Ash Maurya's Blog, page 15

November 27, 2012

Case-Study: How A Scrappy Bootstrapped Team In The Middle Of Nowhere Used Lean Startup To Achieve Startup Success

(This is a great case-study on the “big middle” by Garrett Moon, TodayMade.

I often talk about how most customer learning happens at the tail-ends of the product development cycle – while you’re gathering requirements and after you release your product.

There is a “big middle” where the temptation is high for spending several weeks, months, years building and perfecting the solution. This is often where we also go astray and either build too much or build the wrong product.

The key is building a continuous feedback loop with customers throughout the product development cycle.

Enjoy…

-Ash)

North Dakota.

It isn’t exactly known for its high-tech startup vibe, but it is the place that we call home. We love it, and it really isn’t such a bad place to run a startup. Sure, the winters are cold, but the economy is booming and the workers are hard working.

How A Scrappy Bootstrapped Team In The Middle Of Nowhere Used The Lean Startup Model To Achieve Startup Success

This is the story of TodayLaunch, a product that started with a simple idea and a hypothesis, and learned a lot of lessons along the way.

The BeginningIn 2010, my business parter Justin and I were fresh on the startup scene. With two months of client business under our belt and the launch of our first “web app“, we discovered a new problem that we thought we could solve. That problem? Social media management was hard.

While there were admittedly plenty of tools available, the process of learning how to use them effectively (for business) was complicated. We tried many of the typical software solutions that were available, but our clients rarely succeeded with these tools. Most of the time, they became even more frustrated than ever.

The problem with those tools was that while they technically allowed users to complete social media tasks, they were messy and did little to help make customers actually better at social media marketing. Business owners are busy, and we found that the failure rate with those products, like HootSuite, was high.

We knew there had to be a better way, and so we began with a basic hypothesis: Business owners needed to do three things in order to succeed. From that hypothesis, we developed three tasks.

Respond – Users need a single to-do list encouraging them to respond to all incoming messages.Connect – A tool to monitor outside conversation happening about their brand.Learn – A place to “follow” outside sources (RSS feeds) that could be shared with their brand.Our solution was simple: Create a three-tabbed interface that allowed them to do those three things. Our proof of concept was done by the end of the next day. Our minimum viable product (MVP) was done in two weeks. Within three weeks we hit the road to sell our sorta-working product.

TodayLaunch, the MVP version.

A Hypothesis, a Large Coffee, and a Full Tank of GasWe laugh now about how little coding was done when we made our first sales call, but boy did we learn a lot in a short time. With our product at a reasonable MVP state we contacted approximately 10 local businesses to setup demo meetings. We were able to put together about six great meetings with a variety of local businesses and organizations. Overall, there was great interest in the product, and we sold one copy that day. There were a few holes in our plan, though, and here are a few of the things we learned:

Customers wanted simplicity. We were correct in that users found the current solutions too complex, and that they were willing to explore new platforms.It wasn’t their workflow. While users understood our three tasks, those tasks didn’t really resemble their current workflow. They didn’t fit.Monitoring, not so much. Monitoring was less important that we had realized. There wasn’t sufficient data for most businesses to monitor.Yes to the inbox. The inbox comparison resonated with people. They liked the idea of “archiving” certain messages like email, but our product didn’t look or feel like an email inbox.Adopters, not establishment. Our meetings weren’t with the right kind of people. They were looking for ‘establishment’ products and weren’t willing to gamble on a startup. We needed to find some early adopters.Once we got home, we finished the product. The fist users (one paid, and a few free) received their access within two weeks. It doesn’t get more MVP than that. The product they received was woefully under-built and desperately flawed, but they feedback was positive in the right way, or at least positive enough to continue forward.

The Second IterationIn a matter of a few weeks, we were ready to iterate. We based our second iteration on a few new assumptions and ideas.

Familiarity is not contemptible. We needed to look a bit more like the “other guys” and better resemble an email inbox.Simple and clear names. Our naming conventions for key “tasks” were convoluted. They had to change.Teach the tool. We needed to better convey what users needed to do in order to be successful at social media. We needed to figure out how to teach them while they worked.

TodayLaunch, version 2.0.

A New Interface

The new interface design did a lot to fix the initial problems with the application. We incorporated an email-like feel and new naming conventions. We also added a few giant buttons to help convey the idea of completing or ignoring each message – sort of like a to-do list. This version was a big improvement on the first version, but it still had many flaws.

Our Start In Training

One of the major ways that we began learning about our customers in those days was through a newly developed training program. We created a three-hour social media training course that taught methods that were easily executed using our software. We began offering live-training events to our local market. The training was a great learning experience for our clients, but even more so for us. We began to understand our users’ mindset and needs, and definitely learned about how difficult it can be to host live events.

A Few Lessons Learned

Like clockwork, our second major iteration was a bit hit in the learning department. We picked up a few more users (which wasn’t too easy since they were still being manually added to the system). Some of them actually used it, others didn’t. A few took the effort to send us feedback. We became somewhat discouraged, but stayed committed. We filled the silence with some new assumptions and way too many guesses. We didn’t have a lot to lose.

Our guessing eventually lead to the release of a “fully-baked” version and our first pay-wall. The product was not a success. We had several hundred signups, but only a few organic sales. In the end, there were only a few regular users, and we were most of them.

A Troubled Back-end

One of the things that we learned at this stage was that we needed to look into a complete rewrite of the software. That was heart-wrenching, but the technology used in our MVP was not cut out for the work that we were asking it to do. We needed a modern education in app development. Our interface had also become far too complex for the templating system. If we wanted to do this, we needed to do it another way.

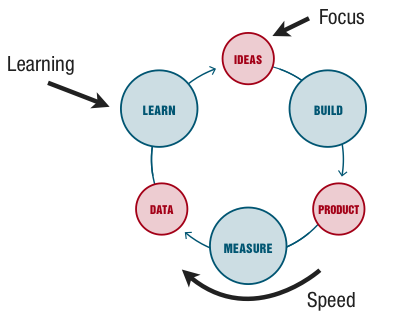

It would be a full year before we made another significant launch of our product. We shied away from selling the current version because we were worried about how it would perform. In reality, this was not a very good decision. We left our build, measure, learn roots. While the rewrite was necessary, we stopped learning, and started guessing. We also hit a productivity rut.

During this time we probably started and stopped three or four new versions of the product. There were difficult conversations, and a few unreasonable accusations about each other’s “commitment to the product.” We felt stuck, and were making big guesses. While we had a few users, we weren’t finding ways to get good feedback. Asking doesn’t always work.

I remember feeling like we had an idea and that we were onto something, but we also felt like we had no hope. It was at this time that we learned the importance of small batches. When we went in for the re-write we chose to build a completely new product to the level of the first, rather than another MVP. This was a mistake. We got buried, and we lost momentum. I am convinced that if we had kept it small we would have launched sooner.

By the time we realized our mistake, we decided that it would be easier to drive through the mud rather than go backwards. In the end, I am not sure that this was the correct decision either. We were bootstrapping our business by doing client projects, so it became really easy for that work to occupy all of our time. TodayLaunch was sort of forgotten, and became a sore subject around the office.

These are the early and dark days of our product. They are frustrating to think about, but served as a valuable lesson.

New WindSomething changed in the spring of 2012.

After growing our client business to a level that could sustain us, we came up with a new plan. As early founders, it felt like we had to let our product go dark in order to shed a few stronghold assumptions. We developed a new name, and a new theory on how everything would work. We cut a bunch of dead weight, and adopted the Twitter Bootstrap framework so we could build faster. TodayLaunch had new wind in its sails.

It was at this time that we killed our first pay model. The first iteration was too expensive, and wasn’t working. We needed to change our focus from revenue to learning. We released a new product on new technology with half of the features in a matter of a couple of weeks. We called it beta, and made it our new MVP.

The New MVP

Build. Measure. Intent.

The one major mistake that we made early on with the new release was in how we approached testing. We hadn’t yet become good at testing key assumptions and theories. We were releasing large-batches and not testing them in an effective way. We were also working heavily off of our own best guesses because we weren’t gathering regular user feedback. It wasn’t that we didn’t want the feedback; we just didn’t know how to get it.

We were dealing with a big misconception that surrounded how we were collecting user feedback. Using Intercom, we were constantly asking our users what they thought about the product. Unfortunately most of them didn’t have a lot to say. They didn’t know what they wanted, and we were asking the wrong questions. We weren’t using a scientific method for learning. We had the data, but weren’t putting it to good use. We finally did three things that helped us get past this problem.

1. We used the data we already had. Our database held important information about all of our users. Once we started digging, we were able to understand how many social accounts each user had, and how many of them were using our product the way we intended. We learned a lot, very quickly.

Business owners did not take the time to learn or implement a social media strategy. They were just trying to survive on their Blackberry!Users weren’t using any of our monitoring tools effectively. The interface was still confusing, and it wasn’t clear what they needed to do with the data.They liked the product. We were gaining passionate users that relied on what we were offering.Our new features were resonating well. Our users wanted a better inbox and awesome publishing. Our worries about monitoring were un-founded. This was not a major reason that our users used the app. We needed to invest our time into alternate areas.2. We conducted a real survey. Believe it or not, but we had never really conducted a survey of our users. I am glad we didn’t, because we would have asked all the wrong questions. We accidentally stumbled on a free tool by KISSmetrics called Survey.io that we shared with our users. We learned at lot.

We learned, again, that our users really liked our product. Almost 90% of our users said they would be “disappointed” if we went away.They were getting our concept. The liked the single inbox interface, and appreciated our clean simplicity. TodayLaunch helped them get more done more often. It was working!We learned that 100%, yes 100%, of our users would use HootSuite instead of TodayLaunch if we went out of business.

As much as we tried to pretend that we weren’t in competition with HootSuite, our users thought we were. This was a huge revelation, particularly with our marketing message. We were being compared to HootSuite no matter what, so we might as well own it. And, own it we did.

3. We gathered feedback from our competitors. Now it just feels stupid. Up until this point we hadn’t done enough to consider what our competitors were doing. For so long, we believed that a scrappy startup couldn’t compete with a VC funded powerhouse like HootSuite so we shut our eyes and focused on our local market. In reality, we did’t need to. HootSuite will always be HootSuite. We had tapped into a group of people that were choosing to not use the biggest name in the business. They had good reasons for doing so, and we could capitalize on that. Even venture-backed businesses have weaknesses.

We spent an entire week researching the most common complaints against our competitors. The great thing about doing business in 2012 is that this kind of information is freely available – everywhere! Our Basecamp project is literally busting at the seams with ideas and features that will clearly set us apart against a formidable competitor. Here are a few things we learned.

We already had key features that our competitors users were asking for, but they weren’t the features that we were talking about in our marketing. We had taken for granted that things that made us the most different.HootSuite has a lot of fans, but there are plenty of people that wanted something different. We could, and already were, building a movement around that.We couldn’t out-develop a venture-backed company — they had a huge running start — but we could develop smarter. By focusing on small batches and a few key features, we could create inroads with new users.

TodayLaunch homepage as it stand today.

A New Product, With A New OutlookGetting TodayLaunch to the point it’s at today took us two years, but once we started learning like crazy, it only took us four weeks to launch a brand new version with an outlook for success. After launching our second MVP, we launched small-batches on a monthly basis until announcing our pay-wall 6 months later.

Now, we are lighter, faster, and smarter on our feet than ever before. In our first life, we believed in learning, but we didn’t know how to get it done. We were also too focused on large releases that bogged us down. Once we re-focused on learning and a few creative ways for doing so, our product exploded. We had more signups in the first day than the entire previous month. We made our first real sale in the new life of the product almost instantaneously.

For the future, TodayLaunch is committed to learning. We’ve embraced KISSmetrics and are committed to releasing in small batches. We know that we have an unlimited number of lessons yet to learn, but the future looks brighter than ever before. All because we decided to focus on learning before and while we build.

September 25, 2012

How We Use Lean Stack for Innovation Accounting

I introduced Lean Stack in my last 2 posts – and . This is a follow-up on how we are using Lean Stack today as our Innovation Accounting framework.

What is Innovation Accounting?Innovation Accounting is a term Eric Ries described in his book, The Lean Startup:

To improve entrepreneurial outcomes, and to hold entrepreneurs accountable, we need to focus on the boring stuff: how to measure progress, how to setup milestones, how to prioritize work. This requires a new kind of accounting, specific to startups.

Innovation Accounting effectively helps startups to define, measure, and communicate progress. That last part is key.

The true job of entrepreneurs is systematically de-risking their startups over time through a series of conversations. Success lies at the intersection of these conversations and each has a specific function and protocol.

For example,

with customers, we first use interviews and observation techniques to inform our problem understanding, then follow up with an offer and MVP to test our solution.with investors, we first use pitches to inform our Business Model understanding, and then use periodic board meetings to update that understanding.Today, I’d like to specifically focus on the conversations we have with our teams.

Experiments are Where the Action’s AtYour initial vision and implementation strategy go through lots of initial thrashing (as they should) but after a while they (should) start to stabilize.

The goal of a Lean Startup is to inform our riskiest business model assumptions through empirical testing with customers – not rhetorical reasoning on a white board.

The focus then shifts more towards empirical validation of your vision and strategy through experiments.

Even though running experiments is a key activity in Lean Startups, correctly defining, running, and tracking them is quite hard.

Here are a few key points to keep in mind:

Experiments are additive versus standaloneThere is a natural tension between keeping experiments small and fast, and the expectation of uncovering big insights. The key is realizing that most experiments aren’t standalone.

You will probably never run a single experiment that will remove all risk from your business model in one fell swoop. Rather, it’s more likely that you will incrementally mitigate risks through a series of small experiments.

Every experiment needs to be falsifiable and time-boxedFrom the Scientific Method, we know that experiments need to be falsifiable (written as statements that can be clearly proven wrong) in order to clearly declare them validated or invalidated.

I additionally recommend time-boxing experiments so that even when the falsifiable hypotheses have not been met, they are still brought up periodically for review. This is to short-circuit our default tendency to wait “just a little longer” when we don’t get the results we expected.

Breakthrough insights are usually hidden within failed experimentsTime is the scarcest resource in a startup.

I find that many entrepreneurs get depressed when their experiments fall flat. They end up at a loss for what to do next or they make too drastic a course correction – justifying it as a pivot (a change in strategy).

A pivot that isn’t grounded in learning is simply a disguised “see what sticks” strategy.

Failed experiments are not only par for the course but should even be expected and embraced as gifts. At Toyota, the lack of problems is considered a problem because it’s from deep understanding of problems that true learning and continuous improvement emerges.

There is no such thing as a failed experiment, only experiments with unexpected outcomes.

- Buckminster Fuller

When an experiment fails, rather than simply declaring failure and/or using a pivot as an excuse, dig deeper instead. Search for the root cause behind the failure using techniques like 5 Whys, follow-up interviews, lifecycle messaging, etc.

There is a reason the hockey-stick curve is largely flat at the beginning. It’s not because founders are dumb or not working hard, but because uncovering a business model that works starts with lots of things that don’t.

It’s hard to be disciplined about time-boxing experiments which is why we have established a regular reporting cadence we use both with internal and external stakeholders.

Establishing a Regular Reporting CadenceWe utilize daily, weekly, and monthly standup meetings described below:

The Daily Standup

Our daily standups are structured around communicating progress on individual tasks and blocking issues. We use a separate online task board outside the Lean Stack that is broken into various sections (swim-lanes). Most tasks are directly tied back to experiments currently underway. Others are grouped more generally into sections such as bug fixes, code refactoring, writing blog posts, etc.

The Weekly Standup

Our weekly standups are structured around communicating progress on current experiments and defining new experiments. We start on the Validated Learning Board and work our way backwards from right to left. We first discuss experiments that completed (either successfully or unsuccessfully), ran past their time-box (expired), or got blocked.

Each of these discussions needs to end with a clear next action:

If an experiment failed, expired, or is at risk, the next action is scheduling a task to determine why. Once we determine why, the corresponding Strategy/Risks board and Lean Canvas are updated (if applicable), and a new follow-on experiment defined.If an experiment passed, the next action is determining if the underlying risk we set out to mitigate was completely eliminated. If not, a follow on experiment is defined.The conversation so far is grounded entirely on empirical learning following the additive rule of experiments.

In addition, we also spend some time discussing any recurring peripheral customer issues and/or feature requests. The level of customer pull is quickly gauged against our current key metric focus and a decision is made to either initiate a “Problem Understanding” initiative or table the issue for now.

A common trap in a startup is overcommitting one’s resources and always being in a state of motion (building too much and/or constantly fire-fighting).

“The only place that work and motion are the same thing is the zoo where people pay to see the animals move around” (not exact phrase).

– Taiichi Ohno

We instead strive to build slack into our schedule – affording us room for continuous improvement. We accomplish this using Kanban work-in-process limits on the Validated Learning Board to constrain the number of experiments we are allowed to run simultaneously. This further forces us to ruthlessly prioritize our next actions so that everything we do is additive and aligned with our current singular key metric focus.

The Monthly Standup

Our monthly standups are structured around communicating progress on the overall business. We compile macro financial and innovation accounting metrics along with a one-page progress report (lessons learned) on the previous month. This is our version of a “pivot or persevere” meeting like the kind Eric describes in his book.

The output of this meeting is also shared with our advisors whose feedback is used to inform our strategic direction.

Applying A3 ThinkingWhile the Lean Stack does a great job of visually communicating progress, post-it note sized summaries don’t do justice to the complexity of experiment design and progress communication.

To overcome this shortcoming, I borrowed another page from the Toyota playbook – the A3 report.

As you can probably tell by now, I am a huge fan of one-page formats.

The A3 report is a one-page format Toyota developed for solving problems, describing plans, and communicating progress. The name A3 comes from the international paper size which also happened to be the largest paper size fax machines could transmit. Nowadays, Toyota uses the more universal A4 size but the original name still stuck.

Here is what our one-page experiment report looks like:

When we commit to run an experiment, the experiment is assigned an owner (usually the initiator) who starts by filling the left hand side of the report. As the experiment progresses, data from the experiment is filled in on the right hand side. And when the experiment ends, the validated learning section is filled in with a clearly stated next action.

We use additional variations of the one-page A3 report for capturing new feature initiatives (MMFs), risks, and monthly progress (lessons learned).

I know what you’re thinking. That’s way too much process for a startup. Surely, it will get in the way of getting real work done.

Like you, I am averse to needless process. Yes, it’s way faster to iterate in your head alone, but I can tell you from first-hand experience, that it’s hard to scale the “mental leaps” approach over time and especially across a team of size greater than two.

The A3 report is less of a template and more a way of crystalizing and visualizing one’s thinking.

Like the Lean Canvas, the A3 report is deceptively inviting to create but the one-page constraint forces a level of conciseness that cuts out all the noise.

The format of the report itself is rooted in the Deming PDCA cycle (Plan-Do-Check-Act) which has lots of parallels to the Build-Measure-Learn loop and the Iteration Meta-Pattern.

A3 reports become archives for your company learning

Our goal with these reports is not just using them to crystalize current thinking but also to turn them into an accessible source for archiving learning for future use.

The ability to playback experiments through these reports not only communicates learning to new team members but also helps demonstrate the modus operandi of how we work and think.

Putting it to PracticeLast time, I described why and how we implemented the Lean Stack MVP using physical posters. I am still a huge proponent of a physical card wall. The card wall serves as an effective progress radiator (even from 20 feet away) and fosters great in-person discussion.

But the biggest challenge we have had is keeping the card wall synchronized across our geographically distributed team. We needed an online solution and tried cobbling together a solution using existing online kanban tools. But they all fell short – mainly for their lack of swimlane support.

At the end, we came up with a simple and elegant solution built using Keynote and Dropbox that far exceeded our original expectations.

The shared Keynote document holds master templates for all the Lean Stack boards and A3 reports. Adding/moving cards on the board is dead-simple through drag-and-drop. Using hyperlinks, we were able to easily build in click navigation which makes the document behave like an app when in presentation mode. But the biggest benefit was being able to capture all this within a single portable document. We named this document the “Spark59 Playbook” because it captures our Vision, Strategy, and ongoing Product Experiments all in one place.

Like the posters, we are making our playbook template available for early access along with additional tutorial video content and an invitation to participate in the evolution of Lean Stack.

August 29, 2012

How to Get Early Customers to Respond to Your Cold Emails

This is a guest post from Robert Graham – a solo bootstrapper who blogs about the experience. Robert has been working in software since 2005. He is a Ph.D. dropout who spent time working for Google. Someday he ‘d like to work for himself. You can learn more about his approach to developing customer relationships in his new book Cold Calling Early Customers.

Any foray into a new entrepreneurial enterprise will hinge on the contacts you forge around this new opportunity. On occasion, you can pursue ventures where you possess bulging rolodexes and everyone you need to speak with is an old friend. More often, you are faced with chasing an opportunity starting from zero. There are many channels that can produce your first early customers and contacts, but the one I see most often is cold email. This post outlines the method I use to approach cold emailing. It is a reflection of the tactics I use when cold calling, and I have seen my success rates improve dramatically when I invest in the process.

I’m assuming that you already have a profile of people you would like to speak with, but before you charge ahead, make sure that it is a specific and useful customer profile. I also assume you can generate a list of those people to contact.

Know your target

This is the most important step of all. You must understand who it is you’re speaking to. It is no different than writing a great speech or putting together a hit presentation. It must fit the audience. I’ve sent poorly targeted email far too often. It is rarely read and even more rarely responded to. The most common reason I send it is because I get in a rush due to something exciting about the opportunity. It rarely pans out. The excitement of getting responses is much better. Put in the time and know your target.

It is easy to think that you know all you need to about your targets by throwing out some guesses and glancing at a few demographics, but I think preparation defines the success or failure of most activities. If you mail this part in, you are crippling your chances for success before you begin.

Check out their website and read their blogs. If they have a demo or a trial, you should pursue it and see what you think. Use a tool like OpenSiteExplorer to see who links to them and take a look at those sites. Find industry groups, conferences, and magazines. Take a look at the rate cards, demographics, attendance, and organizers. Follow them on Twitter and read their stream. Use FollowerWonk to get a feel for their followers. The more information you can get, the more likely you are to find inspiration and understanding. Running through the complete process in the early stages makes you much more efficient in later stages as you get a feel for the industry and have warm introductions.

Core Pitch

There are two routes that I use as my primary pitch in the cold emails I send. The first is to devise a way to offer immediate value to a prospect and integrate that into the email. This approach gives me the best response rates, but it takes more effort to build something valuable that I can offer. Sometimes, I ‘d prefer to send out a few additional emails with a simpler pitch that focuses on getting them talking.

Route 1: Devise a value proposition

You need to build some value to offer a client. There are two avenues I ‘ve used for the value offer.

The first value offer is education-based marketing. You research the market and develop some materials that will improve their standing, sales, or prospects. You then package that material into an e-book, report, video, or other media. This can be really effective, and I was best introduced to the idea in Chet Holmes ‘ The Ultimate Sales Machine.

I ‘ve also seen this used at Star Furniture. I went by one Christmas look at what my options were in leather couches, and I was treated to a tour of the leather types and qualities as well as the materials and construction types for all tiers of furniture. After the information, I felt much more able to make a purchasing decision and I felt that my sales rep was invested with me in that process.

If you spend a few minutes searching the Internet for blogs and you click through to some high traffic ones, you ‘ll probably be given the chance to sign up for a newsletter. The best pitches to do this will include a free template, report, or e-book. This is the mold for Internet marketing with the education pitch. We ‘re just applying that to cold emails. One of the places I have seen also offers a chance to win a 1-on-1 coaching session if you follow them on Twitter and/or Facebook. You can use this pitch to get more followers, or you can build your value proposition around a productized consulting offer (SEO analysis, customer acquisition, etc.).

The next value offer is a play on marketing and lead generation. If you are familiar with my writings on cold calling, you will recognize this pitch, but I hope to add some additional perspective here.

Everyone needs to promote his or her business. You can inject yourself into that equation when you ‘re trying to meet people in an industry. Build a website that has industry awards for various categories and contact people to interview them as nominees. Build a blog about an industry and offer to interview people in the industry for the blog. The blog can address best practices or simply be a rotating feature of options. Best practices are a good play for an industry like engineering consultants. Rotating features would play well for resorts or festivals.

This is free promotion and in most industries it is highly valued. Chet Holmes even recommends that you play the competitors in an industry off of one another by mentioning who else you are speaking to.

Route 2: Quantity has a Quality all its own.

When you don ‘t have the time or interest to build a value offer, you can still craft an email that will get you some responses. The only such pitch I ‘m comfortable making is an honest one that begins a relationship. This section will detail my approach.

I retarget my prospect list at this point to individuals that are similar to me. Ideally, they are entrepreneurs or business owners that are more likely to help someone getting a new venture started. If that isn ‘t possible in a particular niche then I go for geographic locality, shared affiliations, or alma maters. You can improve your success dramatically by personalizing your list to contact. If you ever catch yourself writing something for everyone, pull back and realize that you ‘re writing for no one.

My pitch revolves around asking earnestly to speak with them about their business. The more research you do, the more specific you can be.

“Talk about your business” is less effective than “Talk about the e-book business.” Which is effective less than “Talk about e-book marketing.” Which, finally, is still less effective than “Talk about marketing e-books on Amazon.”

More specific pitches connect directly to the people you are contacting and grabs their attention. Research this and add some cursory but subtle remark about your similarity.

“We both went to Tennessee!” is less than

“Tennessee” in a signature or a probing “I noticed you’re in Ann Arbor. Are you a Wolverine?”

The latter forms initiate the same conversation, but they don ‘t sound desperate and grasping. You can use the Wolverine question type for most remarks even if you know the target is not a Wolverine. It will spark the discussion if it is something they care about. If they respond without mentioning it, you know it doesn ‘t matter to them.

Build your script

I usually personalize cold email from a template. That template can be written or simply in your head. Here is a simple example template for starting the conversation that can be adapted based on your approach and context.

GreetingConnection statementPraisePitchCloseSignatureThe connection statement is a way to relate you to the target. Did you meet at or attend the same conference? Did you read their blog? How did you learn of them? Is there something really interesting about their business to you? Is there something interesting or impressive about their website? If you don ‘t have a statement to fit this mold, then do more research until something falls into place.

You should include some form of authentic praise in your initial communication. I often include it as part of the connection statement, but I think authentic praise is a positive element. Make sure you are as specific as possible to stay away from sounding hollow.

“I like your blog,” is nice but less meaningful than “I read your post about improving conversion rates last week and I thought it was so insightful I ‘m applying it to my site.”

Example Openings:

“Thanks for the blog. I have been reading since June ’11 and it continues to deliver. Your post on gingerbread construction has completely changed my holiday cooking and decor.”

“I was bummed out when I noticed that you were also at Wildlife Expo ’12. I wish we had met there so we could talk about how you guys select bloodlines. Your success has been really impressive.”

“I found your website last week and I was impressed. Is it your primary marketing channel?”

Example Pitches:

“I run a blog that highlights exceptional real estate outfits and I ‘m writing to see if you would be interested in a 30 minute interview via Skype or phone?”

“I am interested in speaking with people in the consulting engineering business to learn what their problems are. I run a software startup and I want to partner with you to improve your business.”

Example Close:

“I look forward to speaking with you.”

“Best of luck at AADC ’12.”

Complete Example:

Hi Jack,

I was bummed out when I noticed that you were also at Wildlife Expo ’12. I wish we had met there so we could talk about how you guys select bloodlines. Your success with genetics has been really impressive. I run a blog that highlights exceptional breeders in Texas and I want to feature you guys. Would you be interested in a 30-minute interview via Skype or phone? Good luck with your booth at TDA this year.

Thanks,

Bobby

Subjects

If you look at email as a funnel, the first big drop off for our purposes is the open rate. The only thing most people will see is your “From:” and “Subject:” lines. You need to use the subject to get people to open the message. Simple subjects are usually the best approach.

A subject should summarize the email and set expectations properly. For these type of emails, I create a summary of my value proposition in subject form.

Examples:

“30m interview to be featured on Blog Name”

“Conversation about marketing yourself as a realtor”

“Chat about networking with City Managers”

“Chat about customer acquisition for bakeries”

“Partnership opportunity with software startup”

Subjects need some experimentation in the context of your market. Some markets are awed by ‘software startup ‘ and others are skeptical and distrustful. Think about what would interest you in an email subject and why. Try to put yourself in their shoes and do the exercise again. Use the responses you get to guide which subjects you continue to send.

Be personal

Each email should be personalized. Your success rate will be a reflection of how well you can connect with the people you are writing. You can trade prep and writing time for blasting out more emails with a lower success rate, but I think your long-term business interests are better off with the personal tactic.

Keep it short

Initial contact should be short for multiple reasons. It respects their time and it increases the likelihood that the message will be read. How often do you read an email from someone you don ‘t know that is a text wall? I usually put off long cold emails with the best of intentions, but I know my response rate goes down relative to length. It isn ‘t because I don ‘t want to answer or help. It ‘s simply because I don ‘t frequently sit down in front of my email with a lot of time to read messages and write responses.

Email is something that people use continually throughout the day. They may be on a computer or a mobile device. They may only have a few moments when they open their email. You need to fit inside of a tiny window while standing out in order to get read and responded to.

Follow up

Because of the nature of email discussed in the prior section, you may end up getting ignored by a large percentage of the people you send a message to. Following up is essential to make sure they have an opportunity to respond. You may be able to connect with them at a better time of day or in a week where they happen to be less busy. Follow up dramatically increases your odds of success.

I heard an interesting tactic for managing email volume when you return from vacation recently. Delete all of the emails, and the important ones will naturally turn up again in your inbox. This observation rings true of my own inbox and it demonstrates how critical follow up is for your response rate.

Keep a record of the addresses you send messages to, when the message was sent, and what version and subject you used. This information will add to your intuition about what the best approach is in addition to providing you the means to make your follow up systematic. I think you can follow up seven days after an initial message and thirty days after that in perpetuity. I have found that people respect the persistence.

If contact with other targets or additional research allows you to improve your value proposition or offer the target something better, then tweak your pitch and try again. Different value propositions can succeed in very similar contexts. It is very common for my insight into a market to improve as I do customer development. I always adjust my pitch and follow up with the most promising contacts I have.

Add touch points

Be in front of the target in as many ways as possible. Participate in community forums, meet-ups, conferences, blog comments, etc. Become a speaker in the community. Don ‘t post comments with your URL and nothing to add to the conversation, but become a real part of the community in a few minutes a day. Recognition is a boon to response rates.

Summary

Do your research, build a loose template, personalize your emails, experiment with your subjects, and follow up with responders and non-responders alike in a systematic way.