Carley Garner's Blog: What's new on DeCarleyTrading.com, page 31

April 25, 2019

Micro stock index futures contracts open the door to less risky speculation

Published in: DeCarley Trading Press

The CME is launching less-scary futures contracts to trade stock indices.

While there are a plethora of advantages to trading futures contracts relative to stock market ETFs such as favorable tax treatment, easier tax reporting, around the clock market access, ease of shorting the market, and trading on margin without the burden of paying interest charges to a brokerage house. There is one large bright pink elephant in the room; leverage and the associated risk (large swings in position profit and loss).

April 10, 2019

The NASDAQ and Crude Oil Futures have been Hot, will it Last?

Published in: DeCarley Trading Press

Jim Cramer, the host of Mad Money on CNBC, used chart analysis by commodity broker, Carley Garner, on the April 9th show.

Garner analyzed the NASDAQ 100 futures contract, symbol NQ, in conjunction with WTI crude oil futures, symbol CL. These two assets have been trading with a positive correlation well into the 90s. While the correlation will likely weaken, it will probably remain intact. Further, the NQ is likely in store for a blow-off top in the coming months and oil, after a short-term pullback, could be headed for $80 per barrel.

April 5, 2019

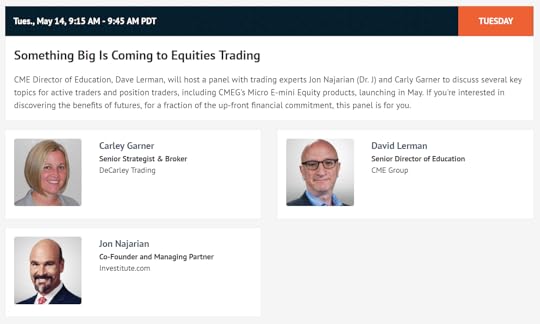

Jon Najarian and Carley Garner host a panel on Micro E-mini stock index futures

Published in: DeCarley Trading Press

Jon Najarian, host of CNBC's Halftime Report, and futures broker Carley Garner will anchor a panel at the MoneyShow Las Vegas discussing the CME's new Micro E-mini stock index futures.

It is free to attend the MoneyShow Las Vegas, and this event. Click here to register.

When: Tuesday, May 14th 9:15 am to 9:45

Topic: Something Big is Coming to Equities Trading: Micro E-mini stock index futures with Jon Najarian and Carley Garner

CME Director of Education, Dave Lerman, will host a panel with trading experts Jon Najarian (Dr. J) and Carley Garner to discuss several key topics for active traders and position traders, including CME's Micro E-mini Equity products, launching in May. If you're interested in discovering the benefits of futures, for a fraction of the up-front financial commitment, this panel is for you.

April 1, 2019

Futures broker, Carley Garner, interviewed by The Lazy Trader

Published in: DeCarley Trading Press

The Lazy Trader interviewed commodity broker Carley Garner of DeCarley Trading.

March 28, 2019

Real Life Trading, Jeremy Newsome and Carley Garner talk about the futures markets

Published in: DeCarley Trading Press

Carley Garner, a futures broker with DeCarley Trading, was recently interviewed by Jeremy Newsome of Real Life Trading.

March 26, 2019

Trading is 95% mental, manage emotions and trader psychology

Published in: Archived Futures Trading Webinars

The Only Magic in Trading: Humility and Common Sense

Trading is 95% mental, free class on managing emotions and trader psychology

Published in: Upcoming Futures Trading Webinars

The Only Magic in Trading: Humility and Common Sense

There is a big difference between being right and making money. Trading success isn't necessarily determined by strategy, entry and exit points, or time frames; the true line in the sand drawn between winners and losers is determined by the ability to manage trading emotions. There are steps that can be taken to mitigate the impact of emotion on a trading plan; including the purchase of cheap weekly options to act as a backstop against runaway day trades and approaching the market with realistic expectations. Join Carley Garner, an experienced futures and options broker with DeCarley Trading, to discuss creative ways to mitigate tail risk in day trading using options, and in turn improve emotional stability in trading. Talking points will include:

Steps to keeping a clear mind and proper psychological preparation for trading.

Buying cheap insurance policies against trades on awry.

Examples of panic-driven trading and tips to avoid being a victim.

The most important quality of a successful trader.

March 13, 2019

Cramer and Garner discuss the US dollar's impact on the stock market

Published in: DeCarley Trading Press

DeCarley Trading futures market analysis was featured on Mad Money with Jim Cramer on Tuesday, March, 12!

Cramer: Charts show the economy could reap benefits from a dollar peak from CNBC.

Could the US dollar be peaking? If so, it would help bullish stock and commodity portfolios. According to the charts interpreted by experienced futures and options broker, Carley Garner, the US dollar could be rolling over and the euro currency putting in a bottom.

March 5, 2019

See Carley Garner at The MoneyShow Las Vegas

Published in: DeCarley Trading Press

From May 13 - 15 Carley Garner, a veteran futures broker with DeCarley Trading, will be attending the Las Vegas MoneyShow. Join her, and over 100 other knowledgeable trading and investing pros to share market analysis and strategy ideas. Registration and attendance are free, see Carley's speaking schedule below (one paid session and one free session).

Click here to register for The MoneyShow Las Vegas.

February 13, 2019

Jim Cramer and Carley Garner went Off the Charts in the S&P 500

Published in: DeCarley Trading Press

Mad Money host, Jim Cramer, consulted with futures broker, Carley Garner, in December about the fate of the US stock market using the E-mini S&P 500 chart; they revisited the topic on February 12th.

Cramer: Charts show steady investor optimism, more upside for stocks from CNBC.

"Remember, ... Carley Garner has been dead-right, and the charts, as interpreted by Carley, suggest that this market still has some more upside here," Cramer continued. "But if we get a few more days like this wild one, she thinks we'll need to start worrying about irrational exuberance. For now, though, she thinks we are headed higher, and I agree."

What's new on DeCarleyTrading.com

- Carley Garner's profile

- 27 followers