Brent Adamson's Blog, page 21

October 2, 2012

Does Your President’s Club Reward the Right People?

Research by CEB’s Corporate Leadership Council shows that by effectively recognizing employee achievements, an individual’s performance can increase by up to 22% and retention up to 31%. That said, many organizations overly focus on monetary incentives, failing to achieve the maximum performance and engagement outcomes from their reward and recognition programs.

Research by CEB’s Corporate Leadership Council shows that by effectively recognizing employee achievements, an individual’s performance can increase by up to 22% and retention up to 31%. That said, many organizations overly focus on monetary incentives, failing to achieve the maximum performance and engagement outcomes from their reward and recognition programs.

SEC’s recent member survey explored how companies are using President’s Clubs to engage and maximize their sales force’s potential. Specifically, we compared the results to our 2010 benchmarking data on President’s Clubs to analyze what’s changed on how companies qualify for President’s Club, the metrics companies use, and the incentives they provide as part of the program.

The biggest change companies have made in the last few years is in evaluating eligibility for the President’s Club. More sales organizations are using other qualification criteria beyond the traditional methods to evaluate their sales force and non-quota bearing employees.

In 2010, companies were not using any other criteria to qualify reps for their programs beyond stack ranking, set percentage over goal, and a weighted average of multiple objectives. Today, 21% of organizations we surveyed evaluate their sales force using other criteria, such as:

Total qualitative and quantitative performance

Sliding scales of business attainment plus stack ranking of their sales force

Meeting or exceeding MBOs

Individual performance to goal versus their area’s performance to goal

Companies are also using fewer metrics to evaluate reps. Whereas some companies were using as many as 10 different metrics in 2010, sales organizations today use no more than 5 (82% use between 1-3 metrics). The most popular metrics include sales quota achievement, behavioral or skill-based objectives, and other qualifiers such as renewals, new business, year-on-year growth, and territorial growth.

More companies (50%) are also allowing non-quota bearing employees to qualify for their programs and use other metrics beyond the traditional criteria to evaluate them. While behavioral or skill-based objectives remain the greatest factor for qualification (43% use it), other qualifiers such as peer or senior leadership nominations, individual’s overall performance, organization or regional goal attainment, providing positive customer experience, and corporate impact are also popular.

In changing the number and type of metrics used to evaluate and qualify employees, organizations are increasingly able to affect levels of engagement and overall performance of the workforce.

SEC Members, listen to the President’s Club webinar replay for a full recap of our findings. Also, learn more about how to design and manage your President’s Club program.

October 1, 2012

The Top Reason Why People Quit

This is a guest post by Marika Krausova of the Communications Executive Council, our sister program for communications professionals. We’ve modified it a bit for a sales audience.

Visit the original here!

This is a guest post by Marika Krausova of the Communications Executive Council, our sister program for communications professionals. We’ve modified it a bit for a sales audience.

Visit the original here!

Every quarter our sister program, CEB’s Corporate Leadership Council, publishes HR news and trends. The Q3 forecast just came out and it highlights some interesting key workforce trends.

In the first half of 2012, a quarter of the workforce was actively looking for a new job, and another 40% are passively open to taking a new position. Which means that there is pretty high chance that the guy two cubicles down from you who has been acting really shady lately and shutting his browser quickly whenever you approach his desk, is very likely out there actively looking for a new job.

If you’re wondering what would make your coworker want to leave his/her job, CLC has the answer. One of the key things that CLC measures each quarter are reasons for attrition. Not surprisingly, compensation is one of the key drivers of attrition, but there is one reason for leaving a job cited by employees even more frequently: future career opportunity. 42% of departing employees cite lack of future career opportunity as one of the top five reasons they are leaving their current employer. Compensation follows as close second, with people management, manager quality, and development opportunities closing the top five group.

To recruit and retain star talent, leading sales organizations provide reps with comprehensive reward packages that include opportunities for learning and advancement. For example, Philip Morris creates a fast-track promotion process for promising sales employees. Its sales leaders mentor high potential reps and encourage them to rotate among Philip Morris’s different business units to gain cross-functional experience. On a similar vein, Anheuser-Busch creates a shadow cabinet that mirrors the roles and responsibilities of the firm’s executive strategy committee to help develop a firm-wide perspective on strategic issues.

How does your organization recognize and reward sales reps through advancement opportunities?

SEC Members, review the Voice of the Sales Force that highlights the drivers of attraction and commitment that appeal to current and future sales employees and helps refine your employee value proposition. Also, see our topic centers on Talent Acquisition and Talent Development.

September 26, 2012

The Secret to Creating High-Impact Tools

Sales organizations often find themselves inundated with rep requests for new sales tools. That said, despite the time and effort Sales Ops spends designing and perfecting new tools, sales force adoption often remains low, with many of the sales tools requested by reps rarely used in the field. What’s more, the high volume of tool requests often leads to high-impact tools slipping through the cracks or Sales Ops expending scarce organizational resources on creating low-value and low-impact tools.

Faced with this problem, Schneider Electric, a global energy management company, took to designing a comprehensive scorecard that helps Sales Ops direct resources to the tools with the highest potential for impact. Schneider broke down its sales tool evaluation process into two separate scorecards—one to analyze impact, and the other to assess resource commitment and feasibility.

The scorecards were evaluated in several impact areas that assessed tool “fit” against organizational priorities. For example, to assess strategic business impact, the urgency of the tool and whether or not it would provide a competitive advantage was evaluated to arrive at a decision.

On the other hand, the feasibility scorecard determined what resources would be needed to develop the tool. This scorecard evaluated corporate demand, the level of resource investment, and the difficulty of project implementation. Current resource needs were balanced with future demands to ensure that ongoing tool maintenance costs were incorporated in the evaluation.

The combination of these scorecards allowed Schneider Electric to create tools with both the highest potential value to reps and the fewest execution barriers. The score produced by both the ‘impact’ and ‘feasibility’ scorecards was evaluated separately, to ensure the tool satisfied both criteria, allowing Schneider Electric to have a more advanced grading system that looked beyond rep productivity as the sole criteria for approval. The scoring scale also adjusted to reflect changes in corporate strategy and priorities, allowing different tool advantages to be prioritized at different times.

How does your company prioritize tools and drive tool adoption in the sales force?

SEC Members, review Schneider Electric’s best practice on allocating resources against highest-impact tools. To learn more about sales tools, visit the topic center, review the full study, and listen to the webinar replay on The Truth About Sales Tools.

September 25, 2012

Finding a Home for Big Data in Sales

Sales analytics is a niche field that has outgrown its foundation. Big data analysis is no longer limited to the lonely quantitative team or the only member of your sales team with a math degree. As companies’ abilities and proclivities to collect and analyze customer and market data grow, so must the capabilities of their sales teams to comprehend and utilize that data in the field.

Sales analytics is a niche field that has outgrown its foundation. Big data analysis is no longer limited to the lonely quantitative team or the only member of your sales team with a math degree. As companies’ abilities and proclivities to collect and analyze customer and market data grow, so must the capabilities of their sales teams to comprehend and utilize that data in the field.

A recent Harvard Business Review blog highlighting an article by Tom Davenport and DJ Patil discusses the developing need for the everyday manager and business analyst to regularly handle big, potentially chaotic, data pools. Similarly, a recent Avande survey cited in the blog reported that “60% of companies need employees to develop new skills to translate big data into insights and business value.”

This type of perspective is to be expected in a tumultuous environment of changing expectations. But, the three elements of the most desirable employees help shine some light on development pathways:

Capable and willing to experiment with data

Proficient in mathematical reasoning

Able to see the “big (data) picture”—keen on deducing, organizing, and competently forming conclusions and insights from the data

A recent CEB survey of 976 salespeople finds that 95% report some or all aspects of their job involves data analytics and 96% see information and analytics as vital for better decision-making.

While the modern salesperson clearly recognizes the need for big data in their function, their ability to independently utilize data is lacking. Only one-in-three salespeople agree that all the information required to do their job is available and only one-in-four are very comfortable with conducting analysis and are able to meet their own informative needs.

That said, the analytic deficiency is not completely the fault of the salesperson. Companies have been following the trend of collecting as much data from as many sources as they can in hope of deciphering new and vital insights for their businesses, but their functional teams can only do so much to catch-up. Data analysis has moved away from its traditional IT-centered base to a home in different functional environments and sales leaders need to quickly equip their teams to make the most of it.

How does your company handle the growing importance of data analysis?

Related Resources:

CRM Data Quality

Improving Sales Predictions

September 24, 2012

Does Challenger Confuse Marketing with Sales?

By Matt Dixon and Nick Toman

Some of the sharper criticism we’ve seen of the Challenger approach stems from observations that the guidance we offer confuses marketing with sales.

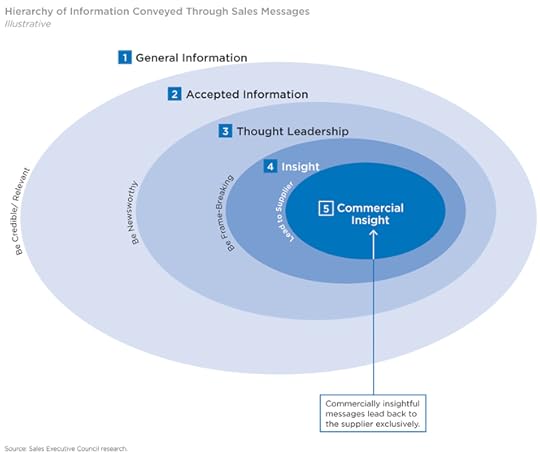

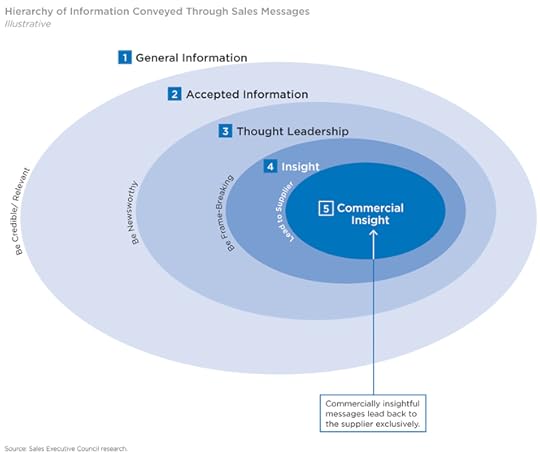

The job of marketing, the logic goes, is to focus on upstream demand generation and nurturing of leads. Marketing channels offer scalable ways to inform prospects and customers alike of new capabilities and benefits, and ultimately earn a supplier a shot at consideration. The job of sales is to drive those leads through to conversion. From this perspective, a Challenger approach (one based on leading with insights designed to teach customers about new opportunities), sounds more like the job of marketing than sales.

While we would argue that the data presented in the Challenger research provides ample evidence that high-performing salespeople are indeed engaging in (and emphasize) insight delivery as a core part of the sale, here’s some new evidence to add to the debate:

Earlier this year, we conducted a study of several thousand salespeople with the aim of better understanding how top performers engage customers in the market—put simply, what do they do specifically to “get in early.” When we look specifically at how average performers engage customers in the market, here’s are the variables that popped in the analysis:

Rep believes lead generation is the company’s responsibility

Rep assesses opportunities based on the clarity of customer needs

Rep undiscerningly uses social media (i.e., “spams” their network)

High performer behaviors couldn’t be more different. Here’s are the variables that described the star rep’s engagement approach:

Rep conducts non-traditional due diligence

Rep personally owns lead generation

Rep leads with insight

Rep uses social media specifically as a channel to deliver insight

Put differently, the average rep fills orders by reacting to existing demand; stars sell where customers learn (not just where they buy), shaping demand and teaching customers into the sales funnel. The best sales reps, it turns out, are just as good at marketing as they are at selling.

But here’s the catch: In order to activate this sort of behavior across the sales organization, the insights reps share and the way in which they challenge customer thinking must elevate above the noise, not add to it. Insights must be disruptive. They must clearly contrast with customer assumptions. This goes well beyond “thought leadership,” which simply introduces new ideas, and instead seeks to break down and upend the “mental model” with which the customers currently see their world. To depend on salespeople alone to arrive at such insights is a fool’s errand. The organization—namely, marketing– must arm sellers with such disruptive insights.

But here’s the catch: In order to activate this sort of behavior across the sales organization, the insights reps share and the way in which they challenge customer thinking must elevate above the noise, not add to it. Insights must be disruptive. They must clearly contrast with customer assumptions. This goes well beyond “thought leadership,” which simply introduces new ideas, and instead seeks to break down and upend the “mental model” with which the customers currently see their world. To depend on salespeople alone to arrive at such insights is a fool’s errand. The organization—namely, marketing– must arm sellers with such disruptive insights.

In what we think is probably the best review of The Challenger Sale that we have seen since its publication, noted blogger and sales expert Dave Brock writes

“Challenger Selling is really not a sales initiative, though the title will be misunderstood…It’s not Solution Selling 3.0. Challenger Selling is really about Challenger Business Strategy…Before an organization can be successful in implementing Challenger Selling, it has to re-examine fundamental business strategies, product, marketing, service, customer experience and positioning issues. Without this, you run the risk of sending your sales people into customers naked! They’re prepared to be Challengers, they’ve been trained and developed the skills, but they don’t know what to challenge on, and how to tie that back to the distinctive value of your products and solutions. It’s not sales job to figure these out, it’s the task of the organizations outlined above.”

We couldn’t agree more. While we’re encouraged to see many sales training vendors and consultants now speaking the language of Insight Selling and Challenger, we’re concerned about some of the solutions we’ve seen for helping sales organizations down this path. Getting this right requires much, much more than a new sales training module. This goes well beyond telling reps to go out there and deliver insight. It’s about the hard work of sales and marketing integration, value proposition definition, disruptive insight generation, content marketing and sales messaging.

Companies that have taken the next step into Insight Selling will tell you that these are not things that can be taught in the classroom. As we’ve said many times, the Challenger story is only partly about individual sales rep skills. It is as much a story of new organizational capabilities. For our part, we would tell every head of sales to ask their training vendor or sales consultant how they plan to support their organization (not just their salespeople) on what is undeniably a long and difficult journey of commercial transformation. (SEC Members, assess your organizational capability for demand shaping with our 10 minute assessment.)

In this new commercial model, sales reps are indeed marketers. They are shaping customer demand well ahead of customer needs being identified. They are driving awareness – not of new products and services – but of new ways for the customer to manage their business. And, most importantly, the capability to do this effectively stems not from the sales training classroom, but from the supplier organization.

We look forward to the continued dialogue and certainly welcome any comments!

September 18, 2012

National Sales Meetings, 3 More Things You Must Know

To expand on my colleague, Scott Collins’ Do’s and Don’ts of National Sales Meetings, we collected recent SEC member views on best practices for running impactful National Sales Meetings. In conversations with us, as well as through the SEC Sales Talent Management Forum, members shared what has worked for them, what innovative tactics they are trying out, and how they are keeping their meetings engaging and productive.

To expand on my colleague, Scott Collins’ Do’s and Don’ts of National Sales Meetings, we collected recent SEC member views on best practices for running impactful National Sales Meetings. In conversations with us, as well as through the SEC Sales Talent Management Forum, members shared what has worked for them, what innovative tactics they are trying out, and how they are keeping their meetings engaging and productive.

Here are a few tips from SEC members:

1. Content is king―whether you hire internal or external speakers, focus on selecting topics that are relevant, speakers that are credible, and learning formats that provide fun and excitement.

Members say:

Often the best rated elements of member meetings are the learning exercises structured in interactive formats. Examples of interactive learning exercises include:

i) Speed networking (roundtable discussions on a range of topics led by an internal subject matter expert where reps rotate from table to table in 15-minute intervals)

ii) Small table workshops

iii) Interactive game shows, such as Family Feud

Gaming simulations are also among the most popular learning formats. For example, members recommended using large-scale games such as “The Search for the Lost Dutchman’s Gold Mine,” which can be aligned with meeting themes and tailored to make use of relevant training concepts.

The key to these exercises is providing reps with actionable take-aways or learning points, and scheduling moderated debriefing discussions to reinforce learning objectives.

2. Get the planning right―it’s easy to build your meeting’s agenda based on last year’s program, but your reps don’t appreciate repetitive content and familiar training formats.

Members say:

Assess whether or not there is a common skill development need across the entire sales organization that can be tackled in a holistic fashion at the meeting. If instead, there are different skill gaps that need to be addressed by level, think of strategic ways to segment your sales force.

Solicit feedback from managers on behaviors that need to be changed or prioritized and adapt your content accordingly.

Think about how you can tell a story to your reps. Start your meeting by including a short update from management, and/or a marketing update with exciting content on what’s coming down the pipeline.

3. Think creatively about post-meeting follow-up―properly documenting your National Sales Meeting online and providing reps with reasons to engage with on-going learning tools can be a powerful way to increase your impact.

Members say:

Encourage reps to leverage current technology and, for example, make videos summarizing meeting topics using smartphones and tabloids, which can be shared with the broader sales force online. Video making contests are also a creative way to increase rep participation and engagement with certain training topics.

See how Grainger and Neopost creatively use video competitions to drive socialization of training.

Make sure to videotape and upload to your sales portal major breakout sessions so that reps can review the content from sessions they were not able to attend.

Think critically when selecting content for the meeting, and remember that some topics are best taught through webcasts or on-going eLearning classes, rather in a face-to-face environment.

What other suggestions do you have for making National Sales Meetings impactful?

SEC Members, review fellow members’ suggestions on the best Inspirational Keynote Speakers, learn the 3 Ways to Keep Your Sales Kickoff Alive, and learn about our research on Boosting Sales Training Stickiness.

Getting Channel Sales Right

[image error]As members re-evaluate their sales cost structures and go-to-market strategies today, the indirect channel offers a paradox of options. From a supplier perspective, all the desirable outcomes of expanded distribution and outsourced sales cost are often complicated by the leverage of an empowered channel partner with other options.

While symbiosis may be the aspiration, both benefiting and requiring the other equally, these relationships can sometimes feel more one-sided. Rather than ‘We’re in this together’, suppliers may hear: ‘You’re not the boss of me.’

Supplier wants to tap new markets and hunt new customers? Channel finds it easier to pick up a new product line from a competitor. Supplier offers training courses to teach partner how to sell its complex solutions? The channel feels paid to focus on volume-only outcomes; what’s their incentive to take their guys off the field?

How do you get someone not on your direct payroll to do what is in their best interest—and yours? For all the challenges of partnering with third parties, getting it right can truly pay off. The journey starts with identifying what good looks like and getting consensus around priorities.

Based on best-practice contributions from dozens of companies across the network, SEC has captured the 16 attributes that define excellence in the Anatomy of a World-Class Channel Sales Organization. This diagnostic allows companies to rate the importance of their biggest effectiveness gaps across four major categories:

Channel Design—examples from IBM and Cargill offer guidance on how to select or deselect partners and plan jointly for growth in end-customer markets.

Policy, Process, and Procedure—how well you enable communication of mutual expectations, share data and support efficient transactions.

Channel Support and Education—for those familiar with SEC’s guidance on insight-based selling, see Challenging in the Channel for the types of conversations you enable your partners to have with end customers. Gore and Autodesk share examples on how to train and coach to the right selling behaviors.

Metrics and Rewards—beyond short term volume-based SPIFF-type rewards, the best channel partner incentive programs focus on long-term sustainable growth. Apollo shares how to set objective, clear expectations for partnership on both sides—and calibrate investment appropriately.

As with all of the SEC’s suite of Anatomy surveys, SEC members have the option of running this survey across the organization to benchmark where you stand and prioritize where to invest next (contact your SEC Account Manager for details).

Do you know where your channel program gaps are and what to fix first?

SEC Members, to learn more about channel sales, read the full study, Enabling Channel Partner Relationships, and visit the Indirect Sales Topic Center.

Breaking the Doom Loop of Sales Hiring

By Doug Hutton

[image error]

Sales hiring decisions often lead to classic buyer’s remorse. Sales managers wonder whether a new hire can thrive in a unique selling environment, particularly if they weren’t involved in the interview process. Nagging doubts remain about whether the candidate had the right knowledge, skills, or abilities to succeed in role. We’ve written before about why members don’t always hire the right candidate, a single mistake that isn’t hyperbole to suggest could cost an organization $1M or more.

CEB Recruiting research points out why buyer’s remorse remains so prevalent in sales hiring decisions. The annual cost differential between organizations that select the right hires compared to those that do not is $28.5 million. That doesn’t even touch on the foregone revenue from hiring a poor seller—it’s simply the bottom line overhead associated with attempting to keep up with higher employee turnover and lower performance. Consider the following data:

Hiring managers who make the wrong hiring decision have new hires that perform up to 24% worse than their correctly selected peers.

New hires that are not confident that they made the right decision to join an organization are up to 22% less engaged, and 46% more likely to leave the company—buyer’s remorse happens to them, too.

These trends are exacerbated by today’s high complexity selling environments, in which high performers are nearly 3x more productive than average performers. Replacing an outgoing high performer with a core performer not only opens that productivity gap but then heightens the risk of turnover, beginning a spiral that is difficult to correct without more accurate candidate insight during the hiring process.

In response to this bad-news barrage, and the continuing member chorus to increase the number of Challengers in their organizations, CEB is launching a new service for our members. Challenger Selection and Assessment can help determine the specific Challenger competencies correlated to high performance for particular roles, and leverage this knowledge to enable the selection of the best candidates during the hiring process.

Too often, we see organizations only assessing for those competencies that will qualify or disqualify a candidate—a basic level of competency that will put an organization squarely in the core performing, higher turnover danger zone.

We designed Challenger Selection and Assessment to find those competencies that differentiate high performers from the rest – Challenger competencies – so that hiring decisions produce less buyer’s remorse and more immediate productivity. Given that the most significant driver of rep engagement is goal achievement, the right hiring decisions become self-reinforcing. Challenger Selection and Assessment provides the objective insight into a candidate’s Challenger potential, that when combined with powerful benchmark data, can yield significant improvement in the hires companies bring onboard.

For more information on this new offering and to begin adding more Challengers to your sales force, please click here to send us an e-mail; we will reply within 24 hours to schedule a subsequent conversation.

SEC Members, to learn more about Challenger Selling, visit the topic center and review the Challenger Rep Starter Kit. In addition, look at the Talent Acquisition topic center for best-in-class practices on attracting and hiring sales talent.

September 17, 2012

Does Challenger Confuse Marketing with Sales?

By Matt Dixon and Nick Toman

Some of the sharper criticism we’ve seen of the Challenger approach stems from observations that the guidance we offer confuses marketing with sales.

The job of marketing, the logic goes, is to focus on upstream demand generation and nurturing of leads. Marketing channels offer scalable ways to inform prospects and customers alike of new capabilities and benefits, and ultimately earn a supplier a shot at consideration. The job of sales is to drive those leads through to conversion. From this perspective, a Challenger approach (one based on leading with insights designed to teach customers about new opportunities), sounds more like the job of marketing than sales.

While we would argue that the data presented in the Challenger research provides ample evidence that high-performing salespeople are indeed engaging in (and emphasize) insight delivery as a core part of the sale, here’s some new evidence to add to the debate:

Earlier this year, we conducted a study of several thousand salespeople with the aim of better understanding how top performers engage customers in the market—put simply, what do they do specifically to “get in early.” When we look specifically at how average performers engage customers in the market, here’s are the variables that popped in the analysis:

Rep believes lead generation is the company’s responsibility

Rep assesses opportunities based on the clarity of customer needs

Rep undiscerningly uses social media (i.e., “spams” their network)

High performer behaviors couldn’t be more different. Here’s are the variables that described the star rep’s engagement approach:

Rep conducts non-traditional due diligence

Rep personally owns lead generation

Rep leads with insight

Rep uses social media specifically as a channel to deliver insight

Put differently, the average rep fills orders by reacting to existing demand; stars sell where customers learn (not just where they buy), shaping demand and teaching customers into the sales funnel. The best sales reps, it turns out, are just as good at marketing as they are at selling.

But here’s the catch: In order to activate this sort of behavior across the sales organization, the insights reps share and the way in which they challenge customer thinking must elevate above the noise, not add to it. Insights must be disruptive. They must clearly contrast with customer assumptions. This goes well beyond “thought leadership,” which simply introduces new ideas, and instead seeks to break down and upend the “mental model” with which the customers currently see their world. To depend on salespeople alone to arrive at such insights is a fool’s errand. The organization—namely, marketing– must arm sellers with such disruptive insights.

But here’s the catch: In order to activate this sort of behavior across the sales organization, the insights reps share and the way in which they challenge customer thinking must elevate above the noise, not add to it. Insights must be disruptive. They must clearly contrast with customer assumptions. This goes well beyond “thought leadership,” which simply introduces new ideas, and instead seeks to break down and upend the “mental model” with which the customers currently see their world. To depend on salespeople alone to arrive at such insights is a fool’s errand. The organization—namely, marketing– must arm sellers with such disruptive insights.

In what we think is probably the best review of The Challenger Sale that we have seen since its publication, noted blogger and sales expert Dave Brock writes

“Challenger Selling is really not a sales initiative, though the title will be misunderstood…It’s not Solution Selling 3.0. Challenger Selling is really about Challenger Business Strategy…Before an organization can be successful in implementing Challenger Selling, it has to re-examine fundamental business strategies, product, marketing, service, customer experience and positioning issues. Without this, you run the risk of sending your sales people into customers naked! They’re prepared to be Challengers, they’ve been trained and developed the skills, but they don’t know what to challenge on, and how to tie that back to the distinctive value of your products and solutions. It’s not sales job to figure these out, it’s the task of the organizations outlined above.”

We couldn’t agree more. While we’re encouraged to see many sales training vendors and consultants now speaking the language of Insight Selling and Challenger, we’re concerned about some of the solutions we’ve seen for helping sales organizations down this path. Getting this right requires much, much more than a new sales training module. This goes well beyond telling reps to go out there and deliver insight. It’s about the hard work of sales and marketing integration, value proposition definition, disruptive insight generation, content marketing and sales messaging.

Companies that have taken the next step into Insight Selling will tell you that these are not things that can be taught in the classroom. As we’ve said many times, the Challenger story is only partly about individual sales rep skills. It is as much a story of new organizational capabilities. For our part, we would tell every head of sales to ask their training vendor or sales consultant how they plan to support their organization (not just their salespeople) on what is undeniably a long and difficult journey of commercial transformation. (SEC Members, assess your organizational capability for demand shaping with our 10 minute assessment.)

In this new commercial model, sales reps are indeed marketers. They are shaping customer demand well ahead of customer needs being identified. They are driving awareness – not of new products and services – but of new ways for the customer to manage their business. And, most importantly, the capability to do this effectively stems not from the sales training classroom, but from the supplier organization.

We look forward to the continued dialogue and certainly welcome any comments!

September 13, 2012

Does Challenger Undermine Questioning Skills?

By Nick Toman and Matt Dixon

As a research team, we’re both humbled and glad to see the huge amount of discourse about the Challenger research and what it says about the changing recipe for sales effectiveness. While not all of the commenters out there agree with our findings or our take on them, you know you’re doing something right when your work sparks debate among some of the biggest names in sales. This debate makes us all better and is ultimately necessary for moving the profession forward.

In the spirit of continuing this conversation, we wanted to flag a few of the misconceptions about Challenger that we’ve seen arise in various blog posts recently. This is the first in a short series of posts designed to address some of these.

The first misconception that we’ll focus on is that Challenger obviates the need for more “traditional” selling techniques. Such techniques include customer questioning, building relationships, and engaging in constructive dialogue with customers. For those who argue such techniques are still necessary, we are in complete agreement.

The first misconception that we’ll focus on is that Challenger obviates the need for more “traditional” selling techniques. Such techniques include customer questioning, building relationships, and engaging in constructive dialogue with customers. For those who argue such techniques are still necessary, we are in complete agreement.

The idea of leading with insight—the core of a Challenger sales approach–is additive to these sales fundamentals. To be clear, leading with insights and challenging the customer perspective gains you access to the sales conversation – it doesn’t guarantee conversion. A lot of things still need to happen in a complex sale. But challenging the customer’s thinking positions a salesperson far more favorably, credibly, and with greater access than leading with questions alone.

Reflecting on our research methodology for a moment can help reconcile this point. Multivariate regression models highlight differentiators – the performance drivers that separate low from high performance. If nearly all salespeople exhibited a specific behavior, that behavior will not show up as a driver of higher sales performance. Since nearly all salespeople practice questioning techniques, they are unlikely to “pop” as a performance driver.

This doesn’t mean that the best reps in the world don’t rely on questioning approaches – they do. But it does suggest that they are doing something different to engage in a far meaningful commercial conversation, quickly distancing them from the competition. The data clearly indicate that challenging the customer’s thinking with unique insights is what differentiates star performers from their average-performing peers. Interviews that we’ve had with the world’s very best sales performers underscore this finding. These reps argue questioning is vital to a sale, particularly in later stages when it comes to customizing a supplier’s solution, but they also realize customers no longer have the patience or grant access to the “interrogator.” They must first earn the right to ask questions.

Let’s look at the role of questioning from the customer perspective – after all, they are the ultimate arbiter as to the effectiveness of this approach. A thorough examination of purchase and loyalty drivers we conducted across more than 5,000 B2B customers showed the most impactful drivers were (in order of impact):

rep offers me unique perspectives

rep helps me navigate alternative approaches for my business

rep helps me avoid mistakes

rep educates me on new issues and outcomes

These drivers clearly reflect the importance of sharing insight about the customer business.

Among the least impactful drivers from that analysis (in fact, these attributes are over 40% less effective than those listed above) were the following:

rep understands my business

rep can diagnose my needs

Customers know their business. They don’t expect reps to know their business as well they do. Nor do customers have the initial patience to “educate” a rep on the ins and outs of their business. Customers aren’t interested in validation of their preconceived notions through questioning, they’re interested in new ideas that can make them more effective. Answering questions is a privilege, not a right, and it’s one that the customer grants to the salesperson who has brought them new insights for improving their business—not reps who are searching for a way to potentially support the customer business. That distinction is critical.

Can insights be shared through smart questioning? Most certainly – just ask anyone well versed in Socratic reasoning. However, today’s customer no longer needs to be tolerant of rep questioning. They can simply hire a consultant—and in some cases, go online–to assess their needs and evaluate vendors. Today’s customer demands new insights on running their business, mitigating risk, generating growth, or reducing cost. In this respect, the salesperson’s biggest competitor today isn’t actually the competition at all—it’s the customer’s ability to learn on their own.

Irrespective of the tactic used to deliver insight, I think we can all agree that the customer must be shown that their current approach no longer works. Implicitly reps have to say “here’s what’s wrong with the status quo and here’s why you should try a new approach.”

The bottom line is this: In order to get the customer to think differently about you as a supplier, you must first get customers must think differently about themselves.

That’s our point of view. What’s yours?

Brent Adamson's Blog

- Brent Adamson's profile

- 9 followers