Matthew Yglesias's Blog, page 2521

October 23, 2010

Broadband Matters

Jay Ackroyd convinced me I should make explicit something that's only implicit in yesterday's post on the vast consumer surplus associated with digital media, namely that the case for some form of subsidization of fast internet access is very strong. When this is talked about it's normally discussed in terms of the idea that digital infrastructure is important to economic growth. And it is. But what that misses is the huge amount of value that can and will be created and distributed for free if people have the means to do it.

Exactly what that means in policy terms is another question. There are a lot of different things you could do. But as just a small example it would make a lot more sense for your cell phone bill to be tax deductible than your home mortgage interest.

More ambitiously, instead of having a US Postal Service whose main mission is to provide subsidized delivery of pieces of paper to low-density areas, we could have a government telecommunications entity whose purpose is to provide fast wireless broadband everywhere.

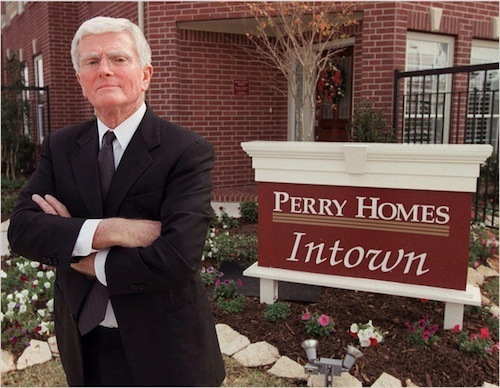

Bob Perry

Bob Perry, a longtime donor to Republican causes, has given $7 million since September to American Crossroads, the conservative group the strategist Karl Rove helped start.

Eric Lichtblau and Michael Luo profile rich homebuilder Bob Perry who "has given $7 million since September to American Crossroads, the conservative group Mr. Rove helped start."

I think it's pretty obvious that Perry didn't do this in order to get elected officials to continue subsidizing his business. But it's a reminder that while there are a lot of issues in this country where a more free market approach would be helpful—and the endless parade of subsidies for suburban homebuilders is one of them—merely voting for candidates who are disposed to say "free markets" a lot is unlikely to produce that result.

October 22, 2010

Endgame

You're so great and I'm so bored:

— UK has so few veto points they're imposing a carbon tax by accident.

— Writing sex scenes well is impossible.

— NFL owners making implausible claims of poverty.

— US calls for Keynes-style restrictions on trade surpluses that US kept out of Bretton-Woods when we had the big surpluses.

— French school lunch (healthy and appealing).

— Finnish school lunch (gross but healthy!)

In a desperate effort to get Kathleen Hannah to give me a sweater or some zines, here's "Breakout A-Town".

Helicopter Drop

Ezra Klein suggests that the United States could use a dose of fiscal/monetary coordination:

The answer is obvious: "explicit (though temporary) cooperation between the monetary and fiscal authorities." In practice, that would mean Bernanke gets John Boehner, Nancy Pelosi, Harry Reid and Mitch McConnell in a room and says the politics and specifics of this are their job, but the economy needs more fiscal stimulus if it's going to recover, and the Federal Reserve stands ready to make that not only possible but also virtually costless. Inasmuch as Republicans aren't big fans of further government spending right now, the best option could be the exact one that Bernanke recommended to Japan: a Fed-financed tax cut. Perhaps a payroll-tax holiday for the next year or two.

Politics aside, the best way to do money-financed fiscal policy is on the spending side. Identify some useful infrastructure projects—like the now-abandoned NJ/NY ARC Tunnel—and print the money needed to pay for them.

If you're going to go the tax cut route, however, you almost don't need congressional cooperation. A money-financed payroll tax cut is awfully close in spirit to the old Friedman/Bernanke thought experiment of dropping money out of helicopters. More practically, you could place the money in envelopes and put the envelopes in the mail. The postage involved would even help forestall US Postal Service insolvency.

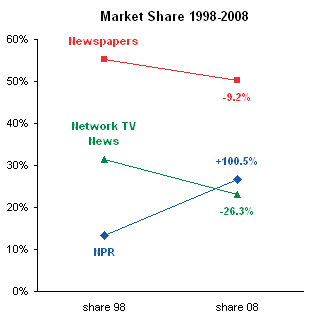

How the CPB Subsidizes National NPR

I think the case for getting the federal government out of the public broadcasting business is pretty straightforward—a given sum of money could be given to public radio or it could be going to preschool—so I'm not sure why National Review has come up with this somewhat misleading editorial on the subject:

NPR's supporters argue that what it provides is not "media," but news and journalism that consumers would otherwise be unable to find anywhere. NPR itself does not receive any direct federal funding, but its supporters howl whenever Republicans try to defund the CPB, because 40 percent of NPR's revenues come from station programming fees, and many of its member stations, especially in rural areas, are dependent on CPB largesse. In this sense, NPR is sort of like Amtrak: Self-sufficient in urban areas where it has lots of listeners but dependent on taxpayer subsidies to broadcast its programming nationwide.

If listeners in Dubuque want NPR content, let them pay for it. We are tired of kicking in contributions so that coastal liberalism may find an audience in Ogallala. NPR offers many fine programs, but it is towering arrogance to imply, as some supporters of public funding do, that residents of Big Sky would be left stranded on an island of ignorance if forced to do without Morning Edition. If it's really that important to them, they can increase their yearly contributions to Yellowstone Public Radio. If not, why should taxpayers in other parts of the country make up the shortfall?

This tries to make it seem like eliminating federal funding to the Corporation for Public Broadcasting would have no impact on NPR listeners in New York or Chicago or Los Angeles or whatever other enclaves of decadent coastal liberalism you care to name. But if the only thing at issue were the availability of NPR programming in rural areas, the whole thing would be almost totally a non-issue. The point, however, is that not only do rural stations depend on CPB largess to keep broadcasting, but they kick some of that money back upstairs in fees to the producers of NPR (and PRI) shows. Thus, the CPB's subsidies to rural stations are, in part, subsidizing the creation of some of the programming that big city NPR listeners hear.

Meanwhile, over at Reason Jesse Walker has an excellent piece about why the CPB never actually gets de-funded—conservatives just like to wield this threat in order to intimidate public broadcasters into changing their programming decisions.

Note that conservative politicians lacked principled opposition to the CPB during the Bush years when they were in a position to do something about it. After all, that coincided with their period of maximal influence over the system. Then, once Juan Williams got fired conservatives rediscovered their principled objections as part of one of their periodic fits of anti-anti-racist passion. At the end of the day, this repeating farce and the leverage it gives the right over NPR mostly strikes me as reason to favor moving toward privatization. NPR is a major 21st century media success story and I think that if given a reasonably scheduled phase-out of government support could certainly find a way to keep operating and then be free of political interference.

Chinese Professor Remix

My colleagues downstairs at Campus Progress did a parody/remix of the Citizens Against Government Waste "Chinese Professor" ad we discussed earlier:

Unsurprisingly, CAGW decided to respond to this by immediately abandoning their belief in economic freedom and threatening to call the copyright police to get the video removed. But for now it's still up.

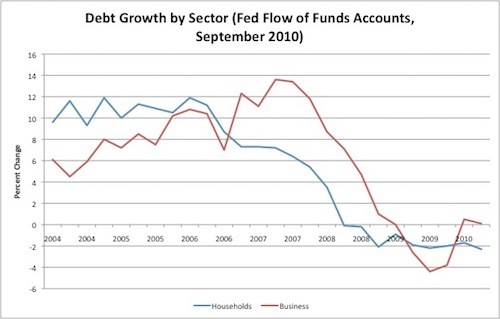

Deleveraging

I have persnickety reasons for objecting to Richard Koo's idea of conceptually distinct "normal" and "balance sheet" recessions, but I did like this Koo-inspired post from Mike Konczal and have every intension of poaching a chart:

The fundamental issue here is that middle class households have no choice but to deleverage and pay down their debts. Business as a whole, by contrast, actually does have a choice. But if you think that future household deleveraging is going to make it hard to find customers for your goods then it doesn't make sense to go into debt to finance investments in expanding your activities. It also doesn't make sense for cash-rich firms (think Apple, Google) to spend their stockpiles down. The problem is that if businesses don't invest, then people don't have incomes, so paying down debt becomes even harder.

This is where there's a role for short-term debt-financed government activities. Such activities both provide income to households, facilitating a speedier deleveraging process, and also provide some assurance to businesses that there will be demand in the form of government purchases. That, in turn, should spur further business investment which will provide additional income to households further speeding the deleveraging process. When household deleveraging is done, it would be necessary to reverse course and reduce public debts. But by maintaining a decent pace of GDP growth during the process we can ensure that public debt is paid down from a relatively strong economic base.

Similarly, monetary action matters a great deal. The more rapidly the price level increases, the more rapidly deleveraging can be accomplished. When the inflation rate runs below the target number, the necessarily painful process of deleveraging becomes more painful. By contrast, if we use level targeting to achieve some "catch-up" inflation we can make the process more rapid. Similarly, those firms and individuals who aren't currently indebted will be more likely to exchange their cash for real assets if inflation expectations rise. That will create income for households and further speed deleveraging.

Tablets In Hospitals

Monifa Thomas at the Chicago Sun Times reports on the latest must-have device at Chicago hospitals—iPads:

Not only does the iPad allow doctors to view electronic medical records, wherever they are, it also gives them a way to show patients their X-rays, EKGs and other lab tests on an easy-to-read screen. Plus, it's lighter and has a longer battery life than many laptops, making it convenient for doctors to take on rounds.

Within the next month, the University of Chicago Medical Center plans to provide iPads to all of its internal medicine residents, expanding on a pilot program launched earlier this year. Similarly, Loyola University Medical Center in Maywood has given iPads to all of its orthopedic residents as part of a pilot program.

This is a nice window into the interplay between technological progress and health care costs. Even though the price of electronic devices tends to fall pretty quickly, if hospitals across the country start replacing clipboards and paper with iPads then that's going to increase costs. But making health care cheaper per se isn't the only thing in life. If getting more expensive gadgets into doctors hands actually leads to major improvements in health outcomes, then the expense will be very much worthwhile.

That said, in most industries one thing people try to do with new technology is find ways to reduce their cost structure. Initially, that leads to higher profits. But as competing firms also adopt cost-cutting technologies, the dominant strategy involves price cuts and the profit rate returns to the pre-innovation equilibrium and consumers benefit. The US health care system, however, is set up so as to strongly discourage price competition. So hospitals are relatively unlikely to focus on the ways in which new technology can reduce their cost structure, and even if they do this they're unlikely to end up passing reductions on to consumers in the form of lower prices.

I Wanna Try On Your Clothes

Buzzfeed reports that "13-year-old fashion blogger Tavi Gevinson met with the former Bikini Kill/Le Tigre front-woman during New York Fashion Week and scored her iconic 'Feminist' sweater and some zines."

That's nice of her, but like Kriston Capps I can't help but think the sweater belongs in a museum or something. And that goes double for "some zines." A lot of culturally significant stuff happened in low-volume zines whose physical manifestations weren't exactly built to last. We need to be collecting and archiving them so that future generations will be able to see them.

Bruce Josten and the Chamber of Secrets

Bruce Josten, chief lobbyist for the Chamber of Commerce, explains exactly what's wrong with the organization keeping its corporate donors secret:

"The major supporters of us in health care last year were confronted with protests at their corporate headquarters, protests and harassment at the C.E.O.'s homes," said R. Bruce Josten, the chief lobbyist at the chamber, whose office looks out on the White House. "You are wondering why companies want some protection. It is pretty clear."

The chamber's increasingly aggressive role — including record spending in the midterm elections that supports Republicans more than 90 percent of the time — has made it a target of critics, including a few local chamber affiliates who fear it has become too partisan and hard-nosed in its fund-raising.

So there you have it. The Chamber's political finance arm exists, in essence, to help Republicans win elections. But many people are not Republicans! Even George McGovern got 37.5 percent of the vote. So individuals, as consumers and as citizens, may choose to not support businesses that take their money and spend it on a political party they don't like. Naturally, no sensible business executive wants to do that. Michael Jordan was famously reluctant to get involved in partisan politics because "Republicans buy sneakers too." Anonymity is so much more convenient.

But does it serve the public interest for this to be kept secret? It seems that for all the reasons the Chamber's members don't want you to know what they're doing that you do want to know who they are. Since these very same business interests successfully beat back congressional efforts to make disclosure legally mandatory, it becomes essentially a journalistic problem. It's possible for diligent reports to find out who the donors are, which is what my ThinkProgress colleagues have been looking into and today's Times piece sheds some further light on. For example, "Prudential Financial's $2 million donation last year coincided with a chamber lobbying effort against elements of the financial regulation bill in Congress."

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers