Brent Adamson's Blog, page 15

March 11, 2013

Retaining High Quality Sales Talent in Asia

This is a guest post by Akshay Chopra of the CEB Asia Sales Executive Council, our sister program that equips Asia-focused sales leaders and their teams with deep insight and actionable, market-relevant solutions needed to transform their Asia sales operations. To learn more, contact us at CEB_Asia_Sales@executiveboard.com.

“We really need to upskill our China Sales team…,” the APAC Sales Leader for a European Chemicals company tells us, “…but how can we do that when we have a new team every three years?”

This is a story often repeated by many Heads of Sales across industries in Asia. In a selling environment that seems to double in competitiveness and complexity every six months, companies witness high attrition rates, requiring sales leaders to be constantly in a “hire and upskill” mode.

The average approach: unsustainable price wars for talent

In a bid to attract and retain top sales talent, companies have traditionally relied on compensation as a key lever. In fact, when compared to the global average, salespeople in Asia are far more confident about their prospects in the job market, and command higher ‘switching premiums’.

That said, a compensation-driven strategy is unsustainable in the long-term. Sales leaders still struggle to retain their best salespeople with increments and counteroffers, as salary levels continue to rise across the board. About 50% of sales leaders we interviewed in Asia are stuck in this spiral.

Growth opportunity: a step in the right direction, but not quite there

In response, companies are beginning to explore other talent drivers—most notably, focusing on professional growth and development. In fact, our data shows that while compensation is table stakes to talent attraction, professional growth and development is key to their retention.

However, many sales leaders misinterpret this aspiration, confusing the need for growth with the lure of ‘titles’, resulting in empty promotions and fancy titles. And, while this tactic works in the short-term, salespeople soon realize their new roles come with little increased responsibility.

What the best sales organizations have learned about retaining salespeople in Asia

The most progressive sales organizations have been able to pinpoint the key levers for retaining their best salespeople. It is closely related to growth and development, but very different from title changes and frequent promotions—rather, it’s the degree to which salespeople consider their manager a good coach and steward of their career. But as we all know, good coaching is often hard to come by.

Sales managers: the solution, but also the weakest link

Sales managers are prone to the ‘great salesperson but bad coach’ syndrome, often confusing managing with coaching, and parachuting in to save deals than developing long-term salespeople skills.

In a recent survey, we asked nearly 3,000 salespeople in Asia to rate how satisfied they were with their managers, on 15 parameters of coaching and manager-led development. Across each of the 15 parameters, sales managers in Asia scored the lowest globally (see graphic below). In fact, nearly 70% of salespeople in Asia felt their managers were not effective at key coaching activities.

Through our work with the most progressive companies in Asia, we’ve seen the key lies in reinforcing coaching with a disciplined framework on how, whom, and on what, to coach. For, the effects of high-quality coaching are felt beyond increased productivity; it also improves sales force retention.

Through our work with the most progressive companies in Asia, we’ve seen the key lies in reinforcing coaching with a disciplined framework on how, whom, and on what, to coach. For, the effects of high-quality coaching are felt beyond increased productivity; it also improves sales force retention.

March 5, 2013

Why Solution Sales is Fading Away

For the past twenty or so years, many companies have pursued a solution sales strategy. However, a growing number have found this approach to be unsustainable.

This article will explain why solution sales was developed and its limitations, the reason for its demise, and finally how to thrive in the post-solution sales environment.

How Solution Sales Became Our Reality

There are two primary reasons why solution sales came about.

First, in order to prevent the commoditization of our products and services, we proactively sought to address larger and more complex needs with customers. That way, we could sell larger deals and maintain or grow margins.

Second, our customers pulled us in this direction. Companies in the mid-1990s began to downsize and shed capabilities that they felt they could more effectively and economically buy in the marketplace. As a result, our customers became increasingly reliant upon their suppliers’ expertise.

The Limits of the Solution Sales Model

When companies began developing and executing a solution sales approach, sales leaders realized that this approach faced three major constraints:

1) Limit on customers’ time—the amount of time needed from the customer during the sales process grew dramatically. This led to what is commonly known now as “solutions fatigue,” with customer stakeholders increasingly intolerant of long, drawn out open-ended needs analysis meetings.

(For your key accounts, this type of commitment is still necessary and even suggested. See how Cargill developed a structured approach to their customer-facing planning meetings.)

2) Limit on the capabilities of the sales force to execute—solution sales required a new set of skills; foremost the ability, in the moment, to diagnose deeper, more complex customer problems and to develop customized solutions to address them. The result of this is what you see in the Figure below, which compares sales force performance in a low-complexity environment (left) with performance in a solution sales environment (right). Here you see that the gap between high-performing and core-performing reps widens dramatically when moving to a solution sales model, where a shrinking percentage of the sales force hits their goal.

3) Limit on the abilities of the organization to deliver—lastly, allowing a sales rep to create customized solutions for individual customers erodes margin and puts severe strain on the production side of the company. The result is lower profitability and dissatisfied customers—the direct opposite of the intent of solution sales.

Reasons for Demise

In addition to these limitations, two new customer-oriented dynamics are in play that, when put together, eliminate the solution sales approach.

1) Customer access to supplier information—with the rise of the internet, as well as the ability to connect via social media, customers have the ability to learn more on their own. In fact, they’re now able to access information that they used to rely on our sales people for.

2) Professionalization of Procurement—procurement is rapidly developing from a cost-cutting function, to a value-creation one. While that is a good thing for sales, procurement is now actively trying to disintermediate the customer-supplier relationship. In other words, they want to break the relationships that their company has with suppliers to ensure that their company is getting the best value in the marketplace.

How to Thrive in the Post-Solution Sales Environment

It’s ok to develop complex solutions to offer customers. In fact, it’s the best way to grow business with customers in a sustainable, profitable way. However, they need to be sold in the right way.

When we analyzed 5000 B2B customers, we found the single biggest opportunity we have is using the sales moment not to diagnose, but to teach customers something new about their business, and ways in which we can uniquely help them. It’s a much more proactive, customer-friendly approach that, if done correctly, leads the customer to the solutions only you can offer.

Instead of relying upon the sales force to execute on this alone, I see sales, marketing, product and other functions joining forces at leading companies to build these insights. These groups need to collaborate in order to build messages for sales people to use, that get customers to think differently about the unique components of your offerings.

Concluding thoughts

Solution sales has come and gone. Now companies need to enable their reps and account managers to sell these complex solutions differently, more effectively—the way, frankly, that customers want to buy. The good news here is that getting this right means you’re going to make it easier for your reps, not harder, even if your products and solutions are getting more complex.

SEC Members, visit the Challenger Selling topic center to learn more about how to lead with insight and challenge customer assumptions. Also read the Ten Trends Every Sales Exec Must Know For 2013.

March 4, 2013

3 Steps to Becoming a Challenger Organization

As David Bowie so eloquently put – “Ch-ch-ch-ch-Changes”. Sums up the world of selling pretty well these days, doesn’t it? In fact, it also sums up the world of customer buying pretty well too. Which is why, we, in Sales, are going through some changes. Certainly, customer buying has fundamentally changed: as they are increasingly engaging us as late as they possibly can.

As David Bowie so eloquently put – “Ch-ch-ch-ch-Changes”. Sums up the world of selling pretty well these days, doesn’t it? In fact, it also sums up the world of customer buying pretty well too. Which is why, we, in Sales, are going through some changes. Certainly, customer buying has fundamentally changed: as they are increasingly engaging us as late as they possibly can.

Our reaction in this more commoditized, price driven space, cannot simply be attempting to differentiate on price. In this world, we’ve seen Challengers and the Commercial Insight that they bring to sales conversation be the critical market differentiator; which is why so many of you have decided to go down the Challenger path or still look at the possibility of it. This is also another major change, in fact, a critical change in the approach of the entire commercial organization.

How can we effectively begin to change into a Challenger organization? In working with a variety of member organizations, we’ve seen a pretty typical process play out. Becoming a Challenger Commercial Organization occurs in three steps:

Pilot Challenger for proof points

Broaden Challenger adoption

Embed Challenger as a capability

For each of these three steps, we need to think about six critical organizational capabilities throughout. Here are those capabilities:

Positioning—the focus here is identifying your unique strengths, creating Commercial Insight and institutionalizing this for the long term

Demand Generation—as it sounds, how does the commercial organization create demand in the market (all three steps are marketing led)

Sales Messaging—here, it’s about enabling the sales organization and those in the field to have a teaching conversation with customers and prospects

Talent Management—here’s the skill and behavior development, i.e., training and coaching

Sales Enablement—ensuring the sales tools and processes align with the Challenger approach

Change Management—since this is a long-term shift and takes time, this last step is critical. We’ve got to own it as sales leaders. We’ve got to show the successes and wins that this new approach has created. Some of our insights might not be as strong as we first thought, so we might need to refine and change our approach.

It’s a lot to think about. It’s a lot to manage. It’s a BIG shift in your commercial organization; it truly is a journey. To help you, the SEC is here to support you. And in fact, this year, we have put all of this together into a Challenger Commercial Roadmap, and you also have the opportunity to take this as a diagnostic to help give you specific guidance, based on your situation.

SEC Members, register for one of the upcoming workshops on Challenger Messaging and Challenger Skills Adoption. Also, visit the topic center to learn more about the Challenger Selling.

February 26, 2013

Your Best Reps Are Leaving

It is well known that the costs of hiring, training, coaching, and compensating new employees are high. According to our 2010 Sales and Training benchmarks, companies spend on average USD 3,400 per year on training reps. However, due to poor talent acquisition strategies, the return on this investment is not always realized, as some employees choose to leave before they are fully on-boarded.

It is well known that the costs of hiring, training, coaching, and compensating new employees are high. According to our 2010 Sales and Training benchmarks, companies spend on average USD 3,400 per year on training reps. However, due to poor talent acquisition strategies, the return on this investment is not always realized, as some employees choose to leave before they are fully on-boarded.

Finding new talent is expensive and time consuming, as new hires receive on average 149 hours of training per year (three times more than experienced reps). Therefore, it is important that sales organizations not only maintain high retention rates, but also hire the right people from the start.

SEC recently analyzed data from the Corporate Leadership Council’s global panel survey, which studied trends in employee engagement, job satisfaction, and recruiting from the last quarter. When we looked at survey responses from sales reps across the globe, we uncovered two interesting trends:

Challenger reps claim to be “actively” looking for new jobs at a higher rate than non-Challenger reps, including other non-Challenger high performers, and core reps.

Core reps and non-Challenger reps hunt for new jobs by sending out their information and calling organizations regarding openings. In contrast, Challenger reps indicate they are looking for other jobs, but tend to not be the individuals who will actively pick up the phone and call your organization inquiring about opportunities available.

Thus, the high-potential employees that your organization wants to attract, are most likely not the ones making themselves available to you. This means that you have to actively seek these individuals out, and engage them whenever possible.

Across 2013, SEC will follow this trend and study which sales environments and culture attract and retain Challenger reps. SEC members, read more about how to hire the right people for your organization and download the interview guide for hiring Challenger reps.

February 24, 2013

Choosing the Right Sales Structure

In today’s complex world of sales where customer buying behavior is becoming increasingly sophisticated, sales leaders are being forced to transform how they approach managing their sales organizations in order to achieve desired business results. One of the many challenging tasks these leaders face is allocating resources across geographies to meet evolving business and customer needs.

In today’s complex world of sales where customer buying behavior is becoming increasingly sophisticated, sales leaders are being forced to transform how they approach managing their sales organizations in order to achieve desired business results. One of the many challenging tasks these leaders face is allocating resources across geographies to meet evolving business and customer needs.

Done right, a well-designed sales organization structure can help reduce costs, drive efficiencies, and increase customer loyalty. But in the current sales environment, the right answer is often a moving target as various sales structures have their own set of advantages and disadvantages. Therefore it’s no surprise that making such a decision is far from easy.

To help make these decisions easier for sales leaders, SEC benchmarked the sales organizational structures of member companies across industries and geographies to assess how the best companies are approaching this challenge. Though we observed a series of interesting trends during this initiative, one of the most important things we learned is that the best companies assess the trade-offs involved in implementing different sales structures to achieve desired results. When selecting an organizational structure, SEC finds that the choice boils down to one of the following consideration sets:

Product vs. Geography vs. Customer-Focused Structure: Sales organizations have traditionally built their structure to map company offerings or regions served. That said, rising buyer sophistication coupled with growing requirements to build consensus in the customer organization is driving the need to be more customer-focused. In particular, the key benefit of a geography- or product-focused structure—deep expertise of reps—is eroding as customers become smarter and complete a lot of the due diligence on their own, rather than engaging suppliers to do this.

Centralized vs. Decentralized vs. Matrix Structure: The choice between centralized and decentralized structures was an either/or choice until the arrival of matrix structures that brought the best of both worlds. Specifically, it allowed companies to operate in a truly global environment, yet at the same time maintain their regional responsiveness. That said, adoption of matrix structures has been slow given the added complexity it brings to the management of resources, with many sales organizations choosing to remain centralized or decentralized in structure.

Vertical vs. Horizontal Structure: The emphasis on vertical (or functional) and horizontal (or business process) orientation of the sales organization is based on the relative importance of cross-functional coordination of activities for the achievement of customer and business goals. The choice of structure ultimately establishes the primary grouping of work-processes, skills, and knowledge used to drive sales. That said, many companies find a carefully balanced combination of the two structures yields greatest success.

Has your sales organization restructured recently or do you plan to restructure soon? What changes have you seen or hope to see as a part of restructuring?

SEC Members, to learn more about the organizing principles, the benefits and drawbacks, and the best fit characteristics of each of these structures, make sure to visit our new resource center on how to Design an Effective Organizational Structure.

February 19, 2013

Who Reps Really Listen to

The traditional method of driving change in an organization is the top-down approach—senior leadership sets the vision, and directions are cascaded down to the field. While it’s important to have strong leadership and vision in place, there’s only one problem—when it comes to behavior change, employees look to their peers more than they look to their superiors.

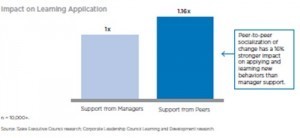

CEB’s Corporate Leadership Council conducted a study to understand what enables employees to transfer knowledge they learn in the classroom into on-the-job performance (they call that “learning application). In that study, they found that support from peers has a 16% greater impact on learning application than support from managers. In other words—reps look to cues from their peers to help them apply (or not apply) new behaviors/strategies on-the-job.

CEB’s Corporate Leadership Council conducted a study to understand what enables employees to transfer knowledge they learn in the classroom into on-the-job performance (they call that “learning application). In that study, they found that support from peers has a 16% greater impact on learning application than support from managers. In other words—reps look to cues from their peers to help them apply (or not apply) new behaviors/strategies on-the-job.

While 16% may not seem like that big of a number, most organizations focus entirely on manager support. Yet how many of us have systematic methods of tapping into peer support for any given initiative?

Now, you may be thinking “how systematically can you tap into informal conversations that happen between reps?” That’s a fair question. Leading edge companies have taught us to think very differently about the peer network, and they tell us there are a few ways that you can better tap into that key source of influence.

Now, you may be thinking “how systematically can you tap into informal conversations that happen between reps?” That’s a fair question. Leading edge companies have taught us to think very differently about the peer network, and they tell us there are a few ways that you can better tap into that key source of influence.

Ownership vs. buy-in: This is probably the most important of the keys to driving change. When people are included in a process, they feel ownership. If people are told what to do, they are inherently skeptical. So stop trying to create buy-in, and start trying to create ownership. But don’t just look at creating ownership of the solution, give reps ownership of the problem. Many companies will build new tools/technologies/platforms/ methodologies and test them with a select group of reps after they’ve been built. Few companies use reps from the onset—to understand why behaviors need to change, what the solution should be, and how to communicate it. Let them own it, and they’ll be more likely to apply it.

Give them something to talk about, in their terms: When companies build “buy-in” for change, it’s usually in practical terms. Here’s what it means for the company. Here’s what it means for your sales numbers. Here’s what you can do to make more money. The problem is, that’s not how sales reps talk, nor is that why people change. Reps don’t talk to each other about their paychecks, they talk in emotions. “How is my customer going to react to this?”, “Is this going to damage the relationship with my customer?”, “What happens if I can’t learn these new skills?”, “What might this mean for my job long term?”. You have to show them that the pain of same is much greater than the pain of change. SEC Members—use our Challenger Change Campaign Framework to build a change campaign that speaks to reps on their terms.

Understand where the influence lies (or, through whom the influence flows): Ask your sales managers who is the flag-bearer or standard-bearer of their team, and they’ll easily point you to one or two individuals that are the leaders of the team. Everyone else looks to them for social cues, and if that person is behind an initiative, the rest tend to follow. They are usually above-average performers, but not always the top performers on a team. These are critical people to create ownership with, as what they say and do will ultimately impact others on their team—for good and for bad.

Use market forces to create demand for change: “The forced march doesn’t get anyone excited. Tell someone they have to do something, they resist. Tell them they can’t have something, and they suddenly want it.” Several members, including ADP and Gen-i have realized that exclusivity or feeling left out breeds interest. Use the folks in #3 above in the “early adopter” phase—they’ll create some early wins and create momentum for new behaviors/initiatives.

SEC Members—we address these concepts, including exploring channels for how to tap into the peer influence, as part of our Challenger Skill Adoption workshop.

Have you had any initiatives that really captured the attention and buzz of the peer network (for good or for bad)? What do you think drove the engagement of the peer-to-peer network?

SEC Members, to learn more, review the key findings from the study and listen to the webinar replay.

February 18, 2013

The Yin and Yang of Challenger Selling

Commercial leaders often ask me how they should be thinking about developing the Challenger approach within their organization.

Commercial leaders often ask me how they should be thinking about developing the Challenger approach within their organization.

As many of you know, we’ve analyzed tens-of-thousands of sales professionals to try and get as clear a sense into what is working to drive growth with customers—even in a more complex (and difficult) buying environment. And we concluded that there is an approach that is outperforming others—which we’ve come to call the Challenger Sales Model.

So when asked how to develop this approach within their business, I say to our member executives that they need to think across two separate but reinforcing dimensions:

(1) The first is skill building. Challenger selling is likely a vast departure from the way that many sales people are selling right now. So before we ask sales people to sell in a different way, we need to make sure that we’re developing the right sets of skills to enable that type of change to happen.

A key to getting this right—or at least giving yourself a better shot at success—is by making reps consciously incompetent. In other words, showing them, specifically, the skills and capabilities that they need to develop or improve to continue to be an effective sales professional. By doing this, you create a (hopefully constructive) sense of fear – that helps get buy in for change.

SEC Members, register for an upcoming workshop on Challenger Skill Adoption.

That said, skill building is only one aspect. Because you still haven’t equipped them with the messages they need to challenge.

(2) So the second dimension is message building. Developing the story or stories that reps need to be using to challenge your customers’ thinking in a way that leads back to your unique differentiators.

This is especially critical as our customers proactively try to commoditize us by either putting our business out to bid or at least pitting us against our closest competitors. Sales messages that are working today are designed to disrupt your customers’ buying process—to get them to think differently about the way that they’re approaching a problem or even educating them on a problem that they didn’t even know existed.

SEC Members, register for an upcoming workshop on Challenger Messaging.

In my conversations with member executives, this is what I like to call the yin and yang of Challenger selling. Developing skills without messages is akin to having a really talent player on your sports team, but you don’t give them a playbook and they end up running around unproductively. On the other hand, developing messages without developing the right skills means that you have given someone a tool who doesn’t know how to use it.

So as you think about how you incorporate Challenger in the way you go-to-market—think across these two dimensions. And make sure that you are focusing on both—skill building for competence, and message building for execution.

One more note—while I didn’t mention this above, the front-line sales manager is a critical element to successfully adopting a challenger sales approach. They are the people who will ultimately work to reinforce and coach these new behaviors—OR they won’t, and your ROI will suffer tremendously. So sales managers, as much as sales people, need to be included in the execution of this approach.

SEC Members, also visit the Challenger Rep Starter Kit that houses resources on assessing, equipping, developing, hiring, and sustaining Challengers. To learn more, also register for our upcoming workshops and webinars on Challenger Skills Adoption and Challenger Messaging.

February 12, 2013

Is Selling Human?

Daniel Pink, the best-selling author of Drive, thinks it is. In his new book To Sell Is Human, Daniel Pink argues that in today’s innovation-driven and interconnected world, all of us (including those of us who do not sell for a living) are in fact in sales. According to Pink, one’s ability to move people or to influence them towards a particular outcome is becoming increasingly critical.

Daniel Pink, the best-selling author of Drive, thinks it is. In his new book To Sell Is Human, Daniel Pink argues that in today’s innovation-driven and interconnected world, all of us (including those of us who do not sell for a living) are in fact in sales. According to Pink, one’s ability to move people or to influence them towards a particular outcome is becoming increasingly critical.

So what can B2B sellers learn from Pink’s advice to all of us who are doing sales every day whether we know it or not?

Acknowledging that the world of sales is changing, from caveat emptor (buyer beware) to caveat venditor (seller beware), Pink says that the ABC’s of selling must also change from “Always be Closing” to:

Attunement—the ability to bring one’s actions and outlook into harmony with others and with the context you’re in.

Buoyancy—the ability to face rejection through grittiness and positive outlook.

Clarity—the ability to move others through surfacing problems, rather than solving them.

Indeed, according to Pink, sellers today are less dependent on reductive, algorithmic, problem solving skills, and instead they are being required to be more creative, heuristic, and problem-finding. He argues that while in the past sellers’ main challenge was accessing the right information; today the goal has become effectively curating information. SEC research has similarly shown how information proliferation is rendering Solution Selling obsolete and increasing the importance of commercial teaching.

Some interesting advice Pink gives to those trying to move others include the following:

Be less extroverted—the most effective sellers are somewhere in the middle on the spectrum between extroverted and introverted. The evidence that Pink reviewed shows that being too extroverted can actually impair performance.

Ask yourself questions—when trying to pump yourself for a meeting with a customer, try asking yourself questions (e.g. how will I win this deal?) instead of telling yourself how good you are. Pink found that interrogative-self-talk is more effective at improving performance since it elicits answers and therefore surfaces winning strategies.

Share with us what you think about Pink’s new selling ABCs, and what you think is universal about selling?

SEC Members, learn what the SEC thinks are the 10 Trends Every Sales Exec Must Know for 2013.

February 11, 2013

What the Best Sales Organizations Have in Common

Do you find yourself wondering if your organization’s sales processes effectively support and drive sales performance, or if your sales talent is appropriately skilled to adapt to changing customer demands? While the answers to these questions seem simple, an increasingly complex sales environment requires organizations to move beyond simply measuring sales results and market share, and instead, focus on measuring organizational capabilities. However, most organizations find it difficult to identify and measure the right capabilities, often using industry standards as reference points.

To help companies gauge how they measure up to the drivers of world-class behavior across sales organizations, SEC used its research across 1000+ companies to define 24 key attributes in the Anatomy of World-Class Sales Organizations.

This diagnostic tool helps organizations benchmark their organizational capabilities and identify gap areas in 4 key sections—Strategy and Culture, Customer Management, Talent Management, and Sales Operations. In addition, to help members interpret world-class correctly, each of these areas consist of key attribute descriptions that distinguish world-class practice from standard practice. They are also paired with best practice case studies and tools to help guide sales organizations towards world-class executions.

This diagnostic tool helps organizations benchmark their organizational capabilities and identify gap areas in 4 key sections—Strategy and Culture, Customer Management, Talent Management, and Sales Operations. In addition, to help members interpret world-class correctly, each of these areas consist of key attribute descriptions that distinguish world-class practice from standard practice. They are also paired with best practice case studies and tools to help guide sales organizations towards world-class executions.

So, is your sales organization world-class?

SEC Members, use the new Anatomy of a World-Class Sales Organization v6.0, or listen to our webinar to understand how and why we updated the Anatomy tool.

February 5, 2013

How to Create Commercial Insights

In recent member conversations about beginning or continuing the Challenger journey a common theme continues to present: Where do I begin? Do I teach reps Challenger skills first? Or, try to work with Marketing to find some good insights?

In recent member conversations about beginning or continuing the Challenger journey a common theme continues to present: Where do I begin? Do I teach reps Challenger skills first? Or, try to work with Marketing to find some good insights?

We recommend beginning with at least one good insight created by a cross-functional team. Commercial Teaching is important to get right, but insight should not be an individual creation. For successful scalability it must come from, and lead back to, your organization. The danger of asking reps to Challenge without furnishing them insight is a plethora of value propositions that may or may not lead back to the capabilities your organization currently possesses.

This may not be as hard as it might seem. Most involved in the commercial process recognize the value of disruptive insight and Challenger Selling, but are unsure about the best place to start a commercial transformation. Sales and Marketing are often willing to work more closely, but finding the common threads, the joint and independent responsibilities, and a roadmap to the process can become more complicated quickly.

Recently, we teamed up across our Sales and Marketing research teams to definitively outline a set of steps to create an integrated, disruptive, insight-led commercial organization. We created a roadmap through three phases of adoption and the six most critical areas to get right: Positioning, Demand Generation, Sales Messaging, Talent Management, Sales Enablement, and Change Management.

We also made it into a diagnostic so organizations can understand clearly what they have accomplished and the most effective next steps. Becoming a Challenger organization is not a short endeavor, but when customers value your insight more than anything else, and when they are already 57% of the way through their purchase process before engaging you, the supplier, it is more important than ever that Sales and Marketing are able to speak the same language, work together, and support each other effectively.

SEC Members, listen to the webinar outlining the important shifts in Sales and Marketing and the way the Challenger Organization Roadmap can help you. Also consider registering your colleagues from sales leadership, sales enablement, marketing and/or product for our next Challenger Messaging workshop.

Brent Adamson's Blog

- Brent Adamson's profile

- 9 followers