Bryan Pearson's Blog, page 2

June 21, 2019

WEBINAR – Dare to Be Different: The Changing Face of Customer Loyalty

June 20, 2019

Research: Half Of Shoppers Buy Perishables Online, And It’s Changing Customer Service

In seemingly less time than it takes for a frozen chicken to thaw, the in-store grocery experience is changing. And online chicken sales is part of the reason why.

PICTURE ALLIANCE VIA GETTY IMAGES

PICTURE ALLIANCE VIA GETTY IMAGESNearly half or more of all shoppers now buy perishables such as meat, produce and dairy items online, according to a global survey of shoppers and retailers by IDC (International Data Company) for Precima, a retail analytics firm. Within a year, one-third of shoppers said they will spend more than 40% of their grocery budgets online.

This transition, and its effect on shopper patterns, is forcing all supermarkets to upgrade the services they deliver online, for shoppers expect it to be better. And it’s requiring merchants to reconfigure their stores. For many, this is playing out as a bigger online presence and smaller physical footprints.

Factor in that the average American household spends more than $7,700 a year on food (about $640 a month), and there is a lot on the table for supermarkets.

So traditional food sellers are investing substantial sums in online ordering, while finding new ways to capitalize on the investments they’ve already made in their real estate. The result is a mesh of more immediate and personalized online fulfillment and stores that aim to be eclectic and easier to shop.

Here are two key takeaways from the survey, and how major retail brands are responding.

Takeaway One: White Glove Online Service

Shoppers expect personal treatment from wherever they make purchases, including online. Of the 4,000 consumers surveyed in December 2018, 68% said customer service is important when digitally shopping for groceries. Among the service features they like:

59% of shoppers want digital apps that provide in-store product locators. 60% say mobile loyalty apps help their shopping trips.66% would like to have personalized communications loaded directly to their rewards cards. Yet just 46% of food retailers do so.

The value of personalized communications heightens as shoppers expand their online baskets into perishable foods that will likely get more scrutiny, and therefore require more options. Retailers should prepare for the following:

48% of consumers said they do or plan to purchase meat within 12 months of the survey.Roughly 55% buy or will buy deli items, dairy, bakery and frozen foods.53% buy or will buy fruits and vegetables.

What’s making online perishables palatable? Amazon, through its acquisition of Whole Foods, might have played a role by lowering food prices and removing some barriers to online ordering. Amazon Prime members have access to free two-hour delivery (on orders over $35) or can pick up their food from Amazon Lockers installed at Whole Foods stores. These lockers are getting credit for contributing to a 10% increase in micro-visits (trips of less than five minutes) to Whole Foods in the first fiscal quarter.

Other chains also are investing heavily in technology. Kroger is testing driverless grocery delivery in Houston, it offers designated online order pickups at most stores and has a “Scan, Bag, Go” self-checkout app. Kroger likewise has paid attention to online service, inviting shoppers to provide special instructions on certain items (requesting green bananas, for example).

Takeaway Two: Save The Store!

Yet even as shoppers buy more groceries online, they still expect the physical stores to be at the ready to meet their needs.

Those needs center on convenience, good experience and ease. For retailers, this translates to smaller spaces and — in cases of large existing stores — areas dedicated to services and categories more likely to attract shoppers. The key is the offerings distinguish the store from nearby competitors.

Supporting facts:

58% of shoppers said if grocers reduced space, it should be in non-food items; 28% think stores should cut back center-aisle packaged products. Just 19% suggest reducing space for fresh foods such as produce, meats and dairies.Consumers are getting less picky about where they buy. Shoppers spend about 72%of their grocery budget with their primary store. That means 28 cents of every $1 is spent elsewhere.

Those “elsewhere” destinations include dollar stores, convenience stores and up-and-coming community shops that meet cultural and social niche preferences. In Vancouver, for example, the store Nada sells everything package-free. A shopper can grab one banana, two eggs and an ounce of honey.

Non-traditional food sellers will generate $200 billion to $700 billion in grocery sales by 2026, according to projections in a recent report by McKinsey. Convenience stores alone now sell $240 million in fruits and vegetables, the National Association of Convenience Stores reported.

Scratching A Niche

Chains from Target to Hy-Vee are responding by planning smaller stores and replacing grocery square footage with in-demand services. The trick is making these features complement and co-exist with their online offerings.

Target’s small-format stores, shoe-horned into urban areas and college communities, carry flexible selections of what’s most in demand in the market. In California, the chain Raley’s operates a store dedicated squarely to healthy eating, called Market 5-One-5. And the Midwestern chain Hy-Vee is adding medical facilities and spa-inspired bath boutiques, according to a report in The New York Times.

These services, offered hand-in-hand with app-enabled digital services, could provide the holistic answer to the spontaneous shopper’s fleeting considerations to grocery shopping, online and instore.

Which services should come first, digital or physical? As long as the shopper continues to buy both eggs and frozen chickens online or from the store, it doesn’t matter.

This article originally appeared in Forbes . Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

June 14, 2019

Father’s Day Expected To Generate $2.5 Billon In Clothing Sales

This Father’s Day, nearly four in 10 children will venture where no father wants to go: the department store. And to prove their dads really are the world’s greatest, they’ll buy what few dads like to shop for: clothes.

Photo: Getty

Photo: GettyOr do they? The findings are among

the results of a National Retail Federation survey, which indicates

Father’s Day spending in 2019 will reach nearly $140 per person, on average,

for a total of $16 billion. The figure represents a 70% increase ($6.6 billion)

from a decade ago.

But perhaps more surprising than the marked increase in spending are the people most likely to purchase the men’s apparel and related items: other men. And not by a little. Men are expected to spend an average of $160.74 for dad, compared with $118.29 in spending by women. In total, purchases of men’s clothing are expected to reach $2.5 billion for Father’s Day.

A look at broader trends, from the influence of

technology to our general health, helps to explain why.

The Evolution Of Father’s Day: A Man-Splaining

First

off, we must bury old misconceptions about men not caring about their

wardrobes. Today’s man spends more on apparel than his dad did, period. The

expectation that men will buy clothes as Father’s Day gifts is, therefore,

logical.

But the uptick in Father’s Day spending, whether it’s for

clothes, golf clubs or “World’s Greatest Dad” mugs, derives from various

broader factors. Here are four:

Men are living longer. Older men can expect to

live longer than their fathers, which means their children will buy more annual

Father’s Day gifts. In 2016, a 65-year-old man could expect to live an

additional 18 years, according to Centers

for Disease Control (DCD) estimates. In 2010, he could count on 16 years, and in 1990, 15 years. This may

explain why the NRF projects the biggest spenders this Father’s Day will be the

older generation’s offspring, ages 35 to 44. This group plans to shell out

nearly $200 for dad. (The NRF does not break out male/female spending in this

age group, but considering men are expected to spend more overall implies those

ages 35 to 44 will spend more, as well.)Men aren’t making as

many babies. Americans are having fewer kids, and have been for a number of years. Figures

released in January by the CDC show 1,766 births per 1,000

women (1.77 babies each), compared with 1,862 in 2014. What’s that? You

think that means there will be fewer fathers for whom to buy gifts? Maybe in a

decade or so, but right now that means a lot of men, especially men in their late

20s, have more money to save and to spend on other people, like dad. The

average age of a first-time father is 31 (compared with 27 in 1972), and the

number of men having babies in their 40s is twice as high as it was in the 1970s. More people are

watching them. Social media platforms, Instagram in particular, play a role in men

placing more emphasis on their appearances. Designers have picked up on this

thread, expanding their offerings to suit men’s lifestyles beyond the workplace

— to streetwear, athleticwear and casualwear (explaining the popularity of men’s sweatpants). Back in 2016, the PR

agency Boutique @ Ogilvy released survey results that suggested sales

of men’s apparel would outpace those of women’s in 2017 — 8.3% to 4.2%. On

a monthly basis, that came out to $85 for men and about $75 for women. The

trend has since continued: The market research firm Euromonitor forecasts sales

of men’s clothing is outpacing that of women’s, at a compounded annual growth rate of 2% from 2017 through 2022.

There are easier

options. Study after study has supported that men approach shopping like it’s a git-r-done

task. They don’t browse much; just find what they already know they need and

finish the job. Online retailers are appealing because they step right into the

man’s path, removing the requirements to drive, park and wait in line. If it’s

an easy-to-navigate site, the male shopper just has to search (dark blue

sweaters, medium), click and purchase. Even Amazon, which is not the

easiest-to-navigate site for apparel, lands more male than female clothes shoppers.

A study by CPC Strategy found that 56% of men are more likely to buy clothing from Amazon,

compared with 53% of women.

This last shopping trend is further supported

by the National Retail Federation’s Father’s Day research. It shows that after

department stores, men are most likely to buy their gifts online — 34% said

they would. Nearly 40% of men are expected to use their mobile devices to

research Father’s Day products, potentially to make that dreaded department

store trip shorter.

Hey, the world’s greatest dads didn’t raise a

bunch of dummies, right?

This article

originally appeared in

Forbes

.

Follow me on

Facebook

and

Twitter

for more on retail, loyalty and the customer

experience.

June 7, 2019

Self-Care 2025: 5 Predictions For How Retail Will Treat Shopper Wellness

If retailers think they can prescribe wellness for their shoppers, their best outcome for success depends, a lot, on prevention.

photocredit: Getty

photocredit: GettyPreventing the suspicion that they are merely delivering “wellness words” in a self-serving marketing pitch. Preventing an expensive tug-of-war competition for shoppers through a glut of new products that all promise the same care. And preventing reputation-damaging missteps while leading a movement that can holistically shape wellness for consumers who urgently need to self-manage their health care.

The consumers’ pursuit of self-care has fertilized a $4.2 trillion global wellness industry that extends from food and beauty to apparel, household cleaning products and routine medical treatments, such as teeth straightening. As a result, the promises these products make are watered down and, in some cases, not trusted. Retailers must earn that trust.

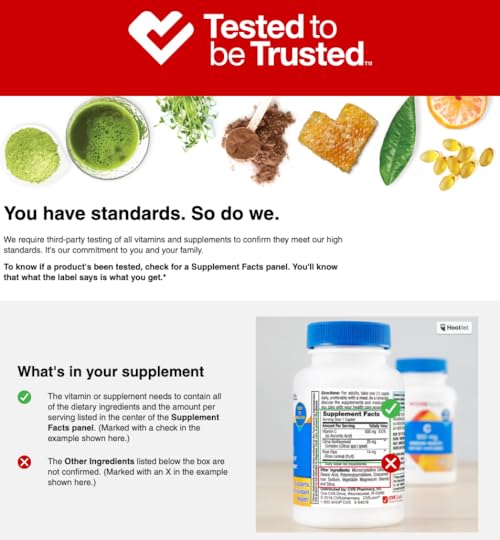

An apt example: CVS Pharmacy’s recent announcement that it is requiring all vitamins and supplements that sell in its stores to be tested for ingredient accuracy. The program, called “Test to be Trusted,“ represents the kind of leadership role retailers need to take.

photocredit: CVS

photocredit: CVSMore retailers and brands are stepping up to that role, in various forms. Shoppers of Walgreens in Florida can have their teeth checked in-store by members of Aspen Dental. Warby Parker customers can have their vision prescriptions updated through its Prescription Check digital app. And Walmart is offering some customers free digital medical consultations through a telehealth service called Doctor On Demand (through a partnership with the maker of Mucinex, Delsym and Airborne).

Each of these efforts is testing and shaping retail’s future role in self-care, but the change shoppers will most likely embrace is that which takes place within the retailer’s organizational culture. In addition to selling services, retailers will have to back the services they sell with their good names.

Here are five predictions of what retailers must do to stand apart and connect with shoppers by 2025 or sooner.

Develop data management as a separate division. Self-care is profoundly personal, so the data retailers gather — and how they store and use it — will be crucial to maintaining a respected role in shopper health. This requirement could become legislatively backed in the U.S. as more countries adopt strict data-privacy rules, such as those under Europe’s General Data Protection Regulation. Wellness-related loyalty programs may be the most logical solution, through which shoppers are rewarded for self-care lifestyle purchases and activities (Walgreens is a good current example). Technology will enable more precise data gathering and product recommendations, such as sun exposure apps that warn the shopper to get hydrated or put on more sunscreen.Shoppers will be consultants.The consumer’s embrace of self-care signals a historic power shift, and retailers will be encouraged to form collaborative shopper relationships to gain and maintain These digital networks of shoppers and health experts will influence retail decisions regarding wellness, and could even become brand extensions with community ambassadors. The basis for these collaborations is already taking form through events such as the Selfcare Summit 2019, scheduled for October, designed to encourage partnerships among retailers, suppliers, tech innovators, healthcare leaders and others.Retailers and customers will become self-care co-producers. Collaborative efforts will extend to the actual products made, which could present significant opportunities in the grocery sector in particular. Supermarkets could form neighborhood food co-ops through which workers and customers/entrepreneurs grow and develop healthy foods together. Various operating models can exist —co-op participants could keep their foods, sell them through the grocer or simply lend their hands-on expertise and/or services. The key is that other shoppers trust the quality.Wellness will become more sharable. Social media has already encouraged people to share highly personal details of their health information, even serious conditions. As wellness increasingly equates with beauty and propels product extensions, retailers will have opportunities to play a role in those shared social images. All-natural cosmetics are just the gateway: Think scalp ornamentation items for chemotherapy patients, post-mastectomy clothing lines and temporary skin art to hide surgical scars. Canny retailers will recognize that these kinds of products have a face for social media, as long as they deliver.Retail will move into the health complex, literally. If dentists operate in drug stores and eye exams can be performed through apps, shoppers can expect that retailers will become mainstays within health complexes as well. These health complexes, therefore, won’t look like the standard medical practices and hospitals we think of today. They will likely evolve into holistic wellness compounds with fitness centers, test kitchens and salons — as long as wellness continues to be equated with beauty.

And as long as retailers continue to equate wellness with customer engagement, they will have an opportunity to maintain relevance in self-care. The accuracy of these predictions, however, will depend a lot on the level of prevention retailers and brands practice in terms of not losing trust.

This article originally appeared in Forbes . Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

May 29, 2019

4 Ways Macy’s Is Controlling Shipping Costs While Investing In Loyalty

At Macy’s Inc., a million shoppers have gone for the bronze, and it could turn out to be both positive and pricey news.

photocredit: BLOOMBERG NEWS

photocredit: BLOOMBERG NEWSThe department store chain reported that since it relaunched its Star Reward program a year ago, 1 million customers have joined its bronze-level tier per quarter. This helped contribute to a sales gain of 0.7% at stores open at least a year, and $5.5 billion in fiscal first-quarter revenue overall.

At the same time, those active bronze members are getting closer to reaching the gold level of the program, with free shipping. And, as Macy’s is learning from its higher-tiered members, they not only will take advantage of free shipping, they’ll make more frequent purchases of smaller sizes, eroding Macy’s gross margin.

And therein lies a challenge facing almost every retailer with a rewards program in the world of Amazon: How do retailers manage the expected cost of free shipping — which totaled $1.5 trillion among U.S. companies in in 2017 — while still investing in rewards perks that surprise members and help the merchant stand apart from its rivals?

photocredit: ASSOCIATED PRESS

photocredit: ASSOCIATED PRESSMore than 50% Upping Loyalty Investments

Most retailers are increasing their investments in loyalty initiatives, according to the recent report “Loyalty Big Picture” By LoyaltyOne. Nearly 70% of the 1,200 global executives interviewed for the report said they upped the funding of their loyalty programs over the past two years. More than half, 55%, expect to further increase their spending in the next two years.

Those investments amount to 2% to 3% of annual sales among 47% of the executives surveyed; 24% are spending more than 3%.

The challenge has been just where to put those dollars. Only 30% of the executives said their loyalty budgets are earmarked toward increasing customer value. About 15% use their loyalty programs for more effective marketing or improve customer engagement.

There’s no question, however, that a lot is being spent on free shipping, even among startup rewards programs. The clothing chain H&M’s new two-tiered reward program, for example, incudes free shipping on orders of at least $40 for lower-tier members, and free shipping on all orders for higher-tier members.

With Amazon expediting its members’ delivery speed, free shipping seems unavoidable. Amazon in April said it would spend $800 million to ensure one-day free delivery for its Prime members, and is recruiting its own employees to deliver.

Ringing The Expense Out of Shipping

The shipping dilemma is especially vexing in the context of retailers’ rewards programs, whose loyal members expect not only free delivery, but fast delivery. Yes, that free shipping eats into the margin, but those program members spend two to three times more than nonmembers, 60% of the executives queried by LoyaltyOne said.

Yes, retail reward operators have to pay to play, but they (like shoppers) can find ways to pay less. Here are four ways retailers can control shipping and free up the expense for customer engagement:

Sell the whole outfit at once, not a piece at a time. Macy’s offers free shipping at its gold level with no minimum on spending, so more members are ordering just one item at a time rather than bundling. Macy’s is testing what the free-shipping thresholds should be, so we may see it offer incentives to get members to combine or increase order amounts to balance out those shipping costs. H&M’s model offers free shipping to lower-tier members who spend more ($40), but it does not encourage limited orders or shipments.It’s letting shoppers BOSS it around. Macy’s encourages its shoppers to have their online orders shipped and/or picked up at one of its stores, often on the same day of the order. Its buy online, pick-up in store (BOPS) and buy online, ship to store (BOSS) orders now account for more than 10% of all digital sales. Macy’s also is consolidating shipments to store locations to reduce internal supply chain costs. These shipments come directly from Macy’s warehouse or the vendor brand.It’s finessing when to hold and when to flow. Macy’s “hold and flow” initiative is designed to reduce shipping expenses and improve margin by ensuring the right amount of merchandise is delivered to each store. Loyalty program data likely informs these decisions: While high-selling stores receive additional inventory, slower-selling stores receive less, for fewer markdowns. In the program’s 2018 pilot, improved in-stock performance contributed to a 15% increase in gross sales. It’s an area long-ripe for opportunities —recent research shows 43% of retailers overbuy inventory and 36% underbuy.Encourage in-store action. Macy’s Star Rewards members can win access to experiences special to the brand, such as fashion events that get them off the website and into the store. Such in-person rewards are not new to loyalty, and they could be expensive as well. But through strategic partnerships with sought-after designers and vendors, retailers can keep costs relatively low while offering VIP treatment.

Macy’s leadership recognizes that increased shipping costs are a necessary investment if they want to retain customers and improve customer loyalty. And investing in its loyalty strategy, even with its free shipping, is paying off. In addition to the 1 million quarterly bronze-tier members, spending among Macy’s free-shipping platinum members, which make up about 30% of all sales, rose 10% in the fiscal first quarter.

If that 10% higher spending, combined with other cost-management measures, can offset delivery costs by more than a few percentage points, it could present a golden opportunity not just for Macy’s, but for its customers.

This article originally appeared in Forbes . Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

May 24, 2019

Thinking Out Of The Eco-Box: 4 Ways Amazon, Kroger, Walmart Will Change Shopping

If you think you hear a giant sucking sound, it’s likely the retail industry siphoning out straws, plastics and other environment-damaging packaging from their shelves.

photocredit: ASSOCIATED PRESS

photocredit: ASSOCIATED PRESSThe retail industry is waist-deep in campaigns to eliminate tons of product packaging materials, from polystyrene to questionably harvested paper. Merchants across sectors, including Amazon, Kroger and Walmart, have committed to formal waste-reducing programs.

The motivation is social as well as economic. Nearly 60% of consumers said they are less likely to buy products in packaging that is harmful to the environment, according to a survey of 5,000 consumers by the Boston Consulting Group for the packaging company Exal Corp. Nearly 25% said they would pay up to 20% more for products in eco-friendly packaging.

In time, shoppers may not have a choice. By 2025, many major retailers plan to meet established goals for waste reduction, and that will make the store shelf look very different.

Money In The Trash

Product packaging represents 65% of household trash, and lots of discarded dollars. For every $10 shoppers spend on goods, 10% is tossed away in the form of packaging, according to the University of Southern Indiana.

The cost of handling that trash escalates from there: $50 per ton to send it off to the landfill, on average. It costs $30 per ton to recycle it and as much as $75 to incinerate it.

Other reasons retailers are rethinking their packaging:

It’s getting crowded. Packaging accounts for almost half of all plastic waste, which itself is massive. Nearly 90% of plastic waste is not recycled, and more than 8 million tons are dumped into the ocean every year, according to National Geographic.It produces by-product waste. Paper packaging, including cardboard, can be just as bad as plastic due to forestation and processing. Paper bag production generates 50 times more water pollutants and 70% more air pollutants than plastic bag production.Reduced packaging reduces retailer expenses. The plastics packaging market alone is valued at about $200 billion, and someone’s paying for that. The cosmetics merchant Lushestimates 40% to 50% of its product cost is attributed to packaging, according to its blog post.

Little wonder, then, that more of Lush’s products are becoming package-free.

Saying No To Paper, Plastic: Amazon, Kroger, Walmart And More

Retailers, in response, are putting their own products in sustainable packaging. Among those with formal campaigns:

Kroger, as part of its effort to optimize the packaging of all its private label products by 2020, has reduced the amount of plastic resin it uses by 10 million pounds. For example, Kroger has redesigned its milk jugs to require 10% less plastic, and they are made from 100% recyclable material.

Target has also set a goal for 2020, which includes sourcing all its private-label paper-based packaging from sustainably managed forests and eliminating polystyrene plastics.

Walmart is reducing packaging waste from its private labels and has set a goal to make all of the materials 100% recyclable, reusable and/or compostable by 2025.

Aldi too has committed to converting 100% of its packaging to reusable, recyclable or compostable materials by 2025. The German retailer has not used single-use plastic bags for decades.

photocredit: © 2015 Bloomberg Finance LP

photocredit: © 2015 Bloomberg Finance LPAmazon, through its Shipment Zero program, aims to make half of all its shipments net zero carbon by 2030. Through its Amazon Day, for example, Prime members can choose to have all orders delivered on one day of the week.

Major consumer brands aren’t about to be upstaged by private label. In January, dozens of companies, including Procter & Gamble, Nestlé, PepsiCo and Unilever, have partnered to introduce a reusable and refillable packaging model, according to a report in RetailDive.

Lighter Packaging, Brighter Shelves: 4 Predictions

photocredit: Procter & Gamble

photocredit: Procter & GambleThese changes will alter the shopping experience in a few ways.

Bulking up. Consumers may see a lot more bulk foods they can carry out in their own reusable containers. This could apply to liquid products as well, as long as the shopper has a vessel.More concentration. More household products will likely be concentrated, resulting in smaller packaging. Procter & Gamble’s Tide is a good example. About a decade after introducing the concentrated formula (in smaller jugs) it has introduced Tide liquid in an “eco-box.”Going naked. Manufacturers may follow the example set by cosmetics company Lush and eschews packaging all together, where it makes sense. Customers of By Humankind, maker of soaps and other personal care items, purchase one container that is refilled through a subscription service.Lighter trips. Less packaging means lighter loads and easier carrying. The number of (reusable) shopping bags required per trip will likely shrink, much like the size of the packaging inside, so the shopper can make fewer trips from the car (or porch, if delivered) to the kitchen.

Best of all, reduced packaging should reduce costs to consumers; if not in the actual price tag, then in value. Smaller packages in the store mean less space taken up at home, and less to throw in the trash.

Most important, there’s the immeasurable benefits to animal and plant life. Among all the reasons to change our packaging habits, environmental damage should be the last straw.

This article originally appeared in

Forbes

. Follow me on

Facebook

and

Twitter

for more on retail, loyalty and the customer experience.

May 17, 2019

Walmart Is Streaming Shoppable Shows, And That Could Change Shopping

Forget the wallet and coupons. Shopping in 2019 is more likely to involve two other essentials: A digital device and a bowl of popcorn.

photocredit: Getty

photocredit: GettyOne of the biggest names in retail, Walmart, is investing in entertainment that will include shoppable programming. Its Vudu streaming video service, which offers digital access to videos sold at Walmart, is expanding into original content and will include a number of “shoppable” shows.

It’s another way retail is stepping into the path of shoppers wherever they are, and if they are binge-watching, then it must be embedded within those programs. For shoppers, this could represent the most literal blend of shopping and entertainment, with potential purchases cat-walking across the screen in the context of storylines.

Consumers should expect to see more options:

Instagram offers Checkout on Instagram, a feature that enables users to buy products directly from the social platform without leaving the app. Brands include Warby Parker, H&M and Burberry.Target plans to rebrand its Target Media Network to include a new name, Roundel, and fresh brand content — including for products not sold at Target. All will be streamed on Target’s website and other channels, including PopSugar and NBCUniversal, but there are no plans for shoppable ads.NBCUniversal, meanwhile is launching ShoppableTV, where interested TV viewers can buy products featured in shows by holding their smart phones to the screen during “on-air shoppable moments.” Among the channels participating will be NBC, NBC Sports, Telemundo, USA Network, Bravo, E! and CNBC Prime.Amazon offers a live-streamed network, called Amazon Live, that features branded videos of the latest deals (often product demos) with prices, ratings and Amazon purchase options directly below the live stream.

photocredit: Getty

photocredit: GettyIs Amazon Prime Video next, in the form of opt-in shoppable ads? And if so, will Netflix — which also has no advertising — follow? The answer likely depends on how much shoppers accept, and take advantage of, the coming “shoppable moments.”

Don’t Sell Us, Entertain Us

Retailers are on the right track by following shoppers to the screen. An estimated 60% of all TV viewers binge watch, and 45% of young viewers have cancelled social plans in favor of catching a program. Those social plans could include shopping.

Walmart responded in 2018 by announcing Vudu would revive the 1983 movie Mr. Mom as an original series. In May it revealed additional content plans that would include shoppable ads. Among the coming shows: a travel and comedy series called Friends in Strange Places; a science fiction program, Albedo; and a documentary series, Turning Point with Randy Jackson. Vudu also plans to deliver a teen movie, Adventure Force 5, as well as test an interactive program that could debut in 2019 or 2020.

This blending of entertainment and acquisition will form a cycle: Consumer activity will generate insights that will feed content decisions, which will be reintroduced to viewers to respond to once more. Product categories that get lots of purchases (read: popular) may figure more largely into programming.

Content In Context: Why Shoppable Programming Fits

Here are three potential reasons why it makes sense.

Character building. Storylines generate emotional engagement, frequently to the characters. Shoppable programming could potentially extend that connection to the products the characters use and wear. For example: If a character is given a piece of jewelry in a very romantic scene, followed by an ad for jewelry, sales of that jewelry may skyrocket. More than 25% of people who see online ads respond by searching for the product or brand, according to the brand consulting firm Invesp.They have the technology, and the data. Walmart has said it is using shopper data to guide its content from early childhood to parenting. Target’s Roundel will use customer insights for more original, and personalized, ad campaigns. And the purchase activity generated on Amazon Live could inform the content on Amazon Prime Video. Do a disproportionate number of Prime Video viewers tend to shop Amazon Live, and if so, is there a correlation between ad and programming view times that could determine when to run specific video ads?Viewer activity equals shopper control. If overt marketing on their programs turns off viewers (even opt-in viewers), they could just stop watching. Retailers should prepare for this early on and be able to detect when in a series the numbers climb or decline. They can tweak programming accordingly, and even engage viewers via email (opted-in by the viewer, of course) to find out what went wrong.

By offering shoppable programs, Walmart is delivering on a prediction that retail futurists have been making since the 1990s. But product sales will only be good if the programming holds up. Netflix may not have joined the fray yet, but it also may be taking a back seat in the theater to see how viewers respond.

This article originally appeared in

Forbes

. Follow me on

Facebook

and

Twitter

for more on retail, loyalty and the customer experience.

May 10, 2019

Kohl’s, Amazon And The Cycle Of Returns: 4 Ways To Manage A Monster

It’s a case of foot traffic beating road traffic. By expanding its agreement to receive returns from Amazon.com, Kohl’s is helping resolve what most online merchants are grappling with today: An investment in returns that is becoming too big, and bulky, to accept.

2018 Bloomberg Finance LP

2018 Bloomberg Finance LPThe two merchants announced in late April that Kohl’s would begin taking Amazon returns at all of its 1,200 locations, after testing the service at 100 stores. Kohl’s explained the option as one way to increase foot traffic, but for Amazon the agreement addresses a burgeoning issue that is estimated to cost ecommerce retailers nearly $550 billion. And that speaks nothing of the cost to the environment.

At least 30% of all items purchased online are returned, according to research by brand consulting firm Invesp. Shoppers are increasingly less willing to pay for those returns, forcing digital retailers to cover the cost.

But retailers must satisfy their profit-seeking shareholders as well, so they’re finding ways to offset those shipping fees, from less-liberal return policies to partnering with brick-and-mortar brands.

The Returns In Store — 60% Are For Them

Even monster-sized Amazon can be brought to its knees by return obstacles.

Nearly half of shoppers said they’d more likely purchase the same item, for the same price, from a physical merchant than from Amazon, according to research by the company Happy Returns, which operates a network of “return bars” that process online orders. More than one-third of shoppers said they’d opt for Amazon Prime — because they are members, meaning free shipping (for the shopper, not for Amazon).

Exacerbating the dilemma is the sheer growth of online orders, which contributes to more returns:

More than 27% of apparel sales in 2017 were made online, compared with 23.5% in 2016, reports the firm Internet Retailer.Online purchases of household items rose 38% from 2018 to 2019, according to Valassis, a marketing company specializing in direct mail and couponing. Online purchases of healthcare and beauty products rose 40%.Many of those items took a roundtrip: More than half of shoppers surveyed said they had returned an online purchase within the previous year, according to Happy Returns.

But free shipping is not the shopper’s first choice: 62% are more likely to shop an online retailer if they can return items in-store, Invesp reports.

The Earth Wants You To Keep It: Boxing Out Emissions

The brick-and-mortar return option resolves not only the financial ramifications of shipping rejected purchases, but the environmental ones.

Online returns are usually shipped in medium to large trucks, which make up nearly 25% of the carbon footprint caused by transportation. In 2016, transportation took over power plants as the leading producer of carbon dioxide emissions.

Returned items are shipped from locale to locale, one to three times each, resulting in 12 million metric tons of carbon dioxide in 2015, according to the most recent research by Optoro, a logistics company focused on returns. That is the equivalent of more than 2.5 million passenger vehicles driven for one year.

Shoppers may prefer to purchase from retailers that are environmentally conscious, but they may need help understanding the role their own returns play in contributing to pollution.

4 Root Causes Of Returns

For these reasons — economic and environmental — retailers are finding ways to reduce the extent of returns. Some are partnering with companies such as Happy Returns, which in April announced an $11 million investment lead by PayPal’s venture capital arm. Others, including Amazon and Kohl’s, are working together to set up central return locations.

It’s a good first step. However, while these efforts will help reduce the financial and carbon footprints of returns, real change requires addressing the root cause of the issue: Diminishing the chances that shoppers will receive something they don’t want.

To do this, retailers can examine their online browsing and purchase data to identify the consumer behaviors that contribute to returns and head them off:

Seek out habitual buy-and-return shoppers. By limiting the number of free returns in a given period (say, two free returns a month), retailers can encourage shoppers to rethink knee-jerk purchases.Right-sized imagery. This seems like a no-brainer, but lots of online retailers lack images that display the goods in the context of their surroundings (a purse on a shoulder, a watch on a wrist, head-to-toe models with height/weight provided). Written dimensions are helpful, but shoppers won’t necessarily get out a measuring tape.Sell the environmental aspect. Retailers could spell out to shoppers that while shipping is free to them, it is not free to Mother Earth. Much like hotel rooms that suggest skipping daily laundry, online merchants can suggest shoppers combine orders into bi-weekly or monthly shipments.Sell the experience of something different. Online merchants can partner with high-traffic destinations, such as movie theaters, health centers and even college campuses, to set up return kiosks that bulk-ship returns, meaning no required packaging from the shopper.

Kohl’s and Amazon, by partnering, are addressing some of these root causes. They may never get to the point of no returns, but if they continue to follow the shopper, they may realize the profit of diminishing ones.

May 4, 2019

4 Retail Dos, and Don’t’s, of Cinco De Mayo: Learning From Victoria’s Secret, Hellmann’s And Others

It was an underdog battle that retailers are still trying to win.

photocredit: Getty

photocredit: GettyThe 1862 Battle of Puebla, during which a sorely outnumbered Mexican army defeated the French, has been recognized in the U.S. as Cinco de Mayo for decades. It is in fact more widely celebrated in the U.S. than in Mexico.

But it’s been more recent that U.S. retailers have tried to gain profit from the holiday. Grocery sales of items such as tortilla chips, salsa and fajita sauce alone were projected to exceed $120 million, up a combined 40%, in 2017, the most recent year Nielsen ran figures. That does not account for the boosted sale of alcohol, limes and avocadoes, the latter of which saw a 45% increase in unit sales (66 million) in the week ending May 6, 2018.

However, there have been some embarrassing missteps over the years, especially among merchants that sell products not remotely Mexican. Capitalizing off another culture’s milestone is a delicate undertaking. The fact that the U.S. Hispanic population, of which the majority is Mexican, rose to 59 million in July 2017 from 50.5 million in 2010, according to the U.S. Census, contributes to the need to better understand the history behind this date.

So let’s start. Following are four essential “dos” that shoppers should expect from brands promoting the holiday, with examples of major Cinco de Mayo fails.

Demonstrate an understanding of the holiday. Respect earns trust, and loyalty. Retailers that recognize Cinco de Mayo as a symbol of Mexican solidarity and passion will likely foster deeper connections with all consumers. This starts at the employee level — a little training on the meaning of Cinco de Mayo could go a long way. Merchants can further deepen customer connections by using a portion of their proceeds to benefit Mexican organizations and causes.

What not to do: Turn the holiday into a misunderstood excuse to sell stuff. In 2013, Victoria’s Secret suffered social media blowback after promoting T-shirts with phrases such as “Let’s no taco ‘bout it.”Be authentic about the food. We’ve come far enough in America to appreciate true Mexican food and culture. This doesn’t mean banning the shelves of taco shells and margarita mix, but Cinco de Mayo is an opportunity for supermarkets to promote authentic dishes and the ingredients to make them. “Did you know” signage in the international food sections of stores could highlight the role of such ingredients.

What not to do: Make ethnic food American. In 2015, Hellmann’s mayonnaise promoted a recipe for guacamole that included a helping of the American condiment but made no reference to Mexican culture. Instead, it promoted the recipe with a tweet, “putting the mayo in #cincodeMAYO.”Rise above stereotypes and appropriations. The term “Cinco de drinko” is not original, and shoppers are likely to appreciate those brands that rise above such clichés. Instead of seeing Cinco de Mayo as an opportunity to get cute, merchants could use social media to embrace the culture through prize-winning quizzes, Mexican fast facts and legitimate party-planning influencers.

What not to do: Dust off and don decade’s old stereotypes. SweetFrog Frozen Yogurt of Virginia dresses its frog character up in a sombrero and poncho for its annual “Cinco de froyo” event, during which it gives “a sweet nod to the celebratory spirit of Cinco de Mayo.” Unfortunately, it does not explain what the celebration is about.Choose holiday items wisely, and stock up. This is basic consumerism 101. Shoppers who want to genuinely celebrate Cinco de Mayo expect the goods to be available and, in the case of food, fresh. Produce should be ripe and ready to use, or retailers risk the chance of being viewed as disrespectful or clueless (ever try to make guacamole with a stone-hard avocado?). Anything stocked specifically for the holiday should be considered with the end user in mind.

What not to do: The jury is still out on this one, but grocery chain The Fresh Market on May 1 began selling Amanti Guacamole Cheese. The combination of avocado and gouda cheese blends the Dutch art of cheesemaking with Mexico’s tenacious history, for American consumption.

Lastly, retailers should recognize that Mexican culture is an important, long-standing part of American heritage. Those that want to win shopper loyalty throughout the year would benefit from incorporating the motivations behind events such as Cinco de Mayo into their day-to-day business cultures.

This article originally appeared in

Forbes

. Follow me on

Facebook

and

Twitter

for more on retail, loyalty and the customer experience.

April 30, 2019

What Retail Apocalypse? 4 Ways Amazon, Samsung, Walgreens And Others Are Preparing For 2026

photocredit: © 2015 Bloomberg Finance LP

photocredit: © 2015 Bloomberg Finance LPWhat does a “retail apocalypse” look like? If the predictions are correct, about 145 Malls of America.

That’s how many combined stores are projected to close between now and 2026 — 75,000, according to Coresight Research. The advisory firm counts 5,994 announced shutterings just in 2019 so far, beating all of 2018.

That much retail real estate, if equated to the Mall of America’s 2.5 million square feet of 520 stores, translates to more than 700 million square feet, or 25 square miles — larger than the city of Manhattan. It’s a troubling image, but instead of wishing this fate away, perhaps we should learn from how retail got to this point, and think about how to better manage its metamorphosis.

It’s accurate to blame online shopping as a key culprit. But it is also ineffective, and overly simple, to place the blame on what is, to many shoppers, a welcome solution to changing lifestyles. The fact is that while some stores are closing, the physical real estate that remains (or is added) is changing shape, driven in large part by online retail. Physical and online retail will coexist, even blend, as technology molds them into easier, more personalized experiences with a distinctly different emphasis and value chain.

Which simply means the scale and footprint of retail and how it operates will look entirely different. Like healthcare and manufacturing, the industry will continue to serve an integral role in everyday lives, but technology is reshaping its physical footprint and experience.

Which leads us to the more pertinent question: What will online retail look like in 2026?

Co-Existence, 4 Ways

For starters, online retail will continue to expand as a favored option, but it won’t exist alone. Physical retail will continue to co-exist with digital, but it will transform into different formats, designed to accommodate whatever immediate needs shoppers have at the time. Retail technology will enable this, guided by the human hand (read: the consumer).

photocredit: Getty Images

photocredit: Getty ImagesHere are four the ways online and offline will meld.

Touchscreen town squares. Retail centers will take different forms and be anchored by destination hubs lined with fitness centers, office buildings and townhouse complexes — anything that will generate reliable and regular traffic. Retail’s footprint within this mix will be smaller, but it also will be more highly functional per square foot. While there will still be storefronts, the experience will be enhanced via a blending of digital and physical retail. Window shopping will take on a new dimension: Customers could shop all the stores online from home, customize their orders and then pick them up at central mall locations once they have reviewed what they want to buy. Further, one membership program would collate shoppers’ browsing, spending and payment activities across merchants, to accurately alert them to upcoming specials and to-do items.If you build, they will come. By 2026, swiping will become so Biometric technology, including facial recognition, is being ambitiously tested in foreign markets and will take root in the U.S. China-based Alibaba launched its facial-recognition ordering systems at KFC stores in 2017, and many U.S. retailers, including Walmart, have tested or are testing it as well — some to gauge consumer sentiment. Walgreens is experimenting with camera-equipped coolers that scan shoppers’ faces for age and gender, to inform better-targeted advertisements. By 2026, those ads may come to roost: Samsung’s new Family Hub suite of smart appliances includes touchscreen refrigerators through which shoppers can order groceries, stream music and control other devices. Issues will arise regarding what should be allowed from a privacy perspective, but it’s likely that as consumers derive value from these kinds of interactions, they will become more commonplace.I’m sorry, Dave, but that size won’t fit you. Retailers already use data from artificial intelligence and machine learning to locate inventory, customize prices and query customers to make more realistic (and welcome) product recommendations. In seven or so years, artificial intelligence will advance personalization so finely that the technology will be able to fuel in-the-moment conversations about a shopper’s immediate needs, such as what to wear to a dinner date that night. This will be carried out on digital devices, on physical smart mirrors (within stores or at home), or through streaming online portals through which shoppers can connect directly to a store’s inventory. And yes, this technology will be honest, but polite, about sizing and age-appropriate style choices.Amazon will do something. Amazon, or the offspring of Amazon, will play a major role in shaping retail formats in 2026, likely from the fulfillment end. Think of small-format, Amazon-anchored shopping centers — The Mall of Amazon — populated largely by merchants that fulfill the online giant’s orders, restaurants that cater to its staff and experiential services that make it a destination. Amazon itself wouldn’t need much of a physical retail footprint (anchors don’t have to be big), just some ordering kiosks and a regular rotation of hot new products that will draw a crowd. It may, for example, follow the shopper’s desire for entertainment and specialize in events that invite customers to test and play with featured products, from ski hoverboards to human-carrying drones.

In the year 2026, the Mall of America may in fact be anchored by Amazon’s Midwest headquarters and a small drone-port (with a delivery distribution center, of course). But between those anchors there will be retail, in some form, even if it is set up to support all those online sales.

This article originally appeared in Forbes . Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

Bryan Pearson's Blog

- Bryan Pearson's profile

- 4 followers