although local investors can’t wait to pour yuan into another commodity contract, international investors may not be as eager because it is not clear yet how much freedom China would allow in that trade. International traders may have to swallow Chinese intervention on the markets or rigid capital controls, Bloomberg reported last week.

In July, the Shanghai International Energy Exchange, INE, completed a four-step trial in crude oil futures denominated in yuan and said that it would carry preparatory works for the listing of crude oil futures, and would try to launch the contract by the end of this year.

The launch of the yuan oil futures contract will be a wake-up call for traders and investors who haven’t been paying attention to Chinese plans to create the so-called petroyuan and shift oil trade out of petrodollars, Adam Levinson, managing partner and chief investment officer at hedge fund manager Graticule Asset Management Asia (GAMA), said in October.

Although the petroyuan is not expected to immediately supplant the petrodollar, the world’s top oil importer launching a crude oil futures contract in its domestic currency is a sign that the Chinese want their yuan to play an increasingly important role in global trade, starting with the oil trade.

…click on the above link to read the rest of the article…

Pesticide Suicide

Photo by jetsandzeppelins | CC BY 2.0

Pesticide suicide refers to toxic chemicals mucking up the health of animals, plants and insects. This worldwide causatum may be totally out of control or maybe not; nobody knows for sure. Therein lies the scary part.

However, what is known is not encouraging: “Industrial toxins are now routinely found in new-born babies, in mother’s milk, in the food chain, in domestic drinking water worldwide… Humans emit more than 250 billion tonnes of chemical substances a year, in a toxic avalanche that is harming people and life everywhere on the planet.” (Source: Scientist Categorize Earth as a Toxic Planet, Phys Org, February 7th 2017) For obvious reasons, it is not at all comforting to hear Earth referred to as a “toxic planet.” Indeed, it would be insulting, if not true.

In that regard, there may be connecting dots around “toxic planet.” A huge increase in the incidence and prevalence of chronic diseases has been reported in the United States over the last 20 years during the same time frame as pesticide/chemical usage has become ubiquitous. (Journal of Organic Systems) At the beginning of the 20th century infectious diseases like tuberculosis, pneumonia, and diarrheal disease were the leading causes of death. By the 21st century mortality by infectious diseases was replaced by chronic illnesses like heart disease, stroke, and cancer. Regrettably, there is a pronounced trend in America. A Rand Corporation study states that 60% of Americans have one and 40% have multiple chronic conditions. (Source: Incidence and Prevalence of Chronic Disease, Autoimmunity Research Foundation)

Sixty percent (60%) of Americans with a chronic condition is almost impossible to grasp becuz it’s a mind-boggling statistic. How is this possible? And, why so many?

…click on the above link to read the rest of the article…