Carley Garner's Blog: What's new on DeCarleyTrading.com, page 35

March 8, 2018

Learn how to analyze the crude oil futures market

Published in: Upcoming Futures Trading Webinars

What is making the crude oil futures markets tick?When: Wednesday, March 21 @1:30 pm Pacific (4:30 Eastern)

In this class, we are going to take a look at the current composition of the crude oil market, including the seasonal tendencies, COT Report analysis, and the chart. We will also discuss the peril of fundamental analysis in a quick moving futures market such as WTI light sweet crude oil. Join experienced commodity broker, Carley Garner, as she lays out the skinny on the energy futures markets.

Topics discussed:

* Why understanding crude oil pricing matters for both commodity and stock trading.

* The downside of fundamental analysis regarding the energy futures markets.

* How do crude oil futures generally behave ahead of the summer driving season?

* What should we know about futures market sentiment?

* Where are WTI crude oil futures speculators positioned?

* How with the US dollar valuation impact crude oil prices?

* Technical analysis of the current oil futures market chart.

March 1, 2018

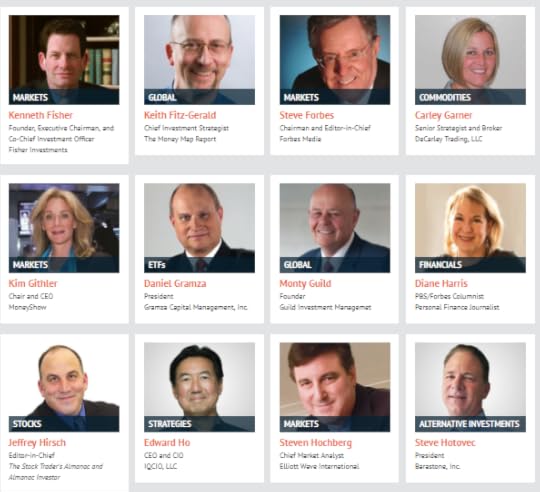

See Carley at the MoneyShow Las Vegas

Published in: DeCarley Trading Press

Experienced commodity broker, Carley Garner, will be speaking at this year's MoneyShow Las Vegas event. The topic will be focused on the practice of selling options on futures.

on futures.May 16th @ 2:15 PM Pacific

The MoneyShow Las Vegas is a FREE event, register here: DeCarley.LasVegasMoneyShow.com

Carley Garner will be one of many speakers at the event. At The MoneyShow Las Vegas, you’ll find sessions on trading tips, economic and market forecasts, investment analysis, capital preservation, asset allocation—and so much more!

Getting started in Option Selling: Selling Commodity Options can be a Higher Probability Strategy, but not if the Proper Steps aren't Taken

Join us to discuss how to get started selling options on futures. In this class, experienced futures and options broker, Carley Garner, outlines the advantages and disadvantages of option selling and highlights the various futures options premium collection strategies, setting up a proper brokerage arrangement, and offers tips and tricks to better the odds of a short option strategy.

February 28, 2018

Garner and Cramer went off the chart to talk irrational exuberance in the stock market

Published in: DeCarley Trading Press

Cramer's charts reveal that investors' euphoria caused the stock market meltdown from CNBC.

Mad Money host, Jim Cramer, recruited experienced futures broker, Carley Garner, of DeCarley Trading in hopes of finding a logical explanation for recent volatility in the stock market. In the end, they found that irrational exuberance in January was a leading contributor to the February stock market fall-out.

February 16, 2018

Download our Mobile App!

Published in: About DeCarley Trading

The DeCarley Trading mobile app is the ultimate communication tool complete with live streaming videos of our commodity trading educational events and interactive chat features. At a time in which email is becoming obsolete and SMS text messaging burdensome and expensive to overseas contacts, this futures market mobile app bridges the gap between the need to communicate in real time and the obstacles more traditional methods face. Armed with the ability to opt in or out for push notifications based on user interest, this communication app words toward streamlining desirable content for the user making for an efficient experience relative to other communication platforms (emails, websites, etc.).

Click here for the Android download

Click here for the Android download

January 25, 2018

Day Trade the E-mini S&P 500 using weekly options

E-mini S&P 500 day traders often manage their risk per trade using stop loss orders. However, stop orders in the futures markets are highly prone to premature election leaving traders watching the market runaway in the anticipated direction without them. Further, traders utilizing tight stop loss orders as a means of mitigating the risk per trade are nearly guaranteeing a small loss as opposed to protecting capital while enabling prospects for profit.

Perhaps a better way to day trade the E-mini S&P 500 is by using weekly expiring options, and possibly even the new suite of Monday and Wednesday expiring options. These products offer traders the ability to speculate on intraday price moves with limited, and surprisingly low, risk. Join us to discuss how these products might help futures day traders mitigate risk and stress.

Topics discussed include:

The biggest obstacle to day traders, stop loss orders

What are weekly options?

What are Monday and Wednesday options?

How to use options in day trading

The beauty of limited risk day trading

The benefit of lasting power (no premature stop outs)

Time value erosion

Hold positions overnight without hefty margins

No longer slave to the market close

How to cope with margin calls using options and futures

Margin calls happen to the best of them, but there are often ways to alleviate margin deficits without adding money to the account or liquidating positions. In this class, commodity broker Carley Garner of DeCarley Trading discusses the nature of margin and margin calls while offering detailed strategies of using long and short calls and puts to reduce the margin in a trading account.

Topics covered include:

• What is margin?

• Who sets margin?

• Why is margin necessary?

• How many days do you have to meet a margin call?

• Initial margin vs. maintenance margin

• Day trading margin vs. overnight margin

• Buying calls and selling puts to reduce margin required for short futures

• Selling calls and buying puts to mitigate the exchange required margin for long futures contracts

January 24, 2018

Crude oil futures speculators holding record net long positions.

Published in: DeCarley Trading Press

Jim Cramer featured the crude oil futures market analysis written by commodity broker, Carley Garner, on the January 23rd episode of Mad Money.

Cramer: With speculators the most bullish in history, charts show oil prices could soon peak from CNBC.

"As of last week, large speculators were holding the single largest bullish position in the history of crude oil futures: ... 666,000 net long contracts," Jim Cramer said. "Being bullish is not a good sign."

Crude oil futures speculators holding record net long positions.

Cramer: With speculators the most bullish in history, charts show oil prices could soon peak from CNBC.

"As of last week, large speculators were holding the single largest bullish position in the history of crude oil futures: ... 666,000 net long contracts," Jim Cramer said. "Being bullish is not a good sign."

December 20, 2017

Bitcoin is not replacing gold anytime soon, according to Garner and Cramer on Mad Money

Cramer's charts reveal bitcoin's not replacing gold anytime soon from CNBC.

"Bottom line? Look, I know the jaw-dropping run in bitcoin has been very exciting," Cramer said. "But gold is not being supplanted by bitcoin as the go-to alternative to actual currency, and the charts, as interpreted by Carley Garner, suggest that gold might be ready to make a comeback. And while I won't discourage anyone from buying bitcoin — just know the risks, know your limitations — I'm with Carley when it comes to the precious metal, not the precious keystroke." - Jim Cramer

December 19, 2017

Join us in NYC for the TradersEXPO

TradersEXPO titled: "How to Modify a Covered Call Strategy for Commodity Trading".

TradersEXPO titled: "How to Modify a Covered Call Strategy for Commodity Trading". The session is free to attend, simply register by clicking here.

When: Monday, February 26th @ 5:45 pm PM - 6:30 PM

The TradersEXPO is a three-day conference designed specifically for active traders and has taken place in New York for 16 years running. The 2018 expo will highlight global macro, cryptocurrencies, and futures trading. Before and after our presentation, registrants will have access to an interactive exhibit hall to shop the latest in trading tools and services.

We hope to see you there!

What's new on DeCarleyTrading.com

- Carley Garner's profile

- 27 followers