Gennaro Cuofano's Blog, page 165

March 12, 2021

Business Motivation Model In A Nutshell

The Business Motivation Model (BMM) is a means of developing, communicating, and managing business plans in an organized fashion. The Business Motivation Model is one of many frameworks that seek to fill a gap between strategic planning and execution. This gap is usually the result of a lack of communication between departments. Communication is also hampered when different departments describe problems using different terminology.

Understanding the Business Motivation ModelTo that end, the BMM seeks to standardize business plan communication within an enterprise. It also encourages businesses to construct tools that help them store, cross-reference, and report on the key elements of business plans.

There are two main purposes of a BMM:

To make decisions that are visible to all decision-makers and explain the rationale for making them. Businesses should also improve decision-making ability by reflecting on the experience and learning.To provide references from the decisions to their effects on business operations. This may include changes to roles, responsibilities, or processes.Key components of the Business Motivation ModelTo help communicate the change associated with implementing a business plan, the BMM has a vocabulary of 22 core concepts.

These core concepts are defined in terms of five key areas:

Ends – what does the business want to accomplish? Goals and objectives are commonly referenced.Means – how does the business intend to accomplish it? The means may be a particular strategy, tactic, or mission.Directives – what are the rules and policies that constrain or govern the means?Influencers – defined as any factor an enterprise believes may affect it. This includes internal influencers (infrastructure, resource quality) and external influencers (customers, regulation, competition).Assessments – or the risk and reward associated with an influencer causing a significant impact on the enterprise. The assessment often involves a SWOT analysis to assess internal and external factors.Conceptually, the relationship between the Ends, Means, and Influencers helps the business answer two fundamental questions:

What is needed to achieve what the enterprise desires to achieve? Here, decision-makers need to identify the Means necessary to achieve the desired Ends.Why does each element of the business plan exist? In other words, which End does each Mean serve? What are the Influencers that provide the foundation for each choice?Business Motivation Model best practicesIt should be noted that the BMM is not a methodology but a blueprint designed to support a range of methodological approaches.

The only stipulations for creating a BMM include:

A business-driven requirements development process.Organized business plans being a fundamental deliverable in any such process.Incorporating business rules and business processes as non-negotiable elements. This helps the business guide the performance of the work and provide an adequate fallback position if some aspect of the plan fails. Rules are also important in resolving conflict that occurs when goals or objectives contradict each other.Key takeaways:The Business Motivation Model is a framework for recording important governance decisions in business plans and associated change management. It also provides a means of connecting decision-making to business operations.The Business Motivation Model contains 22 core concepts that help streamline communication. Each core concept occupies one of five key areas of activity within an organization.The Business Motivation Model is not a methodology but a blueprint designed to support several approaches. With only three general stipulations, the BMM approach is a flexible approach to a variety of business contexts.Read Next: SWOT Analysis, Personal SWOT Analysis, TOWS Matrix, PESTEL Analysis, Porter’s Five Forces, TOWS Matrix, SOAR Analysis.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post Business Motivation Model In A Nutshell appeared first on FourWeekMBA.

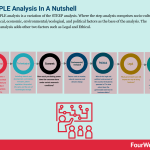

STEEPLE Analysis In A Nutshell

The STEEPLE analysis is a variation of the STEEP analysis. Where the step analysis comprises socio-cultural, technological, economic, environmental/ecological, and political factors as the base of the analysis. The STEEPLE analysis adds other two factors such as Legal and Ethical.

Understanding the STEEP Analysis The STEEP analysis is a tool used to map the external factors that impact an organization. STEEP stands for the five key areas on which the analysis focuses: socio-cultural, technological, economic, environmental/ecological, and political. Usually, the STEEP analysis is complementary or alternative to other methods such as SWOT or PESTEL analyses.

The STEEP analysis is a tool used to map the external factors that impact an organization. STEEP stands for the five key areas on which the analysis focuses: socio-cultural, technological, economic, environmental/ecological, and political. Usually, the STEEP analysis is complementary or alternative to other methods such as SWOT or PESTEL analyses.In addition, to the five factors comprised in the STEEP Analysis, the STEEPLE analysis comprises:

L standing for Legal: What government laws will impact the way of doing business? E standing for Ethical: Based on the current context and landscape what is perceived contextually to be good and bad as a business? STEEPLE vs. SWOT vs. PESTELThe STEEPLE analysis is a more comprehensive way to look at the current business context, compared to other frameworks such as SWOT and PESTEL.

A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future.

A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future. The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.

The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.Read Next: SWOT Analysis, Personal SWOT Analysis, TOWS Matrix, PESTEL Analysis, Porter’s Five Forces, TOWS Matrix, SOAR Analysis.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post STEEPLE Analysis In A Nutshell appeared first on FourWeekMBA.

What is the STEEP analysis?

The STEEP analysis is a tool used to map the external factors that impact an organization. STEEP stands for the five key areas on which the analysis focuses: socio-cultural, technological, economic, environmental/ecological, and political. Usually, the STEEP analysis is complementary or alternative to other methods such as SWOT or PESTEL analyses.

Understanding the STEEP analysisFundamentally, the STEEP analysis is an external environment evaluation strategy.

In business, the external environment is driven by multiple factors that an organization has no direct control over.

Thus, each factor has the potential to force decision-makers to act quickly without duly considering the consequences.

The STEEP analysis gives a business perspective on the market it operates in. It stimulates discussion on the various societal factors that may impede future growth, enabling the creation of reasoned and considered strategies.

Perhaps most importantly, the STEEP analysis allows key personnel to make decisions based on fact and not on their personal experiences or value systems.

The five elements of the STEEP analysisThe STEEP analysis is an acronym of the five key areas that each business must evaluate.

They include:

Socio-cultural (S) – this encompasses a broad range of societal characteristics likely to affect the product offering or operations of a company. This includes factors such as health consciousness, population growth rate, religion, education, and distribution of income. For example, an aging population may result in a smaller workforce and in turn, increasing labor costs.Technological (T) – including research and development, automation, transport, patent regulation, the product life-cycle, and the rate of technological change. Here, companies that rely on advances in technology to generate new products are the most prone to rapid changes in the environment.Economic (E) – how much purchasing power does the consumer have under certain economic conditions? Factors that influence the economy include international trade, interest rates, job availability, inflation, innovation, and currency rate fluctuations. Tesla is benefitting from higher consumer purchasing power as electric cars becoming more mainstream and affordable.Environmental/ecological (E) – or factors such as weather, natural resources, and climate change. The latter in particular is creating new markets while simultaneously destroying others. Businesses also need to be aware of the ecological footprint of their operations in environmentally sensitive areas. To some extent, this involves an understanding of environmental laws and regulations.Political (P) – what is the legal and political environment of the country the business operates in? To what extent does the government intervene in business affairs? Governments may exert their influence with labor laws, trade restrictions, tariffs, or political instability. Despite the success of Tesla, the company continues to face opposition from established automakers who have longstanding relationships with Government lobbyists.Conducting a STEEP analysisTo ensure that the STEEP analysis is effective, decision-makers should follow these steps:

Understand the environmental factors. In other words, what are the current events or trends that prove the factor exists? How have these trends evolved from a historical point of view? How volatile are the trends? What are the short and long-term impacts?Determine trend interrelatedness. Next, assess the relationship between each trend and one of the five external areas. Do conflicts exist? If not, how is each related to the other?Relate trends to company issues. These are trends with the power to either help or hinder a business from carrying out its strategy. From this list, the business should identify the trends with the most potential impact.Forecast the future direction of issues. This step goes beyond information collation. What are the driving forces of the core issues? What are the causes or symptoms of trends? This is a laborious process but well worth the effort.Make conclusions. How will the external environment impact the present and future strategy? A robust conclusion should detail the potential implications for multiple environmental factors on company success.Key takeaways:The STEEP analysis is an evaluative tool used to assess the impact of environmental factors on strategy implementation.The STEEP analysis is an acronym for five key environmental areas: socio-cultural, technological, environmental/ecological, economic, and political.The STEEP analysis is a somewhat laborious process, but the benefits to the organization in being able to executive strategy are significant.Read Next: SWOT Analysis, Personal SWOT Analysis, TOWS Matrix, PESTEL Analysis, Porter’s Five Forces, TOWS Matrix, SOAR Analysis.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post What is the STEEP analysis? appeared first on FourWeekMBA.

March 11, 2021

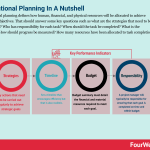

Operational Planning In A Nutshell

Operational planning defines how human, financial, and physical resources will be allocated to achieve strategic objectives. That should answer some key questions such as what are the strategies that need to be completed? Who has responsibility for each task? When should the task be completed? What is the timeline? How should progress be measured? How many resources have been allocated to task completion?

Understanding operational planningIn planning, most businesses develop highly detailed strategies enabling them to realize long-term visions.

Unfortunately, these strategies often lack the support of a solid operations plan. While a strategic plan operates in the context of years, an operations plan is concerned with day-to-day tasks.

It should answer questions such as:

What are the strategies that need to be completed?Who has responsibility for each task?When should the task be completed? What is the timeline? How should progress be measured?How many resources have been allocated to task completion?Developing an operations planDeveloping an operations plan is a matter of following five best practices:

Begin by ensuring that a strong strategic plan is already in place. Writing an operations plan without one is akin to planning a vacation without knowing the destination. Focus on the most important goals. Generally speaking, the more complex the goal the less likely it will be reached. Instead, the focus should be on simplification. Break the strategic plan into one-year objectives and determine the key initiatives that will drive success. Examples of key initiatives include new quality control measures, faster delivery times, and more resources devoted to professional development.Use leading indicators. In operational planning, leading indicators that are predictive measures of success are most effective. Create KPIs based on past success to ensure that milestones are regularly hit during the year.Don’t develop KPIs in a vacuum. Instead, incorporate a wide gamut of skills and experience as the KPIs are created. In smaller organizations, the entire staff may gather periodically to set intentions for the coming year. In larger organizations, meetings may be held for leadership teams only. In either case, diversity of input is non-negotiable.Communication is paramount. Every employee must understand KPIs in the context of how they will assist in the organization achieving its goals. The importance of buy-in cannot be overstated. Regular meetings should be held to discuss progress on the personal and organizational level. Meetings also ensure that daily operational tasks maintain alignment with the broader strategic plan.The key elements of an operations planLet’s now take a more specific look at the structure of an operations plan. What should it contain?

A sound operational plan will detail:

Strategies – or the key actions that need to be carried out regularly to achieve strategic goals.Timeline – for each goal, it is important to set a timeline that encourages efficiency but that is also realistic.Budget – a budget summary must detail the financial and material resources required to meet each goal.Responsibility – a project manager will typically be responsible for ensuring that each goal is completed on time and within budget. Roles or responsibilities that are delegated to others should be detailed in the plan. KPIs – what does successful action look like? Remember to develop KPIs with input from a diverse range of sources.A backup plan – what happens if circumstances change? Contingency plans should be developed under a sound risk management strategy. Key takeaways:Operational planning details the day-to-day actions that will support broader strategic objectives.Operational planning cannot begin until a strategic plan is in place. In developing the plan, businesses must focus on important goals, use leading indicators, and develop KPIs collaboratively. Operational planning must detail several crucial elements, including strategies, timeline, budget, responsibility, KPIs, and contingency plans.Read Next: SWOT Analysis, Personal SWOT Analysis, SOAR Analysis, KPIs, TOWS Matrix, PESTEL Analysis, Porter’s Five Forces.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post Operational Planning In A Nutshell appeared first on FourWeekMBA.

What is the SCOC analysis?

The SCOC analysis is an asset-based strategic planning tool focusing on the core strengths of a business, building upon what it claims to be the shortcomings of a traditional SWOT analysis. Indeed, the SCOC analysis claims that the SWOT analysis focuses on threats that might never materialize, thus underweighting potential opportunities.

Understanding the SCOC analysisThe SCOC analysis is a strategic planning tool that was developed to address shortfalls in the traditional SWOT analysis.

In a SWOT analysis, decision-makers tend to spend most of their time repairing weaknesses and speculating about external threats. The end result is that is the positive aspects of a company – strengths and opportunities – are not given the attention they deserve.

Practitioners of the SCOC analysis argue that the SWOT analysis is a deficit-based approach to strategic planning. Businesses end up planning for threats that never materialize and their focus on negative outcomes blinds them to avenues for growth.

The SCOC analysis is a more balanced approach. It does not exaggerate weaknesses and threats, nor does it undervalue strengths and opportunities.

Running a SCOC analysisA SCOC analysis is an asset-based approach that considers four key areas:

Internal strengths – what is the business already doing well?Internal challenges – how can these strengths be used to solve current or predicted challenges within the business?External opportunities – what are the external opportunities most suited to the strengths of the business?External challenges – how can the business face external challenges with a positive mindset? This is a key differentiator of the SCOC analysis, encouraging decision-makers to maintain an open, curious, and creative mindset when faced with difficulties.Why is the SCOC analysis important?As noted in the introduction, businesses that conduct SWOT analyses tend to become preoccupied with identifying and then planning for negative outcomes.

This phenomenon has been extensively studied. Scientific research has found that negative emotions in have approximately three times the impact of positive emotions.

The SCOC analysis is important in helping decision-makers avoiding devoting company resources to problems that may be overstated or worse still, non-existent.

Mindfulness-based strategic awarenessTogether with the SOAR and SOPA analysis, the SCOC analysis advocates mindful awareness and leadership principles.

Here, mindfulness is combined with aspects of positive psychology to encourage leaders to adopt a results-oriented focus on business strategy. This gives them the ability to perceive, create, and capitalize on potential opportunities for growth.

Importantly, an awareness of the positive aspects (or strengths) of strategy achieves better outcomes for the business and improves company culture. It also gives the employees within a business the cognitive flexibility to adapt to new challenges.

Key takeaways:The SCOC analysis is an asset-based and solution-focused strategic planning tool.The SCOC analysis was created to address a tendency for decision-makers to become preoccupied with weaknesses and threats in a SWOT analysis. In many cases, this preoccupation blinds the company to strengths and opportunities.The SCOC analysis is one of a host of similar analyses advocating a mindful approach to strategy formulation. This allows decision-makers to combine mindfulness with positive psychology to focus on core strengths and the meeting of challenges with an open mind.Read Next: SWOT Analysis, Personal SWOT Analysis, SOAR Analysis, TOWS Matrix, PESTEL Analysis, Porter’s Five Forces.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post What is the SCOC analysis? appeared first on FourWeekMBA.

What are key performance indicators?

Key performance indicators (KPIs) are measurable values that determine whether an organization is achieving key objectives. KPIs will depend upon a business-specific context, as each company and industry will have its own core metrics to track. Indeed, the choice of the right KPIs that can positively affect the business’s long-term perspective is critical.

Understanding key performance indicatorsKey performance indicators are critical indicators of progress toward the desired result.

They also provide a focus for strategic development and create an analytical foundation for decision-making. Perhaps most importantly, KPIs help a business focus its resources on actions that matter most.

Key performance indicators are quantifiable, outcome-based statements. They are used to simplify the often complex process of performance tracking by reducing a large number of measures into a few select “key” indicators.

As a result, KPIs are used when the business needs to evaluate its performance. This usually includes the performance evaluation of projects, plans, people, or departments.

The anatomy of a key performance indicatorEach key performance indicator must contain the following elements:

A measure – what is being measured? Measures can be strategic or operational. They can also be associated with risk and project or employee performance.A target – what is the business seeking to achieve? Targets are usually numerical values that are sensitive to time or other constraints.A data source – the data that underpins the target must be robust. There must be no room for interpretation in how each KPI is tracked and measured.Reporting frequency – to some extent, reporting frequency will depend on the particular needs of the organization. But it is good practice to report at least once a month.Creating a key performance indicatorCreating a KPI takes some work. Successful key performance indicators can only be created once a business has a clear and structured understanding of its aspirations.

After this has been determined, it is a matter of following these steps:

Establish a clear objective. For example, a business that wants to become a market leader must clearly define what it will take to get there. It might involve a 5% increase in revenue each financial year or the expansion of a product range by 15 products.Define the criteria for success. In other words, what will the target be? Is it attainable in the desired timeframe? How will progress be monitored? Early-stage KPI monitoring is most effective when decision-makers focus on long-term targets with midterm monitoring.Collect data. Where is the data located? Are there previous KPIs that might hold relevant information? Here, the business needs to collect and collate data into a central location.Build the KPI formula. While some KPIs measure one metric, most will rely on a combination of metrics incorporated into a single calculation. In any case, it is important to build and then test formulas to make sure the results are what the business expects.Present KPIs. At some point, KPI data will need to be synthesized into a form that is easily understood by others. A host of KPI software and applications can help the business create presentable graphs and charts from its results.Some common examples of key performance indicatorsHere are some common examples of KPIs grouped according to department:

Sales – number of new contracts signed per period, average conversion time, number of qualified leads in a sales funnel.Finance – revenue growth, gross profit margin, operational cash flow, current accounts receivables.Customer service – Net Promoter Score (NPS), average ticket resolution time, percentage of market share, average refund or return rate.Operations– time to market, employee churn rate, order fulfillment time.Marketing – monthly website traffic, blog particles published per month, landing page conversion rate.Key takeaways:Key performance indicators are measurable values that help an organization determine whether it is meeting stated objectives.Key performance indicators are comprised of four elements: a measure, a target, a data source, and a defined reporting frequency.Key performance indicators can be used to track performance across a range of departments, including sales, finance, customer service, operations, and marketing.Read Next: Eisenhower Matrix, BCG Matrix, Kepner-Tregoe Matrix, Decision Matrix,RACI Matrix, SWOT Analysis, Personal SWOT Analysis, TOWS Matrix, PESTEL Analysis, Porter’s Five Forces.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post What are key performance indicators? appeared first on FourWeekMBA.

What is value migration?

Value migration was first described by author Adrian Slywotzky in his 1996 book Value Migration – How to Think Several Moves Ahead of the Competition. Value migration is the transferal of value-creating forces from outdated business models to something better able to satisfy consumer demands.

Understanding value migrationIn marketing, value migration describes the flow of economic value from obsolete business models to models better suited to satisfying consumer priorities.

Value flows in three ways:

Between industries. For example, in-flight entertainment (IFE) transfers value from the airline industry to the entertainment industry. In India, the value of the rail industry as an affordable means of transport has shifted to the airline industry.Between companies. For photographers, value is transferred from Adobe Lightroom to Adobe Photoshop during a processing workflow.Between business designs within a company. A popular example is the transferring of value from IBM mainframe computers to IBM PCs with system integration. In recent decades, telecom service providers have also seen value migrate from voice to data.While every organization seeks to satisfy the end-user, Slywotzky argued that the factors determining value are constantly changing. Therefore, the business that can predict value migration ahead of time is the business that can gain a competitive advantage.

The three stages of value migrationGenerally speaking, value migration has three distinct stages:

Value inflow – in the first stage, a company or industry captures value from another company or industry due to a superior value proposition. The profit margin or market share of the entity expands.Stability – growth rates moderate as competitive equilibrium is established. Market share and margins remain stable.Value outflow – at some point, value begins to migrate toward companies meeting evolving consumer needs. The original company or industry experiences a decline in market share with contracting margins and a reversal in growth.Anticipating value migrationIn the introduction, we noted that competitive advantage could be secured by the early identification of value migration.

This can be anticipated in several ways:

Understanding the customer. Are there observable shifts in the composition of the target audience? Are customer priorities changing due to regulation, increased purchasing power, or technological innovation? Indeed, are customers becoming more powerful or discerning?Understanding the business design. The organization should understand how flexible its business design is. In other words, can it serve different customer priorities? Does it have the ability to provide value for both the customer and the company? What are the chances the design will become obsolete?Avoiding commoditization. How can the business avoid a scenario where its goods or services become devalued commodities? Building a strong brand and avoiding heavy, bulk discounting is a good place to start. But commoditized products are often the result of rigid, undifferentiated business design. In this case, the business must revitalize its product offering with a focus on delivering higher value.Key takeaways:Value migration describes the migration of value from outdated business models to those which are better able to satisfy consumer priorities.Value migration occurs in three ways: between industries, between companies, and between business designs within the same organization.Anticipating value migration is the key to maintaining or securing a competitive advantage. A deep understanding of the customer and business design reduces the odds that a product becomes devalued through commoditization.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post What is value migration? appeared first on FourWeekMBA.

What is hyper-competition?

Hyper-competition describes competition in a market that is rapid and dynamic and characterized by unsustainable advantage. In short, technology, changing consumer behaviors, lower entry barriers, and cheap capital might be enabling many companies to get started, thus creating a context of hyper-competition, where it’s hard to establish market dominance.

Understanding hyper-competitionIn many industries, there has been a general shift in the nature of competition in recent years.

Once the domain of slow-moving, stable oligopolies, these industries are now comprised of companies who strike quickly and unconventionally as a means of gaining competitive advantage.

Indeed, so-called “hypercompetitors” have upset the status quo by generating a competitive advantage that destroys, neutralizes, or makes obsolete the advantage enjoyed by industry leaders. This results in unstable and volatile markets where competitive advantage frequently changes hands.

The fundamental driving forces of hyper-competitionThe driving forces of hyper-competition are so overwhelming that no business has the power to stop them.

Following is a look at four major drivers of hyper-competitive industries:

Consumers have become accustomed to high-value products. This has created a buyer’s market where consumers expect more for less and in a timely fashion. Well-known brands such as Tampax, Gerber, and Kraft have fallen victim to low-priced, private-label goods of similar quality.Technology is causing paradigm shifts in almost every industry. In computing, IBM has lost market leadership to software designers and chip manufactures who now capture most of the value the company used to offer. The ubiquitous convenience of eCommerce continues to threaten the market share and very existence of traditional retail brands.Diminishing entry barriers within nations or industries. Before the collapse of the USSR, a McDonald’s restaurant in Moscow was impossible. Now it is a case of how many fast-food franchises the city can support. Industry entry barriers have also fallen because of advances in information processing. Financial services are one example where competitors can easily disrupt an established player – regardless of their background or expertise. After enjoying success in the U.S. credit card market, Citibank now has to contend with a telecommunications company (AT&T) and an automobile company (GM) as its primary competitors.Money is the last driver of hyper-competition. Disrupters often make their moves backed by Big Money or as a collection of hundreds of different firms in the same supply chain. Some companies opt to enter into partnerships with companies in a different industry with a large bank at the center. When profits are down, they simply cross-subsidize each other – often with governmental assistance.How can businesses manage a hyper-competitive market?In the previous section, we noted that the driving forces of hyper-competition could not be overcome.

However, there are several ways that decision-makers can manage a hyper-competitive market and stay competitive for longer:

Think carefully about pricing strategy. What is the appropriate cost for customer acquisition? What are the downstream implications for low costs? Businesses who undercut a competitor to gain an edge invariably end up in a price war that isn’t sustainable.Find and then dominate the most profitable market segments. That is, which are the segments with high revenue per user and low churn rate? Finding these segments allows the business to double down on profitable opportunities that a competitor will find extremely difficult to penetrate. Use capital as a competitive weapon. Capital is an effective differentiator in a market because every product that can be copied will be copied. Invariably, gaining a competitive advantage comes down to which company can raise the most funds.Key takeaways:Hyper-competition describes competition in a market that is rapid and dynamic. As a result, competitive advantage is unsustainable for any one company.Hyper-competition is driven by four forces that have the power to overwhelm even the largest organizations. They include a consumer preference for high-value products, advancing technology, diminishing entry barriers, and Big Money.Hyper-competition can be managed to some extent. Businesses in competitive markets should consider their pricing strategies and endeavor to identify the most profitable market segments.Read Also: Vertical Integration, Horizontal Integration, Supply Chain, Backward Chaining, Horizontal Market.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post What is hyper-competition? appeared first on FourWeekMBA.

What is the total cost of ownership?

The total cost of ownership (TCO) estimates the total cost associated with purchasing and operating an asset. TCO is a more comprehensive way to understand the real cost of ownership. Thus, how much it really costs in the long-term to own something, with all its related direct and indirect purchase costs.

Understanding the total cost of ownershipThe total cost of ownership places a single value on the life-cycle of a capital purchase.

This value is derived from every aspect of owning an asset, including costs relating to acquisitions, operations, training, documentation, and so forth. The calculation considers the direct and indirect (hidden) costs of purchase.

TCO is an important consideration in any scenario necessitating a large capital purchase. A business wishing to overhaul its IT system needs to consider the cost of new software, installation, security, downtime, and employee training. The purchase of a new business vehicle needs to consider the ongoing cost of fuel, maintenance, insurance, and depreciation.

Ultimately, TCO is used in business to gauge the viability of capital investment over time. It is often incorporated into a cost-benefit analysis.

Calculating the total cost of ownershipThe particular parameters of a TCO calculation will vary from industry to industry. Nevertheless, a standardized calculation allows decision-makers to compare the viability of otherwise unrelated assets.

Incurred costs are usually calculated from eight key areas:

Purchase price – how much did the investment cost to acquire before taxes?Associated costs – such as customs, duties, packaging, transport, or other payment terms.Acquisition cost – or the cost of actions undertaken by the purchasing department. For example, acquiring new software may incur licensing, installation, or subscription fees.Cost of ownership – including stock management and depreciation.Maintenance costs – such as cleaning, training, inspecting, reporting, troubleshooting, or servicing.Usage costs – otherwise known as operating costs, these usually relate to employee wages or other overheads such as rent, electricity, and water.Non-quality costs – what are the costs associated with meeting deadlines or initiating a non-compliance process?Disposal cost – or costs associated with the asset once it reaches the end of its usable life. This includes disposal, resale, or recycling cost.Important TCO considerationsDetermining the total cost of ownership is a nuanced process. Here are some important considerations for all businesses regardless of industry:

Spend some time considering the hidden costs of an asset purchase. The better a business becomes at identifying hidden costs, the more accurately it will be able to calculate TCO.The method of financing used to fund the purchase will have an impact on TCO. Decision-makers must liaise with finance and accounting to understand how factors such as deductions, expenses, and depreciation impact the final calculation.Total cost of ownership is fluid. For example, the costs associated with maintaining a piece of equipment increase over time as the equipment ages. Inflation also increases the cost of long-term maintenance.Do not forget labor costs, which may decrease or increase as the result of new investment.Key takeaways:The total cost of ownership is the purchase price of an asset plus the costs of operation.Depending on the industry, the total cost of ownership can be calculated by considering costs grouped into eight categories: purchase price, associated costs, acquisition cost, cost of ownership, maintenance costs, usage costs, non-quality costs, and disposal cost.When calculating the total cost of ownership, decision-makers must identify hidden costs. They must also understand that the TOC of an asset fluctuates because of age, financing method, inflation, and labor demand.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post What is the total cost of ownership? appeared first on FourWeekMBA.

The Bullwhip Effect And Why It Matters In Business

The bullwhip effect describes the increasing fluctuations in inventory in response to changing consumer demand as one moves up the supply chain. Observing, analyzing, and understanding how the bullwhip effect influences the whole supply chain can unlock important insights into various parts of it.

Understanding the bullwhip effectTo better understand the bullwhip effect, imagine a person with a long whip in his hand. As the whip is cracked, the parts closest to the handle do not move much. However, the parts further away from the handle move in an increasingly erratic fashion.

The same phenomenon can be observed in distribution channels. Here, the customer is the person holding the whip which moves according to demand. As we move away from the customer, the range of movement increases.

The average supply chain has seven inventory points between the customer and the supplier of raw materials. In order of increasing movement and volatility, the chain might look something like this:

Customer.Store.Regional warehouse.Assembly.Module manufacturer.Parts manufacturer.Ingredient (raw material) manufacturer.Each of these points endeavors to minimize out-of-stock situations and missed customer orders by keeping extra inventory. Manufacturers in particular experience high uncertainty and low inventory forecast accuracy. This causes them to stockpile inventory as a hedge against variability.

Common causes of the bullwhip effectSome of the common causes of the bullwhip effect include:

Forecast errors. Each point in the supply chain makes a demand forecast based on adjacent links. Errors in forecasting can lead to miscalculations that are magnified as they move up the supply chain.Lead time. This is defined as the time that elapses between when an order is placed and when it is received. A lack of due consideration for lead time can lead to excess inventory which in turn reduces supplier demand.Sales and price discounts. Continual and periodic promotional cycles cause great fluctuations in distribution channel demand. During promotional periods, large amounts of stock move through the chain. Unfortunately, this is always followed by low product demand once the promotion is over.Minimizing the bullwhip effectAvoiding the bullwhip effect entirely is unrealistic, but there are several approaches to mitigating or controlling it.

They include:

Optimizing inventory management – businesses can decrease the bullwhip effect by using appropriate inventory management software.Maintain smaller, more consistent order sizes – multiple points in the supply chain offer bulk discounts to their customers. This inflating of inventory levels through artificial demand can have serious ramifications for the other players in the chain.Awareness – the reality is that many businesses are ignorant of the bullwhip effect and do not understand the implications of high buffer inventories on demand. Recognition by supply chain managers that a problem exists is an important first step.Key takeaways:The bullwhip effect occurs in a supply chain when orders sent to manufacturers or suppliers create larger variance than the sales to the end customer.The bullwhip effect is commonly caused by failing to consider product lead times. It is also exacerbated by forecast errors and promotional cycles.The bullwhip effect cannot be entirely avoided. However, businesses can mitigate its effects by using inventory management software and resisting the temptation to offer bulk discounts. An awareness that the effect exists is also crucial.Read Also: Vertical Integration, Horizontal Integration, Supply Chain, Backward Chaining, Horizontal Market.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post The Bullwhip Effect And Why It Matters In Business appeared first on FourWeekMBA.