Brent Adamson's Blog, page 32

January 25, 2012

Storytelling: A Dying Art Form?

The rise of big data has been a double-edged sword for some. While customers have embraced data as it allows for easier price comparisons, their persistent focus on short-term savings has created new challenges for sellers—mainly, by undercutting the power of storytelling.

The rise of big data has been a double-edged sword for some. While customers have embraced data as it allows for easier price comparisons, their persistent focus on short-term savings has created new challenges for sellers—mainly, by undercutting the power of storytelling.

A member we recently spoke with shared how increasingly data-driven customers in the electronics industry have become so focused on price that they often lose sight of their vision and initial objectives behind a purchase.

"It's like trying to buy a painting based only on numbers and price comparisons–which is impossible–when in fact it's the story behind the painting that sells," he said, describing the whole situation.

His experience refers to a growing phenomenon we are seeing in sales today: customers' increasing use of data and rational reasoning in the purchasing decision (This, in fact, was one of the trends we believe every Sales Exec must know in 2012).

In today's tough economy, everyone wants to get the most for their money. It's natural for customers to try to break down deal components and compare apples to apples. And if customers want to do it that way, isn't it natural for sales reps to respond using data and numbers too?

But therein lies the problem. The customer's persistent focus on price and short-term savings distracts them from the real issue at hand—the long-term strategic value of your solution.

Likewise, in an effort to meet customer demands, reps have resorted to an emphasis on big data when crafting their pitches. But instead of using data to support their stories, they have in many cases used data in place of stories. Ultimately, this obsession with data has contributed to a decline in storytelling among reps, and caused customers and sales reps alike to lose sight of the big picture.

At the end of the day, your customer will be hearing different stories from each of your competitors—and it will come down to who had the most compelling pitch. While crafting a compelling story can be a struggle, it is a golden opportunity to teach customers something new about their business, and in this particular case, to provide healthy pushback and help them realize what they had lost sight of.

Being able to craft value propositions, identify unique differentiators, and communicate that value through Commercial Teaching is a skill key to closing business. So don't lose sight of the big picture, and remember that Commercial Teaching is both a science and an art.

SEC Members, review more of our Commercial Teaching resources and explore other trends that every Sales Exec must know in 2012.

January 24, 2012

5 Rules For Maximizing Comp Plan Buy-In

This is the time of year where many organizations are finalizing changes to their 2012 compensation plan for the sales force. While it can be a tricky time (as we must always be careful to avoid misunderstandings from the sales rep community around the new plans) – it really doesn't have to be…

This is the time of year where many organizations are finalizing changes to their 2012 compensation plan for the sales force. While it can be a tricky time (as we must always be careful to avoid misunderstandings from the sales rep community around the new plans) – it really doesn't have to be…

When it comes to structuring an effective compensation plan, the first thing to know is that communication can be even more important than the design of the plan itself.

The compensation plan will not be effective if reps do not believe that it is fair, and communication matters nearly twice as much as plan design in driving perceptions of fairness. In fact, in our research we found that Sales employees who believe pay processes are fair exhibit 60% more effort than those who do not.

(SEC Members, read more about the two key components of comp plan fairness, which your communications efforts should strive to emphasize.)

It's also worthwhile to keep in mind that communications from the frontline sales manager community are two times as likely to positively impact sales employees' belief in the fairness of pay processes than communication from the compensation function.

That said, from time to time, we still need to drive communications from the organization around compensations plans. So, here are five rules we see the best companies follow when looking to maximize sales force buy-in to the comp plan:

Consult the sales force on proposed plan changes. Take sales force input into account as you design compensation plans—especially star reps. Plans created "behind closed doors" are unlikely to obtain crucial sales force buy-in.

Communicate transparently. Be honest about your reasons for changing the comp plan, and explain what reps need to do differently to maximize their pay.

Empower first-line sales managers to have tough compensation conversations. As mentioned, Council research shows first-line managers are the most effective channel for communicating the plan. Manager communication is especially critical when bonuses are paid out and during plan changes.

Hold at least two formal compensation conversations per year. Council research shows that fewer than two conversations reduces perceived pay process fairness by 50%, while more than five conversations produces little incremental gain.

Focus conversations on the pay-performance link. Performance criteria used to determine pay is the number one topic managers should discuss. Actively reinforce organizational messages around performance expectations and pay potential rather than just current pay.

SEC Members, check out our newly updated topic center on Communicating Compensation Plan Changes for more detail on these five rules, as well as our Manager Guidebook for Rep Compensation Discussions.

What other rules do you follow when it comes to communicating comp plan changes?

January 23, 2012

Get Your Inside Sales Reps to Want to Stay

Wonder why you've seen increased Inside Sales turnover in your organization recently? Is it because reps are dissatisfied with their compensation package or working environment? Is it their relationships with immediate team members and managers? What about career opportunities?

Wonder why you've seen increased Inside Sales turnover in your organization recently? Is it because reps are dissatisfied with their compensation package or working environment? Is it their relationships with immediate team members and managers? What about career opportunities?

As our members have recently shared on our Talent Management Discussions Forum, providing clear growth opportunities in the organization is key to keeping your Inside Sales reps satisfied and engaged.

What exactly does "flexible career opportunities" mean though?

Inside Sales is a position that often has undefined next steps for advancement. What about those Inside Sales employees who, over time, may want to work in the field or transition into a management type role?

Transitioning from inside sales to the field can be difficult for various reasons. Often times, Inside Sales reps may not necessarily have the right skill set for a role in the field, and little organizational support to equip them to make the switch, forcing these reps to look for the right opportunities elsewhere.

Member perspectives reveal that many companies have taken different approaches to tackling this challenge. One member commented that their organization treats Inside Sales as a mandatory starting point, making it the foundation for any sales rep interested in the organization before they break off into field sales, channel management or account management.

Because of this, according to one member, it's important to continually invest in your Inside Sales employees, and give them opportunities to hone skills that can be utilized in other parts of the sales organization. Companies should make it clear that Inside Sales reps will continue to grow at their organizations whether inside or out in the field.

SEC Members, read more about what your peers have to say on strategies for decreasing Inside Sales turnover on our recently updated Acquiring and Developing Inside Sales Talent topic page or visit our Inside Sales topic center.

Have you experienced this issue in your sales organization? If so, what approach have you taken to reducing Inside Sales turnover?

January 18, 2012

The 4 Customer Contacts That Waste Reps' Time

In today's consensus-driven sales environment, we all agree that engaging the right customer contact is a critical linchpin in deals progressing forward. While we know the best reps lead with insight to challenge customers' assumptions, who your reps challenge can drastically change the course of a deal. So who are the right customer stakeholders to work and how can we help our reps find them?

Sales managers and trainers typically advise our reps to find a 'coach' or 'advocate' to help move a sale forward within a customer organization – preferably someone who is willing to talk, provides critical information, and who can network the rep with other stakeholders, among other qualities. And once reps find this individual it's a clear path to the corner office and a closed deal, right?

Wrong.

It turns out that asking reps to go and find this kind of customer stakeholder is like telling them to find a unicorn. SEC analysis found that the combination of attributes that make an ideal advocate exist in less than 1% of individuals – while customer stakeholders may show some advocate qualities, they just don't have it all.

In fact, we identified seven different customer stakeholder profiles that reps are potentially engaging. Of these major stakeholder types, three are effective in driving organizational consensus (we call them 'Mobilizers'), and three are likely to lead your reps on a long path to a dead-end (we call these 'Talkers'). And, if you're wondering about the last one, we like to call that one the 'Blocker', because they're just not going to talk to anyone.

Our research also found that star and core performers tend to gravitate to opposite customer stakeholder groups. Core performers look for Talkers who are easily accessible and share information because they're encouraged by their potential ability to help them navigate the sale. While these conversations are easy and pleasant, they ultimately lead to the road to Nowhere.

Star reps, on the other hand, instinctively look for healthy skepticism and reliability in a contact to make sure they're able to mobilize a deal to a desired purchase decision – in other words, stars are targeting customers who are open to disruptive insight and who can get it done.

While this strategy may seem vague at its surface, we've seen the best reps use a narrow set of concrete 'tells' to separate Mobilizers from Talkers far before a deal strays from the beaten path. To help core performers spot Mobilizers, SEC built an interactive tool to model the thought process stars use when qualifying customer contacts.

SEC Members- check out the specific cues star performers use to identify true Mobilizers with our new Interactive Stakeholder Identification Tool in our Customer Stakeholders Topic Center. Also, don't forget to register for the final Executive-Only meeting on Rewriting the Playbook: How High Performing Reps Win the Consensus-Based Sale.

Coaches: Your Reps Are Not as Hard-Headed as You Think

Do you ever feel like your salespeople forget almost everything you coach them on? There are few things more frustrating than a seller repeating the same mistakes over and over, no matter how hard you try to show them the better way.

Do you ever feel like your salespeople forget almost everything you coach them on? There are few things more frustrating than a seller repeating the same mistakes over and over, no matter how hard you try to show them the better way.

Why does this happen?

An easy conclusion to draw might be that our salespeople are simply hard-headed. As one sales trainer recently joked to us, "The term 'adult learner' is HR-speak for 'excruciatingly-slow learner." And while there may be some merit to this suggestion, our research also tells us that there is another side to this story. While salespeople may at times be slow – or even outright resistant – to behavior change, many managers may also be coaching in all the wrong ways.

Here's how: A little known fact is that there are two very distinct types of sales coaching – Deal-Level and Skill-Level. Both are important, yet data from our Coaching Pulse Survey consistently shows that most of us over-prioritize Deal-Level coaching at the expense of Skill-Level. This may have worked in years past, but it becomes highly problematic in the age of Challenger Selling.

Here's why: Deal-Level coaching, which is coaching in its most classic or familiar sense, is a foxhole-by-foxhole approach focused squarely on helping individual sellers troubleshoot individual opportunities that have stalled. It's a great way to close business, but used in isolation, it creates a very real risk: It can cultivate an impression among salespeople that Challenger behaviors are a fallback, "Plan B" style approach, a lever that only needs to be pulled when the playbook breaks down.

This would of course be entirely the wrong way of thinking about Challenger Selling. If the whole reason Challenger Selling is so effective is because customers are looking for a supplier who can provide unique insight, why would we risk postponing our "best stuff" until the very end of a deal?

The goal of Challenger Selling is a differentiated sales experience, and if we wait until late stage to begin differentiating, it may be too late. In fact, some of our newest research is showing that this battle for differentiation may begin even earlier in the customer's buying process than we ever imagined.

So how can managers cultivate this "almost always-on" mindset among salespeople when it comes to Challenger behaviors?

The best step we can take as coaches is to periodically but dramatically elevate our coaching conversation to a highly strategic level, one that encourages reps to think not about individual deals, but about how effectively or ineffectively they are applying Challenger behaviors across all of their deals, regardless of situation or opportunity stage.

Difficult though it may be for managers, the key to generalizing Challenger behaviors is to avoid the tendency to always refer to them in a situational sense, in relation to a specific deal that needs to be closed.

These types of coaching conversations are not easy to kick start, so we've recently compiled a Skill-Based Challenger Coaching Guide and list of recommended "starter questions" managers can use. Challenger Coaching on the deal-level should of course still continue– but it shouldn't be the only or predominant way that reps are supported. In fact we'd encourage managers to strive for a 50/50 split between Deal and Skill-Level Coaching, as we've seen becoming the standard at SAP/Business-Objects.

Will this approach alone finally lay to rest the challenge of salespeople forgetting so much of what we coach them on? Probably not, but it will at least ensure that we are taking responsibility for the portion we own as managers.

January 17, 2012

New Year's Resolution: Eliminate THIS PHRASE From Your Vocabulary!

(This is a guest post by Rick DeLisi of the Customer Contact Council, our sister program for heads of Customer Service and Contact Centers.)

New Year's observation: If there's anything longer than the line at the bar/buffet line/dessert table in December…it's the line at the gym/health club/Weight Watchers' meeting in January.

New Year's observation: If there's anything longer than the line at the bar/buffet line/dessert table in December…it's the line at the gym/health club/Weight Watchers' meeting in January.

'Tis the season to resolve.

If your quest for the new year is to drop a few holiday-induced L-B-S's…the best advice I've ever heard is, "Write down everything you eat during the course of the day." Turns out that simply training your brain to become hyper-aware of how many unnecessary calories we each consume every day is the "trigger" to kick-start a whole new mental process, that ultimately makes you eat less, and lose weight. (BTW, 45 minutes a day on the treadmill ain't gonna kill ya either, pal!)

But if your resolution for 2012 is to create an even greater customer experience at your company, here's a small piece of friendly advice that will similarly trigger a new mental process for you and your entire team. It's a matter of eliminating one simple phrase from your everyday vocabulary. It's not a phrase that sounds harmful at any level (in fact, when you use it, you probably think you're doing something positive). But if you stop using it (although it'll be hard at first), many amazing things will happen.

Stop saying, "the customer."

I mean, we say that all the time. We ALL do. We all talk about how important it is to listen to the customer. To treat the customer with respect. To reduce the effort the customer has to put forth to resolve their issue.

But here's where we need to re-wire our brains. 'Cause there's no such thing as THE customer.

Your company has thousands of customers. Or millions. And they are each very different. They have different interests, experience levels, language issues, expectations. And the more we allow ourselves to think about them as if they are one thing, one amorphous mass, one chain-gang of humanity…the further we get from creating the kind of customer experience that defines excellence in today's world:

A tailored, customized interaction that meets the specific needs of that one person, and their issue(s).

So, we need to stop thinking about thousands of different people (our customers) as one thing (THE customer) and start thinking of them as individuals who are as different from each other as — let's say — your grandmother…and that weird dude with the gigantic gauged earlobes who works at the music store.

Now, the fact that you have thousands of different people as customers doesn't mean you need to create thousands of different sales and service experiences. But certainly "one size fits all" isn't the right approach either.

I saw a great sign during this past year in the break room at the Houston-based call center of Southwest Airlines. It reads simply…

Behind every customer, is a person.

Here's wishing that 2012 is the year you and your company refocus on the people you serve, instead of just THE customer.

SEC Members, for more on tailoring, review our best practice on how Solae LLC created 'cheat sheets' to help reps tailor pitches to individual stakeholders and be sure to check out our new training module on Tailoring for Resonance, which teaches reps tailoring techniques.

How about you? What are you resolving to do differently in 2012?

January 11, 2012

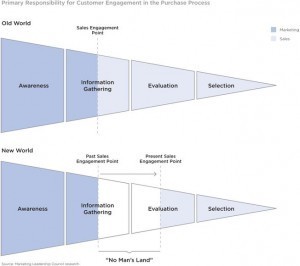

The Emerging No-Man's Land between Sales and Marketing

A fundamental shift in customer buying behavior has created a rift where Sales and Marketing have traditionally engaged customers. This void in the purchase process where customers are free from supplier engagement, a "no-man's land" so to speak, has several implications on what successful selling looks like in today's environment, but one of the more immediate concerns is that most suppliers haven't fully recognized the shift has even occurred.

This lack of awareness could partly be blamed on the fact that there is significant internal confusion in supplier organizations over the ownership of certain commercial responsibilities. Data from the SEC's Commercial Integration Diagnostic illustrates that companies don't have a good sense of which function, Sales or Marketing, owns some of the most important commercial activities—almost 70% of the member companies surveyed were unsure of who owned the insight generation responsibility, for instance.

Click Image to Enlarge

As such, many sales organizations lack the scalable organizational support reps need to successfully sell in today's environment, and are therefore leaving individual reps to do much of the heavy lifting themselves.

What makes matters even more difficult for sellers, and sales organizations alike, is the fact that buyers are not contacting suppliers until they are, on average, 57% of the way through their purchase process—meaning they have already determined their needs, completed due diligence, and have even begun to do some comparison shopping.

Given that this emerging commercial rift or "no-man's land" is essentially enabling customers to make purchase decisions without supplier influence, it is all the more important that suppliers alter their strategies to drive customer engagement at the earliest, most formative stages of a sale and shape customer demand.

The SEC is focusing on just this in our forthcoming 2012 research. Initial findings suggest that the best companies are developing an organizational capability spanning both marketing and sales to generate unique insight, develop scalable commercial messaging based of that insight, and to generate leads/select opportunities based on customer receptiveness to that insight. By doing so, these companies are able to successfully support their sellers in engaging customers early and shaping their demand.

What is your organization doing to tackle no-man's land and increasing buyer sophistication? Does developing an organizational capability to generate unique insight and support sellers sound like the right approach to you?

SEC Members, learn more about our new 2012 research, Shaping Demand to Win Business. You may also want to consider launching the new Pre-Sales Diagnostic (at no extra charge), which examines how high-performing reps shape the nature of demand in "no-man's land."

Additionally, if you are interested in speaking with us about what your company is doing to combat the issue of buyer sophistication and the emerging gap between sales and marketing, please contact us.

January 10, 2012

Stop Leaving Customers in the Dust

Is your sales force experiencing increasingly stalled business, extended cycle times, and inaccurate forecasts? If so, it's time to revisit your sales process and take a hard look at how your customers buy.

Is your sales force experiencing increasingly stalled business, extended cycle times, and inaccurate forecasts? If so, it's time to revisit your sales process and take a hard look at how your customers buy.

Traditionally, companies have taken an inward approach to developing their sales processes—they typically only consider internal senior management requirements that make management and forecasting easier (or so they thought…) Unfortunately, the glaring problem with this approach is that it does not take into account where customers actually stand in the sale.

For most reps, following the traditional sale process is all about providing certain tools and information to the customer to quickly move them to the next step in the sales funnel. However, reps miss a key step here–they take for granted that customers are ready to move on and often end up outpacing them in the deal. As a result, many companies find their reps' books of business bogged down with deals stuck in limbo.

Automatic Data Processing, Inc. (ADP) recognized this problem and created 'Buying Made Easy,' a tool that blurs the lines of distinction between the sales process and the customer's buying process. The tool links selling activities in each step of the sales process with certain reciprocating customer buying activities.

These "Buyer Signals" as ADP calls them, are customer verifiers–stage gates in the sales process that signal customers' readiness to move forward in the sale. A rep proceeds to the next step of the sales process only when a verifier is present, that is, when the customer indicates their readiness to move forward.

By focusing on customers' buying process and the right customer signals, ADP not only improved conversion rates, but also realized a 500% ROI in reengagement of stalled opportunities.

SEC Members, to learn more about Buying Made Easy, read excerpts from our conversation with the creators of the tool on how they mapped out their customers' buying processes, how they built the tool, and how such a tool can help improve your sales function.

Also, be sure to check out the Deal Verification toolkit which can serve as a foundation for the types of customer verifiers to develop to match your sales methodology and reflect how your customers buy.

January 9, 2012

The Rightful Owner of Sales Compensation is…

In the Sales world, the start of a new year often brings with it a fervent roll out of new compensation plans. It's the one activity that garners the most interest from all quarters of the sales force. After all, a good compensation plan can drive the right behaviors, and retain and attract top talent.

In the Sales world, the start of a new year often brings with it a fervent roll out of new compensation plans. It's the one activity that garners the most interest from all quarters of the sales force. After all, a good compensation plan can drive the right behaviors, and retain and attract top talent.

The compensation plan design process itself is anything but simple though. Its scope overlaps with the domain of multiple functions—Sales Ops, HR, Finance, and Legal being the most vocal participants and stakeholders. Each, with often competing interests, claims ownership of sales compensation design. It's no wonder we see compensation plans often stray away from the broader business goals of the organization.

Who then is best suited to own sales compensation?

In the last few weeks, we've seen a healthy debate on the topic take place on the Sales Ops Forum. While most member companies lean towards Sales Ops as the primary owner, two things are clear:

1) It's not who owns sales compensation design but how stakeholders collaborate with each other that results in a strong compensation plan. Undoubtedly, each function has an important role to play. HR ensures plans comply with labor laws, and are fair and transparent. Legal identifies areas of risk, and promotes regulatory compliance. Finance ensures plans align with business goals, and don't strain company health.

The absence of any one stakeholder can seriously jeopardize the entire exercise. Companies where all key roles and viewpoints are represented don't struggle with who owns sales compensation. What's needed is a collaborative "group" approach rather than a single dominant "primary" owner of the design process.

2) How the sales force perceives different stakeholders is important in deciding ownership of the compensation design process. When it comes to sales compensation plan effectiveness, communication is even more important than plan design to secure sales force buy in. Even a brilliant plan positioned poorly in front of the sales force can lead to disengagement and resentment over proposed changes.

One member reported that when Finance was the primary owner of sales compensation, no matter how plan changes were communicated, they were perceived by the sales force as a cost cutting measure. Many companies defer to Sales Ops for this very reason, as plans are then seen as developed by sales peers.

In your experience, is it really important who owns sales compensation? Share your thoughts below.

SEC Members, visit our Compensation Topic Center to learn more on how to design and communicate compensation plan changes. Also, read the ongoing discussion on the Sales Ops Forum about who owns sales compensation plan design.

January 6, 2012

The Rightful Owner of Sales Compensation is…

In the Sales world, the start of a New Year often brings with it a fervent roll out of new compensation plans. It's the one activity that garners the most interest from all quarters of the sales force. After all, a good compensation plan can drive the right behaviors, and retain and attract top talent.

In the Sales world, the start of a New Year often brings with it a fervent roll out of new compensation plans. It's the one activity that garners the most interest from all quarters of the sales force. After all, a good compensation plan can drive the right behaviors, and retain and attract top talent.

The compensation plan design process itself is anything but simple though. Its scope overlaps with the domain of multiple functions—Sales Ops, HR, Finance, and Legal being the most vocal participants and stakeholders. Each, with often competing interests, claims ownership of sales compensation design. It's no wonder we see compensation plans often stray away from the broader business goals of the organization.

Who then is best suited to own sales compensation?

In the last few weeks, we've seen a healthy debate on the topic take place on the Sales Ops Forum. While most member companies lean towards Sales Ops as the primary owner, two things are clear:

1) It's not who owns sales compensation design but how stakeholders collaborate with each other that results in a strong compensation plan. Undoubtedly, each function has an important role to play. HR ensures plans comply with labor laws, and are fair and transparent. Legal identifies areas of risk, and promotes regulatory compliance. Finance ensures plans align with business goals, and don't strain company health.

The absence of any one stakeholder can seriously jeopardize the entire exercise. Companies where all key roles and viewpoints are represented don't struggle with who owns sales compensation. What's needed is a collaborative "group" approach rather than a single dominant "primary" owner of the design process.

2) How the sales force perceives different stakeholders is important in deciding ownership of the compensation design process. When it comes to sales compensation plan effectiveness, communication is even more important than plan design to secure sales force buy in. Even a brilliant plan positioned poorly in front of the sales force can lead to disengagement and resentment over proposed changes.

One member reported that when Finance was the primary owner of sales compensation, no matter how plan changes were communicated, they were perceived by the sales force as a cost cutting measure. Many companies defer to Sales Ops for this very reason, as plans are then seen as developed by sales peers.

In your experience, is it really important who owns sales compensation? Share your thoughts below.

SEC Members, read the ongoing discussion on the Sales Ops Forum on who owns sales compensation plan design. Also, visit our Compensation Topic Center to learn more on how to design and communicate compensation plan changes.

Brent Adamson's Blog

- Brent Adamson's profile

- 9 followers