Steve Bull's Blog, page 1224

December 22, 2017

Will Canada’s Latest Boom in Tar Sands Oil Mean Another Boom for Oil-by-Rail?

Nothing seems able to derail the rise in Canadian tar sands oil production. Low prices, canceled pipelines, climate realities, a major oil company announcing it will no longer develop heavy oils, divestment, and now even refusals to insure tar sands pipelines have all certainly slowed production, but it is still poised for significant growth over the next several years.

In March an analyst for GMP FirstEnergy commented, “It’s hard to imagine a scenario where oilsands production would go down.”

But with pipelines to U.S. refineries and ports running at or near capacity from Canada, it’s hard to imagine all that heavy Canadian oil going anywhere without the help of the rail industry.

“The oilsands are witnessing unprecedented growth that we now peg at roughly 250,000 barrels per day in 2017 and 315,000 bpd in 2018, before downshifting to roughly 180,000 bpd in 2019,” says a new report from analyst Greg Pardy of RBCDominion Securities.

However, much like shale oil in the U.S., increased production doesn’t necessarily mean increased profits. The Wall Street Journal recently reported that since 2007 investors have spent approximately a quarter trillion dollars more on shale production than those investments have generated.

Clearly the oil industry will keep pumping as much oil as they can even while losing large sums of money. And just like in the U.S., Canadian oil producers are facing significant economic challenges, which have caused some companies to get out of the business.

As a result of these challenges, forecasts for future tar sands production have fallen significantly. In 2013 the forecast for 2030 production was 6.7 million barrels per day. That has been revised down to 5.1 million barrels per day. While that is a sizable drop in expected future production, the industry will still be growing in the near future, and most of that oil will be exported to America.

…click on the above link to read the rest of the article…

Designing Against Misinformation

Updated treatment for misinformation in News Feed using Related Articles

Scrolling through News Feed, it can be hard to judge what stories are true or false. Should you trust everything that you see, even if it comes from someone whom you don’t know well? If you’ve never heard of an article’s publisher, but the headline looks legitimate, is it?

Misinformation comes in many different forms and can cover a wide range of topics. It can take the shape of memes, links, and other forms. And it can range from pop culture to politics or even to critical information during a natural disaster or humanitarian crisis.

We know that the vast majority of people don’t want to share “false news.” And we know people want to see accurate information on Facebook, but don’t always know what information or sources to trust—this makes discerning what’s true and what’s false difficult.

After a year of testing and learning, we’re making a change to how we alert people when they see false news on Facebook. As the designer, researcher, and content strategist driving this work, we wanted to share the process of how we got here and the challenges that come with designing against misinformation.

What We Learned

In December of last year, we launched a series of changes to identify and reduce the spread of false news in News Feed:

We made it easier for people to report stories they think are false news

We partnered with independent fact-checking organizations that review articles that might be false

We reduced the distribution of articles disputed by fact-checkers

We launched a collection of features to alert people when fact-checkers have disputed an article, and to let people know if they have shared, or are about to share, false news

…click on the above link to read the rest of the article…

De Facto Travel Restrictions Now Exist For Americans

Green Party presidential Candidate Jill Stein is being investigated by the Senate Intelligence (sic) Committee for “Russian connections.”

What has brought Russiagate to Jill Stein? The answer is that she attended the 10th Anniversary RT dinner in Moscow as did the notorious “Russian collaborator” US General Michael Flynn. RT is a news organization, a far better one than exists in the West, but if you were one of the many accomplished people who attended the anniversary dinner, you are regarded by Republican Senator Richard Burr from North Carolina as a possible Kremlin agent. http://russia-insider.com/en/anti-russian-witch-hunt-comes-jill-stein-because-she-once-sat-next-putin-and-flynn/ri21998

What is going on here? Stein sums it up: “we must guard against the potential for these investigations to be used to intimidate and silence principled opposition to the political establishment.”

Here I sit considering two interesting invitations. One is to speak at the main Plenary Session of the Moscow Economic Forum in April. The other is to speak at the Summit for Global Challenges in the former Soviet Republic of Kazakhstan in May. The very minute I accept, the NSA will notify its mouthpieces, the New York Times, PropOrNot’s promoter the Washington Post, Senator Burr, and Special Russiagate Prosecutor Robert Mueller. Would I be renditioned to Israel or Eqypt or Saudi Arabia and tortured until I confessed that I was a member of the Trump-Flynn-Jill Stein Kremlin spy network?

As the United States is no longer a free country governed by a Constitution that protects civil liberty, that possibility cannot be discounted. What is for sure is that if I accept these invitations, the US Establishment will discredit my voice when I write about US/Russia relations. Indeed, that was the intention of the PropOrNot Washington Post story that attacked 200 truth-tellers as “Russian agents/dupes.” Many of those so attacked have experienced slower growth in their readership.

…click on the above link to read the rest of the article…

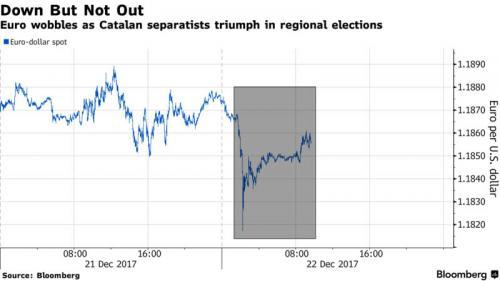

“This is Groundhog Day”: Spanish Stocks Battered By Catalan Vote, Bitcoin Crashes

Spanish stocks and the euro fell, while Spanish government bond yields hit their highest levels in over a month after Catalan secessionists delivered an unexpected blow to the government of Spanish PM Rajoy by winning the Catalan regional election. Meanwhile across the Atlantic, U.S. equity futures and the dollar rose on the last trading session before the Christmas holiday. The MSCI index of world stocks was flat.

Europe’s Stoxx 600 Index traded sideways as Spain’s Ibex 35 underperformed, dropping as much as 1.6%. Spanish stocks dominated Europe’s biggest fallers, confirming analyst expectations that any shake-out from the Catalonia vote would be mostly confined to Spain. Spain’s bonds also fell along with peripheral European government debt, though bunds were little changed after a selloff this week drove yields to five-week highs. For those who missed it, Catalan separatist parties triumphed in regional elections, outperforming some polls and reigniting Spain’s political trauma. While the Euro has stabilized since, it suffered a mini flash crash in the illiquid aftermath of the Catalan election news, momentarily dipping to $1.1817 before trimming losses to last stand at $1.1853, down 0.2 percent.

“This is Groundhog Day, we have been here,” said Christopher Peel, chief investment officer at Tavistock Wealth. “I just don’t think the Spanish government can do anything other than come to the table now.” He added that thin liquidity due to the holidays could be accentuating what he called a kneejerk reaction on the IBEX. “Likely there’s some hedge funds leaning on it, but in terms of long-only money I don’t think there will be much movement now.”

…click on the above link to read the rest of the article…

Peter Schiff: Bitcoin Heading To $0, Many Bitcoin Investors Will Lose EVERYTHING

Investor Peter Schiff is warning once again about Bitcoin’s massive speculative bubble. Schiff, who is well-known for predicting the 2008 financial crash, is saying it’s those who are buying in now will be the most vulnerable when Bitcoin hits $0.

“People who got it years ago, even people who got it at the beginning of the year have the opportunity to cash out and make a lot of money. But people who are buying it at these prices or higher prices are going to lose practically everything,” Schiff told RT International Channel. Bitcoin is speculative bubble set to burst at any time, and when it does, many will lose everything.

Schiff’s main concern with Bitcoin echoes that of many preppers, including Mike Adams, the Health Ranger. “These currencies are going to trade to zero or pretty close to it when the bubble pops,” predicts Schiff. “Right now, the only reason why people are buying bitcoin is because the price is going up. When it turns around, they are not going to sell it for the same reason. There is no value in bitcoin, you can’t use it as money,” Schiff points out. “It’s too slow, too expensive and too vulnerable.”

It also doesn’t physically exist in the way gold and silver do. According to Schiff, there is a problem with fiat currencies. However, there are 1,300 digital currencies with massive inflation. “Even bitcoin itself has spun off bitcoin cash, bitcoin gold. There is no limit to supply of bitcoin-branded worthless tokens that can be created,” he said. But as soon as the price begins a downward trend, Bitcoin will implode.

…click on the above link to read the rest of the article…

The Global Economy in 2018

Getty Images

Getty Images

The Global Economy in 2018

The global economy will confront serious challenges in the months and years ahead, and looming in the background is a mountain of debt that makes markets nervous – and that thus increases the system’s vulnerability to destabilizing shocks. Yet the baseline scenario seems to be one of continuity, with no obvious convulsions on the horizon.

HONG KONG – Economists like me are asked a set of recurring questions that might inform the choices of firms, individuals, and institutions in areas like investment, education, and jobs, as well as their policy expectations. In most cases, there is no definitive answer. But, with sufficient information, one can discern trends, in terms of economies, markets, and technology, and make reasonable guesses.

In the developed world, 2017 will likely be recalled as a period of stark contrast, with many economies experiencing growth acceleration, alongside political fragmentation, polarization, and tension, both domestically and internationally. In the long run, it is unlikely that economic performance will be immune to centrifugal political and social forces. Yet, so far, markets and economies have shrugged off political disorder, and the risk of a substantial short-term setback seems relatively small.1

The one exception is the United Kingdom, which now faces a messy and divisive Brexit process. Elsewhere in Europe, Germany’s severely weakened chancellor, Angela Merkel, is struggling to forge a coalition government. None of this is good for the UK or the rest of Europe, which desperately needs France and Germany to work together to reform the European Union.

One potential shock that has received much attention relates to monetary tightening. In view of improving economic performance in the developed world, a gradual reversal of aggressively accommodative monetary policy does not appear likely to be a major drag or shock to asset values. Perhaps the long-awaited upward convergence of economic fundamentals to validate market valuations is within reach.

…click on the above link to read the rest of the article…

Americans Are Only Now Beginning to Learn that We Live in a Dictatorship

Americans Are Only Now Beginning to Learn that We Live in a Dictatorship

The first time when it became clear to me that I live in a dictatorship was in 2014 when reading, prior to its publication, the landmark (and still the only) scientific empirical study to address the question as to whether or not the United States federal Government is, authentically, a democracy — or, whether, alternatively, it’s instead more of a dictatorship, than a democracy. This study documented conclusively that America’s Government is the latter.

So, on 14 April 2014, I headlined “US Is an Oligarchy, Not a Democracy, Says Scientific Study”. Subsequently, my editor linked it to the published article at the Journal where the study was published, Perspectives on Politics, from the American Political Science Association, and the full study can be read there.

On 30 April 2014, was posted at youtube the video that remains, to this day, the best and clearest ordinary-language summary of what that badly-written academic study proved. See its explanation here:

That summary’s title is also better than the title of my article was; this excellent video headlines “Corruption is Legal in America”, which is another accurate conclusion from that study. Every American citizen should know what this 6-minute video says and shows from the academic study, because it explains how the super-rich, as a class, steal from everyone else (everyone who isn’t super-rich): They do it through corruption.

Then, that same person who created the video did another presentation of it, but this time with text accompanying the video, and this article was titled “One graph shows how the rich control American politics”, and it indeed showed how.

…click on the above link to read the rest of the article…

66% of the Economy is Already Electronic & 99% of Money is Electronic

QUESTION: I loved your mention of how our money is not “printed”. You are THE ONLY financial expert to mention this. And you can’t understand our economy without understanding Electronic Money. I researched this 3 or four years ago and came up with, .003 physical currency vs the rest as Electronic Money. I later stumbled across an article on the same subject by an economics professor who put the ratio at .0003 physical. SO, who/where/how much/ and by who’s authority is E money created? E money is how the economy is propped up, and the amount is in TRILLIONS UPON TRILLIONS.

ANSWER: That is about correct. However, it is actually much worse. About 40% of the value of the paper currency of the United States circulates outside the USA. In fact, about 40% of the debt is also held outside the USA.

Moreover, the bulk of the money is not just electronic already, but people failed to understand the change in the debt structure. Why do governments even borrow money when they have NO INTENTION of ever paying anything back? Once upon a time, before 1971 under Bretton Woods, it was illegal to borrow against government bonds. That was when the theory emerged that it was LESS INFLATIONARY to borrow than to print. The bonds were not part of the money supply. However, post-1971, you could borrow freely against government bonds. It no longer made any difference to print v borrow.

Today, on average, 50%+ of the national debts of most countries is accumulative interest payments. When Federal paper money began, it was really circulating bearer bonds in the United States. In fact, the reverse of the notes displayed the interest you would earn holding that currency.

Today, on average, 50%+ of the national debts of most countries is accumulative interest payments. When Federal paper money began, it was really circulating bearer bonds in the United States. In fact, the reverse of the notes displayed the interest you would earn holding that currency.

…click on the above link to read the rest of the article…

Big Banks Are All Over Blockchain

To process derivatives, currency trades, transactions, etc. Just don’t call it cryptocurrency. It’s a “digital currency.”

As a general rule, most bankers disparage cryptocurrencies, like Bitcoin, as anything but purely speculative instruments. But they don’t disparage blockchain, the technology that underpins cryptocurrencies. On the contrary. They’re pouring money into developing their own “digital currencies,” as they call them. Just don’t call them “cryptocurrencies.”

UBS, BNY Mellon, Deutsche Bank, Santander, the market operator ICAP, and the startup Clearmatics formed an alliance in 2016 to explore the use of digital currency between financial institutions and central banks, using blockchain.

The ultimate goal of the project is to create a digital currency known as Utility Settlement Coin (USC), which will facilitate payment and settlement for institutional financial markets. As the FT reported in October, commercial banks are growing tired of waiting for central bankers to take the lead in fending off the challenge that standalone cryptocurrencies such as bitcoin could pose to their control of monetary policy, and are pressing on with their own pet projects.

According to Deutsche Bank’s website, USC is “an asset-backed digital cash instrument implemented on distributed ledger technology for use within global institutional financial markets.” It consists of a “series of cash assets, with a version for each of the major currencies (USD, EUR, GBP, CHF, etc.) and is convertible at parity with a bank deposit in the corresponding currency.”

It’s easy to see the attraction blockchain holds for big banks like Deutsche, UBS and Santander: Combining shared databases and cryptography, the technology offers multiple parties simultaneous access to a constantly updated digital ledger that cannot be altered. With it, banks could offer a safer, faster, cheaper, more transparent service to their customers, while doing away with the need for a central operator.

…click on the above link to read the rest of the article…

December 21, 2017

Welcome to renewables world: Australia plans for blackouts, throws billions of dollars, but ABC says it will get “cheaper”

The fear is palpable

How much fun can you have living in a global experiment? In Australia, peak summer is about to hit in a post-Hazelwood-electricity-grid. We’re drowning in electricity news as summer ramps up. Everyday there’s another Grid story in the press, and a major effort going on to avoid a meltdown. Minister Josh Frydenberg announced today that “we’ve done everything possible to prevent mass blackouts”. Or as he calls it, a repeat of the South Australian Horror Show. Politicians are so afraid of another SA-style-system-black that they are throwing money: The “Snowy Hydro Battery” will be another $2 billion. Whatever. It’s other people’s money.

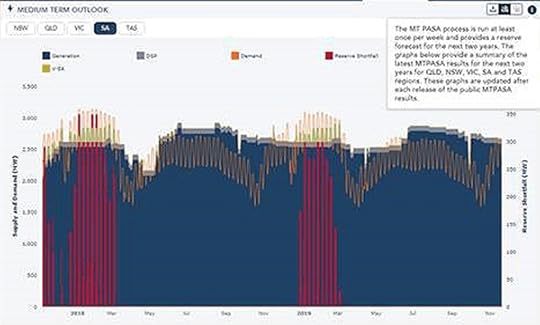

This is what they are afraid of:

The red bars mean “Reserve Shortfall”. The dark blue matter is “Generation”. The graph covers two years (sorry about the quality) so the two red bursts are summer 2018 and summer 2019.

SA Medium Term Forecast, Outlook, AEMO, Nov 16th 2017, South Australia.

Oddly we are headed for a critical time, but this’s the most recent graph I can find — thanks to Wattclarity – from November 16th, 2017. (Here’s an earlier version from March 2017. and from Dec 2016). Perhaps there is a newer kinder forecast, but curiously the AEMO Medium Term Outloook page isn’t working “til early 2018″. Hmm? Odd time to take it down.

The words in that top box (rewritten below*) indicate they do a new outlook every two weeks, but I can’t find one on the Wayback Machine, or Google Cache. Perhaps you can? Please let me know.

Australian electricity prices forecast to rise and fall at the same time

The ABC tells us prices look set to fall:

…click on the above link to read the rest of the article…