Matthew Yglesias's Blog, page 2510

November 3, 2010

Obama Should Move to the White House

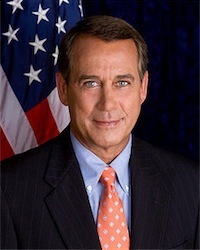

Rather than plunge into the debate over whether Obama should "move to the center" or adopt tactics of high-intensity conflict with congressional Republicans let me suggest another tack. A day contains 24 hours. That's true for you, for me, for John Boehner, and for Barack Obama. But Obama has more job responsibilities than Boehner, and both of them have more responsibilities than I do. So it's important for the President to think about how he wants to spend his time.

For the past 20 months, Obama has spent a lot of time acting as his party's leader in legislative negotiations, especially in the United States Senate. The correct way to respond to the midterms is, I think, to stop doing this. Let Harry Reid do it. As Reid can tell you both from his time as a Minority Leader and his time as a Majority Leader, it's very hard to pass bills through the US Senate. Let this be John Boehner's problem.

Meanwhile, having cleared his schedule of meetings with Phil Schirilo there's time for more meetings with folks from the Counsel's office about judicial vacancies. There should be a nominee for each vacancy! That'll probably set up a problem of getting the judges confirmed, but the first step is coming up with the names. And Obama will have more time to spend on foreign policy. How are we going to extricate ourselves from Afghanistan? How can we continue the dialogue with China over trade and currency issues? How can we strengthen ties with India, Brazil, Indonesia and other large developing democracies? How can he work with Dilma Roussef to check the spread of authoritarian populism in the region?

Given that congress is almost certainly not going to pass any useful bills, what unilateral actions can the administration take to promote economic recovery? What kind of jaw-boning of FOMC members is likely to be useful?

The point is, it's a great big country located in the middle of a great big world. There's more to life than the United States Congress and deep engagement with the legislative process is not a politically rewarding undertaking. So let it go. Staff up the White House with people interested in running the executive branch and focus on doing a good job. Let the Senators fight with each other on their own.

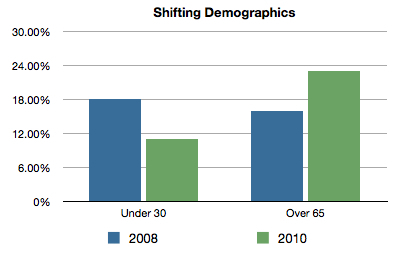

The Changing Electorate

One reason it's difficult to read midterm elections as reflecting shifts in the "national mood" is that the actual set of voting people is quite different. According to exit polls, for example, the relative proportion of youth voters and senior voters shifted quite dramatically:

That under-30 bracket still strongly backed Democrats by a 57-40 margin, turning only somewhat more skeptical of the party. But it also shrunk precipitously as a share of the voting public. But Americans didn't react to "liberal overreach" by suddenly aging four decades in the span of eighteen months. Older people are just more inclined to stay engaged with lower profile elections.

The High Price of Tea

My guess is that conservatives won't spend a ton of time second-guessing themselves after a big electoral win last night, but the fact of the matter is that by putting forward a lot of hard-right nominees Republicans appear to have left a few Senate seats on the table. In some cases, such as Florida and Kentucky, they got their hard-right nominee and also won the seat. But then there's Delaware and Nevada and West Virginia. And there's your Senate majority.

It's interesting that Republicans seem to have fared so much better in the House. I've heard it hypothesized that since these were lower profile races, it was easier for challengers to fly under the radar screen and not attract the kind of scrutiny that undid Sharon Angle. It's easier for a House candidate to be a kind of generic "alternative" to the incumbent.

Final Results

Obviously you can see the numbers elsewhere. But what happened is that Republicans did substantially better-than-expected in the House. The Douglas Hibbs projection forecast about a 45 seat pickup, the generic ballot polling forecast about a 55 seat pickup, and in reality they got a 65 seat pickup which I believe will create the largest House Republican caucus since the Great Depression. Given the vagaries of Southern politics, I'm pretty confident we've seen bigger conservative majorities in the past but the point is it's a big win.

Conversely in the Senate the GOP has underperformed. Harry Reid survived in Nevada. Michael Bennet looks like he'll probably hang on in Colorado. A likely Republican win in Delaware was turned into an easy win for Chris Coons.

Realistically, I think the House margin matters much more. If the GOP had pulled off a very small majority, the White House could hope to attempt to govern via negotiations with a small block of relatively moderate representatives. With a big majority, legislative negotiations need to run through John Boehner. And any Obama-Boehner deal that could pass a Senate with 53 Democrats could also pass a Senate with 51 Democrats or even 48 Democrats. For a bill to become a law under this configuration you'd need a really substantial level of cross-party agreement that's a bit hard to imagine at the moment. But that means that the days of the 111th Congress when things would come down to intense negotiations with individual Senators are probably over. Deals will be big picture or else more likely the deals won't be done.

The Great Reversion

The mainstream press has a vested interested in overreading every election result as do, naturally, the proponents of the winning party. So the pro-overreading faction also wins the argument and one doesn't want to be a "protest too much" type on the other side. But I do think it's worth emphasizing that the state to we'll be entering next year—divided government—is entirely typical in the past thirty years of American political history.

The only episodes of unified partisan control we've seen were 1993-94 and 2009-10 for the Democrats and 2003-2006 for the Republicans. You could posit that the existence of a strong "Boll Weevil" faction of conservative Democrats gave Reagan an effective governing majority in 1981-82 but then by the same token this same phenomenon denied Bill Clinton an effective governing majority in 1993-94. Either way, the point is that this is normally how elections turn out. And when elections turn out in a more lopsided way, they tend to revert to division quite quickly. I think it would be a mistake to infer from this that "Americans prefer divided government" since if you add the Democratic partisans to the Republican partisans you get a clear majority of partisans. But the dynamics of the overall system tend to settle into this kind of equilibrium.

And as far as episodes of divided government go, Barack Obama will, in virtue of Democratic control of the Senate, have a stronger hand legislatively than Ronald Reagan and George HW Bush had in 1983-1992, than Bill Clinton had in 1995-2000 or then George W Bush had in 2007-2008. So this could plausibly be the beginning of the end for Democratic political power (as it was for Bush) or merely the end of the beginning (as it was for Reagan and Clinton).

In any event, knowledge of all this is part of what drives my frustration with supermajority rule in the US Senate. People spent much of the past two years acting as if the 60 vote requirement was the only thing standing between the United States and some kind of plebiscitary democracy. The reality is that most of the time legislation requires bipartisan compromise because most of the time the electorate doesn't deliver the House, the Senate, and the Presidency to one party simultaneously. But it seems to me that when unified government is the outcome, that the winner ought to get the chance to govern. As we saw last night, if the people don't like the results they both can and will vote the other guys back in.

November 2, 2010

Your Kids Will Meditate in School

I think a nice counterpoint to some of the pat conventional wisdom about "anti-establishment" or "anti-politician" sentiment in the current election is simply to look at how successful retreat candidates have been. Once and future Senator Dan Coates (R-Indiana) isn't exactly a breath of fresh air. Nor is former Rep Rob Portman or former Rep John Kasich (both R-Ohio). The trend is a much more literal swing of the pendulum against the folks currently in charge (mostly Democrats) and in favor of the other guys.

The ultimate of all of this is happening in California where Democrat Jerry Brown will once again be governor:

In high school I liked the Dead Kennedys "California Uber Alles" a lot, but had to look up what it was a reference to. The idea that over a decade after my graduation Brown would be governor of California again never occurred to me.

Endgame

Don't ever look back:

— In lieu of watching election returns, I'll be at the Wizards home opener.

— Wizards' season is likely to make Blanche Lincoln's performance look good.

— Third Way to a GOP majority.

— Liquidity traps and rational expectations.

— Pocket guide to vaginal euphemisms.

Listen to Wendy's rendition of "Teenage Dream" and tell me Max Martin isn't a genius.

Zombie Economics

Over the weekend I finished John Quiggin's entertaining and accessible Zombie Economics: How Dead Ideas Still Walk among Us. To switch undead metaphors a bit, the conceit of the book is that the Panic of 2008 ought to be the stake through the heart of what Quiggin calls the "market liberal" paradigm that's prevailed since stagflation killed the postwar Keynesian consensus.

To me the most interesting thing about the book is that even though the rhetoric, tone, and ideological self-positioning are 180 degrees away from Amar Bhidé's book the proposals on bank regulation are literally identical. The same in every way. So hopefully people who enjoy valorizing businessmen and talking about how capitalism is awesome will read Bhidé's book while people who enjoy afflicting the comfortable and talking about the need to tame markets will read Quiggin's book. I'll cross my fingers and hope that Dodd-Frank and Basle III will be all we need to prevent a new financial panic, but realistically I think more far-reaching reforms will be needed and these books point the way.

On the other side of the spectrum, the most provocative argument Quiggin offers is that the contemporary world massively overrates the case for privatization of "natural monopolies" and underrates the case for new public investments. I wish this chapter had been a whole book of its own, since it's extremely thought-provoking but I have a lot of questions about the argument. For example, instead of a case for a small number of state-owned enterprises coexisting alongside private ones, is this possibly a case for sovereign wealth funds and the state acting as a passive investor in a wide range of firms?

Big picture, when the crisis first hit I know a lot of people on the left were excited about the prospect of it discrediting the right. Now heading into the midterms, the momentum has shifted to the idea that somehow the recession may discredit the welfare state. I think if you look back to the prolonged crisis of the seventies you see that this kind of interpretative pendulum can swing around quite a bit, and Quiggin's argument is an important intervention in recapturing the narrative.

The Geography of Overexposure

The most-covered candidate of 2010 turns out to have been Christine O'Donnell, who definitely won't be taking office as a United States Senator. By contrast, we've heard very little about the guy who'll probably beat Russ Feingold or the dude who has at least an outside chance of winning of Washington.

Ezra Klein's theory is that O'Donnell "just made for good copy."

That's true, but I think there's more in play, namely logistics. The Alaska Senate race should be excellent copy. Joe Miller is nuts, Scott McAdams is fascinatingly amateurish, the Palin-Murkowski feud is interesting, everyone likes to talk about Sarah Palin, etc. But Alaska is also cold and remote. Sending a reporter there would be expensive and annoying. The time zones are inconvenient. By contrast, Wilmington is a 2 hour drive or 90 minute train ride from both Washington, DC and New York City. So if you want to get some "real reporting" done it's convenient. And logistics count in life.

HSR Opponents Make the Case for High-Speed Rail

I've been kind of assuming that building a true nationwide high-speed rail network would be unrealistically expensive. According to HSR opponent Tad DeHaven, however, I'm way off base and it'd actually be kind of a bargain. Or as he puts it:

Federal taxpayers can't afford high-speed rail in California or anywhere else. A Cato essay on high-speed rail points out that the cost of California's HSR could be $81 billion and a national system could cost $1 trillion. Samuelson is right: the Obama administration's HSR dreams "represent shortsighted, thoughtless government at its worst."

To get specific, the Cato essay in question is from car-subsidy shill Randal O'Toole and clarifies that for this bargain basement price we'd be getting real HSR and not the Obama's kinda sorta fast trains:

Thus, the costs of a true high-speed rail system would be far higher than the costs of a medium-speed system on existing tracks, as envisioned by the Obama administration. To build a 12,800-mile system of high-speed trains would cost close to $1 trillion, based on the costs estimates of the California system. It is unlikely that the nation could afford such a vast expense, particularly since our state and federal governments are already in huge fiscal trouble.

Taking California construction costs and projecting them nationwide seems methodologically unsound to me since California is an above-average cost jurisdiction. And keep in mind that this is a policy brief from a guy who's entire job is to talk smack about federal investments in rail. So what he'll have done to produce the $1 trillion number is at every step of the way shade things in a high cost direction. But let's stick with the trillion.

Currently, the government needs to pay 4.1% interest on a thirty year bond. And according to the handy dandy amortization-calc.com to amortize a 30 year loan of $1 trillion at an interest rate of 4.1% per year would cost $57.99 billion a year for thirty years. Note that's in fixed, nominal terms, so while it's a fair amount of money in the short term by the 2030s it'll be a joke relative to our Nominal GDP. Contrast that to the $708 billion FY 2011 budget request the Obama administration submitted. It seems to me that an 8.1 percent reduction in defense expenditures in order to create a transformative nationwide new infrastructure program would be a no-brainer.

Of course the larger moral of the story here is that with government borrowing costs currently very low and large quantities of workers and other resources idle, it makes a ton of sense to borrow large sums of money to invest in useful projects. A trillion dollars is a lot of money. And at a higher interest rate, the return on investment you'd need to justify borrowing it might be quite large. But at today's rates and with plenty of genuinely idle resources around the situation is quite different. With high unemployment and a frontloaded pace of construction, the $57.99 billion in annual debt-finance costs would be partially offset in the short-term by increased income and FICA revenue, decreased Unemployment Insurance outlays, and spillover benefits to retailers and other service professionals who would benefit from the increased pace of economic activity.

Let's do it!

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers