Brent Adamson's Blog, page 10

September 3, 2013

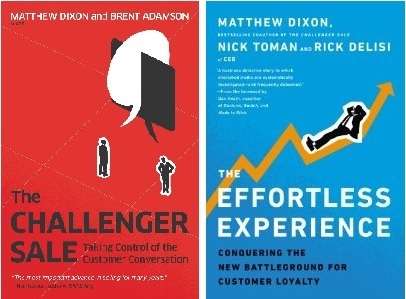

The Challenger Sale Vs. The Effortless Experience

Many CEB members will know that we’re getting set to release our second book, The Effortless Experience: Conquering the New Battleground for Customer Loyalty. And while this is a book about customer service, members rightly want to know how the research in this new book should affect how they think about Challenger.

Many CEB members will know that we’re getting set to release our second book, The Effortless Experience: Conquering the New Battleground for Customer Loyalty. And while this is a book about customer service, members rightly want to know how the research in this new book should affect how they think about Challenger.

First, let’s quickly recap the two books.

The Challenger Sale, as most readers of this blog know, is a study of sales effectiveness. Through extensive quantitative research, we found that (contrary to conventional wisdom) the best salespeople don’t just build relationships with customers, they challenge them. They bring new insights to the customer—ideas for saving money or making money or avoiding risk—that customers themselves hadn’t even realized. They aren’t aggressive or obnoxious, but they are assertive and use “constructive tension” as a means to advance the sales conversation. There’s obviously a lot more to it than that (!), but that’s the argument in a nutshell.

The Effortless Experience is probably less familiar to you—which makes sense since it’s a study of customer service, not sales. Through a separate quantitative study, we learned that the conventional wisdom around customer service—and the role it plays in driving loyalty—is wrong. While companies believe they can create more loyal customers by going “above and beyond” in the service interaction, it turns out that those customers whose expectations are exceeded are really no more loyal than those whose expectations are simply met. What’s more, customer service tends to drive disloyalty not loyalty—in fact, any customer service interaction is four times more likely to generate disloyalty on the part of the customer. To mitigate the natural disloyalty-creating effect of customer service, companies must focus on reducing customer effort by doing things like resolving customer issues the first time around, not passing customers from one department or rep to another, and simplifying their Web sites to make the experience stickier for those customers who want to self-serve. In a nutshell, the argument is that making service easy, as opposed to delightful, is the surest path to mitigating disloyalty and supporting company growth and loyalty-building objectives.

Careful observers of Challenger rightly ask the question whether this is in conflict with our work on sales. Doesn’t a Challenger, by bringing new insights to the customer, delight them? Put simply, yes. A Challenger, you may recall, delivers a sales experience “worth paying for.” An insight-based sales conversation is surprising, even delightful…and, relative to what we tend to expect from salespeople, the experience delivered by a Challenger surely exceeds the customer’s expectations. Does The Effortless Experience imply that this is now a bad thing to do? Should salespeople try to make the interaction easy rather than trying to delight customers with new insights?

Some blog posts I’ve seen have suggested that the two seemingly contradictory findings are due to the fact that Challenger was a B2B study while Effortless was a B2C study. Unfortunately, while that would surely be the most convenient explanation (!), it isn’t the case. While Challenger was a B2B study, we looked at both B2B and B2C in Effortless and we found (with only minor differences that we’ll talk about in a minute) the same thing—service in B2B also should be easy rather than delightful. So, the question still remains: are the two books in conflict with one another?

Let’s dig a little deeper to see if we can square the circle here.

As you may recall, we found in Challenger that 53% of business customer loyalty was a function of the sales experience—much smaller was the customer service experience delivered by the company. While they were two very different studies (with different populations and surveys), this isn’t that dissimilar from what we found in Effortless: customer service doesn’t play a big role in driving loyalty (disloyalty, yes, but not loyalty). In a nutshell, we would say that sales is about offense (building loyalty) and service about defense (mitigating disloyalty). But with a couple of important caveats.

When we looked specifically at B2B service interactions, we found pretty much the same thing we found in B2C interactions—that service tends to drive disloyalty and that the key to mitigating that disloyalty is reducing customer effort. That being said, there is, statistically speaking, one opportunity to drive positive loyalty in B2B service interactions—by teaching the customer something new. For those familiar with Challenger, this should come as no surprise—this is really the essence of the Challenger story and we find that B2B customers look for their suppliers to teach them in service interactions as well. Interestingly, this is something we found only in the B2B cut of the data.

If you think about a B2B purchase, there’s a lot more going on than in a B2C purchase. In B2B, the decision maker who makes a purchase decision is rarely the same person who uses a solution day-in and day-out. The day-to-day technical users of suppliers’ solutions, however, have a ton of sway in terms of affecting the decision maker’s purchase likelihood—something we discussed in The Challenger Sale. In fact, the single most important criterion for a decision maker is whether or not a given supplier has widespread support across the organization. So, when you put this all together, what we can say is this: B2B suppliers need to make sure that they are delivering an effortless service experience to the end users of the products and solutions they sell. And, importantly, they should be equipping their support staff to teach those end users new ways to use their products and solutions to save end users time, money, etc. In other words, other than just making it easy, B2B support staff need to also teach end users new ways to use their solutions to make end users more personally effective. Why? Because the decision maker will want to know whether end users value given suppliers. If suppliers make customer support difficult and if they don’t try to teach end users anything of value, there’s a good chance those end users won’t give a favorable review to the decision maker when he or she asks.

OK, so salespeople should still delight and not worry about making the sales experience easy? Making things easy is the job of customer support, right? Well, not quite. Recall that 53% of B2B customer loyalty is a function of the sales experience—which is mainly about delivering new insights to customers. But, that’s not all that’s driving this 53% effect. One of the variables we don’t spend as much talking about—but one that helps make up this 53%–is that the supplier is easy to do business with. While much of easy to do business with is a function of go-to-market and delivery models, there is an important component that’s about whether the actual purchase experience is perceived as easy or difficult [As an aside, from our research, we know that one of the best ways we’ve seen for salespeople to make buying easy for customers is to coach those customers through the purchase process. Customers are often quite confused about how to buy a complex solution from a supplier—after all, it’s not something they do every day. But salespeople who help guide customers through the purchase process are not only more effective, but are making the buying experience significantly easier than reps who ask customers to coach them through how to sell].

We’d be interested in hearing your thoughts—what do you think are the intersections, complementary points, or potential points of conflict in the two books?

September 2, 2013

Get Your Reps to Take Risks

There is a Dutch town called Drachten that has a population of about 44,000 people. Here, the local government did something that would surprise most of us—they removed traffic lights and signs at an intersection that was handling about 22,000 cars a day. The result? An INCREASE in safety and efficiency at the intersection. What can we learn as sales leaders from Drachten? That monitoring people closely and telling them what to do isn’t always the best way to get the right behavior. Sometimes it’s best to let people manage their own risks by forcing them to think about what risks they are actually taking. And this is exactly what we found in this year’s work, that leading organizations create a climate of “guided rep judgment”. And as part of that, we found one company taking an interesting approach to doing what Drachten did—letting their people manage their own risks, by forcing them to think about them.

There is a Dutch town called Drachten that has a population of about 44,000 people. Here, the local government did something that would surprise most of us—they removed traffic lights and signs at an intersection that was handling about 22,000 cars a day. The result? An INCREASE in safety and efficiency at the intersection. What can we learn as sales leaders from Drachten? That monitoring people closely and telling them what to do isn’t always the best way to get the right behavior. Sometimes it’s best to let people manage their own risks by forcing them to think about what risks they are actually taking. And this is exactly what we found in this year’s work, that leading organizations create a climate of “guided rep judgment”. And as part of that, we found one company taking an interesting approach to doing what Drachten did—letting their people manage their own risks, by forcing them to think about them.

We’re calling this organization Alpha Company (a pseudonym). How did they approach increasing “guided rep judgment”? Well, they did it from a sales coverage and metrics perspective. Here are a few highlights of Alpha’s approach:

First and foremost, Alpha’s main goal wasn’t about increasing autonomy (while that’s a part of it), the critical driver is one we all have—growing PROFITABLE business. Revenues had been increasing, while profits remained flat. Their belief was they could deliver disruptive insights, “unteaching” their customers while growing those profit margins. The organization decided to shift to “market teams”, away from regional sales teams. Here’s a brief comparison:

From

To

Regional Teams

Market Teams

Standard management hierarchy:Account Executives report into a Frontline Sales Manager, who reports into a Regional Sales Manager

P&L Management structure:Account Executive, Project Manager and Development Specialist report into an Area P&L Manager. Sales Manager does not have direct authority—but is a resource to the market team, as an innovator.

Deal authority rests at management level

Deal authority rests at the Market Team level

Pipeline managed by Account ExecutiveResult: pipeline shape = “The Wedge”

Pipeline managed by Market TeamResult: pipeline shape = “The Nail”

Revenue metric

Basic P&L metric

Alpha has given significant control to these market teams. All three members must be unanimous in their decision to pursue opportunities. If there are discrepancies, then management steps in. In order to help the market teams make informed decisions, Alpha gave the teams tools and support such as cost and pricing guides; creating transparency in the true cost of resources and additional support. Additionally, they must meet with a financial controller; a mini-CFO if you will. This ensures they are pursuing profitable opportunities and can help calculate costs associated with opportunities.

What has Alpha seen as a result of taking a market team approach? Here’s a few:

Decrease in cost of sale – by 37.5%

Increase in gross margin – by 21%

Increase in deal size – by 113%

Increase in forecasted revenue – by 55%

This is how Alpha removed controls for their sales organization and increased rep-judgment, while still achieving the critical goal of growing profitable business. How will you allow for increased judgment? Alpha and the town of Drachten found something that worked.

CEB Sales Members, read the full case study and listen to the webinar on how Alpha company structures their market teams to simultaneously provide greater rep accountability and judgment. Also, read the key findings from our latest research, Driving Sales Transformation.

August 27, 2013

FLIP Your Management Style

SEC’s current research on Driving Sales Transformation highlights why sales organizations must empower their reps to Insight Sell, and allow them to exercise judgment in order to compete with more informed buyers. However, this shift cannot be limited to the senior leadership, its effects must marble throughout the organization. Our research shows that first-line sales managers have tremendous leverage in helping to allow for rep judgment and must enable a judgment-oriented climate at the team level. The benefits of establishing this type of climate are significant, as our research finds that a judgment-oriented climate leads to a 23% increase in rep adoption of Insight Selling behaviors.

SEC’s current research on Driving Sales Transformation highlights why sales organizations must empower their reps to Insight Sell, and allow them to exercise judgment in order to compete with more informed buyers. However, this shift cannot be limited to the senior leadership, its effects must marble throughout the organization. Our research shows that first-line sales managers have tremendous leverage in helping to allow for rep judgment and must enable a judgment-oriented climate at the team level. The benefits of establishing this type of climate are significant, as our research finds that a judgment-oriented climate leads to a 23% increase in rep adoption of Insight Selling behaviors.

Our research found that managers actually have a large amount of leverage in creating this climate for reps, and when effective, can actually create a high-judgment micro-climate within a low-judgment organization climate. In order for this to occur, managers must FLIP from a directive style of managing, to a supportive style of facilitating. Directive management style consists of delivering rote directions and emphasizing adherence to the sales process. Instead, supportive managers enable and empower their reps to think independently, allow for collaboration across their team, and leverage knowledge to make more informed decisions during a sale. In order to enable judgment, there are four key activities that a supportive manager must do to establish a judgment-oriented micro-climate.

Managers should:

Facilitate—Collaborate and connect team members with one another, and externally throughout the organization. This serves to improve information sharing, and encourages reps to leverage firm-wide resources.

Long-Term Focus—Encourage long-term pipeline growth, prioritizing smart growth over short term closures. This enables reps to not only have a healthier pipeline, but provides opportunities for reps to exercise their analytical and critical thinking abilities.

Informal Communication—Establish regular and informal 360-degree communication with the team around all topics. This creates trust between a manager and reps and facilitates joint-decision making, while reducing typical micro-managing activities.

Participatory Decision Making—Involve the team in business planning and to jointly tackle and overcome commercial challenges. This encourages collective decision making and increased confidence and trust in the team.

The FLIP model serves to help establish judgment-oriented climates by providing actual examples of these effective behaviors. It can help managers better understand what supportive management looks like in action, and allow them to target specific situations where they can help to enable rep judgment. FLIP can also benefit reps, who can use the tool to identify warning signs that their manager isn’t being supportive. It provides a framework to help reps “manage-up” and ensure that they are operating in a judgment-oriented micro-climate.

CEB Sales Members, utilize our Judgment-Based Coaching guide which provides managers with sample questions to help guide reps through situations that require judgment. Also access our Ideation Toolkit, which contains exercises, guides, and tools to assist FLSMs innovate and our Insight Selling Manager Competency grid to learn about differentiated manager responsibilities needed for Insight Selling.

August 26, 2013

How to Get Social Selling Right

As discussed in earlier posts, we know that the best sales reps are shaping the nature of customer demand by delivering disruptive insight where customers learn, effectively reframing how customers think about their business. Such a strategy has become a necessity for successful selling in the current era of sales as today’s empowered customers have access to more information than ever before and are, on average, 57% of the way through their purchase decision before they need to reach out to a supplier for the first time—meaning they have already likely determined their needs, identified a solution, shopped suppliers, and have arrived at a price they are willing to pay on their own.

As discussed in earlier posts, we know that the best sales reps are shaping the nature of customer demand by delivering disruptive insight where customers learn, effectively reframing how customers think about their business. Such a strategy has become a necessity for successful selling in the current era of sales as today’s empowered customers have access to more information than ever before and are, on average, 57% of the way through their purchase decision before they need to reach out to a supplier for the first time—meaning they have already likely determined their needs, identified a solution, shopped suppliers, and have arrived at a price they are willing to pay on their own.

So it’s clear that successful reps are engaging with customers at the learning phase of the purchasing funnel and are sharing disruptive insights that customers would not have discovered on their own. That said, determining where your customers are learning, and actually getting your reps to engage them effectively in that space is no easy task. Though where customers learn varies greatly from company to company, by industry, etc., there is one common space that we all seem to be learning in to some degree or another these days—social networks and through social media.

In fact, CEB Sales research shows that the best sellers earnpermission to be influencers within their customers’ social networks. Through influence, reps teach customers into the funnel, gather information to more easily identify commercial opportunities, and generally gain more access to customers.

Using social networking and social media channels like LinkedIn, Twitter, etc., enables reps to connect more effectively with prospects as well as existing customers, and also recognize opportunities open to disruption that they would not have been aware of otherwise. Reps who embrace social selling and are able to establish credibility online can position themselves as connectors and information curators who are able to deliver insight in small doses to wide (and scoped) audiences, ultimately creating new opportunities for delivering commercial insight farther down the pipeline.

CEB Sales Members, to learn more about Social Selling, make sure to check out our new resource center, and listen to the webinar replay on Social Selling: Gaining Credibility and Influence in B2B Social Media Networks.

August 19, 2013

What Makes You Unique?

In continuing to share the story of B2B customers being more empowered than ever and driving suppliers into the land of commoditization, senior executives have attached to the value of leading with insight to “unteach” the customer—to disrupt them. What has been consistent, and almost as astonishing as I’ve had these conversations with commercial leaders is the resounding belief that they do not have a good or strong answer to the first critical part of commercial insight—lead to your unique strengths. Sometimes there are even blank stares to the question—what is it that you do better AND different than your competitors? Time and time again, commercial leaders say, “We don’t really know. We think we know.” Then there are some organizations that feel they have it nailed, but too often the responses are “We are customer-centric. We’ve got great people. We’re green! We’re innovative!” And while that all may be true, if everyone is saying it (and doing it), it isn’t unique.

In continuing to share the story of B2B customers being more empowered than ever and driving suppliers into the land of commoditization, senior executives have attached to the value of leading with insight to “unteach” the customer—to disrupt them. What has been consistent, and almost as astonishing as I’ve had these conversations with commercial leaders is the resounding belief that they do not have a good or strong answer to the first critical part of commercial insight—lead to your unique strengths. Sometimes there are even blank stares to the question—what is it that you do better AND different than your competitors? Time and time again, commercial leaders say, “We don’t really know. We think we know.” Then there are some organizations that feel they have it nailed, but too often the responses are “We are customer-centric. We’ve got great people. We’re green! We’re innovative!” And while that all may be true, if everyone is saying it (and doing it), it isn’t unique.

So, if this is an area that so many commercial organizations struggle to identify and define, how can we uncover unique strengths that differentiate? First, let’s share a nice, clear definition:

Unique – this capability outperforms competitors offerings

Valuable – it has economic impact and value to the customer

Proven – evidence of how and why this capability outperforms the competition exists

It can be helpful to define what a differentiator is NOT:

Features and benefits common to your market

Outcomes your product generates

Vague or over used descriptions

Where can you begin to find your unique strengths? Well, we’ve seen companies find them in all kinds of places (because, good news, they already exist! We just have to go hunting for them):

The enterprise or corporate level

At the business unit level

At a segment or vertical level

At a product, solution or service level

Lastly, here are some key questions to ask as you start to hunt for your differentiators:

What do you believe are your strongest unique strengths/capabilities?

What would your customers say are your unique strengths/capabilities?

How do your best customers use your products/solutions/services differently than others?

Are we truly the strongest at this capability?

Talk to all types of people in your organization. Talk to your best customers. Talk to product development, and talk to your best sellers. Your unique strengths truly already exist. Happy hunting!

CEB Sales Members, learn more about Commercial Teaching and identifying your underappreciated, unique strengths. Also, register for an upcoming workshop on Challenger Messaging.

3 Trends in Sales Onboarding

Onboarding is one of the most costly necessities of any talent management strategy. Onboarding processes that are labor-intensive and out-of-date can hurt your sales force by increasing turnover and draining company resources. That said, delivering onboarding that is scalable, cost-effective, and relevant for your sales force is an ever-changing challenge.

Onboarding is one of the most costly necessities of any talent management strategy. Onboarding processes that are labor-intensive and out-of-date can hurt your sales force by increasing turnover and draining company resources. That said, delivering onboarding that is scalable, cost-effective, and relevant for your sales force is an ever-changing challenge.

When a member came to us looking to replace their dated, labor intensive onboarding with more scalable and cost-effective processes, we sent the question back out to the membership. We asked member executives about the: (1) design and delivery of their sales onboarding, (2) key elements of their onboarding program, and (3) recent cost-effective advancements or investments in onboarding.

We profiled five members’ onboarding programs in our latest brief, Delivering Sales Onboarding. The onboarding practices we heard from members helped shed light on how companies are using both in-person and virtual onboarding to increase the efficiency of their onboarding programs. Company perspectives aligned to two main efficiency-increasing priorities; executives at profiled companies either looked to decrease implementation cost (proliferation of virtual channels) or increase delivery effectiveness (enhance in-person training).

Below are three of the most interesting elements from members’ onboarding programs:

Use of managers and experienced sales reps: Members used both managers and tenured reps to deliver training to new hires. This not only cut costs by erasing the need for a separate sales training organization to deliver training to dispersed reps, but also helped to contextualize training. Managers and tenured reps often develop into mentors for new reps and help to guide them through the onboarding process.

Hold new hires accountable: Keeping new hires responsible for absorption of their onboarding materials proved valuable for members who sought to ensure both the effectiveness of their program and the abilities of their reps. Numerous failed assessments give managers an opportunity to identify underperforming reps before they pose a significant drain on resources.

Build social communities: Social communities (LinkedIn, Facebook, Chatter or internally developed groups) enable new hires to form deeper connections, reinforce training, and share success stories. These communities also allow managers and trainers visibility into reps’ training progress.

CEB Sales Members, check out the full report: Delivering Sales Onboarding and use the profiles to validate or compare your organizations onboarding practices. Also, visit the Onboarding Topic Center.

August 12, 2013

What Motivates Reps

Compensation unarguably is an important driver of attraction and retention of sales talent. But, if you try to fix an attraction/retention problem with compensation alone, you’ll end up with an even more expensive retention problem. Above and beyond compensation, there are many job attributes that can significantly impact rep retention. In this post we’ll explore how to build an impactful Employment Value Proposition (EVP), as well as how you can increase engagement and retention beyond compensation.

Compensation unarguably is an important driver of attraction and retention of sales talent. But, if you try to fix an attraction/retention problem with compensation alone, you’ll end up with an even more expensive retention problem. Above and beyond compensation, there are many job attributes that can significantly impact rep retention. In this post we’ll explore how to build an impactful Employment Value Proposition (EVP), as well as how you can increase engagement and retention beyond compensation.

Our sister program for HR executives, CEB’s Corporate Leadership Council, has been studying EVP and engagement for decades. First, let’s level set on a couple of terms:

Engagement is an employee’s rational and emotional commitment to an organization, their manager, and their peers. The output of engagement is how hard a person works and how long they stay as a result of that commitment.

The Employment Value Proposition (EVP) is the perceived value of working for an organization from the employee’s perspective. The job attributes that either cause you to select a particular employer or to leave your current employer for another job opportunity.

Although employee engagement and EVP are intertwined, they are distinct. While EVP looks at attraction and attrition, engagement looks at the reasons why employees stay committed in their role and how hard they work on the job.

CEB’s Corporate Leadership Council surveyed hundreds of thousands of employees around the world and across virtually every industry, function, role, and level. Their in-depth analysis revealed seven universal drivers of engagement: role clarity, career management, performance management, networking, rewards, work environment, and values. While rewards (i.e., compensation) are a part of it, other job attributes are equally important to maximize engagement, productivity, and minimize turnover.

CLC’s research uncovered a cluster of critical levers that have been trending upwards in importance over the last several years. The central theme of these job attributes that are gaining importance in job applicants’ minds is career development—not promotion— but skill development for current and future employment opportunities, attractive career path options, and organizational support for professional development.

So if you are looking to maximize your attraction and retention efforts, before running to compensation, you should first survey your current employees to evaluate your current EVP, identify why your reps stay, and conduct exit interviews to identify your organization’s drivers of attrition.

CEB Sales Members, visit our new Talent Acquisition topic center, and use our new CEB Sales EVP Generator Template. Also review our latest views on How to Hire Challengers.

The Challenger Approach to Opportunity Management

It may have taken less than a day; or perhaps a week, for those on vacation. What took so little time? The time lapse between CEB’s introduction of the Challenger model and when the first member asked, “How can I put this into my sales process?” or, “How do I embed this in my CRM?”

It may have taken less than a day; or perhaps a week, for those on vacation. What took so little time? The time lapse between CEB’s introduction of the Challenger model and when the first member asked, “How can I put this into my sales process?” or, “How do I embed this in my CRM?”

We’ve come a long way since our original Challenger research study, and indeed, there is a right (and wrong) approach to sales process using Challenger capabilities. But before we get there, why the chorus of companies so desperately needing the answer?

Our research has surfaced four major stumbling blocks to effectively managing individual opportunities through the sales process:

Poor sales process – perhaps the most stunning finding is just how few members have a well-documented, strongly adopted sales process designed for an Insight Selling environment. On our recent webinar, nearly 50% of participants copped to having a sales process that had poor adoption at best, with another 20% having no sales process at all. It’s no wonder The TAS Group’s benchmarks have found it takes 65% longer to lose a deal than win one.

Pursuing the wrong deals – a natural outgrowth of poor process, too many organizations focus on deal quantity over deal quality, with core performing reps spending far too much time with prospects who will never buy. Instead of shaping demand through insight, these sellers gravitate to customers with pre-defined needs – a siren song leading to many RFPs and low win rates.

Pursuing the wrong customer stakeholders – we all know the archetype of a ‘coach’ or ‘advocate’ that will help our sellers win each deal, right? Wrong. That stakeholder doesn’t exist, yet core performers try desperately to leverage stakeholders who talk a good game, but won’t lift a finger to change their organization’s perspective.

Offline tools not embedded in workflow – the seller refrain is all too common for our friends in sales enablement. “Anything that takes away from my time in front of a customer isn’t worth it.” Sellers will reject opportunity management and sales process tools that aren’t embedded in what they do day-to-day, and more importantly, don’t help them close larger deals faster.

We knew we needed to solve these challenges for our members, and we’re very excited to announce the launch of CEB Challenger Opportunity Manager. The product is designed to embed Challenger behaviors at the right stages of the sales process to provide sellers with a replicable approach to each opportunity. In particular:

Prescribing how Challengers approach each opportunity, and how the critical behaviors of teaching, tailoring, and taking control manifest at different stages of the sales process

Using rigorous qualification screens and customer verifiers to focus on ‘emerging demand,’ those deals where sellers are uniquely positioned to deliver insight and shape customer thinking, leading to larger and more favorable deals

Identifying and capitalizing on Mobilizers, the customer stakeholders that drive change in the organization and can help shepherd the opportunity through to completion

Embedding the application in seller workflow, specifically, native on Salesforce.com, to create a one-stop portal for all opportunity-related data and insight.

Developing Challenger behaviors in your sales team will greatly improve the value of customer-facing time; embedding them in your approach to opportunity management and sales process can support their use at the right time and with the most impact in every deal. For more information on Challenger Opportunity Manager, contact Doug Hutton directly at dhutton@executiveboard.com.

August 6, 2013

Why Reps Strike Out with Customers

Does this sound familiar—your rep just came back from a meeting with a Mobilizer, who you’ve painstakingly identified as able to build consensus and drive change in the customer organization. You ask your rep how it went and he replies, “Well it was a mess from the start, I tried to sell the benefits of our product, but he didn’t seem interested in listening at all. By the end of it he was so disengaged that he cut our meeting short and left!” You are surprised because both you and the rep felt confident about securing this deal before the meeting. So what really went wrong?

Most reps feel challenged when engaging Mobilizers. And, it’s easy to see why. Our research shows that reps follow the same strategies to engage all types of customer contacts—they communicate product features and benefits, ask probing questions, and push them through the sales process.

While this approach might work with some types of customer contacts, it puts off the most important ones, Mobilizers, that can actually move a purchase decision forward. This is because Mobilizers don’t go out of their way for suppliers—instead they focus on the organizational agenda. Your reps need to engage Mobilizers on their own terms—guiding them to take ownership of the change in the customer organization, while leading that vision of change back to you as a supplier.

Our research finds that engaging Mobilizers requires leveraging specific Mobilizer strengths and compensating for potential weaknesses at each stage of the customer buying process. Each Mobilizer profile—The Skeptic, Teacher, and Go-Getter—can be categorized across two main behavioral spectrums that reps can use to coach Mobilizers on how to take the sale forward:

Rationally-Driven Vs. Emotionally-Driven: The degree to which the Mobilizer’s decisions can be predominantly influenced by logic or emotions. Skeptics and Go-Getters are rationally-driven, and come across as analytical, logical, and objective. In contrast, Teachers are emotionally-driven, and are often subjective, intuitive, and thoughtful.

Detail-Oriented Vs. Vision-Oriented: The degree to which the Mobilizer prefers to focus on the details and specifics of an idea vis-à-vis the bigger picture. Skeptics are detail-oriented and like to work with facts, data, and well laid-out plans, while Go-Getters and Teachers are vision-oriented and prefer to work with ideas, patterns, and potential possibilities and implications.

Armed with this information, reps can tailor their communication style and the nature of support they provide to Mobilizers at each stage of the customer buying process.

CEB Sales Members, visit our new web page on How to Engage Mobilizers in the Sale to learn how reps can actively guide Mobilizers through the customer buying process. Also, read the key findings from the study, and listen to the webinar replay, Mobilizer 2.0: Working with the Right Stakeholders.

August 5, 2013

Does Sales Need to Become More Professional?

In our last post on hiring, I tackled the question of whether or not sales has an image problem. Our research from this year’s study on Driving Sales Transformation found that many prospective job candidates were not attracted to sales jobs. In this post, I will focus on how 3M is combating sales’ negative perception by partnering with universities to develop sales curriculum that is designed to engage students and drive an interest in a career in sales.

In our last post on hiring, I tackled the question of whether or not sales has an image problem. Our research from this year’s study on Driving Sales Transformation found that many prospective job candidates were not attracted to sales jobs. In this post, I will focus on how 3M is combating sales’ negative perception by partnering with universities to develop sales curriculum that is designed to engage students and drive an interest in a career in sales.

As we have mentioned, sales organizations face many challenges when it comes to hiring sales reps. The common solution to this problem is to simply hire better talent. However, the type of talent most organizations are interested in, are likely not looking for a career in sales. The negative perception and reputation of sales prevents college candidates from even considering it as a viable career choice. Thus, the solution to attracting better talent may in fact be to solve sales’ image problem.

Earlier this year we profiled 3M, a company actively working across several college campuses to alter the perception of sales. By working with professors at various universities, 3M has developed sales programs to increase students’ interest in sales careers. These programs provide students with examples of careers paths in sales and teach the actual responsibilities of sales reps, all while debunking commonly held stereotypes about the industry. Due to the success of these programs, 3M is now able to address its need to source high-potential entry-level sales talent.

Recently, CEB sat down with several key participants in 3M’s partnerships to discuss this program more in depth. In the past, 3M faced the issue of attracting high-potential talent. Instead of investing more resources into traditional recruiting initiatives, 3M decided to take a different approach and invested its resources and efforts in the primary source of new-hire talent: colleges and universities. 3M collaborated with professors at schools to build rigorous sales education programs designed to professionalize sales, with the goal of producing better-prepared “performance-ready” talent for 3M.

Candace Mailand, the Director of Sales Innovation at 3M, described 3M’s approach to shifting the reputation of sales, “So the question we {3M} asked, is how do we change that perception? How do you develop a rigorous program that attracts high potential students by convincingly showing them the art of sales, and even more so, the science…the program was designed with the intent of increasing the amount of sales education content, with the goal of elevating sales as both a discipline and a profession. It is because of these university sales programs that are now in place that 3M is able to address our need for attracting a diverse talent pool of performance-ready candidates.”

These programs not only fill 3M’s need for qualified sales talent, but also assist students in discovering a viable career choice. Before 3M’s involvement at DePaul University, one if it’s partner schools, the University surveyed its students to gauge student’s interest in sales careers. They found that 0% of surveyed students had any interest in sales careers. After 3M’s involvement on campus, DePaul found that after just one sales class, 35% of students wanted to pursue a career in sales. More importantly, at the end of DePaul’s sales program, 75% of the students enrolled chose a career in sales, and went to work for one of the University’s partner companies, including 3M.

SEC Members, read the full case study and listen to the webinar replay. Also, read the key findings from the study, Hiring Challengers in Today’s Sales Environment.

Brent Adamson's Blog

- Brent Adamson's profile

- 9 followers