Bryan Pearson's Blog, page 26

May 28, 2015

May 28: Loyalty Links & Likes

Focus on One Thing at a Time in Customer Experience Strategy – PeopleMetrics

Focus on One Thing at a Time in Customer Experience Strategy – PeopleMetrics

The merits of improving the customer experience have become very clear, but where’s a company to start? PeopleMetrics offers some tips on how to properly implement a customer experience strategy, recommending a focus on one thing at a time in order to see long-term results.

How to Leverage Content to Delight Your Customers and Increase Brand Loyalty – Business 2 Community

According to Marketing Metrics, the likelihood of selling to existing customers is 60% to 70%, as opposed to 5% to 20% for new customers. It’s important, however, to remain engaged with these existing customers to stay top-of-mind, and delivering relevant content is a great way to ensure this.

Pinned, Liked and Tweeted Into a Stupor? 8 Tips to Refine the Social-Loyalty Link – COLLOQUY

Social media has become an integral part of engaging a brand’s customer base, and research has shown that it has a large influence on purchasing decisions. COLLOQUY presents some great examples of how large brands are leveraging this technology to engage customers and some tips to ensure that social media strategy complements loyalty strategy.

Scaling Customer Experience in the Sharing Economy – Forbes

The sharing economy has given rise to pioneering companies like Uber, Etsy and Airbnb, amongst others. Since many of the employees of these companies are considered contractors, how do they keep the customer experience consistent? Forbes contributor Blake Morgan makes the case for employee training and onboarding, improved communication and coaching executives.

5 Loyalty Program Do’s and Don’ts – Retail Customer Experience

While the creation of a loyalty program is a good start for a company looking to improve its retail performance, sometimes the attempt can fall short of achieving the original goals. Kevin Yeow of ICLP, a customer relationship consultancy, reviews the five fundamentals that all successful loyalty programs should strive to perfect, and the potential pitfalls of each.

May 26, 2015

Bricks and Orders: How Birchbox, Amazon, Rent the Runway Are Reinventing the Store

A picture may be worth a thousand words, but the real thing is worth five senses, and possibly full price.

That’s one good reason why manufacturers and online vendors are increasingly opening physical stores – to dazzle shoppers with experiences that transcend transactions and venture into fascination.

In the past year several brands, including Birchbox, Rent the Runway, Bauer Hockey and Amazon, have opened or are planning to open shops in efforts to express the brand in a physical setting. The goal, clearly, is to up sales as well, not only through additional purchases but also by wowing shoppers to pay full price.

Photo credit: Birchbox

So promising has the extension from factory to store been that it is now attracting the interest of investors. Rent the Runway, a digital vendor that leases designer dresses, attracted $60 million in funding from Technology Crossover Ventures, along with Bain Capital Ventures, Highland Capital Partners and Advance Publications. The investment will bankroll several Rent the Runway stores, the first of which debuted in New York in September.

Birchbox, an online beauty delivery company, also is expanding geographically with the help of $60 million in recent funding. It opened its first store, in SoHo, New York, in July 2014. The location follows several pop-up test stores and includes among its features a salon and algorithm-enabled touch screens that visitors can use to find well-suited products, as well as to read merchandise reviews and recommendations.

“We want that message to be clearer to consumers,” Birchbox co-founder Katia Beauchamp told The New York Times. “You’re supposed to discover what you love and then act on that.”

Recreational retail

Which leads us back to the lure of the store, and what it is about the retail experience that is causing these companies to build flagships. Beyond the ability to carry a full line of tangible products in one location, stores enable brands to immerse shoppers in their individual wonderlands. They are revising a trend traditional retailers sought to excel at 15 years ago, which is to make the store a recreational experience.

Take by example the leading hockey equipment manufacturer Bauer Hockey, which will open its first store outside Boston this summer. Its employees will be specially trained to take Bauer’s customers through a “fit, learn and experience” process that includes an indoor ice rink.

“At each Bauer retail experience, we will be able to provide in-depth, ‘under-the-hood’ insights into the protection and performance of each product while fitting each player with similar tools and techniques that we use to properly fit the best athletes in the world,” CEO Rich Wuerthele stated in a press release.

Which demonstrates that these experiential stores come at a price, and execution is tantamount to success. There is no shortage of stores – new and shuttered – dotting the countryside. The U.S. alone is home to 12 billion square feet of retail space – 37 square feet for every man, woman and child, according to the real estate firm Cushman & Wakefield. That’s ironically the size of a generous walk-in closet.

More in store

With so many stores out there, I believe the extension from manufacturing to flagships is fueled by a larger trend – one in which brands recognize that their traditional retail counterparts are not fulfilling the omni-channel experience everyone seems to demand. Perhaps these stores serve the role not only of living the brand, but also of establishing a benchmark of how the brand should be merchandised.

Even Amazon is getting into the game. In February, Amazon opened its first physical store, but not in a glamorous setting. Rather, the store is at Purdue University, in Indiana, focusing particularly on the gainful demographic of college students, who in addition to textbooks and computers order lots of easy-to-prepare foods.

This brand-merchandising trend is further supported by a 2014 report by PricewaterhouseCoopers, which concluded that consumers want a fully integrated relationship with a brand, not multiple relationships across multiple brands. Some call this approach omni-channel; PricewaterhouseCoopers calls it the “total retail” experience.

“When it comes to actually making a purchase, consumers make few distinctions between manufacturers and retailers,” the report states. Seventy percent of U.S. survey respondents of the 2014 study said they made purchases directly from a manufacturer. That is up from the year before, when 52% of respondents did so.

It’s not surprising, then, that when consumers do shop in-store, they expect the same kinds of features that are available online or direct-from-manufacturer.

Done well, a store embodies the brand. It becomes a tangible extension of its character – its charisma, even, if the brand is especially good. As more manufacturers and online merchants try on the concept of brick and mortar, it will be interesting to see how the retail landscape further shifts.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

May 20, 2015

May 20: Loyalty Links & Likes

Customer Experience And The ‘With Pleasure’ Principle – Forbes

Customer Experience And The ‘With Pleasure’ Principle – Forbes

Experts have determined that customer experience will overtake price as the key feature distinguishing brands by 2020. With this in mind, Forbes contributor Blake Morgan makes the case for the ‘With Pleasure’ principle and points out that enhancing work environment and company culture can make for better customer-facing employees.

3 Overlooked Retargeting Strategies For Retailers – Marketing Land

Remarketing, the process of analyzing web-browsing behaviors and serving up ads or content based on that browsing history, can be extremely useful when trying to reach new or existing customers. However, while it sounds great in theory, marketers need to make sure they are using the proper methods and tools to make the most of it.

Road H.O.G.S: How Harley-Davidson and Best Western Maximize Membership – COLLOQUY

The 9-year-old Ride Rewards program from Best Western and Harley-Davidson has provided motorcycle enthusiasts with unique perks and benefits since its inception, and program enhancements are being made every year. COLLOQUY offers an inside look at the strategy behind the program and how unexpected partnerships can reap rewards for brands.

Starbucks in Deal With Spotify to Stream Music – The New York Times

Starbucks has long been a shining example of customer loyalty in quick-service retail, and a new partnership with Spotify will allow it to enhance the customer experience even further. Starbucks will be connecting Spotify’s service into its digital ecosystem, allowing subscribers to earn My Starbucks Rewards points and even letting customers help choose the songs played in stores.

Beyond the Buzzword: Big Data – Business 2 Community

The term Big Data tends to be used voluminously in board rooms, publications, trends analysis and even conversation. Few people, however, can grasp and explain how Big Data is leveraged in a large organization and how it can be applied to marketing efforts. This article breaks the concept down and explains that Big Data is more than numbers on a spreadsheet.

May 18, 2015

Delivery as Battleground: Uber, Nordstrom and Macy’s Take Arms, and Armanis

Living mannequins have their place, but few events translate to pure retail progress like a pair of Louboutins arriving by Uber.

Chauffeured shoes, and other goods, are part of an expanding retail trend designed as much in the name of customer service as in merchant one-upmanship. Uber, the app-based transportation network, is partnering with upscale retailers to launch a same-day merchandise delivery service. Hundreds of merchants are reportedly in talks or testing the program, including Neiman Marcus, Louis Vuitton, Hugo Boss and Tiffany & Co., according to TechCrunch, which obtained a training manual.

While curbside diamonds may spell progress, such advancements also have the potential to upset the market dynamic. Depending on how major merchants respond, on-demand delivery – which granted is being tested in various forms – is likely to usher in another herd-thinning era for retailers.

In a way it is a natural progression. I recently wrote about the efforts retailers are making to find the pricing sweet spot among discount-conditioned consumers. Now fulfillment is in fashion, with an increasing number of retailers folding fast delivery into the value-equation mix. Nordstrom is testing curbside pickup, Macy’s is trialing same-day delivery in major cities, and Amazon is chasing drones.

In doing so, they officially raised the question of whether delivery is the next major retail battleground. If so, it was natural for Uber to follow. Where the trend will lead, however, is in the hands of all of the above.

What steers Uber

This consideration of the many players introduces wrinkles, and with them a reminder that a natural progression is also a Darwinian one. Let’s not overlook the effect Uber delivery may have on the traditional benefactors of online retailing, such as UPS, FedEx and the U.S. Postal Service.

Uber itself detected several environmental conditions to which it would have to adapt in order to survive the merchandise delivery business, according to TechCrunch:

“Uber’s original plan for merchant delivery focused on large e-commerce retailers like Amazon and eBay, but found that sourcing inventory from warehouses wasn’t worth the effort. Getting inventory from local stores, on the other hand, is possible as long as the vendor has control over the amount and type of inventory available in a single day.”

“Uber’s original plan for merchant delivery focused on large e-commerce retailers like Amazon and eBay, but found that sourcing inventory from warehouses wasn’t worth the effort. Getting inventory from local stores, on the other hand, is possible as long as the vendor has control over the amount and type of inventory available in a single day.”

Uber is attempting to puzzle a way around the troublesome inventory issue (as long as the merchant has control over the inventory), but what of the products that do not move? For gold-plated merchants like Neiman Marcus and Louis Vuitton, which tend to have more tailored selections, such inventory control is manageable. The middle-pack merchants, however, will have to devise their own strategies not only to deliver on demand, but also to manage such delivery costs.

I can just picture the promotions now: Order standard delivery and get 30 percent off!

Which leads to retail’s version of natural synthesis – data, and those who analyze it.

Moving data to the front seat

In particular, just-in-time delivery requires a de-isolation of data, according to Brett Wickard, founder and president of FieldStack, which specializes in lean retail practices.

“Same-day delivery services will further increase the gap between the modern retailers who have appropriate technology to handle new sales channels and those still saddled with technology from last century,” Wickard recently told Retail Dive.

“By seamlessly balancing the real-time data from e-commerce, supply chain and brick-and-mortar retail, the lean retailer can more precisely forecast the inventory needs same-day delivery will place on their locations,” he said.

To accomplish this, the retailer will have to release its data across every department so the entire organization can benefit. We in marketing have a term for the practice of sharing loyalty program data beyond the marketing department – enterprise loyalty – and it can help shape critical decisions from store layout to pricing.

Appraisal of the fittest

The data is clearly already at play, and pointing out strengths and weaknesses, including cost. Consider Nordstrom’s fresh foray into clothing conveyance. In April it began testing curbside pickup for merchandise ordered or reserved online. Jamie Nordstrom, who oversees company stores, told The Seattle Times the system is working fine now but conceded the holidays could get tricky.

Macy’s, like Uber’s partners, is seeking same-day delivery through a third party, Deliv, which connects a network of drivers through a digital app (like Uber). Macy’s charges $5 over standard delivery. Amazon, meanwhile, is fitting in with one-hour delivery, at $7.99.

Which leads to the one factor that may determine quick delivery’s survival. A fast flight of fancy (or Ferragamos) comes with a price, and many consumers are not willing to pay it. However, if data analysis and technology continue to enable same-day delivery, it will likely progress until the consumer believes it is a necessity (similarly to the pull of Apple products). By then, the cost will come down, at least for the fittest of the herd.

And by then, who knows? Maybe the next major turn in retail evolution will be in full swing. Why wait for delivery, when my Tom Ford sunglass frames can come via 3-D printer?

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

May 13, 2015

May 13: Loyalty Links & Likes

To Move Forward In Customer Service, Measure Outcomes Instead Of Interactions – Business 2 Community

To Move Forward In Customer Service, Measure Outcomes Instead Of Interactions – Business 2 Community

The availability of technology is changing the way organizations are empowering customers – from 24/7 digital service channels to providing instant feedback via social media. This excerpt from a podcast interview between The Service Council’s COO Sumair Dutta and Bill Patterson of Microsoft explores the current state and near future of customer empowerment.

Retailers Cautious About Embracing Upgraded Payment Options – Retail Customer Experience

A new study from ACI Worldwide has found that 54% of retailers are withholding investments on new payment technology due to security concerns. Retail Customer Experience interviewed ACI Worldwide’s Michael Grillo to analyze the findings and find out the extent to which it will effect marketers.

Building Loyalty That Lasts – COLLOQUY

In this Q&A, loyalty marketing consultant Noah Fleming talks about the loyalty marketing principles laid out in his new book “Evergreen: Cultivating the Enduring Customer Loyalty That Keeps Your Business Thriving.” Fleming uses the analogy that a program should be like an Evergreen tree – lush and healthy year-round.

Big Data: Protecting Privacy Is Good For Business – InformationWeek

Many companies struggle to balance the need for consumer privacy against their need to collect the kinds of data necessary to improve profitability. Sometimes the best way to tackle this issue is to simply increase transparency, making sure customers know exactly what your collecting and giving them the choice to opt-out.

How Predictive Analytics Can Boost Customer Experience – Vanilla Plus

The rate at which customer data is collected is expected to increase 23% annually for the next few years. With this prediction in mind, how can companies make sure that they’re mining, and storing, data properly to deal with the influx? If positioned properly, can a company can take advantage of new analytics technology as soon as it’s available?

May 11, 2015

The Price of Loyalty: What Pret A Manger Can Learn From Starbucks, Caribou

For Pret A Manger, the words “no charge” may translate to a big data gap.

The London-based coffee and sandwich chain, which also operates in the U.S., is replacing points with gratis, but will that translate to grateful? Its strategy – an alternative to a formalized loyalty program – is to let employees give away free food and drinks at their discretion.

As Pret A Manger CEO Clive Schlee put it to the London Evening Standard: “We looked at loyalty cards but we didn’t want to spend all that money building up some complicated Clubcard-style analysis.”

He has a point in that many loyalty programs are structured in a way that their value among members may be diminishing. However, while Pret A Manger’s freestyle approach may feel more loose and fun, it does not embody the characteristics that would likely build the emotional and behavioral loyalty that great global brands make their goal. One key factor is that employee-decided giveaways prevent Pret A Manger from gathering data insights and, crucially, do not ensure those who are actually loyal will be rewarded.

He has a point in that many loyalty programs are structured in a way that their value among members may be diminishing. However, while Pret A Manger’s freestyle approach may feel more loose and fun, it does not embody the characteristics that would likely build the emotional and behavioral loyalty that great global brands make their goal. One key factor is that employee-decided giveaways prevent Pret A Manger from gathering data insights and, crucially, do not ensure those who are actually loyal will be rewarded.

Loyalty marketers may want to monitor Pret’s strategy as a competitive concern, but the key to success – regardless of approach – is delivering an experience that sets the brand apart. Two good contrasting examples are the My Starbucks Rewards program, which just surpassed 10 million members, and the newer Caribou Perks, which is structured on a similar surprise-and-delight theme as Pret A Manger, but uses customer data as a backbone to understanding its customers.

In short, each program demonstrates the effectiveness of responsible data use. Let’s review.

Starbucks’ journey

Starbucks took the grande, venti, trenta approach to growing its rewards program. It originated in 2001 as a small, simple payment-card system that members could use like a debit card. A year later Starbucks added an automatic reload feature so holders could replenish their accounts online.

Not until 2008, when CEO Howard Schultz returned to the helm after serving eight years as chairman, did Starbucks introduce rewards. The concept was part of a “transformation agenda” that also included a focus on Starbucks’ heritage, innovation and the customer experience.

The early rewards program did not offer levels or tiers; members registered a card and earned free milk, syrups, beverages and refills. After a year or so of testing (a fee-based gold card came and went, while the mobile payment app came and flourished), Starbucks in 2010 introduced My Starbucks Rewards, a three-tiered program (welcome, green and gold levels) that continues to operate today.

Key changes continue, all apparently geared to lift sales where the data shows potential. In 2012, Starbucks added the option for members to select food as their rewards. It also made it easier to earn free reward cards – with 12 stars rather than 15. That same year Starbucks began testing digital rewards, which continue today. In 2015, Starbucks is rolling out a mobile order-and-pay program.

True, this formalized program is likely costly, and complicated, but it directly correlates with topline performance, Schultz told investors. More than half of My Starbucks’ 10.3 million members are higher-spending gold members, more than 16 million customers use its mobile payment app and in the second quarter alone all members loaded $1.1 billion on their cards.

“My Starbucks Rewards will continue to be among our most important business drivers as new members contribute not only to short-term increases in revenue and profit but also to long-term loyalty for many years to come,” Shultz said.

Caribou steps up

Also seeking longer-term loyalty is Caribou Coffee. Though much newer with a January 2014 launch date, its Perks program has covered significant ground by giving unexpected rewards, from beverage size upgrades to pastries. Members receive text messages or emails when rewards are given, depending on preference, and those rewards are typically good for a week.

In April, Caribou launched a pay-by-phone app that enables members to preload their accounts and offers personalized rewards based on member preferences and behaviors.

The Perks model resembles Pret A Manger’s strategy of unexpectedly giving away items for free, which – granted – ensures the reward is exactly what the customer wants. What distinguishes Caribou Perks from Pret A Manger is its data assures that loyal customers will indeed be recognized in the first place, regardless of the locations or times they visit.

Which leads to an important feature of a formalized reward program: The data collected can help employees better recognize brand-loving customers as it keeps track of visits regardless of where and when they occur (for many merchants, this extends to online purchases). At Pret A Manger, the customer may hit two locations a day, but the workers at each store register that guest only half the total time; even less often if their shifts vary. A deeply committed customer may be seen as an occasional guest.

Further, Pret A Manger’s freebies are arbitrary, relying on the whims of employees. I give its staff the benefit of the doubt as being responsible and committed to the brand, but they are also human. A loyal guest may be overlooked in favor of a less loyal, but more attractive one.

So while Pret customers wait for their lucky moments, Caribou Perks members are guaranteed rewards. And since these rewards come with expiration dates, they are likely to get customers back into the stores soon.

This kind of data delivery may come with a charge, but it is more likely to translate into topline sales that help build the business and in turn lend credibility to the value of a quantifiable reward program.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

May 6, 2015

May 6: Loyalty Links & Likes

Building Customer Loyalty in a Programmatic World – 1to1 Media

Building Customer Loyalty in a Programmatic World – 1to1 Media

Programmatic marketing – the application of automated media optimization – is becoming a big trend among marketers in 2015. However, 1to1 Media warns that while programmatic initiative can be easy to pursue, it works best when combined with other marketing tactics and is just one step of many toward building customer loyalty.

Are You a Habit Your Customers Can Break? – Direct Marketing News

This story serves as a good emotional loyalty refresher. When attempting to measure customer loyalty, some organizations are inclined to look at behavioral loyalty and think that it’s enough, as long as customers are buying from them. Behavioral loyalty, however, can be driven by aspects such as price and discounts – not emotional attachment to a brand – and customers may leave without regret if a competitor lowers its prices.

Taking Loyalty to the Curb: What Coke, Red Lion and Others Would Spring Clean Out of Loyalty – COLLOQUY

Loyalty marketing publication COLLOQUY recently asked its readers what they would “spring clean” out of loyalty in an attempt to identify the superfluous minutiae in modern programs. This article features the responses of retail and agency experts who wish to do away with things like elite tiers and impersonal communications.

Your Customer Experience Must Save Your Customers Time – Business 2 Community

While a key aspect of a good customer experience is making customers happy through unique interactions, some retailers overlook the fact that they also have to improve efficiency and save customers time in order to delight them.

2015: The Year Big Data Becomes Agile? - Forbes

In this article, Forbes contributor Teradata poses that 2015 is the year that big data becomes an integral part of an agile business strategy. We often hear of startup companies being agile because they are able to avoid the bureaucracy typical of large corporations. However, approaching big data with small steps and the proper segmentation can lead any organization to an agile future – regardless of size.

May 4, 2015

Markdowns and Mavens: What Macy’s, Neiman and Guess Reveal About Price Wars

It used to be that inventory control was the unattainable goal in retail; today it is putting a price on what consumers are willing to pay.

Retailers have been testing a variety of options in an effort to either train shoppers to spend more or meet shoppers who demand to pay less. The apparel chains Express and New York & Co. are cutting back on deep discounts, while Macy’s is shopping the idea of a discount chain to complement its flagship department stores.

All these efforts respond to years of habitual discounting that has conditioned shoppers to ignore the suggested retail price. Markdowns are for mavens; full price is for fools. Why pay top dollar when in a week it will be 60 cents on the dollar? And while savvy shoppers wait, merchants fret over what the competition is doing. (Hint, it involves cutting prices.)

Perhaps retailers are looking to the wrong guidance. While they struggle over whether the price should go high or low, the answer may simply come down to Jane or Joe. I refer here to individual preferences, and personalized pricing strategies.

Though it sounds futuristic, the tactic is already in play. A number of retailers use loyalty program data to deliver time-sensitive, digital (app-based) promotions tailored to a specific shopper’s purchase preferences – if she buys organic bananas, it sends an offer for soy milk when she is in the store. As digital technologies advance and become more widely accepted, it’s not unrealistic to expect the mass-market discounting structure that has dominated retail for decades to fall from favor.

And it should. Compared with the sprightly nature of digital marketing, mass-market pricing feels as rigid as warehouse shelving in a big-box store. Mix in the advantages of beacon technology, and it feels as ho-hum as the rows of boxes crowding those aisles.

That said, one-to-one pricing comes with much responsibility. As retailers gain the tools to master the concept, the challenge also will shift, from high or low to how and who.

Express cuts deals; Macy’s seeks outlet

The need to change pricing structures is evident across sales floors and business sections nationwide. According to a recent report in the Washington Post, a range of merchants, from the tony Neiman Marcus to trendy Express, is pulling back on discounts.

“We are structuring many of our future promotions to be more targeted and, at times, less deep and less frequent,” Express CEO David Kornberg told analysts during a fourth-quarter earnings call. “This will help us communicate a clearer value proposition to our customer.”

Kornberg later added that pulling back on promotions is “one essential ingredient” to improving the merchandise margin.

Similarly, the specialty chains Guess, New York & Co. and Quiksilver have all said they plan to shift from mass, storewide promotions to targeted, category-specific deals.

Macy’s, meanwhile, is exploring the feasibility of discount outlets through which it can ship out its off-price or post-season fashions. The chain, which is setting industry standards in omni-channel merchandising, has established a new business organization to pursue the outlet concept, among other opportunities.

While both strategies may work well, they won’t be fully optimized unless they recognize the role of personalized pricing as a competitive device. The ingredients already exist through mobile technology, personalized shopping information, in-store beacons, databases and analytics. The industry just requires some brave pioneers to cut the path forward.

Registering success

Which leads us to the how, and who, of intelligent personalized pricing. For now, the strategy’s success appears to vary by retail category. Some supermarkets, for instance, have so fine-tuned the practice they can send customized coupon books to individual shoppers based on previous purchases. In these cases, loyalty program data helps the merchant pinpoint specific preferences of repeat shoppers.

For instance, through a loyalty app’s unique identifier, a grocer can learn a particular shopper’s in-store browsing patterns and anticipate when she will approach the freezer case so it can dispatch a branded coupon for a product that complements something else she regularly buys.

Department stores and specialty chains, however, are less likely to see their shoppers with such frequency. In these cases, personalized promotions and discounts will likely be more effective on a category or seasonal basis. Merchants can invite subsets of shoppers to petite-only events, or send discount cards to encourage those who visit an average of twice a month to come in for a third time. Such campaigns would limit the discounts while providing an opportunity to more deeply engage that shopper with the brand.

I predict we will eventually see retailers shift their investments from large-scope, untargeted models in favor of digitally personalized pricing. They pretty much will have to in order to remain relevant with the increasingly canny consumer. For make no mistake, if all retailers continue to compete on price, only a few will succeed.

As Marcie Merriman of Ernst & Young put it to the The Washington Post: “They have to differentiate their brand in other ways, because otherwise, it’s a race to the bottom.”

Put another way, the price of retail success will never be found on a tag. It will be registered with the emotions of the consumer as she leaves the store.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

April 29, 2015

April 29: Loyalty Links & Likes

10 Universal Questions You Cannot Skip to Run A Successful Loyalty Program – Business to Community

10 Universal Questions You Cannot Skip to Run A Successful Loyalty Program – Business to Community

Whether an organization is considering starting a loyalty program or already has one that could use some optimization, this list of 10 questions covers all the bases for any program to be successful.

What Shoppers Will Change for Loyalty – BizReport

We often hear marketing experts proclaim that businesses need to adapt to their customers’ needs and wants, but what if a program can be designed so well that consumers change their shopping habits just to use it? This short interview with Christopher Barnard, president of Points.com, provides some insight.

Charged! How Nike, Gap and Gamestop Use Loyalty to Revolutionize the Customer Experience – COLLOQUY

While discounts continue to be a staple of most specialty retail loyalty programs, an increased focus on the customer experience has allowed companies like Nike, Gap, Gamestop and others to reach customers on a more personalized, emotional level.

The Economics of the Customer Experience – CX Journey

One of the biggest roadblocks loyalty marketers face when working to enhance the customer experience involves convincing senior management to make the investment to do so. This article discusses the economics of customer experience initiatives, how to convince senior executives of the return on investment and how to justify the cost.

Report: Path to Online Purchasing is Nonlinear – Retail Customer Experience

New research from Bronto Software has found that today’s consumers use multiple devices to do their shopping on a weekly basis. They also prefer to make purchases on a web browser as opposed to a mobile app. This article examines some other results from the study and the implications for marketers.

April 27, 2015

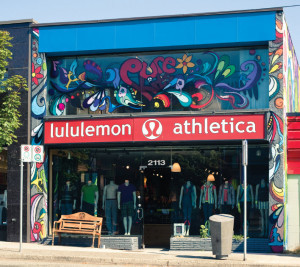

Lululemon’s ABC’s of Marketing: Keeping the Family Jewels Safe

While Lululemon left little to the imagination with its see-through yoga pants crisis two years ago, the active wear chain has applied much imagination to its menswear, which could create renewed energy.

To be specific, Lululemon Athletica is directing our focus to an entirely different part of the anatomy. Its ABC pants, which stands for (apologies) anti-ball crushing, are hoped to make headway in what Lulu sees as a $1 billion opportunity: men’s clothing. Whether men will appreciate this kind of product and support the brand with more fervor, though, may hinge not only on their comfort with these new products but also on the message.

The market certainly comes with upside potential. Lululemon recorded a 16% gain in fourth-quarter same-store sales in the men’s business, thanks in part to the ABC pants, CEO Laurent Potdevin told analysts in a fourth-quarter conference call.

“With men’s, we saw continued success with our pant category anchored by the popularity of our core ABC pant,” he said. Such strong demand for comfortable men’s pants has the company considering larger store footprints.

A key consideration in such expansion is that size will matter, long term, if the marketing falls short. Lulu’s effort to meet demand by addressing a sartorial issue that transcends style indicates it has learned to think like its customers. (No doubt its credit card and online purchase data have helped it determine the potential of the men’s market.) The question – at $128 a pair – is whether the ABC pant addresses a valid need or is an attempt to resolve what for many men may be an unrecognized problem.

Regardless of the answer, if Lululemon puts the right marketing strategy behind its ABCs, they could become its crown jewel of menswear.

Who wears the pants?

The key here is the marketing will need to appeal to women as well as men, which highlights a key challenge for Lululemon – regardless of the potential of the men’s market, it cannot take its eye off the ball of its core business.

Women, after all, do purchase men’s clothing and sales have been strong. Total U.S. sales of men’s apparel rose 5% in 2013 (the most recent year for data), to $60.8 billion, according to the NPD Group. The sale of men’s pants alone rose 12%.

Men, however, represent just one growth market, and that is reflected in Lululemon’s own fiscal sales. For 2014, total revenue rose 13%, to $1.8 billion from $1.6 billion in 2013. Some of that gain can be traced to the addition of 10 Ivivva stores, which cater specifically to teen girls. Ivivva posted a same-store sales increase of 51% in the fourth quarter, making it a giant compared with the 16% same-store sales gain by Lulu’s menswear.

Lululemon plans to open more standalone Ivivva stores in 2015, while it operates just one men’s store. That location, in Soho, N.Y., opened in 2014.

Instead of more standalone stores, Lulu is centering its men’s growth on existing and combination stores, which makes sense. By putting its ABCs near the jog bras, the chain essentially doubles it purchase opportunity.

As Stuart Haselden, chief financial officer, put it to analysts: “We are seeing the potential for expanded store footprints, particularly as we have a growing men’s business that we are now working to ensure that we are presenting (in) the strongest manner.”

Six months after expanding one of its Canadian stores, it recorded a 90% gain in men’s sales, Haselden said.

[image error]

Stiff competition

The side-by-side merchandising not only expands market potential, it is a key distinguishing factor of the ABC pant. Yes, there are other anatomically friendly products out there.

Saxx underwear, designed for athletes and outdoorsmen, addresses the same need with patented technology. Its product is sold in men’s stores as well as boutiques that carry both men’s and women’s clothing. A key difference in Lulu’s merchandising is once a buyer is sold on a pair of ABCs, he or she can then be tempted into an $84 Metal Vent Tech shirt.

The trick is making the ABC message resonate with women. I have a hunch it may. The chances of this topic being broached among men and women are likely not high. Therefore, many women may just accept male discomfort as a problem and buy the pants, happy to have thoughtfully combined style with function.

But the marketing must resonate once the pants are brought home, as well. Trust is an important issue for Lululemon. Two years ago, it suffered a backlash after selling yoga pants that were sheer enough to see through in certain circumstances. It was not so much the $100 yoga pants that cost Lulu part if its reputation, however; it was how sales associates responded. Some news reports told of employees requiring customers to don the pants and bend over in order to prove their claims.

Which brings us back to how much marketing and the customer experience matter. Good marketing is about creating a need, or recognizing one that has not been acknowledged by the consumer (a great example is Swiffer). With its ABC pant, Lululemon is using innovation to shift the value proposition of one of the most basic of products, and in doing so has the potential to expand its business beyond the customer base that has been the foundation of its growth to date.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

Bryan Pearson's Blog

- Bryan Pearson's profile

- 4 followers