Brent Adamson's Blog

July 29, 2014

Why Consensus Is a Customer (Not a Seller) Problem

This is the fifth in a series of blog posts on our latest research: Creating Customer Consensus . To read more, click here.

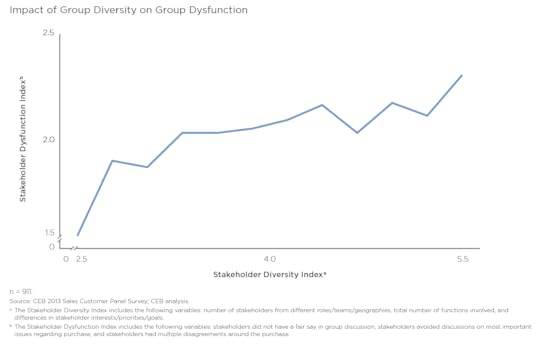

In a previous blog post, we showed evidence that the increasing number of diverse customer stakeholders we must face in consensus deals is leading to dysfunctional buying group behaviors. And worst of all, it is leading to the commoditization of our solutions, as dysfunctional groups, marked by diverging mental models, are unable to agree on anything other than price.

Now you may still be wondering why dysfunction in the customer organization is any of your reps’ business. But here is what is crucial to understand about buying group dynamics: our research shows that coping with increasing consensus requirements is less about helping reps sell differently and more about helping your customers buy differently. At the end of the day, individuals who are part of a buying process need to connect with each other and agree on shared priorities and interests in order to address broad challenges and pursue big opportunities. It is precisely the inability of stakeholders to align on a problem to solve that leads decision groups to default to the basic common desire to either save their company money or avoid organizational risk.

What our data also revealed is that buying groups that manage to create greater overlap in terms of individuals’ goals, priorities, means, and metrics are more likely to interact in a functional manner and therefore purchase more ambitious offerings. In other words, while stakeholders in dysfunctional buying groups have diverging mental models, stakeholders in functional buying groups have converging mental models.

So what does the research say about what sellers can do to encourage convergence among otherwise diverse stakeholders? At a very high level there are three things that can drive stakeholder alignment:

A common language. Building communication bridges between stakeholders who speak IT or speak Marketing is crucial for identifying common objectives and creating greater overlap between stakeholders.

Collective understanding of individual perspectives. Alignment will not be reached without ensuring that everyone understands not only what each stakeholder wants but why.

Overcoming biases. Being open to consider new ideas requires abandoning both individual biases (e.g., my team is not agile enough for this change) and company biases (e.g., internally-built solutions always meet our needs better).

In essence, convergence can be achieved through the process of people learning from one another in order to establish common ground and collective expectations, or what behavioral psychologists refer to as “norming.” And that is precisely what our research this year found. Stay tuned for our next post on this series addressing what the single largest driver of high margin purchases in a consensus sale is.

CEB Sales members, listen to the webinar replay and review the key findings from the study. Also, register for one of our upcoming meetings on the topic.

July 28, 2014

Boost Your Sales With Big Data

By now, you probably know that customers, on average, have completed 57% of the buying process before engaging suppliers. With all of the information available at their fingertips, customers don’t need to engage with a salesperson to evaluate needs and options and won’t contact suppliers until they are much further along in the purchase decision. But information proliferation isn’t a one-way street. Just as customers have access to vast new amounts of data, suppliers have access to a lot more information too, and can use this data to learn more about their customers than ever before.

So why have we, as sellers, been slow in adapting to the new world of big data? Sales organizations face a number of roadblocks when incorporating data and predictive analytics into the sales function, including:

Data quality and management. Many sales organizations struggle to maintain all of the data within their CRM systems, and big data and predictive analytics mean more data from more sources to maintain.

Analytical capability. Big data calls for big judgment and without the ability to interpret, apply, and act on data effectively, more data can actually lead to worse decisions.

Overcoming these, and other, roadblocks requires sales organizations to prioritize and invest in data and analytics, which, when done right, can yield tremendous results. Customers are constantly sending signals indicating their propensity to buy, and big data can help identify the best opportunities for new business, as well as the best opportunities for up-selling, cross-selling, and renewal.

Is your organization using big data and predictive analytics to improve your lead management process? If so, we’d love to hear from you. If you’re willing to discuss your organization’s use of big data and predictive analytics (don’t worry, everything will be confidential), please email Alex Hanson (mhanson@executiveboard.com).

Related Blog Posts:

Finding a Home for Big Data in Sales

‘Big Data’ – a Big Impact for Sales?

July 22, 2014

Want to Hire Challengers? Redesign Your Job Postings First!

In previous posts, we have written about how sales organizations are increasingly implementing Insight Selling to equip their sales force to sell in today’s complex selling environment. That said, in a recent survey most sales leaders reported that only two-thirds of sellers in their organizations have the potential to adopt insight selling behaviors. When you couple this with the issue of an aging sales force, hiring quality sales talent has become a pressing issue for most organizations.

However, before you even get started on hiring Challengers, you first need to encourage them to apply. Most sales organizations’ job postings today fail to attract Challengers as they do not reflect the right skillsets or employee value propositions that attract candidates with Challenger potential.

Below are three key reasons why traditional sales job postings fail to attract candidates with Challenger potential and how you can make them more appealing:

Highlight Traditional Selling Techniques: Most job postings focus on traditional selling skills such as building customer relations, selling business solutions to customers, following sales processes – which might appeal to core sellers but not Challengers. Challengers want to work in an environment that empowers them to make their own decisions, and helps them understand how their work may contribute to the overall growth of the organization.What You Should Do: Include statements that emphasize how your organization provides a high judgment-oriented environment that empowers sellers to make decisions.

Make Sales and Industry Work Experience Mandatory: Most companies mention mandatory sales or industry-specific experience, narrowing the pool of candidates who can apply. CEB research has found that a large number of Challenger candidates in fact lie outside of sales jobs in other industries, and can be discouraged by mandatory sales experience and industry requirements.What You Should Do: Broaden the scope of candidates who can apply by excluding industry- or sales-specific experience requirements. Use our Sample Job Posting tool to learn which keywords will resonate with Challenger potential candidates and create your own custom job posting.

Focus on Emotional Quotient Competencies: While emotional quotient such as negotiation, interpersonal and communication skills are important, they alone cannot help reps succeed in an Insight Selling environment. Insight Selling requires an equal combination of intellectual quotient (strategic thinking, creativity, and problem-solving skills) and emotional quotient for reps to be successful. Challengers themselves love to debate and challenge customer thinking, which is why sales organizations should mention these competencies equally in their job postings.

What You Should Do: For job competencies, highlight critical thinking skills (IQ) such as creative problem solving along with traditional EQ skills such as communication and interpersonal influence.

Related Blog Posts:

Increase Your Chances of Hiring a Challenger

Is Your New Hire a High Performer?

How to Make a Good First Impression with New Hires

Related CEB Sales Resources:

Challenger Job Posting Kit

Attracting Talent and EVP

Challenger Competency Grid

July 21, 2014

5 Statistics Every Sales Executive Must Know

There has been much disruption in the sales world in recent years. And, as we studied these disruptions and associated challenges, our research has thrown some pretty cool (and scary) statistics that debunk conventional wisdom and will forever change the way sales organizations operate.

Below are five statistics that top my list that every sales executive must know:

53% of customer loyalty is driven by a seller’s ability to deliver unique insight: In other words, a company’s brand, products and services, and price are no longer the main drivers that drive customer loyalty. Instead, what customers want today lies within the sales experience itself. And what better way to provide a lasting sales experience than a message that disrupts customer thinking and changes the way they do business, what you all have come to know as Commercial Insight.

CEB Sales members, learn more about the components of a world-class insight.

An average B2B purchase is 57% complete by the time a customer engages a single supplier: With more information available to customers earlier in the sale, suppliers are being contacted later in the purchase decision than ever before. What’s more, customers have already defined their needs, researched solutions, settled requirements, and are starting to benchmark price. So, by the time the customer reaches out, the only thing left for the supplier to compete on is price.

CEB Sales members, use our Opportunity Qualification Scorecard to target the right opportunities.

An average of 5.4 customer stakeholders are involved in a typical B2B purchase decision: As deals become increasingly complex, new stakeholders from different parts of the customer organization are weighing in on purchase decisions. These stakeholders bring diverse perspectives and business needs, making it hard for sales to create consensus among customer stakeholder groups.

CEB Sales members, read our latest research on guiding diverse stakeholders to recognize greater common value.

The ideal customer advocate/coach exists in less than 1% of individuals: Conventional wisdom teaches reps to find advocates/coaches in the customer organization – that can provide inside information, be highly credible, and support the supplier’s solution, among other criteria. Our analysis found that finding advocates is almost impossible as customer stakeholders with all the desired advocate/coach attributes don’t exist in the real world. That said, since sales requires selling to people, sellers must ultimately make a decision on who to sell to. Turns out Mobilizers are best positioned to drive change and that’s the profile high-performers tend to engage.

CEB Sales members, learn more about customer stakeholders who can mobilize an organization around a purchase.

Reps forget 70% of the information they are taught in training within a week, and 87% within a month: We have all seen sales training initiatives falling flat and often the reason cited is the training itself. But what our research found is that more often than not it’s not the training but what happens before and after training that is the reason for training to not “stick” and for sellers to not internalize new skills and behaviors.

CEB Sales members, see how ADP creates “buzz” for training before they roll it out and Siemens creates real-world practice opportunities as part of manager/rep coaching ride alongs.

July 15, 2014

What Sales Can Learn from the World Cup

[image error] This is the fourth in a series of blog posts on our latest research: Creating Customer Consensus . To read more, click here.

Well, after a month of drama, suspense, upset, and excitement (and a few suspiciously long “lunch breaks”), the 2014 World Cup is over. It all came down to the final match on Sunday, where Argentina fell to Germany 1-0. Other commentators have noted how Argentina’s offensive players are much more talented than its defensive ones, and indeed, Sunday proved that relying on a good offense, even one led by a player like Lionel Messi, who many believe is one of the best offensive players in the world, is not always enough to win the game.

Sales, too, relies heavily on the offense. And rightfully so. We all want Messis, Neymars, and Ronaldos on our team—star performers with the Challenger skills and commercial insight to get the ball in the goal. We want to stack the rest of the team with skilled Mobilizers who can drive the ball down the field and help out the rep when he or she gets into a tight spot. The hope is that with a strong offense, your reps will make goals and win the game. (Or rather, win deals and make goal.) And often, it does work.

But, like Argentina learned on Sunday, there may be times when a strong offense is not enough. A determined opposition can block and wear down even the strongest of offenses, and without a solid defensive plan, your team is sure to lose in the end.

In the same way, for Sales, a determined opposition—a Blocker in the customer stakeholder group—significantly lowers the chance of you winning the deal. In fact, our latest research discovered that the presence of a Blocker in the customer stakeholder group decreases the likelihood of making a high-quality sale by 47 percent.

It is possible to win the game still when faced with a strong Blocker, it just requires that Sales begins to put some into time building a defensive lineup, in addition to keeping their offense stacked. Our research shows that the best reps strategize a plan for dealing with potential Blockers very early on, instead of waiting until the Blocker has already interfered.

But dealing with Blockers can be tricky, and it’s hard to know what exactly to do in each situation. To help, we’ve developed a new page for CEB Sales members to learn more about how to effectively manage Blockers, including a case study on how to help your reps identify Blockers early on and a tool to help reps and managers determine the most effective strategy for dealing with them.

July 14, 2014

5 Principles to Managing CRM Data Quality

In response to increasing sales complexity, many organizations are “doubling down” on CRM to drive rep productivity, generate better insight, and improve customer experience. That said, your reps won’t use CRM if the data is not good, and it’s unwise for executives to make strategy decisions using data that is poor or incomplete. In fact, in our recent poll, 48% of respondents indicated that maintaining data quality was the most challenging aspect of CRM.

Hewlett Packard (HP), a global technology company, experienced a similar issue. A study of their CRM data revealed serious flaws in data quality such as duplicate and incomplete entries, and obsolete and inaccurate data—preventing HP from forecasting revenue accurately and supporting reps in sales activities. Consequently, HP experienced not only low levels of CRM adoption amongst reps but also a drop in customer confidence levels.

To overcome these challenges, HP created a CRM data philosophy that centered around five key principles:

Define what “Good” CRM Data Looks Like: Establish data benchmarks that define “good” data, guiding reps’ data entry and helping achieve data consistency. Benchmarks include aspects that are critical to account management such as data category descriptions, contact field descriptions, and taxonomy norms.

Appoint Data Custodians: Identify frontline CRM data solution providers to examine CRM data records, identify deficient or flawed data records, and take corrective action. HP appointed “data custodians” to examine all CRM data records and process those records that are either incomplete or flawed in other ways. Data custodians also ensured that the CRM data for lead generation and sales activities was complete and fully updated as per established data quality standards.

Constitute Data Audit Teams: Use data audit teams to review and certify data quality. To validate quality of CRM data entered by reps, HP performed regular data quality certification using established CRM benchmarks and measures as reference.

Deploy Dashboards: Deploy internal dashboards to assess data compliance and performance. HP created dynamic dashboards for data custodians to highlight blank fields, overdue tasks, and track updates at country, region, and worldwide levels.

Create a Monitoring Protocol: To drive data quality improvement throughout the organization, HP established an explicit plan to measure data quality. This included a methodology for frequent data quality monitoring.

CEB Sales members, learn more on how HP tackled its data quality challenges to provide reliable CRM data to its sales force. Also, visit our CRM topic center for more resources on managing CRM data quality, driving CRM adoption, and selecting CRM vendors.

Related Resources:

CRM Data Quality

Getting Reps to Use CRM

Extracting More Value from CRM

Related Blogs:

How to Not Waste a $20 Million CRM Investment

What You’re Overlooking with CRM Adoption

12 Principles of World-Class CRM

July 8, 2014

Not Closing Deals? Your Customers May Be to Blame

(This is the third in a series of blog posts on our latest research: Creating Customer Consensus .)

As we discussed in an earlier post in this series, the increasing size and complexity of the offerings B2B companies sell has increased the diversity of customer buying groups. This increasing diversity is probably not shocking to you, though—and for good reason. This diversity is visible to anyone looking at today’s customer stakeholder groups. It’s hard to ignore the new people at the table that have little in common with those who have always been there.

What’s less visible—and probably more surprising to you—is the new dynamic that this greater stakeholder diversity has created: dysfunctional stakeholder groups. The data is clear.

As stakeholder groups become more diverse, they are more likely to display the following symptoms of dysfunction:

Stakeholders don’t have an equal voice in group discussions. In diverse buying groups, stakeholders have less experience working together. This inexperience makes it likely that the loudest voice will dominate group discussions, marginalizing other stakeholders who are apt to either veto the deal or squabble about how much money they are putting towards the purchase.

Important issues are ignored. Without a shared understanding of how the purchase could benefit each member of the group, diverse stakeholder groups are likely to get sidetracked with arguments about minor issues. Besides elongating sales cycle times, this can lead the buying group to change their purchase criteria in the late stages of the purchase process—or to abandon the purchase altogether.

Unresolved disagreements. Unable to explain their opinions in ways that others will understand, members of diverse buying groups are likely to abandon productive debates, simply agreeing to disagree with each other. Of course, when everybody agrees to disagree with each other about a purchase, that purchase will never happen.

Besides making it harder to close deals, customer dysfunction has an additional insidious effect. Diverse stakeholders have vastly different mental models—the way an individual sees, thinks about, and talks about the world. This makes it difficult for stakeholders to explain the benefits they’d get from particular features and functionality to the rest of the buying group.

Given that, group discussions tend to drift away from features and functionality to the one thing everyone is able to discuss: price. This means that even when—against all odds—you manage to close a deal with a dysfunctional buying group, you will have faced so much price pressure that the deal won’t close at a high margin. In fact, higher-cost, premium suppliers are 50% less likely to close deals with dysfunctional buying groups.

The data is clear on one additional point: Diversity is not destiny. Although diverse buying groups are more likely to become dysfunctional, sellers can intervene to prevent dysfunction from arising. This antidote to stakeholder group dysfunction will be the subject of our next post in this series.

CEB Sales members, listen to the webinar replay and review the key findings from the study. Also, register for one of our upcoming meetings on the topic.

July 7, 2014

Your Sales Reps Aren’t Robots, So Don’t Treat Them Like They Are!

I’m taking a wild guess here, but I don’t think your sales force is made up of 500 homogenous robots.

If I’m wrong, we need to set up a call. Assuming I’m right, though, the standard national sales meeting experience is probably leaving your sales force unsatisfied. Flying in all of your sales reps from across the country, or globe, isn’t cheap; why waste the time and money by throwing everyone into a cavernous meeting hall for three days of generic presentations?

We recently spoke to four CEB Sales members about their national sales meetings and asked a pretty broad question: what innovative practices are you using to deliver information to reps in an engaging way? The answers we heard were surprisingly similar, and two major themes stood out:

Instead of relying on large, lecture-based training presentations, organizations are transitioning to smaller, interactive learning sessions. By offering numerous small group sessions, sales reps are more likely to find training that applies to their specific development areas and will, therefore, remain more engaged throughout the meeting.

Organizations are also creating opportunities for salespeople to connect with product experts and other internal partners. Facilitating these connections allows product creators and experts to efficiently answer sales reps’ questions, build relationships between groups that don’t typically interact, and expose sales reps to new ideas about the products they sell.

CEB Sales members, to learn more about the specific tactics used by the four profiled companies, read the full research brief, Innovations at National Sales Meetings. If you’re interested in designing a theme for your national sales meeting, check out how four other organizations did it here: Selecting Themes for National Sales Meetings. For information on sales training in general, visit our Sales Training Decision Support Center.

July 1, 2014

5 Signs of Bad Coaching

Few of us will dispute the importance of coaching in boosting seller performance. Indeed, our analysis finds that high-quality coaching can improve seller performance by up to 19%. It’s no wonder sales organizations continue to spend significant time and resources in improving manager coaching skills. And while you can get advice on how to coach from all quarters, we thought we should list down advice on how NOT to coach. Keep these five signs in mind to avoid falling in the trap of bad coaching:

Telling More Than Asking: Managers often tend to spend too much time “telling”, delivering one-way feedback. Coaches should target to speak only 30% of the time, and the best way to stick to this balance is to use open-ended, probing questions to help sellers self-discover.

Focusing on the “Why” and not the “How”: The difference between a good and an average manager is not the amount of time spent coaching but their focus on different aspects of coaching. While good managers spend most of their coaching time guiding reps on “how” to improve on identified skill gaps, average managers focus their time on telling them “why”.

Coaching all Sellers Equally: Most managers believe that all reps should be coached equally. However, not all reps who receive coaching, even from good managers, necessarily perform better through sustained coaching. Coaches must target the core (i.e., the middle 60% of the sales force) to drive performance and stars for retention. Managers should also identify and tailor their coaching approach to reps’ learning preferences.

Relying Solely on Scheduled Coaching Sessions: Star managers integrate coaching in regular conversations and interactions with sellers, helping sellers absorb coaching lessons faster.

Coaching Based on Manager’s Own Experience as a Seller: Managers are often guilty of prescribing their own approach instead of allowing reps to arrive on a solution on their own. Worse is when managers get down to resolving the challenge themselves, not allowing reps to handle the issue.

What other signs would you include in this list?

CEB Sales members, sign up for our upcoming webinar on Driving Manager Effectiveness where our team of in house experts – Brent Adamson, Nick Toman, and Jessica Cash – will answer questions related to building a world-class manager development eco-system within your organization.

Related Blog Posts:

Coaching for Challenger Skills

Should You Videotape Coaching Sessions?

4 Ways to Measure Coaching Effectiveness

Related CEB Sales Resources:

Sales Coaching Topic Center

The Anatomy of World-Class Sales Coaching Practices (4.0)

Sales Coaching & Manager Effectiveness Benchmarking Tool

June 30, 2014

3 Ways to Segment Customers

Navigating customer segmentation is like reading those Choose Your Own Adventure books written in the 80s/90s. There are many different paths to explore and they may/may not lead to the best use of time, money, or resources for your company. How should we segment our customers? Which method makes the most sense for our business and how can we tell? Well, there isn’t a one-size-fits-all approach, but we wanted to provide a quick snapshot of some of the different segmentation methodologies we’ve seen members use, the benefits/challenges inherent with each, and leave you with a couple of tools that may be helpful in your journey. To that end, we’ve boiled down three basic methodologies (that seem to be the most widely used and also the most actionable):

Industry/Firmographic

Customer Tiering

Needs-Based Segmentation

Let’s dive in to each starting with industry/firmographic.

Simply put, industry/firmographic segmentation is to business-to-business, what demographic segmentation is to business-to-consumer.

If we think of demographic segmentation as helping organizations group consumers by shared characteristics (like age, gender, ethnicity, income level and zip code), then we can picture industry and firmographic segmentation as helping organizations characterize customers by industry attributes (such as its competitive environment and fixed costs, or simply its size and geography).

Now, there are some nice benefits here: industry/firmographic segmentation is relatively low cost, it’s easy to measure, and easy to communicate to our team, but it can be difficult to scale since customer needs vary within a segment. To overcome this, many of our members have used industry/firmographic segmentation in conjunction with other methods to get to a much richer understanding of the customer. One such example is customer tiering.

Customer tiering incorporates two key factors into its definition that we didn’t see in the industry/firmographic model: potential fit (or, customer alignment to an organization’s strategy) and opportunity (or, long-term revenue potential). These two factors give us new benefits by particularly incorporating more of a forward look since it captures growth-related information that is often overlooked in other methodologies. However, we still run into the hurdle that tiering does not guarantee a homogenous set of needs within customer tiers. We also find that this approach requires a significant amount of time from management to get it up and running.

Needs-based segmentation, on the other hand, is often seen as the most predictive method because it focuses on the problem our customers are trying to solve and thus often replaces a behavioral-focused or transactional-focused view in many organizations. Members that use needs-based segmentation have found it to resonate with customers and be very scalable since it limits the number of segments to a manageable set. Unfortunately, because it’s tough to just look at a customer and know their needs, it’s very difficult for the sales force to apply a needs-based segmentation when they are out with a prospect.

So, the high-level conclusions. As we move from industry/firmographic to customer tiering to needs-based segmentation there’s an implicit increase in complexity and resources needed (whether that’s staff, skill set, money, or data). The benefit as we move through that same progression of methodologies is an increasing level of insight these models give us.

Want to learn more about how to make the most of your segmentation choices?

Take a look at how Air Products and Chemicals prevented their reps from over-investing time and resources into low-opportunity customers by creating Segment-Level Rules of Engagement.

You may also want to look at how Square D helped their reps assess individual account potential by creating an Opportunity Fit Matrix that helped to map the account’s long-term revenue and strategic fit.

While there may not be any magic bullets for your organization’s segmentation path, these insights and tools may allow you to see several pages ahead in that Choose Your Own Adventure Book on your nightstand…

Related Blog Posts:

When Segmentation Goes Awry

How NOT to Under- or Over-Serve Customers

Related CEB Sales Resources:

Optimize Your Go-to-Market Strategy

Peer Discussion: Re-segmenting the Customer Base

Brent Adamson's Blog

- Brent Adamson's profile

- 9 followers