J. Bradford DeLong's Blog, page 399

February 23, 2018

Paul Krugman Looks Back at the Last Twenty Years of the Macroeconomic Policy Debate

Everybody interested in macroeconomics or macroeconomic policy should know this topic backwards and forwards by heart. My problem is that I do not see how I can add value to it. The only thing I can think of to do is to propose two rules:

Paul Krugman is right.

If you think Paul Krugman is wrong, refer to rule #1.

I do wish that those who were not bad actors who made mistakes would 'fess up to them. Those who don't will get moved to the "bad actor" category: and, yes, I am looking at you, Marvin Goodfriend.

The only remaining question, I think, is whether these should all be read in chronological or reverse chronological order. I find myself torn, with arguments on both sides having force:

Paul Krugman (2018): It���s Baaack, Twenty Years Later https://www.gc.cuny.edu/CUNY_GC/media/LISCenter/pkrugman/Its-baaack.pdf

Olivier Blanchard and Daniel Leigh (2013): Growth Forecast Errors and Fiscal Multipliers http://delong.typepad.com/wp1301.pdf

Paul Krugman (2011): Ricardian Confusions() https://krugman.blogs.nytimes.com/2011/03/10/ricardian-confusions-wonkish/

Paul Krugman (2009b): One more time https://krugman.blogs.nytimes.com/2009/04/06/one-more-time/

Paul Krugman (2009a): A Dark Age of macroeconomics https://krugman.blogs.nytimes.com/2009/01/27/a-dark-age-of-macroeconomics-wonkish/

Ben Bernanke (1999): Japanese Monetary Policy: A Case of Self-Induced Paralysis? https://www.princeton.edu/~pkrugman/bernanke_paralysis.pdf

Paul Krugman (1998): It's Baaack: Japan's Slump and the Return of the Liquidity Trap http://delong.typepad.com/krugman_its_back.pdf

Must-Read: Very few people have properly read Paul Krugma...

Must-Read: Very few people have properly read Paul Krugman's "It's Back". As I understand the paper, one of its key messages is this: When the economy is in a liquidity trap���at the zero lower bound���it wants inflation. Inflation is the way a flex-price economy would keep the zero lower bound from causing a deep, persistent depression. A competent central bank that wants to mimic a flex-price economy as closely as possible in a sticky-price world���a competent central bank that wants to make Say's Law true in practice even though it is not true in theory���will therefore strain every nerve to generate that inflation. Its leader will not say, as Fed Chair Ben Bernanke said repeatedly, that he does not want higher inflation. He will say that he does. But Bernanke never understood that. And few of those advising him understood that. They had not, I believe, understood Krugman: Paul Krugman: It���s Baaack, Twenty Years Later: "In early 1998 I set out to reassure myself... to show that if Japan was having troubles, it was simply because the Bank of Japan wasn���t trying hard enough...

...But as sometimes happens when you try to model your intuitions explicitly (and is one of the main reasons for doing formal analysis), the model ended up telling me something quite different���namely, that when short-term interest rates are near zero it is not, in fact, easy for the central bank to reflate the economy. In fact, even very large increases in the monetary base will have essentially no effect unless the private sector is convinced that there has been a permanent shift in the central bank���s objectives, a new willingness to accept and even promote inflation. As I put it, the central bank needed to ���credibly promise to be irresponsible.���...

Ten years later my fears came true.... With the coming of the global financial crisis the whole advanced world basically turned Japanese, experiencing a protracted era of near-zero interest rates. The United States has emerged from that era, barely; Europe and Japan itself have not. What I want to ask in this paper is how good the analytical approach of 1998 looks in the light of subsequent experience. Were its basic predictions correct? Where did it fall down? What new issues have arisen? And how does its policy prescription look after all these years?...

Live from the Orange-Haired Baboon Cage: So former Minnes...

Live from the Orange-Haired Baboon Cage: So former Minnesota Congressman and Gingrich henchman Vin Weber was one of Putin's stooges in his attempt to keep Ukraine undemocratic and far from western Europe. This is somewhat of a surprise. But not too much of one. The rule of thumb is becoming: don't be surprised by anything somebody still a member of the Republican Party today will do or has done: Allegra Kirkland: Who Was In The Fateful Meeting That Rick Gates Lied To Mueller About?: "Just this month, Gates lied to Special Counsel Robert Mueller���s team and to the FBI about what transpired during a spring 2013 meeting...

...Gates on Feb. 1 knowingly and falsely testified that ���there were no discussions of Ukraine��� at a March 19, 2013 meeting between Manafort... Rep. Dana Rohrabacher (R-CA)... [and] Vin Weber, a former Republican congressman who now works for Mercury Public Affairs, a global PR giant. The meeting between the trio was disclosed on Mercury���s own retroactive FARA filing, submitted in April of last year...

Should-Read: BBC: Amazon buys rights to Iain Banks' Consi...

Should-Read: BBC: Amazon buys rights to Iain Banks' Consider Phlebas: "With the help of Brad Pitt's Plan B production company... the first of Banks' novels to feature the Culture, an interstellar utopian society...

...The story of Consider Phlebas centres on the character of Horza, who is tasked with recovering a missing Culture "Mind"-an artificial intelligence many thousands of times smarter than any human being. Sharon Tal Yguado, head of scripted series at Amazon Studios said: "The story of the Culture is so rich and captivating that for years Hollywood has been trying to bring this utopian society to life on the screen. "We are honoured that we have been chosen, along with Dennis Kelly and Plan B Entertainment, to make Consider Phlebas into a television series we think will be loved by fans for years to come." A spokesman for Plan B Entertainment added: "We revere the work of Iain Banks and continue to be moved by his inimitable spirit and his commitment to imagining a better future even in the darkest of times"..."

Economics as a Professional Vocation: Bulls--- Detection as a Student Learning Goal

Hoisted from the Archives: Economics as a Professional Vocation: The very sharp Binyamin Applebaum had an interesting rant....

Binyamin Applebaum: @BCAPPELBAUM ON TWITTER: "I am not sure there is a defensible case for the discipline of macroeconomics if they can���t at least agree on the ground rules for evaluating tax policy. What does it mean to produce the signatures of 100 economists in favor of a given proposition when another 100 will sign their names to the opposite statement? How does Harvard, for example, justify granting tenure to people who purport to work in the same discipline and publicly condemn each other as charlatans? How are ordinary people, let alone members of Congress, supposed to figure out which tenured professors are the serious economists?...

I would say, first, that journalists (and others) are supposed to use their eyes and their brains. They can take a look at the Nine Unprofessional Republican Economists who placed their letter in the Wall Street Journal... [on a] Saturday containing:

A conventional approach to economic modeling suggests that such an increase in the capital stock would raise the level of GDP in the long run by just over 4%. If achieved over a decade, the associated increase in the annual rate of GDP growth would be about 0.4% per year...

And note that by [the next] Wednesday they were saying:

Our letter addresses the impact of corporate tax reform on GDP; we did not offer claims about the speed of adjustment to a long-run result...

That degree of���four days later���"who are you going to believe: us or your lying eyes?" is a definite tell. Similarly, they can take a look at the Hundred Unprofessional Republican Economists who placed their letter in Business Insider...

One thing Binyamin could do is to not play "he said/she said" a la: "What does it mean to produce the signatures of 100 economists in favor of a given proposition when another 100 will sign their names to the opposite statement?" when he could be doing some of the heavy lifting of intellectual garbage collection and bulls--- detection.

One thing we in the academy can do is to explicitly make bulls--- deduction an explicit student learning goal. For example:

We ask students to do practice problems using the Solow growth model on paper, and then to reproduce the analysis and draw the graphs on the exam. But the problem is that after the final exam students are very unlikely to ever be asked to do anything similar again. If Intermediate Macroeconomics is to be useful���if its learning goals are to be worth anything���it is because it will put in the back of your brain stuff so that when they in the future read things like:

[Such a tax cut would be likely to] increase... the capital stock... raise the level of GDP in the long run by just over 4%. If achieved over a decade, the associated increase in the annual rate of GDP growth would be about 0.4% per year.... [In] the House and Senate bills... the increase in capital accumulation would be less, and the gain in the long-run level of GDP would be just over 3%, or 0.3% per year for a decade...

by the four Stanford professors and the five other economists http://delong.typepad.com/2017-11-26-nine-unprofessional-republican-economists.pdf, they will rapidly think:

Wait a minute! They say this policy change enriches America by increasing investment and making the economy more capital intensive. But policies that work by raising the capital-output ratio do not have anything like their full effect in a decade! Let me dig out my notes... halving the gap to the BGP K/Y ratio takes 0.72/[(1-��)(n+g+��)] years���call it 20 years. So the first ten years are not the whole effect but rather a bit more than a quarter of it...

And the hard question���the one that I have no belief I have solved���is: what kind of exam will induce what kind of learning that will make Intermediate Macroeconomics a useful part of students' intellectual panoplies in the future? Suggestions and advice more than welcome...

Estimating the Long Run Growth Effects of Tax Cuts: An Example: Does this belong in the next edition of Martha Olney's and my Macroeconomics textbook?...

Box 4.4.7: Speed of Convergence and Estimating the Effects of Policy Changes: An Alternative: It is worth noting an alternative calculation of the likely effects of the Trump administration's economic policies, carried out by four Stanford economists and five others.

Even more alarming than the reversal-of-sign of the effect, is the estimate of the growth rate: a jump of + 0.3 percentage points per year. It comes from the nine economists' observation that:

increase... [would] raise the level of GDP in the long run by just over 4%. If achieved over a decade, the associated increase in the annual rate of GDP growth would be about 0.4% per year.... [In] the House and Senate bills... the increase in capital accumulation would be less, and the gain in the long-run level of GDP would be just over 3%, or 0.3% per year for a decade...

But the nine economists know just as well as you do that only 28 percent of the total gain accrues in the first decades, not all of it.

When challenged by former U.S. Treasury Secretary Lawrence Summers and former Council of Economic Advisers Chair Jason Furman https://www.washingtonpost.com/news/wonk/wp/2017/11/28/lawrence-summers-dear-colleagues-please-explain-your-letter-to-steven-mnuchin/?utm_term=.9d690352f4b3:

Since you are explicitly talking about 10-year growth rates in your letter, would it not be better to... show that the effect in the 10th year is less than one-third of the long-run effect, translating into an annual growth rate of less than 0.1 percentage point?...

The nine economists denied that they had made claims about the speed of adjustment to the post policy change balanced growth path and so offered a prediction that real GDP growth would be boosted by not 0.1% (or -0.1%) but rather 0.3% points per year over the next decade https://www.washingtonpost.com/news/w...

First point you raised: Our letter addresses the impact of corporate tax reform on GDP; we did not offer claims about the speed of adjustment to a long-run result...

We believe that Stanford (and Harvard, and Columbia, and Princeton, and the American Action Forum, and the Lindsey Group) have a serious problem here...

Trumpfrastructure: No Longer So Live at Project Syndicate

Donald Trump Is Playing to Lose: Donald Trump is certainly a very different kind of president from what we have been used to���not just in temperament; in (lack of) knowledge about America, its government, and the world; and in public presentation-of-self. He is very different from what we have been used to in his orientation toward policy as well.

After "New Democrat" Bill Clinton won his plurality victory in 1992, he promptly began "triangulating": He talked left with an (unsuccessful) fiscal stimulus bill. He tacked center with a pro-growth deficit-reduction bill He tacked right with the North American Free Trade Agreement. He tacked center-right with a crime bill: "tough on crime, and tough on the causes of crime". He tacked center-right with the reappointment of conservative stalwart Alan Greenspan to run the Federal Reserve. He tacked left with an (unsuccessful) regulatory-heavy health-care reform.

The idea was that he needed to: (a) enact policies that would be successful in their aims, and so make America greater; (b) enact policies that would give many who had not voted for him reason to approve of his performance as president, and so become not a plurality but a majority president; and (c) enact enough of his base's priorities to make them, if not enthusiastic, at least understand that no-compromise leads to only evanescent terms in office and to no durable substantive policy accomplishments at all.

After Barack Obama won his majority victory in 2008, he promptly began moderating: He tacked center with a technocrat-approved financial rescue and fiscal stimulus plan. He tacked center with a market-oriented health-care reform���Republican then front-runner Mitt Romney's, in fact. He tacked center-right with an (unsuccessful) attempt to strike a grand deficit-reducing tax-raising and Social Security and Medicare-cutting "bargain". He tacked center with an (unsuccessful) market-oriented global-warming cap-and-trade plan���former Republican candidate John McCain's, in fact. He tacked center-right with the reappointment of somewhat cautious Ben Bernanke to run the Federal Reserve.

The idea was that he wanted most of all, above everything else, desperately, to be president not of a Red America or a Blue America but of a Purple America. He thus pursued cautious and technocratically-approved policies wherever he could, hoping that their goodness for America would attract Republican support. He would then tell his base that attaining national unity and healing partisan divisions���making a truly Purple America���was more important for the long term arc of the moral universe than was advancing Democratic core goals.

After Donald Trump won his minority victory in 2016, he promptly began... something: He tacked white nativist right with his Muslim ban. He tacked destructive right with his attempt to repeal���without replacing���ObamaCare, thus threatening health-finance chaos without advancing any conservative technocratic ideas about good directions for health-care reform. He tacked white nativist right again in opposing opposition to police brutality. He tacked plutocratic right with a tax cut for the rich that somehow left on the table all of the pieces that might have won at least some approval from any technocrats as likely to spur productive investment and economic growth.

This is not normal politics. This does not seek to unify the country. This does not seek to enact policies that will actually work and achive their purported aims, and so make America greater. This does not provide anybody in the majority who did not vote for him with any reason to approve of his performance as president. This does not try to teach his base the proper road to durable rather than evanescent legislative victories, or even continuance in office.

Again: This is not normal. Here in California last year we were treated to a remarkable spectacle. The California-elected members of the Republican caucus in the House of Representatives did not argue for a version of the tax cut bill that would have been good for their constituents. It was as if they had already given up fighting to retain their seats: they were looking forward to future jobs outside of California in Washington for lobbyists whose water they would therefore carry.

And now we are told that the next legislative priority for the Trump administration, a far as policy is concerned, is infrastructure. But is this an opportunity for the administration to tack left, and enact an infrastructure bill that will have an egalitarian rather than a plutocratic distributional orientation, and so make America greater? Unlikely. Is this an opportunity to tack technocratic, and enact a bill that that technocrats believe will provide a boost to economic growth, and so make America greater? Unlikely.

What will the bill do? First, we do not know, because there has been no policy-design process: no set of hearings and white papers and discussions and arguments and back-and-forth during which the policy and legislative communities reach not a rough consensus but a sense of what the options and their benefits and drawbacks are. The public-sphere process of deliberation has���as wtih the Muslim ban, as with the attempted not repeal-and-repace but the repeal of ObamaCare, as with the collected Twitter musings of Donald Trump, as with tax cut���simply been absent.

What about the shape of the policy we can glean so far is worse than not encouraging. Back in 1776 Adam Smith set out three proper tasks for the government in a libertarian society���one devoted to installing and maintaining the ���system of natural liberty���. Those three were: defense, police���protection of life, limb, and property and enforcement of contracts���and, third, infrastructure. According to Adam Smith, the government has the duty of:

erecting and maintaining certain public works and certain public institutions, which it can never be for the interest of any individual, or small number of individuals, to erect and maintain; because the profit could never repay the expence to any individual or small number of individuals, though it may frequently do much more than repay it to a great society...

And we, who know the economics of public goods somewhat better than Adam Smith did, would add that even when you can make it privately profitable to provide such public works and public institutions���by granting monopolies���it is destructive of societal well-being to do so.

Yet Trump's staff have not gotten Adam Smith���s memo about good government. Or, rather, perhaps, to them Adam Smith���s memo and whether the policy actually makes America greater are irrelevant. Trump's infrastructure program seems highly likely to be much the opposite. It looks to be a policy of providing public subsidies to private investors so they can construct those components of infrastructure for which they can successfully profit by charging monopoly prices.

Thus it looks to be not so much a pivot toward national unity and broad presidential popularity as another plutocratic���or, rather, kleptocratic ��� play. It does not look as though intended to attempt to accomplish any of the end Clinton and Obama sought when they tried to become president of most, if not all, of the people.

Now it may be politically efficacious. America's public sphere is broken. We can all already see now, in our minds' eyes, pundits and reporters at organizations from Fox News to the New York Times, pundits and reporters who have not gotten or pretend they did not get Adam Smith's memo, stroking their chins and lamenting why the Democrats are rejecting Donald Trump's pivot and open hand for infrastructure.

-���

8 long paragraphs

February 22, 2018

Should-Read: Our social insurance state still (largely) p...

Should-Read: Our social insurance state still (largely) presumes the stable two-parent family. In lots of ways it does not fit today's American society, in which men in divorce threaten to seek custody on the basis of their higher incomes and so get women to accept impoverishing negotiated settlements: Susan Pedersen: Reviews ���Bread for All���: "The welfare state emerges in this account as the culmination of a series of individual, sometimes problematic and sometimes heroic, engagements and commitments...

...Edwin Chadwick struggling with drains and contagion, Francis Galton puzzling over ���defect��� and degeneracy, Octavia Hill setting up model housing and disciplining her unruly tenants, Charles Booth sending his army of volunteers out to categorise and analyse London���s working class. Some of the sons and daughters of those evangelical shipping magnates and manufacturers who racked up fortunes during Britain���s free-trading heyday, it seems, felt guilty, not complacent, about their privilege.... A school of thought born to open up a society riddled with rank and patronage to merit and markets ended up documenting the inability of individualised freedom alone to deliver prosperity and justice. At a moment when the public reputation of ���experts��� is lower than that of, say, vivisectionists, it���s nice to read a book that insists so strenuously that social scientists, armed with knowledge and numbers and driven by ambition and empathy, teamed up with politicians (another unloved group) to improve the world decisively and lastingly....

The book does provide a good and readable account of the making of the Beveridgean welfare state. But without a sharper analytical focus, and especially some attention to Beveridge���s ideas about how to provide income security without disordering family life, the book not only ignores the welfare state���s disciplinary function but also rather overlooks how poorly it served disadvantaged groups���notably mothers���when the social relations Beveridge thought so stable came apart...

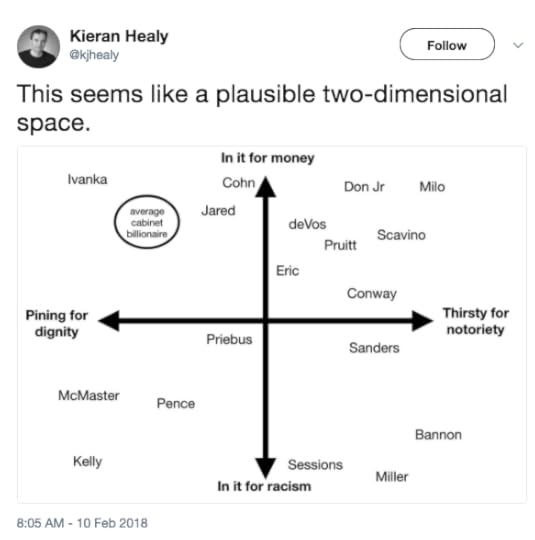

Should-Read: Kieran Healy: On Twitter: "This seems like a...

Should-Read: Kieran Healy: On Twitter: "This seems like a plausible two-dimensional space.��� ": "This seems like a plausible two-dimensional space...

Should-Read: Claudia Goldin: Harvard economist Claudia Go...

Should-Read: Claudia Goldin: Harvard economist Claudia Goldin studies why women earn less than men: "If there���s one thing men can do to improve women���s life at work, it would be���

...Want what women want. If men wanted to take more responsibility at home (real responsibility), then workplaces would be structured differently, and men and women would be treated and paid more equally in the labor market. It���s that simple. BONUS QUESTIONS: The mountain I���m willing to die on�����is freedom. Everyone should own�����a dog (but dogs own us)...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers