Omid Malekan's Blog, page 2

December 23, 2019

What the Hell is a FinTech, Anyway?

Decentralized Finance, or DeFi, has really shined in the past year, and proven resilient during the crypto bear market. If you haven’t been paying attention, there is now a rich ecosystem of blockchain-based, fully-transparent and mostly-decentralized applications that offer lending, saving, trading, market making, derivatives, synthetic assets and even insurance.

MakerDAO, the leader of the bunch and by far the most sophisticated project on the Ethereum platform, recently pulled off a successful transition to version 2.0. It now boasts a $115m loan portfolio backed by close to $350m in assets. It also outputs the most reliable stablecoin in the blockchain ecosystem, one that is always fully backed (unlike Tether) based on sound financial principles (unlike Basis) and doesn’t have any corporate baggage (unlike Libra).

If Maker were a FinTech, the VC community would be tripping over itself to get access. The Fintech Insider podcast wouldn’t stop blabbing about it and PYMNTS would have done an entire series on the transition to multi collateral Dai. But nobody considers Maker a FinTech. If you google “MakerDAO + FinTech” the only hit is the project’s own GitHub.

Most FinTech experts probably don’t even know it exists. That’s not due to size, as Maker is presently at half-Unicorn status. It’s not due to traction either given the over 100,000 different loans the service has already dished out and the hundreds of millions of dollars worth of assets it currently holds as collateral. Maybe the experts are thrown off by the fact that MakerDAO is profitable , violating the sacred notion that the best startups are the ones that lose money today and will lose even more tomorrow.

Or maybe it’s just a lack of imagination. Most FinTechs are nothing more than an old business model using new infrastructure. Stripe is a digital knuckle-buster that embeds into websites. Robinhood is a discount broker with a slick interface (but without the profits discount brokers used to be known for.) PayPal is Western Union using TCP/IP instead of telegraph. Revolut is digitized travelers checks with some random other businesses thrown in (because when losing money is a virtue, you should go into as many random business as possible). Chime is a bank, like any other bank, except that it’s done away with branches, and positive cash flows.

These companies have smart and hard working founding teams and millions of loyal users, for which they deserve credit. They also have the old guard of financial services on their toes to upgrade their systems, which is good for everyone. Some even deploy new tech such as AI in genuinely creative ways. They are incrementally innovative, but only by the standards of existing financial services, an industry that only recently discovered the internet.

Fintechs are far from revolutionary. Most still do what their predecessors have done for centuries — use proprietary ledgers to move client money around or intermediate between savers and borrowers. They have typical management structures and, like those who came before them, gain user trust from reputation and regulation. You, as a concerned client, know as much about what’s going on inside their systems as customers of the First Bank of Wichita did 100 years ago (actually FBW had a banking license, which many Fintechs don’t, so it probably had tighter disclosure requirements). But hey, they use Python, so there’s that.

DeFi projects like Maker are actually different because the root of trust on top of which they are designed is an open, decentralized and censorship resistant blockchain platform. Here is the actual list of every loan Maker has ever given out, open for anyone to see. It’s also the first bank to tell you, Joe Schmo Public, its exact leverage ratio in real-time — a privilege that even the CEO of the hottest challenger bank probably doesn’t have.

Like all DeFi projects, MakerDAO has never discriminated based on race, gender, nationality, income level or any other factor beyond financial qualification. A poor person in Vietnam borrowing a few dollars from Maker pays the same interest rate as a billionaire in America taking down a giant loan. Can your favorite FinTech offer the same?

Then there is the superfluidity of the DeFi ecosystem. Every user can move seamlessly from borrowing to saving to trading to market making to investing in synthetic assets, and from crypto exposure to dollars to gold to the S&P 500, all within a few minutes and for just pennies in fees.

Compare that to the FinTech world where PNC Bank just kicked out Plaid so users can’t cash out from Venmo. That’s problematic for Venmo users wanting to transfer a balance to PayPal, because even though both services are owned by the same company, they don’t interoperate. #innovation

Despite the best efforts of many smart people, the FinTech industry is a lot closer to the legacy financial system than the blockchain-based one. There are projects on Ethereum such as Uniswap for which there is no historical analog. The word innovation has been abused to the point of meaninglessness, but if we are to ever resurrect it, it should mean “that which has not existed before, but should.”

So what the hell is a FinTech anyway? Depends on what you are looking for. If you are looking for easy to understand projects with nice interfaces and fat valuations, look to the traditional names. If you are looking for originality, then it’s time to start paying attention to DeFi. You’ll know you are confronted by actual innovation by how confusing most of the projects will be at the outset. Confusion is a necessary condition of understanding something seminal.

Just as 2019 was the year stablecoins exploded onto the scene, 2020 will be the year DeFi breaks the world, in a great way. Business models will be challenged, the uninformed will be embarrassed and regulators will have yet another freak out. The world will actually change a little bit.

The opinions expressed here are strictly my own and not that of any employer, client or associate. I am a small investor in MakerDAO, but you probably shouldn’t be, unless you fully understand how it works.

November 2, 2019

We Are Not Criminals, Terrorists or Money Launderers

A recent report from the Financial Action Task Force says the following about projects like Libra: “[stablecoins] could…have implications for money laundering and terrorist financing risks.”

We expect an enforcement body to have this viewpoint, but they are not alone in focusing on the nefarious uses. Here’s the Bank of International Settlements: “If not effectively regulated and supervised, cryptoassets, including stablecoins … may create new opportunities for money laundering, terrorist financing and other illicit financing activities.”

All of the backlash against Libra could be explained as either hatred of Facebook or fear of Libra being used for something bad. As a letter from two members of the U.S. Congress to the CEOs of Libra Association members said: “Your companies should be extremely cautious about moving ahead with a project that will foreseeably fuel the growth in criminal activity.”

There is little that’s “foreseeable” about any emerging technology, and politicians are usually not known for their powers of prediction. Nonetheless, most of the companies whose CEOs received that letter dropped out of Libra shortly thereafter.

Let it be stated for the record that the vast majority of digital currency users are not thieves, terrorists or — as the letter from Senators Shatz and Brown hints — child pornographers. Nor is Bitcoin the only, or even primary, medium through which bad guys transact. There is $20B in credit card fraud every year, and more crime gets committed in a single week using good old fashioned dollars than there are bitcoins in existence. Al Qaeda and El Chapo financed themselves just fine without having to learn about private keys, thank you very much.

So why all the hoopla?

Maybe because fear mongering about credit cards doesn’t have the same sensationalist ring to it. Or because there is always a bias against new technology. Thirty years ago, the New York Times ran a story titled “Schools Responding to Beeper, Tool of Today’s Drug Dealer, by Banning It.” Teenagers today have a far more sophisticated mobile device in their pocket, and the world has not ended. (if anything, law enforcement has gotten easier)

Also to blame is the fact that our existing banking and payment systems have been weaponized for policy enforcement. Anti-money laundering and sanctions enforcement is stronger than ever, mostly at the expense of the silent majority who are doing nothing wrong. Libra is proposed in part as a solution for unbanked, poor and disenfranchised people whose exclusion from the current financial system is exacerbated by compliance. Having to identify every user and confirm they aren’t doing something nefarious is cumbersome and expensive, leading to lack of access for some and higher fees for all.

These requirements also lead to centralization and a different kind of abuse. A financial system built on monitoring and identity leads to red lining and discrimination, not to mention databases full of personal data begging to be hacked. Cryptocoins (or fiat-backed coins riding the same infrastructure) offer a different solution. By using cryptography instead of identity to authorize transactions, they enable anonymous usage, and anonymity leads to fairness. The blockchain is the only payment method that treats billionaires and the poor the same.

Anyone worried that anonymous payments are dangerous should remember that cash, still the most commonly used payment method, is also anonymous, and has been for a thousand years. Blockchain technology re-introduces the notion of the bearer asset into the digital world, so instead of having to rely on corporations or governments to establish ownership, users can rely on math. Digital bearer assets allow everyone to reclaim something vital: their data.

How ironic then that the same lawmakers who are concerned about anonymous payments are also lambasting Facebook for wanting to collect financial data. The Libra blockchain was designed to allow anonymous usage, but legally Facebook has no choice but to have its Calibra subsidiary collect reams of personal data on every user.

Crypto is not the first technology to force a difficult decision. Even a service as benign as email can be (and obvious has been) abused by terrorists and criminals. Most countries allow unfettered access anyway, in part because digital footprints help solve crimes. Crypto is now forcing the issue over payments, and the same answer works. Bitcoin transactions might be anonymous, but they take place on a transparent ledger that gives far more clues on money movement than physical cash. All that is needed to solve crime is some good old fashioned police work.

If governments and regulators around the world don’t eventually come around on this technology, we can make two conclusions. One, the real reason they don’t like crypto is not because it empowers the bad guys, but because it diminishes their monopoly over currency, stunting the impact of misguided policies like negative interest rates, bailouts and QE. Two, the technology will be driven underground and become even more anonymous and uncontrollable.

A lot of crypto purists also don’t like Libra, because they view fiat-backed stablecoins as too much of a compromise and too dependent on the legacy financial system they hope cryptocoins can someday replace. The biased, unreasonable and at times ridiculous government reaction is proving them right.

October 19, 2019

The Speculative Case for $1000 ETH (If Ethereum is Valued as a Fiat Payment & FinTech Platform)

I’ve already written about how investors in the red hot payments sector are underestimating the disruptive threat of stablecoins and thus overvaluing the existing business models of proprietary networks. Today I’m going to argue crypto investors are making a similar mistake, and thus undervaluing ETH.

Ethereum is increasingly becoming a fiat payment platform thanks to the plethora of stablecoins that reside on top of it. Tether’s $4B in coins have mostly migrated over from the Omni protocol. All of the next few biggest stablecoins are of the ERC-20 variety, including the new Binance once. Then there’s Dai, the first ever decentralized and uncensorable digital dollar. It’s early days, but stablecoins may have already surpassed Venmo in quarterly volume of dollars moved.

It’s only a matter of time until “fiat on the blockchain” becomes a dominant force in payments. Yes, these products are new and clunky, and the networks they ride on are slow and have scaling problems. But so was every other payment method in its infancy. What matters is the long term potential, and there stablecoins have a lot more to offer, because an open network always beats out a restricted pipe.

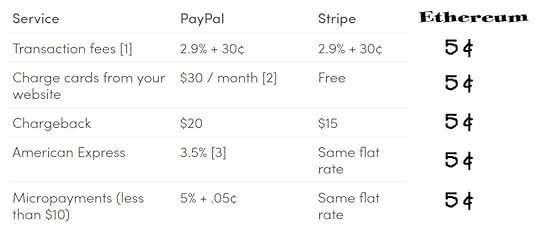

The first differentiator is the variety of options. A user on Ethereum who wants to make a payment via stablecoin has many to choose from and can send their preferred option via an ever growing list of wallets. That competition keeps prices down (close to zero) and service quality up. PayPal on the other hand has only one wallet and one rail, factors that directly lead to the second differentiator, fees.

A $1000 online purchase paid for with PayPal costs the merchant $30. The same via stablecoin on Ethereum costs the sender less than thirty cents. That disparity holds true across all of the legacy gateways on account of their business model, including Stripe, Square, Adyen and so on. Such fees to payment providers eat away a substantial portion of the profit margins of the retail industry. Stablecoins represent a radical solution.

The difference in economics can’t be over stated. Legacy payment rails charge a percentage of the amount being sent to earn income. Stablecoins cost a flat fee to secure the network. A $50,000 payment on Ethereum costs the same as a $5 one, just a few cents. A fifty thousand dollar payment on PayPal cost’s a month’s rent. One of the greatest impacts of the stablecoin movement on the payments industry will be the migration from percentage fees based on payment amount to flat fees based on network congestion.

Legacy payment providers (and those who invested in them) deserve a lot of credit for the rails they’ve built. But there’s a reason we call them payment gateways. Gateways are restrictive and expensive for users, which is why they are so profitable for owners — until they get disrupted by new technology. There was a time when communication gateways (also known as telephone companies) were among the most profitable companies around, because they charged per minute (and later, per text) fees. That all went away, because the internet. Per dollar fees for payments will eventually go the same route, because blockchain.

The current payment industry’s profit margin is stablecoins’ opportunity, and all the stablecoins that matter are on Ethereum. Given this dynamic, investors are overvaluing equity in payment providers and undervaluing ETH. The combined market cap of all of the legacy payment providers, the old and the new, currently sits north of $1T. If Ethereum — arguably the fastest growing fiat payment platform in the world — takes just ten percent of that market share, it will be worth $100B, or approximately $1000 per coin.

Yes, legacy payment companies do more than just move money, and some of those additional services are great. But Ethereum also does more, and by virtue of being a programmable platform, can theoretically do it better and cheaper. Issuing rewards and coupons is complex and expensive using legacy rails because those services require separate systems. On Ethereum they can be implemented with a few lines of smart contract code. But an even more compelling arguing in favor of Ethereum as a dominant payments platform is fluidity.

In the time it’s taken you to read this essay, I could have sent you a $10,000 stablecoin payment to your preferred wallet. You could have then taken those funds and used a decentralized exchange to convert them to a different coin, then sent that coin to Compound’s money market and already earned interest. You could have also cashed out that interest and sent it to a different exchange to buy some ETH, then used that ETH to bet on the next election, buy insurance or grab some tokenized real estate. All on the same network. All within the same wallet. And all for a few cents here and there in fees.

I dare you to replicate that flow using Visa, PayPal, ACH, Transferwise, Square Cash, or any combination therein. You’ll spend ten times as much in fees and not accomplish a tenth as much, even if you wait a week. The real promise of Ethereum as a payments platform is the way it can abstract away the payment into a tiny (and cheap) transfer of data, on top of which users can access a brand new, natively digital and superfluid financial system. If Ethereum as payment platform is not worth just a fraction of the total value of the payment industry, what about Ethereum as the new value protocol of the entire planet?

The opinions expressed here are strictly my own and not that of any associate, employer or client. This is not investment advice, and I have no idea if ETH will appreciate — it’s also possible that all legacy payment providers are overvalued and the valuation gap will be closed that way.

October 11, 2019

Free Money Makes a Fool of You and Me

(listen to the audio version here )

If the company that made the Thighmaster was in its prime today, it could be a unicorn. It could call itself a tech company and offer online classes led by Suzanne Somers. The CEO would give talks about changing the world with “home exercise as a service” while a chart of explosive revenue growth was projected in the background.

If you think I’m kidding, you never read the Peloton prospectus, where the company declared itself — not as you might think, a maker of pricey spin bikes — but as a “Technology, Media, Software, Product, Experience, Fitness, Design, Retail, Apparel and Logistics” company. In his included letter the CEO declared: “Peloton sells happiness.” He then boasted about the opportunity to create “one of the most innovative global technology platforms of our time.” What he didn’t boast about, despite this being a letter to potential investors, were profits. But hey, who could put a price on happiness?

Exercise fads, and the companies that profit from them, come and go. The evidence is in the vintage infomercials uploaded to YouTube or barely used gear downgraded to your basement. We could only imagine the valuations that could have been bestowed on the sellers of Ab Rollers and Tae Bo videos if this was their heyday. Then again, those companies had one serious flaw that may have disqualified them from full unicorn status: they made money.

How, exactly, did we all become so naive? At what point did we suspend all disbelief and start praying at the feet of whichever hype man could sell the grandest vision, one where mounting operating losses and no path to profitability somehow proved his genius? When the history of the current startup boom is written, the focus won’t be on the fall from grace of the Ubers, WeWorks and Pelotons of the world. It will be on how they rose so high in the first place.

Technology cycles also come and go, often accompanied by an investment boom. But at least during the last one, the dotcom bubble, web companies were new and different enough that we could justify suspending disbelief. Executive office companies and exercise bike makers on the other hand have been around forever, and neither business model has proven itself immune from the business cycle. Tech companies can sometimes transcend that cycle, but free beer on tap or an expensive video subscription service does not a tech company make.

Entrepreneurs have always had unlimited faith in their own vision, but the one thing that’s different this time is that they also have unlimited access to capital. There was a time when startups would have to fight to raise money. Now it’s the VCs that struggle to get in. “Money is free,” more than one respectable investor has said to me in the past year, “so you have to fight to get access.” That’s the kind of situation that’s bound to end badly, or maybe already has.

Promising unlimited capital to a startup is like giving a teenager a credit card with no spending limit. Only irresponsible decision making can ensue. As much of a distraction as it may be for entrepreneurs to have to raise capital, that struggle keeps them in check. It reigns in their ambitions and enforces focus. People tend to function better when they have limited choices. If you grant them unlimited options and endless capital you are bound to get something resembling the leadership style of Adam Neuman.

The public markets have turned out to be the Waterloo of this money madness. That could be due to tighter reporting requirements, or the fact that public investors don’t operate in as much of an echo chamber as private ones. Regardless, the stunning post-IPO declines of Uber, Lyft, Slack and now Peloton, and the shocking inability for WeWork to find a bid at any price, are bound to reverberate. Whether this is some temporary blip for a handful of Unicorn-cum-Icaruses or a broader reversal remains to be seen, but the trouble may only be starting for the fallen five.

Losing money, counterintuitively, makes it easier to sell a fantasy. Investors are suspicious of any company that makes a million dollars today projecting making a hundred million tomorrow, as the percentage increase is too steep. But if that same company is losing a hundred million instead, we can all pretend they are a flip of a switch away from making just as much. When unicorns switch to cost-cutting and profit-making mode, they can no longer sell that fantasy.

A WeWork that was going to open a gazillion new centers and take over housing, fitness and education could at least pretend to deserve a $50 billion valuation. A WeWork that is nothing more than a millennial-friendly executive office company with slow growth cannot. Regardless of what happens to the rest of the startup scene, the writing for these companies is on the wall. Or maybe it was in their prospectus all along.

The opinions expressed here are strictly my own and not that of any associate, employer or client.

September 29, 2019

On Coins and Canals

A lot has changed since I first started writing that stablecions would become a big deal and disrupt the booming payments and FinTech industries. On the crypto side, blockbuster projects like JPM Coin, the Utility Settlement Coin and Libra were announced. Dai proved resilient despite an ugly collateral winter and public coins like Tether grew even larger. Regulators and central bankers went from not knowing to what they are to obsessing over them.

And yet, on the FinTech side, nothing has changed. Judging by the capital markets, investors now believe in siloed payment providers who own proprietary pipes more than ever. Visa has overtaken J.P. Morgan to become the world’s biggest financial company. PayPal’s stock is 20% higher from when I first wrote about its inevitable demise. Stripe’s valuation has jumped by 50% in less than a year.

Ironically, the ascent of the (soon to be) old guard happened despite all three companies giving stablecoins the ultimate stamp of approval by joining the Libra Association. Here is David Marcus going on about how Libra will change the world by drastically expanding access and lowering fees, and there are three of the world’s biggest payment companies — with business models based on limited access and higher fees — nodding along.

Say what?

I like history, and analogies, and find an appropriate one in the transportation industry of the early 19th century. Moving money is a lot like moving goods. If either money or a physical item needs to get from point A to point B, and you happen to control the only route, then you get to charge a toll. If an unrelated secular trend leads to a lot more goods or payments needing to traverse that route, then you make a lot of money.

Today, the good is electronic payments, and the routes are cards rails and e-money schemes. As commerce grows increasingly digital, global and platform based, the few available pipes to send payments grow increasingly profitable. In the 1800s the good was industrial and agricultural supply, and the routes were rivers and lakes. As the world grew increasingly industrial and trade-oriented, the few available routes out of North America grew increasingly important. Contemporary companies like Stripe and PayPal are changing the payment landscape by building important bridges between legacy payment pathways. Back then, the same thing was accomplished by building canals.

If you aren’t familiar with the canal boom of the first industrial revolution you are missing out. So much of the map, economic layout, population distribution and culture of America can be attributed to a single piece of infrastructure: the Erie Canal. It connected two major shipping corridors in the form of the Great Lakes and the Atlantic Ocean via the Hudson River and literally redrew the map of North America. The Midwestern farm belt, Northeastern Industrial Belt and New York City all ascended because of it. And of course, it was highly profitable. So much so that its tolls paid for the massive cost of construction within 3 years, a repayment time unheard of in the modern era.

Canals are slow, expensive to build and difficult to maintain. But because they were the only game in town in the early industrial era, they were economically important. There was a time when the fastest way to ship goods across Pennsylvania was up to the Great Lakes and down through New York City. The success of the Erie as an economic gateway inspired many other canals to be built at great expense. They all did great, and made a ton of money, until the railroads did them in.

I like this analogy because it shows how in the absence of a proper network that connects two points directly, even the most cumbersome, indirect and expensive transportation options could do extremely well. That’s the FinTech payment boom of 2019 for you. What makes companies like Stripe so successful is that they can abstract away all of the inefficiencies and messy underbelly of the siloed payment industry and give merchants and users a payment experience that looks seamless. This is a valuable contribution today, but not nearly as good as a grid that allows instant point to point transfers of money. That’s the stablecoin vision of tomorrow.

We can stretch this analogy as far as we like. Just as the biggest payment providers of today have joined Libra because they believe it only accentuates their business model, canal operators initially embraced railroads as a means of bringing more goods to their shores. Both stablecoins and railroads are in some ways limited in capacity compared to the infrastructure they hope to replace, but the efficiencies of shipping (or paying) point to point are worth the trade-off.

Some canals survived deep into the railroad boom and were even expanded as a result, which means some of today’s payment gateways, particularly the wholesale ones that move huge sums of money, will be with us well into the stablecoin boom, and possibly benefit from it. We are already seeing this with Libra. In order for the overall mission to be successfully, the project is going to need a lot of help from the legacy financial system, including certain payment gateways.

I expect the endgame for most of today’s payment players to be the same as those of 18th century canals, now more than ever. A network, be it a physical one for moving goods or a digital one for moving value, wants to be built. The efficiencies and growth economics are too tempting to ignore. The more money the Visas, PayPals and Stripes of the world make operating their canals, the more everyone else will be willing to invest in a network that replaces them — despite challenges like this.

Libra is just the beginning. Whether it succeeds, or even launches, is a moot point. The idea of a decentralized payment network that only charges minimal fees to provide security (as opposed to seeking rent to reward shareholders) has now been validated, and there’s no turning back. If the statement “your profit margins are my opportunity” is to be believed, then there is no greater opportunity in all financial services than a secure global blockchain-based payment network.

August 5, 2019

Why NIRP Can Only Get NIRPier (Part 2)

In part 1 of this post, I wrote about how — similar to the medicine men of old who used to prescribe poisons like Mercury as cures — central banks around the world are trapped in a hamster wheel of their own making. Low interest keep causing economic disruption that is addressed with even lower rates. But unfortunately for them, there’s a natural barrier to how far they can push things, and it is known as “the zero-bound problem.”

The idea behind Negative Interest Rate Policy (NIRP) is to force people to spend or invest the money they would otherwise save by effectively imposing a tax on savings accounts at banks. But unfortunately for economists, the average citizen didn’t go to Harvard, so he or she doesn’t realize that buying things they don’t need or investing in things they don’t like is good for them. Ignorant as they are, the average person likes to save to build a buffer against future setbacks. In a NIRPy environment, the best way to do that is to hoard cash. So long as doing so is an option, taking interest rates significantly below zero is not effective, putting a zero bound on just how much poison the medicine man can force upon his patient.

As we also discussed in part 1, economic models, like the ones that have fallen flat since the economic crisis, are never wrong. It’s always the humans who don’t do what the Excel spreadsheet predicted they would who are at fault. If the natural reaction to NIRP (an idea that is relatively new) is to hoard cash (an idea that is thousands of years old) then the smart move is to eliminate cash altogether. How? By having a central bank issue digital legal tender, colloquially referred to as Central Bank Digital Currency, or CBDC.

CBDCs are the hottest new idea in policy circles, in part because they give policymakers total control over the currency. There are different implementations, and a few include the use of blockchain tech. The original Bitcoin white paper, after all, was titled “Peer to Peer Electronic Cash,” and the technology is an eloquent solution for creating digital bearer assets that can be used as money.

For consumers, the appeal of a CDBC is the elimination of the expensive or fragmented electronic payment solutions of today. Just imagine if your smartphone held your digital dollars, and you could instantly send them to anyone, anywhere, possibly for free. A CDBC could also better incorporate the poor and unbanked into the digital economy.

For Central Banks, having every single payment occur on a ledger they control is the ultimate source of power. The imposition of negative interest rates would now be absolute as users’ digital dollars would literally have nowhere to hide. Even inflation targeting would theoretically become trivial. Want to create instant 2% inflation? Just program every blockchain addresses balance to increase by 2%.

There are many different challenges to building out such infrastructure, starting with the fact that no blockchain today can even remotely handle the volume such a system would require. Even if the technical issues were solved, there would still be systemic challenges, like what happens to the commercial banking industry, a big part of the value proposition for which is payments and cash management.

We are still years, if not decades, from such a solution being viable, but that’s not what matters to policymakers. What matters is that there is a solution to the zero-bound problem on the horizon. Twenty years ago, the idea of deeply negative interest rates would have had to be dismissed due to consumers’ ability to hoard cash. But now, “there’s a blockchain for that.”

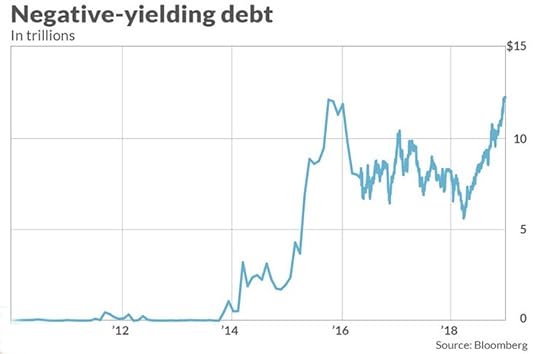

The potential for the development of a CBDC is yet another reason why NIRP is bound to get NIRPier. People are already talking about this with the ascent of Christine Lagarde — current head of the IMF and big fan of the digitization of cash — to replace Mario Draghi as head of the European Central Bank. Dozens of other central banks are already researching how they would deploy digital cash into the economy. Many pay lip service to the practical benefits of such a system, but it’s safe to assume an underlying motivation is the elimination of the zero-bound barrier.

So once again we are back to the conclusion of my original post that NIRP will keep getting NIRPier, and that gold and crypto will be the biggest beneficiaries. Gold is ancient, easy to understand and familiar, but also difficult to acquire, store and transact. Crypto is new and confusing, but easy to store and transfer.

Ironically, the fact that one potential design of a CDBC is to use blockchain tech will further enhance the bullish thesis behind crypto. If Central Bankers — the people whose very existence is anathema to the notion of decentralized money — bless the technology that empowers the likes of Bitcoin and Ether, how bad could those assets really be?

July 30, 2019

Why NIRP Can Only Get NIRPier (Part 1)

Economics is the only profession where the more an idea fails, the more it is believed. Consider the following theory:

Low interest rates lead to higher growth and higher inflation.

If it were true, then a decade of the lowest rates in recorded history would have seen the global economy go gangbusters. Instead it’s been mostly the opposite, leading any reasonable person to at least question this theory.

But wait a second! A wunderkind econ whippersnapper fresh from Davos interrupts. If not for low interest rates, things would have been even worse!

This kind of defensive argument is popular among failed forecasters. And to be fair, I can’t prove that it isn’t true and low rates didn’t prevent some unforeseen calamity. That’s the beauty of the Hyperbolic Avoided Hypothetical (HAH! for short) and why it has become a favorite of the Central Banking elite. But it’s junk science, because you can’t disprove it either. For example: I just used my superpowers to prevent a zombie apocalypse. Go ahead and prove that I didn’t. (Do you see any zombies? No? You’re welcome.)

These twin tendencies of believing and idea that keeps disappointing and justifying it with all the worse outcomes that didn’t happen are the pillars of the global liquidity trap that is slowly pulling us all under. Ten years ago, there was a plausible theory that lower rates were a good idea. When they failed, rates were taken to zero (zero interest rate policy, or ZIRP). When that failed, they were taken negative (negative interest rate policy, or NIRP). At no point was it ever even considered that maybe, just maybe, it’s the theory that’s wrong.

My belief is that in the short term, artificially low rates are deflationary, as they result in investing booms that create excess capacity and misallocation of resources that hurts growth. Uber, Lyft, WeWork and AirBnb have caused plenty of deflation by constantly raising money to operate at a loss. Cheap debt enabled a fracking boom that’s flooded the oil market. Public companies that can borrow for nothing are more likely to spend that money on buybacks than wages.

But don’t say any of that to a central banker. In a profession where the things that didn’t happen matter more than the things that did, where giving free money to billionaires reduces income inequality and iPad prices matter more than the cost of food, the only thing that’s wrong with low interest rates is that they aren’t low enough.

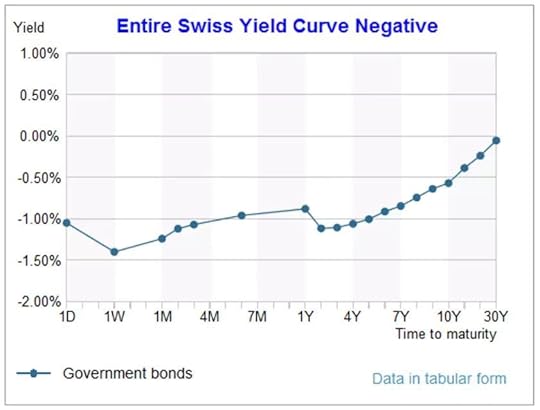

And so, the ECB has just announced it will cut rates from negative 0.4% to negative 0.5%, because clearly what’s ailing Europe in the year 2019, a year of hard Brexits, Yellow Vests and right-wing uprisings is the fact that NIRP isn’t NIRPy enough, and should in fact be even NIRPier.

Here in the US we don’t have NIRP (yet) but the Fed is about to cut rates, despite the fact that unemployment is at an all time low, the stock market is at an all time high, and inflation is sitting just below the Fed’s own target. So why start easing? The Wall Street Journal asks the same question and concludes:

Federal Reserve Chairman Jerome Powell is leading his colleagues to cut interest rates this week for the first time since 2008, even though the economy looks healthy, partly because it isn’t behaving as expected.

Translation: The Fed’s economic models have once again failed to predict the behavior of millions of people, and that could only mean one thing: the people are wrong. It’s tempting to get on these economists for their folly, and lord knows they deserve it, but what we are witnessing is the all too common tendency among smart people to double down on a false belief when confronted with the limitations of their own intelligence. (Unfortunately, and unlike a degenerate gambler, Central Bankers get to double down with our money.)

The great philosopher Homer (Simpson, not the Greek dude) once toasted: “To alcohol: The cause, and cure, of all of life’s problems.” The same can be said for low rates. As the extremity of these policies continue to cause a widening wealth gap, social discord and populist uprisings, they will accelerate the feedback loop. As the drama unfolds, two assets, gold and crypto, will become increasingly sought after.

Yes, you can also use equities, venture capital and real estate to hedge against negative rates. And in fact, that’s exactly what Central Bankers want you to do, along with buying shit you don’t need and taking on debt you might not be able to repay. But too many of us lived through the financial crisis to forget its lessons, and stocks, startups and skyscrapers have already had an epic run anyway.

Gold has been a great hedge against insanity for thousands of years, and with crazy shit like the entire Swiss yield curve being negative out to 50 years being the new normal, these are historically insane times.

Crypto represents a lot of things to a lot of different people, and it remains to be seen whether it ends up being more of a store of value, medium of exchange, equity in decentralized network or some combination therein. But going forward, it will also start to act as a vote against the insanity, for the simple reason that it exists entirely outside of the traditional financial system. In that regard, it is rather undervalued.

July 23, 2019

Stablecoins Revisited

If there was ever a time for a boring company with no reputation issues to introduce a vanilla single-currency stablecoin, now would be it. The push back that Libra’s far more ambitious plans have gotten reminds me of an old joke:

A college student calls her parents to deliver shocking news of having fallen in love, being pregnant and dropping out of school. Once her parents stop yelling, she tells them that she was just kidding and none of those things are true, but that she did get a C in math, which in light of all that could have gone wrong is not that bad.

I like the design of Libra and think its governance model is a good one. But even I have to admit that it’s too ambitious, even if there wasn’t the Facebook reputation issue. This technology greatly challenges the status quo and that has a lot of people reaching for the worst case scenario. I’m already tired of having to explain to otherwise intelligent people why this isn’t some nefarious private currency and more akin to a money order or travelers cheque. (don’t even get me started on JPM Coin not being a coin).

None of this is anyone’s fault but mine, as I made the classic expert mistake of underestimating how ready the world was for a big change, and it wasn’t until reading an insightful newsletter article from Ben Thompson that I fully understood why. At issue are the different ways people think about data and money.

Data is already a deregulated and decentralized global phenomenon. Outside of a few authoritarian countries, the internet is an open platform where bits move freely. Money on the other hand is still a tightly controlled national phenomenon. As a US citizen, there are almost no laws that control how or why I send a text message to a friend abroad. But there are many laws that regulate how I can send the same person money.

Pure cryptocoins like Bitcoin are one solution to this dichotomy. Since the data is the money, there is no way for governments to control it. This solution works for some people but is too radical for widespread adoption anytime soon, and prevents regulated financial institutions from engaging.

Libra tries to walk a tightrope in the middle. At the protocol layer — the blockchain itself — it proposes an open global network of data, free and open for anyone to use. At the application layer, which includes regulated entities like Calibra, the system is to comply by national money regulations, as David Marcus repeated ad nausea to congress. It’s a noble attempt, but unlikely to be accepted. If the project were to succeed, then the top layer would inevitably bleed into the bottom one.

What happens at the application layer only really matters at the edges, where people create and redeem new coins via the banking system. If a stablecoin ever becomes ubiquitous, creation and redemption don’t matter anymore as users become comfortable using the proxy itself as cash — no different than being comfortable maintaining a PayPal balance and not constantly draining it to your bank account.

Such a future state would make enforcement of national laws on AML and sanctions difficult as Libra tokens would be digital bearer assets similar to a duffel bag full of cash. I’m not a fan of strict AML/KYC/Sanctions laws as they punish the 99% who are not criminals to catch the 1% who are, but they are the law and the law cannot be ignored. So long as governments get to issue fiat money, they get to set the rules on how people use it.

For over a year now, I’ve been developing my stablecoin thesis around the fact that since money is just data, it should be permitted to move around as freely and cheaply as any other kind of data. I still believe this, but have to admit that it’s too early.

And so, now that Libra has totally freaked out the powers that be about what is technologically possibly, it may be a good time to introduce a less ambitious version. It would still be a net benefit because a transparent and distributed payment network is better for users and regulators, a key-based wallet system means less fraud, and programmability enables new business models.

For Libra itself to launch, it will have to reign in many of its ambitions. I for one don’t see how the powers that be will allow pseudonymous ownership of the tokens, regardless of the wallet being used. It might also have to dump the basket idea as it needlessly complicates things and brings in the awkward economics of negative interest rates.

All of that said, even if Libra never launches, the very attempt will always be remembered as a milestone for the industry, a sort of digital crossing of the Rubicon. Despite all of the controversy, concern and criticism, I can’t help but smile at the fact that the single biggest fear out there is no longer about the technology failing or being pointless. The biggest fear now is what happens if this technology succeeds.

July 17, 2019

My Conversation with a Congresswoman on Libra

Author’s note: below is a fictitious conversation between myself and an imaginary member of congress about stablecoins and Libra.

Hello. My name is Omid. I’m a blockchain writer, professor and consultant , and am here to answer any questions you may have on Libra.

Great, because I have many questions. First, what is a Libra token?

People call it a cryptocurrency, stablecoin or digital token, but those are unhelpful words that have yet to form consensus definitions. A simple description might then be more useful. A Libra Token is a transferable and programmable digital token redeemable for fiat money. It’s a digital token issued for payments and backed by cash being held somewhere safe.

Why does that sound familiar?

Because that’s how most payment methods work already. Everything from a bank check to a debit card or even Venmo operate on the same principle. Sending actual cash back and forth is not very convenient, so we use proxies instead. As long as people are confident the proxy can be redeemed for the money backing it in the future, the system works. Libra tokens work the same way, except that they ride on a brand new transfer mechanism known as a blockchain.

What is a blockchain?

All payment methods, including the ones mentioned above resolve themselves via some kind of a financial ledger — like the one inside your bank, an even bigger one maintained by the Federal Reserve, or the database used by PayPal. Blockchain is simply newer and better ledger technology.

Why is it better?

Blockchains are distributed, meaning many copies are kept by different users, and decentralized, meaning new entries are made democratically. Those two things make them more resilient than traditional ledgers. They are also transparent so both users and regulators can look inside and inspect them anytime they want, and made immutable with cryptography so it’s harder to commit fraud. Lastly, they are programmable, meaning companies can build more sophisticated accounting into them.

These features mean you can use them for payment schemes that look and feel like the ones we already have, but with several distinct benefits. They include faster, cheaper and more global payments, easier incorporation of digital identity, easier fraud prevention with tighter security, and programmable infrastructure that lets companies offer users cool additional features like instant rewards and smart coupons.

Hmm. That doesn’t sound half bad.

There’s more. Because blockchain is newer and better infrastructure, it’s theoretically easier to build a payment system that is more open and accessible. That’s why the Libra people keep talking about their project being aimed at the poor and unbanked. There’s a large swath of the population that’s been left behind by digitization, and some believe blockchain can bring them into the fold.

So why am I so suspicious?

That’s a good question. It could be because the project is being spearheaded by Facebook, a company that you have good reason to be suspicious of, or that blockchain reminds you of Bitcoin, and you’ve always been told that Bitcoin is bad.

Isn’t it?

Depends on your perspective. There’s a lot about Bitcoin that even you could appreciate. After ten years of operation, its blockchain has never made a mistake, defrauded a user or imposed hidden fees. Nor has it ever discriminated against a user because of race, nationality, gender or class.

Wow. We sure can’t say that about our old school financial infrastructure.

Yup. Plus there’s more, and you might really like this given your political ideology. Although the Bitcoin network is worth billions of dollars, no individual or corporation owns it. It’s owned and operated by a community that is open for anyone to join.

So the Bitcoin blockchain is socialist?

Kind of, except that you don’t have to wait three months for mediocre service provided by a bored bureaucrat. And since it’s fully decentralized, you don’t have to worry about some populist taking over and abusing the system for selfish gains, or restricting access to people they don’t like. Bitcoin is censorship resistant, so nobody has the power to keep anybody else from using it.

But isn’t that why criminals and money launderers like it?

Sure, just like criminals and money launderers like $100 dollar bills, shell companies and Rolexes. That doesn’t mean we should be banning Rolexes. Anything that is good for the general public, right down to the internet itself, can also be abused by the bad guys. But it can also be used by law enforcement. Bitcoin’s transparency means in some ways it’s easier to track criminal behavior than ever before.

And Libra is like Bitcoin?

Yes and no. Think of them as different implementations of a similar idea. The biggest differences are that the Bitcoin blockchain is totally decentralized and run anonymously, while Libra will be run by an association of the world’s biggest companies. Also, whereas the value of a Bitcoin is based entirely on supply and demand and fluctuates wildly, the value of Libra tokens will be tied to a reserve of cash and will be relatively stable.

So Facebook isn’t inventing it’s own private currency?

Not at all, at least no more than PayPal or Starbucks have invented their own private currencies with their mobile wallets.

But isn’t Libra an illegal security?

Think about what you just said. It can’t be both a private currency and a security at the same time. More accurate is to say that it is something new and somewhat challenging to existing regulatory, legal and tax frameworks.

But that’s ok, we’ve been through this before with technology. Remember when digital music first showed up? People overreacted then too, and Metallica started suing teenagers. But Steve Jobs invented iTunes.

And why might this Libra business be a good idea?

Because the world is increasingly going global and digital, and our legacy payment systems are having a hard time keeping up. They are either slow, expensive or siloed. People just want to be able to send money from point A to point B, regardless of time, distance, denomination, amount or reason. They want to be able to send a payment as easily as they can send an email. None of our existing infrastructure can do that but Libra, or another solution like it, might, assuming it’s built and operated correctly.

So what you are telling me is that Libra is a lot like other payment solutions, and the infrastructure it plans to build has some appealing features?

Yes. There are some differences, like the fact that Libra will be backed by a basket of major currencies instead of just one. I’m not sure whether that’s a good idea or not.

Won’t Libra compete with national currencies?

Only in places where the local currency is poorly managed. For reliable currencies like ours, Libra will actually increase their reserve status by providing digital access to millions of people all over the world. Think about how great that would be in all the countries where the government periodically destroys its own currency, mostly at the expense of the poor and powerless.

You sound pretty convinced that Libra will succeed.

Not at all. Facebook’s reputational issues are an impediment, despite what I consider a good faith effort by them to minimize their role in the design and governance of this project. Also, blockchain is really new, and the first iteration of a new item seldom takes over. That said, I do think all the possible benefits of existing currencies riding blockchain rails will eventually lead to a successful implementation.

I hadn’t considered all of that. Maybe I shouldn’t be so knee-jerk against this project, and should instead take some time to think about it.

There’s a first time for everything.

Don’t be so snarky.

I can’t help it, it’s in my nature.

Actually, don’t I know you from somewhere?

Maybe you’ve read my book?

No, but you sound familiar, particularly in the way you mix humor, education and condescension.

Ah. You must have seen my cartoon.

Yes, that’s it! You were really critical of the Fed and Quantitative Easing. Weren’t you totally wrong about that?

Yes and no. Some of my predictions didn’t come true, but I stand by my overall criticism that printing money doesn’t really solve any of today’s problems and creates bigger ones down the road. But there are certainly elements of QE, negative interest rates and aggressive monetary policy that have turned out to be absolutely wonderful.

Like what?

You could have bought Bitcoin for less than five bucks when my cartoon first came out.

What’s it worth now?

A tad bit more.

— -

The opinions expressed here are strictly my own and not that of any client, employer or associate.

,

June 22, 2019

BEEStMoD on a Summer Solstice

My two cents have been known to cost other people a lot more, which is why I don’t generally bother making market predictions. That’s a sucker’s game anyway, because — as any good forecaster would never tell you — being a successful pundit has nothing to do with being right and everything to do with never being wrong. There’s a subtle art to talking a whole lot while saying nothing, allowing for plausible deniability for when you’ll probably be proven wrong.

Only a select few know how to forecast the markets consistently, and the one thing I learned from years of being a trader is that I’m not one of them. (The other thing that I learned is that those who are will not tell you what to do for $99 a month). What I’m good at is thinking about broader themes of economic, technological and social progress, and then writing about how they might play out in the financial markets.

I wrote a blog post last August laying out my thesis as to why the centralized tech platforms of today would eventually be disintermediated, and recommended investors rotate away from the likes of Google and Facebook and invest in the coins of the biggest decentralized blockchain-based platforms. Specifically:

I’m confident that five years from now, $10,000 invested in BEEStMoD will have done much better than the same money invested in FAANG.

Here are the results so far:

Topped FAANG, definitely didn’t bottom BEEStMoD

Topped FAANG, definitely didn’t bottom BEEStMoDAs you can see, I’ve been mostly wrong. Technically the crypto basket is outperforming the tech stock one, but despite mine catching the top in tech, I was too early in the crypto bear market. If nothing else, you could have waited a few months and gotten everything at half price. My timing was terrible.

Nevertheless, with almost one year in the bank, I’m more confident about my prediction than ever before. Investing in digital assets is still nothing more than a bet on an idea, and that idea is starting to take root. Remarkably, it gained the most widespread adoption during the gut-wrenching crypto winter. Case in point: Facebook, one of the companies whose demist I’ve predicted, is now leading the charge toward decentralization, joined by the likes of Visa and PayPal, whose coming trouble I’ve also written about.

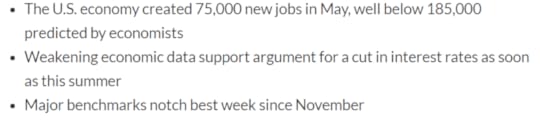

On the flip side, investing in the stock market is increasingly also a bet on a simple idea, and that idea — that liquidity and central bank intervention can fix all ills — is starting to get stale. The S&P 500 made an all time high this week, despite an onslaught of economic and geopolitical headwinds. Or rather because of them. Here are the actual bullet points from a recent Marketwatch story:

The cynicism in markets that rally when actual humans lose their jobs because a central bank will cut rates is palpable. About the worst thing that could happen between now and the expected July cut by the Fed is a strong jobs report. Think about that for a second.

A quarter point cut in the Fed Funds rate, which the Fed all but promised this week, would do nothing to solve any actual problems experienced by real people. If low interest rates created economic growth then the last decade, featuring the lowest in human history, would not have been so anemic. But the assets owned by the rich and powerful went up, so who cares? Like an addict excited to have acquired the next batch of opioids, how risk assets feel is all that matters.

Except in politics, where the economic inequality caused by central banks constantly giving free money to the wealthy and corporations “because the middle class” continues to drive populism. And in technology. What bureaucrats and Central Bankers are want to break, nerds and cypherpunks are trying to fix. On this summer solstice, I’m glad to be in the company of the latter.

Ask a central banker what his best idea is, and he’ll give you some variant of the one that’s already failed to do what he himself predicted the last 30 times it was applied. Ask a group of hedge fund managers, and they’ll tell you to BTFD on expensive tech companies, because “don’t blame me, everyone else was doing it” is the best job security on Wall Street. Ask a crypto nerd and she’ll take you on a journey that dares to re-imagine the nature of money, the spirit of banking and the root of trust.

There are those who keep doubling down on a failed idea, and those who dare come up with a new one. As the night once again begins to grow longer, and the S&P 500 touches a triple top, choose your company wisely. There is no such thing as a free lunch, but there is still (even above $10k) such a thing as a cheap Bitcoin.

The opinions expressed in this blog are strictly my own and not that of any client, employer, associate, colleague, hater, steward or stranger on the subway. Past performance doesn’t guarantee future results, unless you are Mario Draghi, in which case past failure is the best indicator of future action.

P.S: