J. Bradford DeLong's Blog, page 2094

February 14, 2011

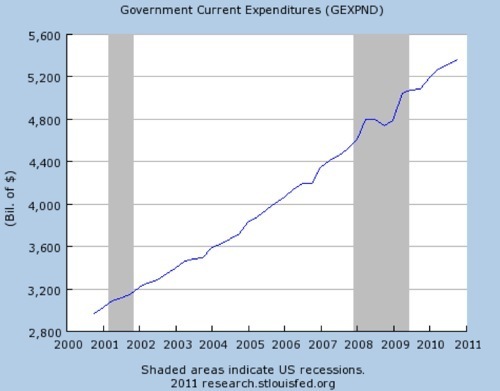

Expansionary Fiuscal Policy Was Never Tried

Paul Krugman:

The Great Abdication: What is Obama saying here? The important thing, I think, is that he has effectively given up on the idea that the government can do anything to create jobs in a depressed economy. In effect, although without saying so explicitly, the Obama administration has accepted the Republican claim that stimulus failed, and should never be tried again. What’s extraordinary about all this is that stimulus can’t have failed, because it never happened. Once you take state and local cutbacks into account, there was no surge of government spending....

[T]he failure of the stimulus that never happened has become conventional wisdom — which is what I feared would happen, two years ago, when I was tearing my hair out over the inadequacy of the original plan.

Yes, I know, it’s argued that Obama couldn’t have gotten anything more. I don’t really want to revisit all of that; my point here is simply that everyone is drawing the wrong lesson. Fiscal policy didn’t fail; it wasn’t tried.

Mark Thoma on the Rhetoric of Social Insurance

Mark Thoma:

Economist's View: "Medicare Recipients Against Handouts": People believe they paid for programs such as Social Security and Medicare. They put in contributions each month, the government saves that money somewhere, somehow, and when they use these programs they aren't consuming from "government," they are consuming their own contributions.... [T]he people answering this question are actually answering whether they've consumed services they didn't pay for in one way or another. The answers reflect the fact that most people believe that anything they get out of the system is far less than what they put into it (though in many cases that isn't actually true).

So it's true that people want the budget cut, but only the parts where people are forced to pay for "underserving" recipients of these government services. The feeling is that they get up every day and do what's needed to support themselves and their families. They go each day to jobs they hate, hate, hate, hate with a passion because that's how life is, and they don't appreciate seeing their hard-earned money taken away and given to people who don't even try, people who could work if they wanted to, but rely on the system instead.

Now, I happen to think that is a very wrong view of the circumstances of the typical aid recipient, but true or not I do think it is the source of the opposition to many social programs. People don't object to Social Security and Medicare because they believe they paid for these programs in full, or close to it. Same for disability, food stamps, and other programs. They paid into these programs for years, just like medical insurance, and now it's their turn to consume some of the funds they put in. They won't object to that even if you point it out to them, it's the people who consume without contributing that raise their ire and cause objections to these programs. It's the "handouts" that are the problem.

Thus, I don't think the key to getting more support for these types of programs is to show the individual that they consume many services themselves. They'll simply say yeah, I know, I paid for them, so what? It's showing them that their neighbors are deserving.... There is a need for social insurance. I had hoped this recession would show people that it can happen to anyone, that high moral character is not enough to protect you from the vagaries of the market system. One day a job can be gone, morals or not, savings can evaporate as a result, and all those years of doing the right thing -- putting a little away each month for the future -- provides little protection against financial ruin when there are no jobs to be found.

Don't get me wrong. I think it's good to make people aware of the amount of government services they consume, and that such awareness could help some in getting support for social insurance and other programs.... But I really do think the key to more widespread support is to make people aware of the need... and the fact that insurance -- by it's very nature -- means that those people unlucky enough to need it will often consume more than they put in.... That's how insurance works and we shouldn't resent those unlucky enough to need it.

The key here is to overcome the belief that the majority of people using these services are "gaming" the system to get handouts they don't deserve. If we are going to successfully defend the social insurance system, it is this belief that must be countered...

February 13, 2011

A Correspondent Writes...

In the inbox:

I am a regular follower of your RSS feed and much appreciate what you and other bloggers have done for increasing my mental stimulation. It's much better than the old days when I would come home from work and sit in front of the TV watching professional wrestling.

In partial payment, here's a tidbit from the latest entry in Pepy's diary which I thought you would like:

Here they did talk much of the present cheapness of corne, even to a miracle; so as their farmers can pay no rent, but do fling up their lands; and would pay in corne: but, which I did observe to my Lord, and he liked well of it, our gentry are grown so ignorant in every thing of good husbandry, that they know not how to bestow this corne: which, did they understand but a little trade, they would be able to joyne together, and know what markets there are abroad, and send it thither, and thereby ease their tenants and be able to pay themselves.

Why Friends Don't Let Friends Even Think About Supporting Republicans, Ever: Environmental Policy Edition

Daniel Weiss:

Bombshell: Bush EPA Administrator said the science necessitated action on global warming — President “overruled” EPA due to “Cheney … and Exxon Mobil”: On the eve of the new House Energy and Commerce Committee’s hearing (watch live here at 9:30 am) on legislation to block EPA from setting standards to reduce carbon dioxide pollution, Ranking Member Henry Waxman (D-CA) released a January 2008 letter from then EPA Administrator Steven Johnson to President George W. Bush. Johnson’s letter told President Bush that the administration must make an “endangerment finding” that carbon pollution endangers public health and the environment. He also told the president to use EPA’s authority under the Clean Air Act to reduce this pollution:

The Supreme Court’s Massachusetts v EPA decision still requires a response. That case combined with the latest science of climate change requires the Agency to propose a positive endangerment finding…. the state of the latest climate change science does not permit a negative finding, nor does it permit a credible finding that we need to wait for more research.... Within the next several months, EPA must face regulating greenhouse gases from power plants, some industrial sources, petroleum refineries and cement kilns...

Unfortunately, Johnson was not allowed to implement this plan. Politico reports that

Johnson was ready to advance on greenhouse gas pollution limits but Bush overruled him after hearing counter-arguments from the office of Vice President Dick Cheney, the Office of Management and Budget, the Transportation Department and Exxon Mobil...

From Information, Ignorance

John Quiggin:

John Quiggin » Adventures in agnotology: A fun list from Ranker, on the absurdities of Bill O’Reilly, some mockery of which is now going viral. And while we’re on the subject of lists, here’s Alternet with 10 historical facts only a rightwinger could believe. Meanwhile, Brad Delong cites an attack on relativity theory by Tom Bethell of the American Spectator and Hoover Institution. Bethell’s source is the “Galilean electrodynamics of rightwing crank physicist Petr Beckman, commemorated in the Petr Beckman award, which has been accepted by a string of the scientific luminaries of the climate science denial movement such as Fred Singer, Sallie Baliunas and Willie Soon. As DeLong observes with respect to the publication of the Bethell piece

from that moment on, my working hypothesis was that the conservative wing[1] of the Republican Party is composed exclusively of people who have completely disabled their bulls--t detectors. That working hypothesis has served me very well for seventeen years now.

Of course, this applies in spades to the Australian importers and distributors of this stuff – Bolt, Devine, Windschuttle and the entire Murdoch press.

The left has its faults and follies, to be sure. But it must be excruciatingly embarrassing to be, for example, a (genuine) scientist or historian of conservative inclinations, aware that your political allies are at best utterly indifferent, and at worst actively hostile, to scientific and historical truth.

Energy and Environmental Policy: What We All Know

For the Atlantic Energy Efficiency Conference, Boalt Hall, February 11, 2011

http://delong.typepad.com/20110211-delong-environment.pdf

Open publication - Free publishing

Jason Kuznicki Misses My Point Completely...

Jason Kuznicki misses my point completely:

How Not to Read with Charity — The League of Ordinary Gentlemen: Brad DeLong is a seemingly limitless source of uncharitable readings. He doesn’t disappoint in his latest:

First, let’s not tell Jason that the Theory of Relativity is the easy, straightforward, intuitive branch of modern physics...

Let’s not tell the economist that physicists disagree with him. It really is hard...

My point is not that Relativity is easy, intuitive, and consonant with everyday human experience.

My point is that Relativity is easy, intuitive, and consonant with every day human experience when compared to Quantum Mechanics, which is the other branch of twentieth-century physics. Quantum Mechanics is genuinely mind-bending, is genuinely incomprehensible in a way that Relativity is not. It is so incomprehensinblr that physicists' standard advice to their students when they try to make sense of Quantum Mechanics is that they should stop: instead they should just "shut up and calculate."

As Richard Feynman used to like to say:

What I am going to tell you about is what we teach our physics students in the third or fourth year of graduate school.... It is my task to convince you not to turn away because you don't understand it. You see my physics students don't understand it.... That is because I don't understand it. Nobody does...

In Which I Protest at a Little Monetarist Revisionism by Scott Sumner...

SS writes:

TheMoneyIllusion » Don’t mind the gap: In philosophy the “god of the gaps” hypothesis suggests that while science can explain most phenomena, certain seemingly inexplicable events (the origin of life, the universe, the laws of nature, Morgan’s comments, etc) must be attributed to a deity. In this recent post, I argued Keynesians were using a similar argument for fiscal stimulus. By the 1990s, most macroeconomists attributed changes in the expected level of nominal spending to monetary policy, and this made fiscal stabilization policy redundant, a sort of 5th wheel. During the recent crisis, some Keynesians have attempted to revive the arguments for fiscal stimulus, arguing that monetary policy was ineffective at the zero rate bound. When a group of quasi-monetarists reminded them that there are all sorts of unconventional monetary policy tools, the Keynesians argued that these tools would only be effective if credible, and it was unlikely that markets would believe central bank promises to inflate. Then the quasi-monetarists showed that markets did react to rumors of QE2 in a way that implied the policy was credible. Once again, Keynesian fiscal stimulus would seem to have no role to play...

As I understood (and understand) the argument, it goes like this:

Monetarism gives you a relationship between the nominal stock of money M and the level of nominal spending in the economy P via the quantity theory of money thus:

PY = M V(i)

where V is the velocity of money, and V(i) indicates that the velocity of money depends on the opportunity cost of holding money i, which is the short-term safe nominal interest rate on Treasury Bills--the higher is i, the higher is the velocity of money.

An open-market operation that expands the monetary base and thus the money supply M is a central bank swap of cash for Treasury Bills, which decreases the economy-wide supply of Treasury Bills. By supply and demand, if you decrease the supply you increase the price of Treasury Bills--which means that the interest rate i on Treasury Bills goes down. This means that the opportunity cost of holding money falls and hence the velocity of money falls.

Does i fall by enough to make monetary expansion completely ineffective? Almost surely not. Does i fall by enough to make monetary expansion relatively ineffective? Perhaps in situations like the one we are in now—certainly the track of the high-powered monetary base in 2008-2009 suggests that that is so.

What then should we do? Analytically, we should follow John Hicks, who pointed out that the quantity theory of money needed to be supplemented by another equilibrium condition in order to pin down both nominal spending PY and the nominal interest rate on Treasury Bills i. He chose bond market equilibrium: supply equal demand in the market for savings vehicles to move purchasing power forward into the future:

I(i-π, other stuff) + (G-T) = S(i-π, Y, other stuff)

This two-equation system tells us that open-market monetary expansions may only be substantially fruitful if they are accompanied by other policy interventions to make monetary expansion effective--to keep the OMO from pushing nominal interest rates down--by shifting the interest rate that equilibrates demand and supply for financial assets.

And even if you don't change the money stock M, interventions in the bond market that raise equilibrium i will raise PY to the extent that V is interest elastic.

What kinds of policies would qualify as interventions in the bond market to raise i, or at least to keep it from falling in response to expansionary open-market operations?

Policies that increase inflation expectations and thus boost I and so increase the supply of financial assets.

Policies that increase the government deficit and thus boost G-T and so increase the supply of financial assets.

Policies that increase business confidence and so boost I and so increase the supply of financial assets.

Note that, at least in this Hicksian framework which Milton Friedman used for his "Monetary Theory of Nominal Income," the channels through which Sumner claims that expansionary monetary policy raises spending in a liquidity trap--the "unconventional monetary policy tools" of which he speaks--work through altering the supply-demand balance in the bond market and thus through the same mechanism that expansionary fiscal policy works.

(And, in addition, expansionary fiscal policy has direct effects on V all by itself--government purchases, after all, do not require as much liquidity backing as your average transaction.)

Think of a model in which the government tunes its fiscal policy to hit a target for the nominal interest rate on Treasury Bills, expanding spending when i is too low and contracting spending when i is too high. In such a model expansionary open market operations are very powerful precisely because fiscal policy is then always tuned to making monetary expansion and contraction effective.

I Really Wish Rand Paul Knew More American History...

Robert Farley writes:

Clay Fight!: I will grant that there’s a certain courage in a Kentucky Senator lauding Cassius Marcellus Clay over Henry Clay:

“As long as I sit at Henry Clay’s desk, I will remember his lifelong desire to forge agreement, but I will also keep close to my heart the principled stand of his cousin Cassius who refused to forsake the life of any human simply to find agreement,” Paul said. Paul criticized one of the most famous Kentucky politicians, Henry Clay, who at one point occupied Paul’s chosen desk in the Senate. Instead of emulating the Kentucky senator known as the “great compromiser,” Paul praised his cousin, abolitionist Cassius Clay, who was attacked politically and physically for sticking to his principles. “Today we have no issues that approach moral equivalency with the issue of slavery. Yet we do face a fiscal nightmare and potentially a debt crisis,” said Paul. “Is the answer to compromise? Should we compromise by raising taxes and cutting spending as the Debt Commission proposes? Is that the compromise that will save us from financial ruin?”

Don't get me wrong. Cassius Marcellus Clay was a very good guy in the context of pre-Civil War Kentucky and the pre-Civil War United States. But his Abolitionist principles were of a peculiar color indeed.

Cassius Clay's proposal for Kentucky was that the legislature should pass a law that slaves would be freed on their twenty-first birthday--giving plenty of time for plantation owners to sell them south out of state down the Mississippi.

His was not a form of Abolitionism that would cheer the slave--rather, it seemed tuned to cheer the land speculator anticipating a flood of northern immigrants once the slaves had been cleared out south.

From William H. Freehling, The Road to Disunion: Secessionists at Bay:

Paul Krugman: Signs of Returning Sanity in Monetary Policy?

Paul Krugman:

Europe Turns on Its Axel: Axel Weber has bowed out of the race for ECB head gracefully.... [Since] this isn’t... about the person... [but] the views... I am therefore glad to hear both that he won’t be taking the job, and that the reason he bowed out was that euro-area leaders didn’t share his hard-money views. Tightening in Europe in the face of continuing very high unemployment and low core inflation is a very bad idea.... I wish Kevin Warsh all the best in his future career — and I’m glad to see someone who believes that both monetary and fiscal policy should tighten to head off fears the market doesn’t even have off the Fed board.

Not a bad few days for future policy prospects.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers