Omid Malekan's Blog, page 4

January 31, 2019

The Original Crypto Bull Thesis, Revisited & Reinvigorated

A lot of people are questioning the reasons to own crypto assets these days, a natural thing to do given the ongoing bear market. But let us not forget the original Bitcoin investment thesis, which thanks to two simultaneous developments this week, is alive and well.

First, the Federal Reserve flinched on further rate cuts, and signaled a desire to slow down the unwind of its balance sheet. For those who think the Fed bases monetary policy on the actual economy, this came as a surprise, as the only major economic report since the last Fed meeting was the hottest jobs report in a decade. But for those who think the Fed mostly cares about financial markets, as was blatantly stated by one of the worlds biggest hedge fund managers, the change was expected. Stocks just recorded their first down year in a decade

For years, those of us who have been publicly critical of the orthodoxy in central banking have asked a simple question: How much of a decline in the S&P 500 does it take for central bankers to admit that, for all their talk about unemployment and helping the middle class, they only care about juicing investments? The answer, we now know, is a little over four percent.

Across the pond, the European Central Bank gave us even more of a reason to be long crypto, by taking the implicit lie at the heart of the greatest monetary experiment in history and making it explicit. Which lie? The one that claims their alphabet soup of programs are designed to help the middle class.

Ever since the crisis, economists have told us that the best way to help ordinary people is not by giving them free money. It’s to give free money to the financial system, then hoping all those printed dollars, euros and yen somehow magically end up in the hands of people who need them — even though by virtue of being poor such people have the loosest ties to that system. My arch nemesis Ben Bernanke even wrote an essay spelling out how this is so. In short, if you are poor, unemployed and don’t even have a bank account, your government is helping you by subsidizing Wall Street.

But this week, the ECB took this deceit even further, by tweeting a video that explicitly claims giving free money to rich people helps reduce income inequality.

body[data-twttr-rendered="true"] {background-color: transparent;}.twitter-tweet {margin: auto !important;}ECB asset purchases have reduced inequality in the eurozone, our research shows. They have especially benefited low-income households, which suffer the most from unemployment. Full Research Bulletin here https://t.co/MlMQO2BXxK

— @ecb

It’s a statement so ridiculous only an economist would be foolish enough to believe it. Their video cites a bulletin, which cites a paper, which is written in that unnecessarily obtuse language economists prefer because it prevents ordinary people from realizing how ridiculous they are. So allow me to translate:

Let’s say that we had 10 millionaires who have jobs, and 2 poor people who don’t. Let’s also say that the ECB prints a trillion euros, and gives each millionaire a hundred billion. To celebrate their government-given riches, the newly-minted billionaires decide to throw a party and hire the poor (at minimum wage) to serve champagne. According to the ECB, they have reduced inequality. How? By reducing the poor-people unemployment rate more than the rich-people unemployment rate. (The rich already had jobs, so their unemployment rate was zero and couldn’t decline.)

Scroll back up and look at the image that accompanies their tweet, and you’ll see that this is in fact what they mean. If you watch the video, they actually mention that their policies make markets rise, then ignore it. That this kafkaesque torturing of the data ignores the fact that those policies made the rich far richer, the ECB, Ben Bernanke and now perhaps even Jerome Powell would like you to believe, doesn’t matter.

Except that it does matter to the yellow vests marching in Paris, the Brits who voted for Brexit and the Americans who voted for Bernie or Trump and now support candidates like Elizabeth Warren. Different as they seem, all of these movements share the core belief that the system is rigged. Our governments just confirmed that it is.

So why crypto? Because no matter how big a lie, how often it’s tweeted or how many Econ PhDs are naive enough to believe it, you can only push it for so long until something breaks. The biggest benefits of radical monetary policy are now behind us, while the biggest costs lay ahead. In other words, there is no such thing as a free lunch, but there is a cheap Bitcoin.

January 29, 2019

JP Morgan Is Using the Wrong Valuation Technique on Bitcoin

What is a good floor for the price of Bitcoin? According to a recent JPM report, it might be at $2800, or a headline generating $1260. The absurdity of such a wide range representing “fair value” aside, the real problem with the analysis is how they got there, by applying a staple of traditional commodity valuation known as marginal cost pricing. Unfortunately for the well intentioned analysts here, and the crypto echo chamber that’s too trusting of anything sciency coming out of traditional finance, that model is useless for Bitcoin.

The marginal cost of production matters for physical commodities because supply is elastic to price. When the price of oil falls , higher cost producers start to lose money and eventually turn off production. This means that all else being equal, the level of production goes down with price, and continues to do so until production falls below demand, at which point prices begin to stabilize.

This concept doesn’t apply to Bitcoin because production is price inelastic. New coins are minted with every new block, and block times are set at an average of one every ten minutes. Anytime the network deviates from this schedule, say due to changes in mining capacity, the difficulty adjustment resets the block time and therefore, the production schedule. This makes Bitcoin unlike any other commodity, as the rate of new Bitcoin production never changes beyond a two week window for any reason, including the amount of mining.

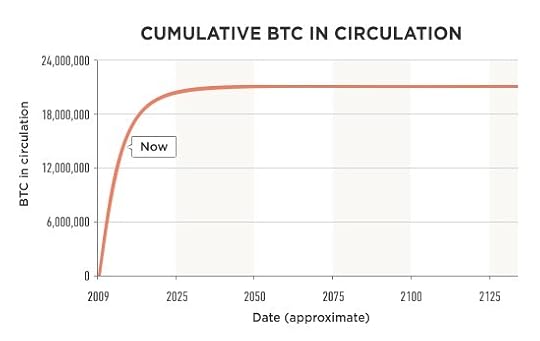

BTC can climb to 10 million this year or fall to 10 dollars, and production would average 12.5 new Bitcoins every ten minutes — until the next halving. The variable that the J.P. Morgan report focuses on, which is the cost of mining, is irrelevant to price, because price has no impact on production. In economics they call this perfectly inelastic supply, and it’s the reason why we can have this popular chart of expected Bitcoin supply going out over a century:

No one ever makes a chart like this for any other commodity, because with physical goods production is at least somewhat correlated with price. But with Bitcoin, not only is supply not impacted by price, but one could argue that — also unlike any other commodity — demand is negatively impacted by price. As prices decline, not only does the store of value appeal decline, but so does the security of the overall network. Although production isn’t impacted by price, the amount of mining and the resulting hash rate are. A blockchain with a lower hash rate is less secure, which might actually make Bitcoin a Giffen good.

Why do otherwise intelligent academics and analysts keep using marginal cost pricing when it clearly doesn’t apply? Maybe because this is a truly new asset class, and we are all grasping at straws to value it. Or maybe because in a bear market where price dictates news, “we have no idea what it’s worth” doesn’t get as much attention. But at least that would be honest.

I have no doubt that someday in the future we’ll have smart and useful valuation metrics. But that day isn’t today. Until then, instead of listening to J.P. Morgan the firm, we should just listen to J.P. Morgan the man, who according to legend once responded to someone asking him what the market will do by predicting that “it will fluctuate.”

January 15, 2019

Calling Out the SEC

The Securities and Exchange Commission keeps rejecting a Bitcoin ETF, supposedly because the agency has a mission to protect investors, which has it worried about custody, liquidity and price manipulation.

Rebutting their concerns is easy — multiple companies have custodied billions in BTC for years, it’s a fast fungible asset that trades at dozens of exchanges around the world, and so on. But today, I want to address the idea that the SEC cares about investor protection in the first place, by looking at some of the products the agency has approved.

There are commodity ETFs whose exposure to the futures curve leads to severe tracking error. There are leveraged ETFs whose path dependance slowly grinds them to worthless. There are daily ETFs that serve no apparent economic purpose other than enabling pros to pick off retail punters (nobody has an economic need to be 3x leveraged long robotics stocks just for one day.) One could even fill up an entire blog post with the ridiculous things written in the prospectus of these products (“There is no guarantee the fund will meet its stated investment objective,” says the robot one.)

But nothing drives home the point that the SEC doesn’t care about investor protection more than those demonic, dangerous, destabilizing and — pardon my vulgarity — dogshit products known as volatility ETFs, like the XIV.

If that symbol sounds familiar, it’s because the SEC-approved VelocityShares Daily Inverse VIX Short Term ETN blew up almost a year ago, vaporizing 80% of its value in a single day and leading to total liquidation. There was shock and horror, and stories of the people who the SEC is supposed to protect losing millions. There were trading irregularities too, like this gem:

People who bought XIV in the last hour of trading on Monday lost more than 90 percent of their money within 24 hours, even though they were basically right, or at least not grievously wrong, about the short-term direction of the VIX

But the real tragedy here is the fact that such a product was allowed to exist in the first place, because to dive down into what it actually was and how it supposedly worked is to get tangled up in such complex and confusing financial minutiae that I’m willing to bet a bitcoin the current Chairman of the SEC could never comprehend them. And just to prove, once and for all, that the Commission doesn’t prioritize investor protection, I’m going to ask and answer a simple question: WTF was XIV?

According to the fact sheet:

The VelocityShares Daily Inverse VIX Short-Term ETNs (the “ETNs”) are senior, unsecured obligations of Credit Suisse AG

WTF was XIV? A loan

An unsecured loan to Credit Suisse, to be exact. But not a normal loan, as the point of the money was to:

The return on the ETNs is linked to the inverse of the daily performance of the S&P 500 VIX Short-Term Futures™ Index

WTF was XIV? A loan for trading to achieve the opposite of the daily moves of an index

Unfortunately for the folks at CS, the “S&P 500 VIX Short Term Futures Index” is not a traded product that you could short, but rather a made up number. So say its creators:

The S&P 500® VIX Short-Term Futures Index utilizes prices of the next two near-term VIX® futures contracts to replicate a position that rolls the nearest month VIX futures to the next month on a daily basis in equal fractional amounts

WTF was XIV? A loan for trading to achieve the opposite of the daily moves of an index of an average of the price of multiple futures contracts.

This brings us to VIX futures. Unlike normal futures, which are simply a promise to buy or sell an asset in the future, VIX futures:

.. reflect the market’s estimate of the value of the VIX Index on various expiration dates in the future

WTF was XIV? A loan for trading to achieve the opposite of the daily moves of an index of an average of the price of multiple market estimates of the future value of another index

The VIX index, which all of this ultimately revolves around, itself has no tangible value, nor does its price reflect anything real, not exactly anyway. According to its creators:

[the vix index] estimates expected volatility by aggregating the weighted prices of SPX puts and calls over a wide range of strike prices.

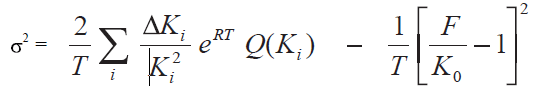

This is an oversimplification. The VIX doesn’t care about the price of those options, it cares about the implied volatility embedded within those prices. The way to get that info, according to its creator’s own white paper, is by applying the following formula:

WTF was XIV? A loan for trading to achieve the opposite of the daily moves of an index of an average of the price of multiple market estimates of the future value of another index whose value is calculated via an incomprehensible formula that I can’t even shrink down to fit a single line of a Medium post.

Forget understanding any of that. I’ll pay Chairman Clayton that Bitcoin if he could just recite that explanation fast three times.

Bitcoin, as we know, is volatile. So is the VIX. But whereas tracking the former with a a ETF is straightforward, doing it accurately for the latter is almost impossible — because you can’t buy something that doesn’t exist. Instead, to even attempt to replicate its price, you have to go through the kind of financial contortion that makes Proof of Work look easy.

Adding insult to injury, all of the so called concerns that Jay Clayton has recently voiced about a Bitcoin ETF always applied to vol products. Worried about manipulation? Here’s academic research pointing it out in VIX instruments. Liquidity too low? Also true with vol, where the tracking products are at times more liquid than the instruments they track, opening the door to tail-wagging-the-dog death spirals like what happened a year ago.

Does the SEC care? Of course not. How can we be sure? Because even after the XIV disaster, similarly structured (and named) products like the ZIV are allowed to exist. That product’s own fact sheet states that it’s meant for “sophisticated institutional investors,” and yet anyone can buy it in their Etrade account — because Jay Clayton cares. What happens when ZIV also blows up and we’ve hit the end of the alphabet, nobody knows.

What we do know is that the SEC’s constant rejection of a Bitcoin ETF can’t be about investor protection. Maybe they just don’t like crypto (or don’t like the kind of people who like crypto). Or maybe they don’t understand it, in which case I will gladly provide them with a complimentary book or seminar.

But the next time the Chairman says anything about protecting investors, someone should ask him a simple question: WTF was XIV?

January 6, 2019

In Defense of Joe Lubin & ConsenSys

Last months layoffs at the incubator arrived like a crescendo in the bear market, with some people eager to turn the story of the quick expansion and quicker decline into a broader metaphor for the industry. Much of that criticism is unfair, and based on a misunderstanding of why ConsenSys was invented in the first place.

Most incubators exist to generate a positive return on investment. ConsenSys on the other hand was created to push Ethereum’s first mover advantage to a point where a newer platform couldn’t catch up. That distinction seems lost on most critics, even though Lubin has been practically shouting it from the rooftops — and the company’s About page:

Our focus is on the ecosystem, the growth of the Ethereum network, and global integration of the benefits of blockchain and tokenization.

Now compare that to the About page of a more standard incubator, like Y Combinator. The latter is all about helping individual companies succeed, while Joe’s mission is the platform. The distinction leads to very different decision making. When you focus on companies, then every failure is just that. But when your focus is on the platform, some failures could still be a successes, so long as they advance the cause of adoption.

Take the example of a hypothetical blockchain scaling company working on things like sharding and plasma. If it were to go through a vanilla incubator, then the rudder for all decision making would be finding a viable business model. It wouldn’t matter how many cool things the founders tried if they never turned a profit. But that same company, trying the same approaches, and even ultimately being shut down for the same reasons, could still be considered a success at a place like ConsenSys — in the same way that Lightening Labs might simultaneously turn out to be a bad investment but great for Bitcoin.

I’m not a fan of decentralized organizations and believe that most human activity works better as a hierarchy. But I’d make an exception if I were a co-founder and major stakeholder — possibly the biggest — of an experimental new platform with competition on the way. In that scenario, I too would take a bunch of money and fund almost every idea. My ultimate batting average wouldn’t matter, because every project would still bring more people, attention and ideas. This, I believe, is what Lubin meant when he referred to “ConsenSys 1.0” in his recent letter to employees:

For ConsenSys 1.0, It was enough to just show up…and do something cool. Everything we built, every story we told, had real impact.

When it comes to new technology, it’s usually the first iteration to reach a critical mass of human attention, as opposed to the best, that wins out. ConsenSys was designed to push Ethereum to that point. Critics only give it credit for the projects that did succeed, like MetaMask & Truffle, but miss the aggregate benefit of all the ones that didn’t. There’s now an army of entrepreneurs, designers and developers who have lived and breathed that platform for years. Even if their tenure at ConsenSys comes to an end, their most likely career path is to stick with Ethereum.

I feel bad for the people who have recently lost their jobs, a few of which were my friends. But that doesn’t change the fact that the ups and downs of ConsenSys were based on sound economic principles for its founder, even if they were made more extreme by the surge and crash in the price of ETH. If you’ve gone all-in on a particular platform with your time and money (check out Joe’s Twitter handle if you doubt that he has), then it makes sense to initially treat your incubator as a loss-leader. So long as your native token stack is big enough, then your ROI on the platform will always exceed your ROI on any one project. This is why most new platforms now launch with an incubator baked into the road map.

“Failing fast” is a popular mantra for startups, and the idea takes on a whole new form with blockchain since you can now own a piece of the platform on top of which the failures take place. We’ve all heard of the historical adoption cycle where the sustainable businesses of the second wave are made possible by the infrastructure and attention brought by the failures of the first. When you own the platform, you can accelerate this process by initially funding everything, including projects that are unlikely to succeed.

Some of the critique of ConsenSys is just schadenfreude from those who have been gunning for Ethereum’s dominance. What these people don’t get is how much tougher that task is thanks to “ConsenSys 1.0.” It still remains to be seen how much the world actually needs a decentralized computing platform, which one should be dominant, and how valuable its native token will be. Years from now, if the answers to those questions turn out to be Yes, Ethereum & a lot, then Joe Lubin & ConsenSys will be a major reason why.

December 5, 2018

Rumors of the Decline of the Blockchain Industry Have Been Greatly Exaggerated

The sharp decline in the price of cryptocoins has spurred an outpouring of commentary from columnists and academics who — suspicious of the asset class all along — now feel vindicated. But their focus on falling prices this year is just as foolhardy as the evangelists focus on gains last year, and somewhat misses the point. The biggest blockchain headline of 2018 isn’t that prices have crashed, but that adoption has accelerated throughout the decline.

Among the entrepreneurs and developers building out the technology, there is a growing sense of satisfaction that an industry primarily known for its hypothetical promise is finally starting to deliver. If you can manage to look past sensational stories of “who lost how much in Bitcoin,” what you’ll find are far more interesting stories on adoption and implementation. Whereas 2017 was the year of whether, 2018 is going out as the year of when and how.

This is an important shift, despite ongoing challenges. Blockchain is a foundational technology, so adoption isn’t just about new systems, but a re-architecting of how business is done. That’s no small task, as we were reminded recently when the parent of the New York Stock Exchange announced a delay in the launch of its physical-backed Bitcoin futures. Tempting as it might be to interpret that news as yet another setback in the midst of a bear market, it’s a startling reminder of how far things have come. Not that long ago, the idea of one of the worlds biggest financial companies adopting Bitcoin felt like a pipe dream. Today, we lament a short delay.

Once rolled out, those futures will be an important bridge between legacy financial markets and natively digital ones. This sort of infrastructure is vital to making good on the industry’s loftier promises, and encouragingly, where progress seems to have accelerated, as told by the people who would know. Konstantin Richter, the CEO of Blockdaemon, a leading blockchain infrastructure company, recently told me: “We are seeing a strong increase in individual nodes getting deployed. Enterprise demand has increased also.” That simple statement says a lot, because nodes to a blockchain are like servers to a network. That people and companies are deploying them could only mean they plan on using the technology.

Progress is accelerating on the “re-architecting how business is done” front too. According to Christiana Cacciapuoti, the executive director of Adledger, a non-profit building new standards for blockchain-based online advertising, the consortium now counts all of the big four ad agencies as members, something that wouldn’t have happened if there was no there there.

The same could be said of names like Walmart and Fidelity, both of which announced major blockchain-based initiatives this past summer. Many more seem to be watching, as expressed by Mike Dudas, founder of The Block, a leading blockchain news and intelligence service. When I asked him whether interest had declined with price, he said “despite the decline, corporate interest is accelerating, and we’ve seen significant professional uptake in our coverage.”

Perhaps the strongest vote of confidence came from Clarissa Horowitz, VP of Marketing at Bitgo, a leading cryptocoin custody tech and service provider. Bitgo announced a new qualified custodian service aimed at institutions just a few months ago, just as the price decline accelerated. Custody being a service only needed by those who deal with the actual coins, I wondered if demand had been tepid. Her response? “Interest has been off the charts.”

From my own vantage point, demand for my education service and sales of my book are as strong as ever. The critics hear all of this, but still obsess over falling prices. To be fair, so do some industry insiders. But if there’s one lesson everyone watching crypto markets should heed from traditional ones, it’s that price seldom matters as much as most people think.

Just in the past two months, shares of graphic hardware maker Nvidia have lost half of their value. Tellingly, no one is interpreting this to mean the end of the industry. Semiconductor stocks have always been volatile, and a volatile asset making big moves is not that revealing. Naysayers have tried to pin the collapse on falling demand from crypto miners, but that doesn’t explain why the stock surged 50% earlier this as the price of Bitcoin got cut in half.

So why did the stock collapse? For a myriad of complicated reasons, including the broader correction in tech stocks. That correction, bye the way, has knocked a trillion dollars off the market cap of just five tech companies, more than the losses in all cryptocoins combined. But nobody is interpreting it to mean the end of smartphones or social media. Wild price swings are often more about marginal changes in sentiment than actual changes in output, a fact perhaps even more true for commodities.

The recent decline in oil prices for example, has little to do with supply and demand, as neither has changed much as prices have fallen. Drawing major conclusions from short-term price swings is tempting, but can be a trap. Ten years ago, a far bigger collapse in oil lead many to predict the end of the US shale boom. History proved them wrong, as American oil output today is triple what it was back then, with most of the gains having occurred in the teeth of the bear market. The decline in prices only drove drillers to become even more efficient at fracking. A decade later, that new way of drilling has really taken over, for the simple reason that it’s a better way of doing things.

Blockchain technology is also a better way of doing things. It’s core tenets of transparency, democracy and cooperation are universally considered desirable in almost any other context. So why do so many remain skeptical? One answer is jealousy from those who missed out on the boom, but there’s more to it.

The bigger issue — haunting enthusiasts and skeptics alike — is the truly transformative nature of this technology. If optimists such as myself are proven right, then we are about to undergo a major re-architecting of many aspects of society, toppling incumbent leaders and anointing new ones. Entrepreneurs worship the mighty god of disruption, but in its path lies the pain of the disrupted.

Just recently, the CEO of the celebrated startup Transferwise declared that his company saw no implementation of blockchain tech that made its online payment service faster or cheaper. His comments made the rounds given the backdrop of falling coin prices, but I took them to be rather bullish. If my overall thesis pans out, then the Transferwises of the world will never find a good use for blockchain, because the technology eliminates the need for them altogether. People can already exchange and send digital dollars all over the world using decentralized blockchain rails, for a fraction of even what Transferwise charges. The only drawback is that the front-end and user experience is not nearly as polished as those offered by a centralized payment service.

That problem will eventually be solved, because a shared global ledger is a better way of handling payments than the fragmented and siloed solutions of today, in the same way that a shared spreadsheet in the cloud is a better way of cooperating with colleagues than passing around a notebook. So to all those who continue to obsess about prices, I offer a simple reminder that what matters most are the opportunities that lie ahead, not the price declines that lay behind. This was true in the energy sector a decade ago, and even more true in the tech sector two decades ago.

Back then, during the aftermath of the dot com bust, the shares of a little online bookseller traded at a mere $6, having lost 95% of their value. Critics took the magnitude of that decline — even greater than the current crypto one — to mean that the promise of eommerce had been exaggerated. But Jeff Bezos and his team still believed that online shopping was a better way of doing things, so despite the raging bear market, they proceeded to significantly expand Amazon’s offering. History, and a subsequent 30,000% appreciation in the stock, proved them right. Sometimes, the biggest takeaway from a major price decline is the emergence of a great opportunity.

Disclosure: I am a small investor in Blockdaemon and a very large investor in better ways of doing things.

November 20, 2018

The Perils of Price Reflexivity

As the price of digital assets make new lows for the year, shocking many (myself included) a lot of people are asking why they have fallen so much. To answer that question, I’d like to pose another question: why did they go up so much in the first place?

There are, of course, plenty of long term investment thesis that can be applied to cryptocoins, having to do with the benefits of decentralization, sovereignty of money, new ways of building online communities, cheaper payment rails, distrust of the banking system, ZIRP, QE and so on. But none of that explains why Bitcoin tripled late last year or is down 30% in the last week. The reasons listed above will play out over the course of years and decades, not days. A better explanation for the seemingly unstoppable unidirectional moves is the fact that price remains the primary input and primary output of any shorter-term investment thesis, creating a feedback loop.

Traditional assets like stocks and real estate have long established valuation metrics that inform investing. These metrics, which tend to be tethered to information outside of the financial system — think company earnings or property location — help longer-term investors anchor their decision making during volatile price fluctuations. Although the absolute levels of things like P/E ratios that are considered desirable fluctuate over time, their very existence and tendency to revert to historical means provide a useful rudder.

Crypto assets have no such framework. Some people attempt to apply existing valuation metrics, like ones borrowed from physical commodities, but those are not a clean fit (unlike oil drilling or gold mining, new Bitcoin production has nothing to do with the price, thanks to the periodic difficulty adjustment).

What remains are technical indicators, but there too we have a newness problem. Most digital assets haven’t been around long enough to have significant price history. Even Bitcoin, which has been around for almost a decade, has gone through enough changes to make its earlier price data questionable. It’s not clear that price data from the days when you practically needed to know how to code to get your hands on some is all that relevant today.

That leaves us with a single valuation metric: price, as both the input and output of most people’s decision function. So why did Bitcoin go to $20k last year? Because it broke above $10k. Why has it fallen below $5k this week? Because it broke below $6k last week. I understand that this isn’t helpful for anyone trying to make a tough decision today, but it does help explain some of the volatility. I’m sure digital assets will eventually have their own sophisticated valuation metrics, but those are going to take a long time to come about, so the volatility is here to stay.

For those who still want to be invested for deeper fundamental reasons, I suggest turning off the quote screen and sticking to your guns. Bitcoin at $4500 means the same thing today as Bitcoin at $20,000 did last year: not much.

This is a brand new asset class that’s still trying to find its footing. Until it does, we’d all be better off spending our time learning, teaching and building the underlying infrastructure. Progress in the industry is not nearly as bad as an 80% decline would indicate today, just as it was never as good as a 300% rally did last year. Progress remains steady, but slow.

October 26, 2018

Hi Boyan. That’s right, the public blockchain infrastructure would replace most of the entities…

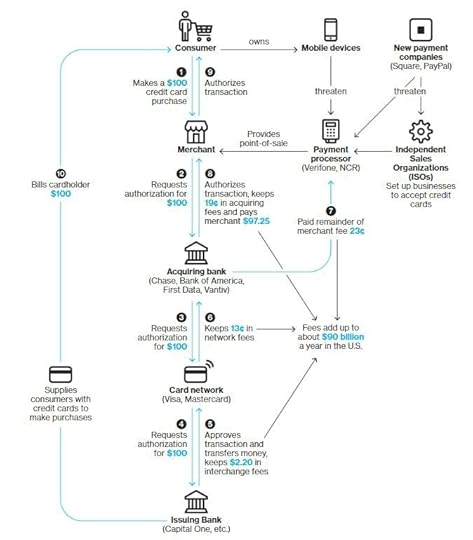

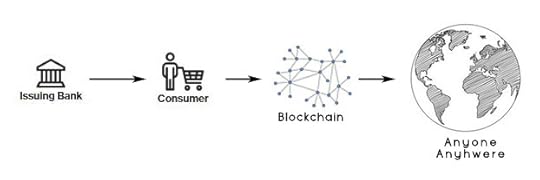

Hi Boyan. That’s right, the public blockchain infrastructure would replace most of the entities involved. Instead of an issuing bank and an acquiring bank, there would just be the custodian bank of the money backing the tokens. Now, if we are talking about credit cards just for payments (how most people use them) that would suffice. But if we are talking about credit cards for lending, then we’ll need additional infrastructure that hasn’t been quite built yet. Also, there are the thorny issues of charge-backs, which don’t exist on a blockchain, and rewards, which although consumers like them, are an extension of the current expensive swipe-fee based system.

October 25, 2018

There’s Nothing Controversial About Stablecoins (except to those they threaten)

The recent decline in the price of Tether has sent the usual crypto skeptics penning articles questioning the viability of the idea specifically and the digital asset ecosystem in general. But there’s no controversy here, because there’s nothing remotely new about these assets.

In traditional finance, the notion of “one asset that is a proxy for another” has been around forever. Paper money, for example, started out as deposit receipts issued by goldsmiths for customer gold held for safekeeping. Since physical gold is hard to carry around, the receipts eventually took over.

Today gold is primarily used as a store of value, and there too a more easily tradeable proxy is wildly popular. ETFs such as the SPDR Gold Shares represent tens of billions of dollars in value via the same exact mechanism as a fiat stablecoin. A trusted party purchases the underlying asset, stores it with a third-party custodian, then issues shares against those holdings. So long as investors trust the parties involved, the value of the proxy instrument maintains parity.

ETFs have been the most rapidly growing products on Wall Street for decades, and today account for trillions of dollars in value. If they can be trusted, so can a dollar-collateralized token. One could even argue that all else being equal, stablecoins are even more trustworthy than an ETF, because its easier to custody dollars in bank than gold bars in a vault, and unlike most ETFs, all the newer stablecoins can be redeemed for the underlying.

About the only thing controversial about stablecoins is the fact that Tether didn’t start falling apart sooner. That it got to almost $3b in market cap despite its numerous problems is both a testament to the demand for such a product and the need for a more legitimate alternative, which we now have thanks to products like TrueUSD, Circle USD and Paxos Standard.

Skeptics highlight the fact that Tether now trades at a discount to parity while the others trade at a premium as a flaw, but this actually proves that the products are working. Money is flowing from the less trustworthy iteration to the more reliable ones, a process you can watch unfold in real time.

Once they are done gobbling Tether’s market share, these new coins will be positioned to start disrupting payment rails beyond the crypto economy. One idea that I try to drive home in my courses and book is the fact that most of our current financial infrastructure, such as the 50-year old SWIFT transfer system, was designed for transactions done on paper. Those same processes were later digitized to work on the internet, but that’s not nearly as efficient as a native digital system, in the same way that ripping an Audio CD and emailing an mp3 to your friend is not as efficient as sharing a playlist on Spotify.

FinTech services such as Venmo and Adyen are one solution to that problem, but they are still limited by their reliance on the rickety infrastructure of the legacy banking system (not to mention their hefty fees). Fiat stablecoins riding decentralized blockchain platform offer a cleaner and cheaper upgrade.

So while the old guard is celebrating the latest upgrade to SWIFT (complete with a fun but perhaps slightly racist video), and bragging about how in the future half of all transfers will settle within 30 minutes (not including the time it takes you to fill out that wire form and fax it to your bank), fiat stablecoin transactions settle within minutes, if not seconds. They are also transparent, programmable and available for the unbanked. Right now, anyone with a smartphone can start using these products with no walled gardens or account registration. SWIFT will never offer that.

Some crypto-enthusiasts find these products troubling because they don’t use a coin like Bitcoin and rely on fiat money deposited in a bank. But to most people, and virtually all businesses, that’s not a problem, it’s a feature. People like using money they already have deposited in a bank they trust. What they don’t like is complexity, lack of transparency, high fees and gated fiefdoms that add up to a system that looks like this:

courtesy of Bloomberg

courtesy of BloombergWhich is why they’ll eventually switch to this:

The digital asset industry is now building a parallel dollar transfer system on blockchain rails. Coinbase and Circle might be competitors in the exchange business, but they’ve partnered up to launch Centre. Paxos and Binance are also competitors, but the stablecoin created by one is available for trading on the other.

It’s only matter of time until the non-financial industries that have been at war with the legacy payment system, like gas stations and retailers, begin to make the switch. Walmart and Amazon might not realize it yet, but soon they’ll be able to use these coins to drastically reduce the payment fees that currently eat up a substantial portion of their profits.

Ten years from now, the only controversy about fiat stablecoins will be the fact that companies such as PayPal and Visa didn’t see them coming.

Omid Malekan is the author of The Story of the Blockchain, A Beginner’s Guide to the Technology That Nobody Understands and the head of content and instruction at Conversance

October 12, 2018

Nouriel Roubini’s 1991 Testimony to Congress About the Mobile Phone Bubble

(in case you missed it, this actually happened yesterday)

Dear Mr. Chairman and ranking members of the committee. Thank you for being smart enough to ask me to testify on these stupid new things called “cellular phones.” My name is Nouriel Roubini. I am a world renowned professor of economics and one of the few people to predict the 1987 stock market crash.

It is clear to me, Nouriel Roubini, that “wireless communication” is the biggest scam in history, and that the stock of fraud companies like Motorola, which went up 500% in a few years, were the biggest bubble ever. And I know about Bubbles Mr. Chairman, because in case you missed it, I’m Nouriel Roubini, and I predicted the 87 crash.

Motorola Stock Performance in late 80s

Motorola Stock Performance in late 80sProponents of this so called “wireless revolution” say it’s going to change everything, but I’ve tried using it, and the experience is terrible. The phones are huge and the call quality is awful. The battery only lasts an hour. When I use the perfectly fine existing technology of a landline to call my model girlfriends to tell them the story of how I predicted the 87 crash, I don’t have to worry about a battery, which is really important, because I’m Nouriel Roubini, and everyone wants to hear my opinion.

Also, just as I have warned with other contemporary scams and bubbles, like those pointless things called beepers, which are only used by drug dealers, these wireless phones are only useful for criminals activity. Why would any decent person ever want a different way to communicate?

Not that they can with today’s cell phones anyway, because the calls drop often, and that will never improve. If there’s one thing we can all agree on about a new technology, it’s that it doesn’t improve. I know about technology, because I’m Nouriel Roubini, and I predicted the 1987 crash.

The scam artists keep trying to tell us that wireless technology will change the world, but that’s only a distraction from the amazing innovations going on with existing landlines. We’ve already transformed from rotary dialing to touch-tones, and now you can even get a phone in the shape of a football. Now that’s real innovation, Mr. Chairman, a subject I clearly know a lot about, because I use a lot of adverbs and adjectives when I speak, and more importantly, predicted the 1987 crash.

The idiots that believe in wireless technology like to fantasize about it someday being used to do other things, like sending text messages or even pictures. That just proves how stupid they are, because if there’s another thing we can all agree on with technology, it’s that it never evolves beyond its original purpose. Besides, you can already use the perfectly fine solution of a fax machine to send pictures over a landline, something I do regularly when I send headshots to reporters to remind them that they should have me on air to talk about how I predicted the 87 crash.

In closing, even a broken clock is right twice a day, and I’ve already been right once, so I’m going to keep calling everything a bubble until I’m right again. I’m Nouriel Roubini. I’ve predicted 9 of the last 2 bubbles, so people should take me seriously.

October 11, 2018

A Warning Against Making Assumptions about Crypto to Stock Market Correlations

Yesterday’s stock market selloff, which was then followed by a crypto market selloff has once again reignited the debate of whether and how digital assets are correlated to other markets. It’s an important question that impacts everything from short term trading to long term hodling, and even I have speculated on the possibilities. But I would strongly warn against reading anything into what happened in a single day.

First, the crypto nose-dive happened hours after US stocks closed. In fact, while the Nasdaq was tanking, Bitcoin was actually trading up, as you can see here:

This is not how correlated assets work in an age when information travels instantaneously. Contagion is usually immediate and almost simultaneous, as was the case with the fall in oil yesterday along with stocks.

It also doesn’t make sense that crypto would play catch-up with a 24 hour move in equities in just a matter of minutes.

More importantly, crypto and stocks have entirely different volatility profiles, and that makes reliably measuring correlations almost impossible. If you are measuring something that might move 15% within a year against something that might move 500%, your results becomes entirely dependent on the time frame you chose.

For example, in January of this year, the Nasdaq 100 gained almost 10% while Bitcoin lost 25%, therefore, strong negative correlation. But in the ensuing 2 months, the NDX lost around 5% while Bitcoin lost 40%. So now the correlation is positive.

This problem persists throughout time and across different scales. If we use month-month data for the past 12 months, a back of the envelope calculation shows the NDX and BTC having a strong negative correlation of 0.6, which makes sense, because the past year has seen tech stocks mostly go up and crypto mostly go down. But look at the same period using weekly data and the correlation changes to negative 0.4. Different magnitude, but at least the same direction, right? Not if you look at monthly data for the past 5 years, because then the correlation jumps to a super positive 0.85!

(I’d love to do this analysis using daily and even hourly data, but since Crypto trades 24/7 and stocks don’t, doing so requires more data massaging than my envelope can handle. I’d love to see someone else do that analysis.)

If I had to guess, I would say yesterday’s move in crypto had a lot more to do with reports of deposit issues at Bitfinex than the stock market. So once again, we don’t know — and can’t know — what these correlations are until crypto volatility settles down and becomes less a slave to industry specific reports and more to global macro developments.