Bryan Pearson's Blog, page 11

November 30, 2017

It’s The First Monday Christmas In 11 Years. What Does That Mean For Retailers?

Want to be nostalgic this Christmas? Put away your smartphone, turn off Netflix, and remember when Amazon didn’t sell groceries or even e-books. This year, for the first time since 2006, Christmas falls on a Monday, and that can bring a lot of opportunities that did not exist 11 years ago.

Photographer: Jason Alden/Bloomberg

What difference does a day make? A heck of a lot, now that online orders can be placed and delivered within 24 hours. That’s just the start of what’s changed in 11 years and how it can play out on a Christmas Monday. Among the differences between 2006 and 2017:

In all of 2006, U.S. big-box and department store sales totaled $252 billion. In 2017, they are predicted to be just $152.5 billion, according to figures from Statista.

U.S. online retail sales in 2006 reached $144.6 billion, according to Forrester. They are predicted to exceed $459 billion in 2017.

Web traffic on smartphones and tablets will likely outpace that on desktops this holiday season, 54% to 46%, according to Adobe’s holiday retail report. In 2006, the iPhone was a year shy of being introduced, and iPads weren’t unveiled until 2010.

In 2006, Amazon generated $10.7 billion in full-year revenue. In 2017, it is expected to post $28.5 billion in holiday sales alone. Six in 10 shoppers said they plan to start their Cyber Monday research on Amazon’s website, according to a survey by Valassis, a media delivery company.

Combine all of these factors, and we’ve got a mix for a memorable Christmas Monday.

Monday, Monday, So Good To E-Tail

What does all this mean for shoppers and retailers? Let’s kick it off with $168 billion. That’s the difference in holiday spending between 2006 ($512 billion) and estimates for 2017 ($680 billion), according to the National Retail Federation. How those sales will be made is of greater significance.

Here are a few key expectations.

Cashing through the snow: A Monday holiday may contribute to higher levels of travel in the days beforehand, and this could interfere with last-minute shopping. Retailers can offset the difference by entering the shopper’s path physically, with pop-up locations or kiosks. They can also expedite online orders to arrive at a desired location on Saturday or Sunday. More than half of shoppers said they plan to buy online and pick up in the store this year; many may prefer pickups closer to their final holiday destinations.

Silver bells ring-a-ling on Sunday: A big factor that will shape Christmas Monday is how e-commerce has changed Sundays. The U.S. Postal Service this holiday season is offering next-day package deliveries on Sundays in 20 major cities. Walmart is among the retailers considering the option. This could cut back on foot traffic but also lead to higher sales, since the delivery service would spare tired shoppers that last harried trip to the mall.

Scrooge-free Saturday: Dec. 23, a Saturday, is expected to be the second-busiest shopping day this season, after Black Friday, according to ShopperTrak. This is because its proximity to Christmas will give last-minute shoppers a fallback date while also taking on a sense of urgency. In 2016, the Saturday before Christmas was Christmas Eve, and shoppers acted pretty much as they would on any Christmas Eve, spending less time shopping for special offers.

Returns on ice: With no guarantee that workers will get the day off on Tuesday, the period when returns will be made is more likely to be put off to the weekend. This could mean fewer returns as other responsibilities take priority. While this sounds good for retailers, it actually means less foot traffic. Retailers would do well to hold special events the Saturday after Christmas (with cookies, even).

It may not take another 11 years to see Christmas on a Monday, but the developments shaping the retail experience are more rapidly changing the Christmas holiday, year to year, in more dramatic ways. No reason to wait for nostalgia; it’s coming at the speed of an app-enabled special offer on a new iPhone.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

November 21, 2017

People Both Want And Don’t Want To Shop On Thanksgiving: How Retail Can Manage The Split

Whether people prefer belly busters or door busters, retailers are preparing to open on Thanksgiving this year, and their choices may have more to do with loyalty than expected.

(Photo credit: Mark Ralston/AFP/Getty Images)

Different surveys reveal sharply different opinions on whether shoppers want stores to operate on Thanksgiving. One study, from the holiday deals site BestBlackFriday, shows nearly 60% of shoppers don’t agree with stores opening on Thanksgiving, up from 55% in 2016. Research by PwC, however, shows 58% of consumers said they would shop on Thanksgiving this year, compared with 40% who said they would in 2016.

Regardless of the results, at least a dozen major chains from Walmart to Best Buy said they’ll open their doors this Thanksgiving Day, and many say it’s because their shoppers want the option. Others, notably REI, have taken a stance against Thanksgiving sales, also explaining it’s what their shoppers want.

Do their decisions reflect what is best for shoppers, or what is best for retail? A review of holiday shopping history reveals some of the thoughts behind their choices.

From Dawn to Black Friday Dusk

Retailers first began opening their doors on Thanksgiving Day in 2013, an evident bid to steal potential Black Friday purchases from rivals. It appears to have worked, and more merchants have joined the fray.

Since then, however, Black Friday is seeing less foot traffic as more shoppers buy online, and that is apparently extending to Thanksgiving. In 2016, shoppers spent $1.9 billion online on Thanksgiving Day and an additional $3.3 billion on Black Friday, according to Adobe, which tracks data from online purchases. In stores, sales declined 5% over the two days, according to the analytics firm RetailNext.

Sales have not declined enough to discourage opening, however. Instead, some merchants are now combining their online and in-store offerings. Some are pulling all-nighters. Among those that will be open:

Walmart will begin offering Black Friday discounts online at 12:01 a.m. Thanksgiving Day, and then open its doors at 6 p.m. Thanksgiving evening. Target, like Walmart, is opening at 6 p.m. on Thanksgiving.

Macy’s, Best Buy, Kohl’s and Toys “R” Us plan to open at 5 p.m. on Thanksgiving. Macy’s will remain open until 2 a.m. on Black Friday, then reopen at 6 a.m. and close at 10 p.m. Best Buy will operate most stores through 1 a.m. Friday, and then reopen at 8 a.m.

J.C. Penney: The department store chain will open stores at 2 p.m. on Thanksgiving Day and remain open until 10 p.m. on Black Friday.

Kmart: Not to be one-upped by J.C. Penney, the discounter will open most stores at 6 a.m. Thanksgiving Day.

Among the more than 60 chains going cold turkey and staying closed: Nordstrom, Neiman Marcus, T.J. Maxx, Costco, Ikea, DSW and H&M.

If It’s What the Shopper Wants …

Macy’s, which will be open on Thanksgiving for a fifth consecutive year, said it is serving customers who have said they want to shop on the holiday. By this logic, being available is akin to being reliable, because the brand is responding to customer preferences.

Shopper behavior indicates they are starting holiday gift planning earlier on the calendar. More than half of shoppers started researching holiday gifts in October or earlier, according to the National Retail Federation (NRF). One third of shoppers start making actual holiday purchases in that time, and 36% start purchasing in November.

Yet research from ShopperTrak suggests that Thanksgiving Day openings do not lead to more overall purchasing, but steal from purchases that would be made the Wednesday before Thanksgiving and the Saturday and Sunday after. Merchants that do open most likely feel they will capture sales from competitors.

Opening? Then Make It Memorable

The numbers indicate shoppers want it both ways, praising retailers that remain closed while taking advantage of deals among those that open. Winning with customers, then, requires getting them to like the brand and its choice to open. This in part means turning holiday interactions into seasonally sensitive memorable moments.

Let data sing: For merchants, the decision to open on Thanksgiving should come down to their target customer. Shopper data, such as that collected through loyalty programs, will help them to better personalize offers for products shoppers will likely be seeking. Six in 10 (59%) consumers use their loyalty program rewards when holiday shopping, according to the report “2017 Holiday Retail Outlook” by Alliance Data. More than 70% said a loyalty program makes them more likely to shop a specific retailer.

Jolly workers: Employees may volunteer to work on holidays and be paid time and a half, but that doesn’t guarantee they’ll go the extra mile for shoppers. If they are rewarded for relationship-building actions, like resolving the need for an out-of-stock item or recommending complementary products, they will more likely provide positive memorable experiences. Shopper data could come in handy here as well, by revealing past purchases that help the employee understand shopper preferences.

Deck the halls with technology: Even if shoppers plan to drive out to the stores on Thanksgiving, they will still likely want to use the technology available to make the trip easier. In-store or curbside pickup, fast-order kiosks that provide endless aisles of limited stock (such as toys in non-toy stores) and employees geared to offer roving checkouts will make the shopping trip more seamless and could lead to larger purchases.

Also, merchants should observe the holiday and demonstrate how much they appreciate the shopper with signage, greetings from the store manager and small gifts or gestures of thanks. Let there be door-busting deals, but do not let the holiday go bust.

November 16, 2017

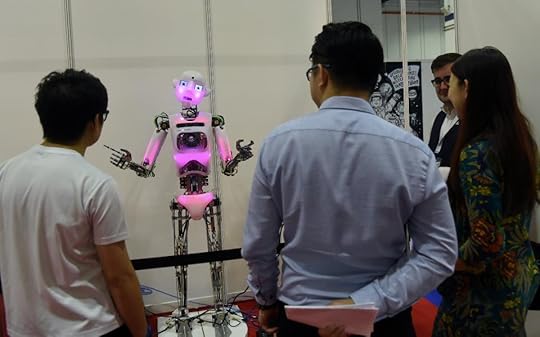

Robot Love: Can Retailers Build Emotional Loyalty With Data Machines?

Data’s what you got now, Mr. Roboto, but can you do the job retailers want you to?

(Photo credit: ROSLAN RAHMAN/AFP/Getty Images)

Robots are entering the aisles of Walmart, Lowe’s and other major retail chains, managing out-of-stocks, checking prices and even (patent pending) identifying unhappy shoppers. For merchants, they solve longstanding, vexing issues that can seriously upend the shopper experience.

But with the data they are able to collect, robots can achieve much more — they can promote emotional brand loyalty. That is, if the retailer knows which data to capture and how to use it responsibly and effectively.

The wherewithal exists; it’s just a matter of how technology investments are directed. Six in 10 retailers are increasing their overall technology budgets to improve personalization efforts and social media presence, according to a report by IFTTT, an app-platform provider. More than half, 53%, plan to increase their investments in artificial intelligence (AI) by 2020.

If those investments include the resources to perform reliable data analytics, then AI can support robots that not only help humanize the retail experience, but also add emotional integrity.

Let’s look at what retailers are attempting, and how they could maximize robot love.

Humanizing, Robot-Style

I’d like to start with a firsthand example from a store I visited in Paris called Uniqlo. Its robots (one at the entrance and one inside the store) are equipped with tablets through which they could locate products and answer questions in many languages — crucially important in a market of international tourists.

It was seamless and fun, but most memorable was what occurred when I walked away mid-session, after having my questions answered. The robot followed me with its head and eyes, as if to assure my needs were met.

This small activity exemplifies how a robot can help a brand gain emotional loyalty. By following us with its eyes, the robot was inviting us to provide more information and contribute to more precise customer understanding. Essentially, this means collecting and analyzing the specific sets of data necessary to accomplish the predetermined goals that would lead to emotional engagement.

For different brands, this could entail different experiences. But emotional loyalty usually boils down to a key definition: connecting with shoppers at such deep, complex levels that they stick with the brand even when there is a comparable, more convenient or less expensive alternative available.

Achieving this level of loyalty requires thinking contextually about customers — including family, interests, pets, friends and careers. It also is a matter of gaining hard-won trust. By examining today’s robot use, merchants believe that trust will be gained through product availability.

Emotional Value of Availability

Indeed, one-third of shoppers say that finding the item they want, where they expect it, is among the top two reasons for shopping a physical store, according to InMoment, a firm that specializes in customer experience intelligence. This takes regular shelf audits, “a job humans don’t do real well, and don’t really want to do,” Andrew Park, senior director for customer experience strategy at InMoment, told DMNews.com.

Not surprisingly, retailers are using their robots accordingly.

Walmart: The discounter is testing shelf-scanning robots in more than 50 stores to identify missing and misplaced items, incorrect prices and mislabeling. The 2-foot-tall robots, which Walmart said are 50% more productive and can scan shelves significantly faster and more accurately than human workers, use cameras to monitor inventory. They then pass the data to employees to resolve problems. Wal-Mart Stores also has filed a patent for a robot that would identify unhappy shoppers through facial recognition software, according to new reports.

Lowe’s: The home-improvement chain’s LoweBot, introduced in 2016, helps shoppers find items and can answer basic service questions. Shoppers simply enter their requests by voice or touch screen. The robot also tracks inventory and captures data in real time to help detect shopping patterns, Lowe’s states. This enables the retailer to more accurately anticipate when and at what speed different pieces of merchandise move.

Ahold USA: The supermarket chain is using a robot to prevent injuries. Marty the robot, in tests in Pennsylvania, scans floors for spills and similar hazards while also ensuring items are stocked and properly tagged. By 2018, Ahold USA plans for 12 robots in its Stop & Shop, Giant Food Stores and Giant Food of Maryland stores, according to reports. Perhaps its most engaging feature: The robot has googly eyes. Similarly, Schnuck Markets is testing the Tally robot (also tested by Target) to monitor shelves and stock.

Transfer From Shelf to Heart

These robots perform functional tasks, but their function can be parlayed into emotional engagement if the data they gather helps to shape shopper experiences that gain trust. Here is a basic primer on how to use the data to build emotional loyalty.

1. Draw your emotional path: The merchant has to identify which experiences are relevant enough to cause its best shoppers to choose its brand over others, even when the competition is more convenient. For some shoppers, a relevant experience is the ability to find products easily with a child in tow; for others, it is a fast checkout or in-store expertise. Regardless, they all come down to the same thing: “This brand understands my needs and values me.” Once these values are determined, it’s time for step two.

2. Commit to the shopper: The retailer should then base every decision it makes on what is best for that shopper, not on what is best for itself. When a retailer adopts customer-committed processes, it is forced to see what its own experience looks like in the shopper’s world, not vice versa. This in turn helps determine which pieces of data are necessary to inform product and operational decisions that serve the shopper’s goal — knowing that more data is not always better data.

3. Rally the troops: Regardless of whether shopper data is coming from a robot or a reward program, its best chances for optimization occur when it is shared across departments. Retail leaders can motivate the entire organization, down to the aisle workers, to responsibly share and use customer data to inform all departmental functions, from store location to promotions. Doing so in the context of the shoppers’ lifestyles and preferences will result in relevant experiences.

Relevance in turn will lead to lasting customer intimacy and, ultimately, emotional loyalty with the brand. If robots can help retailers do that, then we owe them a big thank-you.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

November 13, 2017

Is The Mall Lost On The Supermarket? 5 Facts Say No

Once we bought sweaters at the north end of the mall. Now we go there to pick out Swiss chard.

(Photo credit: LOIC VENANCE/AFP/Getty Images)

The rash of department store shutterings this year (more than 300, according to JLL Retail) has resulted in millions of square feet of darkness at the far ends of many U.S. malls. However, these big empty boxes that once stored the spirit of retail’s future are now proving to be the grounds for retail resilience, in the form of vegetables, steaks and frozen four-cheese pizzas. The question is their shelf life.

More supermarkets are signing leases at shopping malls, adding substantial steam to a trend that emerged tentatively a couple years ago. Kroger, Wegmans and Whole Foods are among the big names that have signed leases to fill former Macy’s, J.C. Penney and Sears stores this year.

In doing so, they challenge tradition as well as real estate experts who suggest strip centers make more sense for supermarkets, due to their ability to shoehorn into residential areas and provide designated parking.

However, like displaying pretzels near the beer, several unmistakable opportunities present themselves for grocery retailers that drop into a mall anchor. Here are five, plus one major watch-out.

From Farm to Label: 5 Major Mall Benefits

Easy setup: Most department stores occupy large footprints that suit a supermarket’s need to stretch out. The average full-line Macy’s store, for example, is nearly 191,000 square feet. Most mall anchors cover two stories, which would net out to 95,000 square feet or so per floor — plenty of space for a supermarket. Also, because anchors usually operate at the ends of malls, they have expansive exterior access for delivery trucks, pharmacy drive-thrus and (already existing) entrances for shoppers who want to avoid the mall interior.

Commuter traffic: Malls typically exist on busy commuter routes and within site of highway exits, making it easy for the supermarket shopper to combine trips without going an extra mile or two. The inconvenience of those additional miles should not be underestimated: Nearly 50% of shoppers said they would like to have a supermarket in the mall, according to research by General Growth Properties, a major mall operator. Bonus: Most malls also are located on mass transit lanes, so placing supermarkets among the mix could potentially alleviate the growing issue of food deserts in some areas.

Community ties: Many supermarkets are already testing community-focused features such as live music at in-store restaurants, as well as fitness classes. In a shopping mall, supermarkets would have the opportunity to expand these features through partnerships with other tenants. A merchant that sells baby clothes and related items could offer nutrition classes (for mother and child) in partnership with the supermarket’s dietician. Cooking classes could be co-sponsored with kitchenware chains. And supermarkets can pair with youth-apparel merchants to offer services for students, a la American Eagle Outfitter’s free laundry services near New York University.

Local sourcing: Since many malls are built on what was once farmland, it makes sense to return to the region’s roots, which many locals may remember. A mall-based supermarket could host weekly farmers markets featuring products grown in the region. In fact, they can source the markets super-locally — within sight of the store. Some overseas shopping centers are experimenting with food production on-site. In Shanghai, an indoor farm grows vegetables and raises pigs, and in Tel Aviv, a farm operates on a shopping mall rooftop.

Good PR: An empty anchor store is like a missing front tooth to a mall — it’s hard to ignore, it mars an otherwise nice lineup and it is a harbinger of other extractions. Emotionally, a dark anchor store is, to many in its community, a hulking threat of failure. A supermarket that swoops in has the opportunity to become a beacon of hope. To this end, the store should offer a regular rotation of lively, family-friendly events that will make it a destination as much as a required stop.

And one hazard — parking: This is a key argument for keeping supermarkets in strip malls. There’s a good chance shoppers would be turned off by the thought of having to roll a cart halfway across a parking lot or lug their frozen foods through the mall’s western corridor. To maximize their opportunity at the mall, supermarkets would need to build grocery-schlepping strategies into their operations. Among the options are dedicated parking, curbside pickup or employee “runners” who could bring groceries to customers’ cars. Also, the store interiors should be designed to anticipate shopper needs. Prepared meals could be near the exterior doors, for instance.

One key factor supermarkets should not have to worry about is shoppers. They will adapt to picking up Swiss chard along with plastic hangers and shoes because they’re doing it already, in many open-air malls. Also, many shoppers want to do it. Supermarkets just need to make the experience fast, friction-free and pleasant, like the ideal family dinner.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

November 10, 2017

5 Principles For Long-Term Loyalty In The Sharing Economy

How do Tory Burch and Valentino survive the sharing economy? By offering many happy returns.

Photo credit: ANGELA WEISS/AFP/Getty Images

Today, more shoppers care less about accumulating things; they’re exchanging ownership for convenience and fun. One only needs to look to the sharing economy for evidence.

The sharing economy, the term used to describe the burgeoning market that enables shoppers to rent products or services rather than own them, is expected to approach $335 billion by 2025. With its growth looms another unmistakable indicator of a shifting shopper value: the desire for pleasure through experiences.

Almost three quarters of people in their 20s and 30s prefer spending money on experiences over material things. This is leading more traditional brands, most recently DSW, to eyeball the sharing economy and join industry leaders such as Le Tote, ThredUp and Rent the Runway, the latter of which is doing well enough to have just added a new membership tier.

How do brands ensure shopper loyalty in a sharing economy? Let’s take a peek.

Matching, Borrowing and Babies: 5 Loyalty-Boosting Sharing Tactics

A key appeal of the sharing economy is that it makes some of the finer things in life affordable, but the success of the concept hinges on the experiential value it offers. A closet full of shoes and designer labels is, for many, being replaced by a storage of memories.

Following are a few of the key principles that retailers can borrow from the sharing economy to build their own customer loyalty.

Identify the match: A lot of sharing merchants are designed for an ideal shopper, identified not simply by age and other demographic boundaries but by personal challenges and needs. The shopper who rents clothes for practical purposes, such as a job interview, will likely want a different experience than the one who rents for luxury. The same guidelines can be applied to specialty merchants of all stripes. Shopper data, through an app or rewards program, can provide the insights to begin a conversation with the shopper that in turn leads to more information and better understanding. Merchant services like Rent the Runway, ThredUp and others require registration, so they gain a more accurate, timely view of the shopper’s preferences with each order (and return).

Zap the friction points: Once the brand has determined its ideal shopper, it can use the data to examine his or her thought passage to purchase. Those insights will help the brand locate friction points that could derail a good experience. Ikea’s recent agreement to acquire TaskRabbit, to remove the barrier of self-assembly, shows how traditional retail can take advantage of sharing services. Walmart’s effort to expand home delivery through Uber reflects similar thinking. The site Bag Borrow or Steal, by leasing (as well as buying and selling) luxury accessories such as purses, takes the pain out of making big investments in items of which the shopper is uncertain.

Take a stand: All brands should stand for something intensely relevant to the ideal shopper, and that mission should manifest itself in the experience. It could be expertise, quality or the comfort in knowing any mix-ups (even the shopper’s) will be handled neatly. The goal is to become the borrowing shopper’s go-to brand based on her priorities, which leads to powerful word-of-mouth. Vigga, a subscription-based provider of pre-worn organic maternity and baby clothes, answers the need of socially conscious mothers to affordably clothe children who will quickly outgrow their tops and bottoms, while saving resources.

Value little things: Shoppers do not equate value with price alone. Time has value, experience has value, and flexibility has value. This principle should complement what the brand stands for and define the brand experience — not just the service or product. Knowing what the shopper counts as important, merchants should ask: What does the shopper value in the experience? The British rental service Girl Meets Dress, for example, invests in expertise by offering personal shoppers who can advise on styles and the proper length of a gown, based on height. It also takes care of dry cleaning and accepts normal wear and tear (it offers low-cost insurance for larger mishaps).

Happier returns: In many cases, the shopper will be returning an item. Considering her needs and how she defines value, the return experience will determine whether she ever comes back to the brand. DSW, which is considering special-occasion shoe-rental service as well as shoe repair and storage, has to give this act considerable thought. How will it clean the shoes after use in a way that assures future renters? Will the process be neat and easy both in-store and online? DSW may benefit from an app that can help locate items, in the spirit of Walmart’s Mobile Express Returns app. It enables shoppers to initiate returns via mobile app and then complete the exchanges in dedicated express lanes.

These principles may appear especially shiny because they are offered by an emerging industry with sex appeal, but they are rooted in practical consumer preferences. Whether the brand is Tory Burch or Stride Rite, shoppers are seeking the same essentials, and those come down to ease, problem solving and satisfaction.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

November 6, 2017

6 Ways For Retailers To Survive The Cannibalism Of Grocery Delivery

If grocery sales were pounds of flesh, shoppers would be making cannibals of retailers.

Photographer: Patrick T. Fallon/Bloomberg

They’re doing it both virtually and overnight, through demand for online groceries. With breathtaking speed, digital food sales have transformed from a “could-do” service to a “must-be-doing” staple for the nation’s biggest retail brands, from Kroger to Walmart. This is despite the risk that online sales will steal from the same retailer’s in-store purchases.

But even the biggest brands can no longer afford to be cautious. The online grocery business, at roughly $21 billion, is estimated to reach as much as $100 billion in annual sales by 2025, according to a January report from the Food Marketing Institute and Nielsen. That figure is based on a compounded growth rate of 20%.

Costco is the most recent merchant to join the ranks. In early October, the warehouse club began offering two-day delivery on shelf-stable foods and fresh-food delivery through Instacart. In an interview with The Wall Street Journal, Costco chief financial officer Richard Galanti addressed the reality of cannibalizing his in-store sales with this statement: “We would rather lose it to ourselves.”

He may as well have said, “We’d rather eat our own arms and legs than hand them over to you.”

However, Galanti’s statement is less a death wish than an observation of the stakes food merchants must wager to stay in the game. Yes, retailers can eat their own sales; the trick is portion control.

Following are six ways retailers can survive cannibalism by managing the two channels together.

Combo deals: Some retailers, such as Walmart, offer online shoppers extra discounts if they pick up their orders in the store. Retailers also can send online shoppers coupons with better-than-average discounts on products when purchased in the store, and vice versa. This second part, of offering great discounts at the store for online purchases, should be geared to reward program members who are easily identified at the register. These point-of-purchase offers could entice online shoppers to drop by the store more often to see what other deals they can get.

Extra dessert: Another strategy tied to a retailer’s reward program, this would grant double points on all in-store purchases for chosen online shoppers on preselected dates. If the reward program is app-enabled and can track the shopper through an opt-in feature, the offer can be further personalized with surprise triple point offers on items the shopper has previously purchased, while the shopper is in the aisles. Re-purchased items can be recorded for future online-ordering promotions.

White tablecloths: Online invitations to in-store events provide retailers an opportunity to deliver a consistent brand experience in store and online. And heck, it’s just fun. Retailers can extend the invitations when shoppers reach specified spending milestones on their online purchases, perhaps a certain sum each quarter. The event can be a VIP sales day, a sneak peek at a new brand or a pre-tour of a new store location.

Carryout: Nearly half of retailers, 47%, have invested in in-store kiosks, but primarily for marketing. The next step is using them for ordering and pickup. Whole Foods uses them in its New York store to deliver prepared foods that are in high demand more quickly, and Walmart is installing kiosks called Pickup Towers where online shoppers can gather their orders at the store. In-store kiosks can also allow shoppers to order seasonal items in advance, or regional items from other markets where the chain operates, such as Wickles Pickles from Alabama or Skyline Chili in Cincinnati.

Food pairings: An advantage of online retailing is that it can extend the product mix to include brands only available online due to their specialty nature. By partnering with the retailer, these brands (including startups and local ventures) could be part of in-store tastings and similar events that introduce new flavors, product lines or formulations. In doing so, they build awareness of the product, so the shopper gets a chance to try online-only brands before committing to purchase.

Ask to be fed: Who better to tell a retailer how to improve its store than the shoppers it wants in the aisles? By asking regular online shoppers to provide feedback through digital surveys, retailers collect firsthand input on what shoppers most want in the store. Often, this simply comes down to value, easy-to-find products and a fast trip, but different shoppers define value and speed in different ways. It may mean putting grab-and-go food near the registers, or placing the kiosks at the curb rather than in the store. Some merchants, such as Kroger, operate regular feedback websites that can be hyperlinked through an online order page.

Shoppers are right to expect more from food retailers, and they will go to those that provide what they want in ways that meet their needs at the moment. It may cost the retailer some in-store sales to do this, but winning the shopper means playing the long game. Giving up a few yards in the process means little if the retailer cements long-term loyalty from the customer.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

October 26, 2017

4 Ways B8ta Test At Lowe’s May Prove Who’s Smartest

The SmartSpot stores that operate within three Lowe’s locations in California do not have walls. Walls are barriers, and barriers are friction. And when it comes to buying smart-home technology, a key friction point is the can’t-try-it-yourself part.

Lowe’s SmartSpot

So a year ago, in November 2016, Lowe’s partnered with B8ta, a retailer that is more concept than commodity; a tracker of experience, not inventory. B8ta provides shoppers a chance to handle and try out a range of new technologies before buying them. It specifically showcases new smart and connected products that have not yet made it into other stores and therefore may only be available online.

In doing so, B8ta eliminates a key challenge for consumers and tech companies wanting to hook up — the getting-to-know-you part. Lowe’s, spotting a dovetail opportunity, wanted to liaison.

The test concept, called SmartSpot, invites Lowe’s shoppers to explore new smart-home products, from garage door monitors to Bluetooth-enabled deadbolts. It also injects an overlooked need into the technology shopper experience — hands-on retail expertise.

DIY Intimidation Removal

That a DIY chain is offering tech expertise is fitting — Lowe’s rival Home Depot was founded on the concept of having highly trained floor staff to teach customers how to use power tools and complete home projects. Smart devices are the new home tools, and require similar training.

The SmartSpot store-within-a-store concept, in Livermore, Burbank and Aliso Viejo, California, “demystifies and simplifies the purchasing process for customers,” Lowe’s stated in its 2016 press release.

It may have also powered a few light bulbs: Since Lowe’s collaboration with B8ta, Amazon and Best Buy set out to resolve the home-tech expertise barrier by deploying salespersons who visit homes and advise on smart-home technology.

SmartSpot differs in that it is a gateway to the broader B8ta store collections (which include a brain-sensing headband for meditation and a robotic lawnmower). Because many of the products B8ta sells are launched and sold only online, its five locations and those of Lowe’s may be the only places where shoppers can handle the devices before buying.

“We wanted to make sure to take away the intimidation in a market that’s saturated with these kinds of products and allow the customer the ability to touch and feel and experience,” Ruth Crowley, Lowe’s vice president of customer experience design, said a year ago.

Billons Of Reasons, Plus Four

Lowe’s should be able to nail the job of eliminating shopper intimidation, since it was essential to convincing homeowners they could install their own flooring, sinks and appliances. The do-it-yourself smart home venture could be a pretty smart bet for Lowe’s for four other reasons:

1. It nails the solution. Smart-home products might not require trying on for fit and comfort, but understanding what is a good fit for the home can be vexing to consumers. A lot of research is required to keep up with tech-product capabilities, and that translates to friction for a lot of time-strapped shoppers who would benefit from smart-home devices. Coming into a store and finding new tech products at the ready for testing actually makes going to the store easier, and simpler, than shopping online.

2. It’s a measurement tool. In addition to carrying dozens of smart-home products from brands including Google, Netgear, Nest and Ring, the SmartSpot shops carry Lowe’s own Iris home energy management devices, launched in November 2015. The side-by-side merchandising provides Lowe’s a line of sight into the complementary products shoppers buy and what influences these purchase decisions. Lowe’s can use these insights to extend its Iris line and develop new products that meet yet-to-be-established needs.

3. It gets your hands dirty. Lowe’s falls behind Home Depot when it comes to attracting home improvement professionals, meaning it relies more heavily on residential DIYers. This could put Lowe’s at a disadvantage if the consumer segment declines. The chain has been investing in increasing its pro customer base, in part by acquiring Houston, Texas–based Maintenance Supply Headquarters in the spring. The SmartSpot test, meanwhile, exposes Lowe’s to a potentially lucrative and growing market. How lucrative? Keep reading.

4. It offers level growth. The smart-home industry — seller of computer-automated appliances, entertainment, security, lighting, HVAC and other home features — is expected to expand to $53.5 billion in 2022, from $24.1 billion in 2016, according to the research firm Zion Market Research. That doubling means new products but also anticipated demand and acceptance. The retailers that remove uncertainty and provide easy-to-access understanding will likely capture those dollars sooner, and therefore longer.

Expertise may be one of the few constants consumers demand of their retail experience. No matter how informed the shopper may be about price, function and capabilities, the concern that a product won’t work out well is real and persistent. It just makes sense that a smart home begins at a smart store.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

October 23, 2017

Giant Eagle’s Got New Rewards, But Does It Have Enough Meat To Satisfy Shoppers?

The Eagle has landed on a new reward program, and it’s got omnivore tendencies.

Photo credit: KITAY

That’s the takeaway from the newly re-launched loyalty program by Giant Eagle, a supermarket chain with roughly 200 locations. The relaunched program, called fuelperks+, enables members to engage with the brand in expanding ways. They can earn and redeem points on fuel and pharmacy, gift cards and dry cleaning. They can keep track of their rewards on a new app. And they can use the program in store or online.

Really, it’s similar to what many major reward programs offer, but it is evidence of a key necessity to retail survival: If a merchant wants to generate enough enthusiasm to achieve maximum reward program participation — and the necessary data insights to support it well — then it has to think omnivore as well as omnichannel.

That means feeding all consumer appetites, from the demand for simplicity to flexibility.

Competition Hungry for Grocery Dollars

And supermarkets shouldn’t wait. Shoppers have no shortage of menu options when it comes to filling their grocery lists.

Mass merchants, dollar stores and fuel stations are all expanding their food offerings to include prepared eats and healthier fare. A Dollar General store in Nashville, Tenn., sells groceries, coffee and other grab-and-go foods within easy access of Vanderbilt University students.

In other parts of the country, European giant Lidl is penetrating major markets, causing rival Aldi to boost its selections, and Amazon is increasing its online food options, already plentiful, through its Whole Foods buy.

All of this leaves traditional supermarkets scrambling for ways to stand apart. They’re investing in meal kits, online ordering and “food theater” attractions such as niche eateries. And many, including Giant Eagle, are looking toward reward programs.

Supermarkets Need Loyalty

The timing is certainly right. A surge in supermarket mergers has resulted in fewer grocery reward programs against which to compete, so upgrades are more likely to get noticed.

The number of U.S. supermarket reward memberships declined by 24% from 2014 to 2016, to 42.4 million, according to the 2017 COLLOQUY Loyalty Census. That follows a 2% decline from 2012 to 2014.

With so many reward programs folding, members are forced to join other programs, which can represent a crucial friction point. If something goes wrong — if the offers are not accurately personalized or the perks are not relevant — shoppers may turn to another chain.

This means that in order to maintain shopper interest, Giant Eagle’s new program features will need to address specific shopper preferences across all touch points — at the moment of interaction. There are just too many other nontraditional food options out there, despite the narrowing number of supermarket chains.

Keys to Winning Shopper Appetites

Which is to say: Think differently. One of the key challenges of boosting shopper engagement through loyalty programs is they are just so prevalent. Shoppers expect them. Standing apart, therefore, will require a sharp shift in very basic applications. Drawing on my decades in the loyalty industry, I suggest three:

1. Remember who serves who. For years, supermarkets tended to limit their reward programs to being discount vehicles. Members got access to special promotions, but the engagement efforts ended there, essentially turning them into coupon programs. In order to generate loyalty, loyalty programs should serve as extensions of the parent brand, meaning all features and rewards answer to the voice and mission of that brand. This is key to an omnichannel strategy as well — the language and tone should be consistent from aisle to app, and the promotions should reflect that. In-house, the reward program should be viewed as a company-wide endeavor. Its insights should support all departmental strategies, from store location to merchandising. Likewise, all departments should have some input into program operations.

2. View services as food groups. Shoppers yearn for more pleasure in their grocery trip, and plenty of rivals are stepping in with enough service options to duplicate the food pyramid. Established grocery chains with reward programs have one important edge: They’ve been collecting shopper data for some time. Those insights could determine which services their shoppers would most likely value, such as ordering online or home delivery. Supermarkets shouldn’t just rush into a service because their rivals have, however. They should first analyze the data (or hire a third party to do so) to establish what specifically shoppers find beneficial about such services, and why they’d choose one over another. In-store features, from coffee bars to in-aisle offers sent via an app, may appeal to some shoppers more, especially during certain times of day.

3. Heat up the redemption experience. Speaking of time, retailers should know their loyalty programs are always on the clock. When program members are about to redeem or pay, that program is on double time. The redemption experience should be packed with random small surprises, such as bonus discounts or chances to try new services for free. And for a real surprise-and-delight reaction, the brand can offer expedited rewards (“We love you so much, we’re giving you next month’s reward today!”). However, supermarkets should be mindful that shoppers have different expectations at different touch points. If a customer is using an app, a push notification of an unexpected reward will likely delight her. If she is in the self-checkout aisle, she is more likely to be focused on the next task and less interested in promotions.

The shopper has many, many needs to be sated. This hasn’t changed in generations. What has changed are the ways shoppers can be satisfied, thanks to the onset of integrated shopping experiences enabled by omnichannel strategies. But supermarkets shouldn’t confuse reward programs with penchants; they should concentrate first on what the consumer seeks and then design the program around it. That alone should put meat on the bones of any strategy.

October 18, 2017

3 Steps To Turn Pumpkin Spice Into Perennial Engagement

Photographer: Ramin Talaie/Bloomberg

Maple pecan? Are they out of their gourd?

Some may be asking this of Starbucks, Dunkin’ Donuts and others that have embraced maple pecan as the latest flavor at the pinnacle of pumpkin spice season (Pumpkin Spice M&Ms, anyone?). But maple pecan is not necessarily a sign of seasonality gone mad.Rather, the sequencing of new flavors into the old simply indicates that brands recognize the perennial need to serve all customer preferences, especially those for surprise, while recognizing our fondness for nostalgia.

“People really do like [pumpkin spice], and they expect it in the fall, but I also think they’re getting tired of it,” Pat Cobe, an analyst at the food research firm Technomic, told The Chicago Tribune. “Everyone wants something new every season.”

However, the pertinent issue isn’t newness. It is whether these efforts retain customers and foster long-term engagement, which should be the aim of any marketing effort. The best measure of an initiative’s success is not the immediate return; it is post-event brand engagement.

Figures of Pumpkin Spice Past

More broadly speaking, no specialty flavor guarantees year-round loyalty. However, by expanding their menus of limited-time products, Starbucks and others do widen their seasonal nets to capture a broader consumer base, which increases the chances of longer-term customer conversions.

This is especially important as consumers expand their palates. Spending on curries, chili peppers and other seasonings by food establishments has risen 7% since 2016, according to market researcher NPD Group. The number of national food chains adding maple pecan products to their menus rose to 14 this fall from four in 2016, according to food researcher Datassential. Limited-time offers of pumpkin spice products, meanwhile, are down to 14 this year, from 17 in 2016.

The challenge for merchants will be extending the limited-offer experience from a one-time indulgence to routine purchases. For example, separate research by the NPD Group revealed that many pumpkin spice latte buyers (not Starbucks-specific) consider the purchase an extravagance.

Almost three-quarters of pumpkin spice latte purchasers (72%) bought just one in 2014. Roughly 20% purchased the drink twice, and only 8% bought three or more during the offer period. (Starbucks introduced pumpkin spice lattes in 2003.)

However, those who purchased the lattes also had larger checks, often because they bought food items. This indicates that seasonal products do expose infrequent visitors to other menu items. The average check for pumpkin spice latte buyers was $7.81 in the fall and winter of 2014, while those who did not buy the drink spent an average of $6.67, according to NPD.

Rewards Also Go Long, Seasonally

Similarly, merchants have used short-term reward-program promotions to support longer-term shopper engagement.

Through multiple short-term loyalty programs, retailers have turned casual shoppers into loyal shoppers and increased long-term sales and market share. Research into limited-time reward programs, conducted in partnership with international loyalty marketing firm BrandLoyalty, shows retailers recorded an 8.8% increase in sales, on average, during the final eight weeks of the events. Four weeks after the events, they recorded a 1.3% sales increase, indicating a change in shopping behavior.

The key to their effectiveness is in creating an integrated calendar, possibly tied to special events such as movie premieres, that gives the consumer a continuous feeling of satisfaction, highlighted by an element of surprise and delight.

Turning Seasonal to Perennial in 3 Steps

Whether the limited-time event is tied to a flavor or a marketing event, its success is determined by the continued frequency of the customer. The following steps should help ensure that those who visit for a maple pecan latte or doughnut today return through to the spring and beyond.

1. Inspire behaviors that serve a perennial goal.

For most retailers, the goal of any promotion is topline sales growth. That’s a short-term objective, though, and its sustainability depends on the shopper behaviors the promotion encourages. The brand should first establish a better-defined goal and then consider the behaviors necessary to achieve it. If the goal of the promotion is to retain existing customers while gaining new ones, for example, the brand may seek to encourage positive word of mouth. Then, rather than emphasizing the short-term availability of the product, which gives it a special-occasion aura, the brand can position it as the gateway to a year of wonderful experiences.

2. Add spice with long-term incentives.

Starbucks is especially adept at using its rewards program to encourage year-round purchases. The same tactic can be applied, with greater focus, to seasonal products. If a brand systematically increases the percentage off a future product with each purchase of the specialty item (10% for one purchase, 20% for two purchases, and so on) there is a better chance the shopper will return — and those chances improve with each subsequent visit. By the time the limited-offer product is out of rotation, the shopper might crave other items on the menu, and a pattern can be established. Importantly, that seasonal spending data can inform promotions in the following year — though it is essential the brand knows when to use the incentive in order to motivate the right customer behaviors.

3. Go for the combo.

Once a defined goal is set and the promotions are aligned, the brand should view the full event as a customer-engagement platform. Sure, maple pecan or pumpkin spice may be available for just a part of the year, but their contribution should have a lasting impression on both company operations and the customer. Insights from the limited-time promotion (including insights from one-to-one consumer surveys) could serve to optimize investments in future promotions. Events of the summer can gradually ramp the shopper up to the fall, and insights from those summer promotions can establish a more complete view of the customer. Promotional partnerships with third-party brands, from Uber to day spas, answer more shopper needs while further rounding out shopper understanding.

Successful brands know that long-term loyalty cannot be achieved with flavor-of-the-month campaigns. However, variety is an important ingredient to maintaining interest. Retaining that relevance means staying top of mind even after the last pumpkin spice latte sale has been carved into the books.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

October 11, 2017

Amazon, Best Buy And Traveling Salespeople: 3 Reasons It Could Work (And 3 Reasons It Won’t)

Photo credit: DAVID MCNEW/AFP/GettyImages

If Best Buy and Amazon are correct, then they may be able to provide at home what shoppers increasingly complain they can never find in the store: a well-informed sales associate.

Call them tech-enabled traveling salespeople. Both retailers are rolling out home-consultation services specific to home technologies, and in doing so, they are answering needs that are as much the shoppers’ as their own.

Amazon is expanding its smart-home consultations, launched in 2016, through which employees provide free smart-home consultations and related product testing. Best Buy began offering free home consultations in the fall. According to its website, its “in-home advisors” can answer questions and help customers make plans for home theaters, smart homes, Wi-Fi, appliances and more.

The anachronistic move is more ahead of its time than it may appear. First off, the service is technology-specific. By bringing their talents to the shopper, Amazon and Best Buy are bridging a purchase gap that has been widening as shoppers find fewer compelling reasons to invest in home electronics. Further, the visits open doors to new, more consistent revenue streams, such as home installations and servicing.

As Best Buy CEO Hubert Joly put it to The Wall Street Journal: “What we’re finding is people in the home tend to spend more because we address a bigger need for them compared to what they spend in the store.”

Could traveling tech salespeople work? Here are three reasons why they could, and three why they wouldn’t.

Why It Could Work

It opens doors to data: Home consultants are able to gather information that is highly specific to a particular shopper but also helpful to understanding others in the shopper’s neighborhood and demographics. The homeowner may use the technology in a way that’s new to the manufacturer, for example. It’s a similar method to those used by Procter & Gamble when it performs in-home interviews with customers, or Nestlé, which employs door-to-door saleswomen to sell its products in poor neighborhoods of Brazil. The brands can learn how shoppers use their products in their homes, which enables them to more ably market for the end user. (Nestlé saleswomen know when customers receive their monthly subsidy checks, for instance.)

They don’t do windows: Remember when doctors made house calls? We may not have liked them as kids, but they made life a lot easier for adults. The same applies to “should do” tasks we tend to put off, such as buying insurance or installing home technology. If the consultant came to us, it would eliminate much of the procrastination, especially when considering we can schedule the appointment online. Amazon promotes “exact” appointment times — no windows — as well as a “happiness guarantee.” Best Buy’s in-home advisors each serve as the customer’s single point of contact, eliminating the need to rehash past conversations (and encourage future ones).

Free samples: Both brands provide their home consultations for free, which means the shopper saves time and gas money. Best Buy consultants help the customer design in-home technology services, such as for the home office, and will arrange deliveries (product prices are the same both in-store and online). Best Buy consultants also schedule Geek Squad repairs or installations. These services, however, are fee-based. Amazon consultants, who are available seven days a week from 8 a.m. to 8 p.m., can give interactive demos of home smart products such as the Amazon Echo smart speakers. It’s basically the same as free samples, though Amazon’s installation services also are fee-based.

Why It Wouldn’t Work (But Could Be Fixed)

Changes of address: If retail home consultations are designed to meet shopper needs at the time of the visit, they risk losing their relevance long-term. Retailers should train their consultants to seek predictive behaviors, ask questions to understand future needs and offer prescriptive solutions or services. Does the customer hint that he may move in the next few years, for example? Is she pregnant? Combining consultant insights from the home visits with historic purchase data will enable brands to gain a reliable understanding of what those same shoppers will need in two or more years.

Lost connections: If retailers do not communicate clearly how their home consultations dovetail with other services and offers, they risk a branding disconnect. Amazon’s consultations are only that — consultations. Shoppers have to purchase the products online separately. Further, a different Amazon employee may make follow-up visits, though armed with data collected from previous consultations. Best Buy shoppers may confuse the home consultations with its Geek Squad service, which is fee-based. Such potential confusion could be avoided with dedicated websites, disarmingly simple communications that visually explain how the services work with other brand features, and with follow-up calls to answer questions.

The hard sell: The most substantial barrier to an open door is fear of the hard sell. Even when the shopper has control over the visit time, she may not believe the brand will put her needs first. This is a trust issue that should be tested among a brand’s most loyal shoppers. Both Amazon and Best Buy seem to have addressed this: Best Buy’s traveling sales consultants are paid by the hour or are salaried, not by commissions; and an Amazon customer told The Wall Street Journal, “He wasn’t trying to sell me anything.” Still, the Amazon consultations typically last 45 minutes, and a shopper may feel that is too great a time commitment for a mere consultation. The “purchase is not required” motto should be stitched into all communications — it can even be a slogan.

Whether tech-enabled traveling salespeople flourish or fail is really up to brand execution. What’s clear is the shopper yearns to have her needs met with little fuss. Send salespeople to the home, but ensure their cases carry simple solutions, not hoops.

This article originally appeared in Forbes. Follow me on Facebook and Twitter for more on retail, loyalty and the customer experience.

Bryan Pearson's Blog

- Bryan Pearson's profile

- 4 followers