Bryan Pearson's Blog, page 22

January 21, 2016

What Dollar Shave Club Knows: Getting An Edge On Utility

The Dollar Shave Club is one sharp example of how manufacturing supply chains are being disrupted. Yet its approach to winning market share is disarmingly simple. Other staple consumer goods, from pet food to diapers, could do the same. Some already are.

The idea appears to have emerged in the nick of time. Back in 2012, when the revelation struck Michael Dubin that men would gladly order razors online if it meant saving a few bucks and trips to Walgreens, the word “omnichannel” was just a twinkle in the eye of retailers and manufacturers.

Photo credit: Youtube/Dollar Shave Club

While YouTube viewers delighted in Dubin’s declaration that “Our blades are f— great,” iBeacon technology was in the test phase, Warby Parker was a relative startup and department stores had yet to consider same-day apparel delivery.

In the following years, Dubin’s company, Dollar Shave Club, grabbed headlines for its edgy marketing as well as its growing market share. Today it is making headlines because of a lawsuit by rival Gillette. But Gillette’s claim of patent infringement has little to do with Dollar Shave Club’s success.

Rather, Dollar Shave Club is an example of the ways in which manufacturing supply chains are continuously, irrevocably being disrupted. Yet Dubin’s approach to wooing customers is disarmingly simple: Put a traditionally ho-hum, replenish-able staple product online and then lather it up with a customized delivery system and scrappy humor.

In short, he is turning a chore into something fun and in the process may be accelerating the consumer’s product repurchase cycle. Other staple consumer goods, from pet food to diapers, can do the same.

No Stubble Bubble

The appeal of online blade replacement is not unlike the appeal of reusable blades themselves: It takes a relatively high-cost but utilitarian item that moves on a fairly regular basis and finds a more seamless way to get it into our hands.

And men are seemingly game for the change. Online sales of men’s shaving products nearly doubled in the 12 months leading to May 2015, to $263 million, according to the market research firm Slice Intelligence (cited in the Wall Street Journal). That represented about 8 percent of the total market, which shakes out to about $3 billion, the Journal reports.

The growth indicates no signs of a stubble bubble. In all of 2014, web sales of shaving products reached $189 million, up 70 percent from 2013’s $111 million.

The Dollar Shave Club, which sells blades across three price points, claims 10 million customers purchase its blades at least every other month, according to a separate story in the Wall Street Journal. In addition to its three blade types – $1 for a shipment of Humble Twins, $6 for the 4X and $9 for the Executive – the company sells shaving creams and hair styling products. In June, Dubin projected his company to generate 2015 sales of $140 million.

What Razors, Diapers Have In Common

Those increased sales, I surmise, are the result not only of captured market share, but also of increased razor consumption by Dollar Shave Club’s customers. Many men use their razors longer than recommended (Gillette blades reportedly can last five weeks). So a home-delivery system may actually accentuate use – men replace them more frequently than they would if buying from the store.

And let’s not ignore the appeal of receiving a package in the mail. By arriving directly to the consumer, rather than being picked up off the shelf (or from behind a security display), Dollar Shave Club’s products generate anticipation. When the package arrives, with its blades and cartridge snug in their custom box, it makes the customer feel special. That the company is called a “club” reinforces this.

Which is why ventures such as Dollar Shave Club are so effectively disrupting the traditional manufacturing supply chain. With its monthly shipments, Dollar Shave Club is merely delivering into men’s hands the convenience they had already wanted. These are blades, not tomatoes, after all. There’s little variation in the task of buying them.

There are other categories like this – multibillion-dollar segments that, if they shift their delivery systems and price approaches, could change the way people buy and use products.

Indeed, the Dollar Shave Club model can be applied to pet food, diapers, coffee and possibly even batteries. In some cases it is. My Nespresso coffee pods arrive every month as reliably as my utility bill, and the Honest Company regularly replenishes earth-friendly diapers and other staples for its customers, with reduced prices for those who sign up for automatic shipments. I wish someone would come up with a way to automatically refuel my car every week.

3 Disrupting Questions

Direct-to-consumer gas may be a while in the making, but manufacturers can benefit from the digital model – especially if they keep in mind that the shift raises challenges for retailers as well, since they are left holding the empty bag of anticipated sales.

To determine the best approach, product makers and sellers should answer three questions:

1: What kinds of products are ripe for change? In addition to existing categories such as diapers and razors, manufacturers can search for emerging product areas that can adapt the disintermediation model Dollar Shave Club embodies. Any product that can support an experience that supplants the in-store experience, through a different channel, has the potential to bypass the normal means of distribution.

2: Why and how are consumers choosing us? Through online surveys, social media feeds, interactive apps and loyalty programs, product makers can regularly assess why their best customers choose their brands. Ongoing research can help them track how consumers purchase the products over time to identify the potential of other supply and delivery methods. One should not assume, however, that an online delivery channel is suitable for all categories. Shoppers are likely to grab their artisan water when they are already at the grocery, or their golf balls when checking out golf clubs.

3: What’s the retailer’s role? Manufacturers and retailers can work together, beginning with an analysis of their own consumer purchasing data. If those insights can be used to create a new service delivery approach, then the only weapon Dollar Shave Club has is its pithy advertising and marketing. If I can get the products I want with the same quality experience from the retailers I already shop, then why would I switch to a new, unknown product or service?

The key, I suspect, is that the product entails a normalized purchase process and doesn’t require the need to be reassessed each time it’s purchased. Timing is crucial, though, as Dollar Shave Club’s Dubin has proved. He helped make razors sexy. Honest Company transforms diapers into responsible consumption. Perhaps someone can do the same with batteries.

One element is clear: If no one is, then someone should.

January 19, 2016

How CVS And Others Can Bridge The Gender Price Gap With Data

Price discrepancies on the retail shelf signal a surprising lack of perspective about those who make most of the household shopping decisions. It also calls to attention a long-standing issue that demands rectification, and retailers can use their data to make those first steps.

This is not a retail story; it is a misplaced opportunity story.

A four-pack of CVS-branded, three-blade disposable razors for men costs $4.99. A four-pack of CVS-branded, three-blade disposable razors for women is priced at $6.99. Elsewhere, at Abercrombie & Fitch, a logo tee will set a man back $30, but a woman will pay $40.

As the New York City Department of Consumer Affairs (DCA) has figured out in an examination of roughly 800 products that come in both male and female versions, a range of female products, from toys to shampoos, cost more than similar products for males, yet may vary only by color. This is price discrimination. Or, as some have coined it, a “gender tax.”

Photo credit: NYC Dept. of Consumer Affairs

“DCA found, on average, that women pay approximately 7 percent more than men for similar products,” the report states. These price differences, it concluded, are “largely inescapable.”

The findings that many female products are priced higher than similar male products should not be a complete revelation. It has been well documented that women pay more for many services, such as car repairs and dry cleaning.

However, the extension of price discrepancy to the retail shelf signals a surprising level of tone-deafness when it comes to those who make most of the household shopping decisions. It also brings to the fore a long-standing issue that demands rectification.

Retailers have a short window of opportunity to turn this potential PR debacle into an opportunity. The first step to doing that may be mapped out in their data.

“Females … Absorb More Cost”

Retail and manufacturing data does, for example, guide the product development that factors into pricing decisions.

Indeed, the DCA review concludes that both manufacturers and retailers – not one or the other – make the choices that result in higher prices in female products. The increases range from 4 percent for children’s clothing to 8 percent for adult clothing to 13 percent for personal care items.

There are variables, such as ingredients and manufacturing costs, that affect price estimations, particularly of personal care items. According to the report, the major cost consideration is research and development, and in some cases a female product may require more R&D than a similar male item.

But this is not always the case, and the upshot is that women cannot avoid the higher prices: “It appears that female consumers absorb more of these costs than male consumers, rather than the costs being distributed equally,” the report states.

Data Can Bridge The Gap

While manufacturers as well as retailers control that cost distribution, retailers can take greater control of managing the prices their female shoppers pay.

The most straightforward way is to simply adjust the prices on the shelf, but such an undertaking would take time as sales forecasts, pricing models and promotional schedules would have to be managed. However, in the short term retailers can launch a number of efforts that provide female shoppers better deals while also communicating how important they are to the brand. Following are four.

Priceless experiences: Retailers can connect with segments of shoppers by offering invitations to events that are free but rich in experiences that fall squarely within a customer’s interest. If the retailer seeks information about customer interests outside of the store, such as through a survey or through social media, it can create a series of events that transcend price. A drugstore chain can, for example, host a women’s walking club that includes leaderboards so loyalty members can join competitive teams. The retailer could kick in for shirts and milestone events as well.

Personalized pricing: More retailers are using their loyalty programs as vehicles through which to send one-to-one special offers that are evident only to the targeted shopper. These offers, often sent by smartphone, can reach the consumer right in the aisle where she is in the best position to take advantage of the opportunity. Paired with iBeacon technology, these offers can further reach the shopper when she is within eyeshot of the product. The added benefit of these private prices is competitors cannot see and match them.

Partner with Vendors: Both retailers and manufacturers play a role in how prices are determined, so perhaps they need to work together to make prices fair for both genders. By sharing data, it may be possible for retailers to help the vendor community identify adjacent products that their relevant customer segments are buying. This could lead to product expansions that would create new revenue streams for both parties. Additionally, this shared data could help them develop new pricing strategies that balance what consumers are willing to pay across a number of categories – which could eliminate the gender discrepancies.

Reach out and fix it: Lastly, perhaps the right thing for retailers and manufacturers to do is just take the hit. If it is that simple to see where price discrimination exists, then they could make the good-faith effort to rectify the situation. They can, for example, issue coupons for those higher-priced items or calculate the value of those price differences in rewards points and surprise shoppers with a range of bonuses.

Getting in front of the issue will build trust and reinforce brand integrity at a critical time. Combined with relevant messaging that is informed by the data, it also could help retailers make the most of a fleeting opportunity.

January 11, 2016

9 Things You Don’t Know About Retail Loyalty Programs In 2016

From the tangible value of data assets to stealth pricing, loyalty programs can offer retailers many advantages that are little understood. With 2016 now upon us, I share nine expert-provided aspects of loyalty marketing that retailers may not know.

An oft-used term in business, especially in fast-expanding industries, is, “You don’t know what you don’t know.” These days, in the loyalty marketing industry, there is much retailers are striving to know, but boy is it work to keep up.

From stealth rewards programs to cloaked pricing to delayed regulations, the retail and loyalty environments are more fluid each month. I spoke with my friends at Precima, our global retail strategy and analytics company, and other experts to learn what loyalty events are likely not known as 2016 gets under way. Following are the top nine:

1) Your best members can be much better: A supermarket’s most loyal customer typically spends only 50 to 70 percent of her monthly budget with that merchant, according to Precima. If retailers directed more of their budgets to better satisfying these customers, rather than acquiring new customers, and used their loyalty data as a guiding light to specific preferences and needs, they could recognize highly significant and attainable growth opportunities. Further, the dollars invested in existing customers deliver a healthier return on investment than those used to acquire new ones. “If a shopper has never been to a specific store, it is probably for a good reason, and a generic offer is not likely going to change her mind,” said Graeme McVie, vice president of business development at Precima.

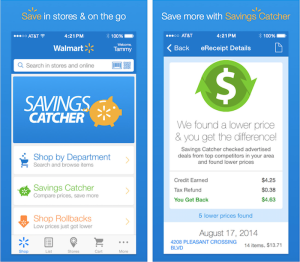

2) Programs are shape-shifting: Some leading retailers not typically associated with loyalty programs, most notably Walmart, are introducing loyalty-like programs by stealth. Walmart’s Savings Catcher app does not issue cards or memberships, but make no mistake – it is a loyalty program in all but name. First, the app enables Walmart to personally identify its customers in much the same way as a rewards program, and second, it provides Walmart with the data and a mechanism (the app) to deliver personalized offers to its shoppers, improving its chances of earning their loyalty for features that extend beyond price.

Photo credit: Apple App Store

3) Prices can be cloaked from competitors: Some leading retailers use their loyalty programs to send one-to-one special offers that are evident only to the targeted shoppers. These offers are increasingly sent via smartphone and often when the shopper is right in the aisle, in a better position to take advantage of the opportunity. These personalized promotions make the standard shelf price less important to loyal customers and, more important, they make it very difficult for competitors to match the price these shoppers receive.

4) Loyalty programs generate their own products: Retailers sell more than sweaters, bananas and electronics. The insights loyalty programs generate are of great value to their retail suppliers. Consumer data and other intangible assets (trademarks, copyrights) could be worth more than $8 trillion, according to a story in the Wall Street Journal. The Kroger Co., for example, was estimated to have sold $100 million worth of data in 2014 to Procter & Gamble Co., Nestlé and other suppliers, according to the report. In September 2014, members of the Financial Accounting Standards Board were advised to research intangible assets for the third time since 2002.

5) Odds of engagement are declining: On average, American households are enrolled in 29 loyalty programs, yet they are active in only 12. This 42 percent participation rate will continue to decline if retailers persist in presenting the predictable, one-dimensional model that rewards customers with points and discounts. This model, while the traditional format, does not maximize the ability of today’s loyalty strategies to identify and accommodate unmet but potentially life-altering needs. Walgreens’ Steps with Balance Rewards program and Sears’ FitStudio both recognize and reward members who increase their physical activities, acknowledging their desire to improve their health and lifestyles.

6) The best programs are not programs: The winners in loyalty will be those organizations that can think horizontally, meaning they see their loyalty endeavors not as mere programs, but instead as strategies that serve the broader brand promise, said Dennis Armbruster, vice president and managing partner at LoyaltyOne Consulting. Retailers that integrate their loyalty data insights, investments and human resources across the organizations can transcend the boundaries and regimens of typical programs. This strategy is further supported when retailers carve out and reserve specific, high-value aspects of their loyalty initiatives (special events such as cooking classes or one-to-one fashion consultations) for those members who show a high likelihood to appreciate such features.

7) Data value is not hitting max: Following up on No. 5, retailers invest a reasonable amount of financial resources into their loyalty programs, but they still don’t leverage that investment – particularly the data stake – across all areas of their businesses. Specifically, too few retailers are consistently incorporating insights from their loyalty programs into their prices, promotions and assortment decisions. As a result, too few are aligning their merchandising decisions along customers’ needs as well as they could. The upshot is these retailers are not maximizing and realizing each program’s potential return on investment.

8) Experience beats rewards: Loyalty programs do not guarantee loyalty when they do nothing to improve the customer experience. Rewards and loyalty strategies should be viewed as means to an end, with the end being a superior experience that is informed by data and designed to address individual shopper needs to the best of the company’s ability. The Nordstrom Rewards program, for example, allows members early access to its highly anticipated anniversary sales. And Caribou Coffee’s Perks program strives to delight members by presenting random surprises at checkout. The message bears repeating: Loyalty programs and the data they generate are often marginalized and not fully leveraged to accomplish these attainable goals.

9) Rewards data regulation is now two years away: Topic 606, the Financial Accounting Standards Board’s method for accounting for contracts that generate revenue from customers – including rewards programs – has been delayed by one year. The revenue recognition standard will now take effect among public companies in December 2017. That gives many retailers 12 more months to prepare and devise currency strategies that factor in the planned policy. We may not know what form these regulations will take when they finally come into effect, but we can keep tabs. The less we do not know, the better.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

January 4, 2016

Silent Night: Almost 20% Of Consumers Would Shop On Christmas

The holidays may be a time for comfort and joy, but to many that means warm stores and deep discounts. Eighteen percent of consumers said they would shop on Christmas Day if given the chance, and they also would expect a good experience. As more sales are shifting online, retailers should take note.

Perhaps it has something to do with the 15th consecutive airing of “A Christmas Story,” or that shiny smartphone just released from its package, but roughly one-fifth of your holiday guests are going to wish they were somewhere else on Christmas Day.

And that somewhere else includes cash registers, carts and lots of “40% Off!” signs.

Photo via Huffington Post

Set aside that pudding and unplug the tree. This year, almost one in five consumers – 18 percent – said they would go shopping on Christmas Day.

The finding could hint at a change in our collective Christmas future. Two years after retailers first opened their doors on Thanksgiving Day, it is only a matter of time before merchants set their crosshairs on the Big Holiday. However, they should do so with caution. The Christmas Day research, conducted in November by LoyaltyOne, indicates those merchants that would open can expect a warm reception by some, but a rather damaging one by others.

At a time when record levels of holiday sales are shifting from the store to online, retailers should take note.

“The holiday gift-buying season is, itself, a high-risk touchpoint,” said Dennis Armbruster, consulting managing partner of LoyaltyOne. “Shoppers are demanding retailers maintain service levels, they’re making it clear to retailers they’re not prepared to cut them any slack when it comes to their expectations.”

Armbruster, who said retailers are discussing the idea of opening on Christmas, projects they will start doing so within three years.

Give, Not Forgive

The LoyaltyOne report, which surveyed 1,267 American consumers, also probed overall retail expectations of the season, including consumer feelings regarding return policies. Turns out that even in this season of giving, consumers are not necessarily forgiving.

While almost 20 percent of those surveyed said they would hit the stores on Christmas Day (if stores opened at 6 p.m.), almost 60 percent said they would never shop on Christmas. Twenty-four percent further said they would not only boycott a store that opened on Christmas Day, but would also cross it off the list of retailers they recommend to friends and family.

It might be worth noting that younger consumers (18- to 24-year-olds) are more likely to shop on Christmas Day – 30 percent gave it a nod.

Shoppers may not see eye-to-eye on Christmas Day shopping, but they do agree on the level of service and experience they deserve, crowded aisles or not. Specifically:

Almost 95 percent of shoppers expect retailers to take the necessary extra steps to keep checkout lines moving during the holiday rush. Almost 90 percent think store employees should maintain their departments and keep them looking orderly.

Eight in 10 shoppers would blame the retailer if they had to wait for checkout because of another customer’s coupons, returns or service problems. Among those ages 18 to 34, 40 percent said they would resent the customer for making them wait.

Roughly six in 10 said a retailer’s holiday gift return policy alone can completely diminish their opinions of the brand.

Thanksgiving A Turkey

What surprises me about these findings is that a desire exists to shop on Christmas Day at all when Thanksgiving Day sales were so disappointing. Consumers spent roughly $1.76 billion in brick-and-mortar stores on Thanksgiving Day, according to ShopperTrak. That is down 12.5 percent from 2014. Over the entire Thanksgiving weekend, physical stores’ sales dropped by roughly 10.4 percent.

The decline can be attributed in part to retailers prolonging the holiday shopping season – Black Friday ads began to surface before Halloween. But more so, I think it is the result of a systemic shift in shopping behavior.

Armed with portable digital devices, consumers are able to research product ideas well ahead of time, the moment the inspiration hits them, so that they can target the specific stores they need to visit. This mission-driven approach to shopping diminishes the likelihood of browsing.

It also reduces the chances of purchasing in person. This year, consumers generated a record $7.2 billion in online sales between Thanksgiving and Black Friday, according to the Adobe Digital Index. That represents a 14 percent increase over the same period in 2014.

Forget about cluttered aisles, next year we will be grousing about sluggish browsers.

There is one other piece of data from the research that surprises me. Could it mean something that slightly more men (18.1 percent) than women (17.2 percent) said they would go shopping on Christmas Day?

Perhaps it has something to do with the in-laws. Or maybe the men surveyed simply anticipate having to return those extra-large sweaters snuggled in the tissue paper. Hopefully, the lines at the return desks are short.

December 23, 2015

7 Loyalty Lessons From Reward Programs Past

As retailers end the year with 1.3 billion loyalty memberships issued, it may be time to reflect on why so few are active. These seven missteps from loyalty programs past can help pave the way to a more prosperous 2016.

Like cookies and milk on Christmas Eve, loyalty programs today have become as plentiful as they are predictable. And each year we put out more, often expecting a different result or a better return.

Now, as we end a year that hit more than 3 billion loyalty program registrations, 1.3 billion of which are retail programs, perhaps it is time to reflect on the mistakes of programs past; to consider why less than half of those memberships (42 percent) are active; and to acknowledge the missteps of our own.

Now, as we end a year that hit more than 3 billion loyalty program registrations, 1.3 billion of which are retail programs, perhaps it is time to reflect on the mistakes of programs past; to consider why less than half of those memberships (42 percent) are active; and to acknowledge the missteps of our own.

Following are seven key reasons loyalty programs fail, or will fail. Consider it a baker’s half-dozen of prevention to be enjoyed now, to help inspire your 2016 New Year’s resolution of losing those few extra pounds of bad practices.

Buying the wrong size: I know someone who cannot figure out why Target continually gives her coupons for a brand of clothing she never purchases. This one-size-fits-all type of recognition can be explained in a compelling data point: Only 11 percent of loyalty programs offer rewards that are personalized based on a customer’s purchase history or location data, according to recent research by Capgemini. Holiday offers that lack relevance aren’t only ignored; they are evidence to the customer that the merchant isn’t trying hard enough to know them.

Checking the list only occasionally: Consistent recognition of a shopper’s engagement is especially crucial now, during the holidays, when gift giving can be a stressful affair. Every small effort to ease the process will likely be remembered. Rather than require the customer to accumulate a certain number of points before receiving a reward, the program could recognize each purchase with a tailored offer to encourage her return or, in the case of Macy’s, an on-the-spot surprise discount at the register.

Mix-matching the giftwrap: Lots of companies have enabled mobile purchasing, but not all mobile experiences are lined up seamlessly with a brand’s other purchase channels and experience. The customer does not particularly care that she is buying Aunt Rita’s earrings via mobile vs. iPad. She just wants to be able to track her purchases, view the offers and redeem reward points easily, regardless of her purchasing device. At Nordstrom, employees merchandise the stores based on input from its Pinterest page. Digitally, in addition to ongoing mobile enhancements, it launched a text-to-buy feature for its associates, so customers can buy products via text.

Sending annoying holiday letters: When it comes to communicating with customers, one simple rule of thumb should apply: If the email, text, direct-mail or phone call is not creating value, then do not send it. When shoppers provide their personal information to retailers, they are not extending an invitation to be annoying. Instead, retailers should see this as an opportunity to establish trust through pointed messages that address shopper preferences and needs. I know someone who gets DSW emails every single day, sometimes twice. They are clearly not targeted. (Why send her a Gucci promotion when she has never purchased a luxury brand from DSW?) Now, a brand she used to browse regularly has become irksome, and she rarely visits its site.

Hurting Santa’s reputation: Even programs with the best intentions can find themselves carrying a big bag of promises they cannot fulfill. Sephora’s Beauty Insider did so in August after enticing members to spend more so they could cash in on “epic rewards” ranging from trips to Paris to hundreds of dollars in cosmetics. But on redemption day, most of the best rewards disappeared. Sephora issued $50 make-up gift cards to angry members, with reportedly mixed results. Perhaps Sephora promoted the offer too long, or maybe it should have made the best rewards part of a contest. Regardless, loyalty program promises should not rest on asterisks and tiny type; the program should offer only what the retailer can shout from the rooftops.

Tarnishing the silver bells: As loyalty gamification expert Gabe Zichermann puts it: A classic mistake of loyalty marketing is revealing too much of the program too soon. This is particularly damaging when the program has not been thoroughly tested to deliver. I know it is competitive out there, and the sense of urgency to introduce the Next Best Thing can be palpable. However, when a program is introduced too soon it risks collapsing under the weight of its loyalty following, by not being able to manage the data, to use that data to deliver meaningful recognition and parlay that customer understanding into significant experiences.

Being a Grinch/Scrooge: It is an incredibly competitive loyalty landscape, as households have on average signed up for 29 programs each, according to the loyalty researcher COLLOQUY. Retail is a thin-margin business, but if one wants to participate in the loyalty business, it can’t afford to be stingy. The opportunities through which members can earn should be broad and creative – not only through purchases but also through social interactions, gamification, participation in brand events or volunteer work to causes the brand supports. The key is to reward for actions that demonstrate brand loyalty, and then make the redemption options accessible enough so the company is not carrying a fortune in points on the books.

Lastly, let’s not lose our heads. As the holidays near, there will be pressure to clear inventories that might not be moving as quickly as predicted. Consider each loyalty program promotion or concept as if it is one cookie on a platter of many. Size them all up and choose the best few, or risk starting the New Year carrying the evidence of a few bad choices.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

December 21, 2015

Zappos’ Santa Claus Feat Leaves Big Shoes to Fill

A recent act of kindness by Zappos has some wondering if it could spin its reputation for feel-good experiences into a marketing tool. This likely isn’t even necessary – Zappos is secure in its ability to generate loyalty organically, and not through campaign stunts, because it begins at home. Here are six ways it achieves in-house loyalty.

An old saying proclaims something along the lines that a happy spouse makes a happy house. At Zappos.com, a happy house makes for happy communities.

The online footwear and apparel retailer, which has established a reputation for delivering feel-good experiences with disarmingly friendly service, has essentially opened its house to an entire town. Specifically, it sent its associates to serve as pre-season Santas, delivering gifts to every home in the college town of Hanover, N.H., where exceptionally loyal customers live, according to one report.

It is a small town, but the project was still an expansive undertaking. Over the course of an evening, the team of more than 30 Zappos employees delivered nearly 1,900 packages to individual doorsteps. The presents included warm-weather clothing, headphones, backpacks and (of course) shoes.

This resulting fanfare has some wondering if Zappos could expand its act of recognition into an annual event, causing people in other communities to place more orders in hopes their town would be the next recipient of Zappos’ largesse. It is an intriguing thought, but I don’t think Zappos works that way. Having been the lucky recipient of a guided tour of its headquarters and call center a few years ago, I can say Zappos is quite secure in its ability to generate loyalty organically, starting at home, and not through campaign stunts.

The trust it affords its team members to do what is right for the brand is why, with every transaction, Zappos leaves big shoes to fill.

Foot Race For Insiders

These transactions, not to mention the shoes, have established somewhat of a cult following among people who want to work for Zappos. And it may have been expanded with a significant organizational shift in 2014 that involved ditching management titles in favor of freedom-embracing roles. The purpose: Give every employee the power to make changes.

This transition was not for everyone. Many employees opted instead for a generous severance. Still, those who want to work for Zappos find themselves in a foot race for the finish. The chance of landing a job at Zappos stood at about one in 100 a couple years ago.

So laced up was the competition that Zappos in 2014 stopped posting specific job openings and instead established a membership for those who want to work there. The group, called Zappos Insiders, is “like a special membership for people who want to stay in touch with us,” its website explains. The company advises those who would like to work for Zappos to join Insiders and create profiles. It also advises candidates to generate video cover letters and to follow it on any of its many social media outlets, including its biweekly #InsideZappos Tweetchats.

Among the questions Inside Zappos posed on its Dec. 3 Tweetchat: Do you have a secret talent? What is it?! (One follower is a Lego Master Builder.)

Culture Of Heart And Sole, Six Ways

Photo credit: Zappos

Being a master employer requires more than excellent perks, however – it also requires the skill to bring out the best in its associates.

Zappos appears to possess both. Among the tangible assets it offers its workers are free food, transportation stipends, massages and deep product discounts. Its single most valuable benefit, though, is intangible, and that is the trust it places in its team.

To illustrate how Zappos establishes its trust, I will share some of the loyalty lessons I picked up while touring its headquarters and call center.

Train well: Every Zappos employee candidate, regardless of role, is required to take four weeks of on-board training across various departments, including the call center. This is a forward-looking strategy: Because each Zappos employee is trained on the phones, the company does not have to bring in extra labor during peak holiday periods. After training, each new employee is given a final exam that carries a 90 percent passing grade.

A good fit requires a little letting out: Zappos CEO Tony Hsieh understands that a good fit is as critical to culture as it is to comfortable shoes. He wants every employee to feel at home under the Zappos roof, so after the first week of training, each trainee gets “the offer” to leave Zappos (the offer shakes out to a month’s pay). If a candidate does not feel comfortable with the Zappos culture, he or she can take the money and leave, no hard feelings.

Coach toward goals: In 2004, Zappos established a Goals Department as a resource for employees to set and achieve specific aspirations. Instrumental in helping them reach these goals is a life coach who regularly consults workers on business and personal issues. Back when I toured, classes of 20 participated in goal-setting programs, and upon graduation they wrote their accomplishments on the walls of a special hall of fame. The success rate for achieving goals was 98.2 percent.

Empower the people: Every employee at Zappos is given the tools and guidance to become a senior leader, but it is up to the associate to get there. Workers are free to make career-defining customer decisions and are famously permitted to talk with customers for however long they deem necessary to result in a good experience. This freedom translates to individual rewards as workers use their imaginations to recognize loyal customers in their own ways – from flowers, to free shoes, to gifts for an entire community.

It honors its heroes: Recognition is appreciated in both small and big gestures. Zappos has held monthly company parades to honor employee “heroes.” Outstanding employees also get to sit at the Desk of Epic Glory or the throne set up for life coach graduates. For those who prefer tangible recognition, there’s the Zollar Store, where associates redeem Zappos currency, called zollars, that they have earned through goal achievements.

Support the freak flag: Creativity is the vital fluid that keeps Zappos’ heart pumping, so the company encourages self-expression in many ways. Workstations are laden with personal items: a license plate that carries a worker’s name and hire date, a disco ball and a Star Wars Chewbacca cutout. During my tour, CEO Hsieh’s desk sat in Monkey Row, covered in jungle vines. Employees also are free to decorate the conference rooms.

The inside of Zappos’ operations may have changed a little over the past couple of years, but its ability to engender loyalty among communities and workers appears to be foundationally solid. As the town of Hanover, N.H., prepares for the holidays, I suspect many there, and elsewhere, will be on the Zappos.com site, looking forward to a delivery to their happy houses.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

December 17, 2015

Naked Ambition: Godiva’s Move To Straddle Premium Approachability

Belgian chocolatier Godiva, a brand long equated with luxury, has launched a holiday campaign to give its image a slightly less formal feel. The move follows its 2014 introduction of less-expensive items like frozen drinks and may signify a richly conceived offensive against a burgeoning craft chocolate industry .

Here’s the situation. You’ve got $50 to spend on a special someone and have two choices: A pair of freshwater pearl earrings from Zales or a box of 24 chocolate truffles from Godiva. Both gifts are displayed in glass cases.

It is a scenario Godiva is evidently well aware of as it seeks to broaden its appeal beyond the premium set. Long equated with luxury, the Belgian chocolatier has launched a holiday campaign designed to give its image a more accessible feel. The “It’s More Than Just Chocolate” strategy will include in-store and digital content, such as a video series featuring one of its chefs sharing themes about chocolate.

Photo credit: Godiva

“Godiva in the past has probably come across as a little bit more formal, but with this campaign, we wanted to make sure we were tapping into a real, authentic look and feel that’s more inviting,” Marie Han Silloway, Godiva’s chief brand equity and customer experience officer, recently told AdvertisingAge.

The campaign may be more than just invitational, however. It could signify a smartly conceived offensive move by Godiva against a burgeoning craft-chocolate industry, many parties of which can be found on grocery store shelves. And it is not the first – the premium chocolate maker has entered the frozen drink fray, and its rewards program is especially generous.

In a nutshell, Godiva’s efforts, particularly with its rewards initiative, serve as a premier example of how to maintain prestige in a market that is quickly crowding.

Chocolate Challenge: Boxing The Bars

If Godiva wants to be the foil-wrapped choice of the chocolate industry, it certainly has its opportunities. Chocolate sales in the United States are expected to reach $22.4 billion in 2017, from an estimated $21.1 billion in 2015, according to Statista. These gains follow a 2013 increase that represents the first time chocolate consumption has risen in the United States in at least five years.

That growth represents challenges as well, however. The chocolate aisle is increasingly populated with brands that tout organic cocoa, free-trade partnerships and healthy ingredients. Private-label chocolate enables supermarkets to be involved at competitive prices. And all are located where most shoppers find themselves at least once a week.

Further, chocolate still accounts for only half of U.S. confectionary spending, according to Mechtronics. Of that share, only about 7 percent of sales are generated from boxed chocolates. The lion’s share goes to chocolate-covered bars, which accounted for almost 47 percent of sales.

Flavoring Moments Of Happiness

Some may consider 7 percent of 50 percent a relative nib in the larger chocolate market. However, several consumer trends play into Godiva’s favor, including the movement toward “moments of happiness” and customization, as described by KPMG in a June 2014 report. It reports the emergence of “hybrid consumers,” who “economize on groceries while brightening life with such everyday luxuries as premium chocolate.”

These consumers may reach for the free trade, peanut butter-and-jelly-flavored chocolate bar in the grocery store, but those bars could in time bridge shoppers to top-shelf makers such as Godiva because they heighten chocolate appreciation.

Indeed, KPMG identifies luxury chocolates as the fastest-growing market segment. A trade group dedicated to the segment – the Fine Chocolate Industry Association – was founded in 2007. Godiva, in keeping with these trends, is polishing its gold-box reputation while inviting everyday consumers in.

In fact, its “More Than Just Chocolate” campaign is the latest in a series of competitive efforts in which Godiva is indulging: In 2014 it introduced less-expensive frozen drinks called Truffelatas and soft serve, and its Rewards Club program is hard to resist, promising members free pieces of chocolate every month and free gifts for every $20 spent.

Bon-Bons Of Relevance

Whether a $6 pumpkin Truffelata or a dark chocolate soft serve will distinguish Godiva from competition is not as important as the evident commitment behind these endeavors. After all, Godiva isn’t competing only against other chocolate makers; it is competing against other gifts, from those pearl earrings to cashmere mittens.

This is why, to me, Godiva is not merely striving for sales – it is striving for relevance.

Godiva is doing so by dedicating special care to customer recognition, product innovation and brand experience. As Godiva’s Han Silloway put it to AdAge in explaining the new holiday campaign:

“We want to connect with all consumers. … Part of this campaign was making sure that we came across as more approachable luxury because beautiful-tasting chocolates are more indulgent, and it’s a way to treat yourself and others, but also we wanted to continue to communicate that it’s something perfect for every day.”

It’s been almost a half-century since Godiva opened its first U.S. location in 1966, and its red-ribbon boxes still embody the meaning of indulgence. As long as they also trigger an emotional response, it has a good chance of remaining the salted caramel to our discretionary whims.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

December 7, 2015

Shopping Takes A Trek: What REI’s Black Friday Shuttering Could Mean For Retail

REI’s decision to boycott Black Friday is delivering positive near-term results. The longer-term implications depend on how well it will continue to understand what resonates with its shoppers. Three keystones of relevance should ensure that it will.

For most retailers, the mile markers of performance come in the form of register receipts, but for outdoor-gear chain REI, they are coming in the form of social registers.

REI is the chain that caused many of its rivals to blink – twice – when it boldly announced it would not open its stores on Black Friday. Instead, REI urged its customers to go outdoors and record their experiences on its #OptOutside. Before Black Friday, REI had attracted nearly 1 million endorsements on social media, prompting President and CEO Jerry Stritzke to call its boycott a “movement.”

Photo Credit: REI

Whether that movement will move sales long-term is yet to be seen, but the leaders of the Seattle-based chain clearly considered what resonates with its customer base when making their headline-grabbing decision. And that is a good sign.

As evidence, let’s look at the short-term results. While Seattle-based REI’s physical stores were closed, its digital aisles were teeming. Traffic on REI’s website rose by 10 percent on Thanksgiving Day and 26 percent on Black Friday, according to GeekWire, citing SimilarWeb. (While its site was up, REI did not process any online orders on Black Friday.)

Traffic elsewhere indicates that perhaps a movement is afoot, as other stores that remained closed on Thanksgiving saw a bump, or leap, in online traffic, according to the GeekWire report (again citing SimilarWeb): At GameStop, Thanksgiving Day traffic rose 132 percent; at Staples, 120 percent; PetSmart, 69 percent; and at Nordstrom and Pier1, 54 percent.

Shop The Insanity

The decision to keep stores closed on Thanksgiving (and Black Friday) can be considered a call for sanity. Holiday hawking is approaching full-tilt, from the carols that were piped (loudly) into coffee shops in the first week of November to the major chains that opened their doors on Thanksgiving Day, oftentimes before the turkey had gone cold.

This is a retailer’s choice, and I do not criticize any decision to be open if people want to shop and employees want to work. But the fact that more consumers shunned the stores may be indicative of promotional fatigue (the sheer number of offers can be paralyzing). Or perhaps some people felt that the lure of materialism has wrecked enough family afternoons, so they latched themselves to their couches, albeit with tablet in hand.

True enough, the call for family time is gaining volume. An October report by Search Institute, a nonprofit children’s advocacy group, emphasizes the importance of family time for healthy child development, stating: “Developmental relationships in families contribute 42 percent of the difference in parents’ reports of key character strengths.”

Yet parents struggle to find the time. About four in 10 (39 percent) of full-time working mothers and half of all full-time working fathers feel they spend too little time with their kids, according to recent findings by the Pew Research Center. About half of all parents, working or not, feel they do not have enough leisure time.

So, many parents may have asked themselves, why spend an added day off in a harshly lit, chaotic superstore? Sure enough, BloombergBusiness reported that online spending on Black Friday morning outpaced the year-before figure by 15 percent.

Relevance Required

These figures and research indicate REI was on to something that many major chains, despite their wealth of resources, might not have noticed, and that is what makes the holidays important to its shoppers.

REI, and other retailers that remained closed, succeeded because they recognized and acted on a few key cornerstones of relevance. Among them:

Opting for best, not bucks: Retailers that chose to remain closed based their decisions on what they felt is best for their customers, not necessarily on what is best for their products and performance. In doing this, they thought about their businesses from a fresh perspective and, I assume in some cases, will use the resulting data to make product and operational decisions that will lead to deeper, more engaging experiences.

Answering clear needs: If the siren song of materialism is deafening, then the only notes that will rise above the noise are those that offer solutions to specific customer needs. For specialty merchants, this means aligning operations with the company mission, always. In REI’s case, the mission includes getting people outdoors. Data from its shopper membership program (REI is a co-op) can further help it identify personal interests and customer life stages, so it can send communications that resonate with their preferences – even if the messages do not involve shopping.

Appreciating emotions: Most retailers with access to data can capture a general idea of their target customers and what makes them tick. Unfortunately, not all retailers know how to optimize the data they have, oftentimes because they have more than they need and the insights get clouded. The most successful retailers are those that consistently reinforce the brand mission with the kinds of experiences their customers treasure, based on the required insights and nothing more. They understand their ideal customers’ main interests, assign value to them and then connect with them in ways that say, “Hey, I know who you are, and I understand your needs.”

This is the message REI sent to its members when it encouraged them to eschew shopping and share their outdoor experiences on #OptOutside. Post-, pre- and present-Thanksgiving Day shopping has for many become a noisy, immense undertaking. Retailers, in tinkering with Black Friday and pulling it into Thursday, may have overstepped.

But even if they had not, digital shopping was already poised to take over the temptation of great deals. REI just supplied the headsets.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

December 4, 2015

Clicks Hit The Bricks: 6 Ways Brick-And- Mortar Is Stealing Cyber Monday

Cyber Monday is no longer the competitor to traditional retail that it was 10 years ago. This year, Cabela’s, Macy’s, Walmart and many others are using the post-Thanksgiving event to promote specials not merely online, but across all channels, all season long.

Now available on Cyber Monday! A new meaning to Thanksgiving leftovers.

A decade after it was first recognized as a retail event, Cyber Monday is projected to generate $3 billion in sales this year. But don’t expect all, or even most, of those sales will be directed solely to cyber-registers. While originally considered a threat to traditional retail, Cyber Monday’s post-Thanksgiving billions are increasingly being spent with traditional retailers as they seek new ways to clear leftover goods from the shelves.

Merchants from Cabela’s and Walmart to Macy’s and Express are using this Monday after Thanksgiving to promote specials – not just on Nov. 30 but also for the entire season, and across all channels. The trend signifies traditional retail’s ability not only to rise to the occasion of digital competition, but in some cases to match or outperform the competition (as in the case of Cyber Sunday; more on that to follow).

Merchants from Cabela’s and Walmart to Macy’s and Express are using this Monday after Thanksgiving to promote specials – not just on Nov. 30 but also for the entire season, and across all channels. The trend signifies traditional retail’s ability not only to rise to the occasion of digital competition, but in some cases to match or outperform the competition (as in the case of Cyber Sunday; more on that to follow).

And none too soon. Traditional brick-and-mortar sales registered $1 billion shy of 2014’s total – falling to $10.4 billion from $11.6 billion, according to ShopperTrak. The decline is attributed in part to extended Cyber Monday promotions, which began early and lengthened the one-day event into a full Cyber Week. The early results: Year-over-year online sales on Black Friday, the day earmarked for physical sales, advanced 14 percent to $2.7 billion.

A review of some of the promotional events illustrates how creative and unconventional traditional retailers can be, especially when another source hangs the door to the opportunity. Not all efforts will float in this parade of initiatives, however – some are simply promotional ads on what feel like refurbished landing pages.

Rather, the retail endeavors that will prove themselves this Cyber Monday, and season, are those that treat the promotions as side dishes to a main course of memorable events.

Founded By Retailers, For Retailers

Before exploring how traditional retail is leveraging Cyber Monday, it is helpful to understand the effect the retail holiday has had on the industry, as well as its surprising origins.

Though considered by many as an initial threat to brick-and-mortar retail, Cyber Monday was founded by one of retail’s largest trade organizations, the National Retail Federation. More specifically, a branch of the NRF that serves online retailers, called Shop.org, coined the day.

At the time, Shop.org reported that 77 percent of online retailers saw an uptick in sales on the Monday after Thanksgiving, many of them smaller merchants that tended to get lost in the noise of Black Friday. Once the day was given a name in 2005, Cyber Monday sales rose 26 percent, to $486 million.

By 2010, Cyber Monday grew into the biggest online shopping day of the year, according to The Washington Post.

Since then, the exponential growth of smartphone and tablet use has made online purchasing a do-anywhere, anytime endeavor, and sales are expected to scale accordingly. The record-breaking $3 billion figure projected this year, by Adobe, represents a 12 percent advance over 2014. The share of orders coming in via smartphones also is expected to reach an all-time high.

Virtually Traditional: Cabela’s, Walmart, Macy’s

This dynamic change in how we shop has enabled traditional retailers, using both in-store and digital data and other resources, to identify shopping behaviors and preferences that are likely informing their Cyber Monday strategies. Among the initiatives:

Walmart: The world’s largest retailer has borrowed from the start-Black-Friday-a-day-early book and kicked off Cyber Monday on Sunday night, creating Cyber Sunday. The deals began at 8 p.m. Sunday evening and kicked off a “Cyber Week” that will extend to Dec. 4. Why wait until Monday? The ubiquitous presence of online access convinced Walmart there is no reason to, Walmart.com CEO Fernando Madeira told USA TODAY.

Cabela’s: The destination outdoor-gear chain has limited physical operations, so Cyber Monday serves as a useful method for reaching outdoor enthusiasts who may be out of driving range. To this end, Cabela’s joined Walmart and others that have lengthened Cyber Monday into Cyber Week, with extended sales and selected markdowns. It also is using the promotion, like several other retailers, as an opportunity to encourage shoppers to sign up for texted offers and emails, enabling it to access more shopper data.

Macy’s: Using a feature recently unveiled by Facebook, Macy’s is targeting its social advertisements toward shoppers who interact with its Cyber Monday content. The ads refer followers to segmented videos on Instagram that reveal snippets of a larger story. “You can tell a piece of the story and then target that customer who engaged with that first ad unit with another element of the story later in the day,” Serena Potter, group vice president of digital media strategy at Macy’s, told Adweek.

Express: The specialty women’s fashion chain set up a dedicated web page to promote Cyber Monday deals while also encouraging shoppers to save every day. Included on the page is a call to register via mobile for special deals and a chance to win a trip for three to New York, effectively folding a memorable (and highly social) brand event into its promotion.

Target: The mass-merchandise chain for the first time is discounting every single item on its website, by 15 percent, and other deals will be available all week. It also is featuring 75 virtual door-busters. To harvest early enthusiasm, Target too established a page dedicated to Cyber Monday, which also links to everyday deals, coupons and its weekly ads that encourage shoppers to shop today, next week and after.

Bon-Ton Stores: In an earnings call with investors on Nov. 19, Bon-Ton Stores CEO Kathryn Bufano said the 270-location department store chain is adding resources to enhance its Cyber Monday sales, particularly among its family and friend promotions. “We have lot more offerings, and we’ve increased our digital marketing around that event, which we think will have a positive impact,” she said. Bufano added that 70 percent of Bon-Ton’s customers search its website before coming into its stores, and she expects the number to grow.

Some may consider traditional retail’s enthusiastic embrace of Cyber Monday as late in the game, but it is the quality of the endeavors that matters. The goal is to move product into the hands of emotionally satisfied buyers. If they are happy enough, they will come back for seconds.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

December 2, 2015

H-E-B’s 15% Investment in Loyalty: How A Family-Run Chain May Upstage Walmart, Others

Supermarket chain H-E-B’s plan to give its workers a stake in the company hints at technological capabilities that enable retailers to better compensate their workers. The task is balancing the benefit of better compensation against using the savings to improve the bottom line.

Craig Boyan would like to offer a 15 percent tip to other retailers: If you want to offer a better experience, then do what you can to keep your best workers working better.

Boyan, CEO Of the Texas-based supermarket chain H-E-B, is giving roughly 15 percent of the retailer’s shares to about 55,000 employees. Workers who are older than 21, have been with the retailer for at least a year and put in at least 1,000 hours annually will qualify for the perk.

Photo credit: Yelp

The 370-store, family-owned chain offered this perk in part to foster loyalty among its workers, as well as improve long-term financial stability through reduced turnover. It also further upends the low-wage retail worker debate, which has recently pressured Walmart and others to raise hourly pay.

To Boyan, the ability to increase compensation is apparently upon us, if not a foregone conclusion. As the CEO told the New York Times: “Technological advances in sourcing and distribution should allow retailers to pay their workers more.” The task, for many retailers, is balancing the benefit of better compensation against using technological savings to improve the bottom line.

Cost of Replacement: 40% of Salary

In an industry where every busted cereal box and broken egg eats into the margin, percentage points count for a lot. So let’s look at the value of loyal and happy workers in that context.

Employees earned raises averaging 3 percent in 2014, according to a well-trafficked story in Forbes. Yet the average pay increase an employee received if leaving for another employer in that year ran from 10 to 20 percent. Makes jumping ship sound rewarding.

In the supermarket segment, where pay has traditionally been tight, employers may feel they were competing in an apple-to-apples arena, but companies such as H-E-B are changing that, and it could pay off well.

The cost of replacing an entry-level worker runs between 30 and 50 percent of that worker’s annual wages, according to the consulting firm Zen Workplace, which specializes in organizational “people problems.” Replacing a midlevel employee can cost more than 150 percent of his or her annual wage.

So if a retailer pays its workers $10 an hour (which is what Walmart raised its hourly pay to this year), the cost of replacing one full-time worker (recruiting, interviewing, training, etc.) would run from an estimated $6,200 to $10,400, according to these calculations.

For skeptics who feel those figures are too high, we can estimate the cost at a modest 10 percent of a worker’s annual wages – $2,000. Multiply that by 10 workers over a year, and the employer ends up spending a sum equal to the annual wages of one full-time worker.

Raise All Ship(ments)

H-E-B is opting to maintain and grow its worker investment by directing more of its own profits into their pockets, a move that ideally will inspire workers to perform better. If the company’s bottom line increases, so will that 15 percent stake. It’s textbook “a rising tide lifts all boats” philosophy.

CEO Boyan also raises a compelling issue in explaining his decision to share the shares: Advancements in sourcing and distribution should result in reduced overhead expenses, which can be redirected to compensation.

Such decisions are not made lightly, however. The same technology that improves distribution also complicates purchase channels and competition. Supermarkets compete with Amazon, Jet, Shell, CVS and even T.J. Maxx. To stand apart, a supermarket may earmark money saved in distribution for enhanced digital communications, delivery options and general promotions.

None of these efforts, however, will be worth the bags the groceries are carried in if the shopper is unhappy while unpacking. The customer experience is the most valuable asset for which a retailer can strive, and its employees are essential to earning it. As Boyan put it to the Times:

“So many in retail are competing in the race to the bottom, and people are the largest cost. So it seems logical to cut people, and lots of folks are doing it,” he said. “We think that’s a trap. We believe the race for the bottom cheapens the American experience. It’s bad for the country and bad for companies.”

Worker Passion, Principles

Boyan expresses a sentiment that is gaining muscle across the country: An engaged, invested employee delivers something that neither income statements nor strategies can quantify, and that is emotional connections. Employee passion picks up where money fails us.

Put in more direct terms: A retailer cannot change customer behavior, reliably and long-term, if it does not positively affect employee behavior. Following are some guiding principles that have worked well for my company and others:

Identify best workers: Many formulas exist to identify high-potential workers, but the results can shift depending on engagement levels, so I look for budding leaders who can bring out the best in their staff. These workers are reliable, unafraid to raise their hands, consistently seek new challenges and opportunities for development, and generally are well liked.

Empower them: Workers who are not free to make independent decisions are often paralyzed by fear of making a mistake. When companies give their workers the power to make decisions that improve the customer experience, the worker becomes creative. At the U.K. grocery chain Sainsbury’s, a customer service manager changed the name of a long-standing bakery item per the request of a 3-year-old, and he sent her a gift card, delighting her family..

Share the insights: Supermarkets with loyalty programs have access to data that can elevate the customer experience from good to made-my-day levels. Department leaders who have access to data can align their priorities against high-value, high-potential customers, identify the critical customer encounters that define the brand’s unique value, and change their activities expressly to better serve those customers.

H-E-B’s compensation strategy may be the latest in a major movement to turn workers into experiential capital. However, the trend could waver depending on the economy and competition. I hope not. The sensitivity and spontaneity of human interactions bridge a gap that financial calculations can never fill.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

Bryan Pearson's Blog

- Bryan Pearson's profile

- 4 followers