Steve Bull's Blog, page 1228

December 17, 2017

Transparent citizens, negative interest rates and other crazy ideas of economic experts

In a March paper, Alexei Kireyev of the International Monetary Fund advises abolishing cash without having the citizens aware of the process. First, large banknotes are to be withdrawn from circulation, next limits on cash transactions are to be imposed, then computerization of the world’s financial system and control of international cash transactions are to be enforced and, finally, private companies are to be encouraged to avoid cash transactions The Macroeconomics of De-Cashing.

Kireyev draws on the ideas of former IMF chief Kenneth Rogoff. In his 2016 book “The Curse of Money”, he advocated the abolition of cash. In his opinion, it would contribute to the fight against crime, tax evasion and the reduction of the grey area. The ECB obliged him and promised not to print the 500 euro note after 2018. The government of India did the same thing: on November 9,2016, it unexpectedly devaluated all 500 and 1000 rupee banknotes over the night – a severe blow against the black economy and corruption. The next day, chaos reigned on India’s streets – crowds of people in front of banks, empty ATMs – everyone wanted to withdraw his money, exchange the old rupees for new, valid ones, and there were even casualties.1)

The other governments eagerly followed this ideas of great economic gurus, not worrying about what was happening in the Indian streets: Australia wants to withdraw its 100 notes from circulation,2)and Venezuela has already abolished the 100 bolivar note. France, Italy, Spain and Greece already have ceilings for cash withdrawals, and a ceiling of EUR €5000 is currently being discussed in Germany. In some countries, the renunciation of cash is becoming a means of political struggle. In Poland, Prime Minister Mateusz Morawiecki introduced cashless payments to the state postal service. Soon it will also be possible to pay his tickets directly on the patrol car.

…click on the above link to read the rest of the article…

Pandemonium: Atlanta Airport Power Outage Grounds Flights, Traps Travelers; Evacuation Underway

Update: Delta has canceled all remaining Sunday flights ”to allow the operation to best reset for Monday,” it said in a statement on its website. The company now anticipates a near-full schedule Monday in Atlanta ”pending full resumption of power”; adding that some delays and cancellations can be expected. Delta noted that it has canceled approx. 900 mainline and Delta Connection flights Sunday as a result of the outage. Full Delta statement below:

The Atlanta airport lost power Sunday across concourses and terminals affecting all airlines. As a result of the ongoing outage, Delta will cancel its remaining Sunday domestic schedule to allow the operation to reset for Monday. The airline has canceled approximately 900 mainline and Delta Connection flights Sunday as a result of the outage and 48 flights have diverted to alternate airports due to a nationwide groundstop for Atlanta-bound flights.

Pending full resumption of power, Delta anticipates a near-full schedule Monday in Atlanta, though some delays and cancellations can be expected.

Delta continues to deplane the remaining customers from aircraft that have not been able to park at terminal gates that require power to operate. The airline will also work to reunify customers with their luggage once power is restored.

The Atlanta Airport, along with Atlanta Police Department, are restricting the vehicles allowed to the terminal drop-off and pick-up area due to congestion. Delta customers are encouraged to check the status of their flight via the Fly Delta mobile app or delta.com before heading to the airport. A travel waiver has been issued for Delta customers flying to, from or through Atlanta allowing customers to make one-time changes to their travel plans. Details are available at delta.com.

Delta has temporarily embargoed unaccompanied minors from traveling Monday due to the power outage. Unaccompanied minors who already began their travel Sunday may continue.

…click on the above link to read the rest of the article…

“It Looks Like A War Zone” – Californians Describe Thomas Fire’s Devastation

Now the third-largest wildfire in California history, the Thomas Fire has blazed through Ventura and Santa Barbara counties since it exploded into existence two weeks ago under mysterious circumstances.

With Cal Fire ordering thousands more people in Santa Barbara to evacuate as dry conditions and powerful winds help feed the flames, which were barely 40% contained as of Sunday. Twelve thousand people were evacuated in Santa Barbara County, with animals at the local zoo threatened as well. Santa Barbara Zoo closed Saturday and many animals were placed into cages in case of possible evacuations, zoo officials said.

Meanwhile, residents who had evacuated their homes in Ventura County, where the fire began, were allowed to return Saturday.

SBCFireInfo@EliasonMike

#ThomasFire– Dozens of Fire engines staged and await orders at the corner of Sycamore Cyn Rd and Cold Springs Road in Montecito Sunday morning.

11:25 AM – Dec 16, 2017

The fire is so massive that more than 8,400 firefighters are working around the clock to save lives and contain it. It’s bigger in acreage than New York City, and has turned neighborhoods to piles of soot and concrete as it churns through the area.

SBCFireInfo@EliasonMike

#ThomasFire– Smoke drifts towards Santa Barbara Airport in the distance while a wind driven spot fire burns on the west side and below Gibraltar Road.

8:00 PM – Dec 16, 2017

At least five of the six wildfires that ignited two weeks ago were still active as of Sunday, according to CNN. But the Thomas Fire is by far the biggest, as the map below illustrates.

Here’s a roundup of the latest developments from CNN and Cal Fire:

…click on the above link to read the rest of the article…

Bitcoin: The Greatest Story Ever Sold

“Sell the sizzle, not the steak.” – Oldest sales trick in the book

“Resistance is futile. You must assimilate” – The Borg

Once I discover what triggers or motivates a person, and then figure out how to activate it, I can sell anything. And it doesn’t even need to be a product or service they previously wanted.

Case in point….life insurance.

I sold life insurance for almost ten years and made a decent living while doing so. I never forced anything on anyone and quickly canceled the policy if they decided later it was not what they wanted.

Very few did. I had the second lowest lapse/cancel rate in my region.

You want the customer to decide on their own volition, and with minimal prompting on your part, that they want; no, they need what you are selling. Once this occurs, you are simply an order taker filling the expressed need(s) of the customer.

To do so you sell the sizzle, not the steak.

I wasn’t selling life insurance. I was solving a financial ‘problem’ everyone has, but often doesn’t recognize as a problem, is in denial of the problem or fears the problem is too big or expensive to solve.

I am not bragging, but rather pointing out something very few people consider. We are all heavily influenced by (psychological warfare) sales techniques deeply rooted in all sales pitches delivered by skilled practitioners. And the number one most powerful technique employed is to plant a seed that leverages the customer’s own emotional triggers.

Taken to the extreme level, once a person is triggered within carefully controlled and presented parameters, anything is possible.

…click on the above link to read the rest of the article…

December 16, 2017

Doug Casey on What Happens After the Next 9/11

Is a police state in the US possible? Absolutely.

That’s because people are essentially the same the world over, regardless of their culture, religion, race, or what-have-you. A certain percentage of them are sociopaths.

There is a standard distribution of sociopaths across time and space. It’s a function of Pareto’s Law, better known as the 80-20 rule. 20% of the people do 80% of the work. Another 20% are responsible for 80% of the crime. 20% of the population always winds up with 80% of the wealth. And so forth, through all areas of human endeavor. This observation can be represented by a bell-shaped curve—a “standard distribution”—with a small minority at each extreme, but the large majority in the middle. The people who will take us to a police state are sociopaths—criminal personalities who don’t respect the liberty or property of others. And sociopaths gravitate towards government, and eventually come to control it.

My view is that 80% of human beings are basically decent, get along, go along types. 20% are what you might call potential trouble sources, that can go either way. But then you take 20% of that 20% and you’re dealing with the sociopaths.

When social conditions reach a certain stage these really bad guys come out from under their rocks and take advantage of the situation. We’re seeing that right now in the US, across the political spectrum. Just as we’ve seen in the past in hundreds of places throughout history.

A major tipping point occurred sixteen years ago, on September 11, 2001, with the attacks in New York and Washington. They were disastrous. But not nearly as disastrous as the government’s reaction to them.

…click on the above link to read the rest of the article…

Stephen Poloz Right To Be Worried

Bank of Canada governor Stephen Poloz cited numerous worries plaguing the economy during his speech to Toronto’s financial elites yesterday at the prestigious Canadian Club.

However, the title of Poloz’s presentation, “Three things keeping me awake at night” seemed odd, given positive recent Canadian employment, GDP and other data.

Poloz highlighted high personal debts, housing prices, cryptocurrencies and other causes for concern, along with actions that the BoC is taking to alleviate them. His implicit message was (as always) “We have things under control.”

But if that’s all true, then Canada’s central bank governor should be sleeping like a baby. So, what is really keeping Mr. Poloz up at night? Three possibilities come to mind.

The Poloz Bubble

Firstly, far from just a housing bubble, Canada’s economy shows signs of being in the midst of an “everything bubble.” Bitcoin, for example, hovered near CDN $23,000 this week. Stock and bond valuations are not far behind in their relative loftiness.

Worse for Poloz, who took office four years ago, his fingerprints are all over those bubble-like levels.

Canadian stock, bond and house prices were already at dizzying heights when Stephen Harper hired Polozwith the implicit expectation that he would juice up the economy, in preparation for what Canada’s then-Prime Minister knew would be a tough upcoming election.

Poloz didn’t disappoint, promptly delivering a nice Benjamin Strong-styled “coup de whiskey” to asset prices in the form of two interest rate cuts, which brought the BoC’s policy rate down to just 0.50% during the ensuing months.

Although Harper lost the election, loose BoC policy continues to provide the Canadian government with free money to borrow and spend as it wishes.

More broadly, the Poloz BoC’s current policy, like that of the US Federal Reserve, is to boost asset prices even higher in the hope that the resulting wealth effect will trickle down to spur economic activity among ordinary Canadians.

…click on the above link to read the rest of the article…

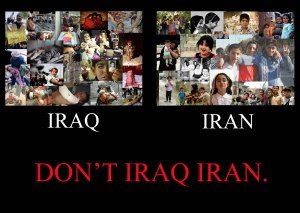

The Case Against Iraqing Iran

The case against Iraqing Iran includes the following points:

The case against Iraqing Iran includes the following points:

Threatening war is a violation of the U.N. Charter.

Waging war is a violation of the U.N. Charter and of the Kellogg-Briand Pact.

Waging war without Congress is a violation of the U.S. Constitution.

Have you seen Iraq lately?

Have you seen the entire region?

Have you seen Afghanistan? Libya? Syria? Yemen? Pakistan? Somalia?

War supporters said the U.S. urgently needed to attack Iran in 2007. It did not attack. The claims turned out to be lies. Even a National Intelligence Estimate in 2007 pushed back and admitted that Iran had no nuclear weapons program.

Having a nuclear weapons program is not a justification for war, legally, morally, or practically. The United States has nuclear weapons and no one would be justified in attacking the United States.

Dick and Liz Cheney’s book, Exceptional, tell us we must see a “moral difference between an Iranian nuclear weapon and an American one.” Must we, really? Either risks further proliferation, accidental use, use by a crazed leader, mass death and destruction, environmental disaster, retaliatory escalation, and apocalypse. One of those two nations has nuclear weapons, has used nuclear weapons, has provided the other with plans for nuclear weapons, has a policy of first-use of nuclear weapons, has leadership that sanctions the possession of nuclear weapons, and has frequently threated to use nuclear weapons. I don’t think those facts would make a nuclear weapon in the hands of the other country the least bit moral, but also not the least bit more immoral. Let’s focus on seeing an empirical difference between an Iranian nuclear weapon and an American one. One exists. The other doesn’t.

…click on the above link to read the rest of the article…

The Rug Yank Phase of Fed Policy

Bogus Jobs Pay Big Bucks

The political differences of today’s two leading parties are not over ultimate questions of principle. Rather, they are over opposing answers to the question of how a goal can be achieved with the least sacrifice. For lawmakers, the goal is to promise the populace something for nothing, while pretending to make good on it.

The short and sweet definition of democratic elections by eminent American wordsmith and political philosopher H.L. Mencken [PT]

The short and sweet definition of democratic elections by eminent American wordsmith and political philosopher H.L. Mencken [PT]

Take the latest tax bill, for instance. The GOP wants to tax less and spend more. The Democrat party wants to tax more and spend even more. We don’t recall seeing any proposals to tax less, spend less, and shrink the size of the state. And why would we?

When the government cuts back… [PT]

When the government cuts back… [PT]

Today’s central planners and social engineers are enlightened and progressive. They know much more about anything and everything than the rest of us. In particular, they share a general sense that they know how to spend your money better than you.

At best, the central planners call your money to Washington so they can then distribute it back to your friends and neighbors. In reality, the lawmakers call your money to Washington where they distribute it to their friends and neighbors – not yours. This is not a matter of opinion. It’s a matter of fact.

Is it a coincidence that the top three wealthiest counties in the country are in the shadow of the Capitol in the D.C. suburbs? What exactly the residents of these counties do that is of tangible value is unclear. However, what is clear is that bogus government jobs in Loudoun County and Fairfax County, Virginia, pay big bucks. But that’s not all…

…click on the above link to read the rest of the article…

Shale gas revolution did not last long for BHP – the Fayetteville story

http://www.naturalgasintel.com/topics/101-fayetteville-shale

http://www.naturalgasintel.com/topics/101-fayetteville-shale

We had these headlines a couple of months ago:

BHP’s $50 billion shale oil blunder

23/8/2017

BHP slapped $US4.75 billion ($6 billion) down on the table to buy the rights from Chesapeake Energy to around half-a-million acres of prospective shale gas reserves at Lafayette in Arkansas.

http://www.abc.net.au/news/2017-08-23/bhp-billion-dollar-shale-oil-blunder/8832698

‘They went too hard’ – BHP’s retreat wins plaudits

22/8/2017

Mr Mackenzie conceded BHP’s entry into the onshore US shale industry was “poorly timed, we paid too much” for the assets.

“We would like to get on with the exit from shale,” he said, adding that BHP would “be patient to make sure we restore value for shareholders”.

http://www.smh.com.au/business/mining-and-resources/they-went-too-hard–bhps-retreat-wins-plaudits-20170822-gy1jfq.html

This post’s focus is the Fayetteville shale gas in the US State of Arkansas. The following map is from a BHP investor presentation in February 2011, shortly before BHP bought shale gas acreage from Chesapeake in March 2011.

Fig 1: Location of the Fayetteville shale

Fig 1: Location of the Fayetteville shale

Let’s hit the road, on route 65 from Conway (Arkansas) towards Greenbrier where many new subdivisions were built like this one:

Let’s hit the road, on route 65 from Conway (Arkansas) towards Greenbrier where many new subdivisions were built like this one:

Fig 2: Testifying to the newly found wealth – as long as it lasts.

Fig 2: Testifying to the newly found wealth – as long as it lasts.

You can buy 5 acre lots for US$ 80,000 and the average house costs just 140 grand.

5 kms north of Greenbrier we find BHP gas well Fielder 8-13 2-33H, carved out of a forest lot.

Fig 3: BHP gas wells in Fayetteville

Fig 3: BHP gas wells in Fayetteville

Fig 4: BHP well locations in Fayetteville

The production history shows that BHP went into shale just 1 ½ years before the whole basin started to peak:

Fig 5: Fayetteville shale gas production up to July 2017

Fig 5: Fayetteville shale gas production up to July 2017

https://www.eia.gov/tools/faqs/faq.ph...

An undulating peak of production is clearly visible between mid 2012 and mid 2014

…click on the above link to read the rest of the article…

OPEC November Oil Production

The OPEC data below was taken from the December OPEC Monthly Oil Maret Report. All data is through November 2017 unless otherwise noted.

OPEC crude oil production declined by 133,500 barrels per day in November.

Algeria was up slightly in November after that huge decline in October.

Angola was the biggest loser in November, down 108,700 barrels per day.

Ecuador, though holding its own for the last year, appears to be in slow decline.

I have managed to cobble together an estimate of Equatorial Guinea’s historical C+C production. I had the EIA’s production numbers through June 2013. I subtracted 10% for “other liquids”, then merged that with the OPEC MOMR data that started in 2016. However, Equatorial Guinea’s production is not enough to make much difference.

…click on the above link to read the rest of the article…