Deleveraging

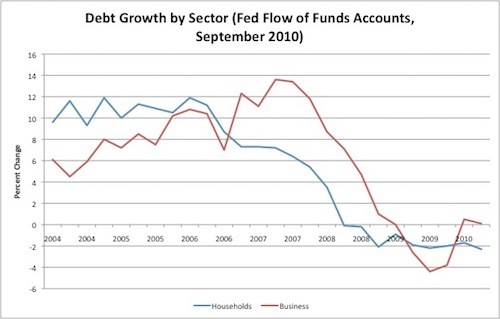

I have persnickety reasons for objecting to Richard Koo's idea of conceptually distinct "normal" and "balance sheet" recessions, but I did like this Koo-inspired post from Mike Konczal and have every intension of poaching a chart:

The fundamental issue here is that middle class households have no choice but to deleverage and pay down their debts. Business as a whole, by contrast, actually does have a choice. But if you think that future household deleveraging is going to make it hard to find customers for your goods then it doesn't make sense to go into debt to finance investments in expanding your activities. It also doesn't make sense for cash-rich firms (think Apple, Google) to spend their stockpiles down. The problem is that if businesses don't invest, then people don't have incomes, so paying down debt becomes even harder.

This is where there's a role for short-term debt-financed government activities. Such activities both provide income to households, facilitating a speedier deleveraging process, and also provide some assurance to businesses that there will be demand in the form of government purchases. That, in turn, should spur further business investment which will provide additional income to households further speeding the deleveraging process. When household deleveraging is done, it would be necessary to reverse course and reduce public debts. But by maintaining a decent pace of GDP growth during the process we can ensure that public debt is paid down from a relatively strong economic base.

Similarly, monetary action matters a great deal. The more rapidly the price level increases, the more rapidly deleveraging can be accomplished. When the inflation rate runs below the target number, the necessarily painful process of deleveraging becomes more painful. By contrast, if we use level targeting to achieve some "catch-up" inflation we can make the process more rapid. Similarly, those firms and individuals who aren't currently indebted will be more likely to exchange their cash for real assets if inflation expectations rise. That will create income for households and further speed deleveraging.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers