Loren C. Steffy's Blog, page 8

August 24, 2015

Is Bitcoin About to Become More Fed-like?

By Mike Cauldwell via Wikimedia Commons

Can Bitcoin retain its anarchist edge while still operating more like a central bank? Last year, I wrote about how Texas has become a hotbed of Bitcoin development.

One of the challenges the digital currency faces is how it can replace conventional central banks without adopting many of the same characteristics, which Bitcoin loyalists loathe. This week, The Economist has a piece on how Bitcoin is now at a crossroads over how the digital currency should be governed:

On August 15th two of [Bitcoin’s] main developers released a competing version of the software that powers the currency. With no easy way to resolve feuds, some are warning that this “fork” could result in a full-blown schism.

The dispute is predictably arcane. The bone of contention is the size of a “block”, the name given to the batches into which Bitcoin transactions are assembled before they are processed. Satoshi Nakamoto, the crypto-buff who created the currency before disappearing from view in 2011, limited the block size to one megabyte. That is enough to handle about 300,000 transactions per day—suitable for a currency used mainly by geeks, as Bitcoin once was, but nowhere near enough to satisfy the growth aspirations of its boosters. Conventional payment systems like Visa and MasterCard can process tens of thousands of payments per second if needed.

By how much and when to increase this limit has long been a matter of a heated debate within the Bitcoin community. Overlapping cabals of “core maintainers” and “main developers” serve as de facto keepers of the currency, especially in Mr Nakamoto’s continued absence. Now one camp wants to increase block sizes, and do it soon. Otherwise, they argue, the system could crash as it runs out of capacity as early as next year. Transactions could take hours to confirm and fees could rocket, warns Mike Hearn, a leading Bitcoin developer. “Bitcoin would survive,” he wrote in a blog post in May, “but it would have lost critical momentum.”

The rival faction, supported by other heavyweight developers, frets that rushing to increase the block size would turn Bitcoin into more of a conventional payment processor. The system currently relies on thousands of independent “nodes”, computers dotted across the world that check whether transactions are valid and keep tabs on who owns which bitcoins. Increasing the block size could make the whole edifice so unwieldy as to dissuade nodes from participating, so hastening a recent decline in users. The result would be a more centralised system, prompting angst among Bitcoin purists who fret concentration could undermine the currency.

Bitcoin at a crossroads ow.ly/RhpKg A sp

Bitcoin at a crossroads ow.ly/RhpKg A spat exposes unwieldy governance at the digital currency #bitcoin

August 12, 2015

Oil Demand Growing at Fastest Pace in Fi

Oil Demand Growing at Fastest Pace in Five Years, Says IEA http://ow.ly/QNZlO Low prices barely slowing non-OPEC production. #energy

July 23, 2015

In Remembrance: Dave Leining

The site of the explosion at BP’s Texas City refinery in 2005. The blast flattened a trailer in which Dave Leining was working and left him trapped under a pile of debris

Dave Leining died last week when his private plane crashed in the San Bernard National Wildlife Refuge south of Houston. He was 63.

I didn’t know him well. In fact, we only met in person once, when I interviewed him for my book, Drowning in Oil. But I’ve found myself thinking about that interview a lot since I first heard of his death. We sat in an office in the back of his archery shop in Santa Fe, Texas, south of Houston, as he recounted in painstaking detail his story of surviving BP’s 2005 Texas City refinery disaster and his year-long recovery from injuries he suffered that day.

I interviewed a lot of people for the book, and I had a lot of discussions about safety, but something that Leining said stood out. Speaking of the refinery, he said: “It’s a dangerous place to work, but it shouldn’t be a hazardous place to work.”

I think of that comment every time someone tries to dismiss an industrial accident as inevitable. After the Texas City refinery explosion, dozens of people in the industry told me something to the effect that “refineries are dangerous; accidents happen.” Leining’s point was that yes, refineries are inherently dangerous. But companies that don’t take the proper steps to reduce risk make them unnecessarily hazardous, too, and put workers’ lives in jeopardy as a result. Companies that operate dangerous work places have a responsibility to make safety paramount.

Leining had been in a temporary trailer, chatting in his boss’s office, when a nearby isom unit at the refinery exploded on March 23, 2005.

The blast flattened the trailer, pinning Leining under piles of debris. He was one of the lucky ones that day. He survived, although he had two broken ankles and would take almost a year to walk again. Many of his co-workers who were in the same trailer that day were killed.

In all, 15 people died in the blast and more than 170 were seriously injured.

When he had recovered, Leining returned to the refinery. It was, as they say, in his blood. His father had worked at the plant, and so had other members of his family. His wife worked there at the time of the explosion.

Leining returned because he thought he could make a difference. He wanted to help institute the changes in safety procedures to which BP said it was committed. After a few months, he quit in frustration over what he described as a dispute about some of those safety procedures.

Lening gave numerous interviews in 2010, both to mark the fifth anniversary of the refinery disaster and then, a month later, in the aftermath of BP’s Deepwater Horizon catastrophe. He didn’t do it for the attention. He did it because he knew that over time, we tend to forget the human toll of industrial accidents. And he did it because he knew that without people like him to tell his stories, change is far less likely to come to unsafe work places. He got a painful reminder of that fact two years after the explosion that almost killed him, when his cousin, Richard Leining, died in another accident at the same refinery.

Dave Leining always said he shouldn’t have survived the accident. The fact that he did, and that he was willing to talk about it, provided an important perspective on process safety. It’s true that refineries will always be dangerous places, but Dave Leining knew that there was no excuse for allowing them to be hazardous, too.

July 20, 2015

The Dangers of the Open Seas

In writing about offshore drilling over the years, I’ve always been stunned by the vagaries of maritime law. The New York Times is running a great series examining just how lawless seas can be. The first installment ran Sunday, with the series continuing this week. It’s a good and disturbing read.

July 19, 2015

Why It Will Take More Than Bass’s Billion to Fix Blue Bell

Fort Worth billionaire Sid Bass is reportedly pumping $125 million into Blue Bell Creameries, a move that will enable the iconic Texas ice cream maker to return to full production and may give Bass one-third ownership in the 108-year-old, family-run business.

Fort Worth billionaire Sid Bass is reportedly pumping $125 million into Blue Bell Creameries, a move that will enable the iconic Texas ice cream maker to return to full production and may give Bass one-third ownership in the 108-year-old, family-run business.

It may not be enough.

To fix what ails Blue Bell requires a cultural change, which is one of the greatest challenges a company can face. As I wrote in the Houston Chronicle in May, Blue Bell’s initial response to the listeria outbreak that forced it to stop production demonstrated an unwillingness to recognize the root causes of the problem. That, combined with the family-run aspect of the business, may make it extremely difficult to implement the changes the company needs to prevent the crisis from recurring, as I outline in my latest op/ed:

Sid Bass is being hailed as Blue Bell’s white knight. The Fort Worth billionaire agreed to make a “significant investment” in the iconic creamery, which has been shut down since this spring because of listeria contamination linked to three deaths and seven illnesses.

Bass tends to be a passive investor, which may not be what Blue Bell needs to fix its problems.

Without any revenue to speak of for months, Blue Bell was undoubtedly growing concerned about its future – it was becoming easy prey for vulture investors.

Enter Bass, bursting with oil billions and benevolence. He can save Blue Bell with the spare change from under his couch cushions – where he apparently found $125 million, enough to buy one-third of the company. But Texas pride and a love of ice cream only go so far.

Because Blue Bell is a private company, and Bass is a notoriously private person, we don’t know how involved he’ll be in the company’s daily operations. But we do know that Bass isn’t the sort of guy to get his hands dirty.

But if he’s really going to save Blue Bell, if he’s serious about turning the company around, a couple of things need to happen. First, he or his representative needs a seat on the board, perhaps even the chairmanship. Second, that representative needs to demand sweeping changes to Blue Bell’s safety culture, and those changes need to be closely monitored.

July 15, 2015

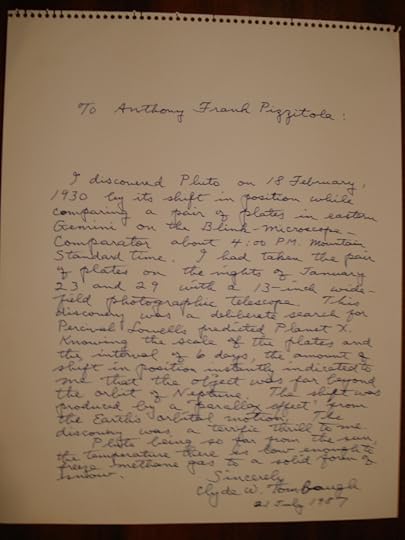

Pluto’s Discovery Described by Tombaugh in Handwritten Note

One of the most popular columns I wrote in my final year at the Houston Chronicle was about the value of Neil Armstrong’s autograph. Anthony Pizzitola, who first tipped me off to the issue, is an avid autograph collector with a particular interest people who played a role in space exploration. In light of New Horizons’ flyby of Pluto, he shared this note from Pluto discoverer Clyde Tombaugh, which he received in 1987. As you can see, it’s far more than a simple autograph.

June 29, 2015

Blowing the Whistle on the Mortgage Crisis

In Texas, we tend to think that the mortgage crisis happened somewhere else. But one of the first warnings came from a manager in the Plano-based appraisal division of Countrywide Financial. Kyle Lagow’s concerns about Countrywide’s mortgage practices eventually cost him his job and his career, and led to a federal lawsuit that resulted in a $1 billion settlement with Bank of America, which bought Countrywide in 2008.

In Texas, we tend to think that the mortgage crisis happened somewhere else. But one of the first warnings came from a manager in the Plano-based appraisal division of Countrywide Financial. Kyle Lagow’s concerns about Countrywide’s mortgage practices eventually cost him his job and his career, and led to a federal lawsuit that resulted in a $1 billion settlement with Bank of America, which bought Countrywide in 2008.

In the latest issue of Texas Monthly, I talked with Kyle about the struggles he and his family endured, and the ultimate reward he received for bringing this fraud against homebuyers and taxpayers to light.

On a weekday afternoon in late April, Kyle Lagow sits in the living room of his home in a tony north Plano neighborhood wearing a blue T-shirt and orange jogging shorts, the casual attire of someone who finds himself unwillingly unemployed. Lagow is tall, with a physique that harks back to his days playing tight end for Southern Methodist University, an avocation and a school he says he gave up on too easily. He later enrolled at the University of Mary Hardin–Baylor before giving up on that too, three hours short of an undergraduate degree in general business studies. Despite his lack of a bachelor’s degree, he was admitted to law school, but didn’t finish that either. So it’s something of a surprise that after Lagow took it upon himself ten years ago to warn people about the impending implosion of the mortgage industry, he didn’t give up, no matter how hard the industry pushed back at him.

Lagow’s strange odyssey into the mortgage crisis began in 2004, when he joined LandSafe, a Plano-based appraisal subsidiary of Countrywide Financial, then the nation’s largest mortgage lender. Lagow, who had been running his own appraisal business for fourteen years, was tasked with hiring and training appraisers to determine whether properties were worth the amount that Countrywide was lending against them.

June 25, 2015

The Eternal Driveway, Filled with Newspapers

This used to be the happiest morning of the week for him. Now, the reminder of his greatest joy only adds to my own sadness. I stare down the driveway, and it seems like a long hard road of sorrow.

He never understood days of the week really, nor could he understand the inherent uncertainty of newspaper delivery. Mondays and Tuesdays were met with confusion and disappointment. Nothing today? Why? Missed deliveries seemed to shake his faith in humanity. Why isn’t it here? Should I check again? Yet he never grew cynical. His faith in newspaper circulation remained unwavering.

Wednesday, when deliveries resumed for the week, were filled with joy, and Thursdays — ah Thursdays! — were the best of all. On Thursdays, our daily Houston Chronicle was joined by The Villager, a free-throw weekly that was a guaranteed bonus. Even if the Chronicle didn’t show up, the Villager was always there, light and tightly wrapped, as if it were made to be carried in the soft spot of his mouth. On Thursdays, he got to make a second trip down the drive. For him, double the work meant double the joy.

Wednesday, when deliveries resumed for the week, were filled with joy, and Thursdays — ah Thursdays! — were the best of all. On Thursdays, our daily Houston Chronicle was joined by The Villager, a free-throw weekly that was a guaranteed bonus. Even if the Chronicle didn’t show up, the Villager was always there, light and tightly wrapped, as if it were made to be carried in the soft spot of his mouth. On Thursdays, he got to make a second trip down the drive. For him, double the work meant double the joy.

Sometimes, he would bound down the drive, so overwhelmed by the options that he would pick up one, drop it, and pick up the other. He might repeat this ritual three or four times, unable to decide which to bring first. And if the Chronicle didn’t come on a particular Thursday, then he would make a detour on his second trip, darting for the neighbor’s drive to retrieve their Villager.

I once tried to make him put it back. He didn’t understand, dancing around me as I pointed toward the neighbors’ yard in admonishment. I pulled the paper from his mouth and tossed it back. He ran and got it again, his tail wagging so hard it slapped his sides. Over my exasperation, I heard my neighbor laughing. He’d seen the whole spectacle. Let him keep it, he said. Who could even think about impeding such happiness?

On Thursday nights, returning from his walk, he would scour the street, scooping up any Villagers that had been left in the driveway. Some people just didn’t appreciate the news the way he did.

In rain, sweltering heat, cold and ice, he found joy in the simple journey to the curb and back, and he dispatched his duties faithfully, eagerly, and yes, relentlessly.

He died on Monday morning, when no newspapers came. Now, it’s Thursday, his happiest day. I see the papers in the drive — the Chronicle and the Villager. Perhaps I’ll go get them later, but I will be walking slowly, reluctantly, where he bounded, tail wagging. When I return, the others, who never learned to retrieve, will not greet me at the door with envy or admiration (I never knew which). Perhaps, instead, I’ll leave the papers on the pavement, a monument for a great and loyal friend.

Eugene O’Neill, a Dalmatian owner, once speculated that in death, dogs would find “a Paradise where one is always young and full-bladdered; where all the day one dillies and dallies with an amorous multitude of houris, beautifully spotted; where jack rabbits that run fast but not too fast (like the houris) are as the sands of the desert; where each blissful hour is mealtime; where in long evenings there are a million fireplaces with logs forever burning, and one curls oneself up and blinks into the flames and nods and dreams, remembering the old brave days on earth, and the love of one’s Master and Mistress.”

And newspapers. Driveways filled with newspapers waiting to be brought to the porch.

May 26, 2015

How does @TheDailyShow find the perfect

How does @TheDailyShow find the perfect video clip? With the help of @RakeshAgrawal and @SnapStream http://ow.ly/Nr5JL @TexasMonthly