Bryan Pearson's Blog, page 27

April 22, 2015

April 22: Loyalty Links & Likes

Don’t Rain on Customers’ Loyalty Parade – Direct Marketing News

Don’t Rain on Customers’ Loyalty Parade – Direct Marketing News

In recent surveys, a large majority of marketers agree that a personalized experience and holistic view of each customer is vital to the customer’s overall level of commitment to a brand, yet less than half say they’re able to deliver relevant communications. This infographic from Direct Marketing News compiles some recent data to illustrate this rift.

Turning Loyalty Into Advocacy: The Evolution of Incentivized Marketing – iMedia Connection

This article highlights a presentation by Jenn McCain-De Jong of The Limited and Cory Powers of Spendsetter about the power of incentivized marketing at the recent iMedia Commerce Summit. By leveraging mobile engagement, they sought to create brand advocates for The Limited.

Made to (Pre) Order: How Taco Bell, McDonald’s May Take Loyalty To Go – COLLOQUY

Quick-serve giants Taco Bell and McDonald’s have both gone on record that they are working on developing mobile-based loyalty Initiatives. This story provides a peek into what each has on the digital menu, the challenges to succeeding in quick-serve app territory, and tips to succeed.

Great Digital Customer Experience Must Be More Than Skin Deep – Forbes

This article from Forbe’s contributor Ken Calhoon of Forrester Research examines the state of the digital customer experience, citing research that indicates most companies are still “digital dinosaurs.” Part of the problem is that when tasked with improving, many marketers focus on high-level, customer-facing interfaces as opposed to optimizing back-end functionality.

Here are 25 Companies That are Revolutionizing the Way We Shop – Financial Post

This list of 25 companies compiled by the Financial Post represents the leading-edge of the modern retail experience. Many of them go above and beyond the ordinary level of interaction a customer typically encounters with a product before deciding to purchase.

April 20, 2015

Run on Fun: Toys “R” Us Playing Customer Experience to Win Against Walmart, Amazon

Toys “R” Us may have decided the best approach to winning customers is by kidding around, but that does not mean it will have to play nice.

Retailers are well known for their price-cutting (and cutthroat) tactics when selling toys. So Toys “R” Us, which has been losing market share to Walmart, Target and Amazon, set its gaze beyond the price tag and onto the tyke. It recently detailed plans to open a prototype store that will include play space and interactive technology to engage kids and attract parents. The chain also is arming its staff with mobile devices so they can provide more on-the-spot product information.

The move is a sign that Toys “R” Us is finally recognizing its most important customers – end users – and reaching them with what they value most: fun experiences. It’s about time. Consider what a standard Toys “R” Us looks like to a parent; then scale that image back to suit the gaze of a 3-foot-tall child.

The move is a sign that Toys “R” Us is finally recognizing its most important customers – end users – and reaching them with what they value most: fun experiences. It’s about time. Consider what a standard Toys “R” Us looks like to a parent; then scale that image back to suit the gaze of a 3-foot-tall child.

And just like 7-year-olds who make their demands in the aisles, Toys “R” Us has sized up its opportunities and struck where it can gain an advantage. It’s well established that not all retailers can compete on price like Walmart, or on scale and convenience like Amazon. Toys “R” Us, aware of the same, is trying to own the competitive category of play, and has apparently drawn up its own game instructions.

These guidelines, embodied in a plan it launched in 2014 called “TRU Transformation,” might determine the chain’s future.

Winding up TRU

Not that Toys “R” Us invented the strategy of in-store play. Specialty toy stores pretty much survive on the concept, and Ikea has offered children’s play areas for decades. Even Apple took the idea of play and used it as a central concept in its in-store experience.

If anything, it is a wonder it took so long for Toys “R” Us to rediscover its childlike curiosity. Now in its mid-50s, the big-box chain has long been stuck in its ways, swapping out high engagement for lower expenses with stores that feel like mini warehouses. Meanwhile, the old strategy of bringing the warehouse indoors has lost its shine thanks in large part to online retail. Why expose yourself (and your child) to the sensory overload of toy skyscrapers when you can just order the Elsa Frozen doll from your smartphone?

Toys “R” Us CEO Antonio Urcelay, appointed in October 2013 after serving as president of Toys ‘R” Us Europe, seems to understand the critical importance of a positive customer experience. In his first year, he focused on making the stores more inviting, with brighter lights, faster checkout lines, better-controlled stock and more regular cleanings. This year he plans to open the prototype store with a play area; the goal is to eventually make all stores more engaging for children.

“It has to be something where kids want to go and play,” Urcelay told Bloomberg. “We have to reinforce that we are a specialist.”

Urcelay has the help of co-pilot Harry Mullany, a 30-year retail executive who was appointed president of Toys “R” Us U.S. in November 2013. Together, they introduced the TRU Transformation strategy in March 2014.

TRU in play

The TRU initiative fires off of three cylinders of service: easy, expert and fair. “Among our highest priorities will be to deepen our focus on the customer, build meaningful relationships through loyalty and targeted marketing programs, and improve the shopping experience both in-store and online,” Mullany said in a statement at the time of launch. Among the customer experience efforts, it is throwing support behind its Rewards “R” Us program and simplifying its promotional offers.

Many factors fall outside of the TRU strategy grasp. Birth rates have declined since 2007, for example, and there is that long shadow that online retail rivals casts. But Toys “R” Us also has itself to blame for waning sales, Urcelay has said.

It won’t be an easy win. Urcelay and Mullany will have to balance top-line goals against bottom-line obligations. Play areas will require investments, and Toys “R” Us has seen its revenue steadily decline, to less than $12.4 billion in fiscal 2014 from almost $13.9 billon in 2010, according to its annual report. Toys “R” Us posted a 2014 loss of $292 million. (Toys “R” Us also operates Babies “R” Us and FAO Schwarz.)

All these factors illustrate the grounds for tough action when it comes to play. They also underscore the fact that play won’t solve all the Toys “R” Us issues. In addition to a declining birth rate, Toys “R” Us also contends with its seasonality – 40% of its 2014 sales were generated in the fourth quarter, while rivals Walmart, Target and Amazon have detergent, running shoes and lawn furniture to balance out month-by-month sales receipts.

So while play may convert the shopping experience into something terrific, Toys “R” Us and the TRU strategy may need to reach even further to get customers coming back. Perhaps the right way to play this out is to blend one part experience with one part loyalty program and the customer insights derived from the program, and then mix in some changes to assortment. The result would reduce the pressure of seasonality while continuing to build on the retailer’s concept of creating more engaging experiences.

It’s not child’s play, but it could be the company’s game-changer.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

April 15, 2015

April 15: Loyalty Links & Likes

Moleskin, Purveyor of Legendary Paper Goods, Goes Digital – Quartz

Moleskin, Purveyor of Legendary Paper Goods, Goes Digital – Quartz

It doesn’t get much more basic than putting pen to paper, but Moleskin, the maker of iconic notebooks used by the professional and design community, has been making the effort to break into the digital space. “We want to serve the needs of the entire creative class,” co-founder Maria Sebregondi tells Quartz. It remains to be seen if it will come at the cost of alienating Moleskin loyalists.

Neighborhoods with Benefits – COLLOQUY

Staying local is paying off with loyalty programs that reward people not only for shopping local businesses but also, in some cases, for volunteering and sharing positive word-of-mouth about their communities. In some locations, rewards can be used to defray property taxes.

6 Practices That Will Shape Retail Digital Transformation – Huffington Post

Sashank Saxena, director of digital and e-commerce for the grocery chain Kroger, shares trends (and the best practices for handling them) when it comes to retail, digital analytics and how to best serve customers. These tips are a must-read for any business owner or marketer, no matter what they’re selling.

The Rise of Inbound Marketing and the Death of the Cold Call – Entrepreneur

The “cold call” is no stranger to marketers, but smart campaigns are built out of more than picking up the phone or hitting send on an email solicitation. This story explores the psychology of why a solid inbound marketing strategy can lead to higher customer satisfaction and sales conversion.

It’s Time to Fight Back Against Big Data – Forbes

Consumers only have so much attention to give marketers, and the competition is fierce. Stephan Brobst from Teradata wonders what it would be like if companies armed consumers with the same customer relationship marketing systems they are accustomed to. Could this be the cure for a bloated inbox filled with irrelevant emails?

April 13, 2015

Exercise in Service: Fitbit Omni-Channel Begs for Omni-Prescience

Photo credit: Wired

For more than a year, I’ve used my Fitbit device to track my exercising. Recently, I learned one of those exercises would be in futility.

This turned out to be the case when the folks at Fitbit invited me, via email, to preorder a Fitbit Charge HR, its latest model. But what started as a piece of positive brand communication turned into a case of blurred distribution lines, and it revealed some fuzzy thinking: When it comes to choosing the best customer to serve, who holds sway, the end user or the retail vendor?

In short, I preordered the Fitbit, but the order never arrived. It took a call to Fitbit to learn that the product was no longer available to me because Fitbit needed to ensure it was available to its retail partners.

Which led me to wonder, “Wait, which customer is king?”

This was a difficult position for me. I have grown quite accustomed to my Fitbit over the past year. In addition to monitoring and encouraging my daily activity (try getting 10,000 steps in on a plane), it has caused me to rethink the role that metrics can play in customer engagement. Are there measures in our relationships with customers that, if shared, could elicit a change in their behaviors?

Now the maker of the tracking device was eliciting a change in my behavior, not to speak of my emotional engagement.

To illustrate the case of Fitbit, let’s step through my purchase experience:

Jan. 6: Fitbit sent me an email newsletter announcing the launch of Charge HR, with a link to preorder. I did, and received an email confirming the order that same day.

Feb. 27: I received a notice that my shipment was delayed. To its benefit, Fitbit, feeling “pretty crummy about all this,” applied a 20% discount to my $149.99 order. Not bad!

Late March: After seeing the Fitbit available at retail, but not having received my preordered device, I contacted Fitbit via email to learn of the order’s status. The company responded that it did not have an available device to send me because it needed to ensure that its retail distributors were stocked. I was advised to cancel the order with Fitbit and then re-order it on Amazon.

March 30: I canceled my order and re-ordered on Amazon. However, because I canceled the order, the 20% discount did not apply. In fact, it cost more.

The experience, while exasperating, became a personal learning moment. At a time when merchants are trying to be wherever the consumer is, seamlessly, is it still possible to manage inventory to meet have-it-now demand? If product makers such as Fitbit, North Face or Nespresso are obligated to supply retail partners from Amazon to Macy’s, can they also commit to directly supporting their best customers?

I think it is possible to blur channels and still serve both kings, though this is a work in progress. Regardless of circumstances, the manufacturer’s distribution capacity is largely dictated by the needs of its retail partners. As retailers expand and crisscross their purchase and order-fulfillment options to meet a need-it-by-noon marketplace, these suppliers are required to be even more fleet of foot. When they add the personal goal of selling directly to consumers, they’ll likely find it as difficult to deliver as the Fitbit I ordered.

Perhaps the answer, for now, is not to be omnipresent, but to be omni-prescient when it comes to meeting consumer needs. Let’s not forget why manufacturers offer direct-to-consumer options to start with – to nurture lasting customer relationships. Fitbit already has a database of customers who have opted in to receive its newsletters; it could begin there.

A bit of data analysis would help it identify those Fitbit owners who use their devices regularly and are likely to be early adopters of the new version. Deeper analysis into how that pool of customers purchased their previous Fitbits can help to separate those more likely to order direct from the manufacturer from those who ordered from a merchant such as Amazon.

Lastly, there’s no shame in limiting availability, as long as the brand is clear about it. If my original email from Fitbit stated “Be among the first 250 to order and get your Fitbit before it hits the market,” I’d at least have realized it might never come. Unfortunately, that is not how the company managed its marketing.

The lesson for direct-to-consumer merchants is as straightforward, and beneficial, as taking 10,000 steps: If you want to be part of the retail community, then operate by basic retail rules. Be in stock. Deliver on what you advertise. Make the parting moment memorable.

Retail is a heady, hairy business largely because of the fuzzy feelings consumers demand from their experiences. When product makers add on retail as if it were a product upgrade or innovation, they risk blurring the lines of customer commitment. Only after a non-retailer has determined its goal for selling direct to the consumer can it begin to effectively exercise the means through which it can deliver an omni-prescient experience.

That goal, in most cases, should be to nurture customer relationships in as few steps as possible. I went ahead and ordered the Charge HR, because I can appreciate the challenge Fitbit has taken on, and because I really like the device. But next time, I may go straight to Amazon first.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

April 8, 2015

April 8: Loyalty Links & Likes

5 Tips for Spring Cleaning Your Loyalty Program – Epsilon

5 Tips for Spring Cleaning Your Loyalty Program – Epsilon

Most of us clean our houses every spring, and the same should apply to our loyalty programs. Rather than think of it as a chore, marketers should consider opportunities to brighten up their programs, get rid of what is not needed, and determine what might be an improvement. Epsilon Senior Vice President Mary Ann Charlton offers five tips for a fresh (and profitable) start to your program this year.

Made to (Pre) Order: How Taco Bell, McDonald’s May Take Loyalty to Go – Colloquy

The quick-serve industry has been slow to embrace loyalty programs due to many industry difficulties such as the hustle-and-bustle of the restaurants themselves and transactions primarily in cash. That could change as Taco Bell and McDonald’s are both experimenting with programs and apps. COLLOQUY reports on what these restaurants need to serve up to be successful with their loyalty programs.

Loyalty Members Hate these Five Things – CNBC

North Americans belong to more loyalty programs than ever, but are active in only a fraction of them. The loyalty landscape is constantly evolving, and a misstep can lead a rewards card down the dark path to the back of a customer’s wallet. Here are five tips to avoid this fate.

For Big Data, It Was The Best of Times, It Was The Worst of Times – Forbes

With big data comes big responsibility – and a whole lot of opinions. While big data can be extraordinarily useful, it is not a silver bullet when it comes to predicting consumer behavior. Forbes contributor Howard Baldwin examines both sides of the issue.

Square Brings Accountability to Email Marketing – TechCrunch

With Apple Pay gaining traction and Samsung in talks to develop its mobile payment platform this summer, Square is feeling the heat. To distinguish itself from rivals, it’s taking on the competitive email marketing space with Square Marketing, a service that provides easy insights that retailers can use in custom campaigns. But will the latest tactics resonate with new users?

April 6, 2015

Borne in the USA: Viewing American Express, Plenti Through Expert Eyes

Once again, one of the latest trends in U.S. retail is following that of Europe, and even the world.

Like shifting hemlines and boot heights, the launch of the Plenti coalition loyalty program by American Express comes after the same movement has been embraced, particularly among retailers, globally. Unlike seasonal fads, coalitions have been around for decades for a good reason – research shows members of coalition programs tend to consolidate their spending to the coalition merchant partners. More on that later.

I know this because I have more than 20 years’ experience operating coalition loyalty initiatives; in 1992 I became the 25th employee of the company that launched Canada’s first and now largest coalition loyalty program, AIR MILES. We also operate the largest coalition program in Brazil, called Dotz.

These markets are very different from the U.S., however, where three unique characteristics have made it challenging for the coalition concept to take root:

• There is high geographic fragmentation among U.S. companies, particularly the high-frequency merchants such as grocers and gas stations. Even some of the largest companies do not operate in all 50 states.

• Unlike Canadian companies, U.S. companies are more protective of sharing their data with other companies, which is an essential component of a successful coalition.

• Many U.S. brands already have invested in their own loyalty programs; some are decades old and have mature banks of data.

Some of these characteristics are evident in Plenti. Plenti’s item-level transactional data will not be shared among partners, American Express told COLLOQUY. It also will not allow competing brands from the same industries and same regions to participate, if existing partners object. This could make building a fully fleshed-out coalition more of a challenge, considering the fragmentation of U.S. companies referred to in my earlier point.

The extent to which these guidelines affect Plenti’s performance will depend on other program features, which I call the six elements to coalition success.

Six elements to success

1. Brand appeal: The coalition partners represent most industries, with a balance of lower-frequency (hotels) and high-frequency (grocery) partners. This mix assures that at least one partner has high appeal among each target consumer, broadening the overall scope and potential of enrollments. It is worth noting that Plenti does not yet have a grocery partner.

2. Sharing: Coalition programs generate shared data pools that can be accessed by all partners. These rich bodies of insight help the partners better understand their customers – within and outside of their own locations – so they can develop more relevant, one-to-one marketing experiences.

3. Marketing control: The partners have the freedom to market their involvement in the program on site, online and through direct communications. There are general guidelines, but the ability to market their involvement and special offers is baked into the model.

4. Speedy earnings: One of the single most attractive features of coalitions, for consumers, is the ability to earn rewards faster. We know, for instance, that collecting enough points for a free flight would generally take less than half as much time through a coalition program than through a credit card-only points initiative. This eliminates one of the pain points for consumers: the inability to earn a relevant or meaningful reward.

5. Reward variety: Along with earning rewards faster, well-operated coalitions offer a broader array of reward or redemption options, reflecting the many services and products provided by the program partners. There are no restrictions on redemption options. The consumer can rack up all her points at the grocery, but redeem them for a plane ticket.

6. Payment freedom: Unlike traditional loyalty programs, coalition programs are tender-neutral, meaning consumers can pay however they want – by credit card, cash, check, you name it.

Growing in multiples

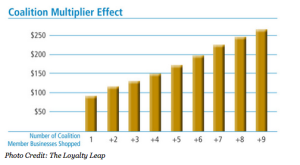

When implemented, these tactics encourage loyalty members to increase their spending with other companies within the same program. We’ve seen it firsthand, and this is what we call coalition multiplier effect.

Think of the coalition environment as a hothouse for participating companies, propagating the effectiveness of each organization’s marketing activities. Each partner benefits from the other brands that also promote the coalition, as well as from the collected customer data. We’ve found, as a result, that the more coalition partners a consumer shops with, the more money she will spend at the company that first brought her into the program.

Say the originating sponsor is the Acme drugstore chain, and the customer purchases beauty products at Acme only, spending $100 at one store. If the same person makes purchases from two other companies within the loyalty coalition, then she is likely to increase her spending with Acme as well. This consolidation of spending among the coalition partners creates the benefits for both consumer and company, yielding a virtuous cycle of benefits.

The U.S. may be later to coalition loyalty than its foreign neighbors, but that does not mean it won’t redefine the trend. Just as hemlines drop and rise, loyalty strategies adapt to the shifting demands of their members. Similarly, the six elements of coalition success can be adapted not only to benefit coalition operators and partners, but also members. It’s the members who will, after all, make the most of Plenti.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

April 1, 2015

April 1: Loyalty Links & Likes

How Companies Put a Dollar Value on Loyalty, and Why They Do It – AdAge

How Companies Put a Dollar Value on Loyalty, and Why They Do It – AdAge

When Caesars Entertainment Corp. recently filed for bankruptcy, creditors valued the company’s Total Rewards loyalty program at more than $1 billion – exceeding the value of any of its casino properties. This proves that loyalty and data collection programs can be measured in more than just marketing results, and AdAge offers additional examples from United Airlines and Starbucks to illustrate this point.

Hide Easter Eggs to Delight Customers and Progress Your Big Data Strategy – TechRepublic

It’s that time of the year again when tech companies like Google release April Fool’s-themed “Easter Eggs” in their software – just yesterday Google launched Pac-maps, which allows users to play Pac-Man on Google Maps in a browser. These hidden features can engender customer loyalty in the same way that surprising and delighting a customer in a retail or service setting can, and savvy marketing professionals are making it a part of their big data strategy.

Taking the Cake in Loyalty: Going Beyond Birthday Rewards With Kellogg’s, Hertz, Smashbox – COLLOQUY

Rewarding and recognizing members’ birthdays is one of the original and most common forms of personalization found in loyalty programs. It’s so common, in fact, that it’s generally expected from modern programs – spurring companies to get creative and offer unique birthday (and beyond-birthday) perks in order to stand out from the crowd.

How Cultural Differences Can Affect Customer Experience – Forbes

As a frequent traveller, I’ve learned cultural differences in the mindset and behavior of both customers and employees can have dramatic effects on the overall customer experience – most notably when traveling internationally. Forbes contributor Blake Morgan conducted some journalistic ethnography on her recent trip to Europe, and discovered how local cultures shaped her overall experience.

Are Customer Loyalty Programs Stuck in the Past? – CMO Australia

A new report from Capgemini Consulting has found that customer loyalty programs are failing to adapt to the digital age, with 97% of programs still following a basic transactional philosophy. This article further analyzes the report, and makes the case for loyalty programs to be integrated into the larger context of an organization’s overall marketing strategy.

March 30, 2015

Re-Assembly Required: What Target, Walmart Could Learn from Ikea’s Expansion

Some retailers are known for careful planning, but when entry into a new market takes six years, that care better ensure every detail is nailed down.

Or, in the case of Ikea, every detail is Allen-wrenched in.

It appears they are, as illustrated with delightful color in a recent feature story. The piece, an anatomy of Ikea’s global expansion, serves as a guidebook to excelling in foreign markets. It also got me to comparing Ikea’s success to the failures of others over the years – most recently Target, which pulled stakes in Canada less than two years after entering, and the older account of Walmart, which abandoned Germany in 2006 after nine years that likely felt like nein years. These comparisons underscore the need for retailers to use history as their guide.

Ikea, for instance, has learned, from its own missteps. When it entered the U.S. market in 1985, it stocked its Philadelphia flagship with beds smaller than the American norm, thus requiring shoppers to buy different sheets, according to the feature story, which ran in Fortune. But the Swedish merchant transformed these flubs into foundational pieces, incorporating the reasons for the errors into its plan book and addressing them as issues before crossing into the next new territory.

Ikea, for instance, has learned, from its own missteps. When it entered the U.S. market in 1985, it stocked its Philadelphia flagship with beds smaller than the American norm, thus requiring shoppers to buy different sheets, according to the feature story, which ran in Fortune. But the Swedish merchant transformed these flubs into foundational pieces, incorporating the reasons for the errors into its plan book and addressing them as issues before crossing into the next new territory.

To me, three key areas together assemble Ikea’s brilliant strategy, but also represent where Staples and Walmart fell apart. Let’s put it together.

Fierce fieldwork: In the Fortune story, David Marcotte of consulting firm Kantar Retail describes Ikea as “ferocious about expanding too rapidly.” Key to this fierceness its dogged commitment to researching its markets before entering them. Among the examples, Ikea studied almost 8,300 people in eight cities just to capture their morning routines (those out the door fastest are in Shanghai, at 56 minutes). It then used this research to create behavior-specific products, such as a self-standing mirror equipped with hooks for jewelry and clothing, so the owner could assemble her outfit in advance.

Target, by contrast, charged headlong across Canada with 124 stores in just 12 months, apparently with little regard for the market’s slower economic growth and higher level of business regulations. Further, many of the locations were former Zellers stores, a beloved brand among thrifty Canadians. Perhaps if Target had assigned a Canadian executive to guide the strategy, rather than relying on its U.S. management team, it would have been alerted of these and other issues, such as pending distribution challenges.

Walmart, too, applied its U.S. business model to a foreign market, thinking it would wallop the competition and woo the Germans with facsimiles of its U.S. operations. Unfortunately, it generally misunderstood the overall culture and evidently had not prepared for Germany’s powerful pro-labor heritage, according to a story in the Atlantic Times. Requiring employees to smile at strangers, to shout WALMART! during gatherings and to refrain from flirting with each other may be acceptable in some parts of the world, but not among Germans.

Price vice: With stores as big as stadiums, Ikea’s success hinges on volume, which ensures lower prices among its suppliers and therefore lower prices for shoppers, and so on. Ikea actually dropped prices by 1% in 2014, according to Fortune. The challenge globally is that what counts as a steal in Chicago is considered steep in Shanghai. Ikea sells ice cream cones in China for 16 cents apiece, a price it can afford because it manufactures in China most of the goods its sells there, cutting shipping costs. It looks at every possible place to cut individual expenses in order to support the whole, including the undersides of its furniture.

For Target, price may have cost it the Canadian market. Shoppers there quickly recognized that the same products they had seen in the United States were selling for a higher amount in their hometowns. Some of the reasons were beyond Target’s control – higher taxes and distribution costs as well as varying wages, for example. However, an early analysis might have helped it locate areas where it could offset those expenses. Walmart and Costco were beating Target on price, after all. Not a good first impression for a chain that boasts: “Expect More. Pay Less.”

Meanwhile, in Germany, Walmart was forced to raise prices on basic food items, such as milk and eggs. This occurred in 2003, after the country’s highest court ruled that Walmart’s below-cost pricing model undermined competition, according to the Institute for Local Reliance. Germany is a very cost-conscious country, but Walmart’s prices were considered a threat to small merchants. The inability to compete on price, combined with mature merchant rivals and a lack of prime developable real estate meant Walmart had nowhere to go but out.

Keeping in character: Every single item Ikea sells is Ikea branded, so it has complete control over the making and distribution of everything, from its Pax wardrobes to Ektorp Jennylund armchairs. This level of control enables Ikea not only to determine where products are made, but also to tinker with them as deemed necessary. It is, for example, in the process of simplifying its assembly requirements, perhaps the most vexing feature of Ikea products and a costly one for Ikea. Fittings can run up to a third of the cost of a product, according to Fortune.

Target forfeited its control on quality largely when it lost the use of its U.S. distribution network, which could not service its Canadian stores. Further, the Canadian stores lacked the local authority to order their own merchandise, resulting in the embarrassing placement of Toronto Maple Leafs apparel, instead of Detroit Red Wings gear, in Windsor, Ontario (you’ll have to trust me on this; it was a major faux pas). Worse, distribution kinks resulted in empty shelves across stores. So not only were shoppers expected to pay more, they were getting less.

Target forfeited its control on quality largely when it lost the use of its U.S. distribution network, which could not service its Canadian stores. Further, the Canadian stores lacked the local authority to order their own merchandise, resulting in the embarrassing placement of Toronto Maple Leafs apparel, instead of Detroit Red Wings gear, in Windsor, Ontario (you’ll have to trust me on this; it was a major faux pas). Worse, distribution kinks resulted in empty shelves across stores. So not only were shoppers expected to pay more, they were getting less.

Walmart was able to distribute and sell popular American brands in Germany, but with an undesired effect – the brands were not familiar to many Germans. When Walmart attempted to better control the quality of its German operations by replacing its American CEO with a British executive, the orderly Germans viewed the sign of instability with a hairy eye. The British CEO left after only a few months to be replaced (finally) by a German executive, but one who mastered gas stations, not superstores.

These three categories combined are what have enabled Ikea to penetrate 25 countries, from Canada and Germany to Qatar and Jordan. And the market that took six years to enter? South Korea, though not without some minor missteps.

Among them, Ikea made the mistake of underestimating the number of parking spots required in the Asian country, but it Allen-wrenched that problem, too. That location is now on track to become one of Ikea’s best-performing stores.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

March 26, 2015

March 26: Loyalty Links & Likes

5 Things SMBs Can Do Better Than Starbucks with Customer Loyalty – Business 2 Community

5 Things SMBs Can Do Better Than Starbucks with Customer Loyalty – Business 2 Community

Starbucks’ sheer size and ability to invest in digital and customer-focused initiatives has allowed it to become a juggernaut in both the coffee and customer loyalty industries. However, small- and medium-sized businesses have an opportunity to not just emulate, but also improve on the concepts Starbucks has introduced by being more nimble and responsive to local tastes and preferences.

Study: Apps Are ‘New Battleground’ in Customer Loyalty – Allvoices

This article highlights the results from a study that found a business risks losing 27% of its customers with an inferior mobile app experience. Dubbing the results as indicative of the “application economy,” the argument is made for apps to become a core part of a customer-facing business.

Reworking Sainsbury’s Recipe – COLLOQUY

When it comes to seeing the retail experience from the customer’s point of view, Justin King, the former CEO of British supermarket chain Sainsbury’s, found it is important to remove the proverbial table and sit alongside the customer. In this Q&A, King talks about how he leveraged loyalty marketing principles to turn that cart around.

Qantas’ Transformation From Airline to Data Hub – ZDNet

This article details the holistic transformation of Qantas’ marketing department from a subset of the ordinary airline business to a stand-alone, customer-data powerhouse. This dramatic shift toward fully understanding its customers has not only allowed Qantas to enhance its frequent flyer program, but also expand into new business territories.

Starwood VP of Marketing: Managing Customer Expectations Requires Emotional Credit – CMO

Starwood Hotels’ Daniel Kerzner, speaking at the ADMA Data Day in Sydney, Australia, gave some insight on how Starwood uses customer data and social media channels to create more personalized experiences that surprise and engage customers. He said that companies need to find a balance between consistent good experiences and used the analogy of customer credit in a bank account to illustrate his point.

March 23, 2015

Man In the Aisle, Woman in the Dealership: How Tesla, Grocers Court the Opposite Sex

A retail truism is that when it comes to most purchase decisions, women are behind the wheel. So it’s no small irony that just as Tesla Motors has taken this truth literally, supermarkets are, evidently, raining men.

More than 40% of men say they do all or nearly all the grocery shopping for their households, according to market research firm NPD Group. Further, men make as many monthly supermarket trips as women, according to “Food Shopping in America 2014,” a study from MSLGroup and The Hartman Group. The result of these “manfluencers” is a marketing bonanza, with male-focused products and displays lining the aisles of supermarkets.

While men are squeezing the produce, women are cruising on autopilot, test-driving the latest electric vehicles by Tesla Motors. The California manufacturer’s latest strategy involves plush locations at high-traffic shopping malls, which are still disproportionately visited by women. Tesla doesn’t expect many vehicles to sell at these locations; rather, it anticipates vehicles will later be ordered online based on the in-mall experience, according to AutoTrader.com.

These retail gender benders can easily be viewed as attempts to keep with the times, but both indicate that a deeper shift is behind these evolving shopping behaviors – and that is a redistribution of financial power. How retailers respond will be crucial to their success in the coming years.

The first step is to understand the dynamics behind these behavioral shifts. The Great Recession cost men 6 million jobs in 2007, but it took only 2.7 million from women, according to the Economic Policy Institute. As a result many men assumed the traditional household chores of women, such as shopping, while women continued to earn and in many cases further their careers. Today, 41% of women make financial decisions alone, according to a 2014 survey by Ameriprise Financial.

This is where the wrinkle enters: As the economy improved, more men returned to work – but they still continued to visit the grocer. Turns out many men found purpose in the aisles, said Phil Lempert, a supermarket consumer behavior expert and founder of SupermarketGuru.com.

“They’ve discovered that it’s a great way to bond with the family,” he said. “Being in the kitchen, preparing food, really gives men a lot more heart and soul.”

Being in a Tesla Model X, meanwhile, with its large trunk and kid-friendly “falcon wing” doors, gives lots of women racing hearts, because it too addresses family needs.

“I sat and watched the video of (Tesla CEO Elon) Musk unveiling the X in 2012, and I was sold,” one woman told the San Jose Mercury News in late 2014. “Usually if there’s good interior seating, there isn’t any cargo space. We need both.”

Musk, at the company’s annual meeting in June 2014, recognized the need to make his vehicles more appealing to women. “We’re certainly paying more attention to the needs of women in the Model X,” he said.

So Tesla is placing itself where women can be found while packaged foods makers place manly items where men are going. General Mills, for example, in 2014 introduced to its Helper line man-friendly flavors such as crunchy taco and three-cheese marinara. Many grocers began installing “man aisles” complete with large cuts of meat, charcoal and I assume bacon-flavored nacho cheese.

The trouble with this plan is many supermarkets and manufacturers have overlooked what is getting men back in the aisles in the first place – that sense of purpose and family. “This was the stupidest thing ever,” Lempert said of man aisles. “Needless to say it fizzled.”

To keep men in the aisles, grocers need to understand that while men and women are different, their household and family needs are not. Rather, the key difference between male and female shoppers is how they buy, not what they buy. They simply have different shopping skills.

Just as Tesla is creating showrooms that answer to women’s shuttle needs, Lempert suggests grocers cater to men’s skill needs. This can range from cooking classes to signage that covers very simple actions, such as reading product ingredients, finding expiration dates or estimating price values – all of which may be second nature to women but not to many men. The same goes for using grocery-store apps.

All of these considerations will combine to form a better-tailored grocery trip. Shopper data will help supermarkets think about how to enhance and shape the customer experience, and segmented data from a loyalty program can further refine the insights, but none of this will of any use if the organization does not have the resources and strategic intent to execute on it.

Doing so takes understanding that all shoppers are driven by needs that transcend gender. That means debunking stereotypes, whether in the aisle or the driver’s seat.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

Bryan Pearson's Blog

- Bryan Pearson's profile

- 4 followers