Brent Adamson's Blog, page 33

January 4, 2012

The Top 10 Sales Questions of 2011

When faced with a tough business challenge, have you ever wanted the advice of someone that's been in your shoes?

When faced with a tough business challenge, have you ever wanted the advice of someone that's been in your shoes?

Across the past year, SEC members have asked more than 400 questions and received nearly 2,000 answers from peers on the SEC Discussions Q&A forums.

Below is a collection of the most popular discussions that took place across 2011 – these questions shed light on the issues that were top of mind to sales executives throughout the year, and the in-depth answers provided by peers provide helpful perspective on how organizations are tackling these sales-related challenges.

Top 5 Questions from the Sales Ops Forum:

1. Sales Compensation Plan Design Ownership—"Who owns sales compensation plan design in your organization? Is it Sales Ops, Finance, HR, or some other function? Are there any pros and cons to going one way or another?"

2. Communicating with Field Sales Teams—"We are looking for ways to communicate sales direction, processes, product info, and tools to our field sales team. What channels and with what frequency have you found help your sales force receive and retain information?"

3. Variable Pay During Onboarding—"Does variable pay tied to onboarding increase retention and/or satisfaction? What tie-in(s) should there be to performance (i.e., training outcome metrics)? Does this have any impact on productivity after the onboarding period?"

4. Reducing CRM Time Burden on Reps—"What strategies have you employed to reduce the amount of time your reps spend on CRM reporting and data entry?"

5. Deploying iPads to the Field—"For those organizations whose reps currently use iPads, would you consider them effective sales tools? Have they had an impact on business results? If you had to roll them out to your sales force again, would you do anything differently?"

____________________________________________________________________________________

Top 5 Questions from the Talent Management Forum:

1. Inspirational Video for Awards Function—"I need a short (3-5 minute) inspirational video to play prior to handing out awards to employees who went above and beyond to support the sales team's success. Does anyone have suggestions on a piece that would be inspirational, and generic enough to cover sales, customer service, and operations?"

2. Pre-Hire Assessment Vendors—"I am looking to test/screen sales candidates before bringing them in for an interview. What experiences have you had with specific vendors? Who would you recommend and what kinds of services did they provide?"

3. Decreasing Turnover in Inside Sales—"We are looking to lower our turnover rate for Inside Sales and part of that involves creating clear career development ladders for them. What does the career path for Inside Sales reps look like at other companies? Do Inside Sales reps typically migrate into field sales?"

4. Award for Completing Training—"We require significant training for all new hires (2 weeks in home office training, 2 weeks riding along with reps, repeated for 4 months). We have previously provided a GPS as a graduation gift, however, a significant portion of new hires already have one. What gifts have you provided upon training graduation, if any?"

5. Getting Managers to be Better Coaches—"We've invested a lot in getting managers to focus on coaching, but we're still seeing them resort to telling reps what to do, rather than coaching them. We're thinking about implementing increased rep feedback to hold managers accountable. Is this an effective method to improve coaching? What are other strategies?"

SEC Members, to join the Sales Ops Forum or Sales Talent Management Forum, click here.

January 3, 2012

Stop Highlighting Unrealistic Customer Expectations

A recent blog post on Harvard Business Review titled, "I Don't Understand What Anyone Is Saying Anymore," was unfortunately very relatable. The core of the article explored how business conversations have evolved into bits of nonsense (e.g., "synergy", "value-add") that make understanding each other much more of a challenge than anything else.

We all fall victim to the excessive use of acronyms from time to time. And while I too find myself guilty of using a lot of acronyms, I also related to something else in the piece, because its description ties perfectly to research produced by both the SEC and our sister program, the Customer Contact Council:

"Another term that has lost its meaning is 'Let's exceed the customer's expectations.' …Customers almost universally never experience their expectations being met, much less exceeded. How can you exceed the customer's expectations if you have no idea what those expectations are? I was at a [hotel] a few weeks ago. They had taken this absurdity to its logical end. There was a huge sign in the lobby that said, 'Our goal is to exceed the customer's expectation.' The best way to start would be to take down that sign that just reminds me, as a customer, how cosmic the gap is between what businesses say and what they do…"

While this was a retail customer setting, the same principle holds true for sales and service organizations. Attempting to exceed customer expectations is a losing battle. You'll unnecessarily spend resources trying to delight your customers, when research shows that doing so has only a marginal impact on customer loyalty.

The most economical thing you can do is to simply meet expectations. And, as in the example above, highlighting your goal of exceeding expectations only brings attention to service that will likely fall short of expectations for most customers.

One of the most important things you can do, then, is to understand your customers' true expectations and then manage them appropriately, while providing service that simply meets those expectations.

Uncovering and verifying customers' expectations is a crucial step in the account planning process, but because reps often make assumptions about what the customer's priorities and expectations are, it's also a step that can go very wrong.

To avoid overpromising and under delivering on relationship benefits, consider implementing a joint expectation-setting and review process that involves the customer and helps you to better understand (and meet) their expectations.

The ultimate lesson to learn from the example highlighted here is that during your sales and service interactions, make sure you're setting an expectation that is easily met. Going beyond that threshold will put you in a hole that's difficult to climb out of.

SEC Members, visit our newly updated web page on Communicating and Monitoring Account Progress, part of our newly updated Account Planning topic center.

How does your organization try to set reasonable expectations with customers?

January 2, 2012

The Real Reason Reps Don't Take Role Plays Seriously

The Council frequently refers to a new breed of high-performing reps–Challenger Reps–in our blog posts and research. But do you find yourself wondering—how do I actually build Challenger reps? Because the three key Challenger skills (teaching, tailoring, and asserting control) are tacit skills, typical approaches to upskilling often are insufficient.

The Council frequently refers to a new breed of high-performing reps–Challenger Reps–in our blog posts and research. But do you find yourself wondering—how do I actually build Challenger reps? Because the three key Challenger skills (teaching, tailoring, and asserting control) are tacit skills, typical approaches to upskilling often are insufficient.

Classroom training alone fails to deliver impact because tacit skills are difficult to describe in written materials such as job aids or a how-to manual, and manager coaching also can be inadequate because it's hard to explain intangible concepts.

Instead, to truly internalize these skills, reps need practice. We've all heard a lot about experiential training, but does it actually work?

The answer is yes, tacit and intangible skills are best taught through experiential training. But it must be the right kind of experiential learning. You cannot risk reps practicing new skills with a customer and, as a result, we often see companies using role-plays.

But, how 'real' are our role-play programs? Reps almost never take these programs seriously because the programs often seem too fake and artificial.

To solve this problem, St. Jude Medical, a manufacturer of medical devices, developed a realistic role-play program that supports sales reps' application of knowledge learned in training and builds their confidence in their new skills.

St. Jude includes the following elements in its role-play programs to make them authentic and effective:

1. It uses customer proxies as role-play partners to make the simulations more realistic and safe.

2. St. Jude selects a limited number of different customer scenarios for role-play, which forces reps to adjust their presentation in the moment.

3. St. Jude amplifies reps' openness to learning by requiring extensive pre-training preparation work, and by videotaping each role-play exercise for post-training debriefing sessions with managers and peers.

This program essentially helps St. Jude break the trade-off between real and safe while ensuring that reps take role-play programs seriously.

We recently spoke with Nicole Montoya and Gabriel Fleres from St. Jude Medical, about the various components of their role-play program.

Why Reps Don't Take Role Plays Seriously

The Council frequently refers to a new breed of high-performing reps–Challenger Reps–in our blog posts and research. But do you find yourself wondering—how do I actually build Challenger reps? Because the three key Challenger skills (teaching, tailoring, and asserting control) are tacit skills, typical approaches to upskilling often are insufficient.

The Council frequently refers to a new breed of high-performing reps–Challenger Reps–in our blog posts and research. But do you find yourself wondering—how do I actually build Challenger reps? Because the three key Challenger skills (teaching, tailoring, and asserting control) are tacit skills, typical approaches to upskilling often are insufficient.

Classroom training alone fails to deliver impact because tacit skills are difficult to describe in written materials such as job aids or a how-to manual, and manager coaching also can be inadequate because it's hard to explain intangible concepts.

Instead, to truly internalize these skills, reps need practice. We've all heard a lot about experiential training, but does it actually work?

The answer is yes, tacit and intangible skills are best taught through experiential training. But it must be the right kind of experiential learning. You cannot risk reps practicing new skills with a customer and, as a result, we often see companies using role-plays.

But, how 'real' are our role-play programs? Reps almost never take these programs seriously because the programs often seem too fake and artificial.

To solve this problem, St. Jude Medical, a manufacturer of medical devices, developed a realistic role-play program that supports sales reps' application of knowledge learned in training and builds their confidence in their new skills.

St. Jude includes the following elements in its role-play programs to make them authentic and effective:

1. It uses customer proxies as role-play partners to make the simulations more realistic and safe.

2. St. Jude selects a limited number of different customer scenarios for role-play, which forces reps to adjust their presentation in the moment.

3. St. Jude amplifies reps' openness to learning by requiring extensive pre-training preparation work, and by videotaping each role-play exercise for post-training debriefing sessions with managers and peers.

This program essentially helps St. Jude break the trade-off between real and safe while ensuring that reps take role-play programs seriously.

We recently spoke with Nicole Montoya and Gabriel Fleres from St. Jude Medical, about the various components of their role-play program.

December 21, 2011

Do Your Sales Metrics Drive Challenger Behaviors?

As we've continued to meet with sales leaders across the globe about our research on the Challenger Rep, we always get a variety of reactions and responses as they think about how the research relates to their own experiences, teams and organization. And quite often, a leader will make a statement about how Challenger correlates to their sales metrics – comments such as "You know, our metrics around activities don't reinforce Challenger behaviors, they are more aligned to Hard Worker behaviors" or "my highest activity reps aren't my highest performing reps."

As we've continued to meet with sales leaders across the globe about our research on the Challenger Rep, we always get a variety of reactions and responses as they think about how the research relates to their own experiences, teams and organization. And quite often, a leader will make a statement about how Challenger correlates to their sales metrics – comments such as "You know, our metrics around activities don't reinforce Challenger behaviors, they are more aligned to Hard Worker behaviors" or "my highest activity reps aren't my highest performing reps."

In fact, our 2011 Sales Metrics Benchmark Survey shows that 30% of respondents measure "customer appointments made per rep per month" as a rep performance metric. But does this metric necessarily align to the Challenger behaviors?

It's one of many interesting insights and questions our members ask when they see the research on the five sales rep profiles, including:

Does our organization have the right metrics in place to drive the Challenger behaviors?

What metrics should we be using to drive the behaviors we want?

Are our front line sales managers using metrics in the right way to coach or are they focused on simply increasing activity ("it's a numbers game, get out there in front of more people")?

While we'd bet that most leaders agree there needs to be some level of minimum activity (let's be honest, people sell to people, so you have to meet, visit and call them). But how can an organization select the best metrics for its organization…metrics that answer the questions posed above?

The Council profiled a best practice from Xerox Company as they encountered a similar metrics challenge. Xerox utilized a robust metrics selection process to identify and define the best set of actionable metrics for their organization. The process also helped prevent the number of metrics on their dashboard from growing too big and overwhelming.

Xerox applied a Lean Six Sigma process to select their sales metrics, which included steps such as:

Defining appropriate metrics—Xerox gathered extensive stakeholder feedback to identify their metrics requirements and to establish the end goal and purpose of the metrics initiative

Measuring and analyzing metrics—Xerox analyzed which metrics from their current dashboard did and did not work, and also conducted internal and external benchmarking to help guide selection of new metrics

(SEC Members can begin external benchmarking with SEC's 2011 Sales Metrics Benchmarking Survey Tool)

While sales metrics will vary from organization to organization, we'd like to hear from those of you who've begun or are on the Challenger journey about how you've used your sales metrics to support Challenger behaviors. How can we enable our sales organizations with the best, actionable metrics, without overwhelming leadership?

December 19, 2011

Never Make Forecasts, Especially About the Future

"Never make forecasts, especially about the future"

-Samuel Goldwyn

While the quote in the title is tongue-in-cheek, in Sales, forecasting is a fact of life. And many members lament that the quality of their sales forecasting is lacking. Information isn't always entered by the sales force – and if it is, it might not be accurate – and even then our ability to analyze the information may not be up to par.

While the quote in the title is tongue-in-cheek, in Sales, forecasting is a fact of life. And many members lament that the quality of their sales forecasting is lacking. Information isn't always entered by the sales force – and if it is, it might not be accurate – and even then our ability to analyze the information may not be up to par.

So to help us out, I went to the definitive source on financial tracking and analysis – the CFO suite. I sat down with Myles Vander Weele, Executive Advisor with our Corporate Finance practice, to talk about sales forecasting from Finance's perspective.

According to Myles, forecasting is a critical responsibility of Corporate Finance. They work to figure out what the organization is capable of and then set targets to track actual performance against those expectations throughout the year. "Since forecasts are assumptions," says Myles, "Finance continuously checks to determine how the business is performing relative to those assumptions."

And, getting sales forecasting as accurate as possible is critical to a well run business. As Myles explains, "Sales forecasts help the company make better decisions on how to manage spending and what expectations they should be setting with investors."

However, relatively speaking, forecasting Sales is difficult. Whereas Finance is reasonably confident in their ability to forecast and track costs and cash flow, they have greater difficulty with sales. According to Myles, "While costs, and to some extent cash flow, are in our direct control, sales is much more complex. There are many ways to grow business with customers, and ultimately, while we can influence customer decision making, we can't control our customers' decisions."

So how can Sales improve sales forecasting? While companies typically have focused on making the information we have more predictive, our experience researching this topic suggests that companies should instead get access to more predictive information.

There are two areas in which we've seen companies innovate to improve our ability to better predict customer/market outcomes:

Use Customer-Generated (rather than Sales-Generated) Information – instead of relying upon our internal assumptions (e.g., reps telling us which deals will be closing), best practice companies confirm with the customer their true intentions to better predict ultimate outcomes. The SEC has profiled how Business Objects and ADP have refashioned their sales process to more effectively gather and confirm their customers' true buying intentions.

Prediction Markets – The SEC has also profiled companies that have begun to leverage the collective knowledge of their organizations to influence their forecasts. Best Buy for example has created an internal prediction market – a fake stock market where outcomes are bought and sold to determine the probability of an event happening (the delivery time of a major project, for example).

Ultimately, sales is harder to forecast and than other line items in your company's financial statements. But by including more effective sources of information (like those above), you can improve your organization's forecasting abilities.

SEC Members, for more information on forecasting, see our research on predicting customer buying behaviors, including our deal verification toolkit.

December 14, 2011

How New Customer Buying Behavior is Hurting Your Bottom Line

Buyers are outpacing supplier capabilities and becoming more efficient at pressuring on price—at least that's the recurring theme the SEC is hearing in our recent conversations with members. But what's enabling this behavior today's buyers, and more importantly, what does it mean for your sales strategy?

Buyers are outpacing supplier capabilities and becoming more efficient at pressuring on price—at least that's the recurring theme the SEC is hearing in our recent conversations with members. But what's enabling this behavior today's buyers, and more importantly, what does it mean for your sales strategy?

The recent member conversations we've had suggest that customers have become more sophisticated at buying over the last several years due to:

Economic pressures that have forced buyers to become increasingly risk averse and focused on cost—In response to the economic uncertainty in the marketplace, customer organizations are relying more heavily on group buying, professionalized, process-driven procurement teams, and third-party consultants to help mitigate risk through well vetted purchases with higher levels of savings .

Increased access to information— Internet access and vast technological advances over the past decade have created a much more transparent buying environment than what existed in the past. Customers can now easily find and access information about their industry, the competition, your product/solution, and your competitors' products/solutions without spending a lot of time or money.

So what are the implications for sellers? Unfortunately, they are far from good as this rise in buyer sophistication has translated into a customer-led sales environment that is being pushed in a much more transactional direction.

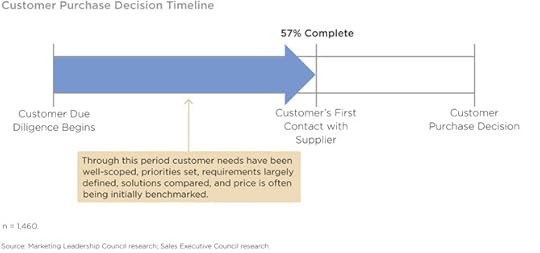

In fact, our research this year shows that customers aren't even contacting suppliers until they are, on average, 57% of the way through their purchase process. This means customers have already determined their needs, completed due diligence, and have even begun to do some comparison shopping before contacting your reps. As such, the opportunities for sellers to influence how customers value a given solution has significantly decreased.

In this world, the only thing customers are leaving sellers to compete on is price. And with customers better positioned than ever to de-bundle supplier solutions and identify cost drivers, you can rest assured that the price will likely be low.

So how can sellers get ahead of their customers and take back control of sales interactions? This is the issue that the SEC will be focusing on in our 2012 research.

SEC Members, you can track our progress on this new research entitled Shaping Demand to Win Business here.. You may also want to consider launching the new Pre-Sales Diagnostic (at no extra charge), which examines how high-performing reps shape the nature of demand within their opportunities.

What else do you think is contributing to the rise in buyer sophistication? How are you seeing it manifest in your industry?

December 13, 2011

The Secret to Hiring Challengers

When it comes to talent management, it's critical for organizations to bring the best talent into their sales forces.

We know from our research on high performing rep skills that companies' best bet is to bring more Challenger Reps into the sales force – Challengers are four times more likely to be high-performers than Relationship Builders in complex selling environments.

But we've seen most sales organizations continue to use traditional relationship-based skills and competencies to screen and select new hires. After all, conventional wisdom tells us that the likable candidate who charms interviewers is bound to be a successful salesperson.

This hiring approach inevitably brings an unpleasant surprise, though. Why? Because if a rep relies on the same relationship-building behaviors they used to close a deal as they do to approach an interview, they'll soon find that their long-term likelihood to succeed is bleak.

So how do companies actually find sales rep candidates with the Challenger skill set in the marketplace?

After working with a number of member companies who have gone down this road, the SEC developed a framework to approach the Challenger hiring process as well as a series of tools to help uncover a candidate's true behavioral instincts.

Through dozens of conversations with both HR and Sales leaders, we believe the key to the Challenger hiring process must incorporate these three steps:

1) Make sure everyone in the hiring process is on the same page about what you're looking for in a candidate.

We found that it is critical to make sure everyone involved in the hiring process is familiar with the Challenger behaviors and why it is important to screen for their differentiating competencies during an interview.

To that end, the Council developed a concise Challenger Hiring Guide to ensure that everyone communicating with a potential hire is consistent about what makes for an ideal sales candidate. This tool provides managers with a quick overview of the particular skills and behaviors to look for when speaking with candidates, as well as sample questions to ask during a formal or informal interview.

2) Surface candidates who are open to the Challenger Rep profile.

The SEC also found that it's helpful to determine the candidate's overall openness to the Challenger Rep profile. Our Initial Screening Assessment outlines a quick way for an HR counterpart to prioritize candidates for an in-person interview, and is especially helpful for those candidates with little or no sales experience. The point of this exercise is not to determine whether candidate fall into a certain profile, but to gauge their understanding of why acting like a Challenger can make them successful as a candidate. (For more tenured reps, you can also use the Challenger Hiring Guide mentioned above to determine if a candidate should be prioritized during the hiring process.)

Not only does this step point to the likelihood of a candidate possessing Challenger skills, but it also indicates how coachable a particular candidate is – an important quality to gain a pulse for, since being coachable is key to effective and efficient onboarding and future development.

3) Test for Challenger potential by providing opportunities for candidates to tell a story.

To break past typical Relationship Builder qualities that are often highlighted during an interview, the Council developed the new Challenger Rep Behavioral Interview Guide to uncover a candidate's true behavioral instincts. The objective of this interview is uncover specific examples from a candidate's past in which desired Challenger skills were exhibited, even if a candidate has little or no sales experience.

This guide provides instruction on how to use the behavioral interviewing technique to ensure that a candidate is comfortable throughout the process and is engaging in an honest and fruitful dialogue with the interviewer. The idea here is to open opportunities for candidates to share a story that shows specific behaviors and gives a holistic sense of Challenger potential once in seat.

And, to give interviewers concrete examples of what to watch for during their conversations with candidates, the guide outlines sample success behaviors and red flags to each of the six competencies that align to Challenger selling behaviors.

Once a candidate is selected and hired, it's also important to set expectations for long-term development by agreeing on the Challenger sales competencies they must build and sustain. Managers need to clearly differentiate between effective and ineffective behaviors to the new hire, and provide a method to track progress toward developing competence in key Challenger skills.

SEC Members, see our guidelines on Developing Challenger Competency Models, including the Challenger Competency Grid, the Sales Competency Design Principles and the Sales Competency Model Development Roadmap.

What other tactics have worked for finding and hiring candidates that have Challenger potential? See our recent member discussion on finding Challengers in the job market, or let us know in the comments section below.

December 12, 2011

5 B2B Marketing Trends for 2012

(This is a guest post by Patrick Spenner of the Marketing Leadership Council, our sister program for heads of Marketing.)

Each year, the Marketing Leadership Council (MLC) surveys our members about their top challenges looking ahead. As we read the tea leaves in this year's survey results, here are our thoughts on what's creeping into (or storming) the B2B marketing consciousness for 2012.

Each year, the Marketing Leadership Council (MLC) surveys our members about their top challenges looking ahead. As we read the tea leaves in this year's survey results, here are our thoughts on what's creeping into (or storming) the B2B marketing consciousness for 2012.

1) Voice-of-Customer 2.0. Marketers are grappling with what kinds of customer data are most important to collect and how to make hay out of the data. Early hypothesis from the MLC team: marketers are over-investing in collecting and analyzing data about the customer, and not enough in gathering information and insight about customer context, which is critical for generating commercial insight (see #5 below)

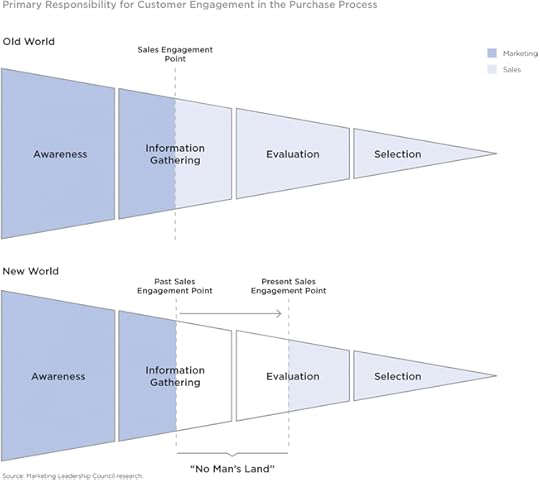

2) Skill Set Reset. There's a creeping sense among B2B CMO's that their marketing teams are in need of a capability overhaul. With the rise of "no man's land" in the mid-funnel and rapid changes in how buying centers are making purchase decisions, out-of-date marketing skill sets are being laid bare.

As one example of B2B marketing teams aggressively managing the skill set transition, consider the example of Cisco starting to "badge" and reward its marketers on their social media impact.

Ask yourself: how sweet/spooky would it be for 20% of your pay to rest on your social graph?

3) Disruption. Uncertainty is the lurking leviathan swimming beneath the surface of commerce these days (cheery, no?) This came through in our survey loud and clear, as the third most popular topic was how to manage risk in changing customer buying behavior, emerging markets, technology and the like. All we can suggest here is to build your house out of bricks, not sticks. In commercial terms, that means delivering insight to customers (see #1 and #5).

4) Going Global. I wouldn't call it new, but the Global Marketing topic continues to be a top priority for the half of the MLC membership that doesn't see a continued growth run in Western economies.

(SEC Members, check out our new resources on assessing your global readiness.)

5) Content Marketing Hits the Breaking Point. As marketing automation, segmentation and targeting continue to evolve and penetrate marketing activities, there comes a tipping point at which creating version X+5 of an email for sub-segment Y to be delivered at trigger Z in the lead nurture program simply becomes unsustainable. We believe many marketers on the content marketing train will hit this point, to be followed by a period of navel gazing, to be followed by a period of content rationalization, to be followed (depressingly) by content proliferation again.

Smarter angle: the answer isn't more content, it's commercial insight. Cut off the long tail of content creation (those white papers are languishing out there, anyway) and re-invest the time and energy into insights that can fuel Commercial Teaching. Commercial insights trump relevant messaging all day long as drivers of loyalty and purchase in the B2B space. This is the rocket fuel of successful go-to-market strategies these days, and it's the heart of what makes the Challenger Sale work.

Mobile! Just kidding. Not ready for primetime for most B2Bs…yet. We're seeing more near-term value creation from mobile as a sales tool than for marketing purposes. Maybe 2013…

(SEC Members, see our newest work on using iPads and tablets as sales tools.)

Any others that you would add to the list? If you want to share your point-of-view on B2B Marketing in 2012, drop in a comment below.

SEC Members, be sure to also review our list of the ten trends shaping sales in 2012.

December 7, 2011

10 Trends Every Sales Exec Must Know For 2012

We hope you'll read this and share this.

We hope you'll read this and share this.

It's a unique occasion when we get to step back from the day-to-day of supporting our members' decisions and reflect on where we believe the world of sales is headed. In 2011, the SEC had thousands of interactions with sales executives around the globe, held dozens of conferences, examined hundreds of thousands data points, and we ended the year with a series of intimate roundtable discussions with leading CSOs.

Given this, we'd like to share the fundamental shifts we expect to play out in increasingly significant ways in 2012.

Granted, it's not a MECE list – there is overlap and implications shared throughout these trends, but we hope you'll take a minute and reflect on how these trends are manifesting in your own organization, disagree if appropriate, and highlight trends you expect to see that we missed. It's meant to be a reflective, but fun list. We look forward to your input!

SEC Members, many of these trends are informing our 2012 research – read more on our newest survey offering and the research itself.

1. Customers increasingly don't need Sales' help or expertise.

Our data shows that, on average, 57% of a purchase decision is complete before a customer contacts a supplier.

At this point in the purchase, needs are scoped, the purchase is funded, and price is often being benchmarked. Customers aren't new to this "solutions purchase" game any longer. They've put in place strong buying systems, processes, infrastructure, consultants, and professionalized their purchasing approach.

Customers aren't new to this "solutions purchase" game any longer. They've put in place strong buying systems, processes, infrastructure, consultants, and professionalized their purchasing approach.

We've hit a point where customer capability to buys things has outpaced our capability to sell things. And this is why customers are increasingly able to de-bundle our solutions and drive the purchase into the realm of price-based order fulfillment. The customer now has the upper hand and is forcing us to reconsider the nature of entire commercial relationship.

Leading sales organizations will find ways to shape customer demand. Our leading hypothesis is that sales channels will take on responsibilities that have traditionally belonged to Marketing, including upstream demand generation, awareness, and early consideration. Such approaches will help mitigate the "no man's land" phenomena that exists between sales and marketing, where customers typically make the bulk of their purchase decision.

2. Finding "ready-made" customers will lose out to "making customers."

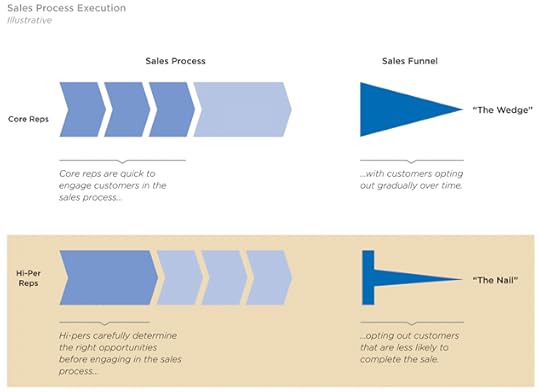

Most sales organizations are unwittingly encouraging their salespeople to pursue opportunities falling into the previously discussed 57% range, where the customer is abundantly clear on their needs (and what they want to pay). For many salespeople, and FLSMs, they'd much rather pursue an opportunity where clear needs, funding, and senior support all exist. This is the strategy of finding good business. High performers look at those opportunities skeptically, at best. They see the impending RFP, concessions, the price pinch, and/or strong likelihood of being the dreaded comparison set.

Increasingly, the best salespeople will not find "ready-made" customers, but rather, make customers. They will seek out change-receptive customers who are not fully settled in their needs. The immediate goal will be to educate that customer on potential ways to change. Through the course of those efforts, these sellers will earn the vaunted "frontrunner" status (for whom our data shows 76% win-rate).

Our current research is focused precisely on how high-performers make customers, and rationalizing these insights for scalable adoption across the entire sales force. Stay tuned for more as we uncover those findings.

3. De-prioritization of traditional discovery skills.

On the heels of the previous trend, traditional discovery skills have largely served the purpose of determining how well a customer's needs align to a given solution. The critical flaw in this rationale is that pursuing business that is well-aligned and ready to move forward is pursuing a customer who is well-informed, likely pursuing other suppliers, and best positioned to have price leverage.

Leading organizations will shift mind-share away from traditional discovery and questioning around alignment to an offering, and move towards discovery of receptivity to change. Qualification of leads who are in the very initial stages of reconsidering the status quo will provide the best opportunity to shape the needs of that customer. With the help of some of the best salespeople from across our member companies, we've created a scorecard for determining these opportunities.

4. The lines of distinction between Sales and Marketing will erode.

The "no man's land" that exists between sales and marketing is permitting customers the opportunity to make their purchase decision without supplier involvement.

The "no man's land" that exists between sales and marketing is permitting customers the opportunity to make their purchase decision without supplier involvement.

Given this, the most progressive suppliers are driving customer engagement from the most formative stages through recognition of value. This new model focuses on extremely early customer engagement, teaching the customer about new opportunities or threats before the customer senses these issues. There is no "handoff" from marketing to sales in this model – in fact, the lines of distinction between sales and marketing are increasingly obscured this in model.

Winning commercial organizations will build a capability spanning sales and marketing that is centered on engaging customers with such insight. This capability includes insight generation, insight messaging, lead generation and opportunity selection based on receptiveness to insight, and insight-focused sales interactions. Keep in mind, these insights are most certainly not generic insights on the market, but unique insights meant to drive commercial success for the supplier. Accordingly, these insights must teach customers about unique supplier capabilities.

5. Longer sales cycles will not only become the norm, they will be encouraged.

Our research on sales process confirms that higher performers have longer sales cycles. For high performers, it's not the latter stages of the sales process that take more time, but rather the opportunity selection – or more precisely – the opportunity formation. High performers are much more selective about opportunities they actively pursue.

Our research on sales process confirms that higher performers have longer sales cycles. For high performers, it's not the latter stages of the sales process that take more time, but rather the opportunity selection – or more precisely – the opportunity formation. High performers are much more selective about opportunities they actively pursue.

Most sales organizations encourage sales efficiency over sales effectiveness, and accordingly have a set of metrics and managerial tendencies that frown upon lengthy qualification. Instead, sellers are encouraged to call on many customers, move opportunities into their funnel quickly and continue advancing them.

Allowing sellers to slow down will require significant organizational tolerance. For this reason, leading companies will add increased demand-sensing and planning stages to their current sales processes, helping provide confidence that the right qualification activity is indeed happening in a measurable fashion.

6. Storytelling becomes an increasingly lost art.

Sales has often held storytelling as a vital skill. While a purchase decision is often governed by rational criteria, buyers are human after all, and subject to emotion when making a purchase decision.

I spoke with a head of sales at a consumer electronics company last week, and he reminded me of a trend we've continued to see – the realization of big data in sales. Not only do suppliers increasingly have data supporting how their products provide value, but customers expect to factor these data points into purchase decision. Therein lies the hidden issue… Both suppliers and customers have come to overly rely upon data in the purchase, losing sight of the broader strategic intentions of both parties and nature of the commercial relationship. When the vision is lost, the purchase inherently becomes transactional, which has serious downside implications for both parties.

Winning organizations will focus on arming sellers with messages and insights to support the data. Data must support a compelling vision.

7. Investments in team-based selling will result in diminishing returns.

To be clear on this point, there is a time and a place for team selling models. However, many sales organizations are falling back on team-based selling in a stop-gap attempt to close the widening disparity between buyer and seller sophistication. Solutions that were recently sold by an individual (perhaps with some support) are now being sold by a full-on team. Human capital costs relative to sales complexity are spiraling out of control.

In the short-term, team selling provides a buffer. However the longer term implications include margin-diluting cost of sales, customer channel conflict, inherently more complex/bureaucratized selling steps, etc. Winning organizations will focus on building an increasingly professionalized sales force, more capable of coping with a more informed and sophisticated buyer. These organizations will properly scale sales support and resist temptation to built full-on sales teams. The smarter economics lie in developing talent, not in introducing unnecessary labor costs.

8. Skill training will lose out to skill development within technology workflow

The promise of SAAS-based CRM, such as Salesforce.com, is making way for significant advances in CRM-integrated selling tools that actually work. The promise of CRM has traditionally been compromised by poor data and poor adoption. These new integrated selling tools provide something that traditional CRM has lacked: visibility of deal progress and a new level of interactivity for reps. In short periods of time, these selling tools are able to "learn" the ideal sales process for a sales group, ideal customer verifiers of that process, and the likelihood and timing of a given deal closing. Predictive models within these sales tools can highlight gaps in the account plan and are able to provide prescriptive coaching to sellers. Imagine getting pretty good sales advice from your CRM platform… Those days aren't far off.

Winning organizations will start to shift budget for traditional classroom training towards integrated CRM sales tools and coaching. These technologies most certainly will not displace traditional coaching, but certainly will provide a more transparent and productive platform for that coaching to occur.

9. Refinement in how sellers identify and use the "customer coach"

Our research this past year uncovered the myth of the coach or advocate in the complex B2B sale. The fundamental issue is that advocate/coach, as conventionally understood, does not truly exist in nature.

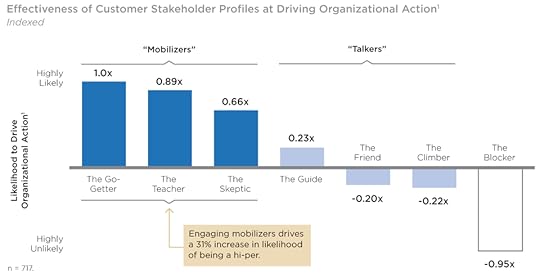

Of the stakeholders who exist, most salespeople pursue those who are accessible and willing to talk. We call these individuals "talkers" as they are poor at driving organizational commitment for a purchase, but readily provide information. The best sellers pursue "mobilizers."

Of the stakeholders who exist, most salespeople pursue those who are accessible and willing to talk. We call these individuals "talkers" as they are poor at driving organizational commitment for a purchase, but readily provide information. The best sellers pursue "mobilizers."

Mobilizers are stakeholders who excel at driving organizational commitment for a purchase, but rarely want to interact with vendors. While this difference may appear trivial, the reality is that who your salespeople tend to engage within an account was one of the most critical distinctions between core and high performers our work surfaced.

Winning organizations will refine their account planning and deal guidance to pursue stakeholders who are best able to drive consensus for today's complex B2B sales interaction. SEC members, be sure to use our interactive tool to help identify mobilizers in your deal reviews.

10. The Challenger Sale will establish itself as a paradigm shift in B2B sales effectiveness.

Perhaps a bit self-serving, but the level and commitment to adoption that we have seen for Challenger Selling is remarkable. Leading organizations are recognizing that the days of relationship-based selling have past, and customers must be challenged to think differently. The nature of trust in the commercial relationship will be built on insight moving forward.

So what did we miss? What do you disagree with? Let us know your thoughts, and in the meanwhile, let the SEC wish each of you has a happy and prosperous 2012!

Brent Adamson's Blog

- Brent Adamson's profile

- 9 followers