Brent Adamson's Blog, page 20

October 23, 2012

Wondering Why Training ROI Is Low

October 22, 2012

The Changing Mandate of Deal Desks

[image error]Much has been written about how deal desks will revolutionize the sales function. In fact, in a recent poll, 87% of SEC Members report having, or planning to have in the near future, a deal desk.

For the last two years, we’ve tracked this emerging function as their role continues to evolve. Last week we sat down with three members to discuss the evolution and development of their deal desks.

Our latest survey discovered two changes in deal desks’ role and operations since our last benchmarking survey in 2011. The first change we found was a shift in deal desk responsibilities. As deal desks are a relatively new function, their internal duties and tasks have continued to evolve as internal demand fluctuates and the full potential of deal desks as enablement tools is realized. Also, as a result of these changing responsibilities, the function deal desks report into has shifted as well.

In the first few years of operation, deal desks primarily approved deals and were involved with deal execution. Now, as deal desks mature, their focus has shifted to deal intelligence and becoming a strategic business partner in deal enablement.

In particular, our latest benchmarking survey found three deal desks’ tasks that have increased:

Approving deals with non-standard terms and conditions

Structuring complex deals and providing negotiation support

Developing and delivering sales enablement tools

However, not every deal desk responsibility has increased. We found a reduction in the number of desks that are tasked with responding to RFPs/RFQs. This change is due to the increasing specialization on complex, cross-functional, and non-standard deals that now consume deal desks’ resources.

Changing responsibilities have led to an internal shift in deal desk reporting structure as well. Our data shows that 45% of deal desk heads report into Finance, compared to only 11% in 2011. Because deal desks are increasingly focused on deal economics, reporting into Finance allows them better access to finance resources, resulting in more pricing consistency and faster approval rates for deals.

As the internal location of deal desks settles, compensation of deal desk employees presents a new challenge to companies. Due to the unique involvement in deal processes, which differs from traditional rep activities, deal desk employees generally have a different compensation structure.

As deal desks are becoming increasingly involved with Finance, and playing a larger role in assessing the risk and reward of deals, companies are ensuring compensation does not influence deal decisions. Variable pay is generally not based off of sales metrics because it could bias deal desk employees and lead them to approve sub-par deals to achieve a target bonus. As compensation for deal desk employees continues to develop, sales organizations are looking at gross margin profit, overall company performance, and realized price of deals as bonus metrics.

SEC Members, listen to the webinar replay where we share the results of our 2012 deal desk benchmarking survey and tips on how to manage and structure these functions. Also, review the key findings page to better understand the emerging role and mandate of deal desks.

Development Dollars (Needlessly) Down the Drain

By Doug Hutton [image error]

Of all corporate functions, Sales consistently spends the most money on a per person basis for training and development. From technical product courses to negotiation or Challenger skills, sales rep development often goes unquestioned as critical to achieve sales outcomes, even after factoring rep time away from customers. Then how do sales leaders square that truism with clear data that training often has limited impact on performance and widespread dissatisfaction persists with current development offerings? SEC research shows that 84% of sales executives rate their sales training programs as being only “somewhat effective” or “not effective” – not a rosy picture for what is likely the largest line item after headcount.

Why are current sales training programs so ineffective? A figure like 84% certainly has multiple culprits, but long-time CEB Sales Executive Council members likely recall the primary reason: sales reps forget 70% of the information they are taught within a week, and 87% within a month, without subsequent on-the-job coaching and reinforcement. We cannot reasonably expect that 13% of training curricula can truly move the needle when it comes to sales performance. The next logical question becomes this – how can we prepare both sales reps and their managers for successful development experiences to boost the amount of retained knowledge?

The answer is surprisingly simple: individual applicability. Research from CEB Learning & Development has found that training’s relevance to urgent individual skill gaps is one of the most impactful drivers of both a rep’s motivation to apply learnings, and (unsurprisingly) corresponding improvement in rep performance. The member imperative becomes this: putting a clear view of those urgent skill gaps in the hands of each rep before training, and providing sales managers with the tools to coach to those gaps afterwards.

As mentioned in an earlier post, CEB is excited to announce our newest service, CEB Challenger Selection & Assessment. Not only can this offering help organizations make more objective hiring decisions, the Challenger Assessment can determine the specific competencies correlated to high performance for particular roles and develop a deep understanding of current skill gaps. This will enable you to deploy targeted, applicable sales training to groups of reps with similar skill gaps. Not only will this save you money by not allocating resources to ineffective training, it will also highlight to employees your intent to provide them with thoughtful, impactful development opportunities.

By assessing your sales reps across a wide variety of competencies, each rep will receive a tailored individual development report, complete with guidance on how to improve Challenger skills and their overall selling ability. Sales managers will then have a roadmap to help each rep close critical skill gaps, while sales leadership can allocate resources most appropriately for training and development.

For more information on this new offering and to begin adding more Challengers to your sales force, please click here to send us an e-mail; we will reply within 24 hours to schedule a subsequent conversation.

SEC Members, to learn more, visit the Challenger Selling topic center and review the Challenger Rep Starter Kit. In addition, look at the Talent Development topic center for best-in-class practices on training, coaching, and developing managers.

October 16, 2012

First 50 Challenger Implementations—Spotlight on Messaging

This is the second in a series of three guest posts about CEB’s solutions for sales effectiveness (read the first one here). Our team helps organizations improve the overall performance of the sales force with customized insights, tools, and training programs (contact us to learn more).

This is the second in a series of three guest posts about CEB’s solutions for sales effectiveness (read the first one here). Our team helps organizations improve the overall performance of the sales force with customized insights, tools, and training programs (contact us to learn more).

The last time we wrote, we shared some lessons learned from the first 50 Challenger Development Programs that we have rolled out with our clients. We discussed the importance of continually refining your commercial teaching messages, the role of the manager, and the process for teaching. In this post, we want to take a deeper dive on lessons learned from building Challenger Messages. We are helping many of our clients apply Challenger in the sales and marketing messages they deliver to prospects, and wanted to share our key takeaways so far.

Don’t Underestimate the Power of Collaboration

When was the last time your sales and marketing leaders actually sat around the same table and developed a message for your customers? In many cases, we are finding that the answer is “never”.

And, without that collaboration during the message formation process, it is highly unlikely that one side will adopt something that the other created. As an innovative concept Challenger can serve as a vehicle to bring both teams together and collaborate on message creation. Our members tell us it works—the two teams strengthen their working relationships, and leverage the messages they jointly create. Some other feedback on collaboration:

“This is the first time I’ve been in a workshop focused on marketing messages with sales people.” — Medical Devices Marketing Manager

“I got to know the marketing team better throughout this process than in 7 years at this organization!” — Consumer Packaged Goods Sales Professional

“The partnership we’ve created from drafting the messages and improving them can be a source of competitive advantage for us in the future.” — Pharma Marketing Manager

Start with the Basics: What Makes You Better?

Pick up the phone and call a colleague. Ask them what your top two differentiators are relative to your biggest competitors. Surprised at what you hear? One of our biggest surprises so far has been the differing opinions within many of our client organizations around competitive differentiators. In the process of developing your messages, a very positive side effect will be gaining internal consensus around your true strengths and the value you deliver relative to the competition.

Engage Your Customers through Storytelling

Storytelling is far too under-utilized in B2B communications. Some of the strongest messages we have helped develop incorporate stories in the form of imagery, metaphor, pictures, and well-crafted case studies. At the center of the story: The CUSTOMER. While data and ROI tools are useful, don’t lose sight of the story! Once you’ve identified the teaching message, think about a simple story or image that might help your sales people convey that message in a more compelling way.

Fewer is More (at First)

As our members begin this journey, many have come to us and said: “we need a Challenger Message for every product, every vertical segment our company calls on – immediately!” Yes, eventually you will want to have Challenger Messages aligned with your entire offering. However—start slow. Focus on a key solution area that is proven, but still critical to your sales strategy this year. Begin with a few messages (around 3) and practice, practice, practice! It’s better to have 2 or 3 really great messages than 15 or 20 good ones. Also, keep in mind that your sellers will need to practice using these with customers, so starting with a few allows for easier adoption by front line sellers and managers.

Be Prepared: The Messaging Learning Curve

As your organization moves from a “product-first” focus to insight-driven, customer-focused messages, prepare for a learning curve that will feel very steep at first. The initial messages that you create will feel different, and in some cases you may meet internal resistance. It won’t seem easy at first. Not to worry, that’s the whole idea. This is a different way of selling, and you’ll have to remind yourself along the way. Why are we doing this? Because our customers want insight from their suppliers, not features and benefits. This is where an external perspective can speed your journey along.

Talk to Your Challengers, and Your Best Customers

Two of the very best sources of key insights and messages will be close to you already. Internally, identify your Challengers and interview them around the key messages that they are using with customers. Going outside your company walls, your top customers will also be invaluable as you workshop the messages that are most likely to resonate with the market.

We’d love to hear your experiences implementing Challenger throughout your sales and marketing messages. Share your thoughts below, or reach out to us directly.

SEC Members, to learn more, visit the Challenger Selling topic center. In addition, review the key components of world-class insight and how you can create your own teaching pitch.

Revolutionizing Social Selling the IBM Way

In the months since our first blog post on IBM’s social selling strategy, there has been overwhelming interest in the process they use to support reps, while maintaining brand standards.

For IBM the process was important; the growth in social among their customers and the shift in related buying behaviors necessitated the change. We recently had the pleasure of welcoming Doug Hannan and Ed Linde II from IBM to discuss in more detail their social engagement strategy.

IBM uses a deliberate process to establish reps as knowledgeable members of their community, linked to thought-leaders, delivering relevant content to their network that transcends their particular offering. Reps are encouraged to educate themselves about industry issues and trends, the competition, customers’ business issues, and share that information with prospects and customers where they learn. That learning largely comes from connecting, listening, and facilitating—in short, becoming a member of the customer’s community. This, in turn, increases levels of trust and credibility crucial to engaging with customers today.

How it works:

A web merchandiser, working with a marketing manager creates a social message calendar. Reps subscribe to an RSS feed that pushes messages to the reps’ inbox when published. The reps then choose the specific message that goes into a Twitter feeds or LinkedIn status updates.

Reps can simply cut and paste, but most choose to personalize the message. Over time some reps become more involved in the process, following SMEs within IBM and externally to create their own content. In all cases the intent is to help customers learn, regardless of the source, not buy.

IBM has been careful to integrate this process into reps’ existing workflow, recognizing that reps are more likely to engage, and to overcome early resistance. “We made social a part of sales enablement, just like they get a sales kit they get social messages, so they can pick and choose.” (Doug Hannan)

Marketing does a lot of the front-end work of both what and where to post. Using developed listening principles, teams supply reps with information to understand trends, keywords, issues, and give reps names of people to follow. Each rep is also provided a personal page that can leverage marketing-supplied messages and also post personal messages relevant to the customers they follow. Each page also has feeds from other social media sites so posting is coherent across channels.

IBM avoids the issue of spam through discrete customer audiences and careful choice of 3rd party content. Each seller is encouraged to develop their personal brand under the IBM umbrella and join and follow networking groups of interest, so they can respond intelligently to customer concerns.

That said, there is a difference in use across sales roles. Inside sales reps have a higher dependence on LinkedIn, professional networks and Twitter, while brand specialists tend to use collaboration tools and personal pages. For all sellers, it is important to have a positive presence online to engage with customers researching the individuals with whom they interact.

In each instance it is stressed that understanding the sales process and customer interactions is important to align the tools reps require with their roles and responsibilities. “The thing you need to be careful about is not trying to build a ‘field of dreams’, where you build it and they will come. It is important to put the right set of capabilities in their hands that they will actually use.” (Ed Linde II)

IBM uses a variety of metrics to measure performance success; retweets, mentions, reach, revenue, and leads. They focus on patterns and trends in the data and use marketing analytics to understand which sales are likely to proceed quickly. The data has shown that using digital tools effectively has an impact. Specifically, reps that have both strong networks and use digital tools effectively have a 2-6% improvement in sales over their peers who were less effective.

SEC Members, listen to the webinar replay for a full discussion on IBM’s social selling strategy. Also, access the case online and review our most recent study.

October 14, 2012

What’s Keeping Asia Sales Leaders Up At Night

This is the first in a three-part series that explores the unique challenges of selling in Asia.

This is the first in a three-part series that explores the unique challenges of selling in Asia.

Over the last three months, we’ve spoken to more than 50+ sales leaders across both local Asian companies and multinational firms based in Asia. What we’ve uncovered through these conversations, and a rigorous quantitative survey, is a wealth of information on the challenges of selling in Asia.

Unequivocally, if there is one issue top-of-mind for every sales leader, it is attracting and retaining quality sales talent. While 63% of companies surveyed point to increasing sales headcount over the coming year, attrition risk remains widespread in Asia. 30% of sales employees see themselves staying with their current company for one year or less, while 20% are actively looking for a job with another company.

With a strong mandate for growth, sales leaders find their teams grossly ill-equipped to perform—both in terms of required headcount for growth and expansion, and requisite selling skills. Compensation is frequently used to attract and retain talent, though many leaders point to compensation spiraling out of control in recent years. What’s more, available talent lacks critical selling skills, most notably the ability to:

Sell Complex Solutions: Higher deal complexity and better informed customers are forcing Asia-based sales organizations to move away from traditional transactional selling models. Customers are increasingly looking to reps to teach them something new about their business.

Sell Across Markets: Asia presents not one homogenous market, but a collection of diverse cultures overlaid with fairly distinct markets. Sales interactions often vary across the region—the best reps tailor the message to the nuances of selling in the specific country.

Sell New Business: Traditionally, high established demand in Asia has meant reps have ample opportunities in their pipeline with little incentive to hunt for new customers. That said, lofty targets are driving demand for hunter reps that can win new business by taking control of the sale.

In response, sales organizations in Asia are adopting a mix of strategies to attract and retain talent. While maintaining compensation at par with market levels; the best companies are highlighting other aspects of the employee value proposition, such as future career opportunities, to attract the right sales talent. In a similar vein, sales leaders are increasingly overweighing non-monetary incentives, such as team events, that are known to drive employees’ discretionary effort and intent to stay in organizations.

Further, to upskill talent, some companies are experimenting with a “reverse expat model” wherein local sales employees are sent to companies’ other global offices to develop next-level skills and gain broader exposure to company operations. In particular, companies are encouraging rotations within other Asian markets to develop talent that can consistently sell across the region. In the long-term, organizations look to these programs as developing future local leaders that can fill management ranks.

Are you based in Asia or have recently completed a sales stint in Asia? What’s your experience been? How has your organization overcome the challenge of talent attraction and retention in Asia?

SEC Members, review executives’ outlook on business conditions in Asia across 2012 and SEC’s most recent analysis of the sales labor market in India and China.

October 9, 2012

The Single Most Important Question for the Challenger Sale

Here at CEB’s Sales Executive Council we are both excited and humbled by the global excitement for our research profiled in The Challenger Sale. Indeed, just last week the book made it into the Wall Street Journal business book bestseller list for the first time. Not surprisingly, that kind of attention has led to a great deal of momentum around the model, but some common questions as well. Many of those questions are easily addressed through a better understanding of how we conduct our work and the assertions we make regarding its findings.

Is the Challenger approach really all that new? In many ways, no. It’s very likely that the best sales professionals have effectively sold this way for years. Indeed, we know the best reps are already challenging customers’ thinking because if they weren’t we wouldn’t see the story in the data. That’s one of the reasons why we rely so heavily on broad-based, data-driven analysis. It allows us to better understand the world as it actually exists today.

Is Challenger always the right answer? Certainly not. Challenger reps are not the silver bullet to every possible sales scenario. In many cases, more transactional customers are better served through a much lower cost sales channel altogether—perhaps even a website—as it’s the cost of sale (more than the magnitude of disruption) that drives margins for customers stubbornly focused on high-volume, low-cost transactions.

What is clear, in a world where customers want more time to decide and bigger discounts, is that allowing customers to decide for themselves how they should be served is a recipe for disaster. Yes, we must give customers what they want, but not at the expense of killing our margins in the process. Prior to any application of the Challenger model, we recommend rigorous customer segmentation and opportunity qualification around criteria designed to determine a customer’s openness to disruption in the first place, irrespective of that customer’s geography, size, or industry vertical. For many companies, more insight and disruption creates more opportunity – but this isn’t the case for all.

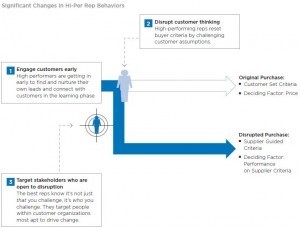

Are Challenger attributes meant to be an exhaustive list of what makes a star a star? Not at all. Challenger reps’ ability to teach, tailor, and take control distinctly set them apart from their core performing colleagues, but they by no means represent the only techniques stars apply to win a sale. In many ways, it’s more helpful to think of those three skills as a definitive list of what core reps are not doing, rather than what star reps are doing. This certainly doesn’t mean, however, that selling skills, such as world-class questioning, effective relationship-building, or proper use of body language aren’t important for effective selling. They absolutely are. Crucial in fact. However, the data tell clearly indicate that Challengers deploy these skills in a very different manner, namely in an effort to disrupt customers’ thinking rather than confirm it—to deliver insight to customers rather than extract it from them.

How comprehensive is CEB’s research methodology? Very. Our sample size now covers over 20,000 B2B sales professionals from around the world, spanning every major industry, geography and go-to-market model. Put simply, it’s very robust. Beyond the raw data, however, CEB brings decades of experience in analytics, interpretation, and validation with our network of 500+ heads of sales to extract the insight and tools leaders need to take very tactical action around the small number of findings most likely to drive the greatest commercial impact. We boil the ocean, so you don’t have to.

Furthermore, we are a research organization above all else. Our understanding and the level of precision we apply to Challenger, or any of our research, continues to evolve. The backbone of any of our research, tools, engagements, or publications is what we see working at the leading edge of sales effectiveness.

Be all that as it may, however, the one question we find relatively fewer people asking is the one we ultimately think matters most. And that’s simply: Why now?

If it’s true that Challengers have indeed been around for a while, and that it is also possible for at least some reps to succeed in other profiles, why place a disproportionately big bet on one set of attributes as opposed to simply making everyone better at everything?

In many ways, the answer is fascinating—if not simultaneously rather troubling—because the urgency we see around getting Challenger right has much less to do with what we see in our massive amount of rep data, and everything to do with what we’re currently tracking in all of our customer data.

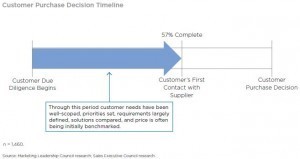

In our most recent study of thousands of participants in a typical B2B purchase, we found that on average customers are nearly 60% of the way through a purchase prior to proactively reaching out to a supplier for their input (indeed some organizations cite similar findings up to 70%).

In our most recent study of thousands of participants in a typical B2B purchase, we found that on average customers are nearly 60% of the way through a purchase prior to proactively reaching out to a supplier for their input (indeed some organizations cite similar findings up to 70%).

And only upon significant reflection and hundreds of conversations with sales and marketing leaders around the world have we teased out the full implications of this blue arrow. Inside that blue arrow, more than anything else, the customer is doing on their own the very things we’ve been training reps for years to do with them in person. Customers have recognized needs, researched solutions, prioritized options, set requirements, and benchmarked pricing. By the time they engage a supplier, the only thing left to “discover” is how big of a discount we’re willing to offer to win their business.

And this phenomenon is new. Very new in fact. If we go back five or ten years, customers used to have virtually no option but to speak with suppliers relatively early in the purchase if they wanted to figure out how to meet their needs (or what types of solutions were even possible) as much of that information simply wasn’t available anywhere else. Today, however, with the explosion of available information, that’s no longer the case. Customers don’t engage suppliers, because they believe they don’t have to.

In fact, the dramatic shift of that blue arrow has led us to postulate a simple truth about customer buying behavior: Given a choice, customers will generally engage a supplier as late as they possibly can.

Why? Because they believe the supplier has nothing unique or valuable to contribute to the conversation. If I reach out to a supplier, the thinking goes, all they’re going to do is ask me a bunch of questions, or drone on about their product or service. It’s biased information, and it’s never really about helping me with my business, so much as selling theirs. In a world of information accessibility, I simply don’t have to have that conversation – I can learn elsewhere.

And herein lies the very real and very unique challenge of selling today relative to any other time in the past. It’s not that sales is different, it’s the world that’s different. And in this world, the most urgent question in B2B sales isn’t so much what reps are doing while they’re selling; it’s what customers are doing while they’re learning.

In this world, the way customers determine what’s important in the first place—the criterion against which they’ll measure any solution—is more often than not through independent learning. Using all of the information sources now at their disposal (e.g., the Internet, online communities, 3rd-party consultants) customers not only identify the criteria they care about most, but they also identify the minimum threshold of performance acceptable for each criteria.

So, for example, if I were buying a machine, I might determine I care most about speed, durability, and up-time. And specifically, I’m looking for 100 units per day, for ten years, running at 95% up time. More might be nice, of course, but all my research and others’ past experience tells me that’s what I need. So what do I do next? I identify the short list of suppliers who can provide me a machine that meets those requirements, and then I reach out to each in turn to determine who can offer the best price.

Welcome to the world of the blue arrow, where you make into the top three, but wind up competing on price every time. It’s a world where you consistently get consideration, but almost always commoditization at the same time. And it’s become a huge challenge for B2B sales and marketing. We call it the “1 of 3 problem,” where customers will acknowledge right up front that you’ve got a world-class solution, but they still won’t pay you for it because there’s at least one or two other companies than can meet their needs equally well. In the world of the empowered customer, no amount of traditional needs analysis or customer discovery will help you win.

Why? Because in a world of traditional sales and marketing, companies seek to first indentify customers’ top priorities and then meet or exceed customer requirement expectations. “If you want 100 units per day, our machine can do 110! You’re looking for 95% up-time, we can guarantee 98%! We are, bar none, the world-class provider of the solution you’re seeking!”

But what many suppliers and sales reps fail to fully appreciate is, having done their homework in advance, at this point customers aren’t looking for maximum performance, they’re looking for a minimum threshold. The customer’s own research has told them that 95% is sufficient to meet their needs. And while they’re happy to take your 98%, they’re less happy to pay you for it, because they’ve determined that the other two suppliers who only offer 95% are not only good enough, but also significantly cheaper. Their response to your pitch? “You’re right! You’ve convinced me that you’re solution is better. And I’d love to have 98% up time. I’ll take it! But… the other two guys are cheaper. So if I can get your solution at their price, then I think we’re good to go!”

More than at any other time in the past, customers will look you in the eye, openly admit your solution is better, and still not pay you for it. And this is the new reality of selling in a world where customers can learn on their own. Outperforming the competition no longer wins business.

But rest assured, today your competition is feeling the exact same pressure from the exact same customers. In many ways, a supplier’s biggest competitor today isn’t so much the competition, but their own customer, and more specifically their customer’s ability to learn on their own. And unless someone unexpectedly shuts down the Internet and purchasing consultants in the next few years, we see this challenge only getting worse going forward.

This is why challenging customers with insight is so important. It’s about proving to customers that they do have to talk to you. That you not only have something valuable to say about their business, but even more importantly, that it’s based on information that, despite all of their research and all of their learning, they would not and could not have discovered on their own. It’s insight that shows customers they’ve somehow missed a criterion or set a threshold too low. Frankly, that they got it wrong, and that oversight is going to hurt their business in a way they’ve failed to fully appreciate.

In a world of information availability, the only way to get customers to think differently about you is to first get them to think differently about themselves. You can’t just teach customers, you have to unteach them. Challengers escape the trap of the 1 of 3 sale by disrupting customer needs, not just fulfilling them.

But the way they make that happen is a crucial part of this story. Yes they do accomplish that task through deploying a wide range of sales skills. But more than anything else, they make it happen through their ability to deploy ideas and insights as part of the sale that forces customers to rethink what they’re doing.

For most reps, the identification or creation of that kind of insight is simply beyond their individual capability. Not because they’re unskilled or lack training. Rather, the organization behind them isn’t set up to find insights on their behalf. Often marketing puts the wrong content in their hands, or managers fail to coach them. Because traditional opportunity qualification metrics drive them to customers with already-established needs, and organizational metrics like pipeline velocity encourage reps to fulfill demand rather than create it.

If nothing else, as we continue our research on the Challenger journey, we find ourselves significantly broadening the scope of our work to include a wide range of marketing activities, account planning practices, and insight generation techniques that cover the broader set of organizational capabilities necessary to make this approach work.

And as a result, we’ve become deeply convinced by everything we see in our research that a single set of individual reps skills, or even a method for reps to follow, is nowhere near sufficient to effectively compete against their customer’s ability to learn on their own.

This is why CEB is investing huge amounts of effort and resources into developing a broad set of solutions designed to provide commercial teams with a single, coherent strategy to adapt to this new world—all built back from the single core idea that disruptive insight is crucial to commercial success.

To that end, we recently introduced our Challenger Messaging workshops and engagements to help companies create the kind of insight they’ll need to effectively disrupt customers’ thinking. Last spring we published the first version of our full suite of account planning tools known as the Challenger Plan. Over the summer CEB announced the acquisition of SHL, the world’s leader in hiring and assessment analytics which has allowed us to create an incredibly robust Challenger hiring and assessment tool, which we publicly announced today. We’ve produced a whole new set of tools for B2B marketers to ensure their content marketing efforts are completely and consistent aligned around commercial insight across every piece of content they produce. And we continue to develop and iterate on our comprehensive Challenger Development Program and Manager Coaching Program designed to train the front line to deploy, execute, and support the model consistently over time.

In the end, it’s a huge amount of effort to ensure we’re equipping commercial organizations with the single, consistent, and complete set of tools they’ll need to succeed rather than awkwardly cobbling together pre-existing approaches never designed to work in this very different era of B2B selling. Because the most important lesson at the heart of all of our research, by far, is not that the Challenger story is transformational, but that information is.

In a world where customers can now do on their own what we’ve spent so many years training our reps to do on their behalf, discover their needs and identify solutions, if suppliers adopt a wait and see or “steady as she goes” approach, they’ll likely find their customers have never been happier, but their margins have never been lower as customers happily buy their world-class performance but at the competition’s rock-bottom prices.

10 Steps to Key Account Selection (and Deselection)

Think to your key account program at your company (a.k.a. major accounts or national accounts program), and see if you can answer these questions:

Think to your key account program at your company (a.k.a. major accounts or national accounts program), and see if you can answer these questions:

Do you know the value a customer receives by being in your key account program?

Further, does your customer know the value of being in that very same program?

Does your organization understand the value proposition of your program?

If your answers to the above are murky, there’s a good chance that you may be over-serving customer accounts that have gone stale, and under-serving accounts that have turned red hot.

We profiled TNT’s efforts to solve this challenge by creating a 10-step process that requires certain customer accounts to demonstrate performance requirements to achieve and maintain “key account” status. Here are those 10 steps:

Each quarter, valuable customer accounts will get nominated for the key account program

Of the nominated accounts, some get vetoed, while others pass the first filter (for more information about how to build a filter, see how see how Square D does it).

This is where it gets interesting. The accounts that pass don’t go straight into the key account program. In fact, the process is just beginning…

If a customer account gets through that first filter, they get nominated for “incubator” status (a trial term prior to being put fully into the program)

This incubator status is a year-long cycle with limited resources provided, all designed to test for partnership potential

A key point to be made here—this isn’t just, “this account looks promising; let’s commit all our resources to this account right away.” Instead, it more closely resembles, “this account looks promising; let’s allocate some of our resources to this customer and monitor the key metrics to ensure they start tipping in the direction we’d expect.”

The incubation period then results in a second filter which is a review of account performance by a senior executive panel—which leads to one of three possible outcomes:

The customer account doesn’t make the cut,

More proof is needed, so the customer account goes back for a second incubation period, or,

The customer account qualifies for key account status

Then, accounts already in the key account program don’t just get the benefit-of-the-doubt; they’re also reviewed annually by the same executive panel using the same filter. These accounts are then either:

Maintained in the program,

Sent back to the incubation period, or,

Down-tiered altogether

It’s helpful to look at this relative to common practice. A lot of members that we work with feel that they do a decent job of nominating the right customers to their program, but are less sure of how they should move customers in and out of that very same program on an ongoing basis. Once they’ve run that initial nomination screen, they’re done, and go after that account full-tilt for better or for worse.

The incubation period described above is what sets a practice like this apart. It provides a mechanism to regularly assess customer accounts based on performance, and provides an avenue to transparently communicate expectations to the customer.

SEC Members, to learn more about TNT’s approach, review the best practice and listen to the webinar replay. Also, visit the Key Account Management topic center to better manage your key accounts.

October 8, 2012

The Official SEC Guide to Office Fantasy Football

Football season is here! Not only does this mean that ESPN finally has something to show other than boring baseball highlights (with apologies to the baseball fans out there) – but it also means its fantasy season. Below are a set of guidelines specific to office leagues to guide those of you that may be new at fantasy football, or new at fantasy football in a work setting.

Football season is here! Not only does this mean that ESPN finally has something to show other than boring baseball highlights (with apologies to the baseball fans out there) – but it also means its fantasy season. Below are a set of guidelines specific to office leagues to guide those of you that may be new at fantasy football, or new at fantasy football in a work setting.

Trash Talking: A Breakdown

If you are anything like me, you have the pleasure of watching your team destroy your competition week in and week out. Striking the right balance between professionalism and reminding everyone who they really should be afraid of in the office is nearly as difficult as deciding who to start every week-especially if the person you beat is your boss.

My suggestion: when you see your boss- wait to see if he or she brings up the game. If the loss is mentioned, it is fair game to unload on him or her. If the game isn’t mentioned- don’t bring it up and take the high road and walk away – your boss is definitely thinking about it, even if nothing was said.

Acceptable forms of trash talking at the workplace:

Self-Promotion – Remind everyone where your team stands in the league. Just be careful not to go overboard – it’s already lonely at the top.

Stat-Based Trash Talk – If your stud RB put up the numbers, then all you’re doing is stating the facts, right? But just like self-promoting, less is more. You don’t want to be that nerd who could work for Elias Sports Bureau because you knew that Aaron Rodgers puts up over 350 passing yards on late afternoon games when there’s a full moon out.

Stay clear of profanity in the office:

Crude and Obscene – Come on, isn’t it bad enough that your boss took Tim Tebow with the #1 pick? No need to take it to the next level by calling him a %&@#in’ idiot, especially on company email.

Personal Insults – Keep it related to how awful their fantasy team is and keep it in good fun.

Team Names

Dedication and respect mandate a creative name-either an insult directed at another member in your league, a player you despise, or an inappropriate pun. Office leagues however require a new type of creativity-one that should still be funny and clever, but not something you are embarrassed to say out loud to your boss. Save your clever, but extremely inappropriate, team names for your personal league with friends.

Trades

There are two very different pieces of advice for office trade rules that are based on your position in the company. If you’re the boss, take advantage of your status. But, if you’re a lowly first year, hold your ground! First, if you are the boss, take advantage of that. Use your position to justify offering your old, banged up WR for your new collegiate hire’s healthy Running Back. Make sure to mention this trade face-to-face in the office, just to remind the poor first year exactly who you are, and that you are asking for something. Feel free to leave a business card on the newbie’s desk with a personal reminder of the proposed trade as well.

If you are a first year analyst, fight the powers that be! Don’t attempt to brown-nose the boss by accepting awful trades. Just because you took your boss’s RB who got injured and is no longer starting, does not mean that you are getting promoted anytime soon.

Celebration Emails

If you’ve drafted as well as I did and haven’t gotten fired because you’ve followed my advice, congratulations! You won your league and now is your time to gloat. Being in a work league does not take this right away from you. However, before you press ‘send’ on your very well written email tearing everyone else down, make sure that nothing in the email makes you an HR liability. Because you are champion, you earned your right to trash talk everyone else, which means you can go slightly beyond insulting draft picks and team performances. Still, keep personal jabs at a minimum – you still have to work with these schlups. I’d recommend calling people out for idiotic fantasy behaviors – i.e. forgetting to start a defense, or starting an injured player as a good way to add insult to the injury of having lost the league.

October 3, 2012

Mr. Customer—Help Me, Help You

Too often in Sales, this is the approach many sellers take when working with customers—help me navigate your company and processes, and that in turn will help me better sell to you.

Too often in Sales, this is the approach many sellers take when working with customers—help me navigate your company and processes, and that in turn will help me better sell to you.

Unfortunately, customers don’t want to interact with sellers who take this approach. It takes time, effort, and is plain boring. When customers have to do that multiple times in a day, there is no value in conversations with sellers.

Over the past year, SEC has found that the very best reps take a whole different approach when working with their customers. Not only do they teach customers, but they go one step further—they coach customers. Rather than trying to have the customer tell them how to sell to them, they take the approach of arming the customer with the information and knowledge to navigate the buying process.

As today’s solutions become more complex, so does the customers’ buying process. Often times they don’t know who needs to be involved, where the sign-off is, and how long it might take. Last year, we uncovered this in our work on customer stakeholders, when we found that there are seven customer stakeholder profiles, three of which are Mobilizers. They mobilize change and build consensus within organizations. Not surprisingly, the best sellers out there seek out and sell to Mobilizers.

But, it’s that critical next part of working with Mobilizers that further sets star performers apart. They arm Mobilizers with tools and information, and coach them on how to take an idea and build consensus around it in their organization. They help customers navigate the challenges of complex buying within their own organizations. We’ve termed this Commercial Coaching.

The critical part of commercial coaching is taking the best approach with each Mobilizer, as each has strengths and deficiencies in building consensus and driving change. We’ve mapped that out in a Commercial Coaching Roadmap designed to help sellers work effectively with identified Mobilizers.

Selling isn’t about working with the customer and getting them to help us, it’s about us coaching and helping them. This in turn, can help us drive the organizational change and consensus needed to win in today’s B2B marketplace.

SEC Members, learn more about Commercial Coaching and how your reps can use this approach with customers. Also, review the full study and its findings, Rewriting the Playbook.

Too often in Sales, this is the approach many sellers take when working with customers—help me navigate your company and processes, and that in turn will help me better sell to you.

Unfortunately, customers don’t want to interact with sellers who take this approach. It takes time, effort, and is plain boring. When customers have to do that multiple times in a day, there is no value in conversations with sellers.

Over the past year, SEC has found that the very best reps take a whole different approach when working with their customers. Not only do they teach customers, but they go one step further—they coach customers. Rather than trying to have the customer tell them how to sell to them, they take the approach of arming the customer with the information and knowledge to navigate the buying process.

As today’s solutions become more complex, so does the customers’ buying process. Often times they don’t know who needs to be involved, where the sign-off is, and how long it might take. Last year, we uncovered this in our work on customer stakeholders, when we found that there are seven customer stakeholder profiles, three of which are Mobilizers. They mobilize change and build consensus within organizations. Not surprisingly, the best sellers out there seek out and sell to Mobilizers.

But, it’s that critical next part of working with Mobilizers that further sets star performers apart. They arm Mobilizers with tools and information, and coach them on how to take an idea and build consensus around it in their organization. They help customers navigate the challenges of complex buying within their own organizations. We’ve termed this Commercial Coaching.

The critical part of commercial coaching is taking the best approach with each Mobilizer, as each has strengths and deficiencies in building consensus and driving change. We’ve mapped that out in a Commercial Coaching Roadmap designed to help sellers work effectively with identified Mobilizers.

Selling isn’t about working with the customer and getting them to help us, it’s about us coaching and helping them. This in turn, can help us drive the organizational change and consensus needed to win in today’s B2B marketplace.

SEC Members, learn more about Commercial Coaching and how your reps can use this approach with customers. Also, review the full study and its findings, Rewriting the Playbook.

Brent Adamson's Blog

- Brent Adamson's profile

- 9 followers