Bryan Pearson's Blog, page 17

November 21, 2016

How To Nail The Retail Experience In 60 Seconds

Photo: Shutterstock

I enter a store pretty much the same way I enter my kitchen.

I know why I’m there, I tend to follow the same path to the refrigerator every time and if I don’t see what I want fairly quickly, I close it and leave.

All in all, that takes about 60 seconds, which may be more than the average consumer gives a retailer upon entering a store or website. Those first few seconds can spell the difference between a long-term customer and zilch.

The retail experience should register with the senses, including — sight, smell and sound. And the product should be in easy reach. (Why so many retailers continue to hang the large clothing on the bottom rack is a mystery on par with why hot dogs are sold in six-packs and buns in eight-packs.)

I was curious to hear what real retailers and experts suggest. So I opened the question to all, from large marketing organizations to independent shop owners. Following are some of their responses, divided by in-store and online (with a bit of overlap)

I enter a store pretty much the same way I enter my kitchen.

I know why I’m there, I tend to follow the same path to the refrigerator every time and if I don’t see what I want fairly quickly, I close it and leave.

All in all, that takes about 60 seconds, which may be more than the average consumer gives a retailer upon entering a store or website. Those first few seconds can spell the difference between a long-term customer and zilch.

The retail experience should register with the senses, including — sight, smell and sound. And the product should be in easy reach. (Why so many retailers continue to hang the large clothing on the bottom rack is a mystery on par with why hot dogs are sold in six-packs and buns in eight-packs.)

I was curious to hear what real retailers and experts suggest. So I opened the question to all, from large marketing organizations to independent shop owners. Following are some of their responses, divided by in-store and online (with a bit of overlap).

In The Store: Show(room) Time!

“For fashion or sports, what’s crucial is that first 20 feet into the store, the display that is on center is the best and highest quality of that brand. If you go into a Nike store, there’s usually a dramatic display of the latest technology leveraged in their footwear at the moment and it’s accompanied by a very sculpture-like mannequin.” — Tim Magill, design principal at retail architecture firm 5+design, Los Angeles.

“We have embraced a ‘red carpet’ sort of approach where our customer service representatives meet and greet our customers as they reach the end of the carpet of our store entrance. This has proven to be successful (as) it shows our customers how important their patronage is to us.” — Steve Michael, executive vice president, enterprise development, Phone-n-Fix, Sioux Falls, South Dakota

“It’s all about trust, so get your digital and physical presence aligned — customers hate price and service differences.” — Joe Carella, assistant dean at Eller College of Management, University of Arizona

“Offer customers craft beer or wine tastings in-store with the option of buying a pint or glass to drink as you go around the store. Lowes Foods (North Carolina) provides this. Also, provide reliable in-store Wi-Fi.” — Graeme McVie, vice president of business development at Precima retail analytics

“Ply them with sweets! Generously offering free samples to customers entering our stores translated directly into increased sales. More importantly, it starts off a relationship loop with our customers that keeps them delighted from store to (website) and back again.” — Sid Gupta, CEO and founder of Lolli and Pops national sweet shop

“Consider ‘retailtainment’ experiences and interactions that will both exceed customer expectations and add a level of unexpected surprise and delight.” — Shannon Andrick, vice president of marketing advancement, Alliance Data Card Services, provider of retailer credit card programs

“I fell in love with a pair of pants that weren’t available in tall length. I ordered them anyway, but when they arrived they were way too short, so I took them to the store to return them. At the register, the associate scanned my receipt and the system recognized me as a tall customer — and alerted the associate that the item was now in stock in my size! He offered to have it shipped to my home, so I ordered five pairs! This seamless and streamlined use of data created an experience that delighted me, all in 60 seconds.”— Lucinda Duncalfe, CEO of Monetate, a Philadelphia-based multi-channel personalization platform.

Online: High Touch On Screen

“Shorten the path to cart. At every step/page, you’ll lose 30% of your audience.” — Josh Blanton, CMO and co-founder of Next Steps Digital

“Think mobile first. Make sure your mobile website is responsive and you can purchase in less than three clicks. Show pricing; show shipping estimates and charges to reduce fallout and returns.” — Carrie Chitsey Wells, CEO of BLK24, mobile strategy consultant

“The most critical component of retailing, especially online, is photography. We never use stock photography and there’s always ‘buyer intent’ behind each image.” — Adrian Salamunovic, cofounder and chief experience officer of Canvaspop.com

“If you don’t make the first three seconds of your visitors’ search count, you will lose the chance to sell to them in the next 57 seconds.” — Brock Murray, co-founder and COO of seoplus+, Ottawa, Canada

“An available inventory count listed along with individual products, as well as a real-time countdown to entice orders placed before xx:00 o’clock ship the same day. (Both are) great ways to not only capitalize on customers’ buying impulses, but also add credibility.” — Jake Rheude, director of business development for Red Stag Fulfillment, Knoxville, Tennessee

For all retailers, wherever they operate, I’ll close with this simple advice from Brad Schweig, vice president of operations at Sunnyland Furniture in Dallas, Texas: “Treat the customer like you would want to be treated. Period!”

Most retailers should nail that in 60 seconds.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

November 16, 2016

How To Improve Online Grocery: Learning From Kroger, Walmart

2016 Associated Press

We can’t squeeze a digital lemon, can’t smell a two-dimensional baguette and, no matter how hard we might try, can’t sample a cyber smoked ham. But should that mean online grocery delivery is dead in the water?

I suspect not. But recent figures are not encouraging. Online grocery shopping, what one would consider the height of convenience for time-starved consumers, is sinking. Shopper penetration among major supermarket brands declined to 11% in 2016 from 16% in 2015, according to the 2016 Food and Beverage Study from TAB Analytics, which serves the consumer packaged goods industry.

This is despite increased investments in grocery delivery, from Walmart’s click-and-collect service to Amazon’s next-day grocery delivery to Kroger’s curbside pickup. The reasons, according to the 1,000 consumers surveyed for the report, are logical and confounding:

A desire to see the food, especially perishables and other fresh items.

Higher prices for most online groceries.

No delivery service or slow delivery time.

Lots of people actually like the brick-and-mortar shopping experience.

All of which translates to a woeful loyalty rate of just 15%, the report states. That compares with a loyalty rate of 75% for brick-and-mortar supermarkets.

“The major stumbling block (to online grocery) is (retailers’) failure to understand that weakness in online grocery is a demand problem, not a supply issue,” TAB CEO Kurt Jetta told Retail Leader. “No amount of drones, curbside pickup expansion, Uber alliances and new warehouses can fix the fundamental issue that consumers currently don’t like to shop online for grocery.”

It’s worth noting that online grocery shopping figures are sharply different elsewhere in the world. About one-quarter of consumers worldwide shop for groceries online, according to a 2015 Nielsen study. In Europe, nearly one in six shoppers (16%) purchased groceries online in 2014, up from 13% in 2013, according to the research firm Sydney. That’s a reversal of what is happening in the states.

For U.S. supermarkets, it comes down to two choices: Cut bait or right their ships. Fortunately, the report includes a few bright spots to guide them.

Four Tips For Grocery Delivery

In the TAB study, 31% of the respondents said they had purchased consumables at an online outlet at least once, down from 34% in 2015. For those that want to stay the course, a few fundamental rules should be followed.

Integrate rewards programs: While consumer loyalty to online grocery shopping is just 15%, it is actually higher than in 2015, when it was 11%. This is all the encouragement I’d need to invest more in integrating my rewards program into online services. Starbucks offers a range of great examples: surprise double-point days, bonus points for purchasing a certain number of items within given dates and extra points for combo purchases. Supermarkets could, for instance, offer double points on all online orders placed on the three Fridays leading up to Thanksgiving.

Keep the store in the mix: Despite an overall decline in online grocery shopping, the option to shop online and pick up at the store has grown slightly, the study found. This has led to a small increase in the number of those who shop online six times or more a year (4.5% from 3.9%). The bump may result from Walmart’s and Kroger’s recent entry into online ordering. Yet at the same time, the report warns, Target abandoned its effort. This may have been a timing decision, or a choice to seek better execution. As Kroger CEO W. Rodney McMullen explained to analysts in a fourth-quarter earnings call, customers do want to shop in multiple ways, they just want to do so seamlessly.

Know your customer: Of all the online grocery sellers, only Amazon saw an increase in its grocery sales, to 16% from 14%. Walmart, which offers free pickup service, was flat at 12%, according to the TAB report. Ravi Jariwala, senior director of Wal-Mart e-commerce, disputes the 12% figure, stating that Walmart has extended its online grocery efforts from five markets in the fall of 2015 to more than 100 markets today. He declined to provide sales for e-commerce. Amazon has mastered the art of online product promotion, matching specific consumers with products they would likely want based on previous purchasing behavior. It also reminds shoppers of items they have purchased that likely will need to be replenished, such as detergent or shampoo. Through reward programs, supermarket companies can use unique identifiers to track shopper purchases and similarly alert them, through an online ordering service, of pending product needs.

Don’t lose site of the aisles: No retailer should ever compromise its foundation in favor of an add-on. Brick-and-mortar supermarkets ranked as the most popular venues for grocery purchases by a landslide in the TAB report, accounting for 78% of sales in 2016. So in addition to keeping the store in the online-ordering mix, it is advisable to maintain investments in in-store technology, staff and appearance. It also is essential to ensure the customer experience in the stores is smooth and pleasurable. Chances are if she likes being in the store, she is more likely to stop by – even if she also orders online.

This may especially be the case if the store offers free samples of smoked ham. Until online ordering can offer that, the store will have that edge.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

November 14, 2016

5 Rules For A Retail Town Square: What Apple, Whole Foods Can Teach Us

Customers check out on the opening day of the 365 by Whole Foods Market store in the Silver Lake neighborhood of Los Angeles, California. (Patrick T. Fallon/Bloomberg)

Here’s a potential formula for retail of the future: One Apple squared equals a community experience minus the traditional sales space.

I am talking town square, as was used to describe Apple’s new concept stores. The plus? That depends on how well the formula is executed, and Apple may be among those setting the standard, along with Whole Foods’ new stores, called 365.

Apple’s next-generation stores won’t exist merely to sell computers, Angela Ahrendts, Apple’s senior vice president of retail, told attendees at Fortune’s Most Powerful Women Summit. It will instead focus on “enriching lives,” with classes and workshops for children, adults and teachers, as well as visits from artists and musicians. By the end of 2016, Apple plans to operate 95 such next-generation stores.

Whole Foods, meantime, is pursuing a similar “Main Street” retail approach with its 365 by Whole Foods stores. These include independent vendors called “Friends of 365,” which could range from local juice bars to bike repairers. Whole Foods operates three of these 365 stores and plans to open an additional 16 in 2017 and beyond.

The sum of these efforts may be greater than mere store numbers, however. Indeed, two influential retailers plus two similar concepts could equal forced change among competitors. And this could transform what consumers come to expect at the store.

Replacing Product With Experience

If Apple and Whole Foods’ community-type store concepts are to take hold more broadly, the retail experience could be rooted not in product, but in how a retailer positions the lifestyle nature of its brand. This would mean a potentially major change in how retail space is used.

And a change in how retail space is used would alter the overall experience.

Picture department stores replacing their first-floor cosmetic counters with workshop spaces where shoppers can learn makeup design, style tips or jewelry making. The actual selling could take place on the upper floors or at the store perimeter.

Extend this experience to mobile devices and the implication is the retailer’s focus on product would have to shift. Would this mean product is to be upstaged by experience? I would argue that product plays a key role in making the experience.

5 Rules For A Town Square

For that town square experience to work, regardless of what one is selling, there need to be rules of authenticity. Following are five guidelines for operating a real “Main Street” store that balances the products we would like with the experiences we seek.

1: Be open to all: A town square, or a Main Street, serves many functions and therefore requires a variety of complementary product offerings and attractions, from bakeries to record stores. Similarly, Whole Foods’ 365 stores complement its products with those of independent businesses. “We’re connecting you with really incredible food, products, services and experiences. Even if they don’t come from us,” Whole Foods writes on its Friends page. Indeed, Whole Foods 365 is not limiting its “friends” to food merchants; it invites all independent business owners (including record shop operators) to apply.

2: Be a familiar (not forceful) face: What distinguishes the Whole Foods and Apple concepts from other store-within-store brand partnerships (think CVS and Target or J.C. Penney and Sephora) is the inclusion of local, familiar faces. Bringing a town musician into an Apple store means drawing the musician’s fans and followers, which could be a great way to capture new sales. But tread deftly. Visitors should not feel pressured into buying anything. It’s like wine stores that offer tastings; a good number of tasters, but not all, will buy a bottle or three. The tradeoff is the store has created a local gathering spot that makes people feel happy, and that feeling oftentimes translates into positive word of mouth.

3: Be a good neighbor: Being a town square retailer means shifting the product focus to local players. This can be challenging if the business partnership does not work out, particularly because visitors may be more loyal to the neighborhood vendor than to the national brand. For this reason, the larger retailer, the “landlord,” should make the terms and conditions clear and easy to understand. Whole Foods’ Friends, for example, must agree to meet Whole Foods Market quality standards before they set up shop in its stores. Further, they are responsible for all operations, including staffing and making the space their own.

4: Location, location, location: There’s a reason gazebos are popular centerpieces of town squares; they are the congregation areas. Similarly, retailers that want to create communities within their walls should be mindful of where to locate their attractions and products. Removing the sales space from workshop areas diminishes the risk of visitors feeling they are being marketed to. Yes, retailers do need to sell products to survive, but it does not have to be a hard sell. Apple’s approach may be perceived as self-promotional (I don’t imagine it is using competing devices in its workshops), but there is a middle ground. A cook teaching a class at Sur la Table can use a blender that is on the sales floor without drawing attention to the fact.

5: Be device-ive, not divisive: Look, even if a store featured a musical fountain in which children could play, its visitors would still be looking at the devices in their hands during their stay. So the merchant might as well be part of it. The trick is being a relevant part of the experience, among all of the apps, mail and texts vying for her attention. If the retailer wants to alert visitors to a special deal on fragrances (if a department store) or oranges (if a supermarket), it can do so by giving them the option to purchase it online, right there. Or it can offer to package the items up and have them waiting at the checkout.

All of these steps would guide a retailer toward more of a town square experience that might shift sales space but not compromise sales. It could, in fact, change the formula for what consumers expect in the sales equation. That is, until the next trend comes along.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

November 11, 2016

5 Priceless Ways Walmart’s Investment In Workers Is Paying Off

A Walmart employee pulls fresh baked rolls out for sale during the grand opening of a Wal-Mart Stores Inc. location in the Chinatown neighborhood of Los Angeles, CA. ( Patrick T. Fallon/Bloomberg)

Last year, Walmart decided to give its associates a 10. In return, they gave it a serious high five, as in $5 billion.

That’s the amount by which Walmart’s sales rose in the first six months of 2016 after it boosted hourly pay to $10 in 2015. Revenue advanced to $149.5 billion from $144.2 billion in 2015, according to its second-quarter earnings report. The company attributes this gain largely to the ‘positive customer traffic’ that followed the pay increase as well as the creation of 200 management-track training centers.

Put another way, better-paid, better-trained workers are creating a better in-store experience for Walmart shoppers. Today, the world’s largest private employer reports its non-management workers make an average of $13.69 an hour, up 16% from 2014, according to The New York Times.

Combined with the training centers, the investment has cost Walmart about $2.7 billion, a bet that many retailers are eager to see played out. Will paying workers more and offering them better opportunities result in higher profits?

Higher Service Scores, Lower Income

The answer is… possibly. Since Walmart increased wages and invested in better training it has recorded the following:

A reduction in employee turnover almost from the outset, according to RetailWire.

An increase in the percentage of stores that meet the company’s internal goals for customer service, to 75% in 2016 from 16% a few years ago, according to the Times story.

An improvement in customer surveys, with “clean, fast, friendly” scores rising for 90 consecutive weeks from early 2015, according to the Times.

A rise in spending at stores by its own employees, the Times reports.

A decline in operating income in the first half of the year, to nearly $8.8 billion from $9.5 billion, due to higher labor costs and other investments, according to Walmart’s earning report.

“During this time of increased investments, operating expenses may grow at a rate that is greater than or equal to the rate of our net sales growth,” the report states.

On the other hand, as it points out, operating income may grow at a rate that is less than or equal to the rate of net sales growth.

Other Ways To Measure Success

This of course should not mean all bets are off when it comes to investing in worker compensation and training. It takes time to recoup a few billion dollars, after all.

Further, it’s possible to record the return on investment in ways that can’t be accounted for in pure dollars. Following are five key return-on-employee investments that won’t make it to the financial report.

A better caliber of workers: Before adding its dedicated training centers, Walmart did not provide its employees a clear structure for achieving management status. This would be like treading water just out of sight of land. It’s not surprising, then, if a lot of workers were less motivated. Since investing in the centers, Walmart has begun attracting a higher standard of worker. “We get more people coming in who want a career instead of a job,” one manager told the Times.

More orderly stores: Hourly employees generally are not likely to make workplace cleanliness a priority, unless they are properly trained, experts say. Using Walmart as a case in point, the retailer said its customers are reporting higher satisfaction rates in store cleanliness, as well as speed and customer service. Clean stores not only are more attractive to shoppers, they make for healthier workers and require less frequent asset replacement (flooring or carpeting, for example).

Brand loyalty: Consumers are drawn to brands that share their beliefs, and most believe in a better living wage. Three-quarters of Americans support increasing the minimum wage to at least $12.50, according to a 2015 report from the Hart Resource Association. There is plenty of evidence that Walmart’s choice to raise employee pay has captured it positive media attention.

Further, better-paid employees are more likely to be brand loyal because the company has made them feel financially secure.

Friendlier environments: Workers who feel appreciated are more likely to seek camaraderie with others (and would be less likely to gripe). The more friends an employee makes at work, the more she is likely to love her employer. More than 70% of employees who have 25 or more friends at work (71%) love their employer. Of those with no friends, 24% love their companies, according to research by the Ohio University. As we know, love means never wanting to hand in your resignation.

Less shrink: OK, this is arguably a bottom-line figure but it gets back to sentiment. Unhappy employees, who are often stressed, underpaid employees, are more likely to take from the company. Also, they are more likely to care less if its products are inadequately cared for – whether the fresh produce is quickly stocked, for example. Employees steal an estimated $50 billion from companies every year, representing 43% of total retail shrink.

It should be noted that not all of Walmart’s 2.3 million employees are paid a minimum of $10 an hour. Those who joined the company since the beginning of 2016 started at $9; they get a buck-an-hour raise once they complete the chain’s skills and training program.

Which reinforces the overall “its pays to pay” strategy. Once trained, workers will be better engaged and worth every penny of that hourly wage, and then some. That’s worth a hive five.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

November 10, 2016

Zappos Rewards And Online Loyalty: 5 Ways Digital Retailers Excel At Rewards

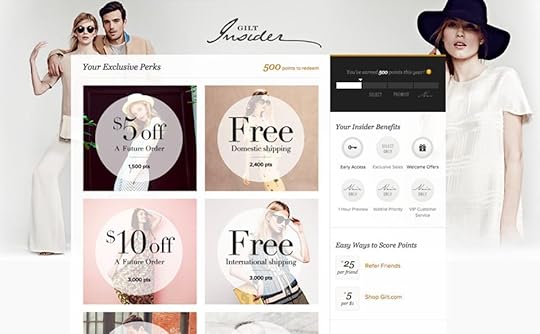

Gilt leverages a graphically attractive explainer that looks like a page from a fashion magazine – not a wall of type – to get readers to better understand its Insider program. Source: Gilt

What is more rewarding, a sandal or a sneaker? If you’re shopping at Zappos.com, the answer may be both.

The online shoe and apparel chain, legendary for its top-shelf customer service, is now offering shoppers a new perk: a free tiered loyalty program that rewards members for making purchases, writing reviews and simply logging into Zappos on a device.

This move has brought renewed interest to the notion of pure online retailers adopting loyalty strategies as part of their customer offerings. Zappos is not the first digital merchant to offer member perks. Gilt, Bulu Box and Zappos parent Amazon.com also operate loyalty programs.

Which raises the question: Is loyalty adoption a sign that the online-only retail category is maturing, or does it signal the need to build more engagement because customers have newer, more intriguing ways to deal with other retailers?

My hunch is it is a little of both. However, the addition of Zappos to the loyalty arena underscores some of the advantages online-only merchants have in this highly competitive industry. Following are five such areas, and examples of how pure online players are maximizing their loyalty propositions.

Benefits, From Data To Dollars

Data

Online merchants are able to identify specific customer interactions (including merely browsing), gather and store information about all those interactions in real time. They can establish highly accurate portraits of their customers and adjust these profiles as shopper needs evolve. Amazon might now operate a few stores, but it launched Amazon Prime when it was an online-only retailer, and perhaps no other merchant has a data warehouse that can compare. Amazon operates an active user base of roughly 250 million worldwide and sells hundreds of millions of products. This translates to a massive supply of online purchase data. These insights provide Prime with added intelligence for better-targeted communications and offers. Prime, in turn, gathers added data to further fine-tune its offerings and communications.

Communications

The shortest distance between a consumer and an online-only retailer is the tap of a few keys, and each is tracked. Online tracking software enables e-tailers to know when customers are on their sites and what they are doing in real time. This enables them to send immediate messages and communications that are relevant at the moment – such as alerts of special reward offers on particular items. On a practical level, online-only retailers are more likely to get loyalty members to read, understand and take advantage of their terms and initiatives because their shoppers are already on their site. The “How it works” page is just a click away. Take a look at luxury online flash retailer Gilt as an example. It has leveraged the opportunity to get readers to better understand its Insider program with a graphically attractive explainer that looks like a page from a fashion magazine – not a wall of type.

Lower overhead

Pure online retailers are not saddled with the expenses related to operating stores, such as staffs, rents and maintenance. This means they have more financial freedom to invest in marketing strategies such as rewards, and in other digital options. Mobile shopping apps, for example, can easily integrate with reward apps. It’s no surprise, then, that a growing number of merchants is lured to the online-only model. Sales among multichannel retailers with a high store presence rose by 9.5% from January to June; among online-only retailers, sales rose 24.8%, according to Clickz Intelligence. The contribution by mobile alone is substantial: Mobile purchases accounted for 45% to 61% of revenue among online-only retailers, with apps accounting for 30% to 40% of this figure, Clickz reported. Among multichannel retailers, however, mobile purchases accounted for 20% to 40% of purchases.

More immediate rewards

A core appeal of reward strategies is they encourage shoppers to increase interactions with the merchant in a quest for more rewards (shopping, posting reviews, following on social media). While more merchants added reward programs, shoppers simultaneously grew accustomed to the immediate gratification of social media, so they began to expect more rapid recognition for their loyalty, as well. The monthly membership program Bulu Box does this by encouraging its members to share reviews of each of the healthy living and nutritional samples it sends, and in return awards them points that can be applied to the next monthly shipment. Among the perks Zappos’ new program offers is free shipping in one or two business days (depending on the tier level achieved). Amazon Prime also offers free expedited service, but requires an annual fee.

There are other advantages for online-only merchants in the loyalty realm. The gamification possibilities, for example, can span across and link all digital interactions to reward opportunities. This time next year I wager more traditional retailers will be studying these players for pointers, or may simply acquire them, the way Saks Fifth Avenue purchased Gilt.

Along the way, I hope retailers keep in mind that the real winner of the digital-only rewards evolution should be the consumer.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

October 27, 2016

Checking Out Of The Showroom: 3 Lessons From West Elm’s Hotel Foray

West Elm’s plan to enter the hotel business is the latest example of a retailer seeking revenue streams beyond the showroom. It also copies the practice of hoteliers that merchandise their own unique experiences. For retailers, any success may hinge on three requirements .

Source: Business Wire, West Elm

Checkout may be at noon, but thanks to the latest crossover between retail and hospitality, today’s memorable hotel experiences can live on in our homes for years.

Home furnishings chain West Elm’s recent announcement to enter the hospitality business, with five West Elm hotels, is the latest example of retailers and hotels crossing paths. While West Elm is using hotels as an avenue to extend its lifestyle brand, many hospitality chains have been using retail to introduce their experiences to the home.

I speak of products well beyond bathrobes and linens. Some hotels sell private-label food products and others offer original household decorative items. A few are exploring the toiletry business, apparently realizing how well Aveda and Bulgari fared with their “try before you buy” experience strategy.

However, for retailers the technique of literal product placement requires more than plopping a lounge chair in a lobby. Let’s look at what the hotels are doing right.

Pillows To Salad Dressings

Hospitality chains discovered the lucrative possibilities of retailing years ago, when soft economic conditions, along with heightened competition, pressured them to reduce room rates. Westin Hotels launched its Heavenly line of products, notably the Heavenly Bed, in 1999.

By retailing its comfortable sheets, robes and mattresses, Westin not only tapped into a new revenue stream, it reminded guests of their stay well after the fact. Its Heavenly line is available not only at Westin’s online store, but also at Nordstrom, Pottery Barn and Amazon.com.

More hotel chains launched their own in-house lines, and the catalog of products extended to include items that reflect a hotel’s brand experience. As described in a story in the New York Times, a high-end hotel might sell exclusive bath salts, while a hotel that supports healthy living could offer branded yoga mats.

Following are some notable examples:

• In Nevada, the Martin Hotel sells it original garlic oil and vinegar dressing, complete with a shaker of “prairie dust” on the side, for $5. But those who want to buy the 60-year-old recipe online may have to wait – at last check it was out of stock.

• The 21c Museum Hotels, known for contemporary art galleries and sleek modern décor, sell miniature ceramic versions of the chain’s mascot: a penguin ($38). One also can purchase framed photography by hotel founder Laura Lee Brown, at $350 a piece, among other items. The hotel operates gift shops as well as an online store.

• The aptly named Hilton to Home collection includes, among its bedding and robes, the Hilton LCD alarm clock, which maintains alarm settings during power outages ($54). Sheraton Hotels & Resorts also sells bedding and mattresses, as well as its Shine brand of hair and body products, on its online store.

• The Shop Marriott site includes the hotel’s exclusive Red Teardrop lamp ($245) and a device that will defuse its signature Attune scent in your home for $169.99 (includes scent). Marriott also offers its mattresses through Amazon.com.

• Westin’s Heavenly products, meanwhile, continue to sell regardless that its parent, Starwood Hotels & Resorts, is now owned is by Marriott (which also sells mattress toppers). As of 2012, Westin had sold more than 250,000 pillows and 100,000 Heavenly Bed mattresses, the New York Times reported. All are identical to the ones in its hotel rooms, a critical point.

Check-In At 3

West Elm’s hotel expansion, scheduled for late 2018, is a bid to build a lifestyle brand through experiences. But success will require understanding the mind frame of a hotel guest. Following are three requirements to succeed in the master suite (or king standard).

1: Check out all guests: Before even picking the curtains, a retailer should know who would be checking in. This means having sufficient data, such as that gathered through a loyalty program, to anticipate what its customers would want as guests. Likewise, it should gather enough information about its new hospitality guests to generate relevant experiences that will lure them to its stores. The Hilton’s HHonors program, for example, collects information that enables the chain to decipher the reasons guests visit its hotels, so it can personalize the details of their experiences.

2: Go double superior on experience: Hotels are generally intangible purchases. The guest arrives, experiences her stay, and then leaves. Westin figured out how to bring that experience full circle by marketing its mattresses. Those mattresses then sell the hotel – those who purchased a Heavenly Bed know that when they travel, the Westin bed will be just as comfy. Similarly, for retailers extending into the hospitality business, they have to create intangible experiences that leave lasting imprints, so guests are excited to shop the brands. This takes identifying the core elements that attract a retailer’s best customers (service, selection, mood), and building the hotel experience around them.

3: Make sure the experience is fitted: West Elm’s foray into hospitality makes sense in that the retailer specializes in creating aspirational environments, or lifestyles. Its customers want to surround themselves with its products. That being said, the hospitality business involves a lot of operations that differ from retailing, from valet parking to the lounge area. Not only must each of these services hit the mark; their delivery should be thoughtfully considered. The music played in the lounge should complement the total brand experience, for example. Is “Midnight at the Oasis” reflective of the company’s emotional mark?

What these three guidelines have in common is they tailor the “try before you buy” experience and make it a long-lasting memory. If retailers want to pursue the ultimate advertisement –physical product placement – they must be able to bounce a quarter off that experience.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

October 18, 2016

Lidl Is Coming: 12 Reasons U.S. Retailers Should Care

The German supermarket chain Lidl is planning to enter the United States by 2018 and has already begun recruiting managers. That gives U.S. supermarket chains a year to prepare for this budget chain’s entry. From its pricing to merchandise, here’s why they should care.

AP Photo/Joerg Sarbach

Walmart, the largest retailer in America, has failed in Germany. Now one of Germany’s biggest supermarket players is coming to the U.S. to see if its own unique model will be successful here.

Lidl, known for its competitive prices and private labels, is preparing to expand up the East Coast, from Georgia to New Jersey, by 2018. It has invested $77 million in a U.S. headquarters in Virginia, about $120 million in a distribution center, and in late August began seeking managers in 12 metro areas, including in Virginia, North Carolina and South Carolina.

According to Reuters, Lidl (pronounced leedle) plans to open 100 stores in America, an already crowded market: More than 38,000 supermarkets with sales of more than $2 million operate in the United States. That compares with 36,000 in 2011. Add to that all the retailers that have begun carrying groceries, from dollar stores to office supply chains, and we’ve got a lot of shelf space, a lot of boxes of cereal and detergent and bananas and milk.

In short, the market is not likely to support so many stores. Some will have to go.

What should U.S. consumers, and supermarkets, know about Lidl? I did some research and found the following 12 facts.

1) It’s big: Lidl is Europe’s largest discount grocery chain, operating roughly 10,000 stores in 26 European countries. By comparison, Kroger Co. – America’s largest traditional retailer – operates nearly 2,800 locations. Lidl posted 2014 revenue of roughly $62 billion.

2) It has rich roots: Lidl is owned by Germany’s third-richest man, Dieter Schwarz, who is the son of the company’s founder, Josef Schwarz. The younger Schwarz does not serve as CEO, however. He passed that baton in 2004 to Klaus Gehrig, who still serves as CEO.

3) Yet it’s simple: Lidl ranked as the world’s third-simplest brand in the 2015 “Global Brand Simplicity Index” by Siegel+Gale, which surveyed more than 12,000 consumers worldwide. To make the cut, Lidl had to prove itself transparent and honest, easy to understand, innovative and able to make its customers feel valued.

4) It favors caution over speed: The chain is careful when it comes to entering new markets. In Lithuania and Serbia, for example, more than five years passed between Lidl’s locating a field office and celebrating its first store grand opening.

5) It’s late getting here: Lidl had originally planned to enter the U.S. market in 2015, but the 2014 departure of its chairman and head of marketing reportedly caused it to put the plan on hold. This supports Lidl’s reputation for caution, but it also gave its arch-rival time to expand its U.S. presence.

6) Its top competitor is a German import: Aldi, another major discount chain, is considered Lidl’s top rival in Europe, and it may be its top rival in the states. Aldi, which has a roughly 40-year head start in America, in 2015 announced plans for a $3 billion U.S. expansion.

7) It is a “soft discounter”: Lidl offers a broader product portfolio and more brand names than a hard discounter, such as Aldi. Hard discounters are marked by a highly limited assortment that is dominated by private labels. Business Insider describes Lidl as a cross between Walmart and Trader Joe’s.

8) Its low prices are up high: While most supermarkets post their pricing below products, and that is where we are conditioned to look, Lidl positions its prices above. At the same time, prices on the bottom shelf tend to be lower and they get progressively higher as the shelves do, according to one report. So I might see a product on shelf five, look below it for the price, and think I am paying what is actually the price for the lower-cost item on shelf four.

9) It’s got the gold: In 2015, the Grocer Gold Awards in London named Lidl the Grocer of the Year. Entrants were required to detail their progress in growing, changing or improving their businesses and provide hard evidence of strategic success, including financials.

10) It just launched a rewards program: The chain’s new My Lidl program in the United Kingdom offers its subscribers (“Lidlers”) exclusive content from its resident chef, a chance to enter competitions and product sampling. The My Lidl website also includes chart forums, a space to enter product reviews and a blog.

11) It sells milk, bananas and office casual: Lidl stocks its European shelves with fashionable, not just functional, clothing. Included in its catalog (“look book”) of private label apparel are a zip-up casual blazer, satiny blouses and stylish skinny jeans.

12) It’s taking location suggestions: Lidl prefers to build its stores, and in the U.S. it’s inviting the public to help choose locations on its website. Specifications include a minimum of 4 acres of space near a busy intersection within 3 miles of a densely populated area. It also wants an area with minimum drive-by traffic of 20,000 cars a day.

In short, it wants what most other U.S. retailers want – the American consumer.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

October 10, 2016

Shopping The Friendly Airports: 3 Ways Technology Can Boost A $32B Industry

Airport retail is expected to grow rapidly in the next 15 years. A look at the trends motoring this growth, and three ways retailers can take advantage of technology to engage travelers.

AP Photo/Mark Lennihan

Think of the last time you walked through an airport. What images come to mind – gate numbers or “on sale” signs?

Odds are a shop of some kind popped into your head. There’s even a good chance that you stopped into that airport shop and bought something, perhaps a gift. This is thanks not only to the convenience of terminal retailers, but also to their growing variety and ability to better engage time-killing customers. Airport retailing is estimated to grow globally to $47.8 billion by 2021 from $31.8 billion in 2016, according to the report Airport Retailing Market.

Several trends, including the quest for retail real estate and airport funding sources, are fueling this growth. But so is traffic. Hartsfield-Jackson Atlanta International Airport, the world’s top-visited airport, counted more than 100 million visitors in 2015. That’s up 5.5% over 2014. The Mall of America, the nation’s top-visited mall, attracts 40 million visitors a year. To get close to the Mall of America’s numbers in airports, we have to scroll down to No. 43 on the traffic chart, to Orlando International, with 38.7 million.

Traffic of course does not guarantee sales, but it is essential to them. As more airports learn to incorporate experience into their retail offerings, the more attractive they will be not just for potential shoppers, but also for tenants.

The key determinant of the industry’s ability to do that may in fact be in the palms of consumers’ hands. Mobile devices, and the apps they enable ranging from loyalty programs to digital wallets, could allow airport retailing to ascend from time killers and souvenir shops to maybe even being planned destinations.

Following are three ways retailers can take advantage of technology to engage travelers.

Triple-Points Landings

It goes without thinking that a good number of terminal trotters are enrolled in frequent flyer programs. There are 3.3 billon memberships in various loyalty programs in the United States (averaging 29 per household), according to COLLOQUY. Of these memberships, 356 million are in airline programs.

Many of these programs form partnerships with complementary businesses, such as rental cars, hotels and, increasingly, retailers. Airports, therefore, represent a burgeoning opportunity for airline-retail loyalty collaborations.

More than seven in 10 travelers (71%) rely on their mobile devices to navigate their destination town, and 66% use them to find attractions, according to the recently released Travel and Loyalty report by COLLOQUY. So consider how interesting that could be for a destination that is really temporary, such as your four-hour layover at an airport.

Mobile devices and loyalty apps could help travelers locate desired shops, such as Harley-Davidson, Lush or Sunglass Hut, within the airport. If the airline partners with a retailer that has a large airport presence, it could send its frequent flyers notice of special sales or events that take place when the member is in an airport that is home to that retailer.

Similarly, retailers with rewards programs could use geo-targeting apps to send customized offers, discounts and rewards to travelers while in the same airport terminals, the COLLOQUY report advises.

“A sunglasses kiosk, for example, might text a special discount to the beach-bound vacationer sitting at a nearby gate, or an electronics retailer could remind a business traveler waiting for an international flight that he forgot to snag a country-specific adapter for his devices.”

Level Off The Stress

Mobile tracking also enables airports to better understand the flow of travelers in the airport, which can be used to provide relevant information to travelers so they can make the most of their time in the terminals.

A significant challenge for airport retailers is that many travelers find being in the airport stressful. Getting them to shop means assuring they can leave the gate area without missing the flight. And doing this means providing easy-to-access details about flight information, ideally in conjunction with airport shops and restaurants.

Some airports have installed iPads that enable passengers to order food while waiting at the gate (these iPads also provide flight status information). Possibly better is when airport restaurants offer their diners individual iPads so they can check their flight status at the table, and possibly order that second glass of wine.

At Tampa Bay International Airport, gate displays show not only if the flight is on time or delayed, but also the progress of the aircraft, according to a story in Tnooz. Travelers can estimate how much time they have before their planes arrive, and use it to shop or dine.

The result: Tampa International recorded a 10% increase in airside concession revenue and a 6.8% increase in dollars spent per passenger.

Make the Shop Terminally Different

A key difference between airport retail and traditional shopping malls is that the visitors at malls can carry their purchases into their cars and leave. But sell a coffee table or set of China in an airport? That won’t fit under the seat.

This is such an easy fix, though. The customer can select a china pattern or coffee table from a store’s selection of floor models or its digital catalog, order it via mobile device and have it delivered to home. Or, the store’s employees can do it for him.

The point is to recognize and embrace the fact that airport retail is different from the traditional mall. (That said, some U.S. airports, such as Minneapolis/St. Paul International, offer retail experiences that feel pretty much just like a mall.) There are some limitations, sure, but also terrific opportunities. If I had a layover at Chicago O’Hare and found a shop or even kiosks offering furnishings from Room & Board, there is a chance I would buy a lamp or side table I might not have considered otherwise.

Similarly, my frequent flyer program can alert me, upon arrival, of all the airport merchants that are unique to that particular city, and their locations. Chances are, I can buy those hard-to-find chocolates or coffee beans while cruising from one gate to the other.

And the next time I think of that airport, I am far more likely to remember that shopping experience than the time spent waiting at the gate.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

October 3, 2016

3 Ways Retailers Plan to Protect Customer Data in 2017

Requirements to install chip card technology in the U.S. has forced retailers to bone up on risk management in 2016, and they will continue to do so in 2017. According to research from the National Retail Federation and Forrester, retailers are looking to protect customer data in three other key ways.

Photographer: Akos Stiller/Bloomberg

There was a time when the most challenging job of a retailer was inventory management. Thanks to the emergence of various payment technologies, that white whale may soon be replaced with risk management.

As retailers test and adopt more payment technologies, such as mobile wallets, they are facing a more acute need to protect their customers’ data. Fraud costs U.S. retailers roughly $32 billion in 2014, up from $23 billion n 2013, according to a recent story in Business Insider.

Leading the precautionary measures are much-talked-about chip credit cards (EMV), which require special hardware at the register. Three-quarters of surveyed retailers put EMV implementation among their top three payment-related challenges this year, according to the report “The State of Retail Payments 2016,” from the National Retail Federation and Forrester. Eighty-six percent plan to be EMV-ready in 2016.

Yet along with the rush to get this technology installed, retailers also are investing heavily in other ways to protect their data, according to the report.

“In recent years, retailers have honed their payments focus on security and fraud, while innovating in growing payment-related areas,” the report states. “Retailers are keenly aware that the stakes are high for fraud and security.”

Interested in knowing how your data is being protected? Following are three ways retailers said they plan to protect their customers’ data through 2017.

Wall-to-wall coding: Ninety-three percent of the 59 North American retailers surveyed said they expect to have point-to-point encryption (P2PE) up and working by the end of 2017. Think of P2PE as the Cloak of Invisibility used in the Harry Potter stories. It conceals the credit card data from the moment it enters a payment portal, so it is encrypted before even being sent to the service provider.

“P2PE protects card data while in transit between the merchant and its processor, making it nearly impossible for hackers to skim the actual, usable card data while it is in transit,” the report states. P2PE protects data collected both in stores and from online retailers. Cabela’s, the outdoors activities chain known for large stores with elaborate displays, is among retailers that have implemented P2PE to protect customer card data.

Tokenization beyond a symbolic gesture: Six in 10 of the retailers surveyed (61%) expect to put multichannel tokenization into practice by the end of 2017. Tokenization, a technology that first caused a lot of buzz in 2014, is the practice of substituting sensitive customer data with a benign equivalent of identification symbols. “Tokenization protects cardholder data that is at rest in a retailer’s or vendor’s system by replacing the real 16-digit card number with another 16-digit reference number, thereby making it useless to a hacker,” the report explains.

Thus protected, the data can be safely referenced across multiple point-of-sale or e-commerce systems. When combined with P2PE, tokenization diminishes the risk of cardholder data being breached if a retailer’s systems are broken into. Further, because it is designed to minimize the amount of data a retailer needs on hand, it has become popular among small and mid-sized merchants seeking to boost security. For example, Casper, a startup online mattress retailer, turned to Braintree, a provider of tokenization services, to process its very first transaction.

Near-field communications are nearer: Half of the retailers surveyed said they would have near-field communications (NFC) in place by the end of 2016. An additional 22% plan to have it ready by the end of 2017. NFC enables two devices to communicate with each when at close range, making it especially relevant for mobile payments. Android, Windows and newer iPhone models (iPhone 6 as well as the Apple Watch) all include NFC technology.

Simply put, NFC enables shoppers to pay at the register by phone or other device, which in turn simplifies the checkout experience. And, as retailers know, seamless is better. “Many merchants are choosing to enable NFC acceptance when they upgrade to EMV-ready POS terminals,” the report states. But there’s no reason to limit NFC to mobile devices. In August, Visa issued payment finger rings to 45 Olympic athletes. They were able to use them to purchase items at 4,000 NFC-enabled terminals in the Olympic Village and nearby stores. All it required was a tap. By late August, the rings became available to the general public.

Which suggests that in the effort to ensure risk management, some retailers are wrapping data security around their fingers. For the moment.

If I may offer a suggestion: Make the data less valuable. Merchants often hold on to much more data than they actually need. They should consider what data they keep and who gets to see it. For example, limit the data’s exposure only to employees who require access to the actual data files (not the general purchasing insights) and then reconsider what information to should hold onto, and for how long. Think: Is there a need to maintain credit card information months after a consumer made a purchase?

Retailers and credit card processors are moving at an impressive rate to secure customer data. It will take ongoing diligence and commitment to stay the course until the next big technology comes along and changes the game again.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

September 26, 2016

Where Is The Uber Of Fashion?

The shared economy is expected to reach $20 billion by 2020, yet retail’s contribution is evolving. A key challenge is mastering both on-demand service and inventory needs. I suspect the Uber of retail is out there, but it may require a role that the sharing economy has strived to eliminate.

Photo credit: Rent the Runway

Every week, consumers are taking more trips in other peoples’ cars, spending more nights in other peoples’ homes and passing off more of their unassembled Ikea furniture to virtual strangers.

Yet when it comes to shopping for fashion, we are still largely confined to the same model.

The shared economy is expected to generate global sales of $20 billion by 2020, compared with $6.4 billion in 2015, according to Juniper Research. Yet it is unclear just what chunk of those sales will retail will generate. This is because the shared economy concept, while perfect for services like transportation (Uber), hospitality (Airbnb) and chores (TaskRabbit), is not so easily applied to the product-dependent retail segment.

In fact, the issue of inventory is not just a key reason why – it could be the only reason why. Open the Uber app and a driver can pick you up and deliver you to a restaurant within 30 minutes. But how many retailers can deliver three different outfits to your front door, in your size, just hours before the reservation – in the suburbs?

There are shared-merchant ecommerce sites such as Rent the Runway and Le Tote, which deliver selections of clothing that members can borrow for a fraction of the cost of buying them. Yet unless the shopper is in Manhattan or other major metro area, this model lacks the on-demand speed and efficiency of Uber, Airbnb and other direct-to-consumer businesses.

The challenge for retailers may be that we as consumers do not think about the products in our homes and closets as things we can “share” or borrow as needed, rather than own. Shared art, shared tools, shared clothes, shared chairs for a dinner party – this economy exists, but perhaps the consumer mindset needs to change to make it real.

Which forces us to ask: Where is the Uber of retail? I suspect it is out there, still getting its wheels under it.

Sharing Defined: Veruca Salt Economy

In her June report, the Sharing Economy: Opportunities, Impacts And Disruptors, 2016-2020, author Lauren Foye described the sharing economy as cheaper or more efficient than service providers, “cutting out traditional players and providing to customers directly.”

Largely possible through smartphones and other connected devices, the sharing economy’s players enable on-demand commerce. Or, to borrow a line from Veruca Salt in “Willy Wonka and the Chocolate Factory,” it defines an “I want it now!” economy.

“Customers today expect services almost instantly,” Foye is quoted as saying in Retail TouchPoints. “With retail specifically, consumers want products delivered as soon as possible. The key is to meet these consumers’ expectations.”

But how? A number of retailers are trying to prove their models by simply taking advantage of the existing shared economy, not creating ones of their own. They are, essentially, intersecting with Uber.

Cole Haan, Nordstrom, Rent The Runway and Dick’s Sporting Goods have all explored the UberRUSH local delivery service, according to Retail TouchPoints. Walmart and Sam’s Club began testing same-day delivery with UberRUSH, Lyft and Deliv in June, Walmart reported on its blog site.

By delivering for major retailers, UberRUSH is serving as the middleman between retailers and their shoppers.

Sharing The Closet

Not all are taking this route. The crafty retail site Etsy, which shares the talents of artisans, opened a pop-up store at Macy’s Herald Square in New York earlier this year. Etsy had previously collaborated with Nordstrom, West Elm and Whole Foods.

However, such partnerships do not fulfill the idea of a shared retail economy (though at least there’s an Uber to get us there).

Closer to target is the site Rent the Runway, which recently extended its rental offerings from women’s gowns and formal wear to all-occasion wear – even baby showers. For $139 a month, subscribers to its Unlimited service can rent up to three items and keep them as long as they’d like. Items can be sent back and replaced with an equal number of others. Shipping is, of course, free.

The Unlimited model is similar to that of Le Tote, whose members can choose from a broad selection of fashions for $59 a month.

Yet while less expensive and convenient, these retail offerings lack the important “right now” feature consumers increasingly expect. Further, while clothing is shared, these sites do not embody the nuts and bolts of the shared economy model.

Ultimately, the success of Uber and Airbnb is they produce software and logistics for use by their independent agents – creating thousands of individual middlemen. If Le Tote and Rent the Runway invite local entrepreneurs to serve their e-customers, they can factor proximity and speed into the equation as well.

They could, in essence, be more like Style Lend, a site that let’s New Yorkers borrow clothes from others within the city. They just browse through the digital closets of others and receive their requested items in hours.

People outside Manhattan also can borrow through Style Lend, but will not receive same-day shipping. I expect the model can be expanded to apply to different cities, though.

Another promising venture, though the clothing is not shared, is Stitch Fix. This site sends stylized apparel to members based on their responses to detailed questionnaires.

Stitch Fix uses independent buyer partners who source the clothing wholesale from hundreds of brands, according to a review in Business Insider. This enables the merchants to get their products into more closets in a new way, while learning from Stitch Fix’s rich data algorithms.

The “Uber drivers” of Stitch Fix are its more than 1,000 stylists who work directly with the customer members.

Still, the end-users have to wait a while to receive their clothing.

But it is measurable progress. I’d wager that a true shared retail economy is closer to the Style Lend model. Whoever successfully builds on that will have a unique opportunity to tap directly into consumer preferences and insights via their local merchant participants.

With that, they can further tailor their selections for customers and overall assortment.

This article originally appeared on Forbes.com, where Bryan serves as a retail contributor. You can view the original story here.

Bryan Pearson's Blog

- Bryan Pearson's profile

- 4 followers