Carley Garner's Blog: What's new on DeCarleyTrading.com, page 37

August 9, 2017

Dukascopy TV and Commodity Broker Carley Garner talk Coffee Futures

August 8, 2017

Options Greeks and Implied Volatility now available in our free platform!

We are constantly searching for better solutions for our clients when it comes to trading platforms, features, and service. We are proud to announce that our most popular free-to-use futures and options trading platforms, the Zaner360, now offers real-time Greeks built into the quote board. Further, we are working hard with the developers to add even more improvements in the coming weeks. Stay tuned!

July 6, 2017

Cramer and DeCarley point out rangebound crude oil futures

July 5, 2017

PTMC Futures and Options Trading Platform

Cost: Starts at $50 per month and goes lower for 6-month and annual subscriptions

PTMC is a cutting-edge futures and options trading platform offering advanced customization and features. Not only is this platform extremely user-friendly but it also offers speedy market navigation through panel linking and access to  real-time news.

real-time news.

Key Benefits & Features:

● Professional charting, analytics, trading and unrivaled interface

● Basic and Smart order types

● Cluster chart and Market Profile chart

● Volume profiles, Real-time and Historical Time & Sales

● Bar Statistics, Price Statistics

● One-click trading from the Chart, Depth of Market and via Matrix panel

● Intelligent Symbol Mapping Manager for creating historical and trading links

● Platform extensions through C# API

● Expert-level analytics and trading with Option Master

● What-if analysis by time and volatility for options

● Option profiles with overlay charts (Greeks with P/L profiles)

● Level 2 Surface displays changes of all Limit orders for every price level (depend on the

depth of market)

Fully customizable and professional interface

PTMC's user-friendly interface allows the trader to customize each single panel settings as well as the whole workspace entirely. Any user can easily create trading layout according to the special requirements or wishes using a wide range of options and preferences.

● Flexible visual settings for any panels

● Dockable panels

● Two interface styles: Dark, Light

● Multiple languages

● Info bar with exchanges time, quotes, and account details

Any chart types and styles

PTMC offers a large number of standard and advanced chart types, which allow analyzing markets from different sides. So using our trading platform, traders can select:

● Time-based and Tick charts

● Renko, Kagi, Price range

● Point & Figure, Heikin Ashi, Line Break

● Cluster chart, Market Profile

● Multiple chart styles: candlestick, bar charts, area, dots, and histogram charts

Multiple symbol Overlay and price Scales

Powerful charting module provides the ability to display two and more assets in the same chart area. By adding several instruments to the existing chart, user can visually compare multiple asset classes simultaneously.

For a correct comparison of several assets, it is important to use a different price scales: absolute, relative, or logarithmic.

Order Flow Surface

A professional analytical tool which provides a comprehensive view of the Limit Orders Flow. Each change in the size of limit orders is recorded in the chart as vertical lines, allowing the trader to see big trades for buy or sell.

Basic and Smart Order Types

Through the PTMC trading platform, you can execute different basic and smart order types which may help to limit risk, boost execution, provide price improvement, allow privacy, time the market and simplify the trading process.

● Market, Limit, Stop, Stop Limit, Trailing Stop

● Market if touched, Limit if touched, Market to limit

● Trailing Stop Limit, Market-on-close, Limit-on-close

● TWAP, VWAP, Iceberg, OCO, Funari, Hidden

● GTD, GTC, IOC, AON, FOK, FAK, GTT, OPG, Day orders

Trading from the Chart, Scalper, Matrix and Market Depth

(DOM)

Chart trading mode was created for active traders who want to react quickly to ever-changing market conditions, send and change orders in a single click.

● Drag & drop order to change its price

● Open/Close position and cancel order by double click

● Visualize your exit points and set Stop Loss/Take Profit instantly

Our Market Depth provides the clear view on the exchange’s order book of resting bid and ask orders with their sizes. Using this trading tool, you can easily change trading symbols, choose order durations, change the order size, select and place order types, including Smart Orders. Through the Mouse trading mode, you can place or cancel orders in one click.

● Place, modify and cancel orders directly on the price ladder.

● Basic and Smart order types

● Default order size preference

Intelligent Symbol Mapping Manager

A professional tool that allows usage of one data feed provider while sending orders to any other broker you wish to trade with. In a nutshell, it allows you to create a link between different quote vendors and Order Management Systems as well as receive an order status. Symbol Mapping also allows automatic creature of links for option strikes of the selected instrument.

Advanced drawing tools and studies

PTMC provides a wide set of drawing tools and technical indicators that allow traders to focus on the main reversal points, gaps, trends and other price movements (60+ indicators by default). All indicators divided by several groups:

● Channels

● Moving Averages

● Oscillators

● Trend

● Volatility

● Custom indicators & scripts

Cluster Chart

This chart type provides an extended volumetric data for every single bar and for every price level, making the trading process more transparent. This creates a clear trading edge and allows you to make more precise entries.

● different data types: volume, delta, trades, bid/ask

● color schemes by volume, delta or trades

● flexible data filters

Profile Chart

Represents price data in the market profile view and allows users to analyze a number of trades and other trading activity based on time. Using this chart type, a trader can clearly see the areas where the market is traded most of the time.

● price data in the market profile view

● the most active trading zones: Point of Control, Value Area

● different color schemes: by Delta, volume or price change

Bar Statistics

Like a cluster chart, this tool provides volume data inside of each bar, showing not only total trading volume but separate volume by sell and buy sides. Additional settings allow customizing filters for calculation of specific volumes.

● shows volume, delta, bid, ask, trades in a table form

● flexible settings and data filters

Volume Profile

A professional tool which allows traders to determine the most significant. Using this functionality, users are able to analyze the distribution of total volume or distribution by volume traded at each side of the market.

● shows the distribution of trading volume by price levels

● shows buying and selling volume as well Delta

● can be placed on the right, left or both scales

● step-by-step or custom volume profile

Option Master

It’s a powerful options analytics and trading module which combines the detailed quote windows as well the ability to perform what-if analysis and evaluation of the volatility smile based on Vanna-Volga model.

● Advanced Options Modeling with What-If Analysis

● Professional Option Chains

● Volatility skew charts

● Option Greeks visualization

● Option profiles with overlay charts

Ideal environment for algo traders

Using our extension for Visual Studio you get the opportunity to work in one of the most popular development environments.

● Editor with syntax highlighting, autocomplete and Intellisense

● Debug code right from the editor

● Visualization of trading strategies testing and optimization. Manual testing mode

● Different types of data aggregation: time, ticks, range, Renko, Kagi

● Three-dimensional surface optimization

PTMC C# API

Using our API which based on C # language you get access to almost any part of the functionality of our platform:

● Positions, orders, and executions

● Trading accounts and balances

● Real-time & historical data

● User interface & Controls

● GDI drawings on charts and indicators

● Free code base for everyone

June 29, 2017

Meet Carley Garner in San Francisco at the MoneyShow!

When: August 26, 2017 @ 8:00 am

Where: San Francisco Marriot Marquis

How: Register Here: http://DeCarley.SanFranciscoMoneyShow.com (Click ATTEND FREE button in upper right corner)

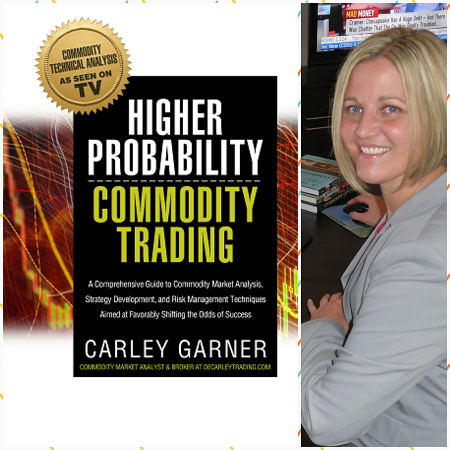

Carley will be discussing many of the topics in her latest book, Higher Probability Commodity Trading.

June 9, 2017

How to choose the right futures trading platform

What: FREE futures and options trading educational event

Where: Online

How: Register using the web form below

When: June 29 @4:30 pm Eastern

Beginning commodity traders often pour countless hours of research into developing a futures and options trading strategy, but few put much effort into choosing an appropriate trading platform. Join us to discuss the key aspects you should be considering when choosing a platform and underlying brokerage arrangement; including many overlooked aspects that can have a significant impact on your experience and bottom line. We will also explore many of the popular trading platforms available to traders and highlight their advantages and disadvantages. Unfortunately, there isn't such thing as a perfect commodity trading platform for most traders, but we'll discuss what should be a priority in your hunt for the best fit.

Futures Broker Carley Garner and David Moad talk Commodities

May 26, 2017

iBroker Web-Based Futures and Options Trading Platform

Compatible on all devices, including MACs.

Markets: Futures and Options

Cost: No monthly fee, surcharge of 25 cents per trade

Email info@decarleytrading.com to request a demo.

This web-based trading platform is a low-cost and convenient solution to traders of all sizes and types. The iBroker web offers traders an extremely user-friendly experience and the ability to log in from any computer without the necessity of a download! It also enables those using MAC computers to access and trade their accounts normally without the need for Parallels, or similar software.

If you are looking for a simple user interface to trade commodity options and futures or would like to be able to trade on the go, we highly recommend that you give this platform a look. The web platform and the Zaner360 can be used simultaneously. This platform also offers mobile access via the iBroker app.

Features of this web accessible futures and options trading platform include, but are no limited to:

Real time quotes on futures and options.

Simple and clear option chain viewing.

Point and click futures and options order placement.

Depth of market data display (DOM panel).

See open positions on the futures chart.

Search, browse, and sort futures and options contract by name (no symbol knowledge necessary).

Fully customizable real-time futures charts with technical indicators and drawing tools such as Fibonacci and the Gann fan.

Easily create convenient "Watch Lists" to monitor the futures and options markets.

Quick access to 'Last Viewed' futures and options contracts.

One-click reverse position, close position, close all positions.

Setup default order settings per contract.

Fractional quotes support (view Treasury and grain futures in terms of their fraction value, not decimal).

May 24, 2017

Carley Garner spoke with Dukascopy about the coffee futures markets

May 23, 2017

Tracy DeCarlo talks lumber futures with Dukascopy TV

Interview transcript:

1. Hundreds of Canadian sawmills hit by new U.S. tariffs imposed by the Trump Administration for fresh shipments of softwood lumber are feeling the burden. How do you see this impacting the Candian Lumber industry?

What many people don’t realize is that the US produces more lumber than Canada does, so the issue isn’t on the supply side of the equation it is enabling true price discovery. I am certainly not a trade agreement expert but in my opinion, the ultimate goal should be for a truly free market on both sides of the border. While in the short-run that could mean pain for all parties involved, the long-term result should be an overall positive for the lumber industry as well as US home builders. The Canadian’s are relatively business savvy, I have a feeling they will find a solution they can live with. The last time the US imposed tariffs on Canadian lumber was 2006 and from what we can tell the Canadian response was to dramatically increase exports to China. After and adjustment period, we believe everything will work itself out.

2. Although these tariffs have been directed to hurt Canada's Lumber Industry, according to the U.S. National Association of Home Builders, it is American's who are going to be the most affected with the association calculating the tariffs will increase the cost of a new house by $1,000 and would put home ownership beyond the reach of more than 150,000 American families and jeopardize American jobs in the industry. Taking this into consideration, do you think Trump will reverse the tariffs?

As mentioned, the US is a significant producer of lumber. The argument prior to the Canadian tariff was that subsidies were pricing US producers out of the market. In theory, a more level playing field will pad the price of lumber in the short-run but we don’t see it being enough to derail economic growth or home ownership. For instance, the median sales price of a new home in the US thus far in 2017 has been roughly $300,000. So if the NAHB’s estimates are correct, we are talking about an increase in the price of a new home by about .3% (point three percent). This likely won’t be enough to prevent properly capitalized home buyers from taking the plunge. I also doubt it will be a deterrent for the Trump administration to continue with its agenda.

3. If tensions escalate between the U.S. and Canada – particularly with NAFTA negotiations set to commence, how do you think this could impact the price of Lumber in the longer term?

We’ve noticed that the price of lumber has been in sharp decline since the Canadian tariff announcement. Looking at a price chart of Random Length Lumber on the Chicago Mercantile Exchange, it is obvious that the market anticipated the political move against Canadian lumber well before the public heard the news. Lumber futures traded limit up on four consecutive days leading to the announcement, but in the aftermath of the actual news, it has done the opposite. In fact, the July contract spent most of yesterday’s trading session limit down! In our opinion, this feels like a textbook “but the rumor, sell the fact” trade. Accordingly, the lumber market will likely get back to focusing on natural supply and demand fundamentals rather than politics, which have already been priced in. If so, we wouldn’t be surprised to see lumber futures make their way back down to the $310 to $300 per 1,000 board feet area.

What's new on DeCarleyTrading.com

- Carley Garner's profile

- 27 followers