Brent Adamson's Blog, page 7

January 20, 2014

Three Ways to Uncover Your Company Culture

Guest author Peter Nolan has over 30 years of experience in global sales and marketing, and is a Transition Mentor for CEB members.

Guest author Peter Nolan has over 30 years of experience in global sales and marketing, and is a Transition Mentor for CEB members.

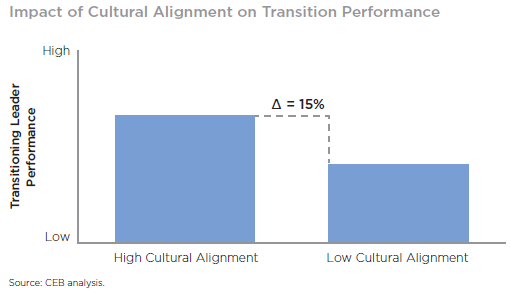

Research by CEB has found that an initial lack of cultural alignment between transitioning leaders’ values and those of their new organization can decrease the likelihood of leadership transition success by up to 15%. This reflects my experience of over 30 years in a number of corporations.

Three Ways to Uncover the True Corporate Culture

What I have learnt through my transitions is that in order to understand and adjust to a new organization’s style, new-to-role executives must proactively pressure-test what they hear to uncover the true corporate culture. This pressure testing can happen through conversations with key “knowledge agents”, by always having ready probing questions, and by comparing what is said to what is done. Who you speak with, what you ask, and what you do with this information matters.

1. Who You Speak With: Identify the Key ‘Knowledge Agents’: I have seen many executives focus only on their immediate peers, and not reach beyond to really understand the organization’s culture. As a new-to-role executive, you should find out who the true ‘knowledge agents’ are — regardless of their status in the corporate hierarchy — and engage them in a conversation on how the organization communicates, makes decisions, and gets work done.

These ‘knowledge agents’ are normally the company “storytellers” — they can be the top level sponsors who have given you the job, peer group colleagues, people reporting to you, or people in the wider organization with many years of experience. I also highly recommend interviewing customers, clients and suppliers to get the external view on how things work in the new company; balancing the internal and external viewpoints is crucial.

2. What You Ask: Have Insightful, Probing Questions Always Ready: Each person you meet gives you the opportunity to ask questions which will give you a flavor of the culture of the organization; you need to make the most of these opportunities and ask insightful and probing questions to accelerate your understanding of your new organization. Have these questions always ready in your mind. Questions about company success stories provide insight to the company culture. Find out which leadership traits are most respected, who is considered a star, and why. By gathering these inputs you can begin to create a “map” of what it takes to succeed in your new environment. Remember, most organizations do not have a cultural guide written down to help you. It is up to you to work it out.

I have seen firsthand what happens to those who ignore this advice. A senior executive joined a major organization in which I worked but, during his introductory period, he spent most of the time giving his own opinion on how everything in the company did not work. His only guide was his previous career experience as a roadmap for success. He didn’t take the time to understand the culture of the new company. His tenure in the company lasted six months.

3. How You Use the Information You Gather: Compare What is Said to What is Done: Take what you’ve learned in your discussions and compare that to how the company actually works. The gap between how a company thinks it works and how it actually works can often be the gap between success and failure.

Observe critical interactions, meetings, events, people, processes, vocabulary, and general behavior. The way people address each other, the dress code and manner of employees, and the way they resolve conflict, are all clear clues to how things actually work.

I also recommend you identify early on which sector of the company actually calls the shots. Is it Finance? Engineering? Sales? A company’s culture is mainly driven around the goals of a key competency area. Other functions of course play a critical part, but it is how these sectors interact that determines a company’s path. Know which one it is.

Once you get a better understanding of your new organization’s culture, you need to understand whether you are being asked to fit into the culture or change it. If this has not been clearly communicated to you, ask.

Quickly getting to know your organizational culture will make or break your transition. I encourage you to proactively pressure-test what you hear during your introductory period to quickly uncover the true corporate culture and adjust to it.

CEB Sales Members, for more support and guidance, visit our topic center on Leadership Transition Support. Also, register for our upcoming webinar for transitioning senior leaders on Setting Personal Performance Goals.

December 23, 2013

5 Trends Every Sales Exec Must Know For 2014

We hope you’ll read and share this.

We hope you’ll read and share this.

It’s a unique occasion when we get to step back from the day-to-day of supporting our members’ decisions and reflect on where we believe the world of sales is headed. Across 2013, the CEB Sales Leadership Council had thousands of interactions with sales executives around the globe, held dozens of conferences and summits, and analyzed hundreds of thousands of data points.

As the world’s preeminent sales excellence research organization, we’d love to give our readers a sense of what we’re exploring and thinking about based on our interactions from 2013. This blog post contains the first of ten trends.

Please note, this is NOT a list of definitive research findings. But it is a series of informed thoughts and hypotheses, often based on some initial data trends we are seeing.

Trend #1: A Dismantling of the Sales Machine

Until recently, customers had to ask suppliers for guidance early in the purchase, because the information they needed wasn’t available anywhere else. But today’s customers are better informed than ever before. By the time they approach suppliers, they generally have a clear idea of the problem they need to solve, the solutions that are available, and the price they’re willing to pay. The reality is that most sales organizations have been caught off-guard by this dramatic shift in customers’ buying behavior. In response, most leadership teams are doubling down on the sales processes that had served so well – creating a climate that can only be described as “compliance-oriented” – only to see sales performance become increasingly erratic. The irony here is that the most successful sales organizations are creating a sales climate that is the exact opposite. Instead these organizations are promoting a “judgment-oriented” climate. This is NOT to say that sales process is dead by any means, but how that process is managed, the permission sellers are granted, how FLSMs work their teams, all need to change dramatically.

[Note: We detailed this first trend in the November issue of the Harvard Business Review if you’re interested in learning more.]

Trend #2: Ease of Doing Business Becomes a Priority for Differentiation

Earlier this year, Matt Dixon, Rick DeLisi, and I wrote a book on the keys to driving customer loyalty in the customer service and support channel called The Effortless Experience (Penguin/Portfolio). The punch line of nearly 8 years of research in that space: delighting customers in service interactions doesn’t pay, but making it easy to get resolution does. We’ve long obsessed with the idea of making things simpler and easier for customers. Companies such as Google and Apple come to mind – at the heart of their products is a relentless focus on intuitive and simple usage. Getting ‘simple’ right is really difficult and many companies struggle mightily in this area.

Our data on general customer loyalty tells us very clearly that in B2B sales (and we strongly believe beyond the purchase experience) that ease of doing business is a critical differentiator. Naturally there are many implications here: channel alignment, customer segmentation, e-commerce platforms, various processes and policies, needs sensing, etc. Few companies understand how customers make purchases – what really happens inside their deliberation, how is consensus really formed, what information helps and harms this process – and what role the sales channel should play in supporting and productively driving those efforts.

Trend #3: Discussing “Personal” and “Emotional” Value Drivers Becomes Encouraged in B2B

Over the past year, our sister program, the CEB Marketing Leadership Council, carefully studied the dynamics occurring within a consensus-driven purchase. The key insight from their work is that all the emphasis suppliers place on demonstrating business value (i.e., ROI, functional benefits, impact on business outcomes for the customer, etc.) does little to actually drive a purchase decision. Appeals to business value drive an individual’s willingness to buy, but fail to drive their willingness to advocate for a purchase. That matters tremendously, as the average B2B purchase involves over 5 stakeholders. Advocacy for a purchase is driven far more extensively by personal and emotional value (i.e., professional benefits unique to each individual, social benefits in the workplace, even self-image benefits). In fact, their data shows that appealing to personal value is more than 2x more likely to drive advocacy for a purchase than appeals to business value.

This finding alone has created a wormhole of sorts into the social psychology of how purchases are really made. Understanding what motivates a single stakeholder to advocate for a purchase, what gets a group to socialize a new idea, how buying groups tend to deliberate and arrive at a decision have tremendous impact to shape how we appeal to customers and more effectively close business.

Trend #4: Increasing Skepticism of Customer Centricity

If you’re customer is truly right, then we’re in trouble. This statement stems from our finding that the average B2B purchase is 57% complete by the time a customer engages a supplier. If the customer is dictating the purchase criteria, commoditization has already occurred. Ironically, the suppliers providing the most value to their customers are casting the traditional “customer-in” view aside and showing customers better ways to both manage their business (this rests at the heart of Challenger Selling), but also how to buy in the first place.

Many customers struggle with making new purchases and the deliberation and debate that ensues. Reflecting on the trend we highlighted earlier – making it easier for customers to do business with us – the very best sellers are teaching customers how to purchase, what to consider, what to evaluate, how to productively debate a purchase, what the hidden risks are, etc. This provides an entirely new window into a supplier’s capabilities that fall outside the traditional value prop.

This isn’t to say that customers are wrong, but often customers have no idea they can work with suppliers in certain ways. Allowing the customer to dictate the nature and terms of the relationship leads to not only commoditization, but often increased friction in the relationship.

Trend #5: Hiring Sellers without Previous Industry or Sales Experience

Given our acquisition of SHL this past year, CEB is now sitting upon a massive database allowing all sorts of interesting research into human capital management. Given the concerns that many of our members share about the impending wave of retirement they’re facing among sellers, as well as significant hiring to meet growth mandates, we closely looked at the state of sales hiring.

Given our acquisition of SHL this past year, CEB is now sitting upon a massive database allowing all sorts of interesting research into human capital management. Given the concerns that many of our members share about the impending wave of retirement they’re facing among sellers, as well as significant hiring to meet growth mandates, we closely looked at the state of sales hiring.

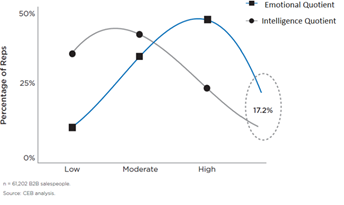

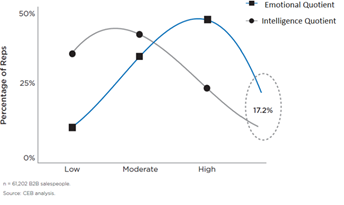

Our first finding is that the current sales force excels at competencies related to influence and emotional intelligence. While this is good news, the bad news is that most sales organizations have deprioritized competencies related to critical thinking at their expense. We found 1 in 6 sellers spike in both influencing and critical thinking. The problem is that those folks aren’t exactly readily available talent because they’re your competition’s top salespeople – and are paid, treated, and engaged as such. However, we also found that 1 in 8 OUTSIDE of sales contain these necessary sales competencies. Not only is that labor pool substantially larger, it’s far more available, and your competition is not focused on recruiting in this pool.

Now, in case you’re wondering if this non-sales talent can or even would sell, we had the same concern. So we tested a variety of different aspects here. Members, feel free to see what we found. For those who aren’t members, let us say, there are huge surprises here. And you’ll definitely want to consider NOT throwing out resumes that don’t show 5 years sales and industry experience.

Check back next week for the remaining five trends…

What other trends would you add to this list?

Follow the SEC on Twitter @CEB_SEC

Follow Nick Toman on Twitter @nick_toman

10 Trends Every Sales Exec Must Know For 2014

We hope you’ll read and share this.

We hope you’ll read and share this.

It’s a unique occasion when we get to step back from the day-to-day of supporting our members’ decisions and reflect on where we believe the world of sales is headed. Across 2013, the CEB Sales Leadership Council had thousands of interactions with sales executives around the globe, held dozens of conferences and summits, and analyzed hundreds of thousands of data points.

As the world’s preeminent sales excellence research organization, we’d love to give our readers a sense of what we’re exploring and thinking about based on our interactions from 2013. This blog post contains the first of ten trends.

Please note, this is NOT a list of definitive research findings. But it is a series of informed thoughts and hypotheses, often based on some initial data trends we are seeing.

Trend #1: A Dismantling of the Sales Machine

Until recently, customers had to ask suppliers for guidance early in the purchase, because the information they needed wasn’t available anywhere else. But today’s customers are better informed than ever before. By the time they approach suppliers, they generally have a clear idea of the problem they need to solve, the solutions that are available, and the price they’re willing to pay. The reality is that most sales organizations have been caught off-guard by this dramatic shift in customers’ buying behavior. In response, most leadership teams are doubling down on the sales processes that had served so well – creating a climate that can only be described as “compliance-oriented” – only to see sales performance become increasingly erratic. The irony here is that the most successful sales organizations are creating a sales climate that is the exact opposite. Instead these organizations are promoting a “judgment-oriented” climate. This is NOT to say that sales process is dead by any means, but how that process is managed, the permission sellers are granted, how FLSMs work their teams, all need to change dramatically.

[Note: We detailed this first trend in the November issue of the Harvard Business Review if you’re interested in learning more.]

Trend #2: Ease of Doing Business Becomes a Priority for Differentiation

Earlier this year, Matt Dixon, Rick DeLisi, and I wrote a book on the keys to driving customer loyalty in the customer service and support channel called The Effortless Experience (Penguin/Portfolio). The punch line of nearly 8 years of research in that space: delighting customers in service interactions doesn’t pay, but making it easy to get resolution does. We’ve long obsessed with the idea of making things simpler and easier for customers. Companies such as Google and Apple come to mind – at the heart of their products is a relentless focus on intuitive and simple usage. Getting ‘simple’ right is really difficult and many companies struggle mightily in this area.

Our data on general customer loyalty tells us very clearly that in B2B sales (and we strongly believe beyond the purchase experience) that ease of doing business is a critical differentiator. Naturally there are many implications here: channel alignment, customer segmentation, e-commerce platforms, various processes and policies, needs sensing, etc. Few companies understand how customers make purchases – what really happens inside their deliberation, how is consensus really formed, what information helps and harms this process – and what role the sales channel should play in supporting and productively driving those efforts.

Trend #3: Discussing “Personal” and “Emotional” Value Drivers Becomes Encouraged in B2B

Over the past year, our sister program, the CEB Marketing Leadership Council, carefully studied the dynamics occurring within a consensus-driven purchase. The key insight from their work is that all the emphasis suppliers place on demonstrating business value (i.e., ROI, functional benefits, impact on business outcomes for the customer, etc.) does little to actually drive a purchase decision. Appeals to business value drive an individual’s willingness to buy, but fail to drive their willingness to advocate for a purchase. That matters tremendously, as the average B2B purchase involves over 5 stakeholders. Advocacy for a purchase is driven far more extensively by personal and emotional value (i.e., professional benefits unique to each individual, social benefits in the workplace, even self-image benefits). In fact, their data shows that appealing to personal value is more than 2x more likely to drive advocacy for a purchase than appeals to business value.

This finding alone has created a wormhole of sorts into the social psychology of how purchases are really made. Understanding what motivates a single stakeholder to advocate for a purchase, what gets a group to socialize a new idea, how buying groups tend to deliberate and arrive at a decision have tremendous impact to shape how we appeal to customers and more effectively close business.

Trend #4: Increasing Skepticism of Customer Centricity

If you’re customer is truly right, then we’re in trouble. This statement stems from our finding that the average B2B purchase is 57% complete by the time a customer engages a supplier. If the customer is dictating the purchase criteria, commoditization has already occurred. Ironically, the suppliers providing the most value to their customers are casting the traditional “customer-in” view aside and showing customers better ways to both manage their business (this rests at the heart of Challenger Selling), but also how to buy in the first place.

Many customers struggle with making new purchases and the deliberation and debate that ensues. Reflecting on the trend we highlighted earlier – making it easier for customers to do business with us – the very best sellers are teaching customers how to purchase, what to consider, what to evaluate, how to productively debate a purchase, what the hidden risks are, etc. This provides an entirely new window into a supplier’s capabilities that fall outside the traditional value prop.

This isn’t to say that customers are wrong, but often customers have no idea they can work with suppliers in certain ways. Allowing the customer to dictate the nature and terms of the relationship leads to not only commoditization, but often increased friction in the relationship.

Trend #5: Hiring Sellers without Previous Industry or Sales Experience

Given our acquisition of SHL this past year, CEB is now sitting upon a massive database allowing all sorts of interesting research into human capital management. Given the concerns that many of our members share about the impending wave of retirement they’re facing among sellers, as well as significant hiring to meet growth mandates, we closely looked at the state of sales hiring.

Given our acquisition of SHL this past year, CEB is now sitting upon a massive database allowing all sorts of interesting research into human capital management. Given the concerns that many of our members share about the impending wave of retirement they’re facing among sellers, as well as significant hiring to meet growth mandates, we closely looked at the state of sales hiring.

Our first finding is that the current sales force excels at competencies related to influence and emotional intelligence. While this is good news, the bad news is that most sales organizations have deprioritized competencies related to critical thinking at their expense. We found 1 in 6 sellers spike in both influencing and critical thinking. The problem is that those folks aren’t exactly readily available talent because they’re your competition’s top salespeople – and are paid, treated, and engaged as such. However, we also found that 1 in 8 OUTSIDE of sales contain these necessary sales competencies. Not only is that labor pool substantially larger, it’s far more available, and your competition is not focused on recruiting in this pool.

Now, in case you’re wondering if this non-sales talent can or even would sell, we had the same concern. So we tested a variety of different aspects here. Members, feel free to see what we found. For those who aren’t members, let us say, there are huge surprises here. And you’ll definitely want to consider NOT throwing out resumes that don’t show 5 years sales and industry experience.

Check back next week for the remaining five trends…

What other trends would you add to this list?

Follow the SEC on Twitter @CEB_SEC

Follow Nick Toman on Twitter @nick_toman

The Challenger Sale: Mindset or Method?

We recently published an article in the Harvard Business Review about our years of research on Challenger selling. The research looks at the recent and rapid evolution of the traditional sales model and what corporate sales teams must do to win in this new environment.

We recently published an article in the Harvard Business Review about our years of research on Challenger selling. The research looks at the recent and rapid evolution of the traditional sales model and what corporate sales teams must do to win in this new environment.

As with so much of this research (including the successful book), the thinking behind it and the recommendations that stem from it provoke many comments. One recent question addressed the implementation of the Challenger sales model and asked if Challenger selling is more of a philosophy than a process or methodology. The key point is that Challenger is actually both.

Organizations absolutely need a sales process and methodology — a philosophy alone isn’t enough. In the HBR article, we take issue with the nature of current process/methodology and how they’re used to govern rep selling efforts, not whether process and methodology have a role to play in today’s sales organization. They absolutely do.

Challenger as Philosophy and Process

First, CEB members know that Challenger has evolved well beyond what’s in the book (which is definitely written more at the level of “philosophy” by focusing on the changes in customer buying behavior we’ve observed and the best selling and marketing approaches in light of those changes). Since the book, we’ve studied much more of the “applied Challenger selling” approach.

We’ve studied the sales process Challengers follow (turns out, it’s not a sales process but a customer-verified buying process). We’ve studied how they select opportunities in their territories (they look for emerging, rather than established, demand). We’ve studied how they identify and prioritize stakeholders within the customer organization (they look for “mobilizers,” not advocates or coaches that don’t actually exist). And we’ve looked at how they manage those stakeholder interactions (they coach the customer on how to buy rather than asking the customer to coach them on how to sell).

Putting all of this together, we can say with confidence that what began as a philosophy has now been codified as a real process and methodology (CEB members can access all of the related process documents, tools, templates, etc., here). It took us four years of in-depth research to come up with this, but we think it was worth the wait. The last thing we were going to do was posit a methodology based on our opinions about what works (there’s plenty of that in the market already!). We wanted to propose a methodology grounded in research—research into how customers are buying differently and research into what best sellers do in light of those changes.

This being said, process and methodology without a guiding philosophy (or belief set) is DOA—at least when it comes to Challenger and Insight Selling.

What Leads Sales Reps to Adopt Challenger?

In our work, we studied precisely what drives rep adoption of new sales behaviors such as Challenger/Insight Selling. It turns out that the number one driver is possessing an intrinsic motivation to challenge customer thinking and deliver insight as part of the sale. In other words, getting these new selling behaviors to take root requires that reps believe deeply that what they’re doing is right for the customer. By contrast, we also examined many “traditional” sales climates – typified by process compliance – and found absolutely no statistical evidence that having belief or conviction in the target selling behaviors was required. The research is pretty clear on this point: If you want to drive compliance to a process or methodology, the old-fashioned carrot and stick approach (extrinsic rewards) are good enough. But, if what you’re trying to do is drive the adoption of Insight Selling behaviors, you need more than that. You need a powerful belief set, or philosophy, that generates intrinsic motivation.

In many ways, this speaks to what is so broken in the majority of sales organizations. Sales leaders pick a process or methodology but never invest in getting buy-in and conviction from the sales organization. Or, perhaps they try, but sellers reject the attempt on the grounds that the method they’re being asked to follow is out-of-date, isn’t based on real research, and doesn’t accurately reflect the current realities of the customer buying environment.

Either way, we’ve all seen the movie that follows: a new methodology is unveiled…but reps don’t really believe in it and aren’t engaged in the journey… so, adoption doesn’t happen… which then leads senior leadership to tighten the compliance screws even more… which then leads to reps merely going through the motions to avoid punishment. It’s a death spiral for the sales organization.

December 18, 2013

What Sales Can Learn From Las Vegas

It’s tempting to believe that Sales can’t change how receptive customers will initially be to your company’s offerings. Customers are more receptive to ideas from a brand they like, after all, and brand is in Marketing’s purview. While this is true, recent experiences in casinos suggests that customers are more open to new ideas when they are in a particular emotional state—a state that Sales can help create. If you want potential customers to break their habits and buy from you, you need to make them feel comfortable.

It’s tempting to believe that Sales can’t change how receptive customers will initially be to your company’s offerings. Customers are more receptive to ideas from a brand they like, after all, and brand is in Marketing’s purview. While this is true, recent experiences in casinos suggests that customers are more open to new ideas when they are in a particular emotional state—a state that Sales can help create. If you want potential customers to break their habits and buy from you, you need to make them feel comfortable.

Steve Wynn has made billions by making customers feel comfortable, at ease, at home. The designer of luxury casinos like the Wynn Las Vegas and the Bellagio, Wynn bucked the standard casino ethos that places customers in dimly lit mazes of slot machines and blackjack tables. Instead, he filled his casino with skylights and vaulted ceilings, keeping his customers relaxed, unstressed, and abnormally profitable.

Generally speaking, when people are comfortable, they are more willing to entertain new, risky propositions. In a casino, unstressed people are willing to think about how they could win that big jackpot—and they’ll spend a large amount of money trying to win those jackpots. In a sales interaction, unstressed people will consider what they might gain from switching to a new supplier—and they’ll be more likely to convert as a result.

If you’re in the business of convincing people to give up something familiar for something unfamiliar, it’s in your interest to make those people feel comfortable. When people are stressed out, they avoid risk, holding on dearly to their money, their supplier relationships, everything moderately valuable that they have. Even if a potential customer likes your brand, they won’t be amenable to your new proposal unless they they’re in a calm state of mind.

Fortunately for anyone who acts on this insight, a small change in comfort can lead to outsized effects. Wynn found this out at one of his high-stakes slot machine rooms that wasn’t producing the anticipated revenue. After an investigation, the problem came down to a mismatch of décor and clientele. The room, filled with heavy curtains and dark mahogany, had been designed to fit the predilections of older men. The clients, however, were mostly older women. After a redesign aimed to create, in the words of the designer, “a place where a lady might feel comfortable,” the room began to produce the higher level of revenue it was designed to generate.

Making customers feel comfortable does not seem, at first glance, compatible with being a Challenger sales rep. However, these goals can actually go hand-in-hand. It’s likely important to make your customers feel comfortable precisely when you’re about to challenge their preconceived ideas, something that is always a bit stressful for customers.

When you’re proffering penny slots or a transactional sale, you can afford to stress out your customers. But when you’re offering high stakes gambles or complex solutions, you can’t afford to make your customers stressed. Stressed people hunker down for safety. Comfortable people, on the other hand, are willing to explore new ideas, to double down on an 11, to entertain the idea that your company is offering exactly what they need right now.

Since most of the research in the area has focused on changing a person’s physical environment, it isn’t clear precisely what salespeople should do to get their customers into a comfortable state of mind. That said, it is clear that whether a salesperson is positioning a product’s benefits, preempting a common concern, or sharing an anecdote about a current customer, they are affecting how comfortable their potential customer feels. The connection between these things—how a salesperson’s actions lead to emotions that lead to a purchase—is something that we’ll be exploring in the coming months.

What do you do that helps your customers get comfortable with you and your company?

CEB Sales Members, learn more about Challenger Selling that leads with insight and challenges customer assumptions to mobilize customers around a purchase. For more about the designer of Wynn’s casino, see the New Yorker article “Royal Flush.”

December 17, 2013

3 Ways to Reduce Communication Overload

On a typical day, reps face a constant flurry of internal communications announcing company events, cross-functional requests, product launches and updates, training and compliance requirements, etc. While this may seem harmless on the surface—What’s one more little email going to hurt? Someone might find this information valuable!—the net result of this communication overload is that reps have less time to focus on value-creating activities. In fact, one member organization found that their managers were spending up to 50 hours a month processing company communications! To deal with this overload, many reps end up filtering communications based on individual preferences and capacities, which may at times contradict organizational imperatives.

On a typical day, reps face a constant flurry of internal communications announcing company events, cross-functional requests, product launches and updates, training and compliance requirements, etc. While this may seem harmless on the surface—What’s one more little email going to hurt? Someone might find this information valuable!—the net result of this communication overload is that reps have less time to focus on value-creating activities. In fact, one member organization found that their managers were spending up to 50 hours a month processing company communications! To deal with this overload, many reps end up filtering communications based on individual preferences and capacities, which may at times contradict organizational imperatives.

The only way to combat communications overload while still ensuring that key messages are received and understood by the sales force is to take a proactive approach to managing and filtering communications. Recently, CEB Sales has had a number of conversations with members on how they have been working to address communications overload within their organization. We’ve found that strategies for doing so generally embrace three concepts: control, consolidate, and customize.

Control

The most effective step in limiting communications overload is to introduce some sort of barrier to access to the all-rep distribution list. Many members have established a centralized place from which all sales communications are sent. They take in all communications requests from throughout the organization, and use a standardized vetting process to determine the importance of each message and the ideal channel through which to distribute it.

This control is generally placed in the hands of the Sales Effectiveness, Operations, or Enablement functions, but some organizations also utilize a dedicated Communications Director. The exact place or function where control over communications is placed matters less than ensuring that whoever has control has a keen understanding of the things that matter most to a rep. Senior sales leaders and management often have at least an informal say in the ultimate communications that are sent out to the sales force as well.

Consolidate

Instead of bombarding reps with messages at any and all times, consolidating product, marketing, and compliance news into regularly scheduled (often weekly or bi-weekly) newsletters reduces time spent reading emails, and lets reps know that the information contained inside is important and pertinent. The updates included should be kept brief to maintain readability. Links for further reading or relevant content should be included where possible. Some organizations also make use of teleconferences or town hall-style meetings for similar purposes. Other organizations may use a combination of communication methods and channels to emphasize different types of messages.

Consolidating other, less immediately important but still relevant communications into portals or intranet sites can also help to reduce communication overload while still ensuring that reps are aware of important messages and updates. Portals and intranet sites are useful as information repositories for reps to actively seek out information, rather than as a source of proactive communication.

Customize

Receiving irrelevant or misdirected communications is one of the primary sources of information overload reported by reps. To combat this, it is important to tailor communications to different audiences within the sales rep community. Reps shouldn’t have to sift through tons of extraneous information to find what is pertinent to them. Communications containing information such as inventory updates and “housekeeping” items should be customized into multiple versions for segment- or region-specific distributions.

Managers also play an important role in ensuring that reps receive and understand important communications. Front-line managers have the greatest ability to personalize messages for their reps and emphasize the importance and relevance of various strategic initiatives. Some organizations send out sales manager-specific emails to highlight specific topics that should be shared and emphasized in team meetings.

CEB Sales Members, to learn more about how your peers are working to reduce communication fatigue, take a look at our research brief on Effective Communication to the Sales Force and check out the forum discussion on How to Communicate with Sales Reps. For further learning on reducing the volume of communication and ensuring that critical information is received by sales reps, including best practices from sales executives, be sure to access our decision support center on Sales Force Communication Management.

December 3, 2013

Get Your Star Reps to Stay

Turnover has always been a problem in sales. But as the role of a sales rep becomes more complex, organizations are growing increasingly worried about the hidden costs of undesired churn, and in particular about the costs of losing their star reps.

Turnover has always been a problem in sales. But as the role of a sales rep becomes more complex, organizations are growing increasingly worried about the hidden costs of undesired churn, and in particular about the costs of losing their star reps.

But what are the costs of turnover anyway? For starters, there are the costs associated with recruiting, onboarding, training, and salary paid to employees who have yet to reach full productivity. But there are some less obvious costs such as the demotivation ripple effects of losing high performers, gaps in continuity of service to clients, or even lost accounts.

So if you are worried about your high-performers jumping ship, you will be pleased to know that our research shows that while on average Challenger reps are accessing professional networking sites more frequently than the average population (or by 28%), are 1.2 times more likely to keep their online professional profiles up to date, and are 1.9 times more likely to apply to new job opportunities advertised on professional networking sites, they are no more likely than average performers and the rest of the population to be actively looking for jobs.

But if you are still worried about the number of high performers you are losing to your competitors, or about the possibility of losing them, review our newest research on Sales Culture.

CEB Sales Members register for an upcoming event on Driving Sales Transformation, to review our newest finding on this topic.

In sum, what our analysis of over 2,000 sales reps from more than 30 CEB Sales member companies showed, is that an organization’s sales climate can have a significant impact on the retention of star performers. Specifically, we found that:

Challengers are 32% less likely to leave organizations with Judgment-Oriented Climates,

Core reps are 15% less likely to leave organizations with Judgment-Oriented Climates, and

Teams with Judgment-Oriented managers have 15% less turnover.

Not surprisingly managers are one of the biggest levers organizations have at their disposal to increase retention of star performers. The research shows that managers play a vital role in creating a micro climate for their teams within the larger sales organization climate, which greatly impacts both performance and retention.

CEB Sales Members, register to attend one of our upcoming workshops on Driving Manager Effectiveness in the Insight Selling Era, and review our Insight Selling Manager Competency Grid.

Share your thoughts with us, and let us know how you are engaging your top performers and retaining high caliber talent.

December 2, 2013

When Segmentation Goes Awry

This week, while waiting to board a flight to return home, I witnessed possibly the worst segmentation of all time. See if you can follow me through this…boarding was called for (in order):

This week, while waiting to board a flight to return home, I witnessed possibly the worst segmentation of all time. See if you can follow me through this…boarding was called for (in order):

First Class;

Premier Access Members;

(Another layer of) Premier Access Members;

Group 1 (group numbers were indicated by a number on the boarding pass); … (keep reading…it gets worse!)

Customers who checked bags and have nothing to put in overhead bins;

Customers who only have one bag and that bag fits underneath the seat in front of them; (really? Are they going to have us solve math problems to see who goes next?!)

Group 2;

Group 3;

Group 4;

Group 5 (*phew*, it’s over).

Call me crazy, but, regardless of the perceived benefit this ordering may have created (making some group(s) feel special?) this was segmentation gone awry. There was confusion throughout the boarding area and folks who thought they were valued by the airline (Groups 1 and 2) waited (impatiently, I might add) for 3 or more groups to board ahead of them. And, the boarding agents themselves appeared confused, too, chirping at each other about who boarded too early and who was next in the queue.

How did something as simple as boarding an airplane become such a convoluted mess? My sense is that the airline couldn’t decide on a single goal (i.e., rewarding customer value) to drive their segmentation strategy, but instead allowed multiple goals and the respective customers attached to those goals (i.e., value AND efficiency of boarding passengers with no luggage) to compete…and the winner? No one. Everyone in the boarding area (airline employees included) looked confused, bewildered, and upset! Segmentation makes sense, but when is it too much?

And that’s my question for you, loyal reader: segmentation can be good, but it can also muddy the water too much. What’s your segmentation strategy?

Simple and straightforward?

Muddy waters?

Segmentation? No way…we don’t differentiate at all!

CEB Sales Members, visit our topic center to see how the best companies segment their customers.

(This is a guest post by Pete Slease of the CEB Customer Contact Leadership Council, our sister program for call center and customer service functions.)

November 19, 2013

Does Your Sales Force Agree With Your 2014 Strategy?

As we all work hard towards a strong 2013 close, most heads of sales and sales enablement are also setting their sights on 2014. As you get ready to put the finishing touches on your 2014 strategies, let’s not forget to ask one important question – what does the sales force think?

As we all work hard towards a strong 2013 close, most heads of sales and sales enablement are also setting their sights on 2014. As you get ready to put the finishing touches on your 2014 strategies, let’s not forget to ask one important question – what does the sales force think?

There are a lot of things we could do to improve our business, and everyone has their opinion of what the strategy should involve. Unfortunately, that makes it harder for everyone to fully buy into yours.

So what does everyone really think your priorities should be? Do all levels in the organization (from reps up through executives) agree? Where do they disagree? What about different regions? Business units? If not, where is the disconnect? And how do you get everyone on the same page?

Understanding how different audiences view priorities and understanding where disagreement lies is a critical way to help you build a better strategy and ensure the buy-in necessary to execute.

One tool that many heads of sales, sales ops, and sales L&D leverage for this is CEB’s Anatomy of a World Class Sales Organization. The Anatomy breaks Sales down into the 24 critical attributes or capabilities of world class sales organizations, and allows you to capture feedback on how employees view current performance against a research-based definition of world class.

You’ll also be able to view where agreement or disagreement lies around priorities. This will help you decide which strategies will be accepted with open arms and which strategies might require more of a communication plan to ensure everyone understands why these initiatives are so critical.

Whether the gap is a perception gap (the sales force doesn’t understand the critical importance of one of your strategies) or a performance gap (everyone agrees, we just have to figure out how to get better), it’s essential to know this information in order to effectively execute on your 2014 plans.

CEB Sales Members, learn more about the Anatomy of a World Class Sales Organization or listen to a webinar replay to understand more about the Anatomy tool. Be sure to also check out our other Diagnostics and Benchmarks that can help you plan for 2014.

November 14, 2013

10 Things to Never Say at Work

Things can get tough at work. But lots of times, people – myself included, sometimes! – get bogged down to the point of negativity and non-constructiveness. In other words, we complain about challenges instead of doing what we can to meet them. Everyone does it sometimes, but it’s important to avoid consistently giving the impression that you’re not willing to do what it takes to get the job done. In that spirit, here are ten things to avoid saying at work:

Things can get tough at work. But lots of times, people – myself included, sometimes! – get bogged down to the point of negativity and non-constructiveness. In other words, we complain about challenges instead of doing what we can to meet them. Everyone does it sometimes, but it’s important to avoid consistently giving the impression that you’re not willing to do what it takes to get the job done. In that spirit, here are ten things to avoid saying at work:

1) “That’s not my job.”

The Great Recession, and the reduction in headcount that came with it, has put workers in a tough spot: they’re increasingly asked to do things that were not a part of their original job description and that conflict significantly with their core duties, necessitating longer hours to compensate. We’re “doing more with less!”

The next request you get from your boss very well might not be your job, but a more proactive approach is to treat time and expertise as a constraint, and manage against them. “Well, I have project X and Y due next week, and I’m not sure how to use Database Z, should I push those projects back, and who should I link up with to discuss the database?”

2) “I’m too busy.”

Again, with headcount dropping, it can often feel like we’re completing and managing a dozen tasks at once, all with near-in deadlines. And, inevitably, the time will come when you’re asked to do a task that’s simply a bridge too far – the straw that broke the camel’s back, so to speak.

This is a difficult situation to be in, and in difficult times it’s easy to let emotions take over and brusquely respond that you’re simply too busy to take on the task. But the better way is to be proactive, let people know what kind of deadlines you’re looking at, and ask what, if anything, should be sacrificed to take on the new task.

3) “I don’t know.”

As tasks get more complex, there will almost certainly be the occasional gap between what you know and what you need to know.

The key thing to do here is to get specific and figure out a strategy for meeting those gaps. “I’m happy to help, but I’m not sure exactly what the project plan is for this campaign, who should I talk with to learn more?”

4) “This is how we’ve always done it.”

Simply put: for many companies, there is no better time than now to begin re-thinking the “way you’ve always done it.” Many corporate business models are under fundamental attack from startups able to compete at scale through the web, and the gradually-improving economy means there will be lots of chances for growth – and process changes that make growth possible – in the near future.

That said, there needs to be a good reason to overturn an established approach. Next time someone wants to throw out the playbook, ask – “How will these changes help us meet our goals?”

5) “I don’t have anything to do.”

In our modern, complex corporate environment, there is almost zero chance that this is true. If you’ve run out of paper to push, start thinking about ways you can improve your personal or team processes to make your work more efficient. If you’ve optimized those, ask people if they need any help with anything. If no one else needs help, start thinking about new products or services your group could create that would add value to your firm.

You get the idea. If you think of your job where you do a defined task for a pre-determined length of time, then go home, your chances of getting ahead are small. Take advantage of lax times to add even more value to what you’re already doing.

6) “That’s not fair!”

OK, first things first: it probably isn’t.

By the time most of us reach working age, we have a pretty well-developed intuition about right and wrong, fair and unfair, and if something strikes us as unfair, there’s a good chance that we’re right. But the problem is – that doesn’t matter. Life in general isn’t fair, and life at work is particularly unfair.

That being said – if you’re being seriously taken advantage of, speak up; if something legally-actionable is happening to you (if you’re being sexually harassed, for instance), don’t stand for it. But for more everyday unfairness – for colleagues that get paid more for doing the same job as you, for being passed up for the promotion for the fifth time – don’t just complain, make a plan to end it.

7) “I have another offer, but I want to stay here. Can you match?”

This doesn’t mean you shouldn’t go get other offers. You should! Aggressively seek positions that’ll pay you what you’re worth (whether it’s in money, work/life balance, job satisfaction, or some combination thereof).

But leveraging outside offers for raises with your current employer rarely works out. It isn’t fair, but bringing another offer to your boss almost certainly will be seen as a sign of disloyalty, and it’ll be assumed that you’ll ship out as soon as a better offer comes available. You might find yourself at the top of the layoff list and paradoxically out of a job not too long after.

8) “Don’t ask me, I just work here.”

“I just work here” is the quintessential expression of powerlessness. “I just work here” says “while I am here, I don’t do things, things are done to me.” It’s usually something someone says when they’re not a part of key decisions that affect their jobs.

The key to making this better isn’t to complain about it – as tempting and as cathartic as it might seem. You have to find a way to make yourself part of those key conversations that will impact the way you do your work and how you’re measured.

9) “It’s all my fault”.

This is a tricky one. Obviously, it’s good to take ownership over mistakes you’ve made and figure out how to improve. Trust me, people who own up to their mistakes ultimately make it farther in life than people who pretend that they do no wrong.

But don’t own up to too much – not because you want to avoid responsibility, but because unless you’ve been actively negligent or destructive, chances are it’s not really all your fault. Our work occurs in a complex organization called “the corporation”, and things that happen in one part of the corporation can very easily affect other parts without there being fault involved. So admit fault when necessary, but think systemically – why did the failure really happen? – to ensure you and your team move on and improve.

10) “I deserve a promotion.”

You probably do! But remember, corporations and life in general aren’t fair, and things go to those who a) ask for them and b) have earned them – however “earned” might be defined.

Chances are, if your organization is a big one, there are somewhat-objective standards for promotion to the level that you want to advance to. Find out what they are, and outline exactly how you compare against those standards. Beyond that, what have you personally done for your boss? What kind of unique, relatively irreplaceable contributions can you point to? How do you make your team work better?

Brent Adamson's Blog

- Brent Adamson's profile

- 9 followers