Brent Adamson's Blog, page 16

February 4, 2013

Why Reps Never Change

Increasing training stickiness with reps is a challenge. In the past few years, the SEC has researched various ways to enhance training resonance with reps. Increasing emphasis on Sales L&D has been a priority for companies for some time, as our 2010 Benchmarking survey found that 76% of respondents were increasing their focus on Sales L&D initiatives.

Recently, much of this focus has shifted towards establishing and operating a Sales Academy or a Sales University. This unique function occurs at the end of the general training process and allows for sales reps to apply and practice skills acquired during training. This additional opportunity to practice is critical because our research shows that 87% of what reps learn during traditional training is lost within 30 days.

Academies prevent this information loss by enabling reps to incorporate lessons from general training into their daily workflow to ensure they are adopted. By doing this, new practices naturally embed into reps’ behavior, causing training to resonate.

In addition, a tailored and detailed curriculum makes Sales Academies better positioned to provide reps with training based on individual needs. Their flexible curriculum enables messages and material to adapt to market changes and corporate strategy.

The internal organization and operation of Sales Academies vary (as shown below). The majority of respondents had programs that were managed by the Sales Function.

Unlike traditional training, Academies do not end when courses are completed. This over-arching approach has proven effective at driving changes in rep behavior. Frequent “check-ups” and examinations ensure reps understand and apply critical skills For example, a written or online test shortly after the Academy tests comprehension, followed by manager observation to ensure reps have integrated the skills into their daily work.

SEC Members, learn how Gen-i established a Sales Academy, and listen to the event replay. Also, review our topic center on how to create a sales academy, and listen to your peers’ perspective on building a world-class sales academy.

January 29, 2013

3 Customer Contacts Reps Must Engage

It seems that star reps have recognized something that their average-performing peers have not: the most accessible customer contacts, the ones that will always pick up the phone and talk to you, rarely have the influence or ability to build the internal consensus required to get a deal done.

It seems that star reps have recognized something that their average-performing peers have not: the most accessible customer contacts, the ones that will always pick up the phone and talk to you, rarely have the influence or ability to build the internal consensus required to get a deal done.

Now yes, it’s certainly easier to call on customer contacts that are always up for a chat. But star performers look for customers that want to do more than just talk. They actively identify and activate a specific type of customer stakeholder, one that we at the SEC have come to call Mobilizers—customer contacts that are focused on getting things done.

Recently, we held a webinar where we dug into the specific Mobilizer profiles in detail. In particular, we focused our time on how to engage the three Mobilizer types, the Go-Getter, Teacher, and Skeptic.

Let’s walk through each in turn:

Go-Getters

Defining Quote: “Show me the business value, and I’ll get ‘er done!”

These are your big picture folks that have a flair for the details.

In the early phase of a Go-Getter’s buying process, we as salespeople will need to think about the higher order business implications for these customers, that’s what they’ll attach to early on. But as we move this type of customer stakeholder through the process, we can’t ignore the numbers and hard-facts that will appeal to their rational side. Productive conversation with these customer contacts won’t come easily, and will require a lot of homework and due diligence to prepare adequately on the part of a salesperson.

Teachers

Defining Quote: “I LOVE THE IDEA! Now what?”

This type of customer contact is also big picture oriented, but more emotionally driven.

After the sales conversation, provided the rep did a good job of building the value proposition, Teachers will want to scream change from the mountain tops inside their organizations with passion and excitement! But that unstructured excitement over time can fizzle unless the rep helps these people. You have to give them a plan. Focus your teacher-oriented customer contacts on the economic needs of the other key stakeholders inside their company. Does the CFO need to be bought in? Great, well what metrics does the CFO care about? What do they use to measure success?

That’s how you equip Teachers to have a successful internal conversation.

And we can’t be afraid to ask these folks questions. “So, Mrs. Customer, if I’m hearing you correctly, you mention that your head of operations will be a key player in driving an initiative like this, correct? Well then, what do you think she’ll be looking for from a project like this? How will she define success?”

If that customer can’t answer, well, as a salesperson, give them that information (so, here’s what an operations person likely cares about based on my experience, X, Y & Z), or, if you don’t know, have them go talk to their operations folks to figure it out. Give that teacher homework, see if they do it!

Skeptics

Defining Quote: “Interesting. But, how does…? Who will…? Where can…?”

Skeptics ask questions, they care, and if you know your stuff as a salesperson, these conversations can be a fun challenge! If you don’t, these customer contacts will seem like jerks.

These folks are detail-oriented and rationally-driven. Very left-brained. So once they’re bought in, how do you help them? It’s pretty simple, HELP THEM TELL THE STORY. What’s the emotional side of the world look like? What are others inside their company going to be passionate about? Because left to their own devices, Skeptics will get bogged down with the nitty-gritty, the nuances.

In fact, you may want to handle the story telling for them. Let them make the necessary introductions for you inside their organization, and you take it from there. Then come back to them when it’s time to iron out the details. They may actually thank you for it!

SEC Members, see how star performers identify true Mobilizers with thisInteractive Stakeholder Identification Tool. Also, read the key findings from the study, Engaging the Right Customer Stakeholders, and listen to the webinar replay, Mobilizer 2.0: Working with the Right Stakeholders.

January 28, 2013

Is Mobile Changing the Rules of Sales Engagement?

The use of web, and now mobile, is changing the way customers make decisions. Real-time access to product information, multiple options, user reviews, and price comparisons has customers moving through 57% of the buying cycle before they interact with suppliers.

The use of web, and now mobile, is changing the way customers make decisions. Real-time access to product information, multiple options, user reviews, and price comparisons has customers moving through 57% of the buying cycle before they interact with suppliers.

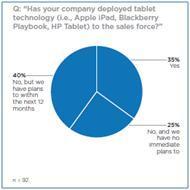

To meet real-time customer demands and increase efficiency, sellers often download different apps on office or self-owned mobile devices. Increasingly, sales organizations too are recognizing the value mobile support provides to sellers in the field. In fact, a recent SEC survey shows that 75% of sales organizations are either already using tablet technology or plan to do so within the next 12 months.

As part of our upcoming research on Mobile Sales Support (take our short survey), the SEC identified a few key mobile capabilities companies use to improve sales performance in the field:

Task and Schedule Management: Reps can save time and improve the sales experience by handling time-consuming, administrative tasks such as order management, accessing sales collateral (e.g., presentations) and schedules on-the-go, all in real-time.

Real-Time Availability of CRM Data: Reps can inform customer management decisions by accessing relevant customer data on account management, lead management, sales performance, and analytics or by participating in social CRM in real-time.

Access to Business Intelligence and Sales Analytics: Reps can inform the sale by accessing business intelligence on customer accounts. Similarly, managers can get greater visibility and strengthen their decision-making abilities through performance dashboards.

Customer Collaboration and Interaction: Reps can share deal or product information with customers through interactive activities, such as e-detailing (e.g., sales presentations, product videos), collaboration (e.g., meetings, visualization), and ROI or benefit modeling.

Information Exchange and Remote Coaching: Reps and managers can drive internal learning through real-time peer knowledge exchange using internal idea exchange platforms like Salesforce Chatter and conduct remote rep coaching for skill development.

How are you using mobile sales technology? What’s your experience been?

SEC Members, participate in our short survey to benchmark your mobile sales capabilities. Also, read more on the Top iPad Apps for Sales and Top Apps for CRM.

January 22, 2013

How to Make a Good First Impression with New Hires

Companies spend a lot of money and resources on locating and hiring the right talent. However, once the employment contract is signed, many new hires feel lost due to ineffective onboarding programs that leave them unprepared for the tasks at hand. The repercussions for ineffective onboarding can be dire and cause missed opportunities for engagement of high-performers, increased time until full productivity, and higher rates of attrition.

Companies spend a lot of money and resources on locating and hiring the right talent. However, once the employment contract is signed, many new hires feel lost due to ineffective onboarding programs that leave them unprepared for the tasks at hand. The repercussions for ineffective onboarding can be dire and cause missed opportunities for engagement of high-performers, increased time until full productivity, and higher rates of attrition.

Typical onboarding programs tend to focus on general corporate process and company logistics, rather than actual material that new hires can use to help acclimate to their jobs. Due to this format, onboarding is viewed merely as a corporate requirement, rather than a helpful resource for new hires.

Providing new hires information that focuses on guidelines, and not on skill adoption, is common practice in many organizations. The same issue is true with training programs that primarily focus on general skills, not on specific job- and task-related activities. However, like onboarding, these training programs are evolving to cover and focus on applicable material.

Companies are taking a varied approach in revamping their onboarding strategies. Some members, like BEA, are creating “dedicated onboarding managers” to enhance employee engagement. They found that managers were more concerned with quarterly goals than acclimating new hires. Other companies, like CertainTeed, place the burden on the new hires to demonstrate their knowledge by proving they have acquired skills at multiple milestones in the onboarding process.

Companies are beginning to realize that like first impressions, they only get one chance to successfully onboard new employees, and thus are investing more resources into onboarding. Xilinx, Inc. recognized that reps need extra support during their first few weeks on the job, and provided them with dedicated phone support. This external support aided new hires in their first few field sales, where there were many missed sales opportunities and frustrated customers. With the help of the outside support in providing reinforcement and tailored presentations, Xilnix was able to shorten new hire ramp-up time and sales cycle times.

SEC Members, read other member’s perspectives on onboarding new hires here. Also, visit the Onboarding topic center for best practices on effectively onboarding new sales talent.

January 21, 2013

Why Should Customers Buy From You?

In July of 2012, SEC launched the Challenger Workshop Series to help members begin building an organizational capability to develop and support Challenger behaviors within their companies. One of the workshops in this series, An Introduction to Challenger Messaging, focuses on arming attendees from members’ sales and marketing functions to create a scalable commercial insight generation capability for equipping reps with the insight necessary to effectively challenge customer thinking and shape the nature of their demand.

In July of 2012, SEC launched the Challenger Workshop Series to help members begin building an organizational capability to develop and support Challenger behaviors within their companies. One of the workshops in this series, An Introduction to Challenger Messaging, focuses on arming attendees from members’ sales and marketing functions to create a scalable commercial insight generation capability for equipping reps with the insight necessary to effectively challenge customer thinking and shape the nature of their demand.

But, it will come as no surprise that developing such an organizational capability is far from easy. Before companies can even begin thinking about moving in that direction, they need to prove they can first develop effective commercial insight. This means creating and piloting a proper commercial teaching pitch that delivers insight in a way that not only scales across customers, but also drives action and reframes customers’ assumptions.

The first and often largest challenge we see organizations encounter when creating their first insight-based pitch deck is identifying their underappreciated, unique strengths in the market that will lead to them as the only supplier positioned to best fulfill customers’ newly taught needs.

Exploring unique differentiators—identifying what they are, and what they aren’t—is one of the first exercises we work with members on during the Challenger Messaging Workshop. In our research over the years here at SEC, we’ve identified several ways the best companies approach distinguishing their differentiators and answering the age old question, “Why should customers buy from us?”

One of these best practices comes from Dow Chemical, where they developed a customer outlier analysis to arrive at their unique strengths. To pinpoint what set their company apart in the market place, Dow took a three-step approach:

Ascertain Relative Performance on Loyalty Driver Survey—Using the results from an existing customer satisfaction and loyalty survey, Dow captured customer opinions on its performance relative to the competition to determine where they had distinct performance advantages.

Segment Customers by Loyalty Drivers—Dow used survey responses to segment customers by similar needs and loyalty drivers to identify large groups of like-minded customers.

Conduct Outlier Analysis—Dow explored variations within the needs-based segments to identify the capabilities that had been highly valued by its most progressive customers, but had not yet been appreciated by other customers in each segment.

So how does your sales organization go about identifying its unique differentiators and developing commercial insight?

SEC Members, to learn more about Dow Chemical’s Customer Outlier Analysis make sure to read the best practice and visit the Identify Your Underappreciated, Unique Strengths resource center. Also consider registering up to three of your colleagues from sales leadership, sales enablement, marketing and/or product for our next Challenger Messaging workshop.

January 15, 2013

How to ID Non-Challenger Behaviors

“How will I know when someone isn’t being a Challenger?”

“How will I know when someone isn’t being a Challenger?”

“You’ll just know.”

Not the response we want to be giving a front line sales manager to that question. If there’s one thing you know (and we’ve worked to help you with at the SEC), is that we need to help managers identify and coach to the right sales behaviors and skills. This help comes in the form of education, coaching tools, questions to be asking, planning guides, and so on. All tools we need to produce.

But, if there is one thing we’ve learned over the course of helping member organizations instill Challenger behaviors, is that the identification of poor Challenger skills has been highly elusive. For many managers, it is easier said than done to spot the “wrong” sales behavior.

Recently, as part of our workshop series on Challenger Skill Adoption, the SEC research team tackled this gap. It’s a new coaching tool, a tool meant to spot those ineffective behaviors, titled the “Ineffective Challenger Behaviors Heatmap”. This tool helps sales managers identify when a rep is heading off track (or has completely derailed). Here’s how the heatmap works:

We start the typical customer buying process and align ineffective teaching, tailoring, and taking control behaviors to each stage

There are three levels of “heat”’ on the map—colored by the frequency of ineffective behaviors we tend to see in these areas—most common, somewhat common and least common.

For example, let’s say the customer is in the “define needs” stage of their buying process. As a manager, I will look in that stage of the map when prepping to coach a sales rep. And, let’s say the greatest opportunity for improvement based on previous coaching conversations is in the “taking control” skill. I can see in the map that the most common ineffective behavior is that the rep “acquiesces if a customer does not attach to an insight immediately, often resorting to features/benefits”. I can also see the one of the least common behaviors is the rep “agrees to almost everything the customer proposes before pressure testing their assumptions”.

So, for a manager if I see and hear these behaviors during the rep’s interaction with the customer I now know, without a doubt, that I’ve spotted a skill gap in “taking control”. This is what “wrong” looks and sounds like. Now that I’ve identified this as a manager, I can take corrective action.

So now, if a sales manager asks: “How will I know when someone isn’t being a Challenger?”

We won’t respond: “You’ll just know.”

We will respond: “Here, this will guide you to clearly identify when someone isn’t using Challenger behaviors with a customer.”

SEC Members, you can get a deeper explanation and dive into this tool, among other Challenger skill adoption tools by registering for one of SEC’s upcoming Challenger Skill Adoption Workshops.

5 Ways to Avoid a Price-Driven Sale

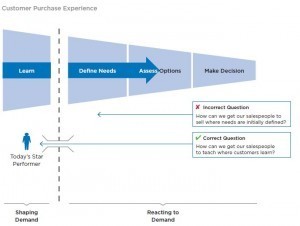

Customers are 57% through their buying process before they seek engagement with suppliers (see chart below). Think about that for a moment. Customers are doing a lot more buying before we have the opportunity to sell.

In fact, many members tell us that customers want to engage with us only when they’re ready to talk about one thing—price—with many more opportunities going out to bid. And a traditional, solutions-selling approach is leading us right into this procurement trap.

In fact, many members tell us that customers want to engage with us only when they’re ready to talk about one thing—price—with many more opportunities going out to bid. And a traditional, solutions-selling approach is leading us right into this procurement trap.

We’ve found that organizations face certain barriers when responding to this dynamic. In other words, there are landmines on the path out of RFP-land. These include:

Landmine #1: Reps cannot (or will not) engage customers earlier in their buying process

Much of the guidance we give salespeople is geared toward indentifying customers/prospects after they have defined their needs, have budget allocated, and a clearly defined timeline to make a decision. Unfortunately, that’s guiding reps to opportunities at the tip of that blue arrow.

At the same time, customers are engaging in new forms of learning—accessing information online and within social networks. This offers a new opportunity to engage customers; however, many sales organizations fail to capitalize on it.

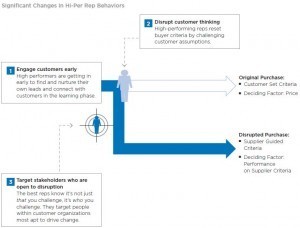

Leading companies are enabling their salespeople to engage customers much earlier in their buying process—even before the buying process begins—by developing insights to share as well as the channels through which to share this insight. The goal here isn’t necessarily selling—but rather networking and influencing.

Learn more on how the best companies engage customers earlier in the sales cycle.

Landmine #2: Reps are ill equipped to disrupt the customer’s internal decision making process—instead they’re too reactive or product-oriented, leading to cost-focused conversations

Existing sales collateral/presentations tend to focus on supplier information—confirming what the customer already knows about our products, services, and solutions. This hinders our ability to clearly differentiate ourselves from our competition, leading to the price-focused conversations we strive to avoid.

Leading companies are developing messages that focus on customer-focused insight that is purposefully designed to disrupt the customer’s status quo. They seek to enable their salespeople to, appropriately, demonstrate where the customer/prospect is doing things wrong, and where they can improve.

Learn more on how to develop a world-class commercial teaching message.

Landmine #3: Reps engage the wrong people at the account/opportunity, hurting conversion rates and account growth

Reps naturally seek to engage with senior decision makers—however, with the rise of the “consensus buy” (i.e., decision makers requiring broad support), reps need to engage lower level stakeholders to get a deal done.

Many reps struggle here to engage the right stakeholders to focus on and they end up wasting time with friendly contacts who actually don’t do anything to help.

Leading organizations focus their account planning methodology to enable their reps to identify “Mobilizers”—those stakeholders, regardless of level, who can rally the internal organization around our value proposition.

Read more about Mobilizers and download the Challenger Account Plan.

Landmine #4: Your sales organization isn’t set up to support meaningful execution of your sales strategy

Sales executives want an organization that is able to translate strategy into business results. However, sales strategy needs to evolve in light of changing customer buying behavior and many executives question whether their organization is prepared to adapt (Note—this is similar to the transition from product- to solutions-selling we saw 10–15 years ago).

Leading organizations seek to understand the changes and investments that need to be made to increase rep engagement and performance. The SEC is currently in the process of analyzing the key drivers of successful sales transformations, with results to be published in early 2013.

Read the early findings from the study here, Driving Effective Sales Transformations.

Landmine #5: Sales training is engineered to develop skills rather than change behavior

Many organizations test for skill acquisition after training; however, far fewer determine whether the reps change their behavior on the front-line and/or whether the training has impacted commercial outcomes.

Without ensuring behavior change happens, training impact is lost when reps go back out into the field.

Instead, leading sales organizations focus on ensuring skill adoption through structured manager-led coaching sessions as well as testing for long term behavior change through certification.

Learn more on how to get training to “stick” and help reps internalize new behaviors.

January 8, 2013

How NOT to Under- or Over-Serve Customers

Increased access to information often means customers approach sellers later in the purchase process. To avoid price negotiations, sellers must teach customers about an unknown problem or opportunity in the customer’s business that the supplier is uniquely positioned to solve.

Increased access to information often means customers approach sellers later in the purchase process. To avoid price negotiations, sellers must teach customers about an unknown problem or opportunity in the customer’s business that the supplier is uniquely positioned to solve.

In highly commoditized markets, organizations have been challenged to differentiate themselves and their products from their competition. Without clear product advantages, organizations must determine what elements of the service they provide sets them apart within the market.

In an effort to identify a differentiator within a commoditized market, DuPont conducted a survey of its customers to determine what different segments value in sales interaction. DuPont ran a conjoint analysis, which forced customers to make tradeoffs on what they would want in the purchasing process. Through the survey, DuPont learned that many of its customers did not require a face-to-face sale and were actually being over-served by the traditional deployment of field sales reps.

In fact, by surveying their customers, DuPont was able to segment customers based on their needs (cost, quality, or service) and preferences, and reevaluate the way in which they were deploying their sales force. Price sensitive customers were served primarily through inside sales. Customers that cared about price and quality, were jointly served by field and inside sales reps. Finally, customers that cared equally about price, quality, and service, DuPont utilized its field sales reps.

Based on the new allocation model and the increased utilization of Inside Sales, DuPont saw inside sales contribution to revenue triple. Additionally, revenue grew by 7% in the accounts that were transitioned from field sales to inside sales. By providing customer segments with the appropriate service, DuPont not only improved its cost-to-serve but also differentiated itself by the way it served each customer segment in a highly commoditized market space.

SEC Members, learn more about how DuPont optimized its sales force by segmenting its customers. Also, be sure to review our Channel Strategy and Management and Customer Segmentation topics for more best practices on improving customer management.

Are You a Leader?

In 2012, I interviewed many heads of sales and sales operations. Like our SEC membership, the executives I had the pleasure of speaking with, span across many industries, go-to-market strategies, and sales force sizes. After months of discussing the most pressing challenges that sales executives face today, I can’t help but wonder: what makes a head of sales a leader?

In 2012, I interviewed many heads of sales and sales operations. Like our SEC membership, the executives I had the pleasure of speaking with, span across many industries, go-to-market strategies, and sales force sizes. After months of discussing the most pressing challenges that sales executives face today, I can’t help but wonder: what makes a head of sales a leader?

As sales organizations across the board struggle to cope with changes in buyer behavior, due in part to an increase in buyers’ access to information, sales executives are focusing their efforts on driving effective sales transformation. Indeed, most heads of sales are being tasked with shifting their organization’s selling approach away from selling solutions towards insight selling. But, executing this shift is demanding more than effective management from sales executives; it requires transformational leadership.

So what’s the difference between an effective manager and a transformational leader?

James McGregor Burns first defined transformational leadership as the capacity to motivate followers to higher levels of performance. According to Burns, while transactional leaders motivate others to perform tasks by appealing to their own self-interest and offering something in return for their work (e.g. attractive sales quotas), transformational leaders are able to raise consciousness of the significance of specific outcomes (such as commercial teaching), and offer followers a purpose that goes beyond short-term goals by focusing on intrinsic needs instead.

If Burns was to look at how sales leaders today prepare to drive long-lasting change in their organizations, he would probably say that the transformational leaders will be those who are able to not only change their sales environments, but also change sales people in the process.

If you are wondering if you have what it takes to be a transformational leader, then ask yourself what transformational leadership theorists would:

Do I have Charisma? Am I a role model for my organization? Do I display convictions and a clear set of values that cause my reps to identify with me?

Do I inspire and motivate? Do I have a vision that appeals and inspires reps, and gives meaning to the tasks they perform?

Do I intellectually stimulate others? Do I change others’ assumptions and encourage creativity? Do I provide a framework for reps and managers to see how they relate to me, to the organization’s goals, and to each other?

Do I give individual/personalized attention to followers? Do I individually coach managers and reps in a way that shows them respect and highlights their contributions to the team? Do I inspire my followers to achieve higher levels of personal growth?

Share with us what you think makes for a great sales leader.

SEC Members, learn more about our newest diagnostic offering: the Sales Transformation Survey. Also, read our latest observations and hypotheses on how to drive effective sales transformation.

December 11, 2012

The Last 5 Trends Every Sales Exec Should Know for 2013

In late November, we released the first five trends of our annual “10 Trends” blog post. Thanks for sharing those as extensively as you did! And thanks to the many readers who insisted we publish these 5 more quickly. Without much fanfare, let’s dive into the remainder of the list. As usual, we look forward to your thoughts and feedback.

6. Your customer becomes your biggest competition. More specifically, your customer’s ability to learn what their business needs are, and options to act on those needs. We call this the “1 in 3” problem and here’s why: customers that are now able to learn on their own (or with a consultant’s support) are also able to arrive at a requirement set without supplier input. For example, they dictate the uptime requirements, the performance thresholds, the expected SLAs, and other criteria. They winnow a list of potential suppliers down to the top 3 that best meet these performance thresholds. Then they call you in to present. Congrats you’re in the consideration set! And so what do you do? You highlight your performance against their criteria. “Well we see that you require 95% uptime, we can deliver 98%. And we see that you need 30,000 units output, but our innovative technology delivers 33,000.” To which the customer replies, “yes, we already know that, but we only need 95% uptime and 30,000 units output, and all the companies in consideration deliver that. So……let’s talk price.” In this world, consideration equals commoditization. There are two vitally important takeaways from this trend:

First, this underscores why the Insight Selling™ approach is so important. Insights which you can teach customers are differentiated, and have the ability revise the purchase criteria, mitigating the “1 in 3” problem. I’ve discussed this in trend #1 and my colleague Brent Adamson has explored this challenge extensively here (this is another must read once you’ve finished this blog post).

Second, this highlights how the customer has taken this new information advantage and used it (as they should) to their benefit. If they can rely on social networks and third party consultants to force us into a price war, they’d be foolish not to do that. We are losing this information game to customers. The best sellers, however, are taking this information disparity right back to customers. Our data shows us that the best reps are conducting deep opportunity/account due diligence with one specific goal: learn something about customers that the customers themselves haven’t realized. This isn’t information in the public filing statement, annual review, or company website. This is information that exists in the deep inner workings of customer organizations. Information that “Talkers” dish out. Information that purchase consultants divulge. [NOTE: This is NOT unethical information or insider secrets.] It is a much deeper understanding of what’s happening in the customer business that often requires outside intervention to even realize. When this context is combined with powerful insights, customers have little choice but to at least listen and learn from suppliers. And that mitigates the “1 in 3” challenge. Sellers who choose to arbitrarily “spray” insights at customers risk harming the relationship permanently, but those who properly tailor those insights in a meaningful and economically-grounded ways will beat the “1 in 3” problem.

7. Early sales stages get an overhaul. Keeping in line with our research underlying the importance of teaching insights to customers, the sales process must evolve. Most organizations have a sales process oriented to identification of needs and alignment of solutions to those needs. Typically stages 1 and 2 are some derivative of understands needs (or, recognize needs from the buyer perspective) and qualifies opportunity (or, evaluate options from the buyer perspective). The sales activities inherent in these stages walk salespeople directly into the “1 in 3” problem articulated in trend #6, above. Why? They are engineered to sniff out and sell into established demand. These are instances where the customer has identified a need and is determining options. Creating emerging demand is the correct goal. And that happens well before the traditional stages 1 and 2. This is often considered marketing’s domain – a place where sales need not go. But increasingly, the best sellers are actively teaching where customers are passively learning.

Therefore, sales stages that support teaching (from the sales perspective) and learning (from the buyer perspective) are required. Implications for rewriting the top of funnel activities are considerable and I won’t go into much detail with this blog post. [SEC members can check out our Demand Shaping Toolkit, which compiles the best of dozens of star reps’ thoughts on early stage engagement into a comprehensive tool.] But here’s one of the most important implications: you can’t simply expect sellers to teach as an incremental stage without rewriting the understand/recognize needs stage. Why not? If you don’t rewrite that stage, sellers will regress right back to selling into the “1 in 3” problem. It’ll reinforce sales based on established demand, and as my colleague Brent Adamson has coined, “put your salespeople on a train to RFP station.” Contrary to what many believe, this is why the Insight Selling™ approach can’t simply be “overlaid” on top of existing sales methods. It requires rewriting the DNA of the sales process, most notably in the early stages, with a series of trickle-down implications throughout the remainder of the sales process. Organizations that get this right, will have to burn many (not all, but many) of the long-standing bridges of traditional solution sales techniques.

8. Identification of where customers learn. For the past year, we’ve been sharing our most recent research entitled “Getting in Early.” One of the critical questions we ask our members is this – do you know where your customers learn? Not learning about a purchase, but passively learning about new ways to manage their business. The instinctive reaction is “of course” – that is, until you really think about it. Then an unsettled feeling takes over. If you’re like most heads of sales, you and your team, likely don’t know. It’s likely some mix of social media, other peer networks, consultants, salespeople and vendors, maybe professional conferences or trade shows. The reality is that customers are constantly learning. They don’t manage their business in a static manner; a significant part of any business stakeholder’s job is to find ways to improve their business whether they’re an end-user of products or a CXO. Now let’s just assume that you have a good understanding of where customers are indeed passively learning. Do you think your salespeople are actively teaching there? Understanding where your customers learn starts with simply asking them. In the first handful of conversations, you’ll learn a tremendous amount about the information sources they trust and engage, and the multitude of sources they tune out and consider noise. You don’t need to engage your market research team to do this, at least not initially. Just ask. Then ask yourself how much permission and opportunity you’re affording your sales force to be part of those conversations.

9. Big data exposes a significant talent gap. At CEB we are fortunate to have a strong cross-functional perspective on what the best companies do. Our IT practice has intensively studied the promise of big data, and recognized that it has been met with an equally large degree of paralysis and low ROI. As our CEO, Tom Monahan, said in a recent interview with Consulting Magazine, “Companies’ love affair with big data has proven fickle. It’s no coincidence that the organizations with the biggest IT and analytics budgets over the last five years are the ones that have gotten into the most trouble.” The amount of big data facing nearly any function – even sales – has placed a higher cognitive burden on all those who use and rely upon this data. This includes sales operations teams, managers, and even sales professionals. The problem is that few have the skills to understand what data truly suggests and how to take action on that data. I had an interesting conversation with a Head of Sales from a major electronics company earlier this year. His team sells into big box retailers (the CPG world will know this problem all too well, though it applies more broadly). He said that the influx of data his team was now able to share with their retail channel partners was absolutely overwhelming. Sales conversations had evolved into data dumps, where account managers basically handed over a giant report to retail partners. The partners expected this, the account managers accommodated. What was entirely lost was the story within the data, and the implications for the retailer – and ultimately the value prop of this electronics company. Data is not insight, nor is insight merely data. The best companies will invest in the proper capabilities for interpreting big data, making sense of the numbers, and providing clear action steps. This doesn’t mean all sales professionals or heads of sales ops will need these data interpretation skills, but it does mean that individuals with this skill set are either hired or this capability is outsourced. As sales analytics gains moment, this will become increasingly important for the sales management function.

10. Personal rep branding is embraced. Admittedly social selling has become all the rage, and having devoted a significant amount of time and energy to the topic through 2011 and early 2012, we’d like to think we helped accelerate this trend. While individual reps are starting to embody social selling, organizations are apprehensive to embrace the notion that reps can, and even should, have their own personal brand in their markets. Social media provides a hugely powerful platform for accessing customers as they learn. Companies like IBM have been lead-steerers for the rest of the sales community time and time again – and their work in the social selling space is no different. They’ve implemented an approach where messages are pre-built and scaled for use in social media by marketing teams, but individual reps broadcast these messages to the market in such a way that identity and personal brand still matter. This is just the start however. Organizations will invest in building rep competency for selling in through social media and other highly-networked channels. While not perfect, metrics such as Klout score (a measure of social media influence) will start to gain momentum in dashboards. In fact, organizations like Network Hardware Resale are using Klout scores and other metrics to allocate territory based on social media proximity. It’s a fascinating idea – one that is likely years off for many companies – but underscores the importance of sellers having access to customers as they learn, yet again.

This rounds out our 10 trends for 2013. Thanks for the engaging conversation, the Tweets, the linkbacks, and sharing your thoughts. We hope all our readers have a success close to the calendar year, and Happy Holidays.

Follow the SEC on Twitter @CEB_SEC

Follow Nick Toman on Twitter @nick_toman

Brent Adamson's Blog

- Brent Adamson's profile

- 9 followers