Gennaro Cuofano's Blog, page 162

March 22, 2021

Stripe Business Model In A Nutshell

Stripe is a payment processing platform making money based on the transactions processed. Stripe charges 2.9% per successful card plus 30 cents. As a SaaS business, Stripe offers Billing (Starter and Scale), enabling customers to schedule clients’ invoicing or charging to analyze the subscription revenues. Other services also comprise Connect, Radar, Terminal, and Atlas.

BackgroundStripe is a financial services and software-as-a-service (SaaS) company headquartered in both San Francisco and Dublin, Ireland.

The company was founded in 2010 by Irish brothers Patrick and John Collison. Both were college drop-outs who received a seed investment from the start-up accelerator program Y Combinator.

In fact, the idea for Stripe was so compelling that it managed to attract $2 million in capital from one of its main competitors in PayPal.

Fundamentally, Stripe exists to remove the difficulty associated with processing online payments. This reality was highlighted for the Collison brothers when they launched their first company Auctomatic back in 2007. They noted that large companies had the capital to build their own payment systems, but smaller start-ups had to engage in lengthy and frustrating conversations with banks.

Collison would later note that “Stripe really did come about because we were really appalled by how hard it was to charge for things online”. The company is now worth about $95 billion, making it the most valuable privately-owned company in Silicon Valley.

Stripe revenue generation modelStripe make money on every successful payment it processes.

It does this through multiple products and associated price packages.

PaymentsThe Stripe Integrated service is the most simple pay-as-you-go payment platform for businesses. To use it, the company charges 2.9% per successful card charge plus 30 cents. International cards requiring a currency conversion will attract a further 2% in fees.

BillingBilling allows Stripe customers to schedule the invoicing or charging of clients and analyze their current subscription revenue.

Here, there are two plans:

Starter – charging 0.5% for recurring charges, or invoices sent every billing cycle. Stripe also charges $7 per invoice for invoice auto-reconciliation.Scale – which charges 0.8% on recurring charges but offers free invoice auto-reconciliation and includes a connection to the NetSuite ERP finance system.ConnectThe Connect application allows sellers to partner with Stripe and add payments to their platform.

There are three Connect options, with each offering a different level of functionality:

Standard – recommended for platforms to directly accept payments with account losses backed by Stripe. Free of charge.Express – suited for marketplaces who need to pay out sellers and service providers. In this case, Stripe charges 0.25% plus 25 cents for every payout sent.Custom – for those who want a flexible API to build a custom user interface. The same transaction charge of 0.25% plus 25 cents applies. There is also a $2 monthly fee per active account.RadarRadar is an application based on machine learning enabling customers to identify fraudulent transactions. Stripe charge 5 cents per transaction.

TerminalStripe also sells two physical payment terminals with card readers. The cheaper of the two is $59 while the other is $299. Both attract transaction fees of 2.7% plus 5 cents.

AtlasStripe customers can also use the platform to form a legal entity. The Atlas application helps users submit the required paperwork and informs of them important ongoing costs once the business has been incorporated.

For this service, the company charges a one-time fee of $500.

Key takeaways:Stripe is a financial services and SaaS company with headquarters in both North America and Ireland. The idea for the platform arose from the difficulty start-ups faced when creating a system to accept customer payments.Stripe drives revenue in multiple ways. Firstly, the company makes 2.9% plus 30 cents from every single transaction it processes. The company also makes money from its Billing and Connect products. These products help businesses schedule invoices, evaluate subscription revenue, and accept Stripe payments on their own platform.Stripe also offers several ancillary services. The company sells two physical payment terminals for use in bricks-and-mortar stores. It also provides an incorporation service, helping start-up founders navigate their first few months in operation.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post Stripe Business Model In A Nutshell appeared first on FourWeekMBA.

Peloton Business Model In A Nutshell

Peloton is a media and exercise equipment company primarily making money making money via its fitness products (indoor cycle with a touchscreen monitor with a base price of $1,895, also known as the Bike Basics package). Other packages are also available, including the Bike Essentials ($2,045), Bike Works ($2,145), and Bike Family ($2,345).

BackgroundPeloton is a media and exercise equipment company founded in 2012 by Graham Stanton, Hisao Kushi, John Foley, Tom Cortese, and Yony Feng.

Peloton sells stationary bicycles and treadmills that enable customers to remotely participate in exercise classes streamed from Peloton studios. Due to the COVID-19 pandemic, this form of remote physical exercise has become extremely popular.

But in the early days of Peloton, John Foley spent three years pitching the idea to thousands of investors. He was largely unsuccessful, securing a small amount of capital through angel investors only. However, the idea gained major traction when customers were given the chance to ride the bike in a class scenario. A retail store selling bikes soon followed.

Today, the company has over 3 million subscribers with 1 million of those being connected fitness subscribers. By the end of 2021, these numbers are expected to double.

Peloton revenue generationPeloton makes money from three distinct sources. Let’s take a look at each.

Fitness productsThe first and most obvious revenue source is fitness products. Peloton sells an indoor cycle with a touchscreen monitor with a base price of $1,895, also known as the Bike Basics package.

Several other packages are also available, including the Bike Essentials ($2,045), Bike Works ($2,145), and Bike Family ($2,345). These options offer the same indoor cycle with a host of accessories including riding shoes, a drink container, weights, headphones, and a heart rate monitor.

The company also sells a treadmill called the Peloton Tread. Like the indoor cycle, this also comes with a touchscreen and the ability to purchase added features. Peloton charges $2,495 for the Tread Basics package and $3,065 for the most expensive Tread Family package.

Both the indoor cycle and treadmill represent a significant source of income for Peloton. Some suggest the profit margin on these products is as high as 43%.

Apparel and accessoriesPeloton also sells fitness clothing under the Peloton Apparel brand, including gym bags, hats, leggings, and t-shirts.

This is a relatively small revenue generator for the company, but sales are growing at a year-on-year rate of 53%.

SubscriptionsWhile Peloton customers are exercising, they can purchase a subscription to exclusive sports content streamed directly to their monitor.

Here, there are two choices. The customer can either join a live class or choose from Peloton’s vast content library. In either case, the customer can view their progress against other program participants.

Peloton charges $39/month for the service, which it notes is a comparable price to a boutique fitness class run by Flywheel.

For those desiring a similar yet more affordable option, the Peloton Digital Membership is available for $12.99/month.

Key takeawaysPeloton is a media and exercise equipment company founded in 2012. The idea for Peloton was deemed unviable for years until customers were allowed to test it in practice. A general shift toward remote exercising has strengthened the already successful Peloton concept.Peloton makes a significant amount of money through the sale of treadmills and indoor cycles that have very high-profit margins.Peloton also makes money selling fitness apparel. This is a very small revenue stream at present, but with 53% year-on-year growth there is also high potential. Customers can also pay for a subscription to join live classes or choose from a vast library of exercise content.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post Peloton Business Model In A Nutshell appeared first on FourWeekMBA.

March 20, 2021

How Does Zelle Make Money?

Zelle is a peer-to-peer payment network that indirectly benefits the banks’ consortium that backs it. Zelle also enables users to pay businesses for goods and services, free for users. Merchants pay a 1% fee to Visa or Mastercard, who share it with the bank that issued the card.

Origin storyZelle is a peer-to-peer (P2P) payment network. It allows users to send money quickly and easily to their friends and family from a mobile device.

Zelle was created in collaboration between 30 U.S. banks. The standalone Zelle app is integrated with approximately 924 financial institutions, including major players such as Chase, Citi, Wells Fargo, and Bank of America to name a few.

The app moves money from one bank account to another in a matter of minutes. The only information required is the email address and phone number of the recipient. This makes it a more attractive option than a traditional bank transfer, which requires account number details and can take several days.

Zelle revenue generationZelle is not a fee-based platform, so it does not generate revenue directly. In fact, it was created to save banks money. Competitor P2P offerings such as PayPal, Venmo, and Square charge banks a fee for every transaction, so keeping these transactions in-house reduces costs. This also allows the banking institutions to capitalize on a general shift toward a cashless society and avoid having to maintain ATMs and branch offices.

Importantly, the app also generates indirect revenue for the consortium of banks who collectively have access to 100 million users in the United States. This encompasses a host of the add-on and complimentary services such as credit cards, mortgages, loans, and insurance.

Generation X and Baby Boomer users have also become a significant growth area for Zelle, many of whom were previously unfamiliar with the P2P concept. After just two years, the app has become the largest P2P service in the U.S with users completing around 743 million transactions worth $187 billion.

Although not explicitly stated, Zelle owner Early Warning Services LLC likely receives a payment from participating banks to maintain the integrity of the Zelle network.

B2C and other potential revenue generation modelsIn 2018, Zelle launched a feature enabling users to pay businesses for goods and services.

For the consumer, Zelle offers this service free of charge. But the merchant must pay a 1% fee to Visa or Mastercard who then share the resultant revenue with the bank that issued the card.

Looking forward, it would not be unreasonable to suggest that other financial products be recommended within the Zelle app. This would allow partnering institutions to generate revenue through affiliate commissions and referrals.

Key takeaways:Zelle is a P2P network allowing users to seamlessly transfer money to their friends and family. It was created by a consortium of 30 North American banking institutions.Zelle is a free platform that does not generate revenue directly. However, the app was likely developed to maintain market share in the P2P industry and reduce third-party fees from competitors. There is also scope to suggest that Zelle causes increased consumer uptake of add-on financial services.In the B2C space, Zelle shares a 1% merchant fee with Visa and Mastercard. As the service becomes more mainstream, affiliated financial products may be recommended in the app itself.Read Next:

How Does Venmo Make MoneyHow Does PayPal Make MoneyHow Does Robinhood Make MoneyMain Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Zelle Make Money? appeared first on FourWeekMBA.

How Does Glassdoor Make Money? Glassdoor Business Model In A Nutshell

Glassdoor is an employer review platform enabling millions of users to grade corporations. Glassdoor monetizes its platform through Job Listings ($249 per opening), Job Advertising (according to the number of jobs promoted), Employer Branding, and through the Glassdoor Review Intelligence (a brand’s sentiment analysis platform).

Origin storyGlassdoor is a platform enabling current and former employees the opportunity to anonymously review their employer.

The company was founded in 2007 by Tim Besse, Robert Hohman, and Rich Barton. During a brainstorming session, Barton recounted the story of unintentionally leaving an employee survey on the printer while working at Expedia.

The men began to consider what might have happened had the information been released to the public. While far from an ideal scenario, they nonetheless agreed that survey data would be extremely useful for those looking to make informed career decisions.

The following year, Glassdoor launched a website collating company reviews and salaries from employees of large companies. Salary data was then averaged and listed with former employee reviews regarding management culture.

Glassdoor revenue generationFrom humble beginnings, Glassdoor has grown to be much more than a simple review site

The company now helps businesses find suitable employees for vacant positions across three different plans: Free, Standard, and Select.

Each plan has different features and levels of functionality. Following is a look at some of the more pertinent features.

Job listingBusinesses that wish to post a job opening on Glassdoor receive the first three postings for free. After this point, Glassdoor charges a fee of $249 per opening.

For larger businesses with similarly large needs, Glassdoor offers more feature-rich packages.

Job advertisingBusinesses can receive additional exposure to their job listings through targeted job ads.

Glassdoor charge for this functionality according to the number of jobs the business wants to promote.

Employer brandingGlassdoor also gives job advertisers the ability to optimize how they are presented to potential employees.

Many choose this option to remove competitor ads from their company profile. Others like to showcase their organization with branded photos and videos. A business also can see where it ranks against competitors in terms of employee satisfaction.

Again, prices are made available on request.

Review intelligenceGlassdoor has also found a way to monetize the original review system on which it was built.

Through its Glassdoor Review IntelligenceTM service, businesses can identify the hidden sentiment found in their reviews around such topics as management, culture, diversity, and inclusion.

This is achieved through natural language processing, which Glassdoor uses to transform review sentiment into high-level, actionable insights.

Ultimately, leadership can use these insights to improve the experience of their current employee cohort.

Pricing for this service can be obtained by contacting the Glassdoor sales team.

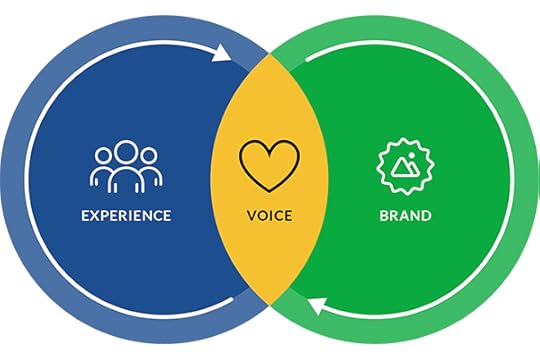

Understanding The Glassdoor Review Intelligence System The Glassdoor Review Intelligence

The Glassdoor Review Intelligence System is thought to enable companies to understand the sentiment around their brands from various standpoints. It leverages NLP to analyze reviewers at scale and guess. the sentiment around them (Image Source: Glassdoor Blog).

System is thought to enable companies to understand the sentiment around their brands from various standpoints. It leverages NLP to analyze reviewers at scale and guess. the sentiment around them (Image Source: Glassdoor Blog).As Glassdoor highlights:

Key takeaways:Glassdoor is an online job search platform. Originally, it was created to allow employees to anonymously share information about their former employer.Glassdoor has grown from a humble review site comparing average job salary with employee satisfaction. Today, it offers a host of features to help employers connect with job candidates. These include a job listing, job advertisement, and employer branding service.Glassdoor also makes money from employee reviews. Using natural language processing, the company gives employers valuable insights into how their organization is viewed from a cultural, management, or inclusion perspective.Review Intelligence

is a powerful sentiment analysis tool that allows employers to unlock insights from employee reviews and understand the “why” behind their ratings, surfacing valuable patterns in feedback so you can better inform your employer brand strategy. Lengthy reviews are distilled into a clear picture of sentiment so employers can discover what’s working, what’s not, why and where, without having to parse through potentially hundreds of reviews. Review Intelligence

automatically surfaces insights hidden in employee reviews, enabling talent professionals to more effectively drive improvements to their employee experience.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Glassdoor Make Money? Glassdoor Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Postmates Make Money? Postmates Business Model In A Nutshell

Postmates is a food delivery service built as a last-mile delivery service platform connecting locals with shops. Postmates makes money by collecting fees (commission, delivery, service, cart, and cancellation fees). It also makes money via its subscription service (called Unlimted – $9.99/month or $99.99 annually) giving free delivery on every order of more than $12.

Origin storyPostmates is a North American food delivery service. The service was founded in 2011 by Bastian Lehmann, Sean Plaice, and Sam Street after the trio unsuccessfully tried to get hot dogs delivered to their residence.

Three short years later, Postmates released a merchant interface allowing small businesses to compete for delivery of consumer goods with larger players such as Amazon. Shortly after this release, the company announced that it had completed 1 million deliveries with 6,000 drivers in its delivery network.

During the height of the COVID-19 pandemic in June 2020, Postmates was acquired by Uber for $2.65 billion. The company continues to operate under the Postmates banner today, serving approximately 3,500 U.S. cities or 70% of the total population.

Postmates revenue generationPostmates drive revenue through the collection of various fees and a premium subscription service.

Following is a look at each.

FeesFor every order placed on the Postmates platform, the company collects a host of fees including:

A commission fee – or a percentage of the total sale price dependent upon the type of product sold and the agreement with the affiliated partner. For example, a supermarket such as Walmart may pay Postmates a small fee because of its very slim margins. A family-owned restaurant, on the other hand, may pay as high as 20% on every order.A delivery fee – or $0.99-$3.99 for partnering merchants and $5.99-$9.99 for all other merchants.A service fee – which is charged for the ancillary services delivery drivers perform, such as selecting items from supermarket shelves.A cart fee – which applies when a Postmates order does not meet the minimum threshold. This cart fee equates to $1.99 per order.A cancellation fee – when a consumer cancels their order, Postmates charge a fee depending on how advanced the order process is. The fee also depends on the particular merchant and the dollar amount of the order.UnlimitedUnlimited is the name given to a subscription allowing Postmates customers to save money on deliveries.

The company charges $9.99/month for the Unlimited subscription or $99.99 annually.

Once on the plan, the consumer gets free delivery on every order of more than $12 as well as access to events and promotional giveaways.

While Postmates claim the plan saves consumers about $185 per year, there is potential for individuals using the service frequently to make the scheme unprofitable in the long term.

Key takeaways:Postmates is a North American food delivery service. It was founded in 2011 after three friends tried unsuccessfully to get hot dogs delivered to their residence.Postmates generate revenue through a multitude of order charges, including a commission fee, delivery fee, cart fee, and service fee. There are also charges for those who choose to cancel an order already in progress.Postmates also offers a subscription service where consumers save money on delivery and get access to certain member perks. However, whether the subscription service is ultimately profitable for the company long term is debatable.Read Next: Grubhub Business Model, Uber Eats Business Model, Last-Mile Delivery, Instacart Business Model.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Postmates Make Money? Postmates Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Vinted Make Money? Vinted Business Model In A Nutshell

Vinted is an online shopping marketplace with a strong secondhand component. The company makes money via its buyer protection service. The buyer pays a fee to Vinted in exchange for services like customer support, insurance, and tracked shipping; Shipping costs; Wardrobe Spotlight (helping users boost the visibility of their items). And Bumping listed items.

Origin storyVinted is an online community marketplace headquartered in Vilnius, Lithuania.

The platform was created by Milda Mitkute and Justas Janauskas in 2008 during the prototype testing of a website where women could trade clothing. The need for a prototype arose after Mitkute found herself with too many clothes while trying to move house.

After recruiting someone to help with advertising and promotions, the site was expanded into Germany where it now operates as Kleiderkreisel.

In 2010, Vinted became available the United States. Two years later, the company launched a mobile app on iOS and Android to partner with the desktop version.

Today, Vinted gives users the ability to buy, sell, and swap clothing or accessories in 12 countries. According to the company, it now has a community of 37 million men and women.

Vinted revenue generationVinted revenue generation used to be reliant on charging seller fees for every completed transaction.

However, the company has moved away from charging consumers to list or sell their clothing items. It now makes money in a few different ways that are explained below.

Buyer protection/service feeThe buyer protection fee is paid by the buyer to Vinted in exchange for services like customer support, insurance, and tracked shipping.

The fee is 5% of the item price (excluding taxes and postage cost) plus an additional fixed amount of $0.70.

It is important to note that this fee is a mandatory charge to protect the integrity of the Vinted payment process.

Shipping costsThe buyer also bears the cost of shipping, with prices dependent upon the size of the package and the type of courier service used.

Vinted passes the freight cost to the buyer and likely makes no money from the arrangement. However, some believe it turns a profit because it can ship in bulk and receive a discounted price from the courier.

Wardrobe Spotlight (UK)Wardrobe Spotlight is a feature unique to Vinted UK, helping users boost the visibility of their items in the marketplace. For a full week, Vinted customers can have items from their wardrobe shown in dedicated spots in the news feed of other members. These members will also have easy access to the rest of the seller’s range of items.

This extra visibility is also targeted. In other words, it will be shown to members with similar body sizes and brand preferences. Vinted charges £6.95 for the service.

Bumping listed itemsSimilar to Wardrobe Spotlight, users can purchase a bumping service to get their items to appear in the news feed or search results of other members.

The bumping service occurs once a day for a predetermined number of days or until the item is sold. Vinted charges $0.95 per item for a three-day bump.

Key takeaways:Vinted is an online community marketplace founded in Vilnius, Lithuania, in 2008. The idea for the platform came when founder Milda Mitkute needed to offload excess clothing during the process of moving house.Vinted does not charge its users for listing or even selling their unwanted items. Instead, their revenue generation is dependent on buyers who must pay all of the transaction and shipping costs.Vinted also makes money with its Wardrobe Spotlight service. For a relatively small fee, users can pay to have their listings made more visible in the news feeds or search results of buyers.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Vinted Make Money? Vinted Business Model In A Nutshell appeared first on FourWeekMBA.

Trivago Business Model In A Nutshell

Trivago is a search and discovery travel platform part of Expedia Group. Trivago is widely known as a trusted hotel comparison service. Trivago doesn’t charge based on bookings but rather through a cost-per-click (CPC) model, monetized when a hotel searcher clicks one of its advertiser listings. This referral revenue comprises most of Trivago’s income. Trivago also has another minor revenue stream via subscriptions to its Business Studio, a tool that helps hoteliers track impression and click data associated with their properties.

Origin storyTrivago is a technology company founded and headquartered in Dusseldorf, Germany in 2005.

Sensing a gap in the online hotel market, university friends Stephan Stubner, Rolf Schrömgens, and Peter Vinnemeier created the first German hotel search engine. The search engine is in fact a hotel aggregator, allowing consumers to compare 2.5 million hotel listings from over 100 travel-related websites across the internet. Some of these websites include Airbnb, Agoda, and Booking.com.

Shortly after launch, Trivago began to gain momentum after partnering with several online travel agencies (OTAs). Such was the success of Trivago that seven years after its inception, Expedia acquired a majority stake for $632 million. In 2016, the company became the first German start-up to list on the NASDAQ stock exchange.

Trivago business modelWhile Trivago is a trusted hotel comparison service, it does not profit from enabling searchers to book a room through the company directly.

Instead, Trivago makes money in two other ways.

Let’s take a look at each.

CommissionsThrough the cost-per-click (CPC) model, Trivago earns money whenever a hotel searcher clicks one of its advertiser listings. This referral revenue comprises most of Trivago’s income.

Using the CPC model, the exact amount of revenue generated is dependent on the ad budget of the advertiser, the keywords they want to be displayed for, and the bids of competing companies. Here, the advertiser in question may be an individual hotel, a hotel chain, or an online travel agency.

A Trivago algorithm ensures that relevant advertisements are matched with relevant user searches. This increases the click-through rate (CTR) of listed ads and drives more revenue as a consequence.

SubscriptionsThe second albeit far less significant source of revenue for Trivago is subscription fees.

The company charges hoteliers access to a product called Business Studio. This tool helps hoteliers track impression and click data associated with their properties. It also helps them create promotional offers and better understand their target audience. Ultimately, a business that enhances its marketing and positioning experience can better consumers with targeted messages. This has significant benefits both the business itself and also for Trivago.

Trivago notes that the basic version of Business Studio is free of charge. However, access to most of the premium features is only available in the Business Studio PRO package. The company, which claims the package can deliver 21% more clicks and 45% more bookings, provides a quote on request only.

Key takeaways:Trivago is an online hotel aggregate company founded in Dusseldorf, Germany. It was created by three university friends who identified that there was a gap to be filled in the online hotel search industry.Trivago makes most of its money through the cost-per-click (CPC) advertising model. When a hotel listing on their site is clicked by a consumer, the hotel pays a small commission back to Trivago.Trivago collects a much less significant amount of revenue from their Business Studio product, which is mostly free. However, the product does teach hotel businesses to optimize their ad placements and drive more revenue for Trivago from CPC advertising.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post Trivago Business Model In A Nutshell appeared first on FourWeekMBA.

How Does NerdWallet Make Money?

NerdWallet is an online platform providing tools and tips on all matters related to personal finance. The company gained traction as a simple web application comparing credit cards. NerdWallet makes money via affiliate commissions determined according to the affiliate agreements.

Origin storyNerdWallet is a personal finance company founded in 2009 by Jacob Gibson and Tim Chen with an initial investment of just $800.

NerdWallet began as a simple web application comparing credit cards. Jobless after the GFC, credit analyst Chen got the idea for NerdWallet after being asked for advice on the credit cards with the lowest foreign transaction fees.

Traffic to the site grew quickly in the following years, allowing the company to expand through capital raisings and the acquisition of retirement planning firm AboutLife.

With Chen sitting on the board of the National Foundation for Credit Counselling, the company maintains a focus on educating consumers about financial literacy. In addition to credit card reviews, NerdWallet now compares banking, investment, loan, and insurance products.

NerdWallet revenue generationNerdWallet makes money via affiliate commissions first and foremost. In this scenario, a business owning a financial product or service pays NerdWallet for sending them new customers.

The exact commission is based on the particular arrangement between NerdWallet and the company it is affiliated with.

The product itself also has a major bearing on the commission. For example, the fee for a new bank account sign-up would be next to nothing. However, the commission for a new mortgage or life insurance account is likely to be a few hundred dollars.

EndorsementsIn addition to receiving affiliate income, NerdWallet receives money from some financial institutions in exchange for a review of their services on the company website.

Collecting revenue from endorsements is somewhat of a grey area for consumers, but NerdWallet maintains that such endorsements do not affect their recommendations or advice in any way.

Content strategyThe NerdWallet website is free to use, but the company banks on the fact that approximately 5% of readers will then go on to make a purchase.

This percentage gives Gibson and Chen clarity on the sort of readership they need to attract to hit revenue targets. Indeed, one of the primary reasons for the success of NerdWallet is its prolific content strategy.

During the early years, the company committed to publishing 500 high-quality articles per month. This has increased to 1000 articles per month over time, creating a vast resource backed by authoritative backlinks from related websites.

This focus on organic search traffic is a key component of the NerdWallet revenue generation strategy. It allows them to expand their reach and increase credibility while keeping costs low.

Key takeaways:NerdWallet is an online personal finance comparison website. It was started with just $800 by Tim Chen and Jacob Gibson with the simple goal of reviewing credit card deals.NerdWallet makes nearly all of its money through affiliate marketing. The exact commission depends on the product being advertised and the arrangement between NerdWallet and the affiliated company.Approximately 5% of all NerdWallet readers make a purchase to earn the company affiliate revenue. As a result, the company has a prolific content creation strategy to build authority and increase its reader base with minimal expense.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does NerdWallet Make Money? appeared first on FourWeekMBA.

How Does GoFundMe Make Money?

GoFundMe is a for-profit crowdfunding platform, which makes money based on donations on the platform. The platform makes money via fees paid by whatever entity runs the campaign and as transaction fees for processing the payments. Also, it makes money via the GoFundMe Charity service (fundraising platform) and donations.

Origin storyGoFundMe is a for-profit crowdfunding platform.

Founded in 2010 by Brad Damphousse and Andrew Ballester, the service enables people to raise money for events including graduations, celebrations, and other personal causes. It also provides a vital source of funding for those who require medical procedures as a result of illness or injury.

Damphousse and Ballester created an early iteration of GoFundMe called CreateAFund, which allowed social media users to raise money for causes near to their heart. At the time, crowdfunding as we know it today was only beginning to become mainstream.

In 2008, GoFundMe was adopted as the preferred name. Less than a decade later in 2017, GoFundMe became the largest online crowdfunding platform, raising over $3 billion since its inception.

GoFundMe revenue generationGoFundMe makes money whenever a user donates to a cause.

For every donation there are two fees:

Platform fees – these are fees paid by whatever entity is running the campaign. The entity may be an organization, team, or individual. Note that the platform fee is 0% for those wanting to start a fundraiser in the UK, Australia, Canada, United States, and most major European countries. For the rest of the world, the exact platform fee depends on the country. In Luxembourg, for example, the platform fee is 5%.Transaction fees – which cover the cost of processing each payment. In the United States, the transaction fee is 2.9% plus 30 cents. Similar to platform fees, transaction fees vary by country. Returning to the Luxembourg example, the transaction fee is 1.4% of the donation in Euros.GoFundMe CharityGoFundMe Charity is a feature-rich online fundraising platform helping organizers raise more money by engaging with donors. Businesses get full access to donor and fundraising data in one place and can create donate buttons and email sequences that are on-brand.

Fundraising campaigns can also be integrated with platforms such as WordPress, Salesforce, and Mailchimp, among others.

Two subscription plans are available:

Free – every donation attracts a 1.9% processing fee plus 30 cents. This gives the fundraising organization a guaranteed 97.5% of the total donation.Flex – every donation attracts a 2.2% processing fee plus 30 cents, giving the organization at least 94.5% of the donation. However, donors can choose to cover the processing fee which means the organization receives 100%.DonationsSome individuals and organizations prefer to donate directly to GoFundMe itself. In this case, the funds are redistributed where appropriate.

Key takeaways:GoFundMe is a for-profit crowdfunding service. The service was originally called CreateAFund and allowed social media users to raise money for causes important to them.GoFundMe makes money on every user donation. The 5% platform fee has recently been waived in several countries such as Australia, Canada, and the United States. However, every fundraising campaign must pay a 2.9% transaction fee depending on where the campaign is located.GoFundMe also offers a dedicated service for businesses running fundraising campaigns. Dubbed GoFundMe Charity, the service helps them create targeted, on-brand messages that can be integrated with popular platforms such as WordPress and Salesforce.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does GoFundMe Make Money? appeared first on FourWeekMBA.

How Does Medium Make Money? Medium Business Model In A Nutshell

Medium is an online media platform leveraging the concept of social media for journalism, where writers are prompted to the platform to build their following through in-depth writings and essays. The platform follows a freemium model, and it makes money by prompting users to subscribe to articles behind paid walls (Medium charges $5/month or $50/year), and writers are paid based on readership.

Origin storyMedium is an online social journalism platform, publishing content from amateur and professional writers alike.

Medium was created in 2012 by former Twitter CEO and co-founder Evan Williams. Indeed, Williams developed Medium as “a new place on the Internet where people share ideas and stories that are longer than 140 characters and not just for friends.”

Once established, the platform grew quickly. Any writer can publish their thoughts to the world in a range of categories such as Health, Politics, and Sport. The company also partners with similar organizations to publish content on its platform, including Sports Illustrated, Hacker Noon, and The Economist.

The company now boasts a monthly readership of between 85 to 100 million users. However, Medium seeks to focus on the amount of time each user spends reading on the platform. This, Williams argues, is a much more accurate determinant of business success.

Medium revenue generationThe Medium revenue model involves charging readers a subscription fee for reading its content.

It is first important to note that readers do get access to three articles per month without charge. But the vast majority of Medium content is hidden behind a paywall. To access this content, Medium charges $5/month or $50/year. This gives the user unlimited access to stories and publications. They can also listen to audio versions of popular articles and log in to a homepage with a list of curated daily articles.

When a reader with a subscription reads a subscriber-only article, a portion of their membership fee goes to the article author. At the time of writing, the exact fee is dependent upon the time spent reading the article itself.

Spotify freemium model as an inspirationFor Medium to be able to make money, Williams frequently cites the Spotify business model where listeners can enjoy ad-free, high-quality music for a small monthly fee. Here, the difference in value between the free and premium versions is clear.

In the case of Medium, however, the difference is less clear. Content on Medium is designated as premium at the discretion of the author – there are no criteria with which it must first be assessed. Authors can also choose to release their work as free content to attract new readers and build a following.

As a result, critics believe the sole method of Medium revenue generation provides little value to consumers. It remains to be seen as to whether this way of making money is sustainable.

Key takeaways:Medium is an online publishing platform. It promotes social journalism, showcasing the work of amateur writers alongside professional authors and large publishing companies.Medium makes money by hiding most of its content behind a paywall. While readers can access three articles per month free of charge, they will need to pay $5/month to access more.The designation between free and premium content on Medium is up to the discretion of the author. Premium articles do not need to meet stringent criteria and authors may choose to release premium content for free if they have an ulterior motive. This has the potential to make the company’s business model unsustainable.Read Next: Spotify Business Model, Freemium Business Model, Subscription Business Model.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Medium Make Money? Medium Business Model In A Nutshell appeared first on FourWeekMBA.