Bryan Pearson's Blog, page 20

June 1, 2016

In Brand We Trust: How Recalls At Trader Joe’s, Costco, Can Enhance Customer Engagement

A recent recall of almost 400 frozen fruit and vegetable products is one more reminder of the effective role data can play in alerting the public to health issues. The challenge is serving an increasingly scrutinizing public without appearing intrusive.

Several major grocery retailers were recently given 358 ways to protect their consumers, and how they respond could determine whether shoppers will have a taste for them in the future.

Photo by Joe Raedle/Getty Images

Trader Joe’s, Safeway and Costco are among the chains affected by a recall of 358 frozen food products under 42 fruit and vegetable brands. And while most headlines address the dangers of food contamination, the recall also serves as one more reminder of the highly effective role retailers and their loyalty programs could play in preventing illness.

Many people are alerted to these recalls through the news, but customer data can serve a more targeted and immediate function in notifying the public to and answering questions about such health scares.

The challenge is enabling the consumer to see that such notifications are an added benefit of loyalty program membership, not an intrusion. How to accomplish this? I can say that retailers that make customer trust a cornerstone of their strategic marketing have a superior edge, while those that do not risk getting lost in that trust shadow.

‘Rare And Powerful Moments’

Research shows there is an appetite for brand reliability, even if it reveals fallibility.

Almost nine out of 10 consumers (87 percent) said they would more likely purchase and remain loyal to a brand that handles a product recall honorably and responsibly, according to a 2010 report from the Relational Capital Group. These same consumers said they’d feel this way about a brand “even though [it] clearly made mistakes that led to a safety or quality problem.”

A similar amount of respondents (91 percent) said they understand that product and safety recalls occur at even the best-run companies.

“Product recalls create rare and powerful moments of truth for companies and brands through which loyalty can actually be strengthened and enhanced,” Chris Malone, chief advisory officer of the Relational Capital Group, said in a press release. “The way they’re handled leaves a deep and lasting impression on consumers, for better or for worse.”

That’s a potentially big burden to bear, but supermarkets that do not get involved in recalls risk appearing as if they are ducking a situation they have an ever-improving ability to manage.

575 Cases in 6 Years

There certainly are enough opportunities not only to respond strategically to food recalls, but also to justify a dedicated program that can parlay the data into an action plan.

From the years 2010 to 2015, the U.S. Department of Agriculture recorded nearly 575 cases of food recalls, according to its website. The Centers for Disease Control and Prevention estimate about 1,600 people are infected with listeria each year.

Factor in family and friends of those sickened, and that is a wide circle of consumers. In the latest recall, manufacturer CRF Frozen Foods, of Washington State, said it is performing the recall in cooperation with the Food and Drug Administration because the products could be contaminated with listeria. The affected brands include Columbia River Organic, Trader Joe’s private label, Farmer’s Bounty, Organic by Nature, Live Smart, Signature Kitchens, Simply Nature and Wild Oats.

Recollecting Moments of Truth

If product recalls have the potential to create powerful moments of truth, then thoughtfulness is a requisite when contacting consumers (this actually should be the case regardless of whether the retailer is alerting them to a listeria scare or delivering a special offer).

Loyal customers tend to deeply identify with the brands they choose, often on an emotional level. The best brands in the business nurture an affinity with their customers that can withstand recalls because customer trust is a foundational element of operations.

Following are four methods for responsibly alerting consumers to potential health scares, and in the process gaining trust.

• Activate the database: Loyalty program data provides unique identifiers that enable retailers to determine which customers purchased certain items, including those on recall. Immediate notices can be sent to the loyalty members via their preferred methods of communication. Kroger Co., for example, has used its Plus rewards program data to aid in food-borne illness investigations and recalls.

• Keep the database current: With that said, it is essential for retailers that use their loyalty data as a source of customer contact information to provide those customers good reason to keep their information current. If these names and addresses are wrong or out of date, then the retailer will be out of luck when it comes to tracking down affected individuals.

• Reinforce trust: Regardless of how quickly they alert customers, retailers should be poised for questions about brand reliability. By offering a hotline through which questions can be answered, as well as the numbers of agencies that can provide information, the retailer can restore its foundation of customer trust. Practice sessions with customer-facing staff can ensure the company is prepared to answer questions quickly and consistently. It’s a good idea to assign a trusted team leader.

• Get in front, but not affront: Outside of staff, all company communications should be direct, thorough and easy to access. Sending vague or hard-to-interpret messages will only dial up the concern, or panic (consider if the consumer is a new mother). In 2011, when Publix Super Markets recalled store-branded ice cream due to undeclared almond allergens, it added a red “Retail Alert” button to its website that directed visitors to a press release, product images and an explanation of the issue, with an apology (in English and Spanish).

Lastly, empathy will help guide the appropriate ways to respond to a recall. In the consumers‘ eyes, the retailer will be part of the circumstance, regardless of whether it is at fault. After-the-fact coupons won’t change that fact.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

May 23, 2016

The Siren Song of Demand: Oculus Rift’s Run to Market

The sudden availability of Oculus Rift 3-D goggles in Best Buy may delight some shoppers, but it is creating another kind of rift among customers awaiting their delayed preorders. Oculus is not the first manufacturer to try serving two kings – retail vendor and direct consumer – but it faces recurring challenges that can be avoided.

Tread carefully into stores, Oculus Rift. Your strategy may turn into an actual rift among your most loyal customers.

The creator of virtual reality headsets, long anticipated by many, is rolling its product into Best Buy before preorders have been filled. This has some shoppers delighted and others irked. For me, it is a reminder of a bad experience I had with Fitbit in 2015, which still stings.

Facebook chief Mark Zuckerberg uses a small drone and an Oculus Rift virtual reality headset during a keynote presentation / GLENN CHAPMAN/AFP/Getty Images

The event took place a year ago when the folks at Fitbit invited me, via email, to preorder a Fitbit Charge HR, its latest model. So I did, but the order never arrived. It took a call to Fitbit to learn that the product was no longer available to me because Fitbit chose to make it available to its retail partners first.

What began as a positive brand experience dissolved into a troubling question: When it comes to choosing the best customer to serve, who is king – the end user or the retail vendor? It’s a question many wannabe Rift owners are asking today.

Oculus, apparently, is trying to make both king, and that’s a heady promise. Oculus is not the first manufacturer to try to serve both consumer and retailer, and history has shown doing so presents recurring challenges. These challenges, however, can be diminished.

Delayed From April To June

Oculus Rift is moving ahead with its retail plans to distribute its virtual reality goggles through Best Buy. This is despite the fact that it is behind on shipping preorders to its first, and therefore potentially most loyal, customers.

“The problem for Oculus is that shipping hasn’t gone smoothly, with the company having to push preorders back substantially for a number of customers,” Patrick Klepek wrote in Kotaku.com. “My own preorder was moved from April to June – a big delay!”

Oculus has said it would make just a small number of its product available to a limited number of Best Buy stores on May 7, and the retail agreements apparently were made in advance. Still, the sudden availability has got to frost those who slapped down their $599 first.

FitBit Gives Fits

My experience with FitBit was similar. Now that I am somewhat inured to the possibility of disappointment, I make my choices more carefully.

Truth is, manufacturers that offer direct-to-consumer options can put themselves at a disadvantage if they choose to go both digital and traditional retail routes. They want to meet various consumer needs in order to build loyalty, but in doing so are vulnerable to the demands of their retail vendors. And since retail vendors buy in volume and require costly contracts, they can have greater kingly power.

Like Fitbit, Oculus should have a database of customers who have purchased its other games, gear and apps. It can use that information to offset disappointments over delays through well-timed communications, and apparently has tried.

An online message to those who preordered Rift offered them a chance to purchase it from retail while maintaining preorder benefits they were promised. These include an EVE: Valkyrie virtual reality game and priority status for preorders of its Touch virtual hand controllers.

“Starting May 6th, if you’re interested, simply go to your order status and let us know you’ve purchased a Rift at retail, and we’ll cancel your preorder,” the message states.

It’s a solid gesture, though it may ring hollow as many customers may wonder exactly what their priority status on preorders stands for now.

Data Rift

However, Oculus can use its data in other ways, as well. An analysis of past customer interactions online could avail Oculus to the experiences its customers most expect and find most relevant. Insights into how quickly certain customers purchased previous Oculus products could distinguish those who are more likely to be early adopters from those who will wait for retail. It can tailor offers for each.

Let’s consider Oculus’ attempts to resolve frustrations among customers who preordered by inviting them to purchase in-store. It also can provide variations of that offer – give those early adopters 20 percent off if they maintain their preorders. Or, if it wants to make both shopper and Best Buy happy, coordinate preorder-only parties at Best Buy, where customers can try out their new games.

And it never hurts to be humble. Customers understand the challenges of supply and demand. A little humility and honesty can go a long way. It helps to demonstrate that events like this are learning experiences. Perhaps next time Oculus releases a new product it should specify that there is only a limited number available for preorder. That would at least manage expectations.

Many manufacturers are vying to straddle both direct-to-consumer and bricks-and-mortar, but they first should establish the end goal in doing so, because the laws of the retail land are fairly rigid: If you want to rule both online and in-store, then deliver on what you promise. Be in stock, be on time and ensure the product’s arrival is memorable for the right reasons.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

May 16, 2016

J. Crewsing Into CEO Branding: What Mickey Drexler Can Learn From Loblaw, REI

In his personal letter to shoppers, J. Crew CEO Mickey Drexler appears to be backing his brand promise with a personal promise. But if he wants to be a branded CEO, he should take a lesson from one of the original retail brand-makers, Dave Nichol, and his contemporaries.

J. Crew CEO Mickey Drexler may be an icon among retailers, but if he wants to be a brand ambassador among his shoppers, he should take a lesson from one of the pioneering presidents of customer engagement: the late, great Dave Nichol.

This photo taken May 14, 2014 shows the J. Crew store in the Shadyside section of Pittsburgh. (AP Photo/Gene J. Puskar)

Nichol was a grocery man; he headed marketing and product development for the Canadian supermarket chain Loblaw. However, to the public and industry, he was the beloved face of a national brand many equated with an experience. From 1972 to 1993, Nichol transformed Loblaw, turning a mundane supermarket into a destination where shoppers eagerly sought to sow a newfound passion for food – a passion he ignited and nurtured.

Nichol’s passion (and that of his ever-present sidekick, Georgie Girl the bulldog) was so authentic that the public quickly equated it with Loblaw quality – they trusted him, so they trusted the brand. This enabled the runaway success of Loblaw’s private-label brands, including its upscale President’s Choice.

In short, Nichol defined personality as a tool for brand loyalty, and it is a tool many retailers are revisiting.

“We Clearly Got Sloppy”

Drexler embodies a more contemporary approach to customer relations. The former head of the Gap during its nothing-can-stop-us, 1990 years (remember the “Jump, Jive and Wail” commercial?) made a recent run for authenticity not with his face, but with an email.

Drexler in April sent J. Crew customers an electronic greeting that, along with pleasantries about his music choices (Springsteen, Motown), invited shoppers to visit a store and email him directly with their thoughts. The reason: J. Crew had, in his own words a year ago, “got sloppy.” Cost-cutting measures resulted in a perceived decline in quality, but not price, and this was turning loyal customers off. J. Crew’s fourth-quarter same-store sales declined by 4 percent.

Drexler is now trying to appeal to his customers on a human level, which is something Dave Nichol did effectively, and effortlessly. The key point of difference: Nichol engaged because he understood the challenges and preferences of his best customers. Drexler, however, is reacting to a misstep that, had he kept his finger on the pulse of shoppers, likely would not have been made.

CEO As Brand

Regardless of motivation, Drexler’s run at personalizing the CEO as a brand is a sound choice for engaging his customers, if he plans to stay the course.

This branding approach is not new, after all – Men’s Wearhouse is a good example. But as retail organizations merged, consolidated and expanded, the practice of executive-as-brand faded among the major chains.

Not that the concept wouldn’t work for a national organization. The trick is possessing a quality that cannot be faked: believability. This was key for Nichol, and it is key for Drexler if he wants to pull off his conversational emails to customers – he needs to be authentic and to follow through.

Here are examples of how other brands do it:

REI: CEO Jerry Stritzke captured headlines last November when he decided not only to remain closed on Thanksgiving Day but also to close all stores on Black Friday. Instead of shop, he urged customers to go outdoors and record their experiences on its #OptOutside.

“As a member-owned co-op, our definition of success goes beyond money,” Stritzke stated in a press release. “We think that Black Friday has gotten out of hand so we are choosing to invest in helping people get outside with loved ones this holiday. Please join us and inspire us with your experiences.”

Stritzke not only struck a relevant nerve, he created a movement by inviting the public to share their experiences with a brand that cared about those experiences. Before Black Friday, REI had attracted nearly 1 million endorsements on social media.

Restoration Hardware: CEO Gary Friedman captured public interest when he fired off a memo to his staff that underscored their urgent role in rescuing the endangered customer experienced. “We cannot afford to lose one single customer,” he wrote, in all caps. “ You will never get in trouble for making a decision to delight our customers. You will, however, lose your job if you don’t.”

Explaining his statement to Bloomberg, Friedman unapologetically explained, “We have a leadership culture, not a followship culture.” And, with his unabashed statements, he demonstrates an essential characteristic of leadership: a willingness to stand up for his belief and, if necessary, fall on his sword for the customer.

Dollar Shave Club: The creator of this online product, Michael Dubin, made himself part of the brand experience from the onset with a personal tone that spoke directly to his target audience – men who find shaving and all of its instruments boring. His opening declaration, “Our blades are f–king great,” is a promise: All the other brands are just selling to you. I, however, am solving a big, pain-in-the-butt problem.

And Dubin puts his dollars where, to use his term, his f–king mouth is. Dollar Shave Club delivers blades into our hands in a seamless manner while also providing an unexpected element of delight. He has cut the bore out of shaving, and trimmed the price as well.

If Drexler can capture this level of authenticity, he may win back his J. Crew clan. But he has to believe it himself, and he has to be seen. Nichol was able to maintain national adoration for two decades by putting himself out there, listening to the customers and addressing their concerns. He introduced environmentally friendly items, and he launched a low-priced store brand that made him an ally to his customers.

Today the face of Loblaw is Galen Weston Jr., a scion of the founder who’s more broadly supporting the banner brand and the company mission to become more earth-friendly. He is, however, considered a face of the brand. To do the same, Drexler may need to put his face, not just his emails, out there.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

May 11, 2016

Data Deals: 9 Little-Known But Highly Profitable Retail Insights

The combination of customer insights available today produces clearer understanding than ever. These nine “gee whiz” insights should cause grocery retailers to look at their data (and how they gather it) differently.

Any retailer who has been around the aisles a few times knows the old chestnut about diapers and beer. But kielbasa and lemon curd, or Coke and … a lot more Coke?

These unorthodox retail pairings are the kinds that become clear through rigorous purchase data analysis, and they can lead to significant sales increases. While the average response rate to consumer promotions is 2 percent, leaders in supermarket data analysis realize an average customer response rate of 10 to 15 percent, according to our research.

These unorthodox retail pairings are the kinds that become clear through rigorous purchase data analysis, and they can lead to significant sales increases. While the average response rate to consumer promotions is 2 percent, leaders in supermarket data analysis realize an average customer response rate of 10 to 15 percent, according to our research.

Curious to know what these grocery leaders are doing right, I reached out to colleagues Brian Ross and Graeme McVie at Precima, a retail analytics provider, and asked what they believe are the most overlooked but highly profitable retail insights. Following are their observations (and yes, kielbasa factors in).

Don’t Promote Underperformers: In-store promotions are a conundrum. They are relied on heavily, yet 20 to 50 percent generate no noticeable sales lift, according to the Boston Consulting Group. Another 20 to 30 percent dilute margins. One reason is that retailers are trained to promote underperforming items, thinking discounts will move them. Instead, if retailers shifted their promotional dollars to best-performing items, they could realize a 10 to 15 percent increase in gross profits.

Cultural Preferences Have Many Roots: Ethnic food preferences cross nationalities, as realized by one grocery store that began stocking foods to appeal to a nearby Polish American population. The foods sold well enough that a company analyst looked into it. “He analyzed other items of those who purchased the Polish items, noting the consistencies,” McVie said. “He then analyzed other stores to locate high proportions of baskets containing the same set of non-Polish items.” The grocer introduced the Polish products to these other stores, and they sold well. The lesson: What made the foods appealing was their uniqueness. The other stores did not operate within large Polish communities, but they included large numbers of adventurous customers who purchased non-traditional and international products.

High Value Is 20-20: In retail, the old 80-20 rule – or Pareto Principle – really plays out more like 60-20. Twenty percent of customers generate 60 percent of sales and 75 percent of profits. That customers are not equal in value is just one part of the equation. Not only do better customers spend more, they buy different categories, different brands, shop different stores, different days and have varying preferences on quality, selection, service, convenience and price. Identifying and analyzing those can inform pricing, promotion and assortment decisions that can result in a 1 to 3 percent increase in sales and profits above organic growth.

SKUs Skew Profit: The irony of choice is that it has the opposite effect with many consumers; faced with shelves stocked to the gills with products, brands and features, customers actually spend less. Walmart, in an effort to make its stores easier to navigate, in 2015 removed about 2,500 items from its shelves. By using purchase data to identify which products, features and brands matter to which customers, retailers can rationalize assortment and actually grow sales. “We recently recommended to one of our clients that they reduce assortment by 10 percent and they saw category sales increase by 4.6 percent as a result, while making room to expand other categories,” Ross said.

Compliance Makes Money: Many retailers would be shocked to discover they aren’t pricing the way they think they are. “In our experience, a retailer complies with its pricing strategy or policy on about 75 percent of prices or stores,” Ross said, “That means that 25 percent of prices are not aligned, leading to inconsistent strategy, customer confusion and lost sales and/or margin.” By using the necessary tools to better assess, manage and execute pricing strategy, retailers can strive for consistency that typically leads to better customer price perceptions and sales gains.

Many Loss-Leaders Are Losers: All retailers know the promise of loss-leaders. Promote a price-sensitive item (think soft drinks or milk) and while the retailer loses on the promoted item, the promise is that it will lure more customers, and those customers will ultimately spend more on other items like chips and cereal. The Boise chain WinCo, for instance, charges 99 cents for eggs.

It sounds so logical. In reality, generally 25 to 50 percent of loss leaders don’t actually increase traffic or lead to ancillary purchases – they can actually lose money. Customer and basket data are key to understanding which loss leaders are losers and which are winners.

Price Sensitivity Trumps Competition: For many retailers, pricing strategy is based on the competitive price index. The retailer identifies a key competitive set and, often arbitrarily, establishes a target price position relative to the competitor – for example, pricing within 5 percent of Walmart. The problem is that this approach is not based on data and it treats all categories and items the same. Customer insights on price sensitivity, in combination with competitive price information and price compliance, would enable a data-driven pricing strategy, allowing retailers to best meet customer demands, Ross said.

Temporary Behavior Shifts Are Big Opportunities: A merchandising analyst noticed that sales from high-value customers decreased sharply at its primary location during the summer months. Further analyses revealed some customers were making purchases from stores more than 100 miles away, in beach communities. “Their baskets were very different, particularly when it came to pack sizes,” McVie said. “It was easy to conclude these shoppers were on vacation, and that they were not spending as much as they would have at the primary store.” To increase sales, the grocer sent shoppers information about the secondary stores as well as offers for smaller pack sizes and vacation items such as sunscreen. The result: The number of vacationers who shopped the secondary stores rose, and their baskets were bigger.

Private Matters: For many retailers, the typical approach to merchandising a private brand is to position it as a value-based alternative to major brands, establishing price points that are a percentage below the nationals. This is a sound strategy, but is not always enough. In many cases, private brands are in enough demand to warrant price-parity. Even when positioning the store brand as a value option, a better understanding of customer expectations and preference should result in more lucrative pricing. The Kroger Co., for example, stocks 14,000 private label items that are primarily produced in three tiers – value, banner and premium – and priced accordingly.

My takeaway from all of these: Look for the unexpected. The combination of customer insights derived from digital interactions, in-store technology and loyalty programs is unearthing new pearls of wisdom, and they are ours for the taking.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

May 9, 2016

How Target’s In-Store Clinics Are Reinventing Retail Wellness

Target’s new in-store wellness sections, called Connected Health, enable shoppers to track personal health information on handheld devices. In doing so, the mass merchant is reformulating health care by making it a consumable retail product – by way of smartphone. What does this mean for the future of retail?

If you want to take the temperature of retail’s future, the best place to do so may be in one of 550 Target stores.

These locations are where the $73.8 billion retailer is piloting its in-store wellness sections, called Connected Health. An evident offspring of its recent pharmacy partnership with CVS Health, these sections will include connected medical devices, such as blood pressure monitors, that can track and record participating shoppers’ wellness information via smartphone, according to the online site Twice.

Such centers may help Target track other shopper needs as well. With these dedicated Connected Health centers, Target is treading beyond offering wellness as a service, which many other retailers already do. Instead, Target is reformulating health care by making it a consumable retail product, by way of smartphone.

Such centers may help Target track other shopper needs as well. With these dedicated Connected Health centers, Target is treading beyond offering wellness as a service, which many other retailers already do. Instead, Target is reformulating health care by making it a consumable retail product, by way of smartphone.

“We know our guests are increasingly interested in these types of products,” a Target spokeswoman told Twice. “(We) will evaluate future growth plans based on their feedback and sales results.”

As any good retailer knows, the purchase of one retail product sheds light on the needs for others. Done well, a retailer can turn health care into wealth shares.

Healthy Connections, Practically

That future is coming fast. It’s been less than a year since Target announced plans to sell its 1,700 in-store pharmacy locations to CVS, a move that enables Target to focus on its core strength of merchandising while putting the task of health care into the hands of an expert, CVS.

The Connected Health sections will operate near or within those CVS-branded, in-store pharmacies and feature smartphone-connected blood-pressure monitors, scales and other medical-grade devices. The sections, being tested in 550 stores, each feature roughly 14 such products. Qardio, a maker of smartphone-connected scales and blood-pressure monitors, is anchoring the sections.

Target’s reasoning behind offering connected wellness, meanwhile, may be anchored in practicality. Or, to put it another way, it could be as simple as consumers want retail-based health options, and Target can do it.

Americans tend to seek after-hours medical care more often than those of almost any other industrialized nation, according to a 2010 survey of 11 countries, cited in the New York Times. Throw in a smartphone, and all the better to see them with. And with nearly two-thirds of Americans holding smartphones in 2015, the potential market has reached critical mass.

Walmart, Walgreens Also On Health Front

Amassing the potential of this market, meanwhile, is a goal of many retailers, though Target and

CVS (as well as Walgreens) are at the forefront of making health a retail cornerstone.

In addition to its pharmacy partnership with CVS, Target in 2015 made the complementary commitment to shift its food focus toward wellness, eliminating processed products in favor of organic, locally grown and natural foods.

Among other retailers in the wellness space:

• Walmart in April joined the InComm Healthcare & Affinity’s Enhanced Payment Platform, enabling members to participate in health plan-sponsored wellness programs and to receive benefits at Walmart stores.

• Also in April, Walgreens extended its partnership with St. Louis-based SSM Health Medical Group, which will own and operate 27 clinics within Walgreens stores in greater St. Louis. Walgreens also offers a loyalty program, called Balance Rewards, that encourages and rewards healthy activities.

• The Little Clinic, operated by Kroger Co., now operates 194 locations in 10 states. In March, Kroger announced it would add dietitians to some locations.

• While not a retailer, insurer John Hancock’s Vitality rewards program presents an opportunity for retailers to offer wellness benefits through a partnership. Vitality rewards its members’ shopping, entertainment and travel perks for living healthy lifestyles.

The connected capabilities of these efforts vary or are yet to be seen, but the fact that these retailers are leaping into the health care arena is likely as much about savings as it is customer service. A Towers Watson study noted that employee wellness programs save employers an average of $100 in health care costs per worker.

Targeting A Healthy Future

So what might this mean for the future of retail? As the Target spokeswoman said, “(We) will evaluate future growth plans based on their feedback and sales results.”

Connecting purchases to immediate health needs, especially on a voluntary basis, is among the few links retailers have yet to close when it comes to providing advisory capabilities to customers. And yet there is still much ground to cover.

There are many tools from which to gather the needed insights – wearable devices, fitness apps, wellness-based loyalty programs – but how do we connect all these databases of actual consumption habits? The pieces are all there, but is any organization stepping up to put the puzzle together, and in the process setting itself apart from the competition?

There would likely be security hurdles, as evidenced in the U.S. government’s recent attempts to hack into an Apple iPhone. Even back in 2011, the British government asked supermarket chain Tesco to share data from its Clubcard loyalty program to help overhaul the nation’s census. Tesco refused.

What this indicates is that the Holy Grail of wellness as a retail product is not just in monitoring, but also in laying the groundwork to connect the entire system, responsibly. Employers would like it and employees or consumers would probably like it too, if it lowered their health premiums.

What is clear to me is Target’s venture is adding urgency to the need for a reliable, robust resource that connects all of these databases of habit. Connected Health may represent the next degree to getting there.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

April 27, 2016

Kroger’s ClickList Fuels Points For Chain, But What’s In The Cards For Customers?

Kroger is extending its ClickList online-ordering service to new markets, but that does not mean a national rollout is in store for consumers . How the supermarket chain balances caution about online ordering against the customer’s need for convenience, as well as rising competition from Walmart and others.

After 133 years, the Kroger Co. is offering virtual shopping carts. The question now: Will they register?

Kroger’s plans to expand its online order and pickup service, ClickList, should save customers hours of time while delivering much convenience. The rewards it will deliver to the grocery chain, however, are less clear.

Photo credit: The Kroger Company

This is largely because Kroger’s adoption of digital commerce is notably conservative, and a little late. Kroger introduced ClickList, which enables shoppers to order online and pick up at the store, in May 2015. The service is now available in 47 locations, and 40 are planned for Texas by year’s end. That’s a minor fraction of Kroger’s 2,775 stores, and the service has yet to be made available as a mobile app.

Meantime, back-yard competitors from Walmart to Amazon have entered the fray, likely causing Kroger to balance its caution against their might. Data will play a key role in delivering the desired results, which are beginning to roll in. Kroger customers in Ohio, where it is based, appear to be embracing it.

“Huge timesaver for the working mom, and no more dragging fighting kids through the grocery store,” one customer wrote on Kroger’s Facebook page, according to a February story in BusinessInsider.

Online Purchase Delivery

Kroger did not go fighting into digital commerce. Rather, it acquired the ClickList technology through its 2013 purchase of Harris Teeter, the southeastern grocery chain.

This inheritance provided Kroger with the necessary data on which to build. Roughly 40,000 items are available on ClickList, and products are hand-selected so orders are customized – how ripe the bananas should be, for example.

Further, a “favorites” feature keeps track of the most commonly purchased items for easy re-ordering. After orders are placed, shoppers retrieve them from a designated drive-thru within a reserved one-hour period.

The fee is $4.95, which could help offset the expense. Selecting and bagging orders requires employee time, and there are digital infrastructure costs. Whether the order fee will become a barrier to entry among consumers, let alone cover the expense for Kroger, may be a consideration at this early stage in the rollout.

Tellingly, Kroger is waiving the fee on a customer’s first three orders.

“Let The Customer Decide”

Such tests are a must for ClickList’s expansion, as online grocery ordering is becoming increasingly available among Kroger’s rivals. AmazonFresh is methodically expanding its next-day grocery delivery options, and Walmart’s click-and-collect service is extending to 30 cities, about 200 stores nationwide. Unlike Kroger’s service, Walmart’s is free.

Further, regional chains offer similar services. Giant Eagle’s Curbside Express, which is fee based, is available at 11 stores in central Ohio, where Kroger competes. In 12 weeks, sales at those 11 Giant Eagle stores quadrupled, according to the Columbus Dispatch.

In a fourth-quarter earnings call with analysts, Kroger CEO W. Rodney McMullen said customers want to shop in multiple ways, seamlessly.

“We’re really striving to make sure that we have a model where we can let the customer decide how they want to engage with us versus us deciding that,” he said, adding: “We feel really good about positioning us to address where the customer is headed versus where they’ve been.”

Proceeding With Caution

Where the customer is headed, however, is not guaranteed, though American merchants can learn from European operators that have been offering online ordering for years.

About one quarter of consumers worldwide shop for groceries online, according to a 2015 Nielsen study. In Europe, nearly one in six shoppers (16 percent) purchased groceries online in 2014, up from 13 percent in 2013, according to the research firm Sydney.

In the United States, the figures trend smaller. Of the $795 billion that Americans are expected to spend on food and drinks in 2016, just $33 billion (4 percent) will come through online orders, according to research from Cowen & Co., as cited on Bloomberg. The discrepancy between the U.S. and Europe is likely due to adoption. Availability may play a role, but it is hard to believe U.S. consumers would not adopt to at least the same levels as in Europe.

Still, the U.S. figure is sizeable enough on which to take a chance, particularly in a market where consumers are adapting to online ordering at exponential rates. Kroger may lose money on ClickList short term, but future sales could depend on it.

Back To Basics With Data

To make the most of its investment, and the customer experience, Kroger is evidently using data insights.

Such efforts may be why Morgan Stanley recently identified Kroger as the best-positioned retail chain for gaining online grocery sales. It may be a little later to the screen than others, but what matters is that the virtual carts register. Among the fundamentals Kroger is employing to really make it work:

Playing favorites: ClickList’s favorites list tracks and stores frequently ordered items so customers can more quickly find and add them to their baskets. What adds relevance to the feature is its ability to change week by week based on the items a shopper purchases, and to alert shoppers if they will soon need to replenish items (or benefit from complementary products).

Initiation: By waiving the fee on the first three ClickList orders, Kroger is inviting customers to test the service while at the same time providing itself the opportunity to understand the adoption process. For example, analyzing the profiles of those who stop ordering after the third purchase (or first) enables Kroger to identify the characteristics of shoppers who are wiling to pay for the service, as well as pain points that prevent others from returning for a second time. Plus, the flat fee probably encourages some shoppers to order a few more items, since the sum won’t affect the charge.

Purchase data: Kroger has a vast database of customer information from its Plus Card rewards program, but it did not get cocky when it came to implementing its online ordering service. It accessed the technology through the much smaller Harris Teeter and no doubt relied on the data insights to track what worked and what did not.

If Kroger’s ClickList lives up to Morgan Stanley’s prediction, it may be the precursor to the future of grocery shopping – evolving from click and pick-up to a true shopping assistant that manages not only the food ordering but also provides additional product information, such as nutritional content, whether the food is organic or even where it was produced, farmed or raised.

Bottom line, grocery shopping has the potential to become enabled in many ways, offering more informational complexity yet being easier to execute. This future, however, will test the boundaries between content and context. Supermarket operators will need to get both right to make this work.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

April 25, 2016

My (Kid’s) Generation: 5 Ways Today’s Tweens Are Changing Retail

With an estimated spending power of $200 billion, tweens are influencing household decisions and reshaping much of retail. How a generation that grew up on Instagram and smartphones is influencing fashion and even food cycles, and how to get into their heads.

Few words should matter as much to retailers today as this one: bra.

This single piece of clothing is one of the most thought-about items for what are likely the most influential shoppers today: tweens, and in particular, tween girls. This generation, defined as kids between 9 and 13 years old, has an estimated spending power of $200 billion, according to one 2013 study. However, to capture this critically important consumer group, retailers need to get into their collective heads and understand what is rocking their world right now.

True, there is more on their minds than undergarments. Tweens grew up on smartphones, seasonal Frappuccinos and Instagram – all experiential attractions that contribute to accelerating fashion and shopping tends. Combine that with their potential spending power and this generation is going to reshape retail in every category, from bras to lip balm to baked goods.

In short, whether the retailer is Justice or Trader Joe’s, its standing among tweens today could determine its income statements in coming years.

Entertain Us

Let’s not forget that many of the products that become relevant to tweens today are products they will purchase for decades. For this reason alone, tweens should be an essential chapter in the retail playbook. Retailers must continuously adjust their strategies to fit in with the next generation of working consumers.

Following are five crucial ways in which teens are reshaping retail.

Smartphones are the new plaid: Retailers compete with smartphones. Period. Mobile devices account for 41 percent of all screen time for tweens, and experiencing their formative years through the lenses of Instagram and Snapchat (meaning their smartphones) means developing appetites for fast-turning, tailored engagement that also is shareable. Merchants are striving to be more relevant in this capacity of sharing experiences among younger consumers. Macy’s One Below concept in Manhattan, for example, offers young female consumers a hair blowout bar, 3-D printed accessories and smartphone charging stations. It targets 13 to 22 year olds, but these services could easily be extended to aspirational tweens through limited events, such as parties.

The mall is soooo 2007: Thank digital devices for this shift. Malls can be big and clunky, but a few interactive screens or virtual retail experiences could capture young imaginations without blowing the balance sheet. Consider this harbinger: Mall traffic by teen visitors declined by 30 percent from 2004 to 2014, according to the spring 2014 report “Taking Stock with Teens,” by Piper Jaffray Cos. The more than 7,500 respondents averaged 29 annual visits to the mall, down from 38 in 2007. The upshot: If retailers fail to connect with tweens via digital experiences, then they are missing out in sales.

The mall is soooo 2007: Thank digital devices for this shift. Malls can be big and clunky, but a few interactive screens or virtual retail experiences could capture young imaginations without blowing the balance sheet. Consider this harbinger: Mall traffic by teen visitors declined by 30 percent from 2004 to 2014, according to the spring 2014 report “Taking Stock with Teens,” by Piper Jaffray Cos. The more than 7,500 respondents averaged 29 annual visits to the mall, down from 38 in 2007. The upshot: If retailers fail to connect with tweens via digital experiences, then they are missing out in sales.

They are of two markets: Tweens, particularly female tweens, have strong opinions about what they wear. However, they usually shop with their moms, who must approve the purchases. To win them both, retailers strive to carry products that nail what I’ll call modest maturity – a mix of youthful relevance and age-appropriate practicality. Simple rule of thumb: Do not offend the parent. Anyone who has experienced the wince-inducing sight of her 12-year-old daughter donning platforms for the first time understands this balance. Perhaps this is why Nike ranks as the No. 1 preferred clothing brand among teens, who likely were indoctrinated as tweens – it can hold that balance.

They are brand-agnostic: Tweens, particularly tween girls, are at the age when they begin to establish their own sense of style, which is influenced by social media and the Internet. At the same time, they are establishing a young lifestyle and want to make their own looks to reflect it. This means they are more likely going to be interested in what is on trend and is relevant to their idols than the name on the label. This could be hazardous to specialty chains, but if a key personality (Taylor Swift, Kendall K.) is wearing it or eating it, then it is a safe bet that tweens will want it, too.

They don’t like seams – for anyone: At a time when we can pre-order our café Americano by app, the need for speed should not be surprising. Adults do help set such expectations, but tweens tend to be more empathetic than their harried parents, noting ways in which the retail experience can be seamless for their peers as well as themselves. A recent study by the British department store John Lewis, for example, revealed that tweens would like to see more efficient discounting as well as language translation assistance, the latter to help global visitors.

Regardless of what market group a retailer is after, it is essential that it recognize how its members think and behave and then adapt its merchandising and marketing approaches to capture their attention. Tweens are no different than other market segments, but the way they see and experience the world is different. Recognizing that purchases they make today may influence the bonds they form with brands for many years to come is not the meaningful insight. Rather, understanding that their approach to shopping could be on the forefront of what consumerism may be in the future – that should change the way retailers head off the challenge.

From a marketing standpoint, this means inviting tweens to share their collective voice and to analyze shopper data not only for key trends, but also for what is missing. What can be learned from the items shoppers are not buying, or from the hours they are no longer visiting?

It can be surprising what the actions of a 10-year-old mean to consumerism, but it is practical knowledge for an ever-evolving industry such as retail.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

April 19, 2016

Three-Pod Might: What Nordstrom’s Festival Tour Means For Retail

Nordstrom’s return to the festival circuit with a series of pop-up retail experiences is an endorsement of temporary events for engaging consumers long-term. A look into the appeal of festivals for retail, and three acts for ensuring a harmonious experience.

There may not be a grand piano at the Beale Street Music Festival, but that won’t prevent Nordstrom from creating resonance with its shoppers.

The department store chain, known as much for its high-touch service as its piano players, is en route to Beale Street in what one can call its second annual Pop-upalooza – a series of retail experiences that are popping up at major outdoor entertainment events this spring.

Nordstrom is traveling to four events – it launched the tour at South by Southwest (SXSW) – with several retail “pods,” each of which houses a distinct experience. Visitors can have their personal auras photographed and interpreted; they can refresh their looks in the beauty pod, equipped with dry shampoo, cosmetics and fragrance; or they can have their photos taken in trendy settings such as New York or Palm Springs, Calif., in the GIF photo booth.

That Nordstrom is returning to the road is an endorsement of the viability of short-term events for engaging consumers in different, unexpected settings. However, the service-attentive chain is not the first to identify the benefits of festivals for pop-up engagement and loyalty. Other merchants have been using events to create emotional ties for years.

But retailers,be warned: Aiming to meet that impulse comes with the risk of overstepping your welcome.

“We Buy With Emotion”

Since the creation of glow sticks and tour posters, music events have proved fertile ground for commerce. It’s logical – the concert is a once-in-a-lifetime event, and those who attend want to commemorate it.

Transferring that desire to larger festivals is therefore natural, but execution should be in tune with the vibe. In short, set promotions aside – it’s better to attend in an experiential setting that festivalgoers remember and relate to the brand.

Some of the best examples are presented by those longest in the field, including Montreal-based Intellitix. A leader in technology-based engagement for live events, Intellitix provides RFID wristbands and works with sponsors to reach attendees through experiences, not advertising. The philosophy: Sentiment is more effective than bargaining when it comes to encouraging desired behavior.

“We don’t buy with objects, we buy with emotion,” Intellitix CEO and founder Serge Grimaux told COLLOQUY in 2014.

At the 2012 Bonnaroo Musical & Arts Festival in Manchester, Tenn., for example, Ford Motor Co. and Intellitix collaborated on a drawing for a Ford Escape. Entry information was stored on participants’ wristbands, which they could click at one of 22 stations to increase their chances of winning. (The stations were all located near stages, so as not to distract from the concerts.) Of the roughly 70,000 attendees who entered the contest, almost 5,000 gave Ford permission to send email communications after the event.

The Coachella Valley Music and Arts Annual Festival has for years hosted pop-up retailers, including Lacoste, Guess and H&M, the latter of which has partnered with Coachella on a co-branded fashion collection. In 2015, Pandora jewelry hosted runway fashion shows that featured specially created pieces.

Nordstrom is not hosting fashion shows per se, but it is inviting festival attendees to create their own personal fashion shoots, activities that not only are fun and therefore more memorable, but also shareable.

“By providing a relevant Nordstrom experience at these festivals, we hope to connect with customers in the festival environment and add to her festival experience,” Nordstrom spokeswoman Pamela Lopez told Luxury Daily.

Nordstrom’s next stop, Beale Street Music Festival, is the last weekend of April. Then it travels on to Shaky Knees in Atlanta and BottleRock in Napa.

Aiming For An Encore, With Three Acts

Many merchants get shaky knees at the thought of investing in such short-term events. The logistics can be daunting and the payoff, not only in terms of profit but long-term engagement, is not guaranteed. How can consumers commit long-term when the event lasts just days?

To ask such questions means one has not reckoned with the increasingly immediate nature of retail, and the importance of emotional experiences. Following are three acts for giving a festival pop-up staying power.

Be community-minded: People drawn to festivals are part of a limited-time community, but they likely have a hard-wired sense of solidarity. Retailers can become part of this community by investing in festival activities that visibly benefit attendees. They can, for instance, sponsor litter clean-up or first aid stations. Visitors will likely remember such efforts, leading to brand affinity.

Recruit festive people: Ideally, a retailer can populate its festival events with existing employees who understand its mission and brand promise. If not, it should recruit its best associates to help vet the candidates. Note, employees are motivated in similar ways as customers – through memorable experiences and time-relevant perks. Retailers can award bonuses or merchant credits to those who hit event goals, such as increasing traffic at slow times.

Let the activities inform the future: The memory of relevant moments can remain with consumers for years. Likewise, a consumer’s activities can help retailers remain more engaging for months to come. Merchants that gather data from events, through a wristband, loyalty program or other opted-in customer-identifying tool, can use the insights to modify in-store events and to shape future festival attractions.

Lastly, be surprising. Nordstrom’s high-end reputation may not make it a predictable fit for music festivals, but this alone could make its presence enough of a curiosity to draw attention, and delight.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

April 7, 2016

The Internet Of Things To Come: How Nespresso, Apple, Nest Grind Out Predictability

The adaptation of digital technology across products, from clothing to coffee, is slowly reshaping what today’s consumers expect from brands and their retail experiences. Here’s one example, by Nespresso, of how the Internet of Things influences not only new consumer behaviors, but also revenue streams.

Smartphone technology can warm my feet, water my grass and brew me a latte machiatto. What it can do for retailers, however, may still be brewing in the minds of consumers.

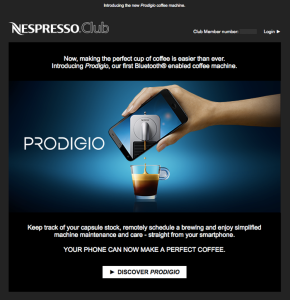

Source: Nespresso

Increasingly, retail products are exploring the Internet of Things (IoT), or the ability of everyday objects to receive and send information through network connections. As more brands adapt this technology, it has the potential to provide many benefits to consumers, but it also has the capacity to change retail, because the technology also provides consumers the means to filter out the exceptional experience from the mere expected one.

An apt case in point arrived to me recently courtesy of Nespresso, the home-order coffee service. The online operator of the Nespresso Club has introduced a Bluetooth-enabled coffee machine, Prodigio, which works with my smartphone to brew my coffee, track my replenishment needs and simplify machine maintenance.

Such digital technology will slowly reshape what today’s consumers expect from IoT-enhanced products – and in turn influence their retail expectations – in the near future. One compelling finding reveals the IoT’s power to change shopper behavior: 27 percent of consumers who said they used to hate shopping now love it because of their wearable (IoT) devices such as smart watches, according to a survey of more than 1,000 consumers by COLLOQUY. Fifteen percent of those surveyed said they look forward to expanding their use of wearable technology.

Utility + Service, A Prodigious Blend

Wearables such as the Apple Watch may not have surpassed mainstream consumption just yet, but the IoT is approaching it, fast. For me, the technology may soon expand to my daily cup o’ Joe.

For the unfamiliar, Nespresso is an online service that supplies each member a compact brewer and a wide offering of color-coded coffee pods. Since joining the Nespresso Club in 2010, I’ve noticed the brand’s steady efforts to amp up the customer experience.

In 2015, for instance, I received a customized package from Nespresso that included two sleeves of coffee pods, neither of which I’ve tried, but both intense blends I tend to like. A note with the package explained the pods were especially selected for me, making for an experience I will remember.

Now Nespresso is giving me the ability to better control that experience with Prodigio, its first connected machine. Through its app, Prodigio could prepare specific brews on a schedule, alert me when my stock of pods gets low (I can reorder with the touch of a button) and advise when the machine needs to be cleaned of built-up water impurities, or descaled.

Not bad for a little coffee machine. The scheduling feature is not substantially different from the good old-fashioned timer on a coffee maker, but it’s cooler because I get to set it via the app. The pod tracker and reorder function is a great mechanism for enhancing utility and sales – it’s just so darn easy to tap the re-order button, and fun to choose a new blend while on the fly. And maintenance notifications not only ensure the machine operates well, but also encourage customers to order more descaling services, introducing the opportunity to enhance a retail revenue stream.

If Nespresso would just close the loop to auto replenishment, then we would really have something.

We Want More

And that desire alone speaks volumes to what retailers can expect from progressing consumer expectations.

It’s the old “give them an inch” axiom, though perhaps in this case we can apply it to coffee: Give them a short pour and they’ll ask for a long one (or lungo). As the little girl in the AT&T commercial put it: We want more, we want more.

Today, dozens of branded items, including an array of wearables, use the IoT. However, it seems to me that niche products have the greatest potential to redefine the customer experience now. Products such as Droplet, a smart watering system that uses weather station data, soil samples and plant information to determine when, where and how much water to dispense. Or Digitsole’s Smartshoes, smartphone-controlled shoes with adjustable heating, shock absorbency and tightening.

Whether newly created products or existing ones adapt the Internet of Things, three key qualities are essential if a retailer wants to build on its successes and introduce this sort of sizzle into its own relationships:

The ability to anticipate: The products foresee a practical or relevant consumer need and provide a simple, but somewhat shiny, solution that provides help along the way. Nest, the home climate-control device, markets itself not simply as an automated solution to the thermostat, but as a lifestyle accessory that complements the contemporary home.

The ability to earn trust: Retailers and manufacturers that capitalize on the IoT rely heavily on hardware to deliver, but trust secures customer engagement. Apple, for example, markets trust as a key product feature. This is necessary, because without trust, consumers would not provide the personal information required for Apple to make the device-to-device connections that sell its products. Earning that trust means delivering (or over-delivering) on the promise of service and easy use.

The ability to jump: If 27 percent of consumers who once hated shopping now love it because of the Internet of Things, then retailers have at their fingertips a powerful purchase influencer – if used correctly. With the right analytical tools, they should be able to identify customer behavioral patterns that hint at unmet needs. This will only work, however, if the IoT technology is easily integrated into the retailer’s own marketing and replenishment systems, so retailers have to ensure the product is built to suit this consideration.

The trick, as always, is wowing customers with products and services they do not expect. Consumers have an ability to adapt to technology faster than technology is able to advance itself – possibly faster than the time it takes to replace my lungo coffee pods order, as Nespresso has made evident to me.

The Internet of Things itself is not good enough. It must be the Internet of things to come.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

March 21, 2016

Restoration Hardware’s Burning Question: 3 Tips For Rescuing The Customer Experience

The CEO of Restoration Hardware captured lots of attention for the message he sent to staff, which compared operations to a burning building. Some wondered if the missive went too far, but it really signifies the urgent role of employees to help rescue the customer experience through engagement. Three ways to motivate change in employees.

“We have a leadership culture, not a followship culture.”

If the leader of the free world said this, he (or she) would get a standing ovation. If the coach of a football team said it, the players would storm onto the field in full roar. When the CEO of a successful retail chain says it, it is to justify his belief in the inescapable role of employees in customer engagement and, ergo, corporate survivability. Damn the formalities.

Restoration Hardware CEO Gary Friedman. Photo credit: Restoration Hardware

The CEO, Gary Friedman, made the “followship culture” statement to Bloomberg in an interview that explained a memo he had dispatched to all employees of Restoration Hardware. His message captured lots of interest for its straightforward and colorful language – at one point he compared company operations to a burning building, and Restoration Hardware’s customers to the victims.

There was no actual fire, but there was a lot of smoke, and that caused some hand-wringers to question whether Friedman went too far. As if honest, from-my-gut-to-yours discussions among team members can no longer be tolerated.

To me, the fact that he had to explain the events at all signifies the urgent role of employees to rescue the endangered customer experience. If employees are not in it to win it, Friedman more or less wrote, they should be out. And why not? A retailer’s future balances on those first encounters between its employees and a potential customer – whether she will spend $25,000 in the coming years, or zero.

If anything, I believe the Friedman memo presents an opportunity to examine some key motivations behind required change, and the needed steps to building a retail culture that is rooted in a customer service environment.

Employees + Motivation = Customer Experience.

I will agree with one observation: Friedman knows how to turn heads with the pen.

Among the statements of his message to staff (the caps were his): “WE CANNOT AFFORD TO LOSE ONE SINGLE CUSTOMER. NOT ONE. YOU WILL NEVER GET IN TROUBLE FOR MAKING A DECISION TO DELIGHT OUR CUSTOMERS. YOU WILL, HOWEVER, LOSE YOUR JOB IF YOU DON’T.”

There’s little argument that employees are a critical factor in determining a retailer’s return on investment. Impassioned employees are easy to spot, and their positivity is infectious – it inspires customer engagement and, ideally, loyalty. No single program can do this alone; it requires total buy-in from the staff. And to get total buy-in, an organization has to prove it has its workers’ backs.

Let’s look at Friedman’s statement in a different way: He is giving his workers (likely through their managers) the freedom to make their own decisions to delight the customer. If an employee doesn’t have the interest or enthusiasm, then it just isn’t a good fit. It’s retail 101.

Genuinely engaged employees deliver something that strategy never will, and that’s passion. But it is the employer’s responsibility to provide its workers with the resources they need to make such important, better-informed decisions in real time.

Three Ways to Motivate Change

Passion is a heady word for retail, I know. Many would be thrilled with genuine enthusiasm, and that’s fine. So how to get it? It begins by motivating change among the ranks:

Back up autonomy with recognition. Friedman told employees they would never get in trouble for making decisions to delight customers. They could, however, get fired. Fear is a proven motivator, but when it comes to creating passion, a more positive approach would likely yield a more authentic outcome. Retailers can make a point of highlighting these employee decisions on a regular basis, perhaps with quarterly celebrations that invite workers to share their own tips.

Inspire feedback: The customer-employee relationship is a collaborative one, and customers would likely welcome the opportunity to play an active role in the company’s success – if it is clear it will benefit their own experiences. We’re talking more than mere email surveys, here. Retailers can send their most frequent guests invitations to coffee with key managers to discuss the good, bad and the ugly. Processes can be implemented to find out why, gently, some would-be customers leave empty-handed (a quick exit interview or postcard-sized feedback form may do the trick).

Change the culture: If retail managers want to know what is working and what is not, they should ask the people who see it everyday: the frontline associates. The payoff to building a sales culture based on customer engagement and a service environment is the feedback from those associates, which makes for the best test lab a retailer could see.

Innovation involves making things real, and in retail, once that product is on the floor, that’s as real as it gets. The customer, via engaged sales associates, will provide feedback on why products aren’t selling and ultimately make it clear to the merchant.

The lament of most retail organizations is location, location, location. The lament of the customer engagement culture, however, is listen, listen, listen – even if that comes from a combination of data, insights and feedback from associates.

This, for many, should be the burning issue.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

Bryan Pearson's Blog

- Bryan Pearson's profile

- 4 followers