Carley Garner's Blog: What's new on DeCarleyTrading.com, page 34

May 30, 2018

Garner tells Jim Cramer, crude oil futures at $80 is as likely as....

Published in: DeCarley Trading Press

DeCarley Trading futures and options broker, Carley Garner, explained to Jim Cramer, the host of CNBC's Mad Money, an $80 handle in crude oil futures is as likely as a hockey team from the desert making it to the Stanley Cup Finals in their inaugural season!The Vegas Golden Knights might be playing for the cup against all odds, but crude oil futures probably won't fare as well in its attempt to buck the probabilities. As we explained to Jim Cramer on Mad Money on CNBC, we believe crude oil has a far better chance of seeing $55 before it sees $80.

Cramer's charts show there could be more pain ahead for oil from CNBC.

View this video clip to find out why being long crude oil is an overcrowded trade facing swift technical resistance and vulnerable to recent changes in the currency markets.

May 24, 2018

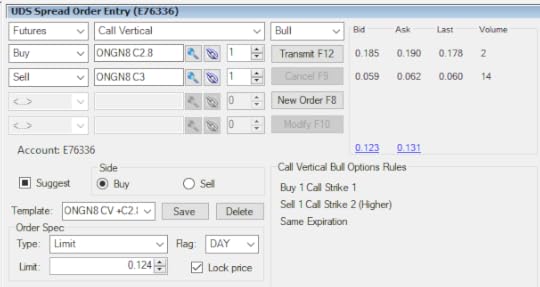

Execute commodity options spreads in our FREE futures and options trading platform

Published in: DeCarley Trading Press

Our most popular complimentary trading platform, the Zaner360, now has option spread capabilities!

The long-awaited update to the Zaner360 is here. Users can now place option spread orders on a single order entry ticket. This means traders can enter orders for options strategies such as ratio spreads, vertical spreads, iron condors, and more on a single ticket at a single limit price. Although entering option spreads as a package, as opposed to entering orders for each leg individually, isn't always the most efficient it is a fabulous tool to have access to because it gives traders more "options" in how they implement their strategy.

Unfortunately, the option spread trading capability is only available on the live platform (it won't be built into the demo platform for some time). Nevertheless, we've created a quick tutorial video to give prospective customers an idea of how it might work, and guide existing customers through the process of placing an option spread order.

Below is a written user-guide for reference:

Click here for the user-guide for entering options on futures spread orders.

We appreciate your business!

May 18, 2018

Carley Garner and Stephanie Kammerman discuss being a commodity broker

Published in: DeCarley Trading Press

Futures and options broker, Carley Garner, enjoyed sharing her story with The Stock Whisperer at the Las Vegas MoneyShow.LIVE in VEGAS Carley Garner, Senior Strategist and Broker, DeCarley Trading, LLCCarley Garner, Senior Strategist and Broker, DeCarley Trading, LLC

Posted by MoneyShow on Wednesday, May 16, 2018

The two women discussed being female business owners and the interesting timing of DeCarley Trading, which opened weeks prior to the financial collapse!

Stephanie Kammerman, The Stock Whisperer, Interviewed Carley Garner

Published in: DeCarley Trading Press

Carley Garner, a futures and options broker with DeCarley Trading, was interviewed by Stephanie Kammerman at the Las Vegas MoneyShow!

part 2 Carley Garner, Senior Strategist and Broker, DeCarley Trading, LLCpart 2 Carley Garner, Senior Strategist and Broker, DeCarley Trading, LLC

Posted by MoneyShow on Wednesday, May 16, 2018

The Stock Whisperer and Garner discuss market risks, commodity option selling, and the benefits of purchasing catastrophic insurance against open-ended positions.

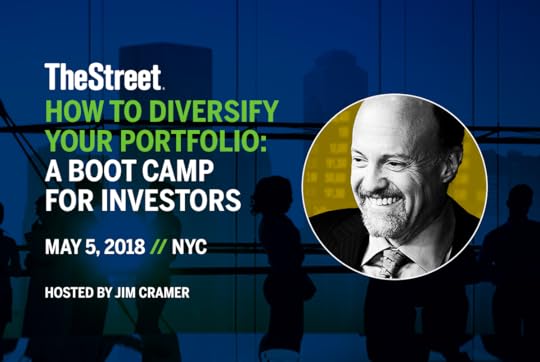

Carley was honored to be a part of TheStreet's investor event hosted by Jim Cramer

Published in: DeCarley Trading Press

Carley Garner was featured on an investment panel at the latest event held by TheStreet with the likes of Jeff Macke, Stephen Guilfoyle, and Paul Hickey!Hosted by Jim Cramer and dissed widely on social media with the hashtag, #CramerTeachIn, DeCarley Trading's own Carley Garner participated in an investor conference in New York City to represent futures and options trading in the investment arena. As a veteran commodity broker, she was up to the task and honored to participate. We hope to see all of you at the next live event!

April 26, 2018

See Carley Garner at an event hosted by TheStreet and Jim Cramer

Published in: DeCarley Trading Press

Commodity broker and founder of DeCarley Trading, Carley Garner, will be featured on a panel at an upcoming event hosted by Jim Cramer and TheStreet in New York City

Commodity broker and founder of DeCarley Trading, Carley Garner, will be featured on a panel at an upcoming event hosted by Jim Cramer and TheStreet in New York City Click here for more information and to register for this event.

"With markets as crazy as they are, it's a remarkable time to be an investor" - Jim Cramer

Join TheStreet for a special educational event for sophisticated investors. Attendees will hear from and interact with the best in the business, including top contributors from TheStreet.

Hosted by Jim Cramer, topics include trading futures, alternative investments, building wealth under the new tax code and more. Plus, Cramer interviews PayPal CEO, Dan Schulman, to learn about the future of commerce.

#CramerTeachIn

April 25, 2018

If gold futures can't rally in this environment, when can it?

Published in: DeCarley Trading Press

Carley Garner, a futures and options broker at DeCarley Trading, recently discussed gold and Bitcoin relative to the dollar index futures with Daniela Cambone with Kitco News.

Earlier in the year, there was some debate as to whether cryptocurrencies, particularly Bitcoin, would be replacing gold as an alternative currency. At the time, the price of gold and Bitcoin were trading in opposite directions of one another; Bitcoin had spent the month of December 2017 exploding in parabolic fashion to a value of $20,000 per coin. At the same time, gold had seemingly lost all of its luster hovering just over $1,100. As we head into mid-2018, we are in a completely different environment. We are still seeing the price of gold and Bitcoin trading in opposite directions, but this time it is gold that is shining and Bitcoin is struggling to prove its value to the markets. Going forward, we tend to believe both gold and Bitcoin will become more positively correlated. Specifically, both quasi-currencies will likely suffer as the greenback gains value.

You can view the archive of this video interview by clicking here.

April 16, 2018

Jeff Hirsch and Carley Garner chat about commodities at the TradersExpo

Published in: DeCarley Trading Press

Long-time commodity broker, Carley Garner, and author of Stock Trader's Almanac, Jeff Hirsch, sat down at the New York Traders Expo to chat about the futures and options markets.

April 6, 2018

Learn how to hedge your stock portfolio with futures and options

Published in: Upcoming Futures Trading Webinars

Learn how to protect your investment portfolio with a combination of E-mini S&P futures and options

When: May 9, 2018 @ 4:30 Eastern

Where: Online

Cost: FREE

The futures markets were originally created to enable farmers and ranchers to hedge their business activities. Further, stock index futures were created to offer portfolio managers an efficient means of hedging; yet, most market participants are purely speculating. Join us as we go back to the basics by looking at the E-mini S&P 500 as a vehicle for hedging rather than speculating.

It is possible to construct a portfolio hedge that involves very little out of pocket expense using a combination of long put options and short call options.

March 26, 2018

BOGO Futures Trading Books by Carley Garner

Published in: DeCarley Trading Press

Purchase an autographed copy of Higher Probability Commodity Trading and receive a complimentary copy of A Trader's First Book on Commodities.

Whether you are a beginning commodity trader or a seasoned pro, this offer has something for you. The combination of these two futures and options trading books written by an experienced commodity broker, Carley Garner, guide prospective traders from ground zero to developing and implementing commodity trading strategies with an edge.

Don't miss out on this deal, click here!

***Available for US customers only.**

What's new on DeCarleyTrading.com

- Carley Garner's profile

- 27 followers