J. Bradford DeLong's Blog, page 401

February 19, 2018

Should-Read: Henry Farrell: The father of consumer sovere...

Should-Read: Henry Farrell: The father of consumer sovereignty: "[Even] the mainstream of Mont Pelerin was... problematic on apartheid...

...William H. Hutt was at the heart of the problem. Hutt indeed condemned racism, and claimed that it was rooted in opposition to the market. Yet his condemnation only went so far. As Slobodian describes it....

The political complement to [Hutt's] workplace liberation was not equality for blacks but their second-class status... What he described as ���the most vital point of my whole thesis��� in The Economics of the Color Bar was not an economic but a political argument: a warning about the ���tyranny of parliamentary majorities��� under systems of universal suffrage. The fact that blacks were the majority population in South Africa made the situation exceptionally perilous.��� Hutt expressed the need ���to protect the minorities [that is, Whites] from spoliation and revenge��� and suggested that the franchise be adjusted on ���some principle of weighting.���... Hutt did foresee the gradual introduction of more equality in some ���very distant future (it would be very optimistic to assume 50 years).���...

These��� subtleties��� in Hutt���s position appear either to have escaped the libertarian critics of MacLean who championed, or to have seemed to them for some reason or another not to have been worth mentioning. But they do point up the... elective affinity between certain forms of libertarianism and racism.... In Hutt we have a libertarian economist who is currently being held forward by libertarians as an exemplar of market based anti-racism. Hutt���s actual position was that racism was bad, but the introduction of actual democracy to South Africa was bad too, since it would lead to expropriation. Hence, Hutt���s solution of a weighted franchise, and Hayek���s apparent suggestion that the South African state ought be limited to a minimal body designed to enforce contracts, protect market competition and no more, lest a democratic majority seize upon it as a tool for redistribution. For sure, neither Hutt nor Hayek appear to have been racist as R��pke was, or direct supporters of the version of apartheid that then applied. But weighting the vote or crippling the state for fear of a black majority is weighting the vote or crippling the state for fear of a black majority, whichever way you slice it.

Should-Read: When I think of the Committee for a Responsi...

Should-Read: When I think of the Committee for a Responsible Federal Budget, I think of its Maya MacGuineas telling me in 2009-10 that they had to repeatedly and enthusiastically praise the best-performing deficit-hawk Republican���then Senator Voinovich���in order to keep lines of communication open, and give Republicans incentive to do better. Perhaps it is time for CRFB to make a public acknowledgement that, ex post at least, this strategy was not so smart? That one was not so reality-based in the past is a strong reason to do a frank and open retrospective, if only to keep one from being not so reality-based in the future: Paul Krugman: Budgets, Bad Faith and ���Balance���: "my anger is... directed at... enablers, the professional centrists, both-sides pundits, and news organizations that spent years refusing to acknowledge that the modern G.O.P. is what it so clearly is...

...Which is not to say that Republicans should be let off the hook. To be sure, American history is full of politicians and parties that pursued what we would now call nefarious ends.... But I can���t think of a previous example of a party that so consistently acted in bad faith���pretending to care about things it didn���t, pretending to serve goals that were the opposite of its actual intentions. You may recall, for example, the grim warnings from leading Republicans about the dangers of budget deficits, with Paul Ryan, the speaker of the House, declaring that our ���crushing burden of debt��� would create an economic crisis. Then came the opportunity to pass a $1.5 trillion tax cut targeted on the rich, and suddenly all worries about the deficit temporarily disappeared. Now that the tax cut is law, of course, deficit-hawk rhetoric is back....

...You may also recall how Republicans posed as defenders of Medicare, accusing the Obama administration of planning to cut $500 billion from the program to pay for the Affordable Care Act.... Why have Republicans become so overwhelmingly the party of bad faith?... The party���s true agenda, dictated by the interests of a handful of super-wealthy donors, would be very unpopular if the public understood it. So the party must consistently lie about its priorities and intentions.... Yet the gatekeepers of our public discourse spent years being willfully blind to this reality. Take, for example, the Committee for a Responsible Federal Budget, a think tank that, to be fair, can be a useful resource for budget analysis. Still, I can���t forget that back in 2010 the committee gave Paul Ryan���whose fraudulence was obvious from the beginning to anyone who actually read his proposals���an award for fiscal responsibility....

Washington is full of professional centrists, whose public personas are built around a carefully cultivated image of standing above the partisan fray, which means that they can���t admit that while there are dishonest politicians everywhere, one party basically lies about everything....But our job, whether we���re policy analysts or journalists, isn���t to be ���balanced���; it���s to tell the truth. And while Democrats are hardly angels, at this point in American history, the truth has a well-known liberal bias...

Should-Read: What you see depends on where you look from....

Should-Read: What you see depends on where you look from. I would not say that economics has covered itself with glory in taking a true 360-degree view of the situation. And Bridget has put her finger on one reason why: Bridget Ansel: The gender gap in economics has ramifications far beyond the ivory tower: "Given the extent to which every individual���s life is intertwined with the economy...

...the need to increase diversity in economics is not just about fairness or productivity within the ivory tower. It affects whether and how the needs of everyone���and not just certain groups���are reflected in our understanding of the economy and accounted for in our national policies...

February 17, 2018

Should-Read: "Switzerland yoked to Spain" was what one Eu...

Should-Read: "Switzerland yoked to Spain" was what one Eurocrat said about England and Wales. Me? I think the City of London should expand its boundaries beyond the Roman walls, and reactivate its Hanseatic agreements with Hamburg and company: Daniel Thomas: London life proves hard to give up for Brexit relocations: "Brexit.... Some of the most important conversations were... but in the kitchens and living rooms of those learning their fates in the first wave of company relocations...

...My Valentine���s Day supper was peppered with too much talk about cutting ties���with my partner���s firm looking to shift staff to Amsterdam. And I���m not the only one..... This is a crunch month for many, especially among the US financial groups that have less capacity in Europe and so have to make plans earlier. The debate has moved out of the boardrooms to the HR departments.... This week, a French financial services lobbyist said up to 4,000 jobs were expected to move to Paris���lured by Emmanuel Macron���s charm offensive and tax exemptions���while Frankfurt now expects up to 1,000 this year. European school intakes are a good gauge. International schools in Frankfurt and Paris are among those expanding while Goldman Sachs has reserved 80 schools places in Frankfurt. Bankers suggest up to 1,000 places are being sought at international schools by financial services groups in Germany alone....

One banker���on the list to move to Paris because he speaks French���says moving from London will be made easier by issues such as local tax and politics as well as the culture and access to the mountains for skiing.... There is also a new tribe being set up of Europe-trotting business people���the 5:2ers with families and homes in Britain who live for the working week out of a suitcase. They are pricing the commute on the Eurostar and into City airport (and talking with spouses about how much they need to be around). One banker says that his francophone members of staff had initially been excited about the prospect of cuts to personal income tax rates. But enthusiasm quickly cooled, he adds, when his ���Eurotrash��� colleagues discovered they could be moving to Dublin, and even further from their beloved beaches and ski slopes...

Should-Read: Another good paper on the costs of a strong ...

Should-Read: Another good paper on the costs of a strong dollar policy. It is one thing if (as in the 1990s) the strong dollar and the consequent downward pressure on (some) tradable manufacturing is a result of high investment spending in the United States. In those cases the bad effects are cushioned by higher productivity in nontradeables and in sectors of emerging comparative advantage. It is quite another if the decline in investment and manufacturing spring from increased deficits. No, this is not the fiscal expansion we were waiting for: Doug Campbell: : "This study uses new measures of real exchange rates to study the collapse of US manufacturing employment in the early 2000s in historical and international perspective...

...To identify a causal impact of RER movements on manufacturing, I compare the US experience in the early 2000s to the 1980s, when large fiscal deficits led to a sharp appreciation of the dollar, and to Canada���s experience in the mid-2000s, when high oil prices and a falling US dollar led to an equally sharp appreciation of the Canadian dollar. Using disaggregated sectoral data and a difference-in-difference methodology, I find that a temporary appreciation in relative unit labor costs for the US leads to persistent declines in employment, output, and productivity in relatively more open manufacturing sectors. The appreciation of US relative unit labor costs can plausibly explain more than two-thirds of the decline in manufacturing employment in the early 2000s...

February 16, 2018

Live from the Grove of Cognitive Philosophy Academe: Hors...

Live from the Grove of Cognitive Philosophy Academe: Horsing around by reading the very wise and clever Scott Aaronson: The Ghost in the Quantum Turing Machine, instead of doing work this morning, has led me to be thunderstruck by an excellent insight of his: Newcomb's Problem is, in its essentials, the same as the problem of Self-Locating Belief, and the solution by Adam Elga: Defeating Dr. Evil with Self-Locating Belief makes as much sense as a solution of one as the other. (I think it makes enormous sense as a solution to both, but YMMV.) As Scott puts it:

In Newcomb���s paradox, a superintelligent ���Predictor��� presents you with two closed boxes, and offers you a choice between opening the first box only or opening both boxes. Either way, you get to keep whatever you find in the box or boxes that you open. The contents of the first box can vary���sometimes it contains $1,000,000, sometimes nothing���but the second box always contains $1,000.... Whatever you would get by opening the first box only, you can get $1,000 more by opening the second box as well. But here���s the catch: using a detailed brain model, the Predictor has already foreseen your choice. If it predicted that you would open both boxes, then the Predictor left the first box empty; while if it predicted that you would open the first box only, then the Predictor put $1,000,000 in the first box. Furthermore, the Predictor has played this game hundreds of times before, both with you and with other people, and its predictions have been right every time. Everyone who opened the first box ended up with $1,000,000, while everyone who opened both boxes ended up with only $1,000. Knowing all of this, what do you do?...

I consider myself a one-boxer, [and] the only justification for one-boxing that makes sense to me goes as follows.... If the Predictor can solve this problem reliably, then it seems to me that it must possess a simulation of you so detailed as to constitute another copy of you.... But in that case, to... think about Newcomb���s paradox in terms of a freely-willed decision... we need to imagine two entities... the ���flesh-and-blood you,��� and the simulated version being run by the Predictor.... If we think this way, then we can easily explain why one-boxing can be rational.... Who���s to say that you���re not ���actually��� the simulation? If you are, then of course your decision can affect what the Predictor does in an ordinary, causal way...

Live from Spooky Action at a Distance: Question: Don't de...

Live from Spooky Action at a Distance: Question: Don't decoherent branches of an Everettian wave function recohere every time somebody runs a quantum eraser? In what sense is testing the existence of decohered states "hopelessly impractical"? Sean Carroll: Beyond Falsifiability: Normal Science in a Multiverse: "(3) There exist tests that are possible to do within the laws of physics, but are hopelessly impractical...

...We can contemplate building a particle accelerator the size of our galaxy, but it���s not something that will happen no matter how far technology progresses; like- wise, we can imagine decoherent branches of an Everettian wave function recohering, but the timescales over which that becomes likely are much longer than the age of the universe...

Yoon-Ho Kim, R. Yu, S.P. Kulik, Y.H. Shih, Marlan .O. Scully (1999): A Delayed Choice Quantum Eraser: "This paper reports a 'delayed choice quantum eraser' experiment...

...The experimental results demonstrated the possibility of simultaneously observing both particle-like and wave-like behavior of a quantum via quantum entanglement. The which-path or both-path information of a quantum can be erased or marked by its entangled twin even after the registration of the quantum...

John A. Wheeler (1978): The ���Past��� and the ���Delayed-Choice��� Double-Slit Experiment

February 15, 2018

Should-Read: Martin Wolf: Brexit has replaced the UK���s ...

Should-Read: Martin Wolf: Brexit has replaced the UK���s stiff upper lip with quivering rage: "In part, the UK is victim of its past successes...

...A small offshore island became, temporarily, a superpower... defined... against Europe and... any power wishing to dominate Europe.... Now, Europe is uniting while the UK is very much not a superpower. So what does it choose? Is it to be an irrelevant offshore island or a part of a united Europe? The choice has to be divisive. When divisions are so deep, nobody is considered neutral....

How will this end? The answer is that anything is possible. Could there still be a ���no-deal Brexit���? Yes. Could there be another referendum? Yes. But the likelihood is that the UK will exit on terms laid down, in detail, by the EU. When a country is this divided and its political processes are in such disarray, someone else has to sort things out. The EU will do so, because that is in its interests. The EU will not let the UK have its cake and eat it. It is led by people who also have a historical goal: not to return to the past. Their history was not British history and their aims are not British aims. They will determine the terms of the separation. We will then see whether the UK���s civil war is resolved, or renewed in other, yet more bitter, ways.

Should-Read: An entertaining rant from Doug Campbell. I w...

Should-Read: An entertaining rant from Doug Campbell. I wonder what triggered this? It is certainly true that the abstract of Acemoglu, Johnson and Robinson (2001), "Reversal of Fortune: Geography and the Making of the Modern Income Distribution" is simply wrong where it says "countries... that were relatively rich in 1500 are now relatively poor": they should have written "countries... that were densely populated and relatively urbanized in 1500���and thus had done well either because of geographic advantages or because of successful matching of technology to environment���are now relatively poor". "Rich" is the wrong word for, as Doug correctly points out, Malthusian model reasons. It is marriage patterns (and, to some degree, vulnerability to epidemics and violence) that determines whether those people still alive to consume in the old days were relatively rich or poor: Doug Campbell: On the Uses (and Abuses) of Economath: The Malthusian Models: "The first year of an Econ Ph.D. feels much more like entering a Ph.D. in solving mathematical models by hand than it does with learning economics...

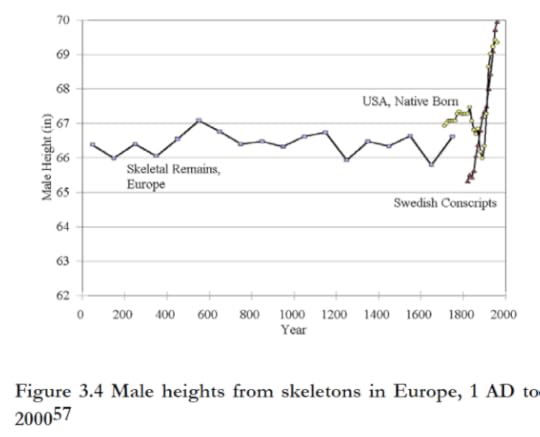

...very little reading or writing... loads and loads of fast algebra.... Why?... The first reason is that mathematical models are useful! Take the Malthusian Model... the birth rate... increasing in income... the death rate... decreasing... income per person... negatively related to population, and... technological growth... slow relative to population growth, and you can explain a lot of world history.... Income in a Malthusian economy is determined solely by birth and death rate schedules, and is uncorrelated with technology. Using this model, you can explain, for example, why incomes before 1800 were roughly stagnant for centuries despite improving technology.... It is a very simple, and yet powerful, model. And it makes (correct) predictions that many historians (e.g., Kenneth Pomeranz), scientists (e.g., Jared Diamond), and John Bates Clark-caliber economists (see below) get wrong.

A second beneficial reason is signalling.... I gratuitously put a version of the Melitz model in my job market paper, and when I interviewed, someone remarked that I was "really teched up!"... versions of peacock feathers....

A third reason to use math is that it is easy to use math to trick people.... If you make your assumptions in plain English, they will sound ridiculous.... A particularly informative example is the Malthusian model proposed by Acemoglu, Johnson, and Robinson in the 2001 version of their "Reversal of Fortune" paper.... They take the same basic assumptions, assign a particular functional form to how population growth is influenced by income, and arrive at the conclusion that population density (which is proportional to technology) will be proportional to income! They use the model:

$ P_{t+1} = {\rho}\left(P_{t}\right) + \lambda\left(y - \bar{y}\right) + {\epsilon}_t $

where $ P_{t+1} $ is population density at time t+1, $ P_{t} $ is population at time t, $ {\rho} $ is a parameter (perhaps just less than 1), $ \lambda $ is a parameter, $ y $ is income, $ \bar{y} $ is the level of Malthusian subsistence income, and $ {\epsilon}_t $ is an error term. If you impose a steady state ($ P^* $ and $ y^* $) and solve for p*, you get:

$ P^* = \frac{\lambda(y - \bar{y})}{1 - \rho} $

Population density is increasing in income, and thus that income per person should have been increasing throughout history.... What exactly was the source of the difference in the classical Malthusian model and the "MIT" malthusian model? The crucial assumption, unstated in words but there in greek letters for anyone to see, was that income affects the level of population, but not the growth rate in population... that a handful of individuals could and would out-reproduce the whole of China and India combined if they had the same level of income.... What this model does successfully is reveal how cloaking an unrealistic assumption in terms of mathematics can make said assumption very hard to detect, even by tenured economics professors at places like MIT. Math in this case is used as little more than a literary device designed to fool the feebleminded. Fortunately, someone caught the flaw, and this model didn't make the published version in the QJE. Unfortunately, the published version still included the view that population density is a reasonable proxy for income in a Malthusian economy, which of course it is not. And the insight that Malthusian forces led to high incomes in the Neo-Europes was also lost.... People are very susceptible to bullshit when written in equations.... This episode shows some truth to��Bryan Caplan's view that "The main intellectual benefit of studying economath ... is that it allows you to detect the abuse of economath"...

You can argue that in a preindustrial society a high population density makes you more vulnerable to epidemics���and thus that there is some drag on population from a high population density. But you can equally well argue that in a preindustrial society a low population density keeps you from developing immunity and leaves you a greenfield devastatingly vulnerable to epidemics.

Should-Read: Facundo Alvaredo, Lucas Chancel, Thomas Pike...

Should-Read: Facundo Alvaredo, Lucas Chancel, Thomas Piketty, Emmanuel Saez and Gabriel Zucman: Inequality is not inevitable���but the US 'experiment' is a recipe for divergence: "Income inequality has increased in nearly every country around the world since 1980���but at very different speeds...

...It is possible for institutions and policymakers to tame the unequalising forces of globalisation and technological change. And it is also possible to unleash those forces with renewed vigour, as in the case of the latest US tax plan. In 1980, both sides of the Atlantic showed similar levels of inequality. Since then, however, the gap between the richest and the rest has surged in the US, while in western Europe it has increased only moderately. In both regions, the top 1% of adults earned about 10% of national income in 1980. Today that cohort���s share has risen modestly to 12% in western Europe, but dramatically to 20% of all income in the US.... This boomtime at the very top has not benefited the rest of the American population in any measurable way.... What explains this dramatic divergence? The US has experienced a perfect storm of radical policy changes which have all contributed to this surge in inequality.... Many observers have been quick to blame globalisation, China and technology for the stagnation of working-class wages in the US. But... the US has run a unique experiment since the 1980s���and the results have been uniquely disastrous. Bad policy can have a real impact on millions of lives, for decades. But what governments have done, they can still undo...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers