Bryan Pearson's Blog, page 14

May 31, 2017

Amazon Rewards Shoppers With New Payment Option, But Is It Easy Enough?

(LOIC VENANCE/AFP/Getty Images)

If Amazon’s latest payment option makes one thing clear, it’s that the path to greater sales is reached not by following the dollar, but by following the shopper.

Make that the loyal shopper, or, at least, the loyalty-enrolled. Amazon recently invited shoppers who hold American Express Membership Rewards cards to use their accumulated points to pay for purchases at Amazon.com. And in doing so, it has ushered in a completely new way to sell products.

Actually, make that ways. Amazon has similar partnerships with Chase Ultimate Rewards and ThankYou from Citi. In the case of American Express, the feature automatically enrolls a cardholder’s card to the service, called Shop with Points at Amazon.com.

The elegance of such a feature is its seeming seamlessness. If the shopper has been eying a new iPhone but couldn’t afford it, she can now offset the price or pay for it in full with her points.

Of that, there’s little confusion.

But behind the scenes, such services may not be so seamless. In fact, the question could be whether paying with points adds too much complexity for the merchants, and even shoppers, even while providing benefits.

Two-Step Challenge

The answer requires an observation of the shifting credit card–retail dynamic, catalyzed by the explosion of loyalty programs.

Credit cards need retailers to be successful but are a drag on profits since they charge a fee for use. For years, this has contributed to occasionally strained relationships, as evidenced in the contentious Durbin Amendment. The amendment, which limits fees credit card companies can charge retailers for credit transactions, may face a legislative challenge.

However, the adoption of rewards programs by so many credit cards over the years now presents retailers such as Amazon their own new revenue opportunity, by tapping into those excess points reserves. For Amazon, this feature expands the possibility of capturing additional purchases. For credit card companies, it helps pull accumulated points, which are considered a liability, off the books.

And for shoppers, it means a new way to pay for purchases, possibly without spending a dime.

The issue? These partnerships create two-pronged payment systems. When the shopper doesn’t have enough points to cover an entire purchase, for instance, she’ll have to charge the balance to a card or retail account.

Three-Step Solution:

With Amazon being the king of one-click buying (heck, it designed and built the throne), it cannot add steps to purchase without breaking its brand promise.

The simple solution for Amazon and credit card reward programs is to create some form of integration between the brands. Sure, this requires investments in technology, but if the pay-with-points option accomplishes what it is meant to, the investment is justified.

Still, an emerging payment option like the one Amazon and its credit card partners presents is — due to its potential for duplication — just aching for a broader market solution. A device or platform that would transform loyalty points into true cash value for a retail world that is looking for speed, efficiency and a new way to win over customers.

And it needs to be simple.

The best chance of accomplishing this is by following the shopper. Here are three recent findings about what shoppers want from their purchase experiences that can help guide the solution.

Integrate spending and rewards: Most shoppers are okay with their credit card companies knowing how they spend, even with outside merchants. Research from the financial technology company Adyen shows 54% of consumers “want loyalty program information automatically tied to their credit card, even when shopping in-store,” according to WWD.

Make it mobile easy: Plenty of people shop Amazon on their mobile phones, so they have the process down. The same applies to any frequently shopped retailer. Any added payment option, such as points, should be made unquestionably clear to qualified shoppers. One tap should do it, for this reason: According to a 2016 study by PwC Global, 34% of shoppers said their mobile phones would become their main purchasing tools.

Combine reward options: In addition to providing shoppers the option to pay with rewards, retailers and partnering credit card loyalty programs could also add more ways to earn rewards. On double-points days, points earned for buying promoted brands and birthday bonus rewards can keep the shopper engaged. It could also help a retailer stand apart: 27% of shoppers ranked the ability to earn points from multiple retailers as one of their top-three appealing loyalty program features, according to research by COLLOQUY.

Shopper loyalty is not easily won or kept. Following her spending dollars won’t reveal as much as following a shopper’s shifting path to purchase. Nor will it deliver the rewards.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

May 23, 2017

Kroger’s Meal Kits Could Make A Meal Of The Industry

What carries hundreds of exotic ingredients, a litany of careful instructions and an overall value of $1.5 billion?

In time, it may be Kroger’s lunch.

Photographer: Luke Sharrett/Bloomberg

With the right ingredients, the Kroger Co. might prove that supermarkets can eat up the burgeoning meal-kit industry, but that means balancing what are now sweet benefits with a few sour notes. Price and ease are key among them.

No surprise, then, that the grocery chain’s recent foray into meal-kit services, with a concept called Prep + Pared, is characteristically conservative. It is being tested in just four of Kroger’s nearly 2,800 stores, all in its hometown of Cincinnati.

However, Kroger plans to expand the test into more area stores, according to Progressive Grocer.

Not the First Grocer to Box It

It’s a fine point, but one worth making, that meal kits should not be confused with fresh prepared foods.

Fresh prepared foods, such as salads and entrées sold by the serving or by weight, are heat-and-serve. Meal kits include the ingredients and instructions to prepare and cook a full meal. They therefore appeal to a different type of consumer — one who is time-starved or curious about making interesting foods with less fuss, and without acquiring excess ingredients.

That being said, Kroger’s foray into the field may have been triggered more by its direct rivals than the meal-kit market. Among other supermarket chains selling meal kits are Giant Eagle, with Fresh in :30; Coborn’s To the Table Fresh Meal Kits, and Whole Foods, which has begun selling Purple Carrot meal kits, Progressive Grocer reports.

Separately, but worth noting: Amazon is delivering same-day meal kits by Martha & Marley Spoon, a partnership of Martha Stewart. The kits can be ordered with an AmazonFresh membership and do not require individual subscriptions.

From Zero to $1.5 Billon

It’s a lot of attention paid to an industry that, in terms of size, does not appear to present a competitive threat to Kroger or other major food sellers.

The meal-kit market, started in 2012, generated an estimated $1.5 billion in U.S. sales in 2016, according to market-research publisher Packaged Facts. It is expected to double to $3 billion in the next few years, the Packaged Facts report states.

By comparison, Kroger posted 2016 revenue of $115.3 billion, while the U.S. supermarket industry is worth $800 billion.

However, grocery operators are battling for share of basket against many rivals that did not pose a serious threat a few years ago. Dollar stores, gas stations and drugstore chains are expanding not only to carry full lines of groceries, but also healthy grab-and-go options.

And let’s not forget the threat of restaurants. At the end of the day, Kroger is vying for share of stomach, and sales at bars and restaurants have advanced at twice the rate of retail since 2005, according to a story in The Atlantic. Perhaps Kroger recognizes that while meal kits represent small relative volume today, they are attracting a type of consumer who is important to the chain.

Sweet and Sour Market

The implications of this splintering competition have been tracked.

The average number of weekly trips to a grocery store is declining, to 1.6 in 2016 from 2.2 in 2005, according to the Food Marketing Institute’s 2016 U.S. Grocery Shopping Trends report. The supermarket is no longer even considered the primary outlet for groceries for the majority of shoppers — just 49% see it as such. In 2005, the figure was 67%.

So supermarkets turn to new revenue channels — enter meal kits. Still, investing in new, potentially labor-intensive services can be risky. This explains Kroger’s measured exploration of the concept.

The test may also be designed to measure the degree of work needed to make the kits a reliable revenue generator. For every sweet spot, there is a slight sour note. How consumers respond may determine the balance of features. Following are just a few.

Sweet: At $14 per kit, Prep + Pared is less expensive than average meal kits, which are estimated by The NPD Group to cost $10 a person, according to Progressive Grocer. This aligns with Kroger’s strategy of targeting the price-conscious shopper.

Sour: The Kroger kits are more expensive than the combined price tag of the ingredients if purchased separately. This is common among meal kits, but it may not appeal to many Kroger shoppers, a lot of whom shop it for its low prices.

Sweet: Prep + Pared is easy. It includes the ingredients and instructions necessary to prepare a meal for two in about 20 minutes. This prep time is a bit shorter when compared with other leading kit providers, including Blue Apron, Green Chef and Purple Carrot.

Sour: With recipes such as Moroccan-Inspired Spring Vegetables, Chimichurri Steak and Japanese-Inspired Beef Bowls (designed to serve two), the kits are not necessarily family friendly. While they may represent an effort to appeal to childless couples who have more time, many of Kroger’s shoppers have families.

Sweet: Prep + Pared kits can be ordered ahead of time online via Kroger’s ClickList service (also in test phase). The kits can be picked up at two designated stores.

Sour: The kits are not yet being delivered, a feature that makes subscription meal kits quite attractive (they can, for instance, be delivered to one’s office and brought home).

Sweet: Kroger is investing in a field of nutritionists and chefs through a culinary training and education center. This could lead to creative recipes and concepts for the kits, while providing Kroger a degree of kitchen credibility — in time.

Sour: While the food institute may establish a culinary reputation for Kroger, the brand is still recognized as a supermarket. The nutritional aspects of its kits, therefore, are unclear.

Put another way, Kroger’s Prep + Pared may lack the foodie appeal of Blue Apron and others, which built a following for their dedication to providing healthy, convenient meals with high-end ingredients.

However these sweet and sour notes shake out, shoppers will determine if Kroger’s test of Prep + Pared is worth pursuing. Tastes change, and meal kits — regardless of the ingredients — will as well.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

May 12, 2017

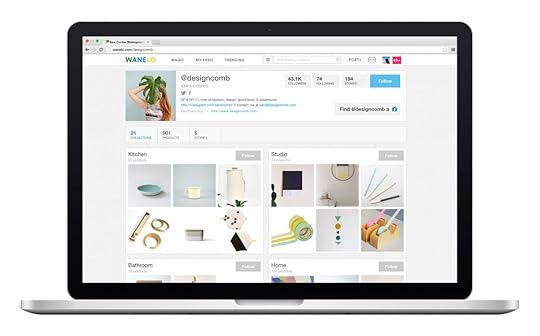

Retail Social Communities: How OpenSky, Wanelo And Others Engage By The Crowd

She may have come to buy a blouse, but she left having designed a five-piece fashion ensemble, acquired 100 likes and, yes, bought the blouse.

Photo Credit: Wanelo

This is the experience, and increasingly the expectation, for more consumers as online shopping communities evolve. Basically online-only retailers that accommodate the shopper’s desire to follow, and offer, style advice, these sites are part Pinterest, part dating service and part international bazaar.

Partaking is a key to their appeal. Take the shopping experience at OpenSky, which bills itself as a matchmaker, “connecting the merchants selling that perfect something to shoppers looking for something perfect.” The site features more than 70,000 retailers across categories, so the product selection reflects that of an exotic Costco. There are strawberry coring tools and balsamic vinegar pearls in one area, LED dog leashes and presidential collectors’ coins in another.

However (as is apparently necessary for functioning shopping communities), the social experience is as important as — if not more than — the selection. On OpenSky, for instance, visitors can follow their favorite sellers, add products to personal wish lists and invite friends so they can earn points toward rewards.

Also, importantly, users of OpenSky can sell products themselves.

A Virtual Block Party

All of this is key to how social shopping communities turn the traditional retail model on its ear. While these communities use technology to imitate much of the physical shopping experience, they also take advantage of tech to enable thousands of human interactions regardless of users’ physical locations.

They are, essentially, cross-country (or -continental) retail block parties. Virtual strangers congregate to share, show off and shop style ideas. There’s also a lot of ratings (liking) and following, as is customary for social communities, to keep shoppers close. Very close.

Creating Fashion, Making Friends, Redefining Retail

Central to the success of social shopping is its ability to entertain the shopper, and that is a tall order. While visitors can be drawn to track the likes of a featured expert or style, that appeal can wear thin quickly. The chances are high the shopper will soon move on to the next shiny site.

Here’s how some other social shopping communities work to keep their users.

Fancy https://fancy.com/

Described as the lovechild of Pinterest and Etsy, Fancy offers a range of personal and household items curated by its global community. Each user establishes a profile that shows what items they “Fancy’d” and can buy from thousands of different stores directly through the platform. The user can further share “Fancy’d” or purchased items with friends and earn credits toward purchases. Likewise, members can follow the profiles of others who use the site and choose what they want to appear in their own feeds. Members who sell through Fancy also have a chance to be featured on its home page along with targeted products.

Kit http://kit.com/

Instead of boards, this social shopping network organizes its products into kits for activities that enrich peoples’ lives. A short list of these activities includes DJing, home improvement, hiking and cooking. The kits are organized by communities, some pretty niched, such as #boxing, #cars and #haircare, and each of which is managed by individual kit creators. With more than 100 featured creators dubbing themselves as fitness experts, musicians, photographers, authors, home design pros and more — each with his or her own offerings of kits — the site runs deep. Visitors also can hunt for, discuss, follow and purchase items (possibly to be redirected to a major retailer like Amazon).

Wanelo https://wanelo.com/

A kind of digital mall, Wanelo sells itself as “All the best stores in one place.” When the shopper clicks on the square representing the retailer Entourage, she is directed to a board of its products. Wanelo is a community with brains, as well. The more a shopper visits the site and saves particular items, the more Wanelo uses the information to recommend products based on the user’s likes. Users also can be contributors, building collection boards of things they like, including goods from outside online retailers, and can buy and sell through Wanelo as well. Wanelo recognizes its top contributors across participating third-party merchants.

Polyvore http://www.polyvore.com/

This is the community for aspiring fashionistas. Visitors join a global community of stylists, sharing advice on new looks, mixing and matching apparel items and spotting emerging fashion trends. They can create boards of fashion ensembles that others can like and comment on. A “white boots” trend board, for instance, leads to a series of individually entered boards by its community members. It’s not a pure shopping site, though consumers can buy an item by clicking through and eventually being directed to the selling merchant. Like Wanelo, Polyvore stores data regarding saved items to better understand shopper preferences and provide personalized product recommendations.

In a year’s time, any of these sites may be gone, merged with another or acquired by Amazon. In the interim, they are shaping the shopper experience, and expectations. That is the takeaway for all merchants, physical or digital: The communities of today shape those of tomorrow.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

May 9, 2017

Digital’s Role In The Shopper Journey: 3 New Takeaways

Photographer: Nicky Loh/Bloomberg

Never underestimate the amount of time a consumer can spend on choosing a rice cooker.

First, the shopper looks online on his mobile phone. Then on his iPad, and then back to his phone. He compares product details, prices and reviews with four retail options, including a warehouse club and a mass discounter.

Finally, two days later, he chooses a rice cooker from a mass retailer’s mobile site based on shipping costs and timing.

Nothing in this decision process reflects the shopper’s age (44) or education (some college). However, his behavior, through the purchase path he traveled, can provide retailers much insight into how shoppers act outside the store.

These are the findings of Bazaarvoice, which helps retailers and brands develop relevant content and advertising to engage consumers. Bazaarvoice tracked the shopping journeys of four shoppers looking for very specific items: the rice cooker, a computer, a purse and a refrigerator.

The results reveal numerous sets of complex and sometimes lengthy shopper journeys, regardless of persona. Indeed, the findings amplify the message that it’s more effective for retailers to understand and target consumers by knowing where they are across devices rather than by who they are.

Extending Data Across Devices

The Bazaarvoice study revealed that individual shoppers may research a single item across several devices before making a purchase. The factors that go into that purchase decision — from price to product reviews to images — can influence the consumer more than features believed to appeal to a particular demographic.

For example, the shoppers Bazaarvoice tracked researched not only retail sites but manufacturer and editorial sites. They also valued visuals that showed how the products can be used, tapping into both the rational and emotional sides of the decision-making process.

What’s this mean for shoppers? That their names, addresses and identities are becoming less necessary in order to understand their preferences. Of greater importance, according to Conversant, a leader in specialized digital marketing, are the shoppers’ past purchases (in-store and online), the devices they used and the sites they visited.

This is an important point, because as the buying process gains significance for targeting purposes, so does the consumer’s preference for anonymity (of their personal data).

If retailers meet both criteria — using data “anonymously” by looking at patterns of behavior that indicate someone is in a buying cycle online — they can meet shopper needs without being intrusive. As Conversant states in a recent white paper: “Make sure that all your data is used anonymously, and you’ll be protecting your consumers and building trust.”

As long as retailers can then identify that individual shopper across devices, they have enough information to try to influence his or her purchase process and end decisions.

Three Personalized Takeaways

For Bazaarvoice, the studied shopper journeys proved that the most effective features of a digital shopping trip reflect those of an in-store visit. These include features that ease the shopping experience and provide the specific information the shopper seeks, quickly.

Following are the report’s three key takeaways:

Upgrade from personas to people: Retailers should target people, not demographics, to better meet the needs of shoppers while in market. They also can do this before the shopper visits a merchant site. The product-research part of the shopper journey can serve as an excellent opportunity to engage him or her early.

Create a “wow-worthy” mobile storefront: The use of mobile to research, compare and select products makes clear that the mobile experience is as important as the in-store or web experience. This means it should not only be seamless (we hear that often enough), but it also has to be useful. Are the product specifications easy to read and access? Is delivery time and cost clear? Are photos large enough to reveal product details?

Earn trust with the content: Interactive photos, Q&As and reviews are essential for engaging the shopper and winning her trust. But it goes beyond simply integrating product images and words into the website or mobile experience. Images, ratings and quotes from reviews should be played up across the website as well as in advertising.

Combined, it all means that in today’s retail environment, the shopper is often better understood by where she is, not who she is.

Whether the consumer is in the market for a tote bag, a rice cooker or a car, the path she takes indicates what will be relevant to her on future purchase journeys. Age and income may matter less than what she bought last week, or reviewed last month.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

May 5, 2017

Experiential Rewards: How Kohl’s, Neiman Marcus And Marriott Set A New Bar

Kohl’s photoshoot

The best retail customer experiences are designed to fulfill consumer expectations. For the shopper who got to participate in a fashion photo shoot for Kohl’s, it meant filling a celebrity’s shoes.

That’s basically what a member of Kohl’s Yes2You Rewards got when the retailer invited her to participate in a photo shoot of the LC Lauren Conrad line, designed by The Hills TV star and fashion designer Lauren Conrad. As Conrad described it, the member (Kayla Watters) got to ”fill my shoes.”

Kohl’s photoshoot

“Kayla never expected she would get this sort of experience from joining a loyalty program,” Conrad said in an email. “She got to model the line at a photo shoot and get a firsthand look at how the LC Lauren Conrad brand comes to life.”

It may seem like an elaborate reward for a loyalty member, but less so than a few years ago. If anything, the fashion photo shoot exemplifies how competition to stand apart in retail, through one-of-a-kind reward-program experiences, is ascending to a new level.

Millions of experiences

For Kohl’s, the Yes2You Rewards program also provides its own set of merchant benefits. These include having “an authentic, two-way dialogue” to learn what its shoppers want, how they interact with the retailer and what matters most in their brand experiences, said Michelle Gass, Kohl’s chief merchandising and customer officer.

“As we learn more about our customers through Yes2You Rewards, we develop deeper relationships and provide promotions, experiences and surprises that are meaningful to them,” she said.

Since the program launched in 2014, Kohl’s has made millions of customer surprises, she said, ranging from a VIP trip to the American Music Awards to an early screening of a blockbuster film to the opportunity to star in a Kohl’s photo shoot. “The positive sentiment we’ve seen from these customers is incredible and absolutely deepens customer affinity with our brand.”

The photo shoot, which took place in March, features the new LC Lauren Conrad Festival collection, which will be available in May. The photos will be used across Kohl’s marketing channels.

As far as experiences go, the photo shoot sets a high bar. Here are a few examples of other standout experiential rewards that retailers can learn from.

Marveling and Magic Tricks

Theory11 — sleight of hand-tailored rewards: The online seller of cards for magic tricks and other magic accessories offers members of its points-based Elite Program a range of exclusive experiences, including a private “cardistry” training session with expert Andrei Jikh. (Cardistry is defined as “the non-magical manipulation of playing cards with intent to display creativity, performance art and skill.”) Past limited-edition rewards included a one-time meeting with renowned magician David Blaine.

My Coke Rewards — recognizing a common factor of members: Coca-Cola is an online retailer these days as well as a major brand (with a World of Coca-Cola store in its home city of Atlanta). It even sells customized bottles for bride and groom, which gets to its status as a family brand. Among the beverage maker’s experience-based rewards is a chance to engage in altruism. My Coke Rewards gives members the opportunity to donate points to their local schools. It also offers a variety of sweepstakes, including a chance to win $24,000 for a home makeover and a family vacation to Orlando.

Neiman Marcus — fitting rewards for the upscale: The luxury retailer’s eight-tiered InCircle program offers those who reach Circle Four access to its InCircle Concierge, who can secure in-demand concert tickets, arrange reservations at select restaurants and personalize travel itineraries with partner hotels from around the world. Achieve the seventh level — President’s Circle — and Neiman’s will throw in a “Fitting Room Experience” with light bites and “unparalleled personal attention in an accommodating setting.” Neiman’s recognizes that for the customer who can buy most of what she wants, preferential treatment is priceless.

Marriott International — shooting beyond Point B: When your members are regular travelers, you’ve got to wow them with experiences that one-up destinations alone. As I’ve detailed in an earlier story, the Marriott Rewards Experiences Marketplace offers for auction a meet-and-greet with Tony Bennett, VIP access to the Belmont Stakes Racing Festival and tickets to the Rock & Roll Hall of Fame Induction Ceremony. Recently, it auctioned off a chance to stay in one of eight tricked-out tents at the Coachella music festival, each of which duplicated a room in one of its eight boutique hotel brands.

Important to these experiential reward strategies is that each is sized up to its audience. From Kohl’s branded photo shoots to Marriott’s customized tents, each brand uses its program data to develop reward options that hit the relevant sweet spots of its core members.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

May 3, 2017

Your Favorite Retailer Has Filed For Bankruptcy; Now What?

(Photo by Drew Angerer/Getty Images)

For many retailers, Chapter 11 does not mean the end of their selling days. For shoppers, however, all sales should be considered final.

This is one piece of advice provided by bankruptcy experts for consumers wondering where on earth it is safe to shop these days.

They have reason to wonder. Nine retailers have filed for Chapter 11 bankruptcy protection so far in 2017, already matching the number that filed in all of 2016. These merchants include The Limited, BCBG Max Azria, Payless ShoeSource, Wet Seal, RadioShack and HHGregg.

In addition, Macy’s, Sears, J.C. Penney and others have each announced they will shutter more than 100 stores (Penney has delayed its closings, but still plans to shutter 138 locations).

For consumers, this presents a range of considerations from whether to put an item on layaway to shopping a particular store at all. But bankruptcy does not necessarily spell demise, said Stephen Newman, an attorney at Stroock & Stroock & Lavan in Los Angeles.

“The purpose of Chapter 11 bankruptcy is to reorganize the business and to restore it to efficient operations and to profitability, if possible, in a manner that will allow creditors to be paid,” Newman said. “For example, less heavily trafficked locations may be closed to preserve resources for the parts of the business that are more successful.”

From “Stuff” To Experiences

A key cause of the rise in retail bankruptcies can be traced to a redirection of spending, from physical “stuff” to experiences, such as meals and entertainment. Sales at bars and restaurants, for example, have advanced at twice the rate of retail since 2005, according to The Atlantic.

Shoppers are dramatically channeling more of their retail dollars to online-only merchants such as Amazon. Amazon’s North American sales accelerated five-fold from 2010 to 2016, to $80 billion from $16 billion.

Considering Amazon’s revenue exceeds that of Macy’s, J.C. Penney, Sears Holdings and Limited Brands combined, it’s understandable why so many merchants are struggling.

4 Caution Areas

So what does this mean to the average shopper? That can depend, in part, on how the retailer operated beforehand. If it provided good service and quality products, shoppers should have less to worry about, Newman said.

However, bankruptcy experts advised against certain types of transactions and suggested some precautions when making purchases. Following is their counsel to consumers.

1. Gift cards

Several experts warned against buying gift cards, even though such purchases may be protected.

“If you have a gift card, you’ll want to use it right away,” said Jef Henninger of the Law Offices of Jef Henninger in New Jersey. “The court will likely set a deadline for when gift cards can be used. Gift card holders who miss the deadline can file a claim to recover the value of the cards. However, those claims will be processed after the company’s major creditors, and there may be nothing left over.”

Put simply, the situation is just too uncertain to take the risk, said Robbin Itkin, bankruptcy attorney at Liner Law in Los Angeles. “Typically motions are filed immediately to have such items honored in the bankruptcy case — but you just don’t know what the situation may be, so it’s safer to not do anything that requires further obligations of the store.”

If in doubt, consumers can check the retailer’s bankruptcy administration website to confirm it has court approval to honor gift cards, said Angela Ferrante, senior vice president of operations at Garden City Group, a legal administration firm with offices in New York, Seattle and Ohio.

2. Layaway

Similar to their views on post-bankruptcy gift cards, many attorneys advise against buying anything on a layaway plan.

“Holding onto store credits and purchasing products on layaway [is] too risky,” said Michelle Novick, a partner in the bankruptcy practice of Arnstein & Lehr in Chicago. “As a bankruptcy professional, my motto is ‘Use it or possibly lose it!’”

This is especially the case since shoppers aren’t guaranteed notice if a retailer shutters its stores. “You will never see the doors closing,” said Erik Klein at Klein Law Group in Boca Raton, Florida. “A customer makes weekly payments and one day shows up to take the item and the store is closed.”

3. Warranties

Bankruptcy often means no guarantees, and that extends to warranties. Shoppers should read the fine print of all warranties before buying one. It’s also not a bad idea to research the brand warranty online to learn what other customers have experienced, said Richard Weltman, an attorney specializing in bankruptcy and creditor’s rights at Weltman & Moskowitz in New York and New Jersey.

“Look for exceptions, exclusions and gaps in coverage,” he said. “Pass up warranty or tech support offers if you can afford to self-insure.”

Lastly, he advises against purchasing any warranty program unless it is backed by a financially strong third party that’s unrelated to the retailer. “Don’t be pressured to buy on the spot.”

4. Credit cards and caution

All of this being said, educated shoppers should take advantage of the sales offered by retailers in bankruptcy protection, but know they may not be able to make returns.

“Shop sales. There will be plenty [to keep them afloat,]” said Travis Vandell, CEO of JND Corporate Restructuring in Denver. “Don’t wait. If you want something, buy it while it still exists.” But, he adds, keep the receipt: “Computer systems may be in flux.”

When it comes to paying for those purchases, shoppers should opt for credit cards, said Klein, from Klein Law Group. This at least provides the shopper with a record of the purchase and many cards offer purchase protection plans.

Lastly, consumers should sharpen their bankruptcy radar. Empty racks with steep sales, closing stores and a reduction of floor staff can all be indicators a retailer may be headed for bankruptcy protection. It’s up to the consumers to protect themselves.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

April 26, 2017

Credit-Freeing Currency: How Nordstrom Rewards Is Benefitting From Ditching The Card

(Photo by Joe Raedle/Getty Images)

If you have to ask, you can’t afford it, the old saying goes. But if you’re shopping at Nordstrom these days, you only have to ask how to pay, and you will be afforded rich rewards.

Close to a year after the Seattle-based retailer changed its Nordstrom Rewards program so members could earn points regardless of how they pay, the numbers are in, and they’re impressive. The change, which means customer no longer have to register for a Nordstrom credit card to earn points toward rewards, resulted in 3.7 million new memberships, escalating total enrollment to 7.8 million active members.

At the same time, the costs associated with Nordstrom Rewards are slightly down. According to the company’s annual report, program expenses declined to $162 million in 2016 from $164 million in 2015. In 2014, costs were $149 million. Revenue advanced to $15.5 billion in fiscal 2016 from $14.1 in 2015.

The takeaway: Giving loyalty members the freedom to choose how to pay can contribute to topline growth and customer engagement — and it can also serve to promote branded credit cards. Let’s explore how other merchants benefit, and why.

Bloomingdale’s, Kohl’s Also Tender-Neutral

Nordstrom is among good company in expanding its rewards to all forms of payment methods. Bloomingdale’s, Kohl’s and others also have made this transformation.

Bloomingdale’s, the luxury brand operated by Macy’s, in 2012 transitioned to the tender-neutral Loyallist program, which does not require members to sign up for a store credit card. Similarly, Kohl’s in late 2014 introduced Yes2You Rewards, which gives members one point for every dollar they spend, regardless of how they pay, including through Apple Pay.

A common feature among many of these programs is that while they have opened up to other methods of payment, they continue to promote and underscore the added value of having a credit card. In essence, by expanding the pool of members, they are creating an expanded audience of potential credit card holders.

Bloomingdale’s, for example, issues three points for every dollar spent using its credit card. Kohl’s sends its credit card holders , compared with eight for non-cardholding members. And Nordstrom provides additional benefits to customers who participate in its loyalty program through store and debit cards. These include reimbursements for alterations, Personal Triple Points days, shopping and fashion events and early access to its popular Anniversary Sale.

Multiple Reasons For Multi-Tendering

In adopting a multi-tender program, Nordstrom, like Bloomingdale’s and others, recognizes the value of capturing not only those customers who use its credit card but also those who prefer to use other forms of payment. This benefits the brand, and shoppers, in many ways:

Value equation: Multi-tender rewards programs extend the value proposition for retailers because they capture more customer data. It’s also more accurate data since shoppers want to ensure their information is up to date in order to receive rewards and other benefits. Retailers can use these insights to provide higher levels of service and improved communications in return.

Engagement: Because customers are not required to register for a credit card, multi-tender programs are accessible to a broader number of people, ratcheting up participation. And they can do so among lucrative market segments. Just 33% of consumers between the ages of 18 and 29 have a credit card, according to Bankrate’s Money Pulse Survey, conducted in 2016. That compares with 55% credit card ownership among those between the ages of 30 and 49. Retailers that rely strictly on credit loyalty programs may not be fully engaging their younger customers, something that they should consider given the decades of shopping they have ahead of them and the ability to influence those purchases (and later credit applications).

More spending options: Give people more ways to pay and earn rewards and they’ll find more reasons to spend with the brand. In most cases, members of multi-tender retail rewards programs generate 70% to 90% of brand revenue, according to Kobie Marketing research.

Easy-pleasy: By extending payment options, retailers such as Nordstrom are recognizing the advantage, and increasing preferences for, mobile wallets. With so many plastic cards issued (credit cards and loyalty cards), consumers are opting for more efficient ways to carry around all those numbers. Mobile phone apps do the trick.

With virtually every retailer offering a rewards program today, standing apart requires greater ease, value and availability. I expect more retailers that never issued reward-based credit cards, such as supermarkets and drug stores, to do the reverse of Nordstrom, and explore issuing credit cards with enriched rewards. Kroger is already doing so.

The trick, of course, is in knowing one’s best customers. If the retailer still has to ask, then it probably can’t afford to take chances.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

April 18, 2017

Shop In The Machine: 3 Ways Retailers Can Maximize Virtual Assistants

(Jack Dempsey/AP Images for LG Electronics)

This is how Alexa buys coffee.

She waits for you to describe what you want, she culls through hundreds of thousands of items in a few moments, and then she asks, “OK, Starbucks Kuerig K-Cup variety pack. It’s $35.98. Should I order it?”

And just like that, Alexa may be turning retail on its increasingly virtual head.

She is not alone. The use of virtual assistants like Alexa, Google Assistant and Apple’s Siri have been growing at a rapid pace — the market is expected to reach $12 billion by 2024, largely thanks to the addition of new functions, such as shopping.

Amazon, notably, has added Alexa to its shopping app so users can chat with the virtual assistant through an iPhone or iPad. And in late March, it added Alexa to its Prime Now two-hour delivery service. Apple, in the interim, is working in its own answer to Alexa, a Siri speaker for the home.

Virtual Transformation In Retail

The implications for retail extend beyond technological acuity. In the process of fetching boxes of coffee pods and candy, virtual assistants are transforming the standards of how consumers expect their day-to-day queries to be answered, said Eli Campo, CEO of Nanorep, a company that specializes in bots for e-commerce companies.

The fact that Amazon, the world’s eighth-largest retailer, owns Alexa underscores the sense of urgency to act, he said.

“To keep pace, retailers of all sizes need to be thinking about how they can implement their own virtual assistant technology,” Campo said. “This doesn’t just mean putting a bot on your website, but strategically identifying how this technology can improve customer relations.”

We Have A Bot For That

Easy to say, but how does a retailer determine the best technology for improving the experience among its customer base? Campo offers three tips:

Be a rover. Virtual assistants should not be limited to a channel or two. Like Alexa’s migration to the iPhone, bots should be transitional and omnipresent to provide instant answers everywhere the customer is, Campo said. “To compete, it’s not enough for retailers to just invest in a virtual assistant on their website. They’ll need to ensure they are allowing customers to engage across every possible touch point — from mobile to email to Facebook,” he said.

This boundless presence would enable retailers to meet the benchmark of convenience and ensure they are at the ready wherever and whenever their customers need them — with virtual effortlessness.

Talk like a sales associate. In order to hold a shopper’s interest, a retailer needs to engage them, and this usually requires contextual conversations. This is one pitfall of Alexa and other personal assistants — they rely on single-transaction communications. Users can ask just one question at a time, and receive the answer only to that particular question.

Campo argues that virtual assistants can evolve beyond such elementary talk, “enabling consumers to engage in a conversation, speaking the same way they would to an actual person.” By mastering this level of communication through a virtual sales associate, retailers can impress their customers by showcasing they not only have the technology to meet their needs, but can take the experience several steps further.

For example, The North Face uses a digital shopping tool that presents online coat-shoppers with a series of questions, such as “Where and when will you be using this jacket?” The answers are used to generate relevant coat suggestions.

Mine the data. A whole lot of Amazon’s and Google’s success is based on their ability to collect and analyze scads of shopper data and, in real time, hone their understanding of consumer needs. These insights further enable these merchants to predict, and suggest, customer preferences.

Retailers can do the same thing with virtual-agent technology, Campo believes. “Collecting data on the success of interactions, these businesses can have a consistent understanding of what their customers are looking for and what roadblocks and frustrations they face,” he said.

This knowledge could be parlayed into engagement strategies, allowing retailers to be more agile in their tactics so they are better positioned to retain current customers and win over prospective ones.

As virtual assistants enter more homes and phones, they inch closer to becoming a universal service for consumers. With shopping coexisting in these same channels, consumers will expect their digital assistants to assume these tasks.

Whether buying something as practical as coffee or a car, the demand will unfold like so many newly ordered sweatshirts. Retailers should help guide the way.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

April 10, 2017

Discounting Can Cost Retailers Millions — By Not Selling

Photographer: Akos Stiller/Bloomberg

Hemlines rise and fall fast, but when it comes to the shelf life of a discounted $500 skirt, the number of days can drag on — to 106, to be precise.

That’s how long it can take an online luxury retailer to sell a piece of women’s wear, even when discounted, according to an analysis of discounts among 114 luxury, premium and mass-market apparel and accessory retailers. Furthermore, when luxury items were marked down at a higher percentage (40-50%) than they took 19 days longer to sell than if marked down 30-40%.

That translated to millions in lost revenue among select women’s luxury goods in 2016, according to the research by Edited, a retail analytics company with offices in New York, London and Melbourne.

Mass-merchandise items, meanwhile, sell faster at discount, especially when marked down by less. Women’s wear products sold 11 days faster when first discounted from 30-40%, rather than 40-50%. The difference cost retailers millions in needless reductions, according to the research.

The same unusual trends occur across retail, from luxury apparel to kids’ clothes, but why? And what does it mean? According to Katie Smith, senior retail analyst at Edited, merchants fail to factor in several basic but highly relevant factors. “The simplest missteps are obvious even when looking at the surface of retail’s discounting woes,” she said.

The same applies to cereal and eggs — issues from shopper behavior to competitive distractions can blur pricing strategies.

Let’s look at factors that should influence effective markdown strategies, and how grocery chains can apply the same.

Timing, Popularity And Other Factors

A key benefit for retailers is they have scads of data to analyze, Smith said. But that also requires that they understand what they have and how to use it. Retailers still miscalculate how much to discount because they fail to include pertinent factors in the formula. Specifically: timing, product type, category and popularity.

There may also be a psychological effect at play — the shopper may perceive a larger discount to mean the product is undesirable.

“As consumers increasingly purchase goods online and expect to only buy goods when they’re ‘on sale,’ retailers must invest in technologies that give them a holistic view of the market, consumer demand and assortments,” she said in an email. “Today, retailers can use analysis tools to understand a trend’s demand before they even put a style into production, which helps buyers know how many orders to place.”

Further, she said, real-time analysis of competitors and other market segments helps merchandisers track a trend’s performance, spot saturation and clear stock before a decline.

Retailers need to become more adept at considering how different factors may affect performance. Take color as an example. A specific item may perform better in one color versus another, and the result may be very different strategies to ensure the most value is captured from the line. Smith said there may even be strong regional variations that can be addressed by monitoring the data.

“Missing out on sale season by so much as a week could be critical for a retailer in a new market,” she said. “Only by having this comprehensive data at their fingertips to identify patterns and make insightful decisions will retailers have a greater chance of getting their discounting approach right.”

And, more importantly, they could put millions back on the table.

Learning From The Grocery Aisle

Similar factors, from customer spending habits to selecting which items to discount, cause supermarkets to make missteps when determining a pricing or discount strategy. First, let’s look at the shopper.

These elements should inform pricing and promotions and can result in a 1-3% increase in sales and profits above organic growth, according to Precima, a retail analytics firm.

But what tools put these elements into play? Among the most popular is the competitive price index. This is the practice of identifying a competitive price set among competitors and establishing a target price relative to that. Pricing within 5% of Kroger, for instance.

The challenge with using this strategy on its own is it treats all categories and items the same and does not factor in spending data. If the retailer folded in its insights on customer price sensitivity, along with competitive price information and price compliance, it could determine promotions based on a broader data-driven pricing strategy.

Lastly, there is the oversold power of the loss leader – discounts on price-sensitive items (like soft drinks or eggs) used to lure shoppers in with the expectation they will spend more elsewhere, offsetting the discount.

In truth, 25-50% of loss leaders don’t actually increase traffic or lead to ancillary purchases, Precima reports. Identifying those that do work requires an in-depth analysis and understanding of customer and basket data.

All this will make a significant difference, but only if the retailer also deals with pricing compliance across its stores. According to Precima research, 25% of supermarket prices are not aligned with the merchant’s own pricing policy, leading to inconsistencies, customer confusion and lost sales.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

March 31, 2017

Can Supermarkets Profit From Delivery? The Challenges Of Groceries On The Go

Photographer: Luke MacGregor/Bloomberg

Who ever thought so much choice can go into a banana?

Ripe or green? Organic or conventional? Pickup or delivery? These are the choices presented to shoppers who purchase groceries online. They also are the demands more supermarkets must meet if they want to remain relevant.

This intensity of service can be expensive, but increasingly non-negotiable when it comes to competing as a major supermarket chain. As online merchants — notably Amazon — offer fast grocery delivery, traditional supermarket chains are pressured to do the same or risk losing market share. The challenge, however, is not just in execution; it’s in cost controls.

Shipping groceries is generally more complex than shipping electronics, shoes and other items, largely because food is perishable. Every melted pint of ice cream or bruised banana nibbles at what are already cracker-thin margins. Add the expense of hand-selecting, packaging and delivering these products and even industry leaders face serious cost issues.

Yet major chains from Walmart to Meijer are exploring ways to deliver groceries while keeping expenses, and prices, down. These options range from third-party home delivery to curbside pickup.

Not all strategies are cost-effective, however. Indeed, it appears some merchants are willing to take the hit on some programs in favor of greater competitive appeal.

One In Five Bought Online

Testing various programs is one way to determine the least-expensive methods of overcoming the grocery-delivery challenge. At the root of that challenge is demand, complicated by expense.

One-fifth of U.S. shoppers bought groceries online in 2016, up from 16% in 2015, according to the Wall Street Journal, citing a Nielsen survey for the National Grocers Association. In Europe, the figures track slightly higher, while globally about one quarter of consumers purchased their groceries online, according to Nielsen’s 2015 “The Future of Grocery” report.

So there’s growing demand. However, the added expense of grocery delivery carves into a supermarket’s profit margin, which in the U.S. is estimated to be just 1% to 3%, on average.

There’s the rub: Despite the convenience, consumers aren’t necessarily willing to pay more for groceries that are delivered, especially with alternatives like Amazon at their fingertips. The online retail giant recently cut the subscription price to its AmazonFresh grocery delivery to $15 a month from $299 a year. (It also is to open its first AmazonFresh Pickup store in Seattle.)

The hope for Amazon and others is that the delivery fees will offset the expenses. However, Amazon also has a vast inventory of cheaper-to-ship goods to help balance out the difference.

From Click To Shipt

Supermarket chains, at the same time, have been testing their own approaches.

Meijer recently entered a deal with the contract-delivery service Shipt to deliver orders to Shipt members from all of Meijer’s more than 230 stores. Shipt membership is $99 a year.

Whole Foods, in a similar vein, uses Instacart, which hires freelance personal shoppers to deliver groceries from the store. Instacart delivery starts at $3.99 an order.

Wal-Mart has doubled the number of stores from which shoppers can pick up groceries purchased online. The service is free with a minimum order of $30 and same-day pickup is available.

And Kroger is testing several options, including Uber delivery at select Harris Teeter locations, grocery pickup through its ClickList service and Shipt delivery. The cost for these services can be as low as $4.95 for a ClickList order.

3 Tips For An Affordable Virtual Cart

Of course, large chains have the resources and reserves to test such programs. Smaller supermarkets risk a greater compromise to profit and longer-term ramifications if efforts fail.

This does not, however, erase the fact that grocery delivery has reached the critical point of acceptance. Ignoring it will not make it go away, but addressing it does not mean a supermarket operator has to lose its shirt over bananas. Following are three cost-effective ways supermarkets can test online ordering.

Baby steps, with vision: Supermarkets should not feel the need to barbecue the entire online oxen at once. The grocery chain Tesco, of the U.K., entered the online fray in 2000 and progressed with patience and caution, favoring long-term vision over short-term tactics. It’s now a standard-bearer of how to do online correctly. Smaller chains can begin an online venture by first offering imperishable items that are less expensive to deliver and less prone to personal inspection, such as cereal, bread and snacks. When shoppers come to the store to buy produce and meats, the store can offer coupons for online purchases.

Let someone else build the infrastructure: Rather than construct a costly in-house delivery system, smaller supermarkets can test delivery through third parties such as Shipt, Instacart or Uber. Or they can go the full grassroots approach and set up local families of shoppers who could communicate via online social communities. The social platform would enable the supermarket to receive feedback from customers as well as the personal shoppers.

Use online rewards to educate: Reward programs can be essential to limiting delivery costs and deepening engagement, particularly online. Supermarkets can populate their websites with a broad range of product information, including nutrition, recipes and short-term offers. This information is likely to encourage more purchases. The activity retailers can track from these interactions (through the reward program’s unique identifier) can be parlayed into more accurate one-to-one customer offers. The more effective the offer, the more likely there will be repeat purchase, offsetting the expense of delivery.

In short, when it comes to online grocery delivery, supermarkets are facing a lot of choices, just like their shoppers. Some will work and some won’t. Until the industry finds a proven method (and it will), supermarkets just may have to split the difference.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

Bryan Pearson's Blog

- Bryan Pearson's profile

- 4 followers